Forex 100 to 1000

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly.

Free forex bonuses

This can help you turn $100 to over $1000 and may help you get to one million dollars in three years! 100:1 = 100 times the funds in your account

Forex 100 to 1000

How to turn $100 to $1000 or more trading forex

Turning $100 to $1000 or more trading forex

To be a successful trader, you need to understand how leverage works . It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to point of no return. Although, if the trade works to your favor, you can gain significantly.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “possible” but not easy! And is always risky.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to turn $100 to $1000 or more

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA , easymarkets and XM .

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

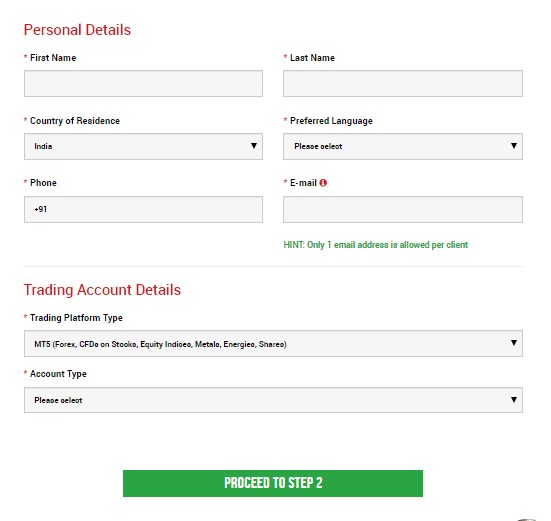

Step 2: filling the personal details

Fill all the box with accurate details

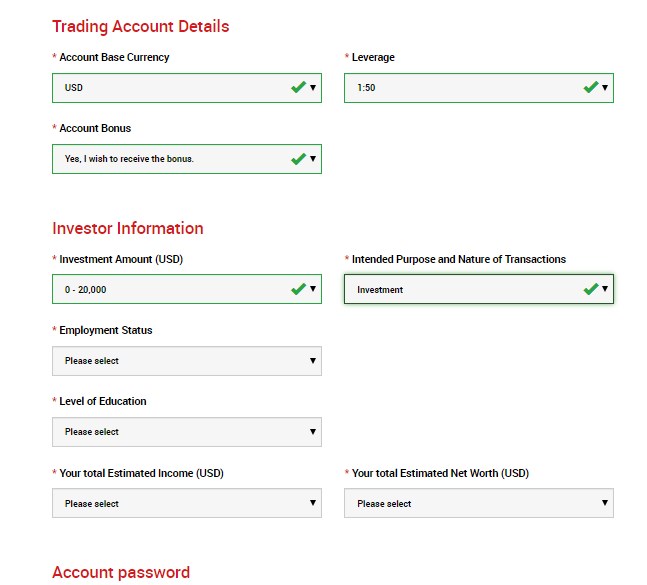

Step 3: investor information & trading account details

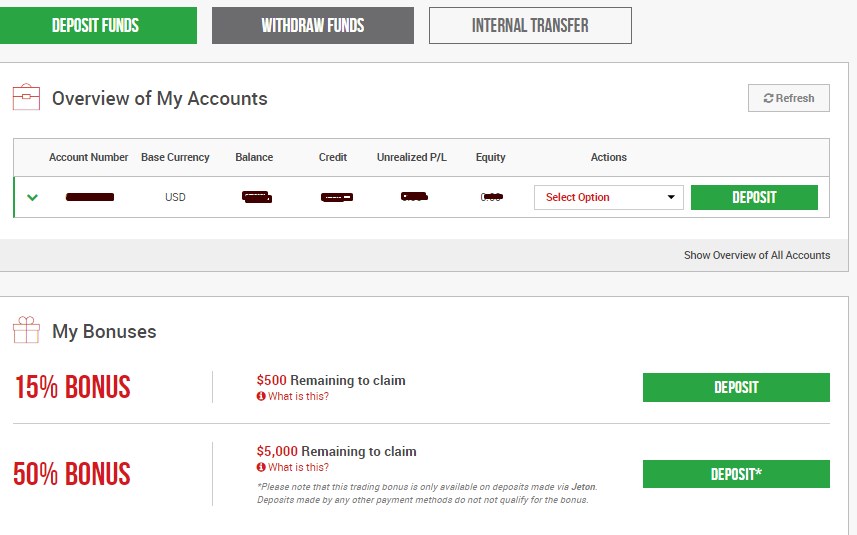

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

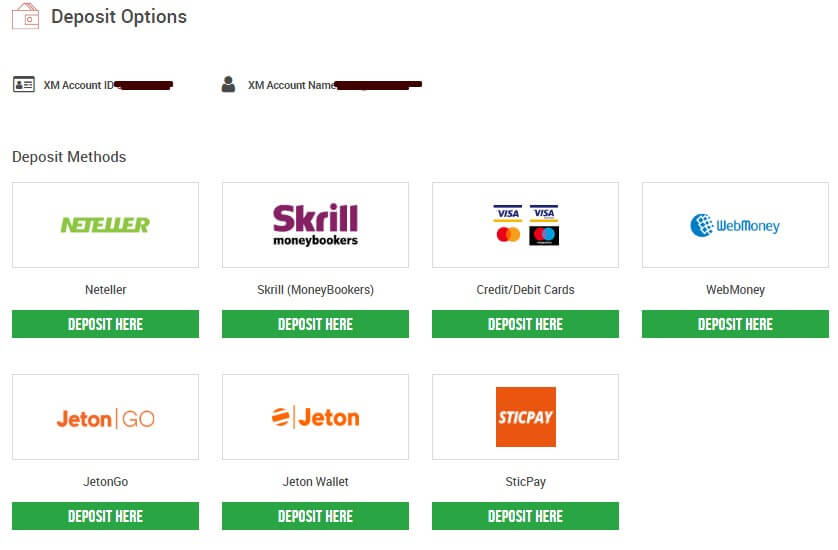

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

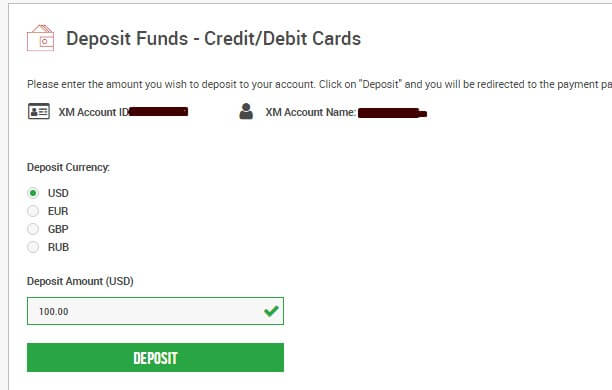

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

Forex 100 to 1000

The highest leverage reputable forex brokers in 2021

There are forex brokers in the industry offering very high leverage such as 1:1000, 1:2000, or even 1:3000. I’ve looked into more than 400 forex brokers in the industry to find the highest leverage among reputable forex brokers. After finding them, I examined their leverages from different angles.

Although you can find very high leverages such as 1:2000 or 1:3000 there are some limitations for such leverages. One of them is that the high leverage is limited to the size of your account; the larger size account is the lower leverage you get.

There are also some limitations for some countries regarding the regulation. Some regulatory bodies don’t allow brokers to offer high leverages.

Other than all that, very high leverages such as 1:1000 or above are not for all trading instruments and are mostly offered for major forex pairs.

So before introducing forex brokers offering the highest leverage, let’s talk about these limitations more.

You'll see in this article:

Forex brokers’ limitations on high leverage

As I mentioned earlier, offering high leverage by forex brokers doesn’t mean that forex brokers give such high leverages to everyone or in all situations. There are some exceptions that I’ve categorized them based on my experience and of course an extra study that I’ve done.

These are the areas that forex brokers may not offer their highest leverage:

Account size

When a broker offers 1:1000 or 1:2000 as leverage, it doesn’t mean that you can use such leverages with any size of accounts and there’s a leverage structure for that.

With larger size accounts, you receive lower leverage and the high leverage of brokers is offered to smaller size accounts.

For instance, up to $200, you can use a leverage of 1:3000. From $200 to $3000, a leverage of 1:2000 is available. From $3000 to $10000, you can use 1:1000 and so on.

This kind of structure is similar among all the highest leverage forex brokers to a great extent and you can’t find any broker that offers very high leverage to large size accounts, however, there are small differences.

For example, broker A offers a leverage of 1:2000 to the account size of up to $2000 while broker B offers the same leverage to traders who want to open an account of $3000 or less.

Given all that, you may want to check out the leverage structure of the brokers to pick the one that suits you the best.

Lot size (notional value)

Some forex brokers don’t consider the size of accounts as a factor for offering high leverage. Instead, they put limits on the lot size or the amount of money that you use for trades. They calculate that based on notional value.

For instance, if the notional value is less than 50000, you can use 1:2000 as leverage; between 50000 and 2000000, you can use 1:1000; and etc.

The notional value is calculated by this formula:

The contract size for one lot of forex pairs is 100000 — for mini lot is equal to 10000 and for micro lot, it’s 1000.

For CFD shares it’s normally 1 and for gold the contract size is usually 100.

Let’s clear that up with an example…

Let’s say that a forex broker offers a lever of 1:2000 if the notional value is up to 50000. You want to buy 2 mini lots (0.2 lots) of EUR/USD and the price of this pair is at 1.1755. According to the formula, the notional value here is:

Since 11755 type of account

As you might know, forex brokers offer different types of accounts such as micro, STP that has floating spread and no commission, fixed spread, ECN, and etc.

For example, a broker might offer 1:2000 as its maximum leverage to its STP or micro/cent account but the max leverage for its ECN type of account is 1:500.

So when you need very high leverage, you may want to choose the type of account that has the highest leverage.

Trading instruments

As you probably know, forex brokers don’t just offer forex or currency pairs. There are other trading instruments such as indices, shares or stocks, metals, cryptocurrencies, and etc.

Every type of trading instrument comes with different max leverage. Forex brokers don’t offer the same leverage even for all forex pairs. For instance, you can use the highest leverage for the major currency pairs and minor or exotic pairs are offered with lower leverage.

As a rule of thumb the more liquid and less volatile the higher leverage. In other words, you are offered the highest leverage for the pairs that are traded the most and aren’t too volatile, which means they don’t make large moves in a short period of time.

For instance, crypto currencies, exotic pairs, and CFD stocks are too volatile and are traded less so brokers offer lower leverage for them — normally lower than 1:10 or 1:20.

As a result, you should consider the brokers with the highest leverage on the trading instruments that you trade.

Regulation

The factors that we’ve talked about so far are related to the terms and conditions that forex brokers set for their high leverage offers but there’s an external factor that makes brokers decrease leverage for retail traders in some areas or countries.

Some forex financial bodies that regulate and watch forex brokers don’t allow them to offer high leverage to retail traders. The simple reason behind that is since trading on leverage can potentially make people lose a lot of money quickly and a majority of retail traders are prone to do so, therefore, lower leverage is in their best interest.

As a result, retail traders can’t use high leverage if they register with a broker or a branch of a broker that is registered under an EU regulatory body such as FCA (the UK regulator), cysec (the cyprus securities and exchange commission), or any other european regulators. It’s the same for US retail traders who want to open an account with a forex broker regulated in the USA by american regulatory bodies, CFTC and NFA.

The maximum leverage that you can get when you open an account with an EU regulated broker is 1:30 and it’s 1:50 if you’re an american retail trader using a US regulated broker.

The maximum leverage is a lot higher for the forex brokers regulated in other parts of the world. For instance, if you go with an ASIC (australian regulator) regulated broker, you can use a maximum leverage of 1:400 and if brokers are regulated by one of the international regulatory bodies, you can receive a very high leverage of 1:3000 from some of them.

OK, now you’re telling me that I can’t use high leverage if I’m an EU or a US resident?!

You can still use that kind of high leverage forx brokers in some conditions.

How can EU forex traders use high leverage?

As we already know, you can’t use higher than 1:30 as leverage if you are an EU resident having an account in a broker under an EU regulatory body.

The 1:30 is the maximum leverage that brokers can offer for major currency pairs (EURUSD, GBPUSD, USDCHF, USDJPY, NZDUSD, AUDUSD, and USDCAD) according to ESMA (the european securities and markets authority) measures on the provision of contracts for differences (cfds) and binary options to retail investors.

It’s even lower for non-major forex pairs or other trading instruments:

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices ;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies;

However, there are two ways that you can use very high leverage as an EU trader.

Become qualified as EPC

First, all that we’ve said so far are related to retail traders so what if you’re a professional trader? Are you still limited to 1:30 if you’re a professional trader?

The answer is no. EU regulators allow forex brokers to offer higher leverage to their professional clients, however, the leverage is not the highest ones — the max that I’ve seen is 1:500.

The question here is how you can qualify as a professional trader or EPC (elective professional clients)?

According to FCA, a trader is considered as EPC if he/she meets at least 2 of these 3 criteria:

- The client has carried out transactions, in significant size, on the relevant market at an average frequency of 10 per quarter over the previous four quarters

- The size of the client’s financial instrument portfolio, defined as including cash deposits and financial instruments, exceeds EUR 500,000

- The client works or has worked in the financial sector for at least one year in a professional position, which requires knowledge of the transactions or services envisaged

It basically means that you need to have a statement of 40 trades with large lot sizes in the past year and your investment must be at least € 500000 whether in forex or out of it such as stocks or savings — property portfolios are not included.

Well, as you can see this is not a viable option for many EU traders who want to use high leverage so if you’re one of them, you can pick the next option.

Use an offshore forex broker

The easiest way that you can apply to have access to high leverage as an EU or UK trader is to use an offshore forex broker or register under an offshore regulation of a broker.

Almost all the forex brokers that aren’t regulated or they have a regulation from agencies that have less strict regulations such as FSA (seychelles), IFSC (belize), BVIFSC (british virgin islands), and some others accept EU residents and allow them to use leverages like 1:1000, 2000, or even 3000.

There are even forex brokers that are regulated by some EU or UK regulators but since they are also regulated by offshore regulatory bodies, you can register with their offshore branch and use some offers such as the highest leverages.

For instance, you live in the UK and want to open an account with a forex broker that is regulated by both FCA and IFSC. If you register with their UK branch, you’re under the regulation of FCA so the maximum leverage that you can use is 1:30. On the other hand, if you open an account with their belize branch, you’re under the rules and regulation of IFSC that allows high leverage so you can use very high leverage such as 1:1000 and higher.

How can US forex traders use high leverage?

As it’s mentioned early on, the maximum leverage offered by US-regulated forex brokers, AKA NFA regulated brokers, is 1:50 which I think is more than enough for many traders. But you may want to need more leverage for any reason whether it’s because you open lots of positions at the same time or you use eas such as grid or martingale strategies, and etc.

For whatever reason that you need more leverage, your options are the same as EU traders which means either you need to be a professional trader or go offshore; however, your choices for offshore forex brokers are limited and are not as wide as EU traders.

There are lots of reputable offshore brokers for EU residents but when it comes to US residents, a handful of them accept US clients.

I’ve done a broad search and a comprehensive study on offshore forex brokers accepting US clients that you can find in this post.

Which forex broker has the highest leverage?

FBS, alpari, and justforex offer the highest leverage in the industry, which is 1:3000; however, this kind of leverage is limited to some conditions.

For instance, it’s available in FBS and justforex for the accounts with the equity of $200 or lower — above that amount, it will be adjusted and lowered. In alpari, you can use such a leverage with a maximum lot size of around one standard lot, more or less (see lot size section).

This condition is better when you want to use 1:2000 as leverage. Roboforex has the best situation in this case and you can use such a leverage for the accounts with the equity of up to $5000.

It’s worth noting that this kind of very high leverage is related to currency pairs, specifically major ones. For minor forex pairs or other trading instruments such as indices, CFD stocks, cryptos and etc.; the leverage is lower.

List of forex brokers with the highest leverage

In the following table, you can find all the reputable forex brokers offering the highest leverage in the industry.

There are some sections about the leverage of the brokers that we’ve talked about in detail in this article.

See the following sections for them:

STP,

ECN, copy trading,

fixed spread, islamic

Forex 100 to 1000

Forex 100 to 1000. Our site gives you recommendations for downloading video that fits your interests. You can also share trade with indian rich forex trader video videos that you like on your facebook account, find more fantastic video from your friends and share your ideas with your friends about the videos that interest you.

Duration: 22:41. Views: 99000+

Duration: 10:18. Views: 5000+

Duration: 04:45. Views: 6000+

Duration: 14:09. Views: 1000+

Duration: 06:58. Views: 12000+

You can search your forex 100 to 1000 or your favourite videos from our video database, youtube, facebook and more than 5000+ online video sites, then download the best quality video for free. Now you can download forex 100 to 1000 videos or full videos anytime from your smartphones and save video to your cloud. You can also be able to collect playlist and download videos you like whenever you want. We also collect and upload classify song playlist information related to the genres, which helps you to find beautiful videos easily.

Don't forget to share or bookmark this page for future references. Localhost is a popular and free video download search engine. Just type your search query (like forex 100 to 1000 movie/video), and our site will find results matching your keywords, then display a list of video download links. Fast & simple.

Fxdailyreport.Com

The advantages of trading with high leverage brokers can make the mouths of even the most experienced traders water. The sheer unpredictability with which positions emerge and the appeal of massive gains from relatively minimal capital investment make it an exciting world to do business. But just as the gains are sweet, trouble is real when trading with high leverage forex brokers. In fact, there have been rising calls amongst international regulators looking to clamp down on the less savvy consumer.

This is to stop traders from investing their life savings without a comprehensive understanding of the pros and cons of this intricate and potentially high-risk investment strategy. That said, here is a comprehensive list of the pros and cons of trading with high leverage forex brokers.

10 best forex brokers with highest leverage

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

Before we delve into the pros and cons, it is worth explaining what leverage is.

What is leverage ?

Leverage is a service offered by forex brokers. It allows FX traders to place orders that are significantly higher than their actual deposit. This, in turn, helps them achieve higher profits in the market. In the same way, when using leverage, the traders risk losing their deposit faster.

Pros of trading with high leverage forex brokers

The first and most obvious benefit of trading with high leverage forex brokers is that it earns you more money for less effort. Regardless of the nature of the instrument being traded or whether you are staking a small or large amount, the key role of high leverage brokers is to increase your profit by multiplying the stakes. Although the same effect could be achieved by investing more capital in each position, leverage works to ensure it is a step ahead in artificially boosting your available capital, usually by hundreds or even a thousand times.

- Increases capital efficiency

In conjunction with the point above, high leverage forex brokers give you the ability to earn high profits per transaction, naturally increasing the efficiency with which you are using your capital. For instance, if it takes you a week to generate $100 with an unleveraged position, leveraging it up means it will take a shorter period to deliver the same results.

In essence, this means that your capital and revenues will be freed up sooner and can be reinvested more times to deliver the most significant and fastest yields possible.

- Trading with low capital

A few years back, only the wealthy could make a profit through forex trading. This is until the introduction of leverage which allows anyone to do it. Leverage allows traders to start trading without having to provide large amounts of funds.

- Eases low volatility

Another important benefit of higher leverage forex trading is its ability to mitigate against low volatility. A volatile trade is one that delivers the highest profits. Unfortunately, due to the cautious nature of forex market traders, volatility tends to be at the lowest end of the scale. High leverage mitigates this by offering larger profits from smaller transaction sizes. High leverages allow traders to capitalize on even the smallest degrees of movement in market pricing.

High leverage FX brokers are the true double-edged sword. When they work for you, they really work for you. But when they turn against your position, trading with them can do some serious damage to your finances within the blink of an eye. Therefore, it is important that as a trader you also understand the disadvantages of trading forex with high leverage brokers.

- Heavier loss risks

The main disadvantage of using high leverage brokers in trading is that it carries a high amount of risk by paving the way for heavy losses. The goal of leveraging is simply upping your ante so that you are essentially playing with more money. Hence, when the games are up and done, you keep huge profits but also bear the losses.

High leverage can end up costing you a lot more than you bargained for, especially when your positions inevitably head south time and again. It is important to know that the higher the leverage you are trading with, the larger your chances of profit and loss are.

- A constant liability

When trading forex, it is crucial to understand that leveraging automatically builds a liability that must be met by your account by the end of the day. Regardless of whether a transaction is up or down, or how many additional costs you have covered at the end of the day, the basic cost must be met and will automatically be applied to your account.

This means that by simply entering into a position, you are by default handicapped since you will need to meet the automatic liability of the leverage portion at the close of the trade. Even if the transaction eventually trends towards zero, the leverage amount will still be owed and must be paid before you can move forward.

Any leveraged trade earns a higher cost. The funding applied to your position must be paid for in terms of interest. Whenever you leverage your transaction, you are essentially borrowing money from your broker and will be required to pay with interest. This interest is calculated and applied daily depending on the rates set by your broker.

Note that the higher the leverage amounts in the trade, the more interest you will incur and the commission the broker will charge to open the contract.

There is also the ever-present risk of falling below the margin requirements set by your broker. The margin call is the set percentage of any transaction size you are required to fulfill in terms of your own capital. If at any time you fall below that threshold, you can expect your brokers to prompt the margin call, which automatically liquidates your portfolio as far as meeting your obligations is concerned.

This could mean that any standing positions that could have run on to deliver massive profits are closed out early in addition to settling losing positions that may never recover.

The bottom line

when managed well, trading with high leverage brokers can be a successful and profitable move. Just make sure to never use high leverage if you are taking a hands-off approach to your trades.

Top 100 forex brokers

How to select the top 100 forex brokers?

Top 100 forex brokers are listed by payment methods,spread,trading platform,acount type.There are so many forex brokers online.If we want to choose a best forex broker that we wishthen we need to compare its spread,leverage,payment methods,even whether the broker allows us trade GOLD,silver,stock,CFD on.We all want a truested and reliable forex broker,in that case,we need do this forex broker comparison carefully.Just for a top forex broker to start our trading journey in the forex market.

| Broker | min. Deposit | max. Leverage | min. Trade | execution | MT4 | spreads | commission | hedging | US clients |

| 5 USD | 1000:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 1 USD | 1000:1 | .01 lot | ECN | Y | details | N | Y | N | |

| 5 USD | 888:1 | .01 lot | STP | Y | details | N | Y | N | |

| 1 USD | 2000:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 5 USD | 1000:1 | .01 lot | ECN | Y | details | N | Y | N | |

| 100 USD | 500:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 200 USD | 500:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 500 USD | 500:1 | .01 lot | STP | Y | details | N | Y | N | |

| 10 USD | 500:1 | .01 lot | NDD/STP | Y | details | N | Y | N | |

| 10 USD | 500:1 | .01 lot | market maker | Y | details | N | Y | Y | |

| 25 USD | 400:1 | .01 lot | market maker | Y | details | N | Y | Y | |

| 1 USD | 500:1 | .001 lot | STP/ECN | Y | details | N | Y | N | |

| 100 USD | 400:1 | .01 lot | market maker (MM) | Y | details | N | Y | N | |

| 5 USD | 500:1 | .01 lot | ECN | Y | details | N | Y | N | |

| 100 USD | 200:1 | .01 lot | market maker | Y | fixed floating | N | Y | N | |

| 1 USD | 500:1 | .0001 lot | market maker | Y | details | N | Y | N | |

| 300 USD | 200:1 | .01 lot | ECN/STP | Y | details | Y/N | Y | N | |

| 50 USD | 400:1 | .01 lot | ECN/STP | Y | details | N | Y | Y | |

| 50 USD | 200:1 | .1 lot | ECN/STP | Y | details | N | Y | Y | |

| 500 USD | 500:1 | .1 lot | maket maker/ECN | Y | details | N | Y | N | |

| 500 USD | 500:1 | .01 lot | STP | Y | details | N | Y | N | |

| 5 USD | 1000:1 | .01 lot | ECN/STP | Y | details | N | Y | N | |

| 25 USD | 500:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 1 USD | 500:1 | .01 lot | STP/ECN | Y | details | N | Y | N | |

| 250 USD | 200:1 | .01 lot | ECN/STP | Y | details | N | Y | N | |

| 10 USD | 500:1 | .01 lot | ECN/STP | Y | details | N | Y | N |

* figures subject to change without notice. Please visit individual broker website for the most current information.

Leverage up to 1:1000

Features of trading with the increased leverage:

New trading opportunities

Operations with the bigger trading volume without making any additional investments to your trading account. It’s the opportunity to move to a higher level of trading on forex.

More available funds, even if you have open positions

The increased leverage will reduce the margin requirements for open positions and you’ll have more available funds on your account.

Higher "drawdown" resistance

Lower margin requirements require less funds to maintain open positions.

Change your leverage in your members area

without stopping your trading operations

Choose the increased leverage when

registering a new account

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

So, let's see, what we have: turning $100 to $1000 or more trading forex. To be a successful trader, you need to understand how leverage works. It is very essential. At forex 100 to 1000

Contents of the article

- Free forex bonuses

- Forex 100 to 1000

- Turning $100 to $1000 or more trading forex

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- Forex 100 to 1000

- The highest leverage reputable forex brokers in...

- Forex brokers’ limitations on high leverage

- How can EU forex traders use high leverage?

- How can US forex traders use high leverage?

- Which forex broker has the highest leverage?

- List of forex brokers with the highest leverage

- Forex 100 to 1000

- Fxdailyreport.Com

- 10 best forex brokers with highest leverage

- Top 100 forex brokers

- How to select the top 100 forex brokers?

- Leverage up to 1:1000

- Features of trading with the increased leverage:

- New trading opportunities

- More available funds, even if you have open...

- Higher "drawdown" resistance

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- Features of trading with the increased leverage:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.