What does platinum 150 mean in forex

I think this company has a solid business model now and will be around for a while as long as the sales keep up and stable, but only time will tell.

Free forex bonuses

After you get started, you will want to keep an eye on your rank and how to increase it.

IM mastery academy review – scam? Compensation plan breakdown

If you are looking for a detailed IM mastery academy review, then you are in the right place.

If you haven’t heard the news yet, IM mastery academy is a rebranding of the company formerly called imarketslive which I covered before and it’s basically the same company but with a few changes that I will cover below.

I am going to take the time to research and review the information about the company, the products, and the compensation plan.

I am then going to give my final thoughts on whether or not it is a scam and worth it and my final recommendation in the last section.

Let’s see what changes have been made.

With that said, let’s dig in and see what we can learn about it.

What is IM mastery academy?

IM mastery academy is an MLM company that can offer you the ability to earn money by recruiting other affiliate members through your affiliate link and building a team.

The membership model is based on subscriptions, so you will be able to earn a residual income with your team members.

The company offers trading education on the subject of forex and cryptocurrency so the niche I would consider this company to be in would be the crypto and forex trading niche.

Company overview

One of the things that I like to see on the company website is who the owner is.

This gives me the ability to take a moment to research the background and experience that the owner has.

I don’t know about you, but I wouldn’t want to join someone that is a known scammer and that is why we take our time to research before we join any opportunity.

The founder of IM mastery academy is christopher terry.

Before terry got involved with making money from home, he was in the construction business.

During that time he was in construction he got into forex to try to make more money from home.

He started doing very well with forex and after just 3 years, left the construction business to go full-time as a forex trader.

He became very good at trading that gave him the comfortability to start speaking at conferences for private groups in 2001 that were interested in trading.

In 2013, christopher founded imarketslive which was an MLM company that offered training and signals with trading forex and cryptocurrency.

The imarketslive company started to get into some legal issues with the CFTC due to their trading bot.

The biggest change that christopher made was to get rid of the trading bot when they rebranded the company over to the new name IM mastery academy which was one of the only options they had if they wanted to continue to do business.

However, this was one of the biggest appeals that the company had (in my opinion), so let’s see how the company will continue to grow moving forward.

With that said, let’s see what product or services they have to offer.

Why did I decide to NOT join IM mastery academy?

The first thing that I want to first say is that I looked at all of the information about the business model that IM mastery academy offers and I do think they offer everything a company needs to be in compliance.

I also think they do offer a good product and a decent comp plan but I decided to not join because the business model was not anything new when it comes to MLM.

Fast forward to a few months ago…

I stumbled upon a similar company to IM mastery academy that offers a similar product but a DIFFERENT type of compensation plan that got me really excited!

Some are even saying that this other company is a “better alternative to IM mastery academy!”

I’ve been watching this “alternative” company for a month to really dig in and after careful consideration, I finally pulled the trigger and joined.

I was SO IMPRESSED that I got to work!

With this other program, you only need 3 personally recruited members to maximize the commissions they offer and I was able to get that on my first day.

With THIS program, it actually is beneficial to you when you GIVE AWAY sponsorships to your downline members that need help getting their 3 after you get your own 3!

The alternative program that I recommend is all about people helping people!

I LOVE how it is designed and it is going to help so many people make money online that has never made a dime online!

After carefully looking through all of the reviews that I completed over the last year, I rated this company my #1 overall best opp for new people and leaders to make money with because of the product it offers and because of how the compensation plan is designed.

If you would like to learn more about my IMA alternative, click on the button below and fill out the form on the next page to get my presentation videos that cover what this program is, how it works, what you will get when you join my team, and how you can make money with it.

What products does IM mastery academy offer?

IM mastery academy offers most of the tools and all of the training that imarketslive had but along with the new branding, it looks like they added a few more tools.

The focus on the companies products is all about forex and cryptocurrency trading and how to make money in that market.

Products/tools

- Delorean – my understanding of how this tool works is it analyzes the trading market to help you make better choices. The cost of this tool is $21.95.

- Steady – my understanding of how this tool works is it analyzes the trading market and looks for long-term, and swing trade opportunities to go after that you don’t have to touch. This is like the delorean, but it looks at the long-term opportunities rather than the short-term opportunities. The cost for this tool is $21.95.

- Vibrata – to my understanding, this tool analyzes several opportunities that are grouped together to help you make the right trading choices. The cost for this tool is $9.95.

- Levels – this tool is the stop-loss detector to help you identify entry and exit points to help you profit in the trading market. The cost for this tool is $21.95.

- Goldcup – another tool that you can use to look for the “higher-profit” trades but of course with what I know about trading, this route is riskier. This tool costs $21.95.

- Bounceback – this is another tool that analyzes the trading market to help you make the right entry point. This tool has a price point of $21.95.

- Pivots – this tool analyzes the trading market to help identify “key reversal zones on many time frames. The cost for this tool is $21.95.

- Liberty – this tool focuses on finding high pace trade ideas for binary options. The cost for this tool is $21.95.

The tools that are listed above are “add-on” products which mean they will have an extra price if you choose to use them.

Retail customer options

IM mastery academy offers retail options for customers only.

There are 7 retail options that the company offers.

Each will come with its own features and tools, the higher the plan costs, the more tools, and training will be included.

Here is a breakdown of the 7 retail options with included pricing:

- 3 month prime package plan – the cost for this package costs $825 in bitcoin every 3 months.

- 6 month prime package plan – the cost for this package costs $1600 in bitcoin every six months.

- 12 month prime 12 package plan – the cost for this package costs $3150 in bitcoin every 12 months.

- Elite starter package pack – the cost for this package is a one-time cost of $325 and then $274.95 per month.

- Platinum starter package pack – the cost for this package is a one-time cost of $199.95 then $164.95 per month.

- HFFX package monthly – the cost for this package is a one-time cost of $189.95 then $179.95 per month.

- Digital currency package monthly – the cost for this package is a one-time cost of $189.95 then $179.95 per month.

The first 3 “prime” options seem to be the equivalent to the value that you would get at the elite starter pack option.

Also, each of the packages come with training on how to use the tools and training on cryptocurrency and forex trading.

Crypto and forex training

The company offers training on the various tools and additional training about cryptocurrency and forex trading.

I believe the company still does webinars a few times per month as they did before but I can’t confirm this.

Replicated affiliate websites

As an affiliate member, the company offers marketing material and tools like replicated websites that you can use to sign up customers and affiliate members.

That is all of the information that I have about the products that IM mastery academy offers, let’s continue to the next section.

How does the IM mastery academy compensation plan work?

In this section of my review, I will cover the information about the compensation plan and how you can make money with IM mastery academy.

Along with the rebranding of the company, they have also made some compensation plan changes to stay in compliance with the MLM laws.

Imarketslive was experiencing pressure from the government to change its business model and there have been some changes that I will cover below.

Along with the tools and training that the company offers in regards to cryptocurrency and forex trading, you can make more money by recruiting people and customers.

Getting started

In order to start earning affiliate commissions, you will need to pay a fee.

I have the fees listed below in my “how much does it cost to start” section below.

After you get started, you will want to keep an eye on your rank and how to increase it.

Ranks and qualifications

When you join any MLM company, you will want to pay attention to your rank and how you increase your rank with the company.

The higher the rank that you can reach will mean the more money that you can make with the company.

Here is a breakdown of each rank that IM mastery academy offers and the qualifications that you will need to reach them:

- The platinum 150 rank – in order to qualify for this rank, you will need to generate at least 435 GV per month and maintain a downline team of at least 3 subscribers.

- The platinum 600 rank – in order to qualify for this rank, you will need to generate at least 1740 GV per month and maintain a downline team of at least 12 subscribers.

- The platinum 1000 rank – in order to qualify for this rank, you will need to generate at least 4350 GV per month and maintain a downline team of at least 30 subscribers.

- The platinum 2000 rank – in order to qualify for this rank, you will need to generate at least 10,875 GV per month and maintain a downline team of at least 75 subscribers.

- The platinum 5000 rank – in order to qualify for this rank, you will need to generate at least 32,625 GV per month and maintain a downline team of at least 225 subscribers.

- The chairman 10 rank – in order to qualify for this rank, you will need to generate at least 72,500 GV per month and maintain a downline team of at least 500 subscribers.

- The chairman 25 rank – in order to qualify for this rank, you will need to generate at least 181,250 GV per month and maintain a downline team of at least 1250 subscribers.

- The chairman 50 rank – in order to qualify for this rank, you will need to generate at least 362,500 GV per month and maintain a downline team of at least 2500 subscribers.

- The chairman 100 rank – in order to qualify for this rank, you will need to generate at least 725,000 GV per month and maintain a downline team of at least 5000 subscribers.

- Chairman 250 rank – in order to qualify for this rank, you will need to generate at least 2,175,000 GV per month and maintain a downline team of at least 15,000 subscribers.

- The chairman 500 rank – in order to qualify for this rank, you will need to generate 3,350,000 GV per month and maintain a downline team of at least 30,000 subscribers.

According to the IM master academy documentation, qualifying subscribers need to have purchased the IM mastery academy package and can be either retail customers or affiliate members or any percentage combination of both.

However, you can only have 40% of your qualifying volume coming from any one of your unilevel downline lines.

The acronym used above that refers to “GV” just means “group volume”.

Group volume is the accumulation that is generated through all of the sales in your downline through the products that the company offers.

Fast start referral commissions

IM mastery academy offers you the ability to earn from retail sales and affiliate sales.

- For every person that purchases the platimum starter level pack, you will earn $35 and each time they renew.

- For every person that purchases the elite starter level pack, you will earn $50 and each time they renew.

The company also offers 2 more levels of fast start commissions that you can earn which are tracked and paid out to you using the MLM unilevel compensation plan.

For those that are not familiar with how the unilevel compensation plan works, here is a quick breakdown:

- Unilevel compensation plan is level based which means that personally recruited members are how it fills up the positions.

- For example, the first level of your unilevel compensation plan will only have your personally recruited members on it.

- The second level will only have team members that your personally sponsored members (level 1), personally recruited on it.

- The third level of your unilevel comp plan will only have team members that your level 2 members personally recruited on it.

- And so on…

With that said, IM mastery academy offers 3 levels of residual commissions.

The first level I explained above, and level 2 and 3 I will breakdown for you here:

- When you qualify for the platinum 600 rank, you will be able to earn $10 on every platinum starter level pack and $12 on every elite starter level pack on your level 2 of your unilevel comp plan.

- When you qualify for the platinum 1000 rank, you will be able to earn $5 on every platinum starter level pack and $7 on every elite starter level pack on your level 3 of your unilevel comp plan.

Residual commissions

The residual commissions that the company offers are based on your rank and how many people you personally recruit and your qualifying volume.

Here is a quick breakdown of what you can earn residually based upon your rank.

- When you qualify as a platinum 150 rank and personally refer 3 customers or affiliates, you will earn $150 per month or $37.50 per week.

- When you qualify as a platinum 600 rank and personally refer 3 customers or affiliates and accumulate and maintain 12 total customers or affiliates in your downline, you will earn $600 per month or $150 per week.

- When you qualify as a platinum 1000 rank and personally refer 3 customers or affiliates and accumulate and maintain 30 total customers or affiliates in your downline, you will earn $1,000 per month or $250 per week.

Compensation plan thoughts

I don’t think that they are done with the compensation plan changes, I do believe more changes will come in the future because the CFTC is looking at the company now.

With that said, that is all there is to how the compensation plan works and how you can make money with the IM mastery academy opportunity.

Let’s continue on and answer some questions.

My IM mastery academy FAQ section

In this section of my review, I will answer some of the questions that people may have when thinking about joining the IM mastery academy opportunity.

Is IM mastery academy BBB accredited?

When the company was called imarketslive, they were listed on the BBB but did not have accreditation.

You can find that listing here.

The BBB page that they were on also had them with a rating of D which is based on customer reviews and complaints.

Now, even though the company is listed on the BBB with negative reviews, I don’t consider that a determining factor for it being a scam or legitimate.

The BBB has been known for having manipulated reviews and ratings which makes them not reliable in my opinion.

This is why I now only take the information that I find out about the company from several different sources and then take that information to make my final recommendation.

What’s the cost to join?

The minimum cost to join IM mastery academy is $16.71 to become an affiliate member.

Now, you will only get so far as a basic affiliate member in regards to how much money you can make.

There are 3 options to join the company as an affiliate member which are:

- Affiliate membership – this level costs $16.71 per month to join and get started.

- Platinum starter level pack – this level costs $225 to join and get started.

- Elite starter level pack – this level costs $325 to join and get started.

Is IM mastery academy A scam?

In my opinion, no, IM mastery academy is not a scam.

They have made several changes to abide by the rules and regulations that they were faced with.

Their old business model did have flaws with it, and this is why they changed the issues that they were presented with.

I think this company has a solid business model now and will be around for a while as long as the sales keep up and stable, but only time will tell.

With that said, let’s finish up.

My final IM mastery academy review and thoughts

In the final section of my review, I am going to share my final thoughts and recommendation about the IM mastery academy opportunity as a whole.

I have taken the time to research and review all of the information and any changes that the company has done with the company, the products, and the compensation plan.

I have also shared my thoughts on why I didn’t think it is a scam and gave my reasons why.

At this point, you should have a clear idea about what IM mastery academy is, how it works, what they offer, and how you can make money with it.

What are your thoughts about it up to this point?

Leave your comments below.

But here is the question…

Do I recommend joining IM mastery academy?

Well, as of right now, you have all of the information that you need in order to make an educated decision on whether or not this opportunity is right for you or not.

If you are asking if it is an opportunity that I would choose, I would say no because I found a better alternative.

Here is why…

After carefully checking through all of my company and program reviews that I completed over the last year, I have now rated this IM mastery academy alternative my #1 overall best opp for new people and leaders to make money with because of the product it offers and because of how the compensation plan is designed.

If you would like to learn more about my IMA alternative, click on the button below and fill out the form on the next page to get my presentation videos that cover what this program is, how it works, what you will get when you join my team, and how you can make money with its amazing comp plan it offers.

It is not an opportunity that I am interested in and due to the rebranding and changes made, and also because they are being more closely looked at by the CFTC, I would personally have to pass and not join.

With that said, I hope you enjoyed my IM mastery academy review.

If you found my review helpful, make sure to click on the social share buttons below to share it with others so that other people can learn more about what IM mastery academy is really all about.

Understanding the forex spread

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-168304532-5902254b5f9b5810dc944eff.jpg)

Filadendron / getty images

To better understand the forex spread and how it affects you, you must understand the general structure of any forex trade. One way of looking at the trade structure is that all trades are conducted through intermediaries who charge for their services. This charge—which is the trade's difference between the bidding and the asking price—is called the spread.

The bid-ask spread defined

The forex spread represents two prices: the buying (bid) price for a given currency pair, and the selling (ask) price. Traders pay a certain price to buy the currency and have to sell it for less if they want to sell back it right away.

For a simple analogy, consider that when you purchase a brand-new car, you pay the market price for it. The minute you drive it off the lot, the car depreciates, and if you wanted to turn around and sell it right back to the dealer, you would have to take less money for it. Depreciation accounts for the difference in the car example, while the dealer's profit accounts for the difference in a forex trade.

Forex market makers determine the spread

The forex market differs from the new york stock exchange, where trading historically took place in a physical space. The forex market has always been virtual and functions more like the over-the-counter market for smaller stocks, where trades are facilitated by specialists called market makers. The buyer may be in london, and the seller may be in tokyo.

The specialist, one of several who facilitates a particular currency trade, may even be in a third city. His responsibilities are to assure an orderly flow of buy and sell orders for those currencies, which involves finding a seller for every buyer and vice versa.

In practice, the specialist's work involves some degree of risk. It can happen, for example, that the specialist accepts a bid or buy order at a given price, but before finding a seller, the currency's value increases. He is still responsible for filling the accepted buy order and may have to accept a sell order that is higher than the buy order he has committed to filling.

In most cases, the change in value will be slight, and he will still make a profit. But, as a result of accepting risk and facilitating the trade, the market maker retains a part of every trade. The portion they retain is called the spread.

A sample calculation

Every forex trade involves two currencies called a currency pair. This example uses the british pound (GBP) and the U.S. Dollar (USD)—or the GBP/USD currency pair. Say that, at a given time, the GBP is worth 1.1532 times the USD. You may believe the GBP will rise against the dollar, so you buy the GBP/USD pair at the asking price.

The asking price for the currency pair won't exactly be 1.1532. It will be a little more, perhaps 1.1534—which is the price you will pay for the trade. Meanwhile, the seller on the other side of the trade won't receive the full 1.1532 either. They will get a little less, perhaps 1.530. The difference between the bid and ask prices—in this instance, 0.0004—is the spread. That's the profit that the specialist keeps for taking the risk and facilitating the trade.

The cost of the spread

Using the example above, the spread of 0.0004 british pound (GBP) doesn't sound like much, but as a trade gets larger, even a small spread quickly adds up. Currency trades in forex typically involve larger amounts of money. As a retail trader, you may be trading only one 10,000-unit lot of GBP/USD. But the average trade is much larger, around one million units of GBP/USD. The 0.0004 spread in this larger trade is 400 GBP, which is a much more significant commission.

How to manage and minimize the spread

You have two ways of minimizing the cost of these spreads:

Trade only during the most favorable trading hours, when many buyers and sellers are in the market. As the number of buyers and sellers for a given currency pair increases, competition and demand for the business increase, and market makers often narrow their spreads to capture it.

Avoid buying or selling thinly traded currencies. Multiple market makers compete for business when you trade popular currencies, such as the GBP/USD pair. If you trade a thinly traded currency pair, there may be only a few market makers to accept the trade. Reflecting on the lessened competition, they will maintain a wider spread.

Forex trading 101: what is FX trading?

If you are interested in the world of trading you may find yourself wondering what is forex, and what is forex trading?

Getting started in the world of forex trading can be a daunting task. There’s an abundance of new terminology to get to grips with, and many of the ‘guides’ aimed at new traders seem to neglect the basics of exactly what forex trading is.

As professionals in the field, there is nothing we enjoy more than being able to pass on our knowledge of forex trading to others. Having become frustrated with the over-complicated nature of other material found online, our expert team has taken it upon themselves to compile a basic, practical handbook to help you to understand forex trading from the very start.

Our forex trading 101 guide covers everything you need to know as a first-time trader. On this page you can:

- Learn the basics of the forex market and how it works

- Discover the pros and cons of forex trading

- Find out what you need in order to start trading

- Learn how to make money trading forex

- Register for a demo account to start practicing

What is forex?

Forex simply refers to the foreign exchange market, a market in which you can trade one currency for another. The word forex itself, which is also sometimes abbreviated to FX, is a portmanteau of the phrase foreign exchange.

One of the most unique things about the forex market is that it’s decentralized. This means that it does not have a fixed location or an owner, and investors deal directly with each other. The decentralized nature of the forex market gives it other distinct qualities too.

Forex trading takes place around the world on a 24-hour basis during weekdays. This is very different from stock markets, which close at the end of the day. As the forex market is global, trading activity simply shifts to a different location, depending on what time of day it is. For instance, when trading finishes in new york, it begins in sydney. Moreover, whilst the forex market is technically closed on the weekends, you will find that these down periods are very short due to the way time zones work.

Forex is also by far the largest financial market in the world, with a total trading volume of over $5 trillion per day. Ultimately, the size and scope of the forex market present you with a huge number of opportunities to trade.

What is forex trading?

Forex trading is the trading of currency within the forex market. On the most basic level, this is done through the trading of currency pairs (one currency traded for another currency). In fact, every time you take a vacation and swap your USD for the currency of your destination country or vice versa, you are participating in the forex market and forming part of the $5 trillion daily volume mentioned above.

Operating in the market as a retail forex trader is not a whole lot different. You are buying one currency at a particular price and hoping that this price then moves in your favor so you can resell it at a later date. What makes forex trading so potentially lucrative, however, is the amounts traded.

The difference in currency values is often negligible unless you are trading with large amounts. Whilst you might not make a lot of profit trading in your cash at the end of your vacation, as a forex trader you will generally trade at least one micro-lot (worth $1,000) at a time. This is facilitated by major forex brokers, who give you leverage to hold large market positions.

This effectively means that for as little as $100 in some cases, you can place trades to the value of $50,000. The market has the potential for you to grow your investment at an extreme rate.

Is forex trading regulated?

Yes. Although the forex market is decentralized, and so it does not have one particular regulatory body, it is operated in an extremely transparent manner. All major forex brokers must meet certain standards, imposed by a number of financial authorities who have established protective frameworks for traders and who monitor compliance closely.

Different regulatory bodies will be active in different areas of rules, and each has its own rules and regulations. These work to ensure that no matter what happens, your investment is used in a safe and secure manner.

Top forex brokers are typically overseen by at least one, if not several, of the following regulatory bodies:

- NFA (national futures association) – US-based regulator

- Cysec (cyprus securities and exchange commission) – the most respected regulatory body overseeing the EU area. They impose a maximum leverage of 1:30 among other rules.

- FCA (financial conduct authority) – UK-based regulatory body

- IFSC (international financial services commission) – popular international regulatory body based in belize which is trustworthy while possessing some more flexible regulations on things such as leverage.

How do currency pairs work?

When you trade in the forex market, you will be trading currency pairs. A currency pair is, as its name suggests, made up of two currencies. One is the base currency and one is the quote currency.

The base currency is always listed first. This is the currency which you are wishing to buy. The quote currency, on the other hand, is the currency you already have. You sell the quote currency to buy the base currency.

For example, in the EUR/USD currency pair, the euro is the base currency and the dollar is the quote currency. When reading this particular example market, you may see 1EUR = $1.20. This means that in order to purchase 1 euro, $1.20 is required.

When you are trading in the forex market, you will always be trading currency pairs. There are hundreds of currency pairs to choose from, depending on your broker, though these can typically be broken down into 3 distinct categories:

- Major pairs – these always include the US dollar. Popular major pairs include EUR/USD, GBP/USD and USD/JPY.

- Minor pairs – these are also sometimes referred to as cross-currency pairs. These pairs do not include the dollar but do include one of the three main non-USD currencies (the euro, the british pound or the japanese yen). Minor pairs include EUR/GBP, EUR/JPY, GBP/AUD

- Exotic pairs – exotic, or emerging, pairs are those which involve only one major currency. For instance, USD/MXN (US dollar and mexican peso).

Currency pairs gain and lose value due to a number of different factors, such as economic news and political announcements. This, combined with the wide range of pairs available for trading, makes the market both lucrative and accessible to traders from all over the world.

The 3 different types of forex trades

There are three main ways in which you can trade on the forex market. These are through spot trades, forward trades, and future trades.

Spot trades are instantly delivered orders. You are buying right now at the current price available in the market, and you will take ownership right away.

Forward trades are trades in which you agree to pay a price for a currency at a set time in the future. This time and price are binding no matter what happens in the interim and no funds are usually required until the agreed date.

Futures trades are trades in which you buy into the market now, with an agreed date on when to sell the current position. These are usually traded as cfds in which case ownership of the underlying asset is not transferred.

Spot trades are by far the most popular type of trade. This is due to the fact they are instant and simple. These are both important qualities in a quickly changing market like forex.

Why is FX trading so popular?

Retail forex trading, which refers to trading which is carried out by individuals, is incredibly popular. Around 5-6% of the entire forex market is made up of retail traders. That counts for around $300 billion of the market’s daily trading value.

Whilst this may seem small in comparison to the value of the complete market ($5 trillion), compare it to the daily value of the new york stock exchange (between $2-6 billion). As you can see, the retail forex trading industry is huge.

Why is this case? Although learning to trade forex profitably requires a lot of time and effort, and without this it can be risky, the simple fact is that there’s plenty of appealing advantages to forex trading too.

Earn extra income

forex trading offers you the opportunity to earn extra income, provided you are suitably prepared for trading, knowledgeable about the market and remain aware of the risks. As the forex market is open 24 hours a day, trading can be done in your spare time. FX trading can be fitted to your lifestyle, not the other way around.

Start trading with ease

one great thing about forex trading is that you typically do not need huge amounts to get started. Most major forex brokers require a first minimum deposit of under $100. Learning about forex trading is similarly accessible. The internet is filled with quality forex trading guides and advice (like this very page), and your broker may even provide you with educational materials to help you improve your skills.

Adapt your trading style to suit your needs

A huge benefit of forex trading is that, wherever you turn, you are presented with a wide range of options. From choosing to trade the currencies you know well, to employing different strategies or using robots, you can always adapt your trading style to make sure you get the best results for you.

Trade wherever you want

in the past few years, forex trading has become increasingly portable. Many of the best forex brokers now allow you trade from almost anywhere, as their trading platforms are available on desktop, laptop, and mobile. You can also use mobile app to keep up to date with trading analysis when you’re on the go.

Open all hours

in addition to being able to trade wherever you like, the non-stop nature of the forex market means that you can trade whenever you like too. No matter which time-zone you’re in or whether you’re a night owl or an early bird, you can always trade at a time that suits you.

Explore a highly liquid market

liquidity essentially describes how easy it is to sell something for cash. In trading terms, this means whether or not you can invest in an asset quickly and sell it again quickly, without impacting the inherent value of the asset. The forex market, with its huge market volume, has high liquidity. As such, there are always trades to be made and prices remain relatively stable.

What do I need to start FX trading?

As we mentioned earlier, forex trading can seem intimidating. Luckily, help is at hand. Our range of forex educational guides and material will put you in good stead to start trading effectively.

Once you’ve done your research and studied hard, you’ll be pleased to know there’s only a handful of other things you need to get started:

Capital

of course, to start trading you’ll need some capital. The amount of capital you need, however, is reducing all the time. Top forex brokers are becoming more flexible with their minimum deposit limits, to a point where you can now get started for under $100.

Hardware and software

next, you’ll need to make sure you have some way of trading. Traditionally this would mean having a PC or laptop yet, thanks to modern technology, you can now easily use top trading platforms on your mobile or tablet.

A quality broker

once you’ve created a convenient trading set-up, you’ll then need to choose a broker to trade with. It is important to find a broker that suits your needs perfectly. This could mean choosing a broker that offers a strong educational infrastructure, a particular trading platform or a certain range of markets. You can use our broker comparison list to help narrow down your search.

Economic insight

last but not least, to trade forex successfully you will need to keep up with economic and current events. There are certain tools that can help you with this, such as economic calendars and market news notifications, and these are often provided by top brokers.

You can also use trading signals or try out copy trading, where you follow the activity of successful traders, to help you to whilst you get started.

How to make money trading forex

To make money trading forex, you need to know one simple thing: when to buy and sell currencies.

Of course, this is easier said than done. To trade successfully, you must invest time in yourself and your learning before you invest your capital in the market. Profitable traders have a firm understanding of economic trades and use this to create tested forex trading strategies. A good trading strategy can help you to interpret, anticipate and make the most out of market movements.

Practice trading forex now

Once you are feeling confident in your knowledge and trading ability, registering for a forex demo account is your next step.

Demo accounts are excellent as they allow you to trade and make mistakes with virtual currency. You can trade in a completely risk-free environment, yet the software and markets will still perform exactly as they would under live conditions. This gives you a comprehensive trading experience, helping to build your knowledge extensively, for free.

Many of the best forex demo accounts, like those in the table below, also offer unlimited use periods. So, even after you start live trading, you can use your demo account for testing strategies.

What is forex trading?

Forex trading is the exchange of one foreign currency for another, in a huge global market which is worth more than $5 trillion in daily volume.

How does forex work?

At its most basic, forex trading works by exchanging one currency for another and exploiting the change in the value of currencies to make a profit.

Can you get rich by trading forex?

Yes. Some of the world’s richest people are or were forex traders. These include the likes of george soros who made the majority of his fortune trading the great british pound.

Is forex trading a good idea?

Sure. If you are interested in trading and keen to learn, the forex market is the largest and most traded market in the world. Forex trading can be very profitable.

Is forex trading legal?

Absolutely. Forex trading is legal and very well regulated by a number of well-respected bodies all around the world.

Video transcription: what is forex trading?

Hello there, we start today a series of video courses here on top rated forex brokers, with the beginner’s part. The aim is to create also intermediate and advanced trading training courses, both from a technical analysis point of view and a fundamental analysis point of view, but we have to start from somewhere. And here we are with explaining ‘what is forex trading?’, and moreover why traders are attracted to forex trading.

(0.35) forex trading means that you come to a place where you buy or sell a currency, but currencies are arranged in currency pairs. You can not only buy a currency, but you can also buy currency or sell a currency based on the way a currency pair moves, and against another currency. For example, this is the euro/USD that you see here listed on the trading platform and it is under ‘four hours’ chart. What does it mean?

(1.05) it means that every candle that you see here, green candles or red candles on the screen, they represent four hours as a timeframe. If we want to buy the euro/USD or to sell, for example, let’s buy at market the euro/USD, now trading at 1.19180 – 1.19184. This is the quotation. If you want to buy you always buy it from the right side, this is called the ‘ask’ price. You buy from the ‘ask’. If you want to sell, you always sell from the left side, from the bid price.

(1.45) when you do that, you can take a trade either based on bullishness – being bullish on the euro means that you expect the euro to move to the upside – or you can take a trade being bearish on the dollar – namely, you expect the dollar to move to the downside and hence the euro/USD pair will move to the upside.

(2.14) when it comes to forex trading, everything relates to the number of pips that you make. A pip is the difference between the bid and the ask price. For example, now the price is 1.1918, therefore if we buy it here at 1.1918, and the market moves to the upside to 1.1980 or 1.20, the difference between the higher price and the entry price, or the exit price and the entry price, represents the profit.

(2.54) or, if the market moves to the downside, it represents the loss. That’s forex trading, ladies and gentlemen, nothing else.

Now imagine how this world functions, or not how it functions, but how it is organized. Imagine that this is the world. Now, every country that we have here in the world has a currency.

(3.23) we have the USD in the united states, let’s put it here, we have the euro in the eurozone and so on. So, let’s actually put the euro here as well – this will be the euro. We also have the japanese yen and so on and so forth, all the currencies in the world. Now if you combine them two by two you will have currency pairs.

(3.58) so this will be the euro and the USD, or the euro and the japanese yen, or the japanese yen and the australian dollar, the australian dollar, and new zealand dollar, the new zealand dollar and the euro, the euro and australian dollar, and so on, you get the picture.

When buying and selling a currency pair it means that effectively you have an opinion about how the economies – the two economies in a currency pair – evolve.

(4.29) because if you look at the currency pairs and how they are part of the forex ledge board, the way it moves represents the imbalances between those two economies. The australian and new zealand dollar pair, for example, this one shows the weakness and the strength of an economy. As long as the AUS/NZD pair moved from 1.06 to 1.14 this can happen only in two instances.

(5.01) either the australian economy outperformed the new zealand dollar economy, or the monetary policy in new zealand is easiest, if you want, or is not that tight like the one in australia. The differences between the two economies, the differences between the two monetary policies, are seen in a currency and in a currency pair.

(5.28) traders strive to have a competitive edge or to have an educated guess about fundamental, or about technical parts, in order to interpret how the market will move. That’s what makes a successful trader.

When it comes to forex trading or to entering a market, you can enter a market either from a fundamental point of view – there are a lot of macro traders that look at different economic aspects around the world’s regions, around the different countries and so on, and they buy or sell a specific currency pair or a specific currency like the euro against everything else, or the dollar against everything else.

(6.14) or you can be a technical trader – if you are a technical trader then you have any trading platform, like this one, that offers a bunch of technical indicators to use. If you go here to ‘add indicator’, you have indicators for everything. You have indicators for the bill williams indicators, you have math transform, you have momentum, which are more or less oscillators, you have trend indicators, and so on, statistical, volatility indicators, you name it, everything you need to have from a technical point of view exists in a trading platform today.

(6.52) if it doesn’t exist it can be imported as long as you have your own indicator or technical approach.

There are also trading theories that we will cover in these courses, like the elliott wave theory, the gartley theory, the gunn theory and so on, but in the end what matters is to answer a very simple question – which by its simplicity makes forex trading so complicated…

(7.24) – is the market, any market, moving to the upside or to the downside?

(7.36) or will it range? Because if it ranges you may have some problems, because if the market ranges and takes its time on the daily chart or on the bigger timeframes and you play a negative swap – you will learn later what a negative swap is – then the balance of your trading account will decrease, which is not something that you actually want.

(7.58) to sum up, forex trading, or the foreign exchange market, is the biggest financial market in the world. There is no lack of liquidity here, you can sell and buy whatever you want. You will always find someone willing to take the other side of the trade. And every day over five trillion dollars exchanges hands. This makes it not an impossible, but a difficult trading environment.

(8:31) this makes it mandatory to understand how the market moves and what are the best approaches to technical analysis, and this is why we have created a trading academy destined to help everyone. We’ll start from scratch by explaining various concepts, technical analysis concepts, explaining a trading account, pros and cons of different brokers and trading platforms, and so on.

(9.01) then we will move slowly but surely into fundamental approaches. Into central banking, into basic technical analysis concepts, and then to advanced stuff to see how to trade the forex market to make a profit.

Thank you for being here and let’s move on.

What are key chart levels and how to trade them

If you’re just starting out with trading and technical analysis, you need to cover the market’s foundations. Identifying key chart tools and knowing how to trade them plays an important role in your trading performance.

Support and resistance levels form the basis of many technical price-levels and are essential tools in any technical toolbox.

In this article, we’ll cover what key chart levels are, how to spot and trade them, and answer a few common questions that beginner traders have when it comes to support and resistance trading.

What are key chart trading levels?

Key chart levels are important technical levels at which a financial instrument could face increased buying or selling pressure.

Traders look out for key chart levels to place their buy and sell orders around those lines, which accelerates price-moves and increases volatility when the price reaches those levels. Typically, key chart levels are identified by support and resistance lines, which act as barriers for the price when reached from the upside or downside, respectively.

Support levels are price-lines at which the market had difficulties to break below, signalling that buyers may join the market again if the price falls to a key support level. Resistance levels are quite similar to support levels, only that they form to the upside and signal price-levels at which the market had difficulties to break above.

When the price reaches a key resistance level, sellers may jump into the market and send the price lower again.

Types of support and resistance levels

There are many types of key chart levels which act as important support and resistance levels in the chart. We’ve outlined the most common ones in the following lines.

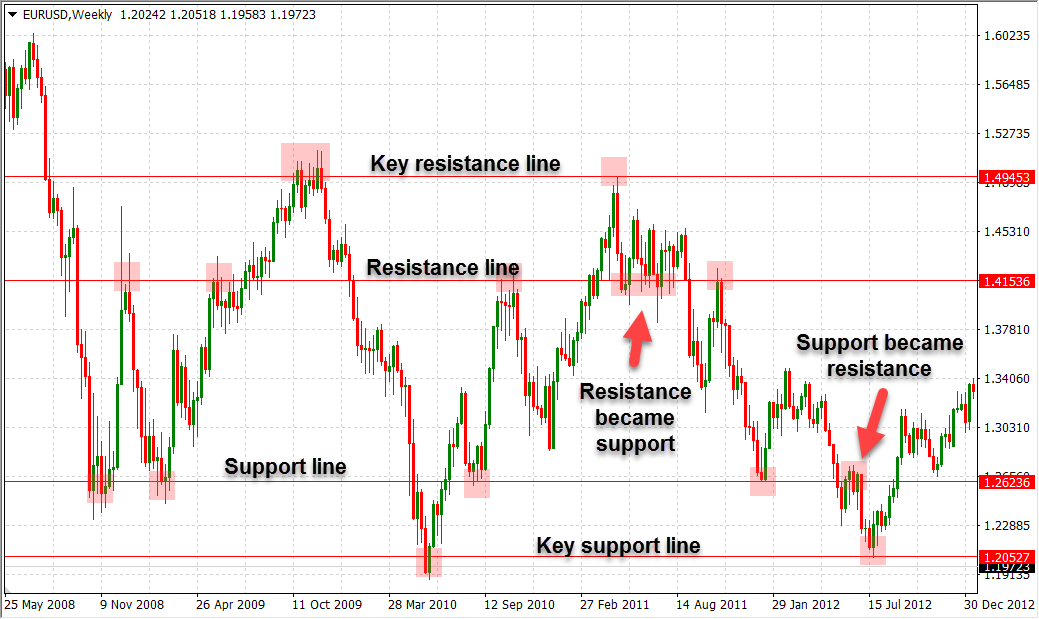

1. Horizontal key chart levels: as their name suggests, these are horizontal levels which are placed at the top of a previous swing high, or at the bottom of a previous swing low. Horizontal key chart levels are then projected into the future to mark price-levels at which the market may retrace, as shown on the following chart.

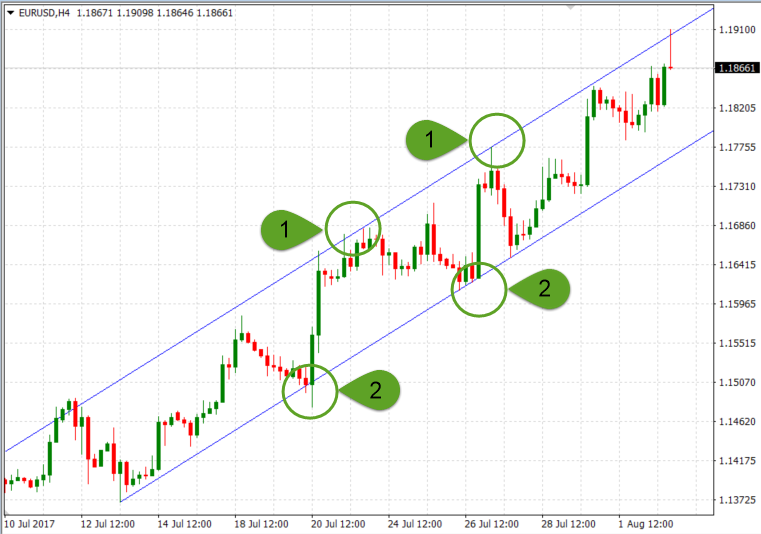

2. Non-horizontal key chart levels: besides horizontal key levels, traders can also draw trendlines and channels which don’t have to be horizontal in order to act as key support and resistance levels. Trendlines and channels are commonly used in forex trading to spot uptrend and downtrends and ride the trend. The following chart shows how trendlines and channels could act as important turning points for the price.

Example of non horizontal key chart levels – trendlines as key turning points

Points (1) and (2) acted as resistance and support for the EUR/USD pair, respectively, identified by a simple rising channel. Just like with rising channels, the lower boundaries of a downward sloping channel act again as support levels, while the upper boundaries act as resistance levels for the price. Channels are quite similar to trendlines, only that they include a second trendline which is drawn parallel to the first trendline.

3. Round-number key chart levels: these levels form around round-number exchange rates, such as 1.00, 1.50, 0.50, 1.25 etc. The psychology of market participants shows that traders tend to place their market orders around round numbers, increasing the buying or selling pressure around those levels.

4. Dynamic key chart levels: last but not least, dynamic key chart levels change with each new price-tick. They’re usually drawn automatically by your trading platform by applying specific technical indicators, such as moving averages or pivot points.

How to trade support and resistance

If you’re serious about your career as a trader, you need to learn how to trade support and resistance levels early in your trading career.

Not all support and resistance levels work the same or produce trade setups with equal probability of success. Here’re some pro tips on increasing the likelihood that a trade based on key support and resistance levels becomes a winner.

Pro tip #1: use higher timeframes to mark key support and resistance levels

Higher timeframes are more reliable when it comes to trading key chart levels, because a larger number of market participants pays attention to those levels. That’s why you should focus on higher timeframes, such as the daily and weekly ones, and bear in mind that support and resistance levels on timeframes lower than the 4-hour one could produce a lot of fake signals.

Pro tip #2: if you miss a break of a key chart level, wait for a pullback to get into a trade

Pullbacks refer to a retest of a broken support or resistance line before the price continues in the direction of the breakout. Pullbacks work because support and resistance levels change their roles once broken. A broken support level becomes a resistance level, and a broken resistance level becomes a support level in future trading. This is shown on the following chart.

Example of a broken support level with pullback

The horizontal level marked with point (1) acted as a support for the price at point (2). After the horizontal support was broken, the same line provided resistance for the price at points (3) and (4), signalling potential short setups.

Take our free course: technical analysis explainedtake our free course:trends, support & resistancetake our premium course: trading for beginnerstake our free course:japanese candlesticks decodedtake our free course:reversal price patternstake our free course:continuation price patterns

Key levels identified by channels and trendlines

Channels and trendlines are essential tools in any technical trader’s toolbox. They are used in finding uptrends and downtrends in the market by connecting higher lows in uptrends and lower highs in downtrends. Again, try to focus on higher timeframes when using trendlines and channels in trend-following trading strategies, as market trends tend to be more predictable in the medium and long-term than on an intraday basis.

Deutsche bank published a great research paper on the forex market and asked FX dealers to rate the predictability of market trends in the short, medium and long run. The table below shows the results:

“how do UK-based foreign exchange dealers think their market operates?”, NBER working paper 7524, february 2000.

As the table above shows, FX dealers believe that market trends are most predictable in the medium-term and long-term. The majority of FX dealers (40.3%) believe that market trends are extremely difficult to predict on an intraday basis.

That’s why using support charts and resistance charts that include a few months of data are likely to produce better results than shorter-term charts.

Support and resistance FAQ

Let’s take a look at a few common questions regarding support and resistance trading.

How to trade moving averages as support and resistance

Moving averages can act as a great support and resistance indicator. Moving averages are a technical indicator which takes the average price of the last n trading periods and plots it on the chart. While simple moving averages give an equal weight to all trading periods included in their calculation, exponential moving averages give more importance to the most recent price-data.

The following chart shows how 50-period, 100-period and 200-period emas can work as dynamic support and resistance levels for the price. The 200-day EMA is especially important and followed by a large number of traders. The scenarios of the price testing dynamic S&R levels drawn by emas are shown in red circles.

Example of price testing dynamic support and resistance levels

How to trade support and resistance zones on 15-minute trades

Many retail traders focus on day trading, especially in the beginning of their career. Short timeframes such as the 5-minutes or 15-minutes ones are often used by these traders to get the thrill that day trading provides. That said, trading on such short timeframes can often lead to costly mistakes and the accumulation of losses.

As elder alexander puts it in his famous book, come into my trading room,

“… the great paradox of day-trading is that it demands the highest level of discipline, while attracting the most impulsive, addictive, and gambling-prone personalities. If trading is a thrill, then day-trading provides the best rush. It is a joy to recognise a pattern on your screen, put in an order, and watch the market explode in a stiff rise, stuffing thousands of dollars into your pockets. A former military pilot said that day-trading was more exciting than sex or flying jet aircraft.”

To increase the likelihood of profitable trades, first mark key support and resistance levels on higher timeframes, such as the 4-hour and daily ones. After this, zoom-in to the 15-minutes charts to trade on shorter-term support and resistance levels.

Whenever the price reaches towards the longer-term, but the 15-minutes chart sends an opposing trading signal, your best bet would be to stay away from trading.

How to set support and resistance lines on metatrader 4

As one of the most popular trading platforms for retail forex traders, chances are you’re using metatrader 4 or 5 as your primary trading software. The good news is that it’s easy to set support and resistance lines on the metatrader 4 platform.

Step 1: open the currency pair that you want to analyse

step 2: select the 4-hour or daily timeframe to draw key support and resistance levels first

Step 3: identify obvious swing highs and lows and draw a horizontal line on them. In the case of a price trending, use trendlines or channels to connect the highs or lows

Step 4: zoom-in to shorter-term timeframes and repeat step 3 to find entry and exit points, or keep trading from the longer-term timeframes to get trade signals with higher probabilities of success.

Example of drawing tend channels to connect highs and lows

When all is said and done, key chart trading levels are important

Despite the fact that these levels form the foundation of many technical tools, they’re relatively simple to identify and trade. Many trend-following trading strategies rely on key chart levels to spot areas of major buying and selling pressure.

This is done by using trendlines and channels. If the price reaches a channel’s boundaries, there is a high chance of a price correction or reversal.

Learning the ins and outs of trading key chart levels is best achieved by studying financial trading, experience and screen time.

How to calculate forex price moves

A pip is the unit of measurement to express the change in price between two currencies.

Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. The term ‘pip’ is actually an acronym for ‘percentage in point’.

Professional forex traders often express their gains and losses in the number of pips their position rose or fell.

For example, if the EUR/USD moves from 1.2712 to 1.2713, that 0.0001 rise in the exchange rate is ONE PIP.

All major currency pairs go to the fourth decimal place to quantify a pip apart from the japanese yen which only goes to two.

Some brokers only quote to the fourth and second decimal place (for JPY pairs) but others, including AVA trade, quote to the fifth decimal place of the currency to provide even greater accuracy when measuring gains and losses. This fifth decimal place is what we call a pipette – one-tenth of a pip.

So for example, if the EURUSD moves from 1.27128 to 1.27129, we can say it has moved one pipette or 0.1 pips (1 tenth of a pip). So now that we know what a pip is, what does it mean to us in terms of how much money we make or lose for each movement?

Well, this depends on the size of the position we opened. Larger positions mean each pip movement in the pair will have a greater monetary consequence to our balance.

To calculate this it is quite simple. We simply multiply our position size by 0.0001 (i.E. ONE PIP): let’s take an example and stick with our EURUSD pair. We can forget what price it is trading at for now and we’ll concentrate on how much money a pip move will be for various position sizes.

So say we wanted to open a position size of 10,000 units.

Our calculation to establish what a one pip movement means to us is as follows:

10,000 (units) * 0.0001 (one pip) = $ 1 per pip

So a position of 10,000 (BUY or SELL) means that every time the pair moves 0.0001 (i.E. ONE PIP) then we will make a profit or loss of $1.00 depending on which way it moved.

Therefore, for a position of this size – 10,000 units – we will gain or lose $1 for every pip movement in either direction. So if the EUR/USD moves 100 pips (i.E. 1 cent) in our direction we will make $100 profit.

We can do this for any trade size. The calculation is simply the trade size times 0.0001 (1 pip).

5,000 (units) * 0.0001 (one pip) = $ 0.50 per pip

60,000 (units) * 0.0001 (one pip) = $ 6 per pip

123,000 (units) * 0.0001 (one pip) = $ 12.30 per pip

Our pip value WILL ALWAYS BE MEASURED IN THE CURRENCY OF THE QUOTE CURRENCY OF THE FX PAIR i.E. The currency on the right-hand size of the pair.

So in the example of the EURUSD, we see our pip value is always in US dollars.

If we were trading the EURGBP pair, the pip value will be in pound sterling.

10,000 units * 0.0001 = £ 1.00 per pip

Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in US dollar, euro, pound and yen.

So let’s say we have a euro platform taking our EURGBP example above and the current EURGBP exchange rate is 1.5000.

Then each pip movement of 1.00 would be automatically converted by our broker to – we simply divide 1$ by the current EURUSD rate which is 1.26500 which equals 0.79c.

If we are using a GBP platform one pip will equal 1$/1.59500 (the GBPUSD rate) or 0.63 pence.

These calculations will be done automatically on our trading platform but it is important to know how they are worked out.

At this point, you may be asking ‘how can I trade such large positions such as 10,000 units of a currency pair? That sounds like a very large investment!’ the answer to that question is leverage which we will discuss in another article.

Forex trading 101: what is FX trading?

If you are interested in the world of trading you may find yourself wondering what is forex, and what is forex trading?

Getting started in the world of forex trading can be a daunting task. There’s an abundance of new terminology to get to grips with, and many of the ‘guides’ aimed at new traders seem to neglect the basics of exactly what forex trading is.

As professionals in the field, there is nothing we enjoy more than being able to pass on our knowledge of forex trading to others. Having become frustrated with the over-complicated nature of other material found online, our expert team has taken it upon themselves to compile a basic, practical handbook to help you to understand forex trading from the very start.

Our forex trading 101 guide covers everything you need to know as a first-time trader. On this page you can:

- Learn the basics of the forex market and how it works

- Discover the pros and cons of forex trading

- Find out what you need in order to start trading

- Learn how to make money trading forex

- Register for a demo account to start practicing

What is forex?

Forex simply refers to the foreign exchange market, a market in which you can trade one currency for another. The word forex itself, which is also sometimes abbreviated to FX, is a portmanteau of the phrase foreign exchange.

One of the most unique things about the forex market is that it’s decentralized. This means that it does not have a fixed location or an owner, and investors deal directly with each other. The decentralized nature of the forex market gives it other distinct qualities too.

Forex trading takes place around the world on a 24-hour basis during weekdays. This is very different from stock markets, which close at the end of the day. As the forex market is global, trading activity simply shifts to a different location, depending on what time of day it is. For instance, when trading finishes in new york, it begins in sydney. Moreover, whilst the forex market is technically closed on the weekends, you will find that these down periods are very short due to the way time zones work.

Forex is also by far the largest financial market in the world, with a total trading volume of over $5 trillion per day. Ultimately, the size and scope of the forex market present you with a huge number of opportunities to trade.

What is forex trading?

Forex trading is the trading of currency within the forex market. On the most basic level, this is done through the trading of currency pairs (one currency traded for another currency). In fact, every time you take a vacation and swap your USD for the currency of your destination country or vice versa, you are participating in the forex market and forming part of the $5 trillion daily volume mentioned above.

Operating in the market as a retail forex trader is not a whole lot different. You are buying one currency at a particular price and hoping that this price then moves in your favor so you can resell it at a later date. What makes forex trading so potentially lucrative, however, is the amounts traded.

The difference in currency values is often negligible unless you are trading with large amounts. Whilst you might not make a lot of profit trading in your cash at the end of your vacation, as a forex trader you will generally trade at least one micro-lot (worth $1,000) at a time. This is facilitated by major forex brokers, who give you leverage to hold large market positions.

This effectively means that for as little as $100 in some cases, you can place trades to the value of $50,000. The market has the potential for you to grow your investment at an extreme rate.

Is forex trading regulated?

Yes. Although the forex market is decentralized, and so it does not have one particular regulatory body, it is operated in an extremely transparent manner. All major forex brokers must meet certain standards, imposed by a number of financial authorities who have established protective frameworks for traders and who monitor compliance closely.

Different regulatory bodies will be active in different areas of rules, and each has its own rules and regulations. These work to ensure that no matter what happens, your investment is used in a safe and secure manner.

Top forex brokers are typically overseen by at least one, if not several, of the following regulatory bodies:

- NFA (national futures association) – US-based regulator

- Cysec (cyprus securities and exchange commission) – the most respected regulatory body overseeing the EU area. They impose a maximum leverage of 1:30 among other rules.

- FCA (financial conduct authority) – UK-based regulatory body

- IFSC (international financial services commission) – popular international regulatory body based in belize which is trustworthy while possessing some more flexible regulations on things such as leverage.

How do currency pairs work?

When you trade in the forex market, you will be trading currency pairs. A currency pair is, as its name suggests, made up of two currencies. One is the base currency and one is the quote currency.

The base currency is always listed first. This is the currency which you are wishing to buy. The quote currency, on the other hand, is the currency you already have. You sell the quote currency to buy the base currency.

For example, in the EUR/USD currency pair, the euro is the base currency and the dollar is the quote currency. When reading this particular example market, you may see 1EUR = $1.20. This means that in order to purchase 1 euro, $1.20 is required.

When you are trading in the forex market, you will always be trading currency pairs. There are hundreds of currency pairs to choose from, depending on your broker, though these can typically be broken down into 3 distinct categories:

- Major pairs – these always include the US dollar. Popular major pairs include EUR/USD, GBP/USD and USD/JPY.

- Minor pairs – these are also sometimes referred to as cross-currency pairs. These pairs do not include the dollar but do include one of the three main non-USD currencies (the euro, the british pound or the japanese yen). Minor pairs include EUR/GBP, EUR/JPY, GBP/AUD

- Exotic pairs – exotic, or emerging, pairs are those which involve only one major currency. For instance, USD/MXN (US dollar and mexican peso).

Currency pairs gain and lose value due to a number of different factors, such as economic news and political announcements. This, combined with the wide range of pairs available for trading, makes the market both lucrative and accessible to traders from all over the world.

The 3 different types of forex trades

There are three main ways in which you can trade on the forex market. These are through spot trades, forward trades, and future trades.

Spot trades are instantly delivered orders. You are buying right now at the current price available in the market, and you will take ownership right away.

Forward trades are trades in which you agree to pay a price for a currency at a set time in the future. This time and price are binding no matter what happens in the interim and no funds are usually required until the agreed date.

Futures trades are trades in which you buy into the market now, with an agreed date on when to sell the current position. These are usually traded as cfds in which case ownership of the underlying asset is not transferred.

Spot trades are by far the most popular type of trade. This is due to the fact they are instant and simple. These are both important qualities in a quickly changing market like forex.

Why is FX trading so popular?

Retail forex trading, which refers to trading which is carried out by individuals, is incredibly popular. Around 5-6% of the entire forex market is made up of retail traders. That counts for around $300 billion of the market’s daily trading value.

Whilst this may seem small in comparison to the value of the complete market ($5 trillion), compare it to the daily value of the new york stock exchange (between $2-6 billion). As you can see, the retail forex trading industry is huge.

Why is this case? Although learning to trade forex profitably requires a lot of time and effort, and without this it can be risky, the simple fact is that there’s plenty of appealing advantages to forex trading too.

Earn extra income

forex trading offers you the opportunity to earn extra income, provided you are suitably prepared for trading, knowledgeable about the market and remain aware of the risks. As the forex market is open 24 hours a day, trading can be done in your spare time. FX trading can be fitted to your lifestyle, not the other way around.

Start trading with ease

one great thing about forex trading is that you typically do not need huge amounts to get started. Most major forex brokers require a first minimum deposit of under $100. Learning about forex trading is similarly accessible. The internet is filled with quality forex trading guides and advice (like this very page), and your broker may even provide you with educational materials to help you improve your skills.

Adapt your trading style to suit your needs

A huge benefit of forex trading is that, wherever you turn, you are presented with a wide range of options. From choosing to trade the currencies you know well, to employing different strategies or using robots, you can always adapt your trading style to make sure you get the best results for you.

Trade wherever you want

in the past few years, forex trading has become increasingly portable. Many of the best forex brokers now allow you trade from almost anywhere, as their trading platforms are available on desktop, laptop, and mobile. You can also use mobile app to keep up to date with trading analysis when you’re on the go.

Open all hours

in addition to being able to trade wherever you like, the non-stop nature of the forex market means that you can trade whenever you like too. No matter which time-zone you’re in or whether you’re a night owl or an early bird, you can always trade at a time that suits you.

Explore a highly liquid market

liquidity essentially describes how easy it is to sell something for cash. In trading terms, this means whether or not you can invest in an asset quickly and sell it again quickly, without impacting the inherent value of the asset. The forex market, with its huge market volume, has high liquidity. As such, there are always trades to be made and prices remain relatively stable.

What do I need to start FX trading?

As we mentioned earlier, forex trading can seem intimidating. Luckily, help is at hand. Our range of forex educational guides and material will put you in good stead to start trading effectively.

Once you’ve done your research and studied hard, you’ll be pleased to know there’s only a handful of other things you need to get started:

Capital

of course, to start trading you’ll need some capital. The amount of capital you need, however, is reducing all the time. Top forex brokers are becoming more flexible with their minimum deposit limits, to a point where you can now get started for under $100.

Hardware and software

next, you’ll need to make sure you have some way of trading. Traditionally this would mean having a PC or laptop yet, thanks to modern technology, you can now easily use top trading platforms on your mobile or tablet.

A quality broker

once you’ve created a convenient trading set-up, you’ll then need to choose a broker to trade with. It is important to find a broker that suits your needs perfectly. This could mean choosing a broker that offers a strong educational infrastructure, a particular trading platform or a certain range of markets. You can use our broker comparison list to help narrow down your search.

Economic insight

last but not least, to trade forex successfully you will need to keep up with economic and current events. There are certain tools that can help you with this, such as economic calendars and market news notifications, and these are often provided by top brokers.

You can also use trading signals or try out copy trading, where you follow the activity of successful traders, to help you to whilst you get started.

How to make money trading forex

To make money trading forex, you need to know one simple thing: when to buy and sell currencies.

Of course, this is easier said than done. To trade successfully, you must invest time in yourself and your learning before you invest your capital in the market. Profitable traders have a firm understanding of economic trades and use this to create tested forex trading strategies. A good trading strategy can help you to interpret, anticipate and make the most out of market movements.

Practice trading forex now

Once you are feeling confident in your knowledge and trading ability, registering for a forex demo account is your next step.

Demo accounts are excellent as they allow you to trade and make mistakes with virtual currency. You can trade in a completely risk-free environment, yet the software and markets will still perform exactly as they would under live conditions. This gives you a comprehensive trading experience, helping to build your knowledge extensively, for free.

Many of the best forex demo accounts, like those in the table below, also offer unlimited use periods. So, even after you start live trading, you can use your demo account for testing strategies.

What is forex trading?

Forex trading is the exchange of one foreign currency for another, in a huge global market which is worth more than $5 trillion in daily volume.

How does forex work?

At its most basic, forex trading works by exchanging one currency for another and exploiting the change in the value of currencies to make a profit.

Can you get rich by trading forex?

Yes. Some of the world’s richest people are or were forex traders. These include the likes of george soros who made the majority of his fortune trading the great british pound.

Is forex trading a good idea?

Sure. If you are interested in trading and keen to learn, the forex market is the largest and most traded market in the world. Forex trading can be very profitable.

Is forex trading legal?

Absolutely. Forex trading is legal and very well regulated by a number of well-respected bodies all around the world.

Video transcription: what is forex trading?

Hello there, we start today a series of video courses here on top rated forex brokers, with the beginner’s part. The aim is to create also intermediate and advanced trading training courses, both from a technical analysis point of view and a fundamental analysis point of view, but we have to start from somewhere. And here we are with explaining ‘what is forex trading?’, and moreover why traders are attracted to forex trading.

(0.35) forex trading means that you come to a place where you buy or sell a currency, but currencies are arranged in currency pairs. You can not only buy a currency, but you can also buy currency or sell a currency based on the way a currency pair moves, and against another currency. For example, this is the euro/USD that you see here listed on the trading platform and it is under ‘four hours’ chart. What does it mean?

(1.05) it means that every candle that you see here, green candles or red candles on the screen, they represent four hours as a timeframe. If we want to buy the euro/USD or to sell, for example, let’s buy at market the euro/USD, now trading at 1.19180 – 1.19184. This is the quotation. If you want to buy you always buy it from the right side, this is called the ‘ask’ price. You buy from the ‘ask’. If you want to sell, you always sell from the left side, from the bid price.

(1.45) when you do that, you can take a trade either based on bullishness – being bullish on the euro means that you expect the euro to move to the upside – or you can take a trade being bearish on the dollar – namely, you expect the dollar to move to the downside and hence the euro/USD pair will move to the upside.

(2.14) when it comes to forex trading, everything relates to the number of pips that you make. A pip is the difference between the bid and the ask price. For example, now the price is 1.1918, therefore if we buy it here at 1.1918, and the market moves to the upside to 1.1980 or 1.20, the difference between the higher price and the entry price, or the exit price and the entry price, represents the profit.

(2.54) or, if the market moves to the downside, it represents the loss. That’s forex trading, ladies and gentlemen, nothing else.

Now imagine how this world functions, or not how it functions, but how it is organized. Imagine that this is the world. Now, every country that we have here in the world has a currency.

(3.23) we have the USD in the united states, let’s put it here, we have the euro in the eurozone and so on. So, let’s actually put the euro here as well – this will be the euro. We also have the japanese yen and so on and so forth, all the currencies in the world. Now if you combine them two by two you will have currency pairs.

(3.58) so this will be the euro and the USD, or the euro and the japanese yen, or the japanese yen and the australian dollar, the australian dollar, and new zealand dollar, the new zealand dollar and the euro, the euro and australian dollar, and so on, you get the picture.

When buying and selling a currency pair it means that effectively you have an opinion about how the economies – the two economies in a currency pair – evolve.

(4.29) because if you look at the currency pairs and how they are part of the forex ledge board, the way it moves represents the imbalances between those two economies. The australian and new zealand dollar pair, for example, this one shows the weakness and the strength of an economy. As long as the AUS/NZD pair moved from 1.06 to 1.14 this can happen only in two instances.