Tickmill login client area

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose.

Free forex bonuses

Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of AUD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. - IC markets (EU) ltd, regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18

- IC markets global regulated by the financial services authority of seychelles with a securities dealer licence number: SD018

Tickmill login client area

IC markets does not accept applications from residents of the U.S, canada, israel and islamic republic of iran. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets does not issue or sell cryptocurrencies nor is it a digital currency exchange service provider. IC markets is the issuer of over-the-counter derivatives such as cfds over various underlying instruments or other assets including cryptocurrencies.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of AUD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

International capital markets pty ltd (ACN 123 289 109) (trading as IC markets) holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities including.

- IC markets (EU) ltd, regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18

- IC markets global regulated by the financial services authority of seychelles with a securities dealer licence number: SD018

A reference on this site to IC markets is to one of the above entities with whom you have, or may have, an account.

© 2020 international capital markets pty ltd | all rights reserved.

Tickmill login client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill login client area

IC markets does not accept applications from residents of the U.S, canada, israel and islamic republic of iran. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets does not issue or sell cryptocurrencies nor is it a digital currency exchange service provider. IC markets is the issuer of over-the-counter derivatives such as cfds over various underlying instruments or other assets including cryptocurrencies.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of AUD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

International capital markets pty ltd (ACN 123 289 109) (trading as IC markets) holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities including.

- IC markets (EU) ltd, regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18

- IC markets global regulated by the financial services authority of seychelles with a securities dealer licence number: SD018

A reference on this site to IC markets is to one of the above entities with whom you have, or may have, an account.

© 2020 international capital markets pty ltd | all rights reserved.

Tickmill login client area

Trade our company's capital .

Receive 70% of profits,

we cover the losses.

Trade for proprietary trading firm

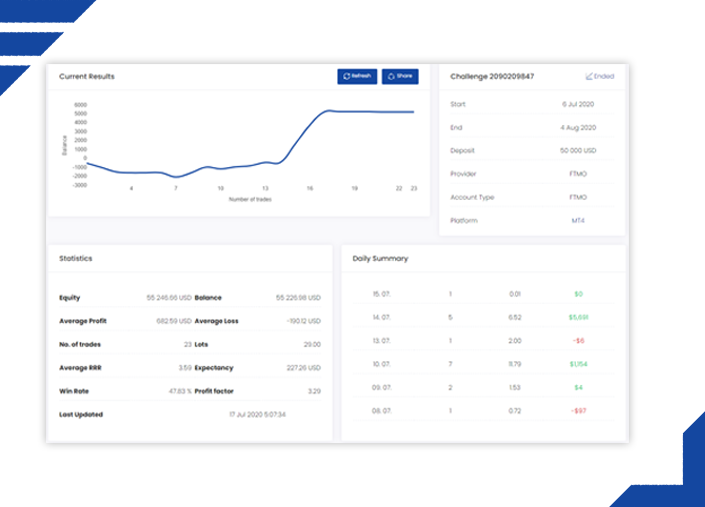

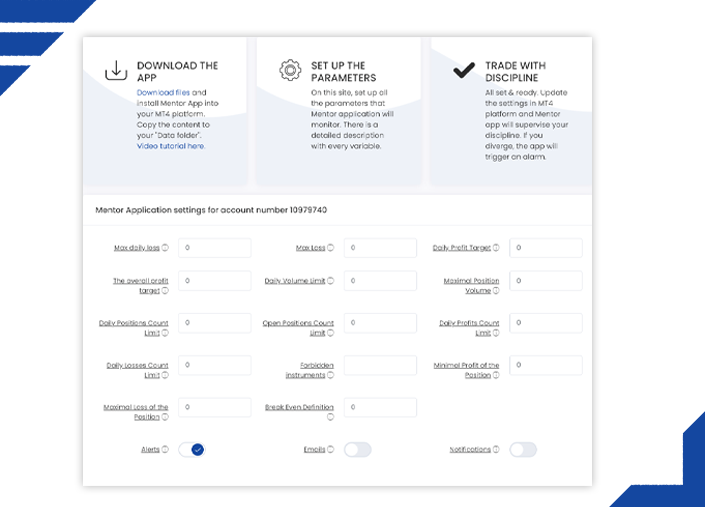

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

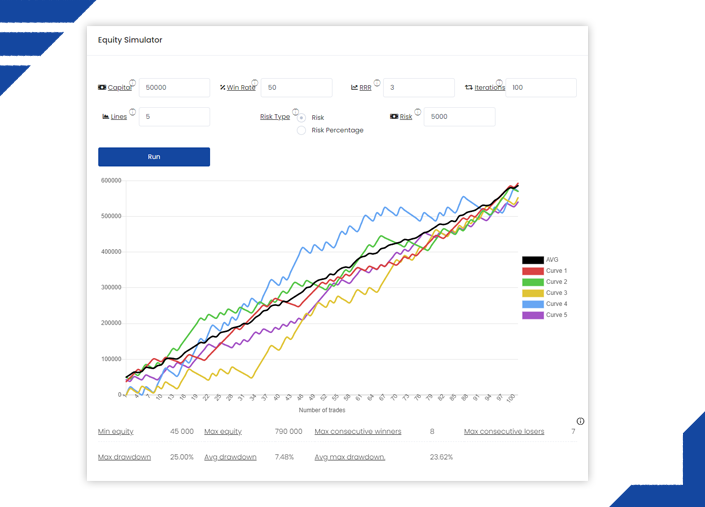

Upon successful completion of the evaluation course, you are offered a placement in the FTMO proprietary trading firm where you can remotely manage the FTMO account with a balance of up to 100,000 USD . Your journey to get there might be challenging, but our educational applications, account analysis and performance coach are here to help you on the endeavour to financial independence.

We fund good traders

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the trading course, you are guaranteed a placement in the FTMO proprietary trading firm where you can remotely manage funded account of up to 100,000 USD. Your journey to get there might be challenging, but our educational applications, account analysis and performance psychologist are here to guide you on the endeavour to financial independence.

Evaluation process

FTMO challenge

Verification

FTMO trader

Know your trading objectives

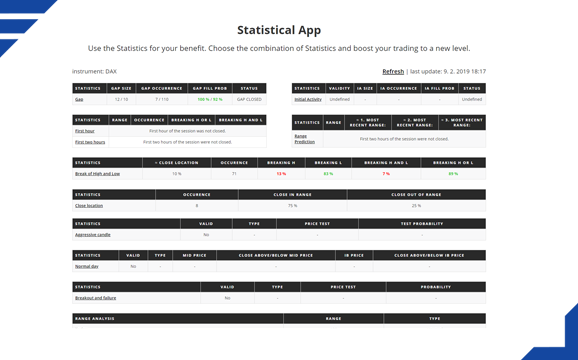

Before we allow you to trade for our proprietary trading firm, we need to be sure that you can manage risk. For this reason, we developed trading objectives. By meeting the trading objectives, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you; we don’t set any limits on instruments or position size you trade.

| Step 1 FTMO challenge | step 2 verification | step 3 FTMO trader | |

|---|---|---|---|

| trading period | 30 days | 60 days | indefinite |

| the FTMO challenge duration is 30 calendar days; the verification duration is 60 calendar days. |

If you manage to pass the trading objectives sooner, you do not need to wait for the remaining duration days.

A trading day is defined as a day when at least one trade is executed.

If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

Current daily loss = results of closed positions of this day + result of open positions.

For example, in a case of the FTMO challenge with the initial account balance of €40000, the max daily loss limit is €2000. If you happen to lose €1000 in your closed trades, your account must not decline more than €1000 this day. It must also not go -€1000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit €2000 in one day, then you can afford to lose €4000, but not more than that. Once again, be reminded that your maximum daily loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of €1000 and then you open a new trade that goes into a floating loss of some -€1200 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -€2200 on the equity, which is more than the permitted loss of €2000.

Be careful as the maximum daily loss resets at midnight CE(S)T! Let’s say that one day you had a profit of €600. On the same day, you have an open position with a currently floating loss of €2500. On this day, the maximum daily loss is not violated. The current daily loss is €1900. ( €600 closed profit – €2500 open position). However, if you hold this position with the open loss of €2500 after midnight, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of €2500 exceeds the max daily permitted loss of €2000.

The size of the maximum daily loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why maximum daily loss limit includes your possible floating losses.

You can get more insight into why this rule is in place in this article.

10% of the initial account balance gives trader enough space to prove that his/her account is suitable for the investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% (80% in case of aggressive version) of its value under any circumstance.

For example: if you trade challenge with $100,000 account balance, your profit target is $10,000 in the FTMO challenge and then $5,000 in the verification.

Note that we will provide you with a new free challenge every time you meet all the trading objectives (regardless of whether that is challenge or verification) except for the profit target. To receive the new FTMO challenge for free, your account profit must be positive at the end of the duration with all positions being closed.

Cara buka akun tickmill lengkap

4.96/5 (24) anda hanya memerlukan waktu beberapa menit untuk mendaftar dan buka akun tickmill, langkahnya pun sangat mudah.

Berikut ini tutorial cara daftar akun tickmill lengkap dengan gambar. Silakan lihat di bawah ini:

- Kunjungi halaman resmi tickmill

- Ada 3 jenis akun di tickmill, classic, pro, VIP (untuk contoh, kami menggunakan akun classic)

- Klik “detail akun” pada tipe akun tickmill classic

- Kemudian klik “buka akun”

- Selanjutnya klik tombol “FSA of seychelles”

- Lengkapi data pribadi sesuai dengan data ID anda, setelah itu klik tombol “lanjut ke tahap 2”

- Anda harus melengkapi semua data pribadi anda sesuai dengan data ID anda dan isi beberapa pertanyaan yang harus anda jawab

- Pastikan pada bagian “kode IB” anda isi “IB82498702“

- Setelah anda mengisi semua kolom yang wajib diisi, klik tombol “buka akun”

- Jika data yang anda masukkan sudah benar, maka akan muncul pemberitahuan, bahwa anda telah selesai melakukan registrasi akun tickmill

- Silakan lihat email yang anda masukkan pada saat registrasi, untuk melakukan konfirmasi pendaftaran

- Klik link konfirmasi yang ada di email, maka anda akan dibawa ke halaman client area tickmill

Sampai tahap ini, anda sudah berhasil membuat akun tickmill. Agar anda dapat menggunakannya untuk trading, silakan melakukan validasi akun anda.

Untuk cara validasi akun tickmill, akan dibahas pada artikel selanjutnya.

No deposit bonus, withdraw profits – tickmill

Make your perfect risk-free start with $30 forex no-deposit welcome bonus presented by tickmill. Feel the superior execution quality and the perfect trading environment with no-deposit bonus where no investment involves trading live forex. Besides, withdraw all profit earned traded by non-deposit welcome bonus, with a single condition given below. Each client can open only one account for this welcome no-deposit promotion.

€£$ TICKMILL 30 forex no-deposit welcome bonus

Joining link: get-bonus

Ending date: december 31, 2021

Offer is applicable: new traders with a live account

How to apply:

- Register a client account

- Make a live account under client profile

- Bonus is added after complete the registration.`

Cash out: only profits can be withdrawn as below

- Verify the profile by uploading the required documents.

- Trade 5 lots to withdraw all profits.

- At least a 100 deposit must be made to another live trading account.

Terms – tickmill NO deposit bonus

The bonus is not available for the client of algeria, armenia, australia, azerbaijan, belarus, bulgaria, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

Bonus need to claim within 14 business days from the date of registration.

This forex bonus is available to one per client.

Tickmill $30 no deposit bonus

Tickmill is giving away 30 USD for free to all new MT4 traders!

Experience one of the best trading environments in the industry risk-free with the $30 welcome account.

Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30 welcome account

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and conditions

Tickmill $30 welcome account

Tickmill offers free 30 USD to start trading forex online.

30 USD is available in the “welcome account” which each eligible client can open only one time.

No risks, costs or hidden commissions are involved to the promotion.

Here is how the promotion works for new investors.

- Open tickmill’s welcome account.

- Receive login credentials and login to the MT4 account.

- Start trading forex without risking your own funds.

- Withdraw profit (from $30 to $100) by meeting the criteria.

$30 welcome account is available for all new traders of tickmill!

Tickmill 30 USD no deposit bonus promotion

Here are the main information of tickmill’s $30 no deposit bonus promotion.

| Promotion type | no deposit bonus |

|---|---|

| cost for participation | zero |

| requirement | only account opening |

| trading platform | MT4 (metatrader4) |

| account type | pro |

| bonus withdrawal | not available |

| profit withdrawal | from $30 to $100 can be withdrawn |

Participating in the promotion and getting 30 USD in tickmill’s welcome account costs nothing.

All you need is internet connection and a desktop or mobile phone to trade forex online.

How to get tickmill’s $30 no deposit bonus?

To participate in the promotion and get 30 USD no deposit bonus from tickmill, follow the steps below.

1. Go to the promotion page

Go to tickmill official website and proceed to the main promotion page.

Then proceed to “FSA SC”, “promotions” and “$30 welcome account” as shown in the screenshot below.

2. Fill in the application form

Then fill in the application form available in the page.

3. Receive login credentials

Once your application has been approved, $30 welcome account will be created and login credentials will be sent to your registered email address.

4. Start trading in $30 welcome account

Download MT4 (metatrader4) or access to the web-based platform in tickmill official website.

You can also download mobile applications for android and ios devices.

When trading in $30 welcome account of tickmill, please note the following 4 important rules.

- Use of eas (expert advisers) is prohibited in $30 welcome account

- Arbitrage trading strategy is prohibited.

- The “arbitrage” trading strategy includes hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- $30 welcome account is available for trading for 90 days from the account opening date.

- Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

Fund withdrawal conditions of tickmill $30 welcome account

30 USD no deposit bonus amount itself cannot be withdrawn, but it is available only for trading purpose.

If you have made profits in $30 welcome account, you have an opportunity to transfer the profits to your other MT4 live accounts.

The available amount for profit transfer is from 30 USD to 100 USD.

The requirements for profit transfer are the followings:

- Registration to the client area

- Account verification

you must submit copies of ID and proof of address to complete your verification. - Live account opening

this can be done for free in tickmill’s client area. - $100 minimum deposit

After a deposit is made to a live MT4 account, the client should contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

After the transfer of profit is completed, you can use the amount for both trading and fund withdrawal as you want.

Faqs of tickmill $30 welcome account

Do you have any other questions to ask before participating?

Visit tickmill official website and contact multilingual support available for 24/5.

Tickmill $30 welcome account – terms and conditions

Here are the terms and conditions of the promotion “tickmill $30 welcome account”.

Make sure to read and understand the rules of the promotion before participating.

- The promotion is run by tickmill ltd licensed by FSA SC.

- Tickmill brand is owned and used by multiple companies. If your account is not registered with tickmill ltd, then you may not be able to participate in the promotion.

- The promotion is available for all new traders of tickmill ltd with restrictions of the following countries: algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- Investors residing in european union cannot participate in the promotion.

- Use of expert advisors (eas) in $30 welcome account is prohibited.

- The promotion is available only one time per person.

- $30 welcome account has the same trading conditions as pro account type. For more information about pro account type, please visit the page here.

- $30 welcome account is available for trading for 90 days from the date of account opening.

- $30 welcome account will be disabled after 90 days, but will be still accessible only for profit withdrawal for an additional 30 days.

- $30 welcome account has USD as the base currency.

- Once an eligible client register for the promotion, login credentials of his/her $30 welcome account will be sent to the registered email address.

- Registration and account opening of $30 welcome account does not give the eligible client access to the client portal.

- The profit amount you can transfer from $30 welcome account is limited from $30 to $100.

- Profit withdrawal from $30 welcome account can be done only one time.

- In order to withdraw profits from $30 welcome account, you must register your client profile with tickmill and deposit at least $100.

- Once profit is withdrawn from $30 welcome account, the account will be fully disabled.

- Any profits transferred to live MT4 trading accounts of tickmill can be withdrawn at anytime without limitation.

- You cannot make deposits to $30 welcome account.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Tickmill review

Regulated by: FCA, cysec, seyschelles FSA

Headquarters: united kingdom

Ranking: 7

Spread: 0.1 pips (EURUSD)

Leverage: 500:1

Minimum deposit: $100

Tickmill review & author's comment

Is tickmill reliable?

One of the best CFD and forex brokerage firm, tickmill was launched back in 2011 to provide traders with a great trading experience. With its headquarters located in both UK and seychelles, the company offers its clients a wide range of account choices with respect to the status of tax and location.

The UK headquarters is located in london and the accounts registered to this office are controlled by the financial conduct authority or FCA. The best thing about the UK accounts is that they come with protection up to an amount of £50,000 deposit. Seychelles financial services authority or FSA regulates the seychelles accounts of tickmill.

The best thing about tickmill is that it offers you to trade in a large variety of instruments listed under cfds including four different german government bonds. Apart from the government bonds, you will also be able to trade on more than 62 currency pairs, commodities like gold, silver, crude oil, 15 different equity indices and also bitcoin when with US dollar. As a matter of fact, all the trading instruments are equally available for both UK as well as seychelles accounts. The only difference lies in the requirement of minimum deposit. Furthermore, the maximum leverage that is available for UK accounts is 30 to 1 as per regulations of ESMA. On the contrary, the maximum allowable leverage in seychelles is up to 500.

Tickmill account types

One of the most helpful things that the brokerage firm does is to offer new clients with a demo account which is free of any risk. Apart from the complete access to the MT4 platform, the demo account also provides you with all the assets that can be traded. Apart from that, the demo account also shows the real-life volatility as well as prices to help you to get acquainted with the market.

With tickmill, you will also be able to choose from at least 5 different real money account types.

Out of all the accounts that tickmill offers, the classic account is undoubtedly the most accessible. The classic account is obviously an entry level account which allows you to enter the trade without having to spend much money on deposit or commissions. The minimum amount that you need to deposit is 100 of whatever the base currency you choose. The maximum leverage that you can obtain from this account type is 1:500 with the spread starting from 1.6 pips. Furthermore, the trade execution on this account type is of NDD variety.

The pro account type, on the other hand, provides you with a much-improved spread. While you need to pay a commission of 2 per side on every lot, the spread starts from 0 pips with a maximum leverage of 1:500.

If you can manage to maintain a minimum balance of 50,000 base currency then you are qualified enough to open a VIP account. While the commission for this account is just 1 for every side and every lot, the spread starts from 0 pips and the maximum leverage is 1:500 too.

Tickmill also allows traders to become professional clients if they can log high trading volumes. However, there are a few conditions that you must fulfil to become a professional client.

First of all, you need to have a very impressive portfolio which needs to exceed the amount of EUR 500,000. Secondly, you need to have a trading volume of 10 trades in every quarter over the past four quarters. Lastly, you need to have a working experience of at least a year in the financial sector to become a professional client of tickmill.

Tickmill also allows you to open an islamic account which is fully compliant to the sharia law. To have an islamic account, you will have to open any of the aforementioned accounts and request the brokerage to convert it into an islamic account. The trading conditions for the islamic accounts are same as the previously mentioned account types.

Tickmill customer support

Tickmill is especially popular for its extraordinary customer support. It offers you with robust customer support in 14 different languages through phone calls, live chat, social media, email and call back request.

The support team takes only 5 minutes to respond to live chat. On the other hand, it usually takes an hour to get responded on the social media posts. Furthermore, the callback requests are obviously attended within the same business day. So, you will not have to worry about getting helped by the support team.

Tickmill trading platforms

Similar to several other forex brokers, tickmill also provides you with highly advanced as well as user-friendly MT4 trading platform which is also available in mac as well as windows OS, android, ios and web-based versions.

MT4 has undoubtedly remained the most popular trading platform since 2005. This trading platform offers you a completely user-friendly interface along with all the tools that you require including technical indicators, charting packages, expert advisors and a highly advanced backtesting environment.

Moreover, tickmill has also collaborated with myfxbook to provide you with advanced trading options through the autotrade platform. The brokerage also offers their clients with VPS service so that they can install their preferred eas and run them on any device. You will be able to acquire the VPS package at an expense of £20 per month.

Tickmill deposit and withdrawal methods

If you have an account in tickmill then you will be able to deposit and withdraw money through different channels.

The very first option that you will be able to use is the debit or credit cards. The thing that you need to note here is that only the cards issued by visa and mastercard are allowed. And it usually takes about one business day to process the payment.

You will also be able to deposit money through wire transfers. Moreover, the vietnamese and thai clients of tickmill’s seychelles branch are provided with the option of instant online bank transfers.

You will also be able to deposit money through skrill, neteller, paysafecard, fasapay, china unionpay, dotpay, qiwi wallet, nganluong and globepay. Out of these e-wallet options, dotpay, skrill and neteller are available on a global scale. Other options are specific to the clients of seychelles.

The best thing about tickmill is that it does not charge anything on withdrawals and deposits. Moreover, the lowest amount that can be withdrawn is $10.

Tickmill bonus and promotions

- $30 welcome bonus – $30 bonus shall be credited to your trading account when you open a real account. You do not have to deposit any more to get this bonus and the profits are withdrawable.

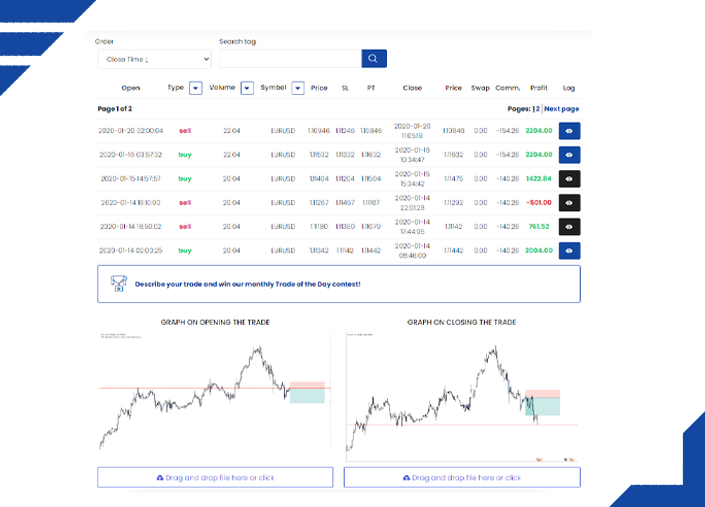

- Trader of the month – tickmill chooses the best among existing clients and award the best performing trader with a $1,000 prize every month.

- Tickmill NFP contest – during every NFP week, tickmill chooses one instrument during every US non-farm payroll week and challenges traders to guess its price in MT4 platform at 16:00 which is 30 minutes after the NFP release. An exact hit shall be rewarded with a $500 bonus. In case of no exact hit, the trader with the closest prediction will get a $200 prize.

Tickmill final word

The brokerage understands that trading conditions are not similar across the globe. Thus, they have modified the offerings as per the location and economic conditions of their clients. Tickmill allows the traders to trade with tickmill seychelles if they need high leverage. And those who can comply with the regulations of ESMA can obviously join the UK or europe branch of the brokerage. In other words, you will be able to achieve complete flexibility as a trader with tickmill.

Tickmill – step by step live account opening guide

In this section, I will guide you through the account opening process in order to be able to make the deposit and start trading at tickmill. There are two major steps which are very easy and should not take more than several minutes

Step 1 – fill the registration form

First of all, you have to choose the regulator that your live account is going to be registered to. The clients living outside european union should select FSA of seychelles whereas european clients should proceed with FCA of the united kingdom regulator.

Registration form requires you to submit your basic personal information such as country, name, last name, phone number, e-mail and date of birth. All the information must be correct so that you will need to verify this information later.

So, let's see, what we have: tickmill login client area IC markets does not accept applications from residents of the U.S, canada, israel and islamic republic of iran. The information on this site is not directed at at tickmill login client area

Contents of the article

- Free forex bonuses

- Tickmill login client area

- Tickmill login client area

- Tickmill login client area

- Tickmill login client area

- Trade for proprietary trading firm

- We fund good traders

- Evaluation process

- FTMO challenge

- Verification

- FTMO trader

- Know your trading objectives

- Cara buka akun tickmill lengkap

- No deposit bonus, withdraw profits – tickmill

- €£$ TICKMILL 30 forex no-deposit welcome bonus

- Tickmill $30 no deposit bonus

- Tickmill is giving away 30 USD for free to all...

- Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30...

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and...

- Tickmill 30$ welcome bonus (no deposit required)

- Tickmill review

- Regulated by: FCA, cysec,...

- Headquarters: united kingdom

- Ranking: 7

- Spread: 0.1 pips (EURUSD)

- Leverage: 500:1

- Minimum deposit: $100

- Tickmill review & author's comment

- Is tickmill reliable?

- Tickmill account types

- Tickmill customer support

- Tickmill trading platforms

- Tickmill deposit and withdrawal methods

- Tickmill bonus and promotions

- Tickmill final word

- Tickmill – step by step live account opening guide

- Step 1 – fill the registration form

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.