Copy trade

SITE DISCLAIMER

trades signals sent through this website are solely those of the customers quoted.

Free forex bonuses

They do not represent the opinions of duplikium on whether to buy, sell or hold particular investments.

While duplikium try to ensure that all of the information provided on this website is kept up-to-date and accurate we accept no responsibility for any use made of the information provided. You agree not to hold duplikium liable for decisions and trades that are based on information from this website. Duplikium cannot be held responsible for the software, broker or other issues that result in the failure to execute a trade command. It is inherent upon you, the client, to make sure you are aware of when trades have been taken, adjusted or closed.

The purchase, sale or advice regarding a particular investment can only be performed by a licensed broker/dealer. Neither our website nor our associates involved in the production and maintenance of these products or this website is a registered broker/dealer or investment advisor in any state or federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website.

Please note that the servers names listed on this website are not a recommendation nor an advertising made by duplikium. Duplikium is totally independent and has no partnership with any brokers.You have to make your own due diligence when selecting a broker. You can trade manually from your mobile phone or you can attach your trading robots (EA) to your master account(s) and the trades will be copied to all your slave account(s).

The most flexible trade copier on the market!

Multi-broker, multi-currency, flexible and designed for high-frequency trading

The fastest trade-copier

MT4, MT5, ctrader, FXCM, lmax, FIX API

Remote trade copier

Welcome to the world of our trade copier

MT4, MT5, ctrader, FXCM trade station, lmax or various FIX apis, whatever is the technology we can copy trades from/to these platforms.

You can trade manually from your mobile phone or you can attach your trading robots (EA) to your master account(s) and the trades will be copied to all your slave account(s).

Our trade copier is self-hosted, it means that you do not need to keep your computed or VPS running, everything is managed by us on our own servers.

Everything works and is setup in the cloud!

Start to copy trades in 3 minutes, no installation required on your side, no VPS, PC or server to run 24/24. You save costs and headache! Duplikium is a remote trade copier and mirror trading platform hosted in the cloud.

- Just link your master and slave accounts on duplikium’s website and trade as usual on your preferred trading platform, your trades will be automatically copied on your slave accounts

- No software installation, no VPS, PC or server to run permanently, it means no IT updates and maintenance

- Access anytime, anywhere from your mobile

- Fastest solution on the market with an ultra-low internal latency below 1 ms to improve your trading performance

- Suited for high frequency trading perfectly fits asset managers' and signal providers' needs

- Live monitoring service and live chat support 24/7

Combine brokers, account currencies and technologies

Hundred of brokers are supported no matter the technology used and the instrument you want to trade.

- Free choice of the brokers to use for you and your clients

- All the brokers using MT4, MT5 or ctrader are supported, FXCM and lmax are available, too

- Trade all the instruments offered by your broker, including forex, cfds, crypto, metals, commodities, stocks, volatility index,…

- Mix real and demo accounts to test your strategy

- Unlimited number of master and slaves accounts

- Manage each account in the preferred reference currency USD, EUR, JPY, CHF,…

Manage risk of the copied trades

Easily define the trade size to copy for each slave using our advanced risk management tool.

- Set a different and independent risk factor for each master and slave

- Define groups of slaves with a similar risk factor

- Even configure risk for a specific symbol

- Select the risk factor method of your choice:

- Auto risk (on equity, balance or free margin)

- Multiplier (notional) or multiplier (lot)

- Fixed lot

- Fixed leverage (on equity, balance or free margin)

Access to advanced copy trading features

Discover all the features of duplikium trade copier and mirror trading platform to assist you to improve your trading and account management.

- Transform a loosing strategy to a winning strategy using the reverse trading option

- Define blacklist/whitelist to filter symbols to be copied

- Apply some particular settings on specific symbols

- Set global account protection to protect your equity

- Easily switch to open only, close only or frozen mode

- Choose your preferred server location (france, frankfurt, london LD4, new-york NY4 or singapore)

Use all the arsenal of order management

Trade as usual on your master account, all the main orders' types are supported.

- Copy market, instant and pending orders like limit and stop

- Manage your risk using protection orders like stoploss or takeprofit

- Update or delete of pending or protection orders is possible anytime

- Partial close is supported for all brokers

- Close directly the slave position from duplikium’s website

- Manual trading in the slave account still possible

- Receive alerts when the connection to your broker is lost or when an order fails

Use the trade copier according to your needs

The tool is designed for all types of professionals

- Standard trade copier - fully manage masters and slaves

- You register slaves yourself in the trade copier

- You define the trade size to copy and other settings for your slaves

- Provider/follower - two distinct access for provider and follower

- You configure your provider account and manage trades

- Your followers add their broker account using their credentials and define their risk factor to follow your trades

- Web API - access to our advanced technology through a restful API

- Build and host your own control panel connecting your own application or website to our trade copier server

- Manage trading accounts and risk factor, get orders, open and closed positions

- Designed for white label platform or signal provider

Affordable pricing for businesses of all sizes

Start free and upgrade when you’re ready!

- Just register for free and start to copy trades in 3 minutes

- No setup fees, nothing to install, nothing to pay

- You have the choice between flexible plans:

- Free plan: for 1 master and 1 slave, with volume restrictions and less features.

- Flexible plan: you pay per account connected without any restrictions

- Prepay plan: you pay for the volume copied no matter the number of slave accounts. Interesting for small accounts

- Online payment by credit card, paypal, skrill and bitcoins (only for prepay)

- Automatic renewal. You can cancel your plans at anytime if necessary

MARGIN TRADING DISCLAIMER

trading foreign exchange and CFD's on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange and CFD's trading, and seek advice from an independent financial advisor if you have any doubts.

SITE DISCLAIMER

trades signals sent through this website are solely those of the customers quoted. They do not represent the opinions of duplikium on whether to buy, sell or hold particular investments.

While duplikium try to ensure that all of the information provided on this website is kept up-to-date and accurate we accept no responsibility for any use made of the information provided. You agree not to hold duplikium liable for decisions and trades that are based on information from this website. Duplikium cannot be held responsible for the software, broker or other issues that result in the failure to execute a trade command. It is inherent upon you, the client, to make sure you are aware of when trades have been taken, adjusted or closed.

The purchase, sale or advice regarding a particular investment can only be performed by a licensed broker/dealer. Neither our website nor our associates involved in the production and maintenance of these products or this website is a registered broker/dealer or investment advisor in any state or federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website.

Please note that the servers names listed on this website are not a recommendation nor an advertising made by duplikium. Duplikium is totally independent and has no partnership with any brokers.You have to make your own due diligence when selecting a broker.

SOFTWARE DISCLAIMER

although rare, internet-based trading can involve technical risks related, but not limited to, internet connection, software or hardware failures or delays. Duplikium implements a backup system to minimize such occurrences, but is not responsible for any losses or missed trading opportunities as a result of communication failures, disruptions or unexpected system failures.

FBS copytrade

Profit by copying skilled traders

Join the league of smart investors with FBS copytrade. This social trading platform allows you to follow the strategies of the top market performers and copy them to earn money effortlessly. When professionals profit, you profit too!

Confusion and insecurity while trading are no more – now a huge professional community is by your side 24/7. Start today and let the selected experts work for you!

FBS copytrade introduces you to the financial market and helps to manage your investments wisely.

Copy the best traders and earn like a pro

Trade together with the best players by following in their footsteps

Get detailed trader information

Browse the list of top traders, check their profit statistics, and pick the most successful ones to copy

Create a unique portfolio

Favorite the best traders, track their progress, network with them, and make money

Start and stop copying anytime you want

Take action when traders are doing their best and alter the schedule depending on your needs

Copy pro traders with the app

Investing has never been easier!

- Enter the market without any specific financial knowledge

- Earn money effortlessly – chill while others work

- Invest in just one tap!

- Deposit and withdraw via a variety of payment systems

- Track all your progress and manage risks

- Increase your investment amount whenever needed

Share your skills and get paid!

Once confident enough, you can become a trader to be followed in FBS copytrade. Just share your FBS account from the personal area. Investors will get a chance to copy your orders, and you will get a commission from their trades. That’s it!

Copy pro traders with the app

Top 5 traders to copy

Return rate over the period

- 1w

- 1m

- 3m

- 6m

- 12m

Video tutorial for ios

Video tutorial for android

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Best copy trading brokers in 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

The ascent of forex copy trading – also known as social trading, mirror trading, or auto trading – has been ongoing for over a decade. Thanks to social media and an increasingly faster web, financial news and market analysis propagate at lightning speed.

What is copy trading?

The idea of copy trading is simple: use technology to copy the real-time forex trades (forex signals) of other live investors (forex trading system providers) you want to follow. This way, every time they trade, you can automatically replicate (copy) their trades in your brokerage account.

Best forex brokers for social copy trading

Based on over 105 different variables, here are the best forex brokers for copy trading.

- Etoro - best overall platform for copy trading

- Avatrade - metatrader suite, zulutrade and duplitrade

- Pepperstone - metatrader and ctrader platform suites

- Vantage FX - metatrader, zulutrade, duplitrade, and myfxbook

- IC markets - metatrader, ctrader, myfxbook, and zulutrade

- Octafx - metatrader and ctrader platform suites

- XM group - metatrader with custom indicators

Best overall platform for copy trading - visit site

Etoro is a winner for its easy-to-use copy-trading platform where traders can duplicate the trades of investors across over 2300 instruments, including exchange-traded securities, forex, cfds, and popular cryptocurrencies. (75% of retail investor accounts lose money) read full review

Metatrader suite, zulutrade and duplitrade - visit site

Avatrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found avatrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. (73% of retail investor accounts lose money) read full review

Metatrader and ctrader platform suites

While pepperstone offers a small set of tradeable products, it provides one of the largest selections of third-party platforms, including multiple social copy trading options. (between 74-89% of retail investor accounts lose money) read full review

Metatrader suite, zulutrade and duplitrade

While offering forex and CFD traders the metatrader platform suite, multiple social trading platforms, and a proprietary mobile app, vantage FX trails industry leaders in key areas, including mobile apps, research, and education. (74-89% of retail investor accounts lose money) read full review

Metatrader, ctrader, myfxbook, and zulutrade - visit site

IC markets caters exceptionally-well to algorithmic traders through its commission-based accounts. Third-party research and trading tool plugins are part of the IC markets metatrader platforms offering, making it our number one metatrader broker in 2021. (74-89% of retail investor accounts lose money) read full review

Metatrader and ctrader platform suites

From among its account offerings, including metatrader and ctrader platforms, the metatrader 5 (MT5) pro account stands out but still trails industry leaders in terms of low-cost forex trading and range of markets. (74-89% of retail investor accounts lose money) read full review

Metatrader with custom indicators - visit site

XM group is a vanilla metatrader broker that offers the complete metatrader suite, along with a few notable upgrades to enhance the experience, in addition to custom indicators. Trading tools aside, XM group’s research offering is rich with depth and variety, challenging industry leaders such as IG and saxo bank. (77.55% of retail investor accounts lose money) read full review

Copy trading history

Thanks to precise legal terms and ever-evolving trading technology, many regulators consider copy trading self-directed. In almost every jurisdiction, copy-trading is self-directed because the client must decide who to copy, even if the copying happens automatically (for each signal).

It’s important to note that not all trading platforms with social features provide copy trading.

Fun fact: many of the early pioneers in social trading technology started out first as third-party platform developers, such as tradency, zulutrade, and etoro. While some of these firms are still independent service providers (isps), etoro became a broker, for example.

Forex copy trading platforms comparison

Using our forex brokers comparison tool, here's a summary of the trading platforms offered by the best copy trading brokers.

| Feature | etoro visit site | avatrade visit site | pepperstone | vantage FX |

| proprietary platform | yes | yes | no | no |

| desktop platform (windows) | no | yes | yes | yes |

| web platform | yes | yes | yes | yes |

| social trading / copy-trading | yes | yes | yes | yes |

| metatrader 4 (MT4) | no | yes | yes | yes |

| metatrader 5 (MT5) | no | yes | yes | yes |

| ctrader | no | no | yes | no |

| duplitrade | no | yes | yes | yes |

| zulutrade | no | yes | no | yes |

What is the best copy trading platform?

Our testing found etoro to have the best copy trading platform for 2021. Etoro is excellent for social copy trading and cryptocurrency trading, and is our top pick for both categories in 2021. Furthermore, etoro offers a user-friendly web platform and mobile app that is great for casual investors, including beginners.

Is copy trading legal?

Copy trading is legal in most countries, pending the broker itself is properly regulated. When investing in the financial markets through a regulated-broker, procedures during the account opening process help ensure it is legal for you to trade, depending on your country of residence.

How does copy trading work?

With copy trading, a trader (signal provider) shares their real-time trades with other traders (users). Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Each copy trading platform provides optional controls to protect investors. For example, traders can customize the amount of capital they are risking and which signals to copy.

Can you make money from copy trading?

Like any investment, you can make money or lose money copy trading. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. However, as the market adage goes, "past performance is not indicative of future results." copy trading is risky, and many traders lose money. Only invest what you are willing to lose, start with a small amount of capital, and do thorough research before committing to a strategy.

How do I choose the best trading system to forex copy trade?

The best trading system to copy isn't necessarily the most profitable. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. On the other hand, a more aggressive investor may choose a strategy which has higher volatility, which means higher risk for losses.

Many modern copy trading forex platforms contain hundreds or even thousands of signal providers. As a result, it can be difficult for traders to decide who to follow. Thus, it is always important to do research, start with a small amount, and never risk more than you are willing to lose.

Is copy trading a good idea?

Copy trading requires active account management, as it is considered self-directed, compared to a set-it and forget-it investment fund or other passive investments. Therefore, only you can determine whether copy trading is a good idea and if it should be included in your portfolio. If used correctly, copy trading can help you diversify your existing portfolio, and the best copy trade brokers offer the most tools.

How do you copy a trade?

First, use the platform's filters to narrow strategies and traders to copy. Next, compare strategies side by side to review historical returns and performance. Finally, enter an amount you are willing to risk and initiate the copy trade.

Copy trade tip 1: besides choosing a trader with good historical results, it’s important to look at the performance statistics for each system, such as the amount of risk taken (maximum draw down) and average trade size, duration, and frequency of trades.

Copy trade tip 2: some investors select more than one strategy, but having enough capital and choosing the right risk parameters, if any, are crucial when you copy trade forex strategies. Remember, copy trading is risky. Never invest more money than you are willing to lose.

Other thoughts on copy trading

Understanding how social copy trading networks calculate trading performance is an essential aspect as it affects the ordering of trader rankings. The method used to measure and track profit and loss also influences trade copiers.

Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button.

Such challenges have been known for years, and thanks to broker procedures, regulation, and robust technology, these concerns are mostly non-issues, especially for top-rated fx brokers. Nonetheless, if in doubt, it’s always prudent to check and ask questions.

Winner: etoro

Etoro is a winner for its easy-to-use copy-trading platform where traders can duplicate the trades of investors across over 2300 instruments, including exchange-traded securities, forex, cfds, and popular cryptocurrencies.

- Trust: etoro was founded in 2007 and is regulated in two tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (low-risk) for trading forex and cfds.

- Commissions: for trading forex and cfds, etoro is slightly pricier than most of its competitors, despite recently cutting spreads and introducing zero-dollar commissions for US stock trading.

- Copy trading platforms: etoro's main innovation is merging self-directed trading and copy trading under a unified trading experience. It is a winning combination.

Runner-up: avatrade

Avatrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found avatrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education.

- Trust: founded in 2006, avatrade is regulated in three tier-1 jurisdictions and three tier-2 jurisdictions, making it a safe broker (low-risk) for forex and cfds trading.

- Commissions: compared to pricing leaders such as IG and saxo bank, avatrade does not rank among the best brokers for low-cost trading, except for clients designated as professional traders in the EU.

- Copy trading platforms: alongside metatrader, avatrade offers its proprietary platforms, as well as zulutrade and duplitrade, for social copy trading. The variety of platform options makes avatrade competitive in this area.

Summary

Here's a summary of the best forex brokers for social copy trading.

Read next

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

How to copy trades across multiple MT4 accounts different brokers

A step by step tutorial on how to copy trades between multiple metatrader 4 accounts

If you want to copy your trades across multiple MT4 accounts or you only want to copy trades from your MT4 account to MT4 accounts of others the easiest and most reliable solution is to use an expert advisor.

It will save you time and more importantly, it will let you focus on the market price action rather than needing to open trades across multiple MT4 platforms manually. It’s like a multiterminal, but here you can control MT4 accounts of different brokers.

The main concept behind copy trading is that by using special software to mirror trading, it will allow you to automatically copy your trades from one MT4 account to another one. Simply put it you’ll be able to mimic the performance from one MT4 platform to another MT4 account. To exemplify this process, we’re going to use the local trade copier which is a proprietary copy trading software created by rimantas petrauskas.

This guide will explain step-by-step how trades can be copied and also briefly cover the installation process of the local trade copier for which you can find more details here: easy way to open same trades on many MT4 accounts at once.

For simplicity, we’re going to use the abbreviation LTC for the local trade copier software. Simply follow this guide to complete the installation process of the LTC software, then after a short restart, the LTC will be available on your MT4 platform.

What is the local trade copier?

The LTC is an expert advisor designed to work on the MT4 terminal. The LTC helps forex traders and account manager to copy trades on multiple MT4 accounts that run on the same computer or even the same virtual private server. It can be a great tool if you want to operate multiple MT4 accounts at the same time and have the same trades execute across multiple MT4 accounts.

Trade copier installation process

Make sure you save the LTC EA somewhere handy. You can download and choose the right plan for the trade copier here.

After you have located the LTC package folder on your PC, you’ll note that there two executable files.

Use the auto-installer “LTC server auto-installer.Exe” file to install the server expert advisor in the MT4 account from where you will be doing all the trading operations. This MT4 account will be your master account.

Then, use the auto-installer “LTC client auto-installer.Exe” file to install the client expert advisor into all other MT4 instances where you want local trade copier to copy the trades. These accounts will be client accounts.

If you still need help with the LTC installation process, here’s a comprehensive video tutorial that you can follow: how to install trade copier.

LTC EA – installation process

If you have successfully installed the trade copier EA on your MT4 terminals, you can now start copying trades between as many MT4 platforms you need.

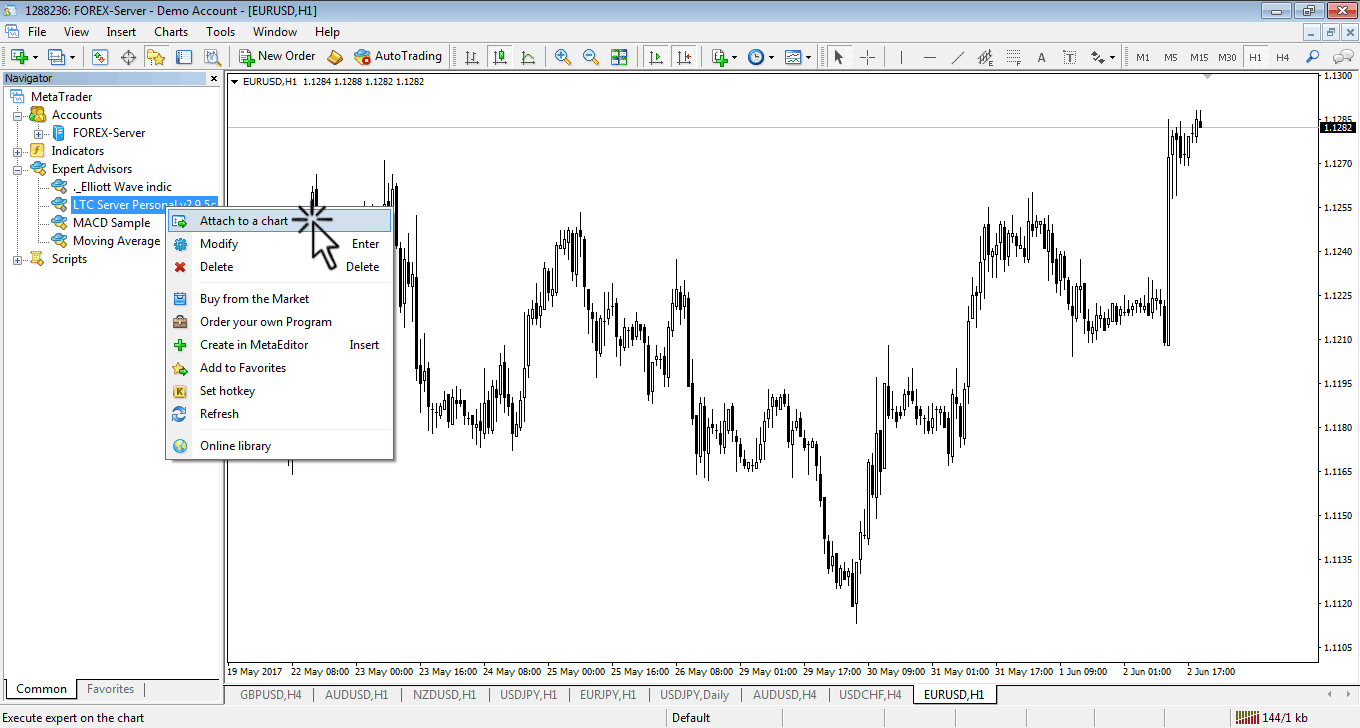

Tip: to make the trade copier EA appear on your MT4 terminals you will have to do a REFRESH in the navigator window or simply restart MT4 platforms.

MT4 personal trade copier setup

Step #1: attach LTC EA to any chart and enable expert advisor on MT4 terminal

Before you can start copying trades across multiple MT4 accounts, you want to make sure the LTC EA is running on all your master and client accounts.

The LTC EA can be located under the expert advisors drop down menu inside the navigator window on your MT4 platform. To activate your EA, we’ll have to drag and drop the expert advisor on a price chart or simply do a right‐click on the LTC EA in the navigator window and select “attach to a chart.”

Attach LTC EA on A chart

Step #2: enable expert advisor on MT4 terminal and live trading

For the LTC EA to work, you have to turn on the autotrading by clicking on the “autotrading” button in your MT4 toolbar.

Additionally, once you drag and drop your EA anywhere on your chart a box will pop‐up with some different tabs (about, common, inputs, dependencies) across the top. Make sure that under the common tab and live trading section you check the allow live trading and allow DLL imports boxes.

Enabling expert advisor and live trading on MT4

Do the same thing for all the client eas for all other MT4 instances where you want to copy your trades.

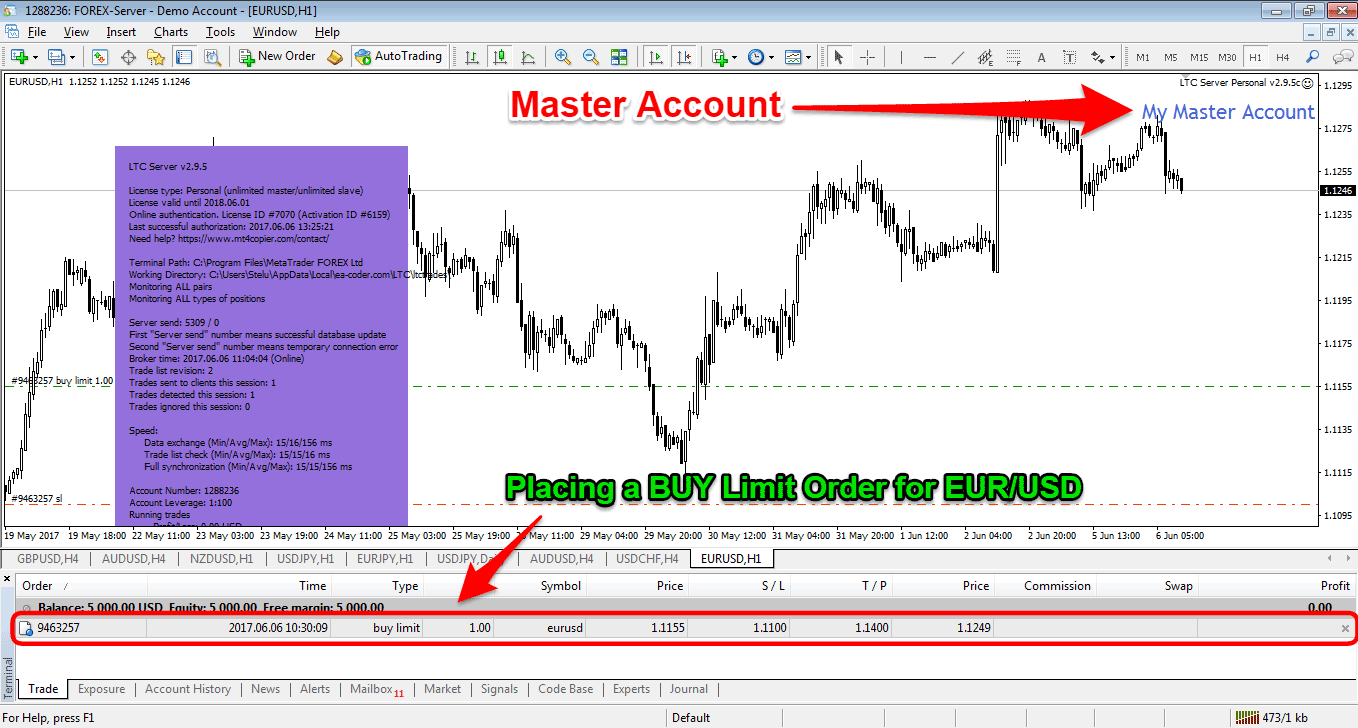

Step #3: how to copy your first trade using the LTC EA

Open trade in master account

To be able to copy your trades on multiple MT4 terminals, you have to use the master trading account where you have installed LTC server.

All pending orders and market orders executed will be copied on every MT4 instance where the LTC client EA is enabled.

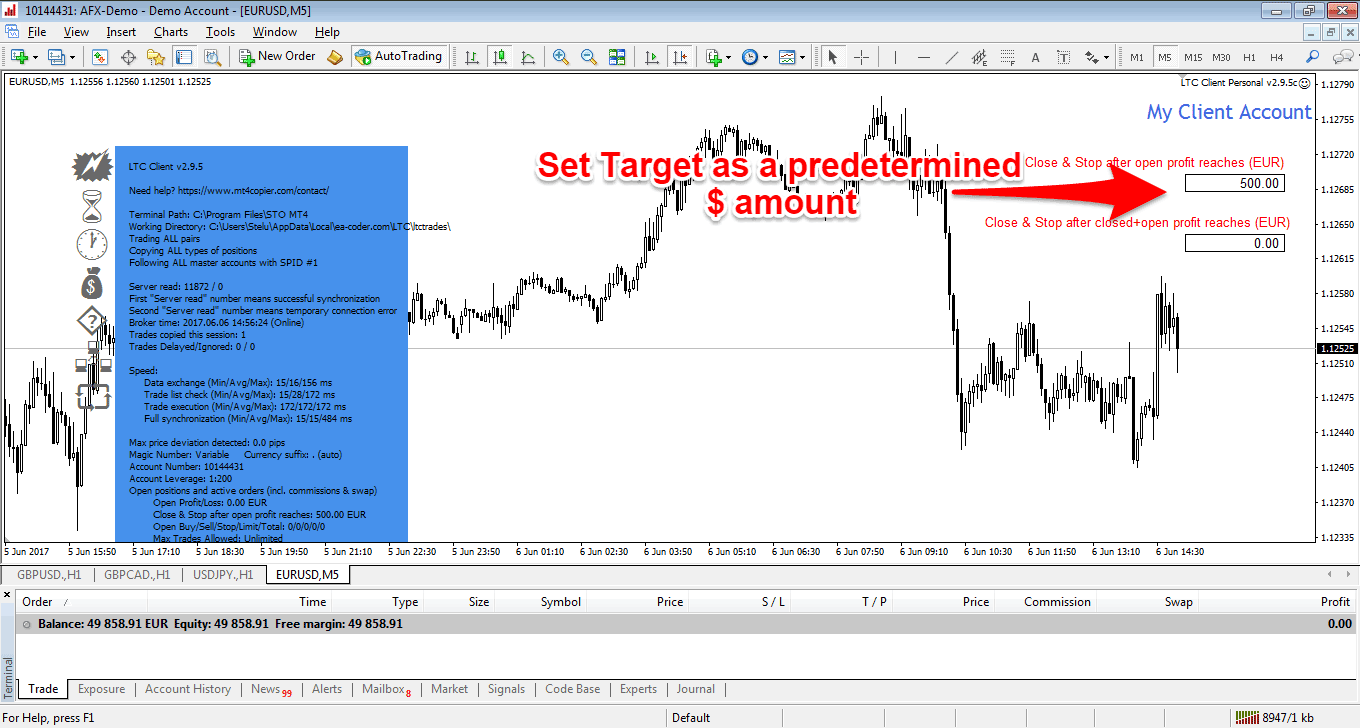

Trade copied in client account

Once I place my buy limit order, it gets copied to client account immediately.

Once I close the trade on the master, or price reaches either the SL order or the TP order, it will be closed automatically on all MT4 terminals.

The LTC EA gives you full control over your copied trades.

You can delete pending orders from any client account, and the order will be removed only from that MT4 terminal.

You can also close running trades before they reach the SL or TP level.

Another important feature of the LTC EA is that it allows you to set your profit target as a predetermined $ amount directly from your charts.

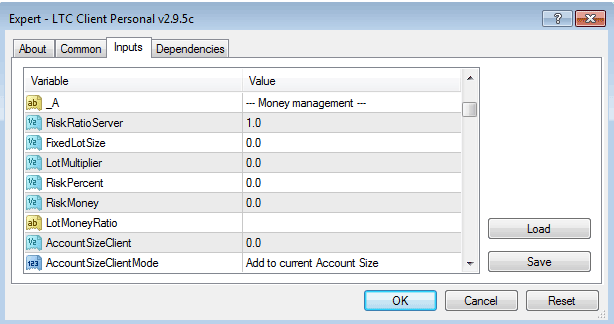

Step #4: LTC EA risk management parameters

The trade copier app also allows controlling the position size of copied trades. It offers multiple risk parameters starting with the:

- Auto-allocation of a lots size according to account size differences;

- Using predetermined fixed lot size;

- Using a lot multiplier;

- Using a fixed percent equity risk;

- Using a fixed $ equity risk;

LTC client EA – money management parameters

How to copy trades using different risk management parameters

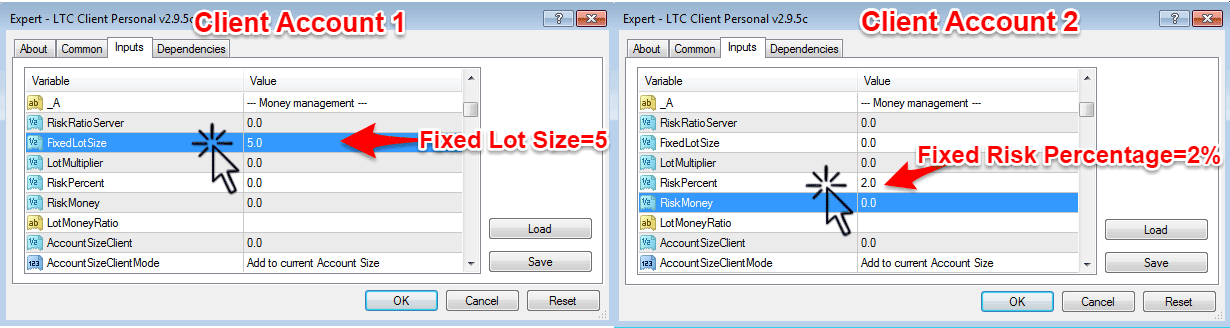

With the LTC EA, it’s possible to open the same trade on multiple MT4 platforms but using different risk parameters. Consider the example below where we have the following situation:

- Master account: buy EUR/USD 1 standard lot.

- Client account 1 – uses a predetermined fixed lot size equal to 3 lots.

- Client account 2 – uses a fixed percent equity risk equal to 2%.

LTC EA – money management settings

You can use your imagination as there are various ways in which you can use the LTC EA and most likely it can accommodate all your trading needs regarding copying trades on multiple MT4 platforms.

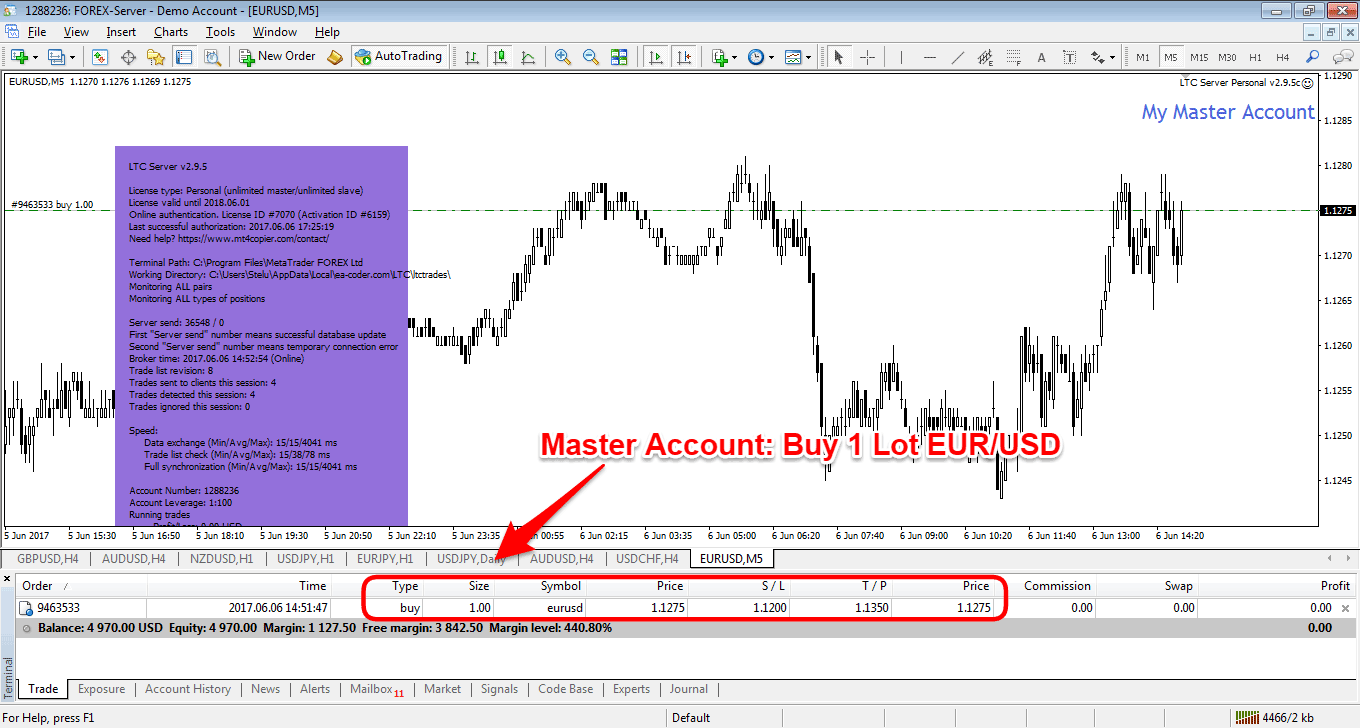

Master account – open trade

In the example above, we’ve opened one standard lot long position in the EUR/USD currency pair.

By default, once a trade is executed in the master account the LTC EA will copy all the other orders (stop loss and take profit orders) associated with this trade. Of course, you can control how you want this to work, but in this guide, we do not cover customization of SL/TP on copied trades.

Client accounts – copied trades

Conclusion

Copy trading or mirror trading is a simple and straightforward process that doesn’t need to be complicated, and you can do it between the same or different brokers. By applying this step by step tutorial on how to copy trades on multiple MT4 accounts, you can become yourself a sophisticated money manager.

© 2021 trade copier how to's. Built using wordpress and onepage express theme.

Alpari copytrade

Boost your potential profits with our copy trading service

How does alpari copytrade work?

If you’d like to get into the financial markets but you don’t have the knowledge or confidence to start, of the time to research and monitor the markets, our copy trading service could be the perfect solution.

Alpari copytrade allows you to copy the trading positions of experienced traders, known as strategy managers. Once you decide whom to follow, your account will automatically copy their trades – with no action required on your part.

Let’s say you make an initial investment of $1000 . You start following and copying the trades of a strategy manager who makes a $500 profit on his next successful trade. Through alpari copytrade, the strategy manager earns 10% of this profit, while you add $450 to your investment for a total of $1450.

The best part? You only pay your strategy manager when they produce a profitable trade.

Top 3 strategy managers

Choose experienced traders, follow them, and sit back while they do all the work.

Past performance does not guarantee future results

A strategy manager’s past results do not guarantee future returns, and the likelihood for losses is always present, but everyone still has the possibility to profit from alpari copytrade.

Join alpari copytrade today

with just

$/€/£100!

Convenient

Get in to the markets without having to research, plan and execute trades yourself.

Controlled by you

You choose your strategy manager and how much you want to invest.

Safe and secure

Your account is only visible to you and is completely protected

Up-to-the-minute updates

Monitor your investment account in real-time & get notified of each copied trade.

Accessible from anywhere

Stay connected on our website or wherever you are in the world at a time to suit you.

Simple to manage

Manage your funds the way you want to – withdraw, invest and pay your strategy manager only if you profit

Register or log in today

to start copy trading

Register or log in to your alpari account

Choose the strategy manager that best suits your investment needs

Deposit funds, sit back and watch that strategy manager trade for you!

Trading conditions

About us

Policies & regulation

Promotions

Trading guides, articles & insights

ALPARI INTERNATIONAL is the business name of exinity limited which is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Registered address: 5th floor, 355 NEX tower, rue du savoir, cybercity, ebene 72201, mauritius.

Card transactions are processed via FT global services ltd, reg no. HE 335426 with registered address at tassou papadopoulou 6, flat/office 22, ag. Dometios, 2373, nicosia, cyprus. Address for cardholder correspondence: [email protected]

Risk warning: trading forex and leveraged financial instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the client to ascertain whether he/she is permitted to use the services of the alpari international based on the legal requirements in his/her country of residence.

Regional restrictions: alpari international does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, brazil, puerto rico, the occupied area of cyprus. Find out more in the regulations section of our faqs.

Система forexcopy від інстафорекс

Що таке форекс копі?

Форекскопі - сервіс компанії інстафорекс, який дозволяє копіювати угоди успішних трейдерів в режимі онлайн. Всього за кілька хвилин кожен клієнт компанії може вибрати трейдера і налаштувати автоматичне копіювання його угод на свій рахунок, або надати для копіювання власні угоди.

Одним з переваг системи форекскопі є її надійність. Ви можете повністю контролювати ситуацію, оскільки ваші гроші залишаються на вашому рахунку, ви самі вибираєте налаштування копіювання і можете навіть вручну скасувати скопійоване автоматично угоду, якщо вважаєте її потенційно збитковою.

Форекскопі - сервіс для копіювання угод успішних трейдерів в режимі онлайн, розроблений компанією інстафорекс. Кожен клієнт всього за пару хвилин може налаштувати автоматичне копіювання угод трейдера на свій рахунок або надати власні угоди для копіювання.

Перевага системи - це надійність: гроші залишаються на вашому рахунку, ви контролюєте їх, самостійно вибираєте налаштування і навіть можете скасувати скопійоване угоду, якщо вважаєте її збитковою.

Як працює форекс копі?

Зареєструватися в системі форекскопі можна в якості трейдера або підписувача.

- Трейдер поповнює реальний рахунок або отримує бездепозитний бонус і починає торгівлю. Інформація про його угоди розміщується в публічному моніторингу.

- Підписчик стежить за статистикою трейдерів в моніторингу, вибирає того, чия торгова стратегія йому підходить. Вибравши трейдера, підписчик знайомиться з пропонованою системою оплати підписки і налаштовує параметри копіювання.

- Трейдер торгує на форекс, його угоди копіюються на рахунок підписувача відповідно до заданих параметрів. Оплата підписки відбувається в залежності від обраного способу, або шляхом списання коштів з рахунку підписувача, або шляхом зарахування необхідної суми на рахунок трейдера з коштів компанії.

COPY TRADE

Social platform for copying trades

Liteforex social trading

Discover the forex social world of professional trading by copying trades or become an example to follow!

Take advantage of successful traders’ experience or share your own success with others through our social forex trading system. Depending on your goals, choose the role that really suits you and achieve your objectives!

Social trader

Social traders are experienced and successful trader that make trades in their аccount and makes own trading profits plus commission from their followers or copy traders.

Copy trader

You want to make money but don't have enough experience? Become a COPY TRADER and earn profit. Copy traders make profits while copying the social traders in the system.

How to get started?

Using computer

- How to open liteforex account

- How to complete account verification

- How to deposit thru local deposit

- How to use promo code

- Bonus condition (promo code)

- How to withdraw thru local withdraw

- How to copy trade

- 4 types of copy

- How to edit copy trade

- Integrate liteforex to metatrader

- How to set a social trading account

- How to edit social trading account

- How to change master/investor password

Using smartphone

- How to deposit thru local deposit

- How to use promo code

- Bonus condition (promo code)

- How to withdraw thru local withdraw

- How to copy trade

- 4 types of copy

- How to edit copy trade

- Integrate liteforex to metatrader

- How to set a social trading account

- How to edit social trading account

- How to change master/investor password

how to open liteforex account how to complete account verification

Copy trade webinars

Online live COPYTRADE webinars are online sessions on liteforex social trading platform provided by an active traders that analyze the social trader’s performance. Join our COPYTRADE webinars every wednesday 8pm manila time.

Participation in our seminars will guide you how to participate and navigate through the social trading platform. Also, we will provide insights of the most profitable social traders, reviewing their running earnings, number of followers, risk level and their copy settings.

Copy trading

It’s time to try avatrade UK.

Enjoy competitive spreads & high leverage.

Copy trading with avatrade UK

Trading forex in UK can be a complex endeavour. To achieve success in this dynamic market, new UK traders require the appropriate education, skills, strategies and trading experience. Fortunately for such traders, the copy trading offered at avatrade UK has ensured that our traders can start trading the financial markets and gaining insight into effective trading strategies, while continuing their forex education. Copy trading is simply that: investors copy the trades of successful traders on the platform, giving them first class access to diversify their trading portfolios and to watch trading skills in action.

With so many benefits to copy trading, it is important to understand that while you get to replicate top traders’ success, you also get to share in their losses. Which is all part of online trading. Despite this, avatrade UK offers our clients access to successful traders on our intuitive platforms; so, come get in on the copy trading action.

How copy trading works

Copy trading is a form of automated trading where trade positions are copied from one trading account to another. Copy trading is really straightforward for traders: you add your investment amount, select a trader to follow, and then the copy trading platform will replicate all the selected trader’s positions in your trading account. The world-class platforms at avatrade UK offer copy trading functionality – some are semi-automated, automated, or manual.

Automated copy trading

With automated copy trading, you select strategies (traders) that match your desired trading preferences and risk appetite. After that, all positions taken by the selected trader will be mirrored automatically in your trading account. No human intervention whatsoever is required when you are copying trades in this way.

Semi-automated copy trading

When copytrading in semi-automated mode, you will be able to view all the positions taken by the selected trader you wish to copy, in real time. You then choose the positions you wish to replicate in your trading account. Once your desired trades have been copied, you can track them and then close them anytime you wish. You can however, also let them run so they can close automatically when your signal provider closes their trades.

Manual copy trading

This is a little more like normal trading except traders now have access to the extensive knowledge and strategies of experienced traders. You get to glean from their vast trading experience and to get some real insight as to which factors prompt them to enter or exit trades. You then ‘manually’ decide who to follow and which trades to copy as well as their strategies. In a sense, this is what is referred to as social trading.

How did copy trading become so popular?

Copy trading has witnessed immense popularity in the UK as most traders view it as way of trading in the financial markets, while they still possess limited knowledge and experience in these markets. For new traders, copy trading has allowed them to take a slice of the $6 trillion a day currency trading market without committing the time resource needed to carve out a successful trading career.

Also, contrary to popular belief, copy trading is not just ideal for newbie traders. Even experienced traders copy other traders in order to enhance their profitability and to learn new trading strategies and techniques. No matter how good or experienced a trader you are, there will always be someone better, and always something more to learn. Here at the avatrade UK website, you can enjoy world-class signal providers that rank among the best in the industry.

Advantages of copy trading

Many traders nowadays attribute their success to copy trading techniques. The advantages of copy trading are as follows:

- The main advantage of copy trading is the opportunity to earn from the financial markets with limited knowledge. When new traders achieve profitability, they become more confident and are inspired to improve their trading knowledge further, since they understand that it is indeed possible to have a successful trading career.

- Copy trading frees up time for both new and experienced traders. Even investors with tight job schedules can earn in the markets without having to monitor their trading charts all day.

- Copy trading allows traders to choose the trading style that suits their risk tolerance and trading preferences.

- Copy trading allows for the diversification of risk. That is, you can trade manually by yourself, plus you can boost your market insight by integrating copy trading into your trading activities. Even while copy trading, you can select different signal providers in order to hedge trading risks in case different trading strategies become successful in different market conditions.

Start trading with a regulated award-winning broker!

The risks of copy trading

While copy trading feels like a way to earn while riding on the experience of others, it carries some risks.

Here are the inherent risks associated with copy trading:

- There is risk of losing your capital. This seems natural as you are engaging in a high risk, high reward endeavour. Despite some successful profitable trades, the signal provider may make a mistake, or the market might turn, and this can be disastrous for your trading capital.

- Choosing a reliable trader to copy is not an easy task. A trader topping the leaderboards today may not have been there a few weeks back. He may just be undergoing a good streak, and an inevitable drawdown may catch you off guard and result in big losses.

- Copy trading does not consider your personal investment goals or financial circumstances. You are still relying on a third party for trading decisions but absorbing full liability in case anything goes wrong.

- There are also signal provider risks. The signal provider may discontinue their service without notice, or get margin called by their broker, and this could inconvenience you if you have no plan B. The trader you have chosen to copy may also change their strategies to become more aggressive, and this could mean riskier trades.

Tips and tricks for successful copy trading

Even with the natural risks associated with online trading as well as copy trading, the process can be done more effectively. Here are some tips and tricks when copy trading:

- Pick the perfect broker–

this is where avatrade UK takes centre stage. While it is third party software that powers and enables copy trading, the process is still done through a brokerage’s platform. Picking a reliable and regulated british broker, such as avatrade, is the first step to achieving successful copy trading. Copy trading is always done in real time, and it is important that your broker’s copy trading platform conforms to the latest financial technological advancements in order to achieve seamless trading. Here at the avatrade UK website, you’re in safe hands. In addition to being 100% safe, secure, and regulated, avatrade ensures that the integrity of client accounts is protected at all times. Avatrade UK also allows copy trading across all its platforms, seamlessly. - Find the right account –

avatrade UK offers multiple copy trading options for its traders, such as mirror trader and zulutrade. These are the leaders in the automated strategy field and their platforms are incredibly user-friendly and guaranteed to meet your needs. Having multiple accounts also widens the pool of signal providers you have to choose from. - Choose the ideal signal provider –

this is the most challenging part of copy trading. Once you activate your account on the avatrade british website, our platforms will generate a list of numerous signal providers and you can choose one that suits your desired trading style and preferences. When choosing a signal provider, you should not just simply pick the one topping the charts. Instead, it is important to review the history of the trader’s trading activities. The trader should have a trading history not less than 60 days. A trader with a lot of subscribers is also desirable, as this might be the first sign of reliability. A consistent signal provider is also better than a one-time big hitter. Furthermore, the signal provider should also not have a drawdown exceeding 25% in any given month in their history. - Choose a signal provider with a trading account similar to your capital –

this is very important as it will give you a proper idea of the risks and returns you are exposed to. If you intend to trade with $5,000, it might be a bad idea following a trader with a $1,000,000 account. - Proper settings –

copy trading replicates the positions of your signal provider in your trading account, so you should ensure you have set the right parameters for all types of trades that will be copied into your account. If you are following a scalper, for instance, it would be wise to replicate trades in smaller lot sizes because of the volume of trades such a trader may execute in any trading session.

Copy trade with avatrade UK

Our avatrade UK trading platform offers you multiple direct and indirect copy trading options. Avatrade has also partnered with the world’s finest signal providers to ensure that you can follow the best copy traders – wherever they may be.

Our leading copy trading platforms include the following:

- Mirror trader – enjoy manual trading, semi-automatic trading, or automatic trading when following your preferred signal providers. You also get to copy the algorithmic trading strategies developed by experienced UK traders in conjunction with top developers.

- Zulutrade – select from a large number of signal providers, who have been ranked using various practical parameters including maximum drawdown and average profitability.

Our sterling reputation, in tandem with the world’s finest signal providers, ensures that you can make safe and secure trades within our all-inclusive trading environment.

Follow the best performing british traders on our automated CFD trading platforms as well as from the pool of our copy trading partners and mirror their skills and strategies in your trading account. Additionally, please feel free to contact our support team should you require any information or assistance with copy trading.

Copy trading main faqs

If your plan is only to follow and copy other traders there is no experience required, although it can be helpful in analysing and selecting a good trader to copy. In reality it is often the traders with no experience who like to use copy trading. It can be a good way to begin growing an account, and if you take the time to analyse the trades being made by those you follow it can also be a very good way to learn about trading too. If you’re a new trader and are worried about losing money with copy trading you could always try it with a demo account first before funding your account.

If you take the time to identify good traders to copy you aren’t taking any more risk than when trading your own account. That is to say trading is inherently risky, and there is always the possibility that you will lose money. Also note that the past performance of a trader is no guarantee of their future performance, so even if they’ve been profitable for three years running, they could have their first losing week right after you decide to follow them. As always, never invest more than you can afford to lose.

While it might seem tempting to copy the trader with a 300% annual return, in general these traders are taking on far too much risk and eventually will blow up. Instead look for traders who have at least 1-year trading history and a return somewhere between 10% and 30%. The trader should also be active enough that they are placing a minimum of one trade per week. This ensures that they are trying to grow their trading base rather than just locking your money in a single trade. If you want to spread out your risk you can spread out your copy trading between 2-4 different traders.

It’s time to try us.

Enjoy competitive spreads & high leverage.

FX blue personal trade copier for MT4

The personal trade copier duplicates orders between two (or more) instances of MT4/MT5 running on the same computer. It is trusted by tens of thousands of traders all over the world, and is even used by brokers to offset risk and liquidity from one server to another.

Changes in this new release, v10:

- Versions for both MT4 and MT5. Send and receive between any combination of MT4 and MT5 accounts.

- Improved copying speed

- In MT4, run trading actions in parallel - copy multiple new signals at the same time - using an optional worker EA

- Improved automatic detection of different symbol names on different broker accounts, reducing the need for manual settings

- Override the copier's actions using your own MQL code

This is the MT4 version of the copier. There is also a version for MT5.

The trade copier has a wide range of features. These are covered in greater detail in the user guide:

- Adjust lot sizes, including risk-based adjustment based on the relative equity of the two accounts

- Adjust the s/l and t/p

- Only copy orders for specific symbols

- Only copy orders with specific magic numbers

- Copies both manual and automated trading activity

- Send email alerts on trading activity

- Uses a single magic number for all orders, allowing analysis of results by EA

- Automatically adjusts between different broker symbols names such as EURUSD and eurusdcx

- Automatically adjusts between brokers who use 2/3DP and 4/5DP pricing

- Invert original trade direction

- Daily trading hours during which the copier is allowed to trade

- Handles partial closes

The sending copy of MT4 does not need the ability to place trades. It can be logged in using the read-only MT4 "investor" password.

The personal trade copier duplicates orders between two (or more) instances of MT4/MT5 running on the same computer. It is trusted by tens of thousands of traders all over the world, and is even used by brokers to offset risk and liquidity from one server to another.

Changes in this new release, v10:

- Versions for both MT4 and MT5. Send and receive between any combination of MT4 and MT5 accounts.

- Improved copying speed

- In MT4, run trading actions in parallel - copy multiple new signals at the same time - using an optional worker EA

- Improved automatic detection of different symbol names on different broker accounts, reducing the need for manual settings

- Override the copier's actions using your own MQL code

This is the MT4 version of the copier. There is also a version for MT5.

The trade copier has a wide range of features. These are covered in greater detail in the user guide:

- Adjust lot sizes, including risk-based adjustment based on the relative equity of the two accounts

- Adjust the s/l and t/p

- Only copy orders for specific symbols

- Only copy orders with specific magic numbers

- Copies both manual and automated trading activity

- Send email alerts on trading activity

- Uses a single magic number for all orders, allowing analysis of results by EA

- Automatically adjusts between different broker symbols names such as EURUSD and eurusdcx

- Automatically adjusts between brokers who use 2/3DP and 4/5DP pricing

- Invert original trade direction

- Daily trading hours during which the copier is allowed to trade

- Handles partial closes

The sending copy of MT4 does not need the ability to place trades. It can be logged in using the read-only MT4 "investor" password.

Thank you for your download of FX blue personal trade copier for MT4!

Your software is now downloading in your web browser. For more information about how to set up and use the software, please see the online user guide:

Find out about the top brokers worldwide. Keep updated about news about their latest developments, market analysis, bonus, promotions. Compare spreads and choose the broker that adjusts to your needs.

So, let's see, what we have: the best forex trade copier for signal provider. Mirror your trades on MT4, MT5, ctrader, FXCM and lmax. The fastest remote copier managed in the cloud at copy trade

Contents of the article

- Free forex bonuses

- The most flexible trade copier on the market!

- Welcome to the world of our trade copier

- Everything works and is setup in the cloud!

- Combine brokers, account currencies and...

- Manage risk of the copied trades

- Access to advanced copy trading features

- Use all the arsenal of order management

- Use the trade copier according to your needs

- Affordable pricing for businesses of all sizes

- FBS copytrade

- Profit by copying skilled traders

- Copy the best traders and earn like a pro

- Get detailed trader information

- Create a unique portfolio

- Top 5 traders to copy

- Video tutorial for ios

- Video tutorial for android

- FBS at social media

- Contact us

- Data collection notice

- Best copy trading brokers in 2021

- What is copy trading?

- Best forex brokers for social copy trading

- Copy trading history

- Forex copy trading platforms comparison

- What is the best copy trading platform?

- Is copy trading legal?

- How does copy trading work?

- Can you make money from copy trading?

- How do I choose the best trading system to forex...

- Is copy trading a good idea?

- How do you copy a trade?

- Other thoughts on copy trading

- Winner: etoro

- Runner-up: avatrade

- Summary

- Read next

- Methodology

- Forex risk disclaimer

- How to copy trades across multiple MT4 accounts...

- What is the local trade copier?

- Trade copier installation process

- MT4 personal trade copier setup

- Step #1: attach LTC EA to any chart and enable...

- Step #2: enable expert advisor on MT4 terminal...

- Step #3: how to copy your first trade using the...

- Step #4: LTC EA risk management parameters

- How to copy trades using different risk...

- Conclusion

- Alpari copytrade

- Boost your potential profits with our copy...

- How does alpari copytrade work?

- Top 3 strategy managers

- Join alpari copytrade today with just

- Convenient

- Controlled by you

- Safe and secure

- Up-to-the-minute updates

- Accessible from anywhere

- Simple to manage

- Register or log in todayto start copy...

- Система forexcopy від інстафорекс

- Що таке форекс копі?

- Як працює форекс копі?

- COPY TRADE

- Liteforex social trading

- How to get started?

- Using computer

- Using smartphone

- Copy trade webinars

- Copy trading

- Copy trading with avatrade UK

- Automated copy trading

- Semi-automated copy trading

- Manual copy trading

- Advantages of copy trading

- The risks of copy trading

- Tips and tricks for successful copy trading

- Copy trade with avatrade UK

- FX blue personal trade copier for MT4

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.