Sinosoft fx

The allegedly available MT5 is only mentioned on the website, there is no concrete evidence to support its actual presence -as we mentioned, we were not able to register-.

Free forex bonuses

However, the MT5 is downloadable and bears the name of the broker, which is reassuring enough. However, the scammers have anticipated this development, and are ready to counter any withdrawal request. Typically they find excuses for delaying the request in the legal documents that hold specific clauses for these purposes. The reasons are many. One thing to remember is that all illicit brokerage firms will deny the withdrawal request for as long as they can, because of the imposed time limit traders have for filling a chargeback. Once the crucial due date is not met, any chargeback requests will be denied.

Sinosoft FX review – 5 things you should know about sinosoftfx.Com

Beware! Sinosoft FX is an offshore broker! Your investment may be at risk.

RECOMMENDED FOREX BROKERS

Don’t put all your eggs in one basket. Open trading accounts with at least two brokers.

Sinosoft FX is a broker that took us some time to label, yet we still achieved to reveal its true nature. The biggest issue we had with this one was that the registration page was broken, and thus we could not register an account. This means that we have to trust the company’s website for trading conditions. Nevertheless, the accounts page reveals that the leverage is capped at 1:300, and the minimum EUR/USD spread is 0.2 pips (for the platinum account).

SINOSOFT FX REGULATION AND SAFETY OF FUNDS

We will briefly cover two alleged claims that the broker reveals. The first is its location in dubai. In dubai brokers must be authorized and regulated by the dubai financial services authority (DFSA), for them to operate within legal frames. Of course, sinosoft FX is not to be found on the official DFSA website, and furtheremore, the broker does not actually claim that it is regulated in dubai, only that it is located there.

The second piece of info that we stumbled on is found in the funds protection document, stating that sinosoft FX is in fact regulated by an independent international organization called the financial commission. There is such a commission, with many benefits to brokers (and other companies) such as compensation funds, yet sinosoft FX’s name was not found among the list of authorized companies.

There is further evidence of sinosoft FX suspicious nature, including short and incomplete legal documents, and the aforementioned broken registration page.

We can therefore conclude that sinosoft FX in UNREGULATED, making it a financial risk to anyone that invest with it!

Traders should be trading with risk-free brokers, that hold licensed from renowned and austere agencies, like the FCA or cysec , which have made a name for themselves as some of the top regulators. Readers should be aware that both agencies have adapted very strict rules of conduct, and their licensing framework guarantees safety and security for all clientele. A good example of this is the segregation of accounts which assures that client money and broker money are kept in separate accounts. Furthermore, FCA/cysec brokers participate in a financial reimbursement scheme that cover traders losses in case the broker becomes insolvent. The FCA provides up to 85 000 pounds per person, while cysec guarantees up to 20 000 euros.

SINOSOFT TRADING SOFTWARE

The allegedly available MT5 is only mentioned on the website; there is no concrete evidence to support its actual presence -as we mentioned, we were not able to register-. However, the MT5 is downloadable and bears the name of the broker, which is reassuring enough.

Nevertheless, the MT5 still retains some great features even if it is still shadowed by the immensely popular MT4. MT5 is certified by many stock exchanges and allows for a centralized market trade. Improvements have been made with the chart time frames, there are better charting tools to further otpimize the trading experience, and there are more pending order types.

SINOSOFT DEPOSIT/WITHDRAWAL METHODS AND FEES

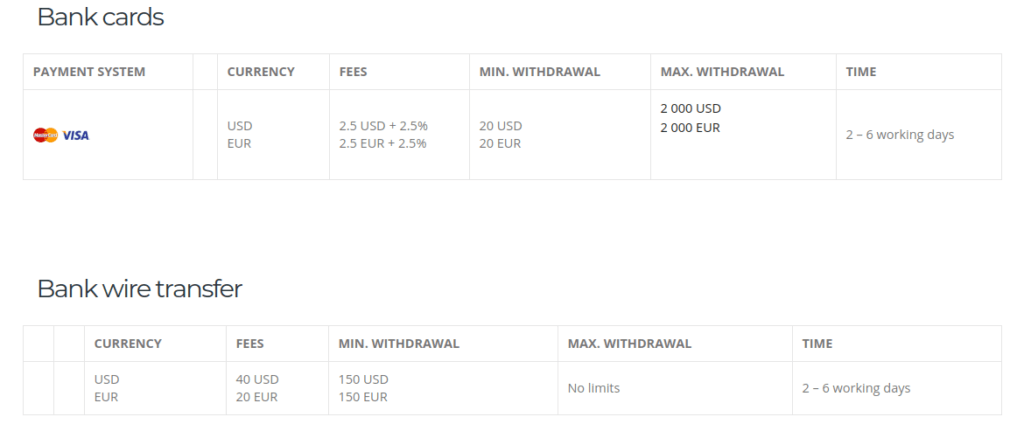

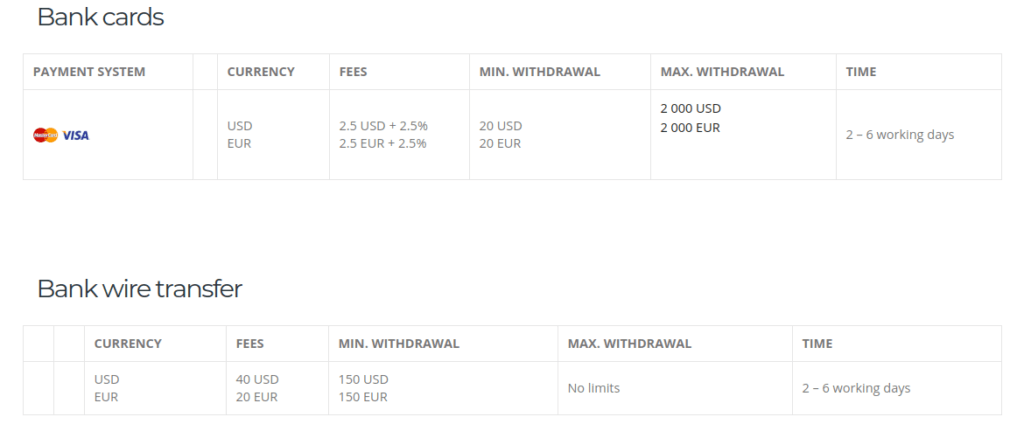

Currently, the only way to get any information on both deposits and withdrawals is the accounts page and the withdrawal and deposit funds page. In it is stated that funds can be deposited via cards, bank transfer, neteller, skrill, perfectmoney, and webmoney. The minimum deposit is $100. The minimum withdrawal amount is $1-$2 for epayments, 20$ for cards, and $150 for bank transfers.

As for fees, they seem to be the same for both deposits and withdrawals: neteller fees are 2%, skrill charges are 1%, webmoney’s toll is 0.8%, pefectmoney charges 0.5%, withdrawals via cards are burdened with $2.5 + 2.5%, and wire tarsnfers have fees of $40.

We strongly advice traders to only deposit the minimum deposit, or better yet – not deposit at all! As for the withdrawals, scammers are known to either deny such requests, or impose incoming and unexpected charges.

How does the scam work?

Users will be in the middle of a scam without even knowing it, that’s how efficient these scams are. Yet, clients will also be surprised that the most utilized scammer structure is laughably easy to grasp, making it predictable. We have dedicated the following section to the reveal of how the scam works.

The internet is filled with ads, it’s the fuel of the industry, and a big chunk of said advertisements are misleading and some are downright deceitful. The ads concerned with unregulated forex brokers are often very promising, and most of the times utilize completely false claims of immediate profit. Those tempted enough will be redirected to a robo-scam website that further guarantees profits. The only thing that separates the user from the unrealistic promises is a fast registration process that requires a phone number and an email address. After inputting this info unsuspecting users will start getting phone calls from illicit broker representatives, whose one and only job is to initialize the scheme by pushing a trader to make that first deposit of around $250. After that’s done, the senior representatives will be calling. These expert scammers are extremely good talkers, and will start working on you to start putting even more money in. They say that the more money invested, the higher the profit will be. At this point most traders start seeing the big picture, and will want to withdrawal their money and get out fast.

However, the scammers have anticipated this development, and are ready to counter any withdrawal request. Typically they find excuses for delaying the request in the legal documents that hold specific clauses for these purposes. The reasons are many. One thing to remember is that all illicit brokerage firms will deny the withdrawal request for as long as they can, because of the imposed time limit traders have for filling a chargeback. Once the crucial due date is not met, any chargeback requests will be denied.

What to do if scammed?

Those of you who deposited using VISA and mastercard wil be glad to know that both companies have extended their chargeback time span to 540 days, especially if the reason for it is an online scam.

Scammers will steal directly from a bank account, if the traders has provided crucial details, like banking password or security code. If it get down to this, be sure to either block the account or change the password.

Sometime victimized users will stumble upon the so called recovery agents that promises to magically reclaim all lost investments, for a fee that is. Needless to say, they will not get back any of the lost funds, and will basically scam you a second time.

Sinosoft FX – is it a scam broker?

Stop! It’s a scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Sinosoft FX - DO NOT TRADE WITH THIS PROVIDER

Sinosoft FX claims to be an award-winning broker based out of dubai in the united arab emirates. The broker also claims to offer trading in forex currency pairs, cfds on stocks, indices as well as commodities.

The broker offers its clients 3 different account types:

- Silver account: which has a $100 minimum deposit requirement, and a spread of 1.6 pips.

- Gold account: which has a $2,000 minimum deposit requirement, and a spread of 1.2 pips.

- Platinum account: which has a $20,000 minimum deposit requirement, and a spread of 0.2 pips along with a $4 per lot.

The leverage ratio of all the three accounts stands at a maximum of 1:300, which is quite solid.

Try these regulated brokers if you want to start trading cryptocurrencies

Plus500 is a FTSE 250 listed brokerage providing online trading services in cfds, across 2,000+ securities and multiple asset classes.

Founded: 2018

Regulations: unregulated

Languages: english (and 40+ other)

Deposit methods: credit/debit cards, bank transfers, skrill, neteller, perfectmoney, webmoney

Minimum deposit: $100

Free demo account: no

Number of assets: unknown

Types of assets: cfds on indices, commodities, stocks, and forex

Trading accounts and conditions

Sinosoft FX claims to be an award-winning broker based out of dubai in the united arab emirates. The broker also claims to offer trading in forex currency pairs, cfds on stocks, indices as well as commodities.

The broker offers its clients 3 different account types:

- Silver account: which has a $100 minimum deposit requirement, and a spread of 1.6 pips.

- Gold account: which has a $2,000 minimum deposit requirement, and a spread of 1.2 pips.

- Platinum account: which has a $20,000 minimum deposit requirement, and a spread of 0.2 pips along with a $4 per lot.

The leverage ratio of all the three accounts stands at a maximum of 1:300, which is quite solid.

The trading conditions seems to be rather attractive, but do read on to find out what the advantages and disadvantages of this broker are.

Sinosoft FX – advantages

Here are some of the advantages we found during our research into sinosoft FX:

Low minimum deposit requirement

This broker offers a competitively low minimum deposit requirement, which is a great positive.

Solid leverage

Sinosoft FX offers a leverage ratio of 1:300, which is quite solid and would even appeal to traders with a higher risk appetite.

However, we need to also offer a word of caution here. Most regulated jurisdictions have placed a cap on how much leverage brokers can offer, since higher leverages also expose trader to higher risk.

So, if a broker offers really high leverage ratios, it may not always be a good thing.

Decent spreads

Spread determine the amount of money you stand to make from each trade. So, the higher the spread, the lower your returns. Sinosoft FX has slightly higher than average spreads, but are still within acceptable limits.

Sinosoft FX – disadvantages

Looking at the trading conditions and the website, you would wonder whether there is any wrong at all with this broker. However, do read our list of disadvantages before you invest any money with sinosoft FX.

Not regulated

Sinosoft FX says it is owned and operated by sinosoft global company limited. This company is supposed to be based out of the city of dubai in the UAE.

The thing is, all financial services companies are supposed to be registered with and regulated by the DFSA (dubai financial services authority) if they are to operate within the bounds of the law.

However, when we investigated sinosoft FX’s claims of being regulated, we looked through the DFSA register, but did not find the parent company (or even the broker) listed there.

Of course, the broker did not claim to be regulated by the DFSA – just that it was located in dubai. Then, while through the broker’s funds protection page, we discovered that sinosoft FX claimed to be regulated by the financial commission.

The financial commission does exist, but sinosoft FX’s name in its register does not.

The misleading information posted by this broker on its website leads us to conclude that sinosoft FX is not actually regulated at all.

Plus500

Plus500 is a FTSE 250 listed brokerage providing online trading services in cfds, across 2,000+ securities and multiple asset classes.

Avatrade

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

Inability to register an account

Sinosoft FX claims to offer its clients 3 different account types. However, when we tried to register for them, we were unable to do so; the registration page seemed broken.

What this means is that we were unable to verify whether the trading conditions – which look very attractive – are true or not.

Managed accounts

Another cause for concern is that sinosoft FX offers fund management services to its clients. Why this is a cause for concern is simple. Forex brokers are market makers. This means that they profit only when traders lose money.

So, if a market maker is in charge of your funds, there is actually a conflict of interest, since the broker could ensure that you would keep losing money, while it keeps profiting off your losses.

Trading bonuses

Trading bonuses have been prohibited in most regulated jurisdictions. This is because such bonuses come with ropes (not strings) attached. Traders are lured by unscrupulous brokers with seemingly attractive bonuses, and once they accept those bonus promotions they are trapped.

These brokers then reveal the almost impossible to achieve trading volume conditions. And if a trader does not meet those volumes, then he or she is not allowed to withdraw his or her funds. In essence, the money the trader put in with that broker through the bonus scheme is lost forever.

Thus, the fact that sinosoft FX offers trading bonuses is just another indicator that this is not a broker you should trust.

No demo account

A demo account is required for traders to be able to test the trading conditions put forward by brokers. It also allows them to familiarize themselves with a new trading platform.

Because of this, most shady brokers do not offer demo accounts – they don’t want their future victims to get a chance to see what could happen to them if they trade on their platform.

So, if sinosoft FX doesn’t offer a demo account – that is a clear warning sign that you should stay away from this broker.

Unbranded trading account

When we tried to download sinosoft’s trading platform, we were redirected to the homepage of metaquotes, the developer of the MT5 software. Then, we were offered the option to download an unbranded trading platform that had no relation to sinosoft FX.

This platform did not even represent the trading conditions advertised on the broker’s website.

Conclusion

After we investigated all of sinosoft FX’s claims, we have come to the conclusion that this broker is a scammer and that it would in your best interests to stay clear of this scam operator.

Sinosoft fx review - is sinosoftfx.Com scam or good forex broker?

RECOMMENDED FOREX BROKERS

Sinosoft fx is presented as an award winning broker from dubai, offering forex pairs and cfds on commodities, indices and stocks, with a choice of three account types, leverage as high as 1:300, trading bonuses, and the metatrader5 platform.

And sinosoft fx also claims to be regulated, and to offer asset management services for clients willing to deposit at least 10 000 USD.

As fine as all of this may sound, it turned out the broker is nowhere to be found in the registers of the local financial regulator - the central bank of united arab emirates (CBUAE), so if you are still considering whether it would be a good idea to deposit your funds with them, better read the following paragraphs.

Sinosoft fx advantages:

Except for their minimum deposit requirement, which is just 100 USD and the generous leverage, there are no other notable advantages about the broker. Besides, with some big and popular brokers like FBS and IG you will be able to open a trading account with just 5 USD or so.

Sinosoft fx disadvantages:

No license, shady background

Sinosoft fx is said to be owned and operated by sinosoft global company limited, a company supposedly based n dubai, the united arab emirates. And they also say to be regulated. So we diligently checked the registers of the central bank of united arab emirates, but were unable to find nether the company nor the broker there.

That means sinosoft fx are deliberately trying to mislead investors that they hold a legit license, while in reality they are just another unregulated website with shady ownership. We were not able to confirm that sinosoft global company limited is incorporated in the UAE either.

Bear in mind that proper regulation is of utmost importance for the safety of your funds and depositing any money with unregulated websites like sinosoft fx sounds like a recipe to get scammed.

So our best advice here is to trade only with legit and properly regulated brokers like the once licensed and authorized by the financial conduct authority (FCA) in the UK, the cyprus securities and exchange commission (cysec) or the australian securities and investments commission ASIC).

Here we would also suggest that you check our list of FCA regulated brokers, where your funds will even be covered by a special client compensation fund, basically insuring your trading account for up to 85 000 GBP:

Sinosoft fx offers a fund management services and that is yet another worrisome sign. Bear in mind that like virtually all other brokers sinosoft fx acts as a market maker, which means that they make money whenever traders lose. So you can easily imagine that if you trust market makers like sinosoft fx to manage your account, they will surely have an incentive to mismanage your money and lose them in their own pockets.

The reason why we do not like trading bonuses is quite simple – they always come with strings attached – some minimum trade volume requirement, which scammers handily use as a pretext to cancel your withdraw requests. Besides, such promotions are altogether banned on regulated market like the european union for example.

No real demo account, unbranded trading platform

Sinosoft fx says to be offering a demo account, but when we tried to download their trading platform – we were redirected to the metaquotes homepage, which is the developer of metatrader5, and were offered to download a unbranded, default version of the platform, which has nothing to do with sinosoft fx and in no way represents the real trading conditions of the broker. In fact we can not even be sure that sinosoft fx really offers metatader5.

In any case metatader5 is one of the leading trading platform on the market, featuring numerous market indicators and trading robots with the help of which one can easily run algorithmic trading sessions. Also, meatrader5 comes with an excellent set of advanced charting tools, so here you may check as well our list of brokers, which do support the platform:

Sinosoft fx is a low credibility, unregulated website, which according to our expertise is most probably involved in scam. So once again here we will repeat our usual advise to avoid unregulated brokers, and to trade only with companies that are licensed and authorized by well known institutions like the FCA in the UK, cysec in cyprus or ASIC in australia.

Sinosoft FX review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

Sinosoft FX forex broker markets itself as a well established forex and commodities brokerage. According to the website, the company behind sinosoft FX is sinosoft global company limited which is located in dubai. There is no mention of license and regulations, meaning that the broker does not have any license. Sinosoft offers traders to trade currency pairs and cfds on indices, cryptocurrency, and commodities. The minimum deposit required to open an account with the broker is 100 USD for the standard account. Traders are allowed to use leverage up to 1:300 depending on the account type. This sinosoft FX review will discuss the features and offerings of the broker in details to see if the broker is legit and worth trusting or not.

Is sinosoft FX legit?

The award-winning broker and industry leader – this is how the broker characterizes itself on its own website, but as you could already guess it is not quite the case. Sinosoft FX was established in 2018 and has only one year of experience at operating on the forex industry market. It is not a long time for the newly established brokerage to get the title of an industry leader. The broker is simply claiming this title, so can sinosoft FX be trusted? Let us see. The company that operates sinosoft FX is called sinosoft global company limited. According to the website, the brokerage is located in dubai. However, seemingly it is not regulated by the dubai financial service authority (DFSA) and by any other financial authorities. Despite being unauthorized forex broker, sinosoft FX claims that it has regulated services.

Sinosoftfx.Com review

The website of the broker does not create a very good first impression. The main problem of the website is the navigation, it is almost impossible to find necessary information without much hassle. Moreover, the information provided on the website does not cover all the needed subjects, for example, the trading instruments. The technical side of the website is not very good, and contentwise it is poor as well. Another big issue you might face while wandering on the broker’s website is the grammatically incorrect sentences. It is not known if the website was made in english first, or was translated to english, in any case, the website of the international broker should have correct sentences. The language is so poor that some of the content does not make any sense.

While making sinosoftfx.Com review we also checked the social media pages of the broker. Social media accounts of sinosoft FX can be found on facebook, instagram, and twitter. The broker is not very active on social media, it has up to 10 followers on twitter and only one follower on instagram. The facebook page of the broker was created in 2019, and according to facebook is managed from india. The overall review of the website makes us think that sinosoft FX scam is possible and traders should be aware of the brokerage.

Sinosoft FX trading conditions

The information about trading conditions is very limited on the broker’s websites. It offers ECN accounts where traders can trade with currency pairs and cfds on commodities, indices, and cryptocurrencies. However, which instruments are offered by the broker is not listed anywhere on the website. The broker offers metatrader 5 for PC, IOS, and android.

The minimum deposit requirement is 100 USD which is considered to be an average minimum deposit on the forex trading market today. However, there are many regulated and trustworthy brokers who enable traders to open an account with much less minimum deposit than 100 USD.

According to the information about account types, spreads start from 1.6 pips. As usual, the lowest spread is for EUR/USD pair, meaning that other major or minor currency pairs will have much higher spreads with sinosoft FX forex broker. As for the leverage, traders can use leverage up to 1:300.

Sinosoft FX account types

Unsurprisingly the account types are not designed well. There are three account types one can choose from silver, gold, and platinum. The accounts do not differ from each other much. They all have the market execution, 0.01 minimum trading volume, and bonus programs. EA and hedging are allowed with sinosoft FX, but the swap is not allowed.

- The silver account can be opened with a minimum deposit of 100 USD, the spreads start from 1.6 pips and there is no commission on trades.

- The minimum deposit requirement for the gold account is 2000 USD, spreads start from 1.2 pips, and the commission is not applied.

- The platinum account has spread from 0.4 pips and has 4 USD commission both sides per lot traded. The account can be opened with 20.000 USD. Traders are allowed to use leverage only up to 1:100.

Sinosoft FX withdrawal

On the front page of the website the broker claims that it has no commissions for deposit and withdrawal, it is unlimited, and withdrawals take 24 hours. However, the reality is different from it which creates very negative sinosoft FX opinion. For depositing money to the account traders can use debit/credit cards, wire transfer, and several payment methods – skrill, neteller, webmoney, and perfect money. The fees for deposit and withdrawal varies from 0.5 to 2 percent when using electronic payment systems. For bank cards fees are 2.5 USD/EUR + 2.5 percent of the money. For the bank wire transfer, the fee is 40 USD or 20 EUR. There are also minimum withdrawal and maximum withdrawal limits for most of the payment methods. Sinosoft FX withdrawal might take from 2 to 6 business days.

Sinosoft FX rating

Based on the detailed review of sinosoft fx we can say that the broker is not trustworthy. It is not regulated by any financial regulators but claims to have authorized services. The website of the broker looks sketchy and scammy and indicate the possibility of sinosoft FX fraud. Apart from it, the service and features of the broker are not designed very well. Some of the necessary information is absent from the website, meaning that the broker chooses to hide it which is never a good sign. At the same time, the broker has a lot of misleading information on the website that is intended to lure the customer into opening an account with sinosoft FX. Hence, it is not recommended to start trading with sinosoft FX as you might end up being scammed by the shady broker.

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

Is sinosoft FX fraud possible? This review will show

Starting capital

Extra feature

Gearing up to

Founded in

Licensed by

Software

This is not a verified broker!

We do not recommend you trading with this broker. Its regulation and reputation is doubtful.

Sinosoft FX is forex and cfds broker that claims to be the leading forex broker worldwide. We are already used to such bold announcements from the scam brokerages that try to convince inexperienced traders and make them open an account with them. Sinosoft FX forex broker seems to be that kind of brokerage. While it claims to provide regulated and fully authorized services it does not have a license from any financial regulators. At first glance, the broker’s service looks average, it has 100 USD minimum deposit requirement, 1:300 leverage, and spreads from 1.6 pips. I think you would agree that these offerings do not look very exciting, especially since there are a lot of regulated international brokerages that offer far better trading conditions. But the more you learn about the brokerage, the worse things get. This detailed sinosoft FX review will let you know what the broker really has to offer and if it is a good idea to trade with it.

Can sinosoft FX be trusted?

The company behind sinosoft FX is sinosoft global company limited which was founded in 2018. The website does not tell where the broker is registered, however, according to the front page, the brokerage is located in dubai. The registration number or place, as well as the license number or regulator, is not mentioned anywhere on the website. Obviously, there is no reason to hide this information if the regulatory side of the brokerage is in order. The fact that it does not disclose such information makes us think that sinosoft FX scam can be real.

Another concerning thing about sinosoft FX is that it makes false claims about the brokerage. For example, the website shows that the broker is an award-winning brokerage, and is named to be the leading broker in the forex industry. Needless to say, none of them are true, especially if you consider that the broker is relatively newly established. The need question such claims and the legitimacy of the broker being the leader is supported by the absence of the sinosoft FX opinions. There are no opinions or reviews made by the customers of sinosoft FX which means that the broker is not as well established as it claims to be.

First impressions

The first impressions one might get about sinosoft FX is that the broker does not care much about its customers. The website of the broker does not serve the purpose to keep the traders and simple visitors well-informed about the brokerage and its services. There is no information about the broker itself, only the claims that it is a good and reliable broker. The navigation is very bad while making sinosoftfx.Com review we could hardly find the information about the features of the broker. Another concerning thing is that the content on the website is written in very bad english. It means that the broker did not put much effort into making the website useful for the worldwide audience while claiming to be an international broker.

What does the broker offer

Sinosoft FX broker offers customers to trade forex and cfds on three trading asset classes: commodities, indices, and cryptocurrencies. Unfortunately, there is no list of the trading instruments that show which currency pairs or cryptocurrencies are offered by sinosoft FX. Other trading conditions that can actually be seen on the website are not very satisfactory. For example, the broker features that the lowest spread is 1.6 pips for the standard account which is higher than what other brokers offer on average, such high spreads lower sinosoft FX rating a lot. One can open a standard trading account with 100 USD minimum deposit and trade with the leverage up to 1:300.

Trading account types

Sinosoft FX offers silver, gold and platinum accounts. The trading conditions are almost similar for these three accounts. All of them have market execution, the minimum trade volume of 0.01 lots, the maximum trade volume of 500 lots, and the bonus program. The silver account can be opened with a minimum deposit of 100 USD, the gold account is from 2000 USD, and the platinum account can be opened with 20000 USD. The spreads are different for each account as well, the silver account has spread from 1.6 pips, gold from 1.2 pips, and the platinum account from 0.4 pips, however, this account has 4 USD commission per lot traded.

Sinosoft FX withdrawal

As you could already understand, the broker likes to make false claims about its services and quality of them. The same goes for sinosoft FX withdrawal. The website shows that withdrawals are made in one day, there is no commission applied and there are no limits for withdrawal. However, the page for withdrawals and deposits gives different information.

According to it, the withdrawal can be made by the debit/credit cards, bank wire transfer, and electronic payment systems such as webmoney, perfect money, neteller, and skrill. There are commissions applied for the deposit and withdrawal, the amount of commissions depends on the payment methods. So does the withdrawal limit and time. The commissions vary from 0.5 percent to 2.5 percent of the money deposited and withdrawn, and the withdrawals take from two to six business days.

Sinosoft FX opinion

While sinosoft FX wants to be seen as the legit and trustworthy brokerage, the website and the features of it makes it obvious that the broker is nowhere near to a good broker. Even more, as it seems there is a big possibility of sinosoft FX scam. First things first, the broker is not regulated by any financial authorities, hence traders are not protected from the scam and wrongdoing of the broker. The website, as well as the basic features of the broker, is not well-designed and cannot be satisfactory for any trader. The spreads are too high and overall trading experience with sinosoft FX seems to be very poor based on the features. Last but not least, the broker has spread misleading information about its services on the website. So can sinosoft FX be trusted? The answer is obviously no, every trader should be very careful when coming across to the brokers like sinosoft FX and stay away from it.

This is not a verified broker!

We do not recommend you trading with this broker. Its regulation and reputation is doubtful.

Sinosoft fx review - is sinosoftfx.Com scam or good forex broker?

RECOMMENDED FOREX BROKERS

Sinosoft fx is presented as an award winning broker from dubai, offering forex pairs and cfds on commodities, indices and stocks, with a choice of three account types, leverage as high as 1:300, trading bonuses, and the metatrader5 platform.

And sinosoft fx also claims to be regulated, and to offer asset management services for clients willing to deposit at least 10 000 USD.

As fine as all of this may sound, it turned out the broker is nowhere to be found in the registers of the local financial regulator - the central bank of united arab emirates (CBUAE), so if you are still considering whether it would be a good idea to deposit your funds with them, better read the following paragraphs.

Sinosoft fx advantages:

Except for their minimum deposit requirement, which is just 100 USD and the generous leverage, there are no other notable advantages about the broker. Besides, with some big and popular brokers like FBS and IG you will be able to open a trading account with just 5 USD or so.

Sinosoft fx disadvantages:

No license, shady background

Sinosoft fx is said to be owned and operated by sinosoft global company limited, a company supposedly based n dubai, the united arab emirates. And they also say to be regulated. So we diligently checked the registers of the central bank of united arab emirates, but were unable to find nether the company nor the broker there.

That means sinosoft fx are deliberately trying to mislead investors that they hold a legit license, while in reality they are just another unregulated website with shady ownership. We were not able to confirm that sinosoft global company limited is incorporated in the UAE either.

Bear in mind that proper regulation is of utmost importance for the safety of your funds and depositing any money with unregulated websites like sinosoft fx sounds like a recipe to get scammed.

So our best advice here is to trade only with legit and properly regulated brokers like the once licensed and authorized by the financial conduct authority (FCA) in the UK, the cyprus securities and exchange commission (cysec) or the australian securities and investments commission ASIC).

Here we would also suggest that you check our list of FCA regulated brokers, where your funds will even be covered by a special client compensation fund, basically insuring your trading account for up to 85 000 GBP:

Sinosoft fx offers a fund management services and that is yet another worrisome sign. Bear in mind that like virtually all other brokers sinosoft fx acts as a market maker, which means that they make money whenever traders lose. So you can easily imagine that if you trust market makers like sinosoft fx to manage your account, they will surely have an incentive to mismanage your money and lose them in their own pockets.

The reason why we do not like trading bonuses is quite simple – they always come with strings attached – some minimum trade volume requirement, which scammers handily use as a pretext to cancel your withdraw requests. Besides, such promotions are altogether banned on regulated market like the european union for example.

No real demo account, unbranded trading platform

Sinosoft fx says to be offering a demo account, but when we tried to download their trading platform – we were redirected to the metaquotes homepage, which is the developer of metatrader5, and were offered to download a unbranded, default version of the platform, which has nothing to do with sinosoft fx and in no way represents the real trading conditions of the broker. In fact we can not even be sure that sinosoft fx really offers metatader5.

In any case metatader5 is one of the leading trading platform on the market, featuring numerous market indicators and trading robots with the help of which one can easily run algorithmic trading sessions. Also, meatrader5 comes with an excellent set of advanced charting tools, so here you may check as well our list of brokers, which do support the platform:

Sinosoft fx is a low credibility, unregulated website, which according to our expertise is most probably involved in scam. So once again here we will repeat our usual advise to avoid unregulated brokers, and to trade only with companies that are licensed and authorized by well known institutions like the FCA in the UK, cysec in cyprus or ASIC in australia.

Sinosoft FX – is it a scam broker?

Stop! It’s a scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Sinosoft FX - DO NOT TRADE WITH THIS PROVIDER

Sinosoft FX claims to be an award-winning broker based out of dubai in the united arab emirates. The broker also claims to offer trading in forex currency pairs, cfds on stocks, indices as well as commodities.

The broker offers its clients 3 different account types:

- Silver account: which has a $100 minimum deposit requirement, and a spread of 1.6 pips.

- Gold account: which has a $2,000 minimum deposit requirement, and a spread of 1.2 pips.

- Platinum account: which has a $20,000 minimum deposit requirement, and a spread of 0.2 pips along with a $4 per lot.

The leverage ratio of all the three accounts stands at a maximum of 1:300, which is quite solid.

Try these regulated brokers if you want to start trading cryptocurrencies

Plus500 is a FTSE 250 listed brokerage providing online trading services in cfds, across 2,000+ securities and multiple asset classes.

Founded: 2018

Regulations: unregulated

Languages: english (and 40+ other)

Deposit methods: credit/debit cards, bank transfers, skrill, neteller, perfectmoney, webmoney

Minimum deposit: $100

Free demo account: no

Number of assets: unknown

Types of assets: cfds on indices, commodities, stocks, and forex

Trading accounts and conditions

Sinosoft FX claims to be an award-winning broker based out of dubai in the united arab emirates. The broker also claims to offer trading in forex currency pairs, cfds on stocks, indices as well as commodities.

The broker offers its clients 3 different account types:

- Silver account: which has a $100 minimum deposit requirement, and a spread of 1.6 pips.

- Gold account: which has a $2,000 minimum deposit requirement, and a spread of 1.2 pips.

- Platinum account: which has a $20,000 minimum deposit requirement, and a spread of 0.2 pips along with a $4 per lot.

The leverage ratio of all the three accounts stands at a maximum of 1:300, which is quite solid.

The trading conditions seems to be rather attractive, but do read on to find out what the advantages and disadvantages of this broker are.

Sinosoft FX – advantages

Here are some of the advantages we found during our research into sinosoft FX:

Low minimum deposit requirement

This broker offers a competitively low minimum deposit requirement, which is a great positive.

Solid leverage

Sinosoft FX offers a leverage ratio of 1:300, which is quite solid and would even appeal to traders with a higher risk appetite.

However, we need to also offer a word of caution here. Most regulated jurisdictions have placed a cap on how much leverage brokers can offer, since higher leverages also expose trader to higher risk.

So, if a broker offers really high leverage ratios, it may not always be a good thing.

Decent spreads

Spread determine the amount of money you stand to make from each trade. So, the higher the spread, the lower your returns. Sinosoft FX has slightly higher than average spreads, but are still within acceptable limits.

Sinosoft FX – disadvantages

Looking at the trading conditions and the website, you would wonder whether there is any wrong at all with this broker. However, do read our list of disadvantages before you invest any money with sinosoft FX.

Not regulated

Sinosoft FX says it is owned and operated by sinosoft global company limited. This company is supposed to be based out of the city of dubai in the UAE.

The thing is, all financial services companies are supposed to be registered with and regulated by the DFSA (dubai financial services authority) if they are to operate within the bounds of the law.

However, when we investigated sinosoft FX’s claims of being regulated, we looked through the DFSA register, but did not find the parent company (or even the broker) listed there.

Of course, the broker did not claim to be regulated by the DFSA – just that it was located in dubai. Then, while through the broker’s funds protection page, we discovered that sinosoft FX claimed to be regulated by the financial commission.

The financial commission does exist, but sinosoft FX’s name in its register does not.

The misleading information posted by this broker on its website leads us to conclude that sinosoft FX is not actually regulated at all.

Plus500

Plus500 is a FTSE 250 listed brokerage providing online trading services in cfds, across 2,000+ securities and multiple asset classes.

Avatrade

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

Inability to register an account

Sinosoft FX claims to offer its clients 3 different account types. However, when we tried to register for them, we were unable to do so; the registration page seemed broken.

What this means is that we were unable to verify whether the trading conditions – which look very attractive – are true or not.

Managed accounts

Another cause for concern is that sinosoft FX offers fund management services to its clients. Why this is a cause for concern is simple. Forex brokers are market makers. This means that they profit only when traders lose money.

So, if a market maker is in charge of your funds, there is actually a conflict of interest, since the broker could ensure that you would keep losing money, while it keeps profiting off your losses.

Trading bonuses

Trading bonuses have been prohibited in most regulated jurisdictions. This is because such bonuses come with ropes (not strings) attached. Traders are lured by unscrupulous brokers with seemingly attractive bonuses, and once they accept those bonus promotions they are trapped.

These brokers then reveal the almost impossible to achieve trading volume conditions. And if a trader does not meet those volumes, then he or she is not allowed to withdraw his or her funds. In essence, the money the trader put in with that broker through the bonus scheme is lost forever.

Thus, the fact that sinosoft FX offers trading bonuses is just another indicator that this is not a broker you should trust.

No demo account

A demo account is required for traders to be able to test the trading conditions put forward by brokers. It also allows them to familiarize themselves with a new trading platform.

Because of this, most shady brokers do not offer demo accounts – they don’t want their future victims to get a chance to see what could happen to them if they trade on their platform.

So, if sinosoft FX doesn’t offer a demo account – that is a clear warning sign that you should stay away from this broker.

Unbranded trading account

When we tried to download sinosoft’s trading platform, we were redirected to the homepage of metaquotes, the developer of the MT5 software. Then, we were offered the option to download an unbranded trading platform that had no relation to sinosoft FX.

This platform did not even represent the trading conditions advertised on the broker’s website.

Conclusion

After we investigated all of sinosoft FX’s claims, we have come to the conclusion that this broker is a scammer and that it would in your best interests to stay clear of this scam operator.

Sinosoft FX review – 5 things you should know about sinosoftfx.Com

Beware! Sinosoft FX is an offshore broker! Your investment may be at risk.

RECOMMENDED FOREX BROKERS

Don’t put all your eggs in one basket. Open trading accounts with at least two brokers.

Sinosoft FX is a broker that took us some time to label, yet we still achieved to reveal its true nature. The biggest issue we had with this one was that the registration page was broken, and thus we could not register an account. This means that we have to trust the company’s website for trading conditions. Nevertheless, the accounts page reveals that the leverage is capped at 1:300, and the minimum EUR/USD spread is 0.2 pips (for the platinum account).

SINOSOFT FX REGULATION AND SAFETY OF FUNDS

We will briefly cover two alleged claims that the broker reveals. The first is its location in dubai. In dubai brokers must be authorized and regulated by the dubai financial services authority (DFSA), for them to operate within legal frames. Of course, sinosoft FX is not to be found on the official DFSA website, and furtheremore, the broker does not actually claim that it is regulated in dubai, only that it is located there.

The second piece of info that we stumbled on is found in the funds protection document, stating that sinosoft FX is in fact regulated by an independent international organization called the financial commission. There is such a commission, with many benefits to brokers (and other companies) such as compensation funds, yet sinosoft FX’s name was not found among the list of authorized companies.

There is further evidence of sinosoft FX suspicious nature, including short and incomplete legal documents, and the aforementioned broken registration page.

We can therefore conclude that sinosoft FX in UNREGULATED, making it a financial risk to anyone that invest with it!

Traders should be trading with risk-free brokers, that hold licensed from renowned and austere agencies, like the FCA or cysec , which have made a name for themselves as some of the top regulators. Readers should be aware that both agencies have adapted very strict rules of conduct, and their licensing framework guarantees safety and security for all clientele. A good example of this is the segregation of accounts which assures that client money and broker money are kept in separate accounts. Furthermore, FCA/cysec brokers participate in a financial reimbursement scheme that cover traders losses in case the broker becomes insolvent. The FCA provides up to 85 000 pounds per person, while cysec guarantees up to 20 000 euros.

SINOSOFT TRADING SOFTWARE

The allegedly available MT5 is only mentioned on the website; there is no concrete evidence to support its actual presence -as we mentioned, we were not able to register-. However, the MT5 is downloadable and bears the name of the broker, which is reassuring enough.

Nevertheless, the MT5 still retains some great features even if it is still shadowed by the immensely popular MT4. MT5 is certified by many stock exchanges and allows for a centralized market trade. Improvements have been made with the chart time frames, there are better charting tools to further otpimize the trading experience, and there are more pending order types.

SINOSOFT DEPOSIT/WITHDRAWAL METHODS AND FEES

Currently, the only way to get any information on both deposits and withdrawals is the accounts page and the withdrawal and deposit funds page. In it is stated that funds can be deposited via cards, bank transfer, neteller, skrill, perfectmoney, and webmoney. The minimum deposit is $100. The minimum withdrawal amount is $1-$2 for epayments, 20$ for cards, and $150 for bank transfers.

As for fees, they seem to be the same for both deposits and withdrawals: neteller fees are 2%, skrill charges are 1%, webmoney’s toll is 0.8%, pefectmoney charges 0.5%, withdrawals via cards are burdened with $2.5 + 2.5%, and wire tarsnfers have fees of $40.

We strongly advice traders to only deposit the minimum deposit, or better yet – not deposit at all! As for the withdrawals, scammers are known to either deny such requests, or impose incoming and unexpected charges.

How does the scam work?

Users will be in the middle of a scam without even knowing it, that’s how efficient these scams are. Yet, clients will also be surprised that the most utilized scammer structure is laughably easy to grasp, making it predictable. We have dedicated the following section to the reveal of how the scam works.

The internet is filled with ads, it’s the fuel of the industry, and a big chunk of said advertisements are misleading and some are downright deceitful. The ads concerned with unregulated forex brokers are often very promising, and most of the times utilize completely false claims of immediate profit. Those tempted enough will be redirected to a robo-scam website that further guarantees profits. The only thing that separates the user from the unrealistic promises is a fast registration process that requires a phone number and an email address. After inputting this info unsuspecting users will start getting phone calls from illicit broker representatives, whose one and only job is to initialize the scheme by pushing a trader to make that first deposit of around $250. After that’s done, the senior representatives will be calling. These expert scammers are extremely good talkers, and will start working on you to start putting even more money in. They say that the more money invested, the higher the profit will be. At this point most traders start seeing the big picture, and will want to withdrawal their money and get out fast.

However, the scammers have anticipated this development, and are ready to counter any withdrawal request. Typically they find excuses for delaying the request in the legal documents that hold specific clauses for these purposes. The reasons are many. One thing to remember is that all illicit brokerage firms will deny the withdrawal request for as long as they can, because of the imposed time limit traders have for filling a chargeback. Once the crucial due date is not met, any chargeback requests will be denied.

What to do if scammed?

Those of you who deposited using VISA and mastercard wil be glad to know that both companies have extended their chargeback time span to 540 days, especially if the reason for it is an online scam.

Scammers will steal directly from a bank account, if the traders has provided crucial details, like banking password or security code. If it get down to this, be sure to either block the account or change the password.

Sometime victimized users will stumble upon the so called recovery agents that promises to magically reclaim all lost investments, for a fee that is. Needless to say, they will not get back any of the lost funds, and will basically scam you a second time.

Is sinosoft FX fraud possible? This review will show

Starting capital

Extra feature

Gearing up to

Founded in

Licensed by

Software

This is not a verified broker!

We do not recommend you trading with this broker. Its regulation and reputation is doubtful.

Sinosoft FX is forex and cfds broker that claims to be the leading forex broker worldwide. We are already used to such bold announcements from the scam brokerages that try to convince inexperienced traders and make them open an account with them. Sinosoft FX forex broker seems to be that kind of brokerage. While it claims to provide regulated and fully authorized services it does not have a license from any financial regulators. At first glance, the broker’s service looks average, it has 100 USD minimum deposit requirement, 1:300 leverage, and spreads from 1.6 pips. I think you would agree that these offerings do not look very exciting, especially since there are a lot of regulated international brokerages that offer far better trading conditions. But the more you learn about the brokerage, the worse things get. This detailed sinosoft FX review will let you know what the broker really has to offer and if it is a good idea to trade with it.

Can sinosoft FX be trusted?

The company behind sinosoft FX is sinosoft global company limited which was founded in 2018. The website does not tell where the broker is registered, however, according to the front page, the brokerage is located in dubai. The registration number or place, as well as the license number or regulator, is not mentioned anywhere on the website. Obviously, there is no reason to hide this information if the regulatory side of the brokerage is in order. The fact that it does not disclose such information makes us think that sinosoft FX scam can be real.

Another concerning thing about sinosoft FX is that it makes false claims about the brokerage. For example, the website shows that the broker is an award-winning brokerage, and is named to be the leading broker in the forex industry. Needless to say, none of them are true, especially if you consider that the broker is relatively newly established. The need question such claims and the legitimacy of the broker being the leader is supported by the absence of the sinosoft FX opinions. There are no opinions or reviews made by the customers of sinosoft FX which means that the broker is not as well established as it claims to be.

First impressions

The first impressions one might get about sinosoft FX is that the broker does not care much about its customers. The website of the broker does not serve the purpose to keep the traders and simple visitors well-informed about the brokerage and its services. There is no information about the broker itself, only the claims that it is a good and reliable broker. The navigation is very bad while making sinosoftfx.Com review we could hardly find the information about the features of the broker. Another concerning thing is that the content on the website is written in very bad english. It means that the broker did not put much effort into making the website useful for the worldwide audience while claiming to be an international broker.

What does the broker offer

Sinosoft FX broker offers customers to trade forex and cfds on three trading asset classes: commodities, indices, and cryptocurrencies. Unfortunately, there is no list of the trading instruments that show which currency pairs or cryptocurrencies are offered by sinosoft FX. Other trading conditions that can actually be seen on the website are not very satisfactory. For example, the broker features that the lowest spread is 1.6 pips for the standard account which is higher than what other brokers offer on average, such high spreads lower sinosoft FX rating a lot. One can open a standard trading account with 100 USD minimum deposit and trade with the leverage up to 1:300.

Trading account types

Sinosoft FX offers silver, gold and platinum accounts. The trading conditions are almost similar for these three accounts. All of them have market execution, the minimum trade volume of 0.01 lots, the maximum trade volume of 500 lots, and the bonus program. The silver account can be opened with a minimum deposit of 100 USD, the gold account is from 2000 USD, and the platinum account can be opened with 20000 USD. The spreads are different for each account as well, the silver account has spread from 1.6 pips, gold from 1.2 pips, and the platinum account from 0.4 pips, however, this account has 4 USD commission per lot traded.

Sinosoft FX withdrawal

As you could already understand, the broker likes to make false claims about its services and quality of them. The same goes for sinosoft FX withdrawal. The website shows that withdrawals are made in one day, there is no commission applied and there are no limits for withdrawal. However, the page for withdrawals and deposits gives different information.

According to it, the withdrawal can be made by the debit/credit cards, bank wire transfer, and electronic payment systems such as webmoney, perfect money, neteller, and skrill. There are commissions applied for the deposit and withdrawal, the amount of commissions depends on the payment methods. So does the withdrawal limit and time. The commissions vary from 0.5 percent to 2.5 percent of the money deposited and withdrawn, and the withdrawals take from two to six business days.

Sinosoft FX opinion

While sinosoft FX wants to be seen as the legit and trustworthy brokerage, the website and the features of it makes it obvious that the broker is nowhere near to a good broker. Even more, as it seems there is a big possibility of sinosoft FX scam. First things first, the broker is not regulated by any financial authorities, hence traders are not protected from the scam and wrongdoing of the broker. The website, as well as the basic features of the broker, is not well-designed and cannot be satisfactory for any trader. The spreads are too high and overall trading experience with sinosoft FX seems to be very poor based on the features. Last but not least, the broker has spread misleading information about its services on the website. So can sinosoft FX be trusted? The answer is obviously no, every trader should be very careful when coming across to the brokers like sinosoft FX and stay away from it.

This is not a verified broker!

We do not recommend you trading with this broker. Its regulation and reputation is doubtful.

So, let's see, what we have: sinosoft FX review – 5 things you should know about sinosoftfx.Com beware! Sinosoft FX is an offshore broker! Your investment may be at risk. RECOMMENDED FOREX BROKERS don’t put all your at sinosoft fx

Contents of the article

- Free forex bonuses

- Sinosoft FX review – 5 things you should know...

- Beware! Sinosoft FX is an offshore broker! Your...

- RECOMMENDED FOREX BROKERS

- SINOSOFT FX REGULATION AND SAFETY OF FUNDS

- SINOSOFT TRADING SOFTWARE

- SINOSOFT DEPOSIT/WITHDRAWAL METHODS AND FEES

- How does the scam work?

- What to do if scammed?

- Sinosoft FX – is it a scam broker?

- Stop! It’s a scam! Your money is not safe if you...

- Trading accounts and...

- Sinosoft FX – advantages

- Sinosoft FX –...

- Not regulated

- Inability to register an account

- Managed accounts

- Trading bonuses

- No demo account

- Unbranded trading account

- Not regulated

- Conclusion

- Sinosoft fx review - is sinosoftfx.Com scam or...

- RECOMMENDED FOREX BROKERS

- Sinosoft fx advantages:

- Sinosoft fx disadvantages:

- Sinosoft FX review – is this broker trustworthy?

- Is sinosoft FX legit?

- Sinosoftfx.Com review

- Sinosoft FX trading conditions

- Sinosoft FX account types

- Sinosoft FX withdrawal

- Sinosoft FX rating

- Is sinosoft FX fraud possible? This review will...

- Can sinosoft FX be trusted?

- First impressions

- What does the broker offer

- Trading account types

- Sinosoft FX withdrawal

- Sinosoft FX opinion

- Sinosoft fx review - is sinosoftfx.Com scam or...

- RECOMMENDED FOREX BROKERS

- Sinosoft fx advantages:

- Sinosoft fx disadvantages:

- Sinosoft FX – is it a scam broker?

- Stop! It’s a scam! Your money is not safe if you...

- Trading accounts and...

- Sinosoft FX – advantages

- Sinosoft FX –...

- Not regulated

- Inability to register an account

- Managed accounts

- Trading bonuses

- No demo account

- Unbranded trading account

- Not regulated

- Conclusion

- Sinosoft FX review – 5 things you should know...

- Beware! Sinosoft FX is an offshore broker! Your...

- RECOMMENDED FOREX BROKERS

- SINOSOFT FX REGULATION AND SAFETY OF FUNDS

- SINOSOFT TRADING SOFTWARE

- SINOSOFT DEPOSIT/WITHDRAWAL METHODS AND FEES

- How does the scam work?

- What to do if scammed?

- Is sinosoft FX fraud possible? This review will...

- Can sinosoft FX be trusted?

- First impressions

- What does the broker offer

- Trading account types

- Sinosoft FX withdrawal

- Sinosoft FX opinion

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.