Free trading capital

It’s the free version of our premium buy sell volume indicator. With this indicator you can see only buy volume plotted on your chart.

Free forex bonuses

Normally with traditional volume indicators, you can plot total volume. But with this indicator, you can plot only buy volume to give you better insights of the market. If there is high buy volume, possibly institutional players have placed buy orders for the instrument – try for yourself. This is one of the most widely used trend indicators for all types of traders to understand the overall market trend across short and long term time frames. And also, you will have a clear idea about current position of the market within that over all trend. Good number of traders have developed strategies with this type of indicator – use it for FREE for lifetime.

Free

indicators FOR YOUR TRADING

You can download and use FREE indicators below to help you with your trading decisions. These can be used for day trading, swing trading and for long-term position trading as well; unless mentioned otherwise for that specific indicator.

TRY ALL THESE FREE INDICATORS

All these indicators are always free to use for lifetime. You PAY NOTHING for your subscription.

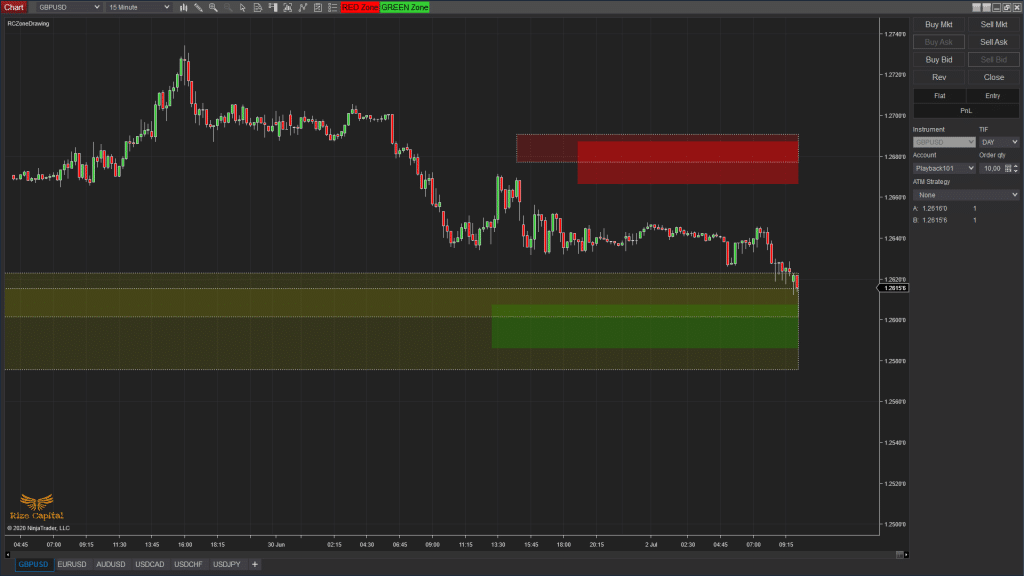

Zone drawing - FREE indicator

This amazing free for lifetime indicator will help any trader or investor who loves to draw support/ resistance or supply/ demand or any other type of zone on chart for trading and investment decisions. This free indicator will draw other time frame zones on a single lower time frame chart to give you entire view of the market for ninjatrader 8 platform. GET this indicator for FREE NOW.

Free multi time frame trend line - FREE indicator

Highly popular and very useful for your trading and investment analysis. With this indicator for NT8, you can plot and view all different high and lower time frame trends in the market at a glance by drawing trend lines. This indicator is completely FREE for life time. You can see all different time frame trends being on just any one time frame chart for entire market view. Why don’t you GET this indicator for FREE NOW?

Initial balance with extension levels - FREE indicator

This indicator shows initial balance for the session and plots highly likely levels on both sides of the initial balance from where market is going to turnaround or react significantly. Really useful indicator, if you want to know early the levels for the day so that you can plan your trades beforehand. Also you can use it for swing trading to see the regular behaviour of the market levels – we are offering it for FREE for lifetime.

Daily deviation counter - FREE indicator

This indicator is really useful for day trading. If you want to see how far market has deviated for the day in ticks. If it’s extended too high, probably you want to be mindful before you buy. Because market is already stretched too much high, it may be wiser to sell with less risk with more odds in your favour. Opposite for the low. It will help you to find sweet spots for placing trades for the day – use it for FREE.

Buy volume only - FREE indicator

It’s the free version of our premium buy sell volume indicator. With this indicator you can see only buy volume plotted on your chart. Normally with traditional volume indicators, you can plot total volume. But with this indicator, you can plot only buy volume to give you better insights of the market. If there is high buy volume, possibly institutional players have placed buy orders for the instrument – try for yourself.

Multiple emas - FREE indicator

This is one of the most widely used trend indicators for all types of traders to understand the overall market trend across short and long term time frames. And also, you will have a clear idea about current position of the market within that over all trend. Good number of traders have developed strategies with this type of indicator – use it for FREE for lifetime.

TDI - FREE indicator

Traders dynamic index -TDI, is a well known and vastly used indicator by professional traders around the world. This free TDI indicator for ninjatrader 8 is available now to use for your trading strategies, like lots of professional traders do. This indicator shows you market trend with short term possible entries and exit points – we are offering it for FREE for lifetime.

Daily change - FREE indicator

This free indicator is very useful, if you trade based on daily market change. It shows daily market changes in percentage. If you change the instrument, it updates it’s calculation automatically; so that you can make real quick decisions about your trading and investment. You will never pay for this indicator developed for NT8. Why don’t you download and use it now FREE.

Get every month

By registering and subscribing to our

Subscribe here for our offers / discounts/ bonus/ promotions

Not ready to subscribe yet, join us for free to explore more

With free account, you can visit different parts of this website. You can get free indicators, strategies, videos and free bonuses. There is nothing to lose with free account.

Registered address

Registered in england and wales. Registration # 12039916

20-22 wenlock road, london

N1 7GU united kingdom

Information

Follow us

Resources

Risk disclosure: an investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical performance disclosure: hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Testimonials: testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Live trade room: this presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Trading capital

Get funded trading stocks, futures and forex.

Get the right amount of trading capital to earn profits in day trading.

Each and every trader in your trading office can trade with:

For NYSE (AMEX), NASDAQ, toronto stock exchange, chicago stock exchange, bovespa, and all the other american markets.

$50K for NYSE (AMEX), NASDAQ,toronto stock exchange, chicago stock exchange, bovespa and all other US markets.

$400K for the forex market.

And that's just the beginning. With better performance, each trader can easily get higher trading capital.

We give generous trading capital, please ask us for updated figures. Buying power limit increases can be requested as a trader's performance improves.

Note: these figures can change. Contact us today for updated figures.

How much capital should I budget to run an effective and efficient trading office?

If you provide me with your capital to trade, how will you trust me if you don’t know me or if I don’t have any experience?

What kind of buying power can a trader receive to start?

Live trading with DTTW™ on youtube

DTTW ™ is proud to be the lead sponsor of tradertv.LIVE ™ , the fastest-growing day trading channel on youtube. With over 150k subscribers in less than a year, tradertv.LIVE ™ features a daily live trading broadcast, professional education and an active community.

Training for new managers

Trading floor development

Market wisdom on youtube

Accepted payment methods:

Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, united states citizens or residents are kindly asked to leave this website.

© 2011-2020 day trade the world™ all rights reserved.

Best free stock trading brokers of 2021

Disclosure: thesimpledollar.Com has an advertising relationship with some of the offers included on this page. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. For more information, please check out our full advertising disclosure. The offers that appear on this site are from companies from which thesimpledollar.Com receives compensation. All products are presented without warranty and all opinions expressed are our own.

Trading stocks used to be difficult for newer investors or people with smaller portfolios to make a profit. Any hopes of gains would evaporate when it was time to pay the transaction fees on purchases and sales. However, that’s all changed with the new trend of free stock trading sweeping the industry. Investors can now make commission-free stock trades through online brokerage firms. The best free trading platforms offer no commissions, no membership fees, helpful research resources and user-friendly websites and apps that cater to investors of all skill levels.

Featured stock brokers

The 7 best free stock trading brokers of 2021

- Robinhood: best for beginners

- Charles schwab: best for buy-and-hold

- E*TRADE: best for active traders

- Fidelity: best mobile app

- Merrill edge: best for self-directed investors

- Interactive brokers: best desktop platform

- TD ameritrade: best educational resources

Best free stock trading brokers at a glance

| provider | mobile app rating | self-directed, robo or advisor? | Key benefit |

|---|---|---|---|

| robinhood | 3.75/5 | self-directed | cash not invested earns 0.30% APY |

| charles schwab | 4.6/5 | self-directed and advisor | widest array of additional products |

| E*TRADE | 4.1/5 | self-directed, robo and advisor | no fees for mutual funds |

| fidelity | 4.6/5 | self-directed, robo and advisor | margin rates starting at 5.00% |

| merrill edge | 4.35/5 | self-directed and advisor | integrates with bank of america banking |

| interactive brokers | 3.5/5 | robo | invest in global stocks |

| TD ameritrade | 4.0/5 | self-directed, robo and advisor | multiple innovate account management tools |

Best for beginners – robinhood

Although robinhood has made a name for itself in recent years, its lack of customer support and market insight make it more of a back-up option than first-choice investing platform.

Robinhood offers fee-free stock trades, fractional shares and informative resources for beginners as well as options for seasoned investors.

Robinhood offers several great benefits for beginner investors on its commission-free trading platform. One of the biggest standout features of robinhood for beginners is fractional shares, a feature recently rolled out on the platform to all customers. This will allow smaller investors to get involved and not have to sacrifice diversification. On top of all this, your cash that’s in your account uninvested will earn 0.30% APY and comes with a debit card to access it.

However, robinhood’s customer support is lacking — customers can only fill out a form online to reach out with issues. Its platform also experienced serious downtime in march 2020, causing many people to miss out on opportune stock trading for almost three days.

Best for buy-and-hold – charles schwab

High customer satisfaction and a bevy of investing products ranks charles schwab high in our review. However, high minimum deposits may keep beginners from starting with this firm.

Charles schwab offers a limited number of fee-free trades on stocks and etfs ideal for lower volume traders.

Investors looking for fee-free trades will be able to get them through charles schwab. However, there are some limitations. You will need to invest at least $100,000 into your trading account. This may limit a lot of investors from being able to take advantage of fee-free trading. Additionally, the program is limited to 500 equity or options trades good for the next two years. Compared to some of the other free trade brokers, this is rather limiting. But if you have the money to open the account and are planning on holding a lot of your equities for a while, it may work for you.

If you’re looking for a broker that offers additional services, though, charles schwab could be a good fit. The bank has a laundry list of additional services all the way from bank accounts to retirement accounts to managing trusts. Charles schwab could be best for people looking for all of their banking needs in one location.

Best for active traders – E*TRADE

Known for being a great platform for day traders, E*TRADE makes it easy to stay updated on market news and research. Coupled with no account minimums, customers can get started easily.

E*TRADE offers commission-free trades on stocks, mutual funds and etfs with no caps on how many trades you can make.

Active traders looking for uncapped commission-free trades should check out E*TRADE. The company has no limits on the number of trades you can make on stocks, etfs and mutual funds. E*TRADE’s expansive learning library not only has great articles for beginners, but the company also includes many resources for advanced training.

E*TRADE offers all three forms of stock investing — self-directed, robo and dedicated advisors. Whatever level of involvement you want with your account, it can be achieved through the platform.

Best mobile app – fidelity

Fidelity scores high due to its high customer satisfaction from J.D. Power and robust, easy-to-navigate mobile app. This brokerage account is highly recommended as a great platform to start investing.

Fidelity delivers investors a high-quality mobile app allowing for unlimited commission-free trades on stocks, etfs and options.

Fidelity is a well-rounded option for investors looking to cash in on commission-free trades. The company offers self-directed, robo advisor and dedicated advisor support for whatever level of help you’re looking for. Fee-free trades are available on U.S. Stocks, etfs and options trades. Additionally, more seasoned investors looking to get into margins trading will see published rates as low as 5%.

The company’s app scored well in both the apple store and the google play store with tons of glowing reviews. Investors looking to stay up with their trades on the go will like what fidelity has put together on the mobile front.

Best for self-directed investors – merrill edge

Bank of america’s investing arm scores average in customer service, but its variety of products and low minimum deposit make up for its faults. If you’re already a bank of america customer, this is a great place to start investing.

Merrill edge from bank of america offers lucrative sign-up bonuses and unlimited free trades.

If you’re looking to open an investment account you’re in charge of, merrill edge is a viable candidate. What jumps out first is that the company is offering up to $600 in bonus funds for investors who open new self-directed brokerage accounts in may 2020. To get the full reward, you will need to invest $100,000.

Merrill edge’s ios app has one of the highest ratings in the industry, with the android app not far behind. The bank-backed company offers self-directed investment accounts as well as merrill’s guided investment program. Annual fees for advised accounts are 0.45% for guided accounts and 0.85% for managed accounts, but have $5,000 and $20,000 account minimums, respectively.

Best desktop platform – interactive brokers

Interactive brokers’ desktop platform makes it easy to interpret the market and make self-directed investing decisions. Additionally, investors looking to expand their portfolio will find a variety of investment products at their fingertips here.

Interactive brokers offers robo advisor options with several different portfolios investors can choose from.

With your interactive brokers account, you have the option of investing in several pre-setup portfolios or answering questions and getting a more personalized portfolio. The majority of investment opportunities are managed automatically, which makes this a viable option for investors who want to be hands-off.

The desktop platform is quite intuitive but may feel a little overwhelming for a newer investor, however, investors looking to trade in more unique fields will enjoy the options at interactive brokers. These include futures, options, fops, forex, metals and global investments.

Best for resources – TD ameritrade

A great mobile app, amazing customer service and multiple portfolio options make TD ameritrade a great place to start — for both beginners and experienced investors alike.

Customers can learn more about the world of investing with TD ameritrade’s wealth of online resources.

TD ameritrade is jam-packed with technological resources to help you take advantage of unlimited fee-free trades and other investment products. The company has extensive third-party research resources, the bond wizard, market java, alerts and watch lists and market edge. If you’re looking to invest somewhere that gives you some of the tools the pros use, TD ameritrade should be on your radar.

Opening an account with TD ameritrade is simple, and you have extensive customer support options available in case you have questions. The company can be reached through most traditional methods, as well as by direct message on facebook and twitter.

How to find the best free stock trading brokers

It’s not hard to find an offer from a broker that promises you free trades. But not all “commission-free” platforms are created equal. I dug into roughly a dozen of the most popular brokers out there.

Among these platforms, I investigated the following factors.

Free trades that last: it’s common practice in the broker biz to offer an initial discount to win new clients and then ratchet up the cost per trade after a few months. But what’s the point of buying a stock or an ETF for free today only to be charged a big-time commission to sell it tomorrow?

A wide menu of commission-free options: it’s also increasingly common for brokers to tout commission-free ETF trades. For instance, vanguard offers about 70 commission-free etfs under its own brand to customers. But many of them are boring mainstream funds that skew toward large, US-based corporations — meaning any truly tactical trades won’t be covered in this limited universe of commission-free options.

No sneaky costs that offset savings: brokers aren’t nonprofits, of course, so if they’re waiving fees, then they’re looking to make money in other ways. That means reading the fine print to see if there are other surcharges that could eat away at your savings in a similar way to conventional commissions. For instance, it’s also worth noting that vanguard’s brokerage platform will tack on a $20 annual account maintenance fee if you’re a small-time investor with less than $10,000 invested in its branded mutual funds and etfs.

How should I choose the right free stock trading broker?

Choosing the right free stock trading broker is a critical step in your investment journey, as you will most likely spend the next few years or longer investing through the platform. Some of the most important things to consider when making your decision include the quality of the desktop and mobile apps, the reliability of the customer service, any lucrative promotions and the overall trust you have in the provider.

Additionally, look for any added resources, helpful tools or research platforms that you may gain free access to as a client. While these things are not necessary to make a commission-free trading platform the right fit, it’s always smart to get the most bang for your buck.

How do I claim stock returns on my income taxes?

If you make money on your stock investments, you will be required to pay taxes on those gains. What you will pay and when you will pay will depend on several factors. For stocks that you hold for less than a year, you’ll pay your normal income-tax rate.

If you hold the stocks for longer than a year, you won’t owe income tax, but you will owe capital gains taxes. The percentage you owe on these gains will be from 0% to 20%, dependent on your taxable income.

For investors that own dividend-paying stocks, you’ll need to ensure you pay taxes on your dividend payments every year. You will receive a form 1099-DIV each year from each company that you earn dividends from letting you know how much you need to report.

While paying taxes on income gains is never fun, many would agree it’s a good problem to have.

Stock trading fees to keep in mind

I’m a big believer in keeping down investing costs. And keeping your commissions in check isn’t the only way to guard against unwanted fees in your investment portfolio. A few other important expenses that can add up include:

Margin interest: as mentioned in reviewing robinhood above, the company makes its money by charging investors who trade “on margin” with borrowed money. The fee structure at robinhood allows you to secure $1,000 of buying power for 30 days for a cost of $5. Doesn’t sound like a lot to you? Then consider it adds up to $60 a year if you don’t pay the $1,000 back quickly. You easily offset any savings from commission-free trading with that kind of cost structure, so be wary of trading on margin.

Fund expenses: while brokers like fidelity, vanguard, and charles schwab may waive commissions on some funds, those investments aren’t 100% free. Every mutual fund or ETF carries an “expense ratio,” or an annual charge that is automatically deducted from your investment returns without you seeing it. Take two commission-free offerings from charles schwab: the U.S. Broad market ETF (SCHB), with a super-low expense ratio of just 0.03%, and the john hancock multifactor mid cap ETF (JHMM), with a moderately high expense ratio of 1.11%. The first will cost you just $3 annually on every $10,000 invested while the other will cost you $110 in expenses. If you really want that second fund for the strategic advantage, that’s fine, but remember it needs to perform much better to offset the additional cost.

Taxes: the IRS taxes all investment profits as capital gains, but short-term investments are taxed at a significantly higher rate. For a married investor who files jointly and has a household income of $120,000 a year, they would pay a 15% tax rate on profits for stocks held more than a year. But if that investor buys and sells within a few months, they would pay a 25% tax rate. Or put another way, a $10,000 investment profit turns into $8,500 after a 15% tax if you held your stock for 366 days. If you hold for 365 days, that profit is just $7,500 after a 25% tax.

Going with either of these “free” brokers is a great start to keeping your expenses down. But remember that commissions aren’t your only cost center.

Even modest stock trading fees can add up

Of course, the irony of me harping on costs is that many investors are paying lower fees than ever before to invest in the market. Consider a business insider report that quotes one veteran broker who estimates an average trading commission was $45 in the 1980s, and it wasn’t uncommon to see larger orders cost an investor hundreds or even thousands of dollars.

If you’re paying $10 a trade, then it may seem like you’re way ahead of the game. But even a small amount of fees matters big-time, since any money you give your broker is cash that’s not accumulating bigger profits in the market.

- You have $1,000 to invest, and make five consecutive trades that net 30% returns each. With zero transaction fees and compounded returns, you finish with $3,713.

- You have $1,000 to invest, and make five consecutive trades that also net 30% returns each, but this time you are charged a $10 commission to buy or sell. You instead finish with $3,531 – a nice gain, but around $200 less in total profits when you account for both the cost of commissions and lost profit on money paid to your broker.

On the surface, $10 doesn’t sound like a lot of money. But as you can see, over time even those seemingly modest costs can really add up.

Too long, didn’t read?

Trading stocks can be a fun and fruitful addition to your investment strategy. With the introduction of commission-free trading, smaller investors can turn a profit while still actively trading. No longer will you be forced to decide between giving up profits to transaction costs or making the right trade. The best free stock trading brokers of 2020 can help investors of all levels get started today.

Remote prop trading firms for beginners no capital contribution

In prop trading, a proprietary firm makes funds available to the trader. Who then enters the market to make profits for the firm.

Remote prop trading, is used by proprietary trading firms (prop trading firms) to extend leveraged funding to qualified traders to trade stocks, bond currencies, commodities, their derivatives and any other form of financial instruments with the firm’s own money.

This arrangement helps prop firms maximize returns by hiring traders who have profitable trading portfolio’s. And the trader benefits by receiving generous commissions from the gains.

And as you can imagine, the major aim of the firm allowing a trader to use their money is strictly to make a profit for itself.

For that reason, many prop trading firms have “tests” or “challenges” to assess the skills of rookie traders.

Traders 4 traders is a reputable prop trading firm that requires no capital contribution. New traders are asked to join the forex t4tcapital trading program to be assessed. And if they pass, they’ll be funded with up to $100,000 in buying power.

The traders are often allocated with capital from the remote prop trading firms with the sole aim of extracting profits from the market through their activities.

Unlike stockbrokers, prop traders don’t have clients but rather use

the firm’s capital to trade in order to gain some profits from the market.

In most of the cases, propriety trading is carried out by banks, as well as small boutique firms who engage the services of experienced traders train and provide them with the funded capital to trade with.

As a beginner, locating a remote prop trading firm may be a thing of challenge owing to the fact that you may not adequately trained on how it works and how to locate the best.

For example, traders 4 traders offers prospective traders free online training courses, apps and analytics tools. This is to increase their chances of success with the challenge and to get funded.

In this article, we shall enlighten you on the characteristics of the best remote prop trading firms for beginners with no capital contribution.

How to identify the best remote prop trading firms for beginners

To identify the best remote prop trading firms which offer no capital contribution we strongly suggest you take note of the following factors.

Flexibility

Remote prop trading firms must offer a wide range of flexibility which allows you to remotely gain access to their services from any place in the world as long as there is an internet connection.

They should also offer an option where you can trade by hand or develop an automated strategy for all your transactions. The higher the rate of the flexibility of the remote prop trading firm, the better the type of services they render.

High level of technology

Propriety trading firms should make available professional grade software which will assist the traders in monitoring the activities in their funds and accounts.

This software should be built to meet the demanding needs of the active traders and the market at large. It should be easy to navigate and should run on almost all platforms for easy access.

Capital

The capital interest offered by the remote prop trading firms should be made as simple and convenient as possible to assist the traders to make the most out of their trading.

Payouts and other benefits

The best prop trading firm should offer you a flexible method or system of payments from the proceedings of your profit in the market.

These payout systems should be accessible with much ease. Other benefits such as bonuses should be adequately provided by the firm.

We suggest you go through the terms and conditions of each remote prop trading firm to be acquainted with the rules guiding their operations.

Free trading capital

ACM maintains the highest standards of the customer services, protection of financial information and security of funds.

Easy funding

The most convenient methods of payment that are safe and easy to make.

User friendly platforms

Choice of award winning user friendly platforms suiting forex beginner to fxpro.

Secure trading environment

Lowest available market spreads, leverage of 1:400, expert account support.

Fast order execution

Fast, accurate, reliable and transparent execution means best price for your trading.

Simple withdrawal

Withdrawal processing with ACM can be done in a few simple steps.

You can find a wide range of commercially available eas and then test different systems using the historic data centre and strategy back testing. Join the meta community and share ideas on algorithmic currency trading with other traders.

Full EA capabilities for all your automated needs. We accept all EA’s* limit, stop limit, stop loss, take profit, market orders and trailing stops MT4 netting functions, such as manual close, stop-out close, partial close, full close-by, partial close-by, full multiple close-by and partial multiple close-by super low-latency processing.

We are an expert in

FOREX trading

Request a call back?

Free forex demo account.

Free forex trading training.

Free forex signals.

Free forex trading robot.

Alite capital markets is a london based, online forex broker. We offer various trading accounts, free forex signal, software and trading tools to trade in forex market for individuals, fund managers and institutional customers.

Useful links

Contact us

Holborn viaduct EC1 city of london, london, united kingdom

Risk warning: trading foreign exchange, commodity futures options, and other on-exchange and over-the-counter products carry a high level of risk and may not be suitable for all investors. The high degree of leverage associated with such trading can result in substantial losses, as well as gains. The past performance of any trading strategy or methodology is not indicative of future results, which can vary due to market volatility; it should not be interpreted as a forecast of future performance. You should carefully consider whether such trading is suitable for you in light of your financial condition, level of experience and appetite for risk and seek advice from an independent financial advisor, if you have any doubts.

FREE FOREX COURSE FOR FOREX TRADERS

1,000s of forex traders go through our free forex course every month.

“finally, a proven free forex course that highlights how to accurately trade properly and not another cut and paste guide!”

(zero experience required)

Isn’t it time you separated from the beginners & amateurs and joined the experts?

Trading is not something you should be taking lightly and neither is your education. How many youtube videos and free guides must you take before you take real action to obtain real results?

We have worked with many clients who have been in your position, most likely watched youtube videos and read re-hashed content that has been lost in translation from one guru to another…

You wouldn’t want a surgeon who youtube’d “open heart surgery” to perform an operation on you, would you?

You must stop living in dreamland where the idea of making money from trading feels A LOT better than putting in the work, effort and money (and losses) to learn and take risks to become the ideal trader you have a picture of in your mind.

No, not the trader that is sitting on a throne made out of cash…

Trading and making money is an ART and it has been LOST.

Even in today’s teachings online, you are NOT even taught how to properly execute a trade… trust us, this is one of the most common problems we fix and it can save you A LOT of money.

What you will learn is the EXACT SAME process successful traders have been monetising from for DECADES. The strategies, execution plans, frameworks and systems included in this FREE forex

Course have been fine-tuned and brought up to speed in the 21st century.

If you’re serious to become a better trader, become consistently profitable and take your knowledge to the next level, then this is the first step.

Open trading account

OPEN YOUR FREE TRADING ACCOUNT WITH EASE

Open trading account online with arihant capital & start trading with our best hassle-free process.

We're glad you chose to start your investment journey with arihant capital. Opening a paperless trading account and getting started is easy, just choose from one of the following 3 options and take control of your financial future.

Fill your information in the below form for an online trading account opening

Get a call back

Arihant ekyc

Now you can use ease way to open an online account through arihant ekyc with no paperwork.

Arihant ekyc is a paperless know your customer( KYC) process, wherein the identity and address of the subscriber are verified electronically through aadhaar authentication.

Download and print

A SMARTER WAY TO MANAGE YOUR INVESTMENTS

When it comes to investments we don't want you to leave anything to chance. We have the tools, resources, and personalized support to help you make the right investment decisions.

TOOLS & SUPPORT

Whether you are looking for self-assisted or broker-assisted trading, you get access to our expert investment advisors and powerful trading tools

GET IDEAS

Investment education and tools that will make it really simple for you to plan your investments

DIVERSIFY

Get the benefit of diversification with our full range of investment options , free research and innovative tools

1. How long does it take to open an account?

Once we receive your signed forms and proper documents, your account will be opened within 24 working hours, assuming everything is in order. At any point of time you can check the status of your account by e-mailing us or calling us and any of your queries will be responded promptly.

2. What documents do you need?

You need to submit the following in order to open an account with us along with the application form (for individuals):

- PAN card (compulsory)

- Address proof (ration card / passport / driving license, electricity/telephone bill)

- Bank statement

- Demat account statement or slip (if any)*

- Latest passport size photograph (one)

*if you do not have a demat account, you would also be required to open a demat account to start trading.

3. Will you send someone to my house?

We try to make it convenient for you to open an account. I fyou cannot come to our office, we can try to send someone at your place to help you with the documentation process. However at certain locations we may not be able to send an advisor to distance or unavailability of staff. In such instance we can schedule a video chat on a convenient date and time, wherein our advisor will help you with the form and also conduct the mandatory in-person verification (IPV) to verify that your identity proof match yourself.

4. Why do you need these documents and an IPV?

As per SEBI regulations the know your customer (KYC) formalities that includes the documentation and in-person verification (IPV) are mandatory for every client. Being a financial services company we are subject to strict laws and regulations just like banks. These processes allow us to identify who you are, how to contact you and your general profile and also prevents any potential frauds.

5. Can a foreign national invest in india?

Yes. Foreign citizens can invest in equity markets under foreign portfolio investors regulations, 2014 by registering themselves with a designated depository participant. For more details please write to us at contactus@arihantcapital.Com .

Trade your way

Online, mobile, on the phone, trade the way you want, from where you want

How it works

Have a query?

PRODUCTS AND SERVICES

MEDIA CENTER

OTHER LINKS

Connect with us on

ATTENTION INVESTORS :- a) prevent un authorised transactions in your account. Update your mobile numbers/email ids with your stock brokers. Receive information of your transactions directly from exchange on your mobile/email at the end of the day; b) KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, mutual fund etc.), you need not undergo the same process again when you approach another intermediary; c) prevent unauthorized transactions in your demat account. Update your mobile number with your depository participant. Receive alerts on your registered mobile for all debit and other important transactions in your demat account directly from NSDL / CDSL on the same day. (issued in the interest of investors). Please read the risk disclosure document and do's & dont's prescribed by the exchanges carefully before investing.

Arihant group companies are registered broker and dealer. SEBI registration number for NSE & BSE :- INZ000180939; NSDL - IN-DP-127-2015 DP ID-IN301983; CDSL DP ID-43000; NCDEX - 00080; MCX - 10525; AMFI - ARN 15114; SEBI merchant banking regn. No. - MB INM 000011070; SEBI research analyst regn. No. - INH000002764. Arihant capital markets ltd provides services with respect to commodities derivatives trading through its group company arihant futures and commodities ltd. Please carefully read the risk disclosure document as prescribed by SEBI & FMC and do's & don'ts by NCDEX. Existing customers can send in their grievances to compliance@arihantcapital.Com. And for DP related queries & complaints please write us to depository@arihantcapital.Com if you want to register your complaints through SEBI score portal please click here.

ARIHANT CAPITAL IFSC LIMITED | SEBI regid. No. : INZ000157539

address: unit no. 424, 4 th floor, the signature building, block 13B, road 1C, zone 1, GIFT SEZ, GIFT city, gandhinagar, gujarat - 382355. | tel: 079-40701700

Disclaimer: arihant capital markets limited and arihant futures & commodities limited are engaged in client based and proprietary trading on various stock and commodity exchanges. Arihant capital IFSC limited is engaged in proprietary trading in NSE IFSC stock exchange and india INX stock exchange.

#1011 solitaire corporate park, andheri ghatkopar link road, chakala, andheri (E), mumbai - 4000093. Email: contactus@arihantcapital.Com

Copyright © 2021 arihant capital markets ltd. All rights reserved.

COVID-19 important update: we are experiencing high call volumes and we appreciate your continued patience. We strongly encourage you to use our digital tools for self-servicing. You can download arihant mobile or trade online through invest ease (web trading) or ari trade speed (ODIN) and access your backoffice reports through client login dashoboard or arihant backoffice mobile app

New partnership new features.

Exciting new partnership announcement for MES capital & oneup trader.

We are pleased to announce that MES capital has officially joined oneup trader. Together, we are bigger, stronger, and better positioned to provide innovative solutions, enhanced services that improve the quality of trader evaluations and funding.

Oneup trader will provide technical, comprehensive and innovative tools to all prospective traders seeking funding and to facilitate their pursuit of financial and professional independence

With this announcement, we would like to inform you that effective december 29, 2016, MES capital will no longer offer evaluation accounts and all future evaluations must be submitted through oneup trader starting june 12, 2017.

Oneup trader new features

Account options

Your account, your choice. Choose from a variety of trading accounts, from $25,000 to $250,000.

Simplified funding

Fair, attainable, and simplified funding goals. No grey areas, offering the fairest seeding program in the industry

Analytics that matter

Advanced reports, performance analysis tools, so you can better adjust your trading for maximum performance

Community integration

Discuss, collaborate and share ideas. Comprehend and utilise the wisdom of the trading crowd!

Launched june 12, 2017

To learn more, visit the oneup trader website or get notified by joining our mailing list

Effective december 29, 2016, MES capital will no longer offer evaluation accounts. We partnered with oneup trader to bring traders an enhanced user experience with a multitude of options. All future evaluations must be submitted through oneup trader starting june 12, 2017

All current traders participating in an MES capital evaluation will not be affected and will be reviewed for funding upon completion

Trading capital

Get funded trading stocks, futures and forex.

Get the right amount of trading capital to earn profits in day trading.

Each and every trader in your trading office can trade with:

For NYSE (AMEX), NASDAQ, toronto stock exchange, chicago stock exchange, bovespa, and all the other american markets.

$50K for NYSE (AMEX), NASDAQ,toronto stock exchange, chicago stock exchange, bovespa and all other US markets.

$400K for the forex market.

And that's just the beginning. With better performance, each trader can easily get higher trading capital.

We give generous trading capital, please ask us for updated figures. Buying power limit increases can be requested as a trader's performance improves.

Note: these figures can change. Contact us today for updated figures.

How much capital should I budget to run an effective and efficient trading office?

If you provide me with your capital to trade, how will you trust me if you don’t know me or if I don’t have any experience?

What kind of buying power can a trader receive to start?

Live trading with DTTW™ on youtube

DTTW ™ is proud to be the lead sponsor of tradertv.LIVE ™ , the fastest-growing day trading channel on youtube. With over 150k subscribers in less than a year, tradertv.LIVE ™ features a daily live trading broadcast, professional education and an active community.

Training for new managers

Trading floor development

Market wisdom on youtube

Accepted payment methods:

Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, united states citizens or residents are kindly asked to leave this website.

© 2011-2020 day trade the world™ all rights reserved.

So, let's see, what we have: you can download & use FREE for lifetime trading indicator for ninjatrader 8 to help you with your trading decisions. At free trading capital

Contents of the article

- Free forex bonuses

- Freeindicators FOR YOUR TRADING

- TRY ALL THESE FREE INDICATORS

- Zone drawing - FREE indicator

- Free multi time frame trend line - FREE indicator

- Initial balance with extension levels - FREE...

- Daily deviation counter - FREE indicator

- Buy volume only - FREE indicator

- Multiple emas - FREE indicator

- TDI - FREE indicator

- Daily change - FREE indicator

- Get every month

- By registering and subscribing to our

- Not ready to subscribe yet, join us for free to...

- Registered address

- Information

- Follow us

- Resources

- Trading capital

- Get the right amount of trading capital...

- How much capital should I budget to run an...

- If you provide me with your capital to trade, how...

- What kind of buying power can a trader receive to...

- Live trading with DTTW™ on youtube

- Best free stock trading brokers of 2021

- Featured stock brokers

- The 7 best free stock trading brokers of 2021

- Best free stock trading brokers at a glance

- Best for beginners – robinhood

- Best for buy-and-hold – charles schwab

- Best for active traders – E*TRADE

- Best mobile app – fidelity

- Best for self-directed investors – merrill edge

- Best desktop platform – interactive brokers

- Best for resources – TD ameritrade

- How to find the best free stock trading brokers

- How should I choose the right free stock trading...

- How do I claim stock returns on my income taxes?

- Stock trading fees to keep in...

- Too long, didn’t read?

- Remote prop trading firms for beginners no...

- In prop trading, a proprietary firm makes funds...

- For that reason, many prop trading...

- Unlike stockbrokers, prop traders...

- How to identify the best remote prop...

- Free trading capital

- Easy funding

- User friendly platforms

- Secure trading environment

- Fast order execution

- Simple withdrawal

- We are an expert in FOREX trading

- Request a call back?

- Useful links

- Contact us

- FREE FOREX COURSE FOR FOREX TRADERS

- “finally, a proven free forex course that...

- Open trading account

- OPEN YOUR FREE TRADING ACCOUNT WITH EASE

- Get a call back

- Arihant ekyc

- Download and print

- A SMARTER WAY TO MANAGE YOUR INVESTMENTS

- TOOLS & SUPPORT

- GET IDEAS

- DIVERSIFY

- 1. How long does it take to open an account?

- 2. What documents do you need?

- 3. Will you send someone to my house?

- 4. Why do you need these documents and an IPV?

- 5. Can a foreign national invest in india?

- Trade your way

- How it works

- Have a query?

- New partnership new features.

- Oneup trader new features

- Account options

- Simplified funding

- Analytics that matter

- Community integration

- Launched june 12, 2017

- Trading capital

- Get the right amount of trading capital...

- How much capital should I budget to run an...

- If you provide me with your capital to trade, how...

- What kind of buying power can a trader receive to...

- Live trading with DTTW™ on youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.