How to trade with 100 dollars

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Free forex bonuses

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

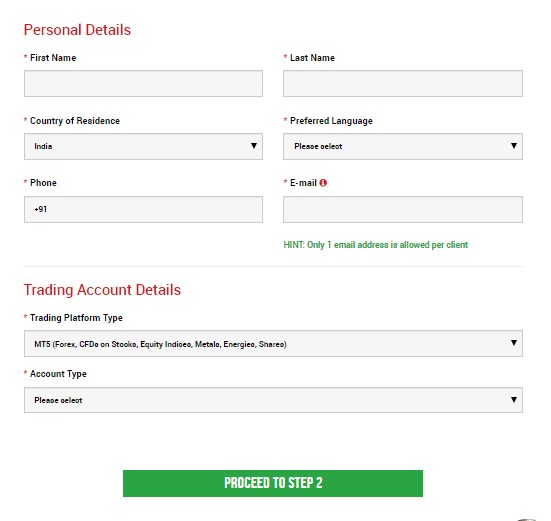

Step 2: filling the personal details

Fill all the box with accurate details

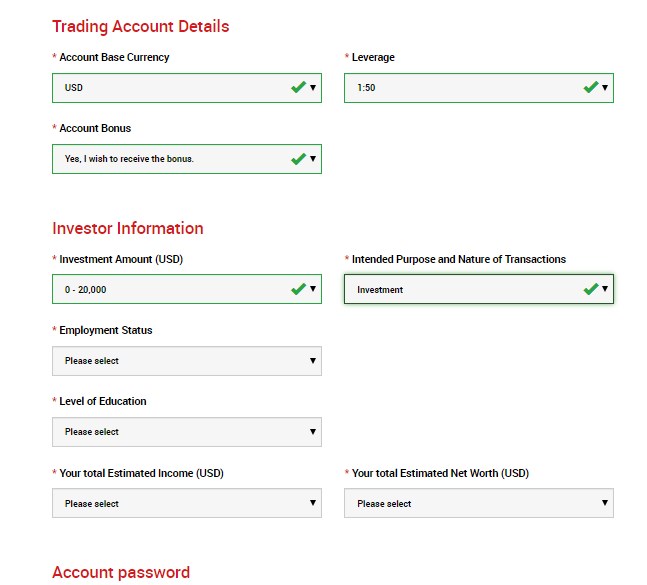

Step 3: investor information & trading account details

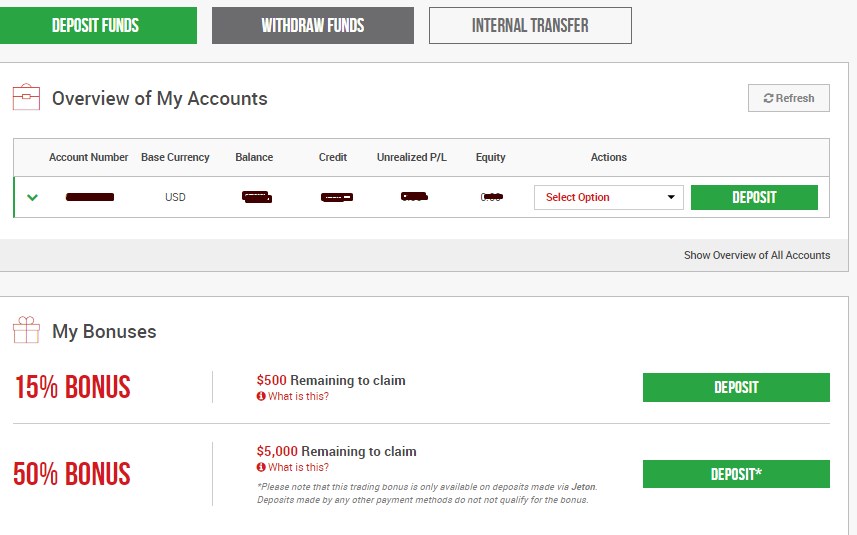

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

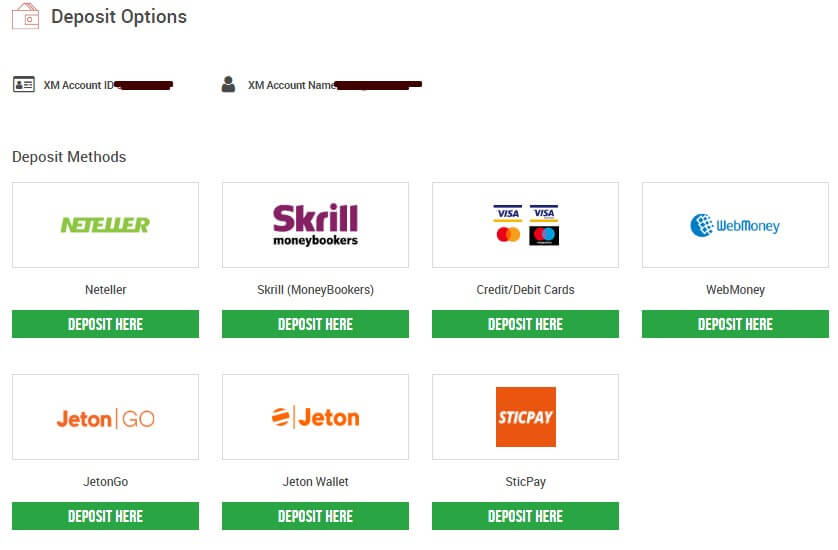

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

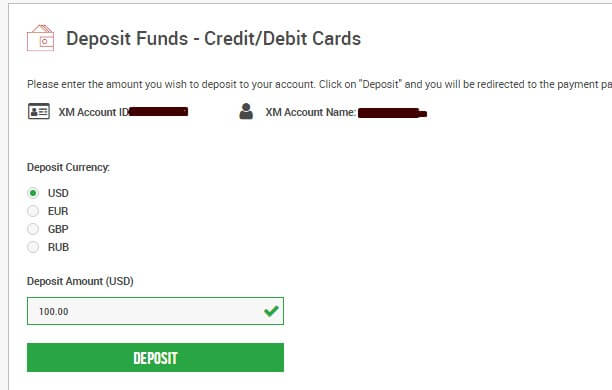

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

6 easy ways to invest $100

Some of the links included in this article are from our advertisers. Read our advertiser disclosure.

You might think that investing with smaller amounts of cash is pointless. However, the truth is that even if you start investing with only $100 you can build wealth. Your investments still have the potential to grow to six or seven figures.

I remember reading a story one time about a couple in their sixties who were millionaires. When asked about how they got to millionaire status, they had one simple piece of advice. They said, “we started by saving only ten dollars a week. We never dreamed our savings would grow to this magnitude”.

Are you feeling like it’s useless to start saving and investing because you have very little money to begin with? If so, don’t give up just yet. No matter how much money you have to start with, you can build an investment nest egg.

And you can build one that’s big enough to fund your financial dreams. You just have to start by choosing some of the investments we’ll talk about below.

How to invest $100

Before you start investing, you need to know a bit about the different types of investing. You need to know what you’re getting into before you put your money down on the table. So check out different types of investments. Work to determine which types of investments are most suited to your risk tolerance and your knowledge base.

Some investments do better over the long term even though they may seem volatile during the short term.

Diversifying your investment choices will help protect you from market downturns. It will also help protect your money from economic ups and downs, whether personal or global. Now we’ll talk a little bit about a few different types of investments.

1. Investing in the stock market

It’s smart to check out the fine print when investing with small dollar amounts. Brokers who charge high fees can eat up the profits of beginner investors real fast. However, when done right, beginner investors who start investing with smaller dollar amounts can grow some serious wealth.

You can build wealth through the stock market by purchasing stock funds, index funds, etc. During the open trading times.

Education is key before you start socking money into the market. Luckily, the internet is filled with great articles explaining the ins and outs of stock market investing. You be cautious though and only do your research using credible investment websites.

Also, there are great books on investing by experts such as john C. Bogle and warren buffett. Read books and articles by investing experts. This way you can begin to understand how to make money through the stock market.

Beware of get-rich-quick schemes and other promoted methods that promise big profits overnight. Smart stock market investing involves a “slow and steady wins the race” mentality.

And it also involves sticking with your investment through the ups and downs of the market. In addition, beginner investors will want to choose a brokerage account that they can manage themselves online. This is especially true if you’re starting with a smaller amount of cash. These types of brokerages charge little or no fees. So this way you can be sure that as much of your money as possible is used for growing wealth.

Here are some options for stock investment accounts for beginner investors.

Ally invest

One of my favorite investment companies is ally invest. I like them because they allow you to begin investing with no account minimum. Also, stock and EFT trades are $0 each and you can open an account with as little as $100. Ally invest is considered a “self-directed” investment firm, which means they don’t provide investment advice.

Instead, they provide custom charts and other investing tools to help you analyze trades and performance. This way you can learn to make your own educated choices about what to invest in.

With ally invest, you can access your investment account via multiple types of devices. This allows for easy and convenient investing. In addition, they also keep you aware of the latest investing information. They do this with live news streaming information.

Betterment

Betterment is another company that offers stock investment accounts. One of the cool things about betterment is that they charge you zero for transaction fees and trade fees. Since they will actually give you investment advice, they’re a little different than ally invest. They base their advice on your risk tolerance and how long you have to invest.

Betterment charges an annual fee, but it’s super affordable (0.35% on accounts with balances below $10,000). This is a benefit for clients who make a recurring account deposit each month of at least $100.

Each of these companies offer affordable fees and commissions for those just getting started in investing.

2. Open a savings account

Online savings accounts are an option to make money if you are nervous about investing in the stock market. Most banks pay next to nothing. However, CIT bank typically offers a higher rate you will not find at any local bank.

You won’t get rich by investing only in high-yield savings accounts. But you will get paid much more than you would at most traditional banks.

3. Peer-to-peer lending

Another less traditional investing option is peer-to-peer lending (often called P2P lending). Peer-to-peer lending companies such as lending club and others like it work differently than banks. With P2P companies, investors choose to lend money to those seeking personal loans.

Loan applications get analyzed and approved by the peer-to-peer lending staff. Then those loans are offered to investors who can contribute all or a portion of the loan amount to the applicant. Detailed information about the loan applicant (such as credit score and payment history) gets shared with potential investors.

When investors open a lending club account, money is withdrawn for loans as the investor chooses. They lend money to borrowers after reviewing the borrower’s credit and other facts. When a borrower makes a loan payment, you (the investor) get paid back – with interest.

It’s important to be aware of the fact that you can lose your cash in a peer-to-peer lending investment. If a customer you choose to loan money to decides to stop making payments, you’ll lose your investment. However, many people choose to invest in peer-to-peer lending and are happy with the results. Proceed with caution if you choose this route.

No matter which of these investing routes you choose, you can start earning money on your cash. But only if you’re willing to take the plunge and open an account. And luckily, many of these businesses will let you invest even if your account only has $100 in it.

4. Investing in a business

Many people choose to grow their money by investing in a business of some sort. Some people choose to invest in an existing business, while others choose to start their own. Personally, I have found success with business ownership by starting an SEO company.

Investing in a business can be costly, but even those with only $100 to invest can make money with their investment. In the case of my SEO company, it cost very little up front to start. This is because the business involved using my skills. I could share my knowledge with people and help them get better rankings with their websites. And I only needed my knowledge and my laptop.

Fortunately, there are many business startups you can do with only $100. Consider chris guillebeau, author of the $100 startup: reinvent the way you make a living, do what you love and create a new future. He wrote a book sharing what he learned from interviewing over 1500 business owners. And each business owner started their businesses with a smaller amount of capital.

In many cases, the successful business owners that chris interviewed spent no more than $100 on their startups. And his interviewees weren’t all people with special skills. They were ordinary people like you and me. As chris states in his book, they simply “discovered aspects of their personal passions that could be monetized.”

You never know; maybe you’re one of those people. You might be able to turn doing what you know and love into a business that grows into unimaginable wealth.

I’m not saying that this will happen without a lot of hard work. Growing a business always involves hard work. However, if you are willing to put in the time, you might be able to grow a successful business even without having to put down a lot of cash up front.

5. Investing in yourself

Another way to consider growing your $100 into a lot more is to invest in yourself. By that, I mean invest in yourself to learn more about how to grow your skills, and eventually your net worth. You can do this in a number of ways.

- Purchasing books to learn about investing or business ownership

- Taking online courses to learn a new skill

- Taking in-person classes to learn a new skill

- Joining an investment club or another networking group that aligns with your interests

The more you learn about money, whether earning, saving or investing, the more tools you have to grow wealth. In fact, in thomas corley’s book, rich habits, he shares that 88% of wealthy people read at least 30 minutes every day. And they’re not reading rag mags.

Instead, they’re reading books that will educate them on improving their skills. So consider investing your $100 in yourself and see where it leads you.

6. Pay off debt

This is one investment I can’t overstate enough. When my wife and I were first married, we were sitting with over $52,000 in consumer debt. It was like a weight hanging over our heads.

Through a lot of hard work, we paid off that $52,000 in debt in just 18 months. That one (albeit tedious) step has led to exponential wealth growth for us. Putting an extra $100 (or $100 per month) toward debt may not seem like it will do much good.

But I promise you that it will add up because you’ll be paying less interest on the debt over time. And once you’re debt free, you’ll have more money to save and invest.

The importance of contributing regularly

Contributing regularly to your investments is definitely one of the keys to successfully building wealth. And it doesn’t matter if you’re only contributing a small amount. Of course, contributing more money each month helps. The more money you put into your investment accounts each month, the more compound interest can work to grow your wealth.

But the habit of making monthly investments is the most important thing. Consider making a habit of contributing to your investment accounts on a regular basis. Do this by treating them like a bill.

Talk to your bank or investment firm about setting up an automatic transfer. They’ll transfer money each month from your bank account to your investment account. This will help you to make regular deposits on the same day every month.

Automatic investments will help you eliminate the need to think about investing each month. It just happens magically for you. But if you leave your investment deposits as a non-automated “choice,” you might not make the investments. Instead, you might find yourself making excuses for why you can’t contribute. Bills will come due, as will the chance to spend the money on other things.

However, if you choose to treat your investment account like a bill, you’ll “set it and forget it.” when you automate savings and investments, you can train your mind to forget the money ever existed. So you’ll probably find your investment growing at a more rapid pace than you had imagined it would.

Summary

If you being investing today, your future self will thank you as the account grows trying to reach the six and seven digit figure range. In the process, you’ll create a more secure future for you and your loved ones.

Are you investing on a regular basis? What types of investments do you prefer? Share your thoughts on our facebook page.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

How to become a day trader with $100

Damyan diamandiev

Contributor, benzinga

Jump straight to webull! Now open to ALL stocks.

Day trading is one of the best ways to invest in the financial markets. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday.

Trades are not held overnight. Day traders profit from short term price fluctuations. Day traders can trade currency, stocks, commodities, cryptocurrency and more.

You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. We’ll show you whether it’s possible to start trading with a very small amount like $100.

How to start day trading with $100:

- Step 1: select a brokerage. Finding an online broker that allows you to trade in the style you want will help you successfully conduct trades.

- Step 2: pick the securities you want to trade. Do your research and decide what you want to start trading.

- Step 3: work out a strategy. Before you begin making your trades, decide what strategy you want to stick to.

- Step 4: begin trading. Once you have your account set up and have taken the necessary prerequisite steps, you can start day trading.

Can you day trade with $100?

The short answer is yes. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use.

Technically, you can trade with a start capital of only $100 if your broker allows. However, it will never be successful if your strategy is not carefully calculated. For this reason, you should support the idea to trade with only $100 through detailed research, a thorough calculation of your strategic outcomes and strict risk management rules.

How to start day trading with $100

We’ll show you what to look for in a broker, how to choose security, how to build your strategy and how to open your first trade.

Step 1: find a brokerage

If you want to trade successfully with only $100, your broker needs to meet some requirements from your side.

Charges: it’ll be better if your broker charges you based on spread rather than based on commission. Commission-based models usually have a minimum charge. Trading small amounts of a commission-based model will trigger that minimum charge for every trade.

The spread fee is the better alternative, as it charges you considering the amount you trade.

Minimum deposit: your broker of choice should have a minimum deposit requirement of $100 or less. Otherwise, you can’t deposit just $100.

Leverage and margin: if you trade with only $100, day trading price ticks are insufficient to give you reasonable earnings. Imagine you invest half of your funds in a trade and the price moves with 0.2% in your favor:

$50 x 0.002 = $0.1 profit

This is why you need to trade on margin with leverage. If you are in the united states, you can trade with a maximum leverage of 50:1. If you are in the european union, then your maximum leverage is 30:1.

This is due to domestic regulations. The maximum leverage is different if your location is different, too. In australia, for example, you can find maximum leverage as high as 1,500:1.

Here are a few of our favorite online brokers for day trading.

Best for

Overall rating

Best for

1 minute review

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best robinhood alternatives.

Best for

- Commission-free trading in over 5,000 different stocks and etfs

- No account maintenance fees or software platform fees

- No charges to open and maintain an account

- Leverage of 4:1 on margin trades made the same day and leverage of 2:1 on trades held overnight

- Intuitive trading platform with technical and fundamental analysis tools

Best for

Overall rating

Best for

1 minute review

Tradestation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Tradestation’s app is also equally effective, offering full platform capabilities.

Best for

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating tradestation’s platform more difficult than it should be

Best for

Overall rating

Best for

1 minute review

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

Best for

Overall rating

Best for

1 minute review

Moomoo is a commission-free mobile trading app available on apple, google and windows devices. A subsidiary of futu holdings ltd., it’s backed by venture capital affiliates of matrix, sequoia, and tencent (NASDAQ: FUTU). Securities offered by futu inc., regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Moomoo is another great alternative for robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, international trading, research and analysis tools, and most popular of all, free level 2 quotes.

Get started right away by downloading moomoo to your phone, tablet or another mobile device.

Best for

- Free level 2 market data for all users who open an account

- Commission-free trading in over 5,000 different stocks and etfs

- Over 8,000 different stocks that can be sold short

- $0 contract fee for trading options, no commission either

- Strong market data and analysis tools with over 50 technical indicators

- Access trading and quotes in pre-market (4 a.M. To 9:30 a.M. ET) and post-market hours (4 p.M. To 8 p.M. ET)

- No minimum deposit to open an account.

- Active trading community with more than 100,000 app users

Step 2: choose securities

Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace.

You can achieve higher gains on securities with higher volatility. Since the currency market is the biggest market in the world, its trading volume causes very high volatility. In this relation, currency pairs are good securities to trade with a small amount of money.

But which forex pairs to trade? Since your account is very small, you need to keep costs and fees as low as possible. You can keep the costs low by trading the well-known forex majors:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- NZD/USD

- USD/CAD

The major currency pairs are the ones that cost less in terms of spread. At the same time, they are the most volatile forex pairs.

Step 3: determine strategy

Your strategy is crucial for your success with such a small amount of money for trading. You need to consider when to trade, the amount you’ll invest in each trade, when you’ll enter a trade, how you will manage your risk and when you’ll exit a trade.

When to trade: A good time to trade is during market session overlaps. For example, the EUR/USD and the GBP/USD are most volatile in the time when the london markets and the U.S. Markets are both open.

The U.K. And europe conduct transactions in GBP and EUR and the U.S. Conducts transactions in USD. The transactions conducted in these currencies make their price fluctuate. Since the GBP, the EUR and the USD fluctuate, the GBP/USD and the EUR/USD forex pairs are very volatile at this time.

This is an image that shows the forex market overlaps. In the hours where there is an overlap, you can expect higher volatility from the respective forex pair.

Amount per trade: the best approach is to invest a large amount of your $100 in each trade but to have no more than a single trade open. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. You can invest 60% of your bankroll in each trade and at the same time to have no more than one trade open.

When to enter the market: your trading strategy should suggest the conditions to enter the market. You can use various technical indicators to do this. Some of these indicators are:

- Candle patterns

- Chart patterns

- Oscillators

- Momentum

- Volume

- Volatility

You can use such indicators to determine specific market conditions and to discover trends. You can aim for high returns if you ride a trend.

Risk management. When you’re trading in normal conditions with a comfortably high amount of money, you shouldn’t risk more than 2% of your capital per trade.

However, since you have only $100, you can take a bit higher risk as your losses are limited to only what you have in our account. A risk of 3% per trade is reasonable for these trading conditions.

Three percent risk per trade means $100 x 0.03 = $3 maximum risk in each deal. You can trade with a maximum leverage of 50:1 in the U.S. This will give you a total buying power of 50 x $100 = $5,000.

If you invest 60% of your bank in each trade, this is $3,000 per trade. Your stop-loss order should be at a percentage distance from your entry price equal to 3/ 3,000 = 0.001 or 0.1%. In other words, if you buy the EUR/USD at 1.1450, your stop-loss order should stay 0.1% below the entry price.

You can calculate it this way:

1.1450 x (1 – 0.001) = 1.1439

1.1439 is the level of your stop-loss order once you take these conditions into consideration.

Conditions to exit a trade: the $100 bankroll trading requires a more aggressive approach, so here are some different exit rules.

Use a trailing stop-loss order instead of a regular one. Still stick to the same risk management rules, but with a trailing stop. Catching a trend will put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit.

In this case, you will only exit the market if the price hits your stop and you will stay in the market as long as it is trending in your favor.

Success rate and profit-loss ratio: if you manage to get 3:1 profit-loss ratio with 30% success rate, you risk $3 per trade aiming for $9 and you succeed in only 30% of the trades, you will generate around 7% profit per 10 trades using the above rules. Here’s how your account will look after 1,000 trades:

If your account grows by 7% per 10 trades, your $100 bankroll will grow to more than $80,000 after 1,000 trades. Of course, this is a very straightforward example and 7% per 10 trades is a big profit, which not many traders achieve.

The suggested strategy involves only one trade at a time due to the low initial bankroll. You can hardly make more than 10-15 trades a week with this strategy. If you conduct 2 trades per day, you’ll need 500 trading days to reach these results with the above success rate. Since every trading year has about 250 trading days, you will need 2 years of strict trading to achieve these results.

Notice that the above trading rules you will need 250 trades (around half a year) to reach $500 and 360 trades (around 9 months) to reach $1,000 in your bank.

On each of these milestones, you can always consider a different strategy where you can trade with less risk (1-2%), invest less in a single trade (25%-30%) and open more than one trade.

Step 4: start trading

Next, create an account. Navigate to the official website of the broker and choose the account type. Remember, you’re looking for an account that lets you trade with only $100 on margin. You’ll need to submit personal details like email, address and phone number and will receive an email message to confirm your email address.

You’ll need to send some identity confirmation, which is a standard procedure and may need to provide some income information, though this is unlikely to happen if you want to fund your account with only $100.

After you confirm your account, you will need to fund it in order to trade. Use a preferred payment method to do so. Download the trading platform of your broker and log in with the details the broker sent to your email address. Make sure you adjust the leverage to the desired level.

Navigate to the market watch and find the forex pair you want to trade. This could be the EUR/USD or the GBP/USD. Open the trading box related to the forex pair and choose the trading amount. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk.

Get started day trading

Day trading could be a stressful job for inexperienced traders. This is why some people decide to try day trading with small amounts first. Trading with a bankroll of only $100 is possible but will require some extra amendments in order to reflect your account on an acceptable pace.

You can always try this trading approach on a demo account to see if you can handle it. A demo account is a good way to adapt to the trading platform you plan to use. You can $100 account trading once you feel comfortable on the demo account.

Turn to webull

0 commissions and no deposit minimums. Everyone gets smart tools for smart investing. Webull supports full extended hours trading, which includes full pre-market (4:00 AM - 9:30 AM ET) and after hours (4:00 PM - 8:00 PM ET) sessions. Webull financial LLC is registered with and regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA). It is also a member of the SIPC, which protects (up to $500,000, which includes a $250,000 limit for cash) against the loss of cash and securities held by a customer at a financially-troubled SIPC-member brokerage firm.

How to trade with 100 dollars

How to turn $100 to $1000 or more trading forex

Turning $100 to $1000 or more trading forex

To be a successful trader, you need to understand how leverage works . It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to point of no return. Although, if the trade works to your favor, you can gain significantly.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “possible” but not easy! And is always risky.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to turn $100 to $1000 or more

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA , easymarkets and XM .

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

Penny stocks for beginners (trading with just $100)

Wondering how to trade penny stocks? Penny stocks are a great option for traders who want to start investing with just $100. The popularity of penny stock trading has skyrocketed because penny stocks are “designed” for investors who have little start-up capital. In this step-by-step guide, you'll learn how to trade penny stocks for beginners.

If this is your first time on our website, our team at trading strategy guides welcomes you. Make sure you hit the subscribe button, so you get your free trading strategy every week directly into your email box.

Jordan belfort, also known as the "wolf of wall street," is a stockbroker who made his name dealing in penny stock trading, which made him millions in profit. Now, his name has a negative connotation. Nack in 1999, he was convicted of manipulating the stock market and running a penny stock boiler room.

We're not here to promote penny stock scams, we just want to show you what can be accomplished if you follow our penny stocks for beginner's guide.

Before you risk any of your hard-earned money, let’s learn what penny stocks are and how to buy them. By the end of this guide, you’ll know the exact trading tips, methods, and strategies to successfully trade penny stocks.

What are penny stocks?

What are penny stocks? According to the US securities and exchange commission (SEC), penny stocks are shares in companies that trade below $5 five dollars. In the past, only stocks under $1 were considered penny stocks. Penny stocks are also referred to as "pink sheet stocks."

Usually, penny stock companies operate outside the major exchanges like the NYSE or NASDAQ. They are traded over the counter. However, if a penny stock's price is consistently between $1 and $5 dollars a share, it can be listed on NYSE.

If you want to learn more about the OTC market, please visit over-the-counter trading – how the whales trade.

The second characteristic of penny stocks is that they have a small market cap. These cheap penny stocks generally have a market cap of less than $300 million or $50 million.

Risks and benefits of trading penny stocks

There are multiple benefits of trading penny stocks. Because these stocks are priced under $5, there is a limited risk. The most you can lose is $5. By choosing the right stocks, however, you have access to an unlimited upside. Though they are rare, instances of stocks rising from $1 to $100 within a month are not unheard of.

Penny stock price movements are usually more volatile than normal stocks. For day traders, this means there will be multiple opportunities for profit within a given trading period. Even if a stock only moves from $0.20 to $0.30, this is still a 50% increase in value.

Another benefit of trading penny stocks is that unlike stocks listed on the S&P 500, penny stocks are loosely correlated with the market as a whole. Even if the entire economy is undergoing a recession, there will still be penny stocks rising in value.

There are drawbacks to trading penny stocks. Many of these companies have very little (or even negative) value, which is why they are priced so low to begin with.

The majority of penny stocks will remain penny stocks for life. Furthermore, because they are often traded over the counter and with little oversight, these stocks are a prime target for pump and dump or insider trading schemes. Still, when managed correctly, trading penny stocks can still be quite profitable.

Let’s dive into how to find penny stocks using this smart, simple strategy.

How do I find penny stocks?

In order to find penny stocks, you need to use a penny stock scanner. A scanner will help you find hot penny stocks that are hidden from the general public attention.

Finviz.Com stock screener is our favorite free penny stock screener. This is by far the easiest way to find penny stocks.

A good penny stock screener will let you scan for stocks under $5 or for stocks under $1 using customized parameters. You can find the best penny stocks to buy for 2019 that meet your specific parameters and filters. If you’re just getting started learning how to trade penny stocks, don’t be afraid to play with the online stock screen tool testing different filters. This can lead to a powerful penny stock list to buy.

If you lack ingenuity, try scanning for the most active penny stocks in the premarket. This will give you a list of day trading penny stocks.

Remember - A lack of research can lead you to invest in some of the worst pump-and-dump scams. Learning how to make money from trading penny stocks comes down to putting in the time and effort. There is no secret formula to find stocks before a pre-spike. But, learning how to find the right penny stocks can definitely improve your chances of success.

Now that you've learned how to find the hottest penny stocks the next big question is where to buy penny stocks?

Where to buy penny stocks?

Most penny stocks are listed on the OTCBB (over-the-counter bulletin board), however, some of them can also be found on the regular stock exchanges. Professional traders on wall street refer to penny stocks as over-the-counter stocks.

There are more than 10,000 securities listed on the OTCBB. Investors can trade and access these pink sheet stocks via an online stockbroker.

Since OTC stocks are very volatile and illiquid, we recommend only to invest in penny stocks listed on NYSE and NASDAQ.

So, how do you buy penny stocks?

How to buy penny stocks?

The best way to buy penny stocks is to go through a regulated stockbroker. A broker will get you access to the market with leverage, so you can begin trading quickly. Besides a using broker, learning how to buy penny stocks requires two more things:

- Money to purchase the penny stocks.

- A penny stock trading strategy to help you pick the best penny stocks.

Try to avoid buying penny stocks directly from dealers who call you to pitch investment opportunities. Try researching low commission stock brokers that offer OTC stocks and penny stocks listed on the NYSE or NASDAQ. You'll want to have a wide variety of options, so you can find the best-performing stocks.

Here are the top brokers we recommend:

- Fidelity investments - $4.95 per trade

- Charles schwab - $4.95 per trade

- Eoption - $3.00 per trade

- TD ameritrade - $6.95 per trade

- Interactive brokers - $.005 per trade

- Tradestation - $5 per trade

What's the difference between OTC and NYSE/NASDAQ penny stocks?

Penny stocks come in two different forms: pink sheet stocks and exchange penny stocks. “pink sheet” penny stocks are traded over the counter. "exchange" penny stocks are still priced under $5 but are featured on a major exchange such as the NYSE or NASDAQ. Blockbuster is a prime example of an exchange stock that eventually achieved “penny stock” status.

Usually, when people refer to penny stocks, they probably referring to stocks being traded over the counter. These stocks usually have very small market caps and the market itself is very lightly regulated. While the right pink sheet stocks can yield profitable returns, they are usually considered riskier than those listed on the major exchanges.

Now that you know about the two different types of penny stocks, the next step is learning how to trade.

How to trade penny stocks?

Ever wonder how to trade penny stocks?

Anyone can learn the ropes of how to trade penny stocks for free. There are no hidden secrets because the game on wall street never changes. Penny stocks are characterized by big volatility. They can go from a few cents per share up to a couple of dollars very fast.

You can make a lot of money from volatility, but you can also lose lots of money.

Most people trading penny stocks tend to lose money because they trade incorrectly or use a penny stock trading strategy that is not suitable for their type of trading environment. That’s what makes penny stocks a high-risk, high-return investment.

At the end of the day, you have to keep in mind that 85% of active traders lose money trading the stock market.

However, if you learn how to trade penny stocks the right way, you can skew the odds in your favor and be part of the 15% of active traders that are profitable day trading penny stocks.

All you have to do is to learn how to buy penny stocks and find potential winners before they spike.

There are only a handful of hot penny stocks that make big moves on a day to day basis. Not all the stocks under $5 are hot penny stocks. The trick is to learn what penny stocks to buy pre-spike. We have developed a penny stock trading strategy that uses some trading rules that we found 20 years ago.

If you want to become a better penny stock trader, try learning how to trade penny stocks using our methodology.

The best penny stock trading strategy

The best penny stock trading strategy is broken into three steps: scanning, searching, and striking. The goal is to identify when a penny stock is spiking. This is very important for penny stock traders. Not even the best trading rules in the world can tell you what every penny stock will do in every situation.

However, if you use our “secret sauce” you can predict with a high degree of accuracy when a penny stock is about to get pumped.

If you want to learn how to trade penny stocks, simply follow our three S’s rule:

- Scan for the best penny stocks using our 6 filters.

- Search for a technical pattern.

- Strike using a market order.

Step #1: scanning

Use a penny stock screener to find hot penny stocks. We prefer using the free stock scanner offered by finviz. Customize the penny stock screener to match our parameters and filters. This will give you an edge in the market.

Penny stocks parameters to find the best penny stocks:

- Market cap: between $50 million and $300 million

- Target price: 5% above price

- Current volume: over 1M

- Country: USA

- Price: under $5

- Technical: price above the 200-day simple moving average

List of penny stocks to buy:

If you use our penny stocks filters, you have the potential to find penny stocks that are going to make a big run. As you can see, the penny stock screener only displays a handful of penny stock examples.

Once you have your penny stock watch list, it’s time to search for a technical pattern.

Step #2: searching

If the penny stock screener only displays a handful of stocks we like to look through all of them and see which of them presents the clearest technical pattern. If you’re an experienced technical trader you can use your skills to pick the best pattern.

After looking through our watch list, the penny stock UUUU (energy fuels INC) presents the clearest price pattern.

We manage to find a neat rectangle pattern developing on this hot penny stock’s chart. You can’t go wrong trading when you have such a clear pattern.

After we picked up the penny stock that shows the clearest price action, it’s time to pull the trigger.

Step #3: striking

For entry, we wait for our rectangle pattern to get confirmed. Once we break above the rectangle resistance line, we pull the trigger and buy the UUUU penny stock.

The rectangle pattern is a super easy chart pattern to trade because it gives you a very precise entry point and risk point as well.

The key to trading any breakout of a chart pattern is to also see the volume picking up as smart money pumps the penny stock.

Best penny stocks to invest for 2019

The list of the best penny stocks to invest in is constantly changing. Most penny stock trading trends unfold quickly. However, here is a list of the best penny stocks with the greatest daily increases for july 2019:

- SG blocks (57.77% increase)

- FTE networks inc. (22.44% increase)

- Synthesis energy systems (19.48% increase)

- Innodata (17.39% increase)

- Taronis technologies (16.28% increase)

- Iconix brand group (14.71% increase)

- Remark holdings (12.20% increase)

- Sierra oncology (11.04% increase)

Pro tip - to reduce the risk attached to any given stock, consider diversifying your holdings and purchasing multiple stocks at once.

Final thoughts – how to trade penny stocks

Penny stocks present opportunities that are independent of how the overall market is performing. Penny stock trading can be an important part of a diversified stock portfolio. But, before you put your hard-earned money at work, you need to find penny stocks that are more tradable and liquid than average.

Penny stocks are very speculative in nature, but this market can provide you with a probability to make money if you learn how to trade correctly. Proper preparation, research, and scrutiny are needed to be successful. Always due your due diligence, and make sure to try our suggested penny stock scanner settings for best results.

We hope you enjoyed this penny stocks beginner's guide. Don't forget to check out this guide to altcoins and penny cryptocurrencies.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

(17 votes, average: 4.06 out of 5)

loading.

Please share this trading strategy below and keep it for your own personal use! Thanks, traders!

So, let's see, what we have: trading scenario: what happens if you trade with just $100? What happens if you open a trading account with just $100 ? Or €100 ? Or £100 ? Since margin trading allows you to open trades at how to trade with 100 dollars

Contents of the article

- Free forex bonuses

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- 6 easy ways to invest $100

- How to invest $100

- 1. Investing in the stock market

- 2. Open a savings account

- 3. Peer-to-peer lending

- 4. Investing in a business

- 5. Investing in yourself

- 6. Pay off debt

- 1. Investing in the stock market

- The importance of contributing regularly

- Summary

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- How to become a day trader with $100

- How to start day trading with $100:

- Can you day trade with $100?

- How to start day trading with $100

- Step 1: find a brokerage

- Step 2: choose securities

- Step 3: determine strategy

- Step 4: start trading

- Step 1: find a brokerage

- Get started day trading

- How to trade with 100 dollars

- Turning $100 to $1000 or more trading forex

- Penny stocks for beginners (trading with just...

- What are penny stocks?

- Risks and benefits of trading penny stocks

- How do I find penny stocks?

- Where to buy penny stocks?

- How to buy penny stocks?

- What's the difference between OTC and...

- How to trade penny stocks?

- The best penny stock trading strategy

- Best penny stocks to invest for 2019

- Final thoughts – how to trade penny stocks

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.