Trade forex broker

Before choosing a forex broker, it’s always recommended that you settle for one who can effectively and immediately resolve all customer issues.

Free forex bonuses

In this case, most regulated brokers are always competent enough when dealing with technical support or account issues. In addition, they are very helpful and kind during the whole account opening process. Though true ECN and STP brokers can add markups when necessary, they cannot in any way take it further down than the amount provided.

Fxdailyreport.Com

Till about a decade ago, you had to make use of the telephone if you wanted to invest in the financial markets. You had to call up your broker for placing as well as closing orders. Introduction of online trading has, however, simplified every aspect of the investment process. You can carry out trades from the convenience of your home or on-the-go using the platform provided by brokers. Sounds simple, but the problem is there are umpteen number of forex brokers that offer trading platforms out there in the market. And, you need to work with the best forex broker if you want to achieve your financial goals. So, it all boils down to identifying the right broker to work with and it is definitely not an easy task. Read on to find out as to how you can identify the best forex brokers. In this post, various aspects you need to take into consideration when choosing a forex broker are discussed in detail so that the selection process becomes simpler and easier for you.

Top recommended and the best forex brokers for 2021

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | ||

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: €100 spread: the spread can be as low as 0.01%” (0.01% = spread for EUR/USD) leverage: 1:294 regulation: ASIC, cysec, FCA (UK) | visit broker | ||

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker |

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Main parameters to be checked for identifying the best forex brokers:

#1: regulations and licenses

It is highly recommended that you choose only forex brokers that are regulated or authorized by leading regulatory bodies such as commodity futures trading commission (CFTC), national futures association (NFA) and financial conduct authority (FCA in UK), among many others. This is because regulated brokers are more reliable than their non-regulated counterparts. Further, your hard earned money remains safe with such brokers for two reasons: they will be appropriately capitalized and they maintain segregated accounts for theirs as well as traders’ funds.

#2: forex trading platform

The online trading platforms that recommended forex brokers provide would not only be simple, but also intuitive and easy to operate or navigate. It, therefore, makes sense to try out a few online forex platforms and see for yourself as to which one has a better user interface and is easily navigable.

#3: customer support services

Customer support is a key aspect that you need to evaluate. Best fx brokers would often be aware of the needs of the traders and provide good, efficient and responsive customer support services. During the course of trading forex on an online broker’s platform, there will be times when you need certain time sensitive clarifications. If the customer support service of the broker you are planning to work with is not good enough, you could end up losing money. It is, therefore, recommended that you evaluate the brokers’ customer support service both by speaking to their representatives on telephone and by communicating with them through email.

Leverage offered for forex trading varies from one broker to another. If the leverage is high, the trader can make more profits. However, the risk of accumulating losses is also equally higher. Therefore, you should choose a broker that offers leverage suiting to your needs and based on your style of trading.

Brokers often try to attract you by offering high capital bonuses when you make your first deposit. This is good because you get more money for trading. You can choose the broker that offers the highest first deposit bonus, but you should make sure other aspects discussed above and those that are discussed below suit your needs.

#6: deposits and withdrawals

It is important that you understand the brokers’ policies related to deposits and withdrawals. The features to be evaluated when choosing top forex brokers are minimum amount to be deposited to start trading, deposit methods offered, currency options provided, minimum withdrawal amount specified and waiting time for withdrawals, among others. Further, it makes sense to go through all other written policies in detail.

Brokers make money by charging a fee for each of the trading transactions that you execute on the forex trading platform provided by them. As far as the broker and you are concerned, the significant source of revenue would be the spread, the difference between ask and bid prices. It pays, therefore, to check as to how the brokers you have shortlisted handle spreads:

Do they offer fixed or variable spreads?

What is the average and maximum spread for the currency pairs that you are planning to trade?

What spreads are offered when the volatility is very high?

Do you have to pay any commission for each trade apart from the spread?

Before buying a car, you always go for a test drive. Similarly, look for forex brokers that offer demo accounts. This helps you to open a practice account. You can try out their platform and find out for yourself as to which of the shortlisted brokers is best suited to your requirements. Most brokers offer practice accounts these days. So, it is easy for you to get a feel of the brokers’ platform before committing to depositing money and trading.

#9: other parameters for identifying the best forex brokers

The forex brokerages that offer very low account minimums can be considered for evaluation under the category “best forex brokers”. This is good because you don’t have to deposit large amounts of money in order to trade forex. Minimum account balance can be as low as $5 in the case of some of the reliable forex brokers.

Online forex brokers often try to snatch business through promotions. Do not fall prey to their sales gimmicks. Best forex brokers would never make unbelievable and unachievable promotional offers. It is true that cash and prizes form part of the game, but they should be reasonable.

Another aspect to look for when evaluating online forex brokers is the educational services offered by them. This helps you to master the art of forex trading. Brokers that provide you with a variety of educational tools for assisting you in assessing the forex market are the best forex brokers to work with.

Why expert traders trade with regulated forex brokers

If you’re looking to become a successful forex trader, then working with a skilled and trustworthy broker is very crucial. In the forex market, the two main types of brokers you’ll get include the regulated and the non-regulated brokers. Obviously, the former typically operates under regulations stipulated by a forex regulator. Regulated forex brokers must also be fully licensed and registered in their country of operation, unlike their non-regulated counterparts.

Role of regulation

Of course, the role of regulation in forex market cannot be underestimated. Regulation ensures that all players in this booming industry are strictly supervised. This way, merchants are protected from the many unscrupulous traders out there looking to swindle them off their hard earned money. Another thing, regulation also builds trust between merchants and their brokers, since most merchants don’t have enough time to monitor every investment.

Let’s take a quick look at some of the leading regulatory agencies:

- CFTC and NFA: commodity futures trading commission and national futures association, regulate the financial services sector in united states of america (USA).

- Cysec: the cyprus securities and exchange commission is the regulatory watchdog within the cysec domain. It offers services to the EU member states.

- FCA: the financial conduct authority regulates the operations of over 56,000 financial services and companies in the UK.

- ASIC: the australian securities and investment commission regulate the financial services sector in australia.

- FSB: the financial services board is a south african agency which oversees functioning, regulation, and licensing of south african forex brokers.

- Bafin: bafin is a financial supervisory authority providing its services to forex companies in germany.

Advantages of regulated forex brokers

With regulated brokers, you’ll always have some peace of mind when carrying out your real-money transactions. To expound more, here are the main reasons why expert traders prefer regulated brokers:

1. Credibility

It’s an open secret that most of us like to deal with trusted organizations, especially when money is involved. That being said, the credibility of any forex broker is greatly enhanced if the company is regulated by the relevant agencies. Remember that all regulated forex brokers are mandated to follow some strict rules put in place by their respective regulatory bodies. Furthermore, their regulatory bodies expect them to regularly present a copy of their audit report. Therefore, if a broker is listed on its regulatory body list, then it’s safe to say that the forex broker has fully complied.

2. Compensation

Getting compensated in case of any unfortunate scenario is arguably the best reason why most expert traders opt for regulated brokers. With most regulated brokers, you can rest assured that all your hard earned money will be refunded in case your brokerage firm goes down. For example, brokers operating under cysec are required to remit their contribution to the ICF (investor compensation fund). This pool of funds is to help settle any form of customer claims in case of any eventuality.

3. Effective customer service

Before choosing a forex broker, it’s always recommended that you settle for one who can effectively and immediately resolve all customer issues. In this case, most regulated brokers are always competent enough when dealing with technical support or account issues. In addition, they are very helpful and kind during the whole account opening process.

4. Quick deposits and withdrawals

Any reputable forex broker will allow their merchants to make deposits and withdrawals without any hassle. A regulated broker should have no reason whatsoever to make your earnings process difficult because they don’t have control over your funds. All they have to do is to facilitate the platform to make it convenient enough for you to trade.

5. Updated trading platform

Most regulated brokers are mandated by their respective regulatory authorities to provide their clients with the latest, powerful, and easy-to-use trading platforms. In fact, most of their platforms will readily provide you with all that you need to begin trading immediately. You’ll get a lot of educational materials including webinars, videos, articles, seminars, and e-courses at no extra charge. It goes without saying that regulated brokers also offer their clients free demo accounts to help them sharpen their skills before going live.

6. Legality

All over the world, governments are struggling to deal with issues concerning money laundering. Some of them have even gone ahead to pass very strict anti-money laundering laws. So to be on the safe side, you should always trade with a regulated broker. Most regulated forex brokers will ask you to provide some of your personal identification documents such as proof of address and photo ID. This might sound tedious to you but it’s always safe to be part of a regulated organization that can prove your money is being used in a legal way.

To sum it up, regulated forex brokers are always the best as well as the safest option to trade with. This is because they are always ahead in terms of legality, security, and safety of your funds. All in all, you can manage your risks better if you opt for a regulated forex broker.

Understanding true ECN vs STP broker

The foreign exchange market, also known as currency market, is a universal decentralized market that provides traders an opportunity to trade currencies. It is a market which incorporates all aspects of buying, selling, and exchanging currencies at the present-day or determined rates.

There are different kinds of forex brokers that you can choose to trade forex with. However, though all the brokers in forex are intended to provide a similar basic solution, the way they operate behind the scenes is different. Different types of brokers have varying techniques of operation, and the specific broker you cooperate with can significantly determine your success rate as a forex trader. Here are some crucial factors that will enable you determine which broker between a true ECN and STP broker is the best one to trade forex with:

Understanding true ECN vs STP broker

True ECN i.E. Electronic communications network brokers operate without their individual dealing desk. These brokers provide an electronic trading platform where professional market makers at monetary organizations such as banks, and other online trading participants including traders can enter bids and offers through their particular systems.

STP i.E. Straight through processing brokers are brokers without a dealing desk also. These brokers apply some of the techniques utilized by market makers to provide their particular clients with trading conditions which are more flexible. By STP brokers hiring some of the tactics of market makers, they are able to bypass the limitations connected to trading exclusively within the interbank market.

General overview of true ECN and STP brokers

- Use of scalping techniques

True ECN and STP forex brokers do not care about how much their particular traders make. Therefore, these types of brokers allow traders to utilize scalping techniques to close their respective positions. Note that false ECN and STP brokers cannot allow you to use scalping techniques as a trader since they will be disadvantaged anytime you make small profits.

True ECN and STP brokers are types of forex brokers without a say when it comes to control on spread provided. These brokers have no control on spread offered since it’s the liquidity provider that determines the spread which is to be provided.

Though true ECN and STP brokers can add markups when necessary, they cannot in any way take it further down than the amount provided.

Difference between true ECN and STP brokers

- Commission charged

On true ECN accounts, as a trader you will be required to pay a fixed commission to open and close trades. The spreads offered on true ECN accounts are determined by the rates of liquidity providers.

When using STP accounts as a trader, you will not be required to pay any commissions.

Pros of trading forex with a true STP broker

- Cannot bankrupt themselves

True ECN brokers cannot trade against their specific clients to bankrupts themselves.

- Similar price rates

If you are a forex trader, trading with a true ECN broker means you are guaranteed of price rates that are similar to those of the interbank market.

- Negative balance protection

As a trader utilizing the trading account of a true ECN broker, the broker will be accountable for any dues with liquidity providers should your account read negative as a result of any reason beyond their control.

Cons of choosing a true ECN broker

Dealing with a true ECN broker will require you to pay rollover fees and commission at times.

Pros of trading forex with an STP broker

- Their rates and the interbank prices are same

- They provide their clients low entry capital requirements

Cons of choosing an STP broker

Choosing an STP forex broker means when you enter a trade you’ll not be informed what spread to expect.

Most true ECN and STP brokers are linked to several liquidity providers at the same time period. Despite both true ECN and STP brokers having incredible trading solutions which can meet your needs as a trader, their terms of operation vary. Whether you will choose a true ECN or STP broker, the rule of thumb is always ensuring you minimize losses and maximize profits as much as you can when trading forex. Ensure you compare carefully the terms of service of both a true ECN and STP broker before you choose one to handle your trading needs.

Alpari cashback

No points, vouchers, discounts. Just cash.

Get up to $5 back on every trade you make.

*terms and conditions apply

Your path to trading

glory starts here

Join an industry leader and trade over 250

forex & CFD instruments that keep the

world moving.

Your path to

trading glory

starts here

Join an industry leader and trade

over 250 forex & CFD instruments

that keep the world moving.

Want more out of your forex trading?

Our loyalty cashback promotion has you covered (T&cs apply).

High-tech solutions meet instant execution

Trade on MT4 and MT5 platforms with direct pricing and instant processing

We are one of the world’s most trusted brokers

Trade and invest with one of the most trusted names in the business

We cater to all experience levels

Whether you’re brand new to trading, or a seasoned veteran, we have what you need.

Why trade with alpari international?

Refer-a-friend

Invite your friends to join you and earn yourself a cool $50 – your friend will get $50 too! T&cs apply.

So many payment options for deposits & withdrawals

We know how much you care about your money – that’s why we have a wide range of options for you to manage it.

Don't have time or enough knowledge to trade?

Copy the strategies of more experienced traders and profit when they do.

Learn how to trade with alpari international

New to the forex world? Looking for a refresher? Check out our guides below.

Make a deposit in any convenient way.

Trading conditions

About us

Policies & regulation

Promotions

Trading guides, articles & insights

ALPARI INTERNATIONAL is the business name of exinity limited which is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Registered address: 5th floor, 355 NEX tower, rue du savoir, cybercity, ebene 72201, mauritius.

Card transactions are processed via FT global services ltd, reg no. HE 335426 with registered address at tassou papadopoulou 6, flat/office 22, ag. Dometios, 2373, nicosia, cyprus. Address for cardholder correspondence: [email protected]

Risk warning: trading forex and leveraged financial instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the client to ascertain whether he/she is permitted to use the services of the alpari international based on the legal requirements in his/her country of residence.

Regional restrictions: alpari international does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, brazil, puerto rico, the occupied area of cyprus. Find out more in the regulations section of our faqs.

Trading advantages of roboforex forex broker

No limits in providing outstanding benefits to roboforex clients.

- Tight spreads

from 0 pips - Fastest order

execution - 4 account currencies

(EUR, USD, CNY, GOLD) - Micro accounts with the

minimum lot size of 0.01 - 8 asset

classes - Affiliate program

50% profit sharing

Roboforex bonus programs

Roboforex provides for its clients best promotional offers on financial markets.

Start trading with roboforex now and unleash the powerful benefits!

Profit share bonus

up to 60%

- Bonus up to 20,000 USD.

- Can be used during "drawdown".

- Deposit from 10 USD.

- Withdraw the profit received when trading your own funds.

Get bonus

Classic bonus

up to 120%

- Bonus up to 50,000 USD.

- Сan’t be used during "drawdown".

- Deposit from 10 USD.

- Trade with bonus funds and withdraw the profit.

Get bonus

Cashback (rebates)

up to 15%

- Receive cashback for the trading volume of just 10 lots.

- Available for all verified clients.

- Receive real money as cashback and withdraw it instantly.

Learn more

Up to 10%

on account balance

- Payments for the trading volume starting from 1 lot.

- No restrictions: withdraw instantly.

- Receive % on account balance every month.

Learn more

Account types

- First deposit

- Execution type

- Spreads

- Instruments

- Bonuses

- Platforms

Pro-standard

The most popular account type at roboforex, which is suitable for both beginners and experienced traders.

Prime

"prime" accounts combine all best features of ECN accounts and are suitable for advanced traders.

Pro-cent

Pro-cent accounts provide an opportunity to trade micro lots and is best suitable for beginners, who want to test our trading conditions with minimum investments.

ECN account type is intended for professionals, who prefer the best trading conditions with tight spreads.

R trader

R trader is a multi-asset web platform, which combines modern technologies, a classic but taken to a new level design, and access to the world’s major financial markets.

- First deposit 100 USD

- Execution type market execution

- Spreads floating from 0 points

- Instruments over 12,000 stocks, indices,

forex, etfs, cfds, cryptocurrencies - Bonuses not available

- Platforms R trader - web platform

By opening a demo account at roboforex, you can test our trading conditions - instruments, spreads, swaps, execution speed - without investing real money.

- First deposit not required

- Execution type market execution

- Spreads depends on type of account

- Instruments depends on type of account

- Bonuses limited number of offers

- Platforms

depends on type of account

Trading platforms

The most popular platform for trading on the forex market, which includes a knowledge database, trading robots, and indicators.

- 3 types of order execution

- 9 time frames for trading

- 50 integrated indicators for technical analysis

- Variety of order types

The latest version of metatrader platform with an opportunity to choose between netting and hedging systems.

- 4 types of order execution

- Multi-currency tester

- Market depth

- 6 types of pending orders

Roboforex trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

- Trade from any browser or mobile device (ios, android).

- Get the same functionality as on desktop platforms.

- Control your positions and orders from any place in the world.

Multi-asset web-based trading platform with the fastest in the industry financial charts and advanced technical analysis tools.

- Over 12,000 stocks, indices, FX, etfs, cryptocurrencies.

- Minimum deposit: 100 USD.

- Trading robots builder. No programming skills required.

Trading platforms center

Exclusive trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

Security of client's funds

Your funds are fully secured when you trade with roboforex.

- Regulated activities: IFSC license

no. 000138/107 - Negative balance

protection - Participant of the financial

commission compensation fund - Execution quality certificate

start trading now

8 asset classes

Discover the world’s key markets through roboforex accounts and platforms.

Forex

We offer transparent and reliale access to trading FX with more than 40 currency pairs

Forex trading benefits

- Institutional spreads from 0 points

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:2000

- Fastest execution possible

read more

Stocks

Access to more than 12,000 stocks through R trader platform and more than 50 via metatrader 4/5 terminals

Stocks trading benefits

- Minimum deposit: 100 USD

- Free stock exchange market data online

- Leverage: up to 1:20

- Metatrader4, metatrader5, R trader platforms

read more

Indices

In its most regularly traded format, an index is defined as a portfolio of stocks that represents a particular market or market sector

Indices trading benefits

- Metatrader4, metatrader5, R trader platforms

- Tight spreads - no mark up

- Leverage: up to 1:100

- Over 10 instruments

read more

Trade fast-growing global ETF industry with over $3 trillion in assets in management

Etfs trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Leverage: up to 1:20

- Сorporate events supported and handled by the system automatically

read more

Soft commodities

Trade etfs on grown commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit

Soft commodities trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Over 100 instruments

- Leverage: up to 1:20

read more

Energies

Trade cfds and commodity etfs on energy market including oil, natural gas, heating oil, ethanol and purified terephthalic acid

Energies trading benefits

- Tight spreads

- Metatrader4, R trader platforms

- Ideal instrument for day traders

- Minimum deposit: 10 USD

- Leverage: up to 1:100

read more

Metals

Trade cfds and commodity etfs on precious metals including gold, platinum, palladium, silver as well as gold/dollar and silver/dollar pairs.

Metals trading benefits

- Hedge against political instability and dollar weakness

- Minimum deposit: 10 USD

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:1000

read more

Cryptocurrencies

Bitcoin, litecoin and ethereum proved to have great potential for investment and speculation

Cryptocurrencies trading benefits

- Metatrader4, metatrader5, R trader platforms

- Over 20 cryptoinstruments

- Leverage: up to 1:50

- Trading 24/7

read more

0% commissions

When our clients deposit their trading accounts, the commission is always 0%. Roboforex covers all expenses. Choose the payment system according to your convenience, not cost effectiveness.

Roboforex also compensates its clients' commission for funds withdrawal twice a month.

Instant withdrawals

- Automatic withdrawal system: withdrawals within a minute for certain payment methods

- System works 24/7

- Simple, reliable, and fast

More than 20 ways to deposit funds

Become an investor on forex

For easy short-term investments

- Choose among over 1,000 traders.

- Get detailed statistics on trader's performance.

- Unsubscribe at any time.

Copyfx platform will be perfect for those, who search for a simple but reliable way to invest on forex.

Roboforex market analytics

Forex analytics

Fibonacci retracements analysis 29.01.2021 (BITCOIN, ETHEREUM)

EURUSD is under pressure again. Overview for 29.01.2021

Ichimoku cloud analysis 29.01.2021 (NZDUSD, USDJPY, USDCAD)

Economic calendar

Exclusive market analytics

Claws & horns is an independent analytical company providing brokers with a set of necessary analytical tools.

Fxwirepro™ is a leading analytical company, which provides the participants of financial markets with research reports in the real-time mode.

Company news

Roboforex: changes in trading schedule (martin luther king jr. Day)

Roboforex: changes in trading schedule (christmas and new year holidays)

Roboforex received prestigious awards of the financial sector

Winner of more than 10 prestigious awards

Roboforex was recognized by the most respected experts of the financial industry.

More than 800,000 clients from 169 countries.

Best investment products (global)

Best partnership program (LATAM)

Most trusted

broker

Most transparent

asian forex broker

Best global mobile

trading app

Best broker

of the CIS

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

Trade forex broker

Whether you're getting started or want to invest with the help of an experienced professional, we can help you find the right strategy for you.

Your capital is at risk. We cover you with negative balance protection

- Cysec #298/16

- Mifid

- SSL secure

Safety & security of funds

Great choice of account types

Exclusive loyalty program

Safe deposits & fast withdrawals

Safety & security of funds

Great choice of account types

Exclusive loyalty program

Safe deposits & fast withdrawals

Authorized, licensed, registered, and regulated

Tradefw, unlike many other online trading platforms, is licensed and regulated. We are registered and authorized to operate by the cyprus securities and exchange commission (cysec), the independent public supervisory authority responsible for the supervision of the investment services market and transactions in transferable securities carried out in the republic of cyprus. As such, our license (number 298/16) is recognized throughout the european union (EU), of which cyprus is a member. Tradefw is also fully compliant with the markets in financial instruments directive (mifid), the EU legislation for investment intermediaries that provide shares, bonds, units in collective investment schemes, and derivatives (collectively known as “financial instruments”) to traders.

Award-winning broker

Best performing CFD broker, europe 2020

Best multi asset trading platform europe 2020

Best forex CFD provider 2020

Global banking & finance award 2020

Chasing investment? Seeking opportunities? Whatever your investment style, we’ve got an account that’s right for you.

Your capital is at risk. We cover you with negative balance protection

- Cysec #298/16

- Mifid

- SSL secure

Let’s find the right product for you

What are cfds

A contract for difference (CFD) is a form of derivative trading. When you trade cfds you are speculating on the price action of fast-moving financial assets such as shares, commodities, currencies, indices, or bonds. The advantage of cfds is that you don’t buy/sell the underlying asset (such as stocks or commodities). Instead, you buy/sell a predetermined number of units that you think a particular asset will rise/fall over a predetermined time frame. For every point the price of the instrument moves in your favor, you gain multiples of the number of CFD units you bought/sold. For every point the price moves in the other direction, you incur a loss.

Forex trading strategies

Forex (a contraction of “foreign exchange,” also known as FX) trading is the decentralized global market in which all currencies are traded. The forex market is the largest, most liquid market in the world with an average daily trading turnover of more than $6 trillion. Our online forex trading option enables you to buy/sell all major currency pairs, including U.S., canadian, australian, and new zealand dollars, euros, british pounds, swiss francs, and japanese yens. Many investors consider the forex market particularly user-friendly because it never closes. Trading goes on constantly 24 hours a day, five days a week.

Stocks

The first stock markets appeared in europe in the 16th century in trading hubs and today we can find hundreds of public stock markets all around the globe, with the two most well-known being nasdaq and the new york stock exchange. What started off as an active market between just two dutch companies five centuries ago became one of the most representative images of modern-day capitalism and private property. Our clients are able to analyze and trade a wide variety of stocks offered on the world’s major exchanges with all industries being well represented. Start stock trading with us and catch significant opportunities.

Commodities

We proud ourselves in offering you access to every category of commodities: metals, energy, livestock and meat, cereals and grains. You can trade the whole range, from gold, silver, copper, and platinum to crude oil, heating oil, natural gas, and gasoline to cattle, feeder cattle, lean hogs, and pork bellies to coffee, cotton, soybeans, and sugar. We provide a huge variety of commodity investments for novice and experienced traders. Gain the extra edge by taking full advantage of the comprehensive education section on our website. Open an account with our commodities trading platform and discover great trading opportunities.

Indices

An index (the plural of which can be written as indices or indexes – both are correct) is a portfolio of stocks that’s traded on a stock exchange. These stocks are selected to be grouped together because their evolution is presumed to represent a nation’s economic performance or that of a particular market sector. All major global indices are available on our trading platform. Investing in indices is preferred to trading individual stocks for a variety of reasons, the main one being the lower costs it entails. It’s easy to begin trading indices with us, you just need to open up and account and start exploring the potential opportunities.

New to investing? See how far investing can take you

It’s important to know the basics of forex and CFD’s trading before actual diving into trading currencies. Our online broker provides a huge variety of resources for the beginners. We provide fundamental trading instruments along with excellent support for our clients. Different types of platforms make your trading process flexible. With our trading company the investment process becomes user-friendly. Experienced as well as beginner traders will feel comfortable using our platform. To accomplish that, we offer four account types. Choose the best trading account for yourself and start trading right away. Tradefw.Com is a licensed forex and CFD’s broker. Our sophisticated account managers are ready to assist you with any question related to online trading. We are here to assist your trading experience.

Chasing investment? Seeking opportunities? Whatever your investment style, we’ve got an account that’s right for you.

Your capital is at risk. We cover you with negative balance protection

- Cysec #298/16

- Mifid

- SSL secure

We have the right tools for you

We go beyond other online trading sites by offering our clients a high leverage option. This trading tool allows you to borrow from us a pre-determined amount of funds to meet an initial margin requirement that you otherwise would have to miss. Leverage is a key tool to being able to maximize your trading potential and your trading opportunities. We also offer exchange-traded funds, or etfs. An ETF is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. It trades like any ordinary common stock, and is therefore, subject to price changes throughout the day as they are bought and sold. Unlike mutual funds, however, an ETF typically has a higher daily liquidity. Another benefit of an ETF is that it trades like a stock, so, unlike a mutual fund, it does not have a net asset value (NAV) calculated at the end of every trading day. And here’s the best part: generally speaking, the fees investors are generally charged for buying and selling etfs tend to be lower than those for mutual fund shares. Combined, all these characteristics make etfs an attractive alternative for individual investors.

We’ve got the right account for you

STANDARD

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 2.7 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.01

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 2 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.05

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 1.7 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.1

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

PROFESSIONAL

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 1.7 pips

- Maximum leverage up to 1:500

- Minimum contract size: 0.1

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 5%

Your capital is at risk. We cover you with negative balance protection

- Cysec #298/16

- Mifid

- SSL secure

STANDARD

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 2.7 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.01

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 2 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.05

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 1.7 pips

- Maximum leverage up to 1:30

- Minimum contract size: 0.1

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 50%

PROFESSIONAL

- Trade using the popular MT4 platform

- Tight spreads – starts from as low as 1.7 pips

- Maximum leverage up to 1:500

- Minimum contract size: 0.1

- Forex, metals, energy, commodities, indices: no commissions

- Cfds on stocks:

- France, germany, italy, spain -> commission pattern: 0.1% or minimum 10 EUR

- Sweden -> commission pattern: 0.1% or minimum 70 SEK

- Switzerland -> commission pattern: 0.1% or minimum 10 CHF

- UK -> commission pattern: 0.1% or minimum 10 GBP

- UK international -> commission pattern: 0.1% or minimum 10 USD

- US -> commission pattern: 0.1% or minimum 10 USD

- Hedging: allowed

- 24/5 support: superior customer service – 24/5 dedicated live support

- Traded assets: 170+ currency pairs, cfds, indices, metals, commodities and stocks

- Education: educational materials & daily analysis

- Account currency: USD or EUR or GBP

- Stop out level: 5%

Your capital is at risk. We cover you with negative balance protection

- Cysec #298/16

- Mifid

- SSL secure

Trade on the go with our mobile app

FX/cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.78% of retail investor accounts lose money when trading FX/cfds with this provider. You should consider whether you understand how FX/cfds work and whether you can afford to take the high risk of losing your money. You should make sure that based on your country of residence you are permitted to trade products of the tradefw.Com. Please make sure you are familiar with the company’s risk disclosure.

The information on this website is not targeted at residents of the united states, canada, israel, iran, japan and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to applicable law or regulation.

Any information/article/material/content provided by tradefw or is shown on its website is intended to be used solely for educational purposes and does not constitute investment advice and/or consultation on how the client should trade. Although tradefw has taken care to ensure that the content of such information is accurate, it cannot be held responsible for any omission/mistake/miscalculation and it cannot warrant the accuracy of any material and information contained herein. Any reliance you place on such material is therefore strictly at your own risk. Please note that the responsibility for using and/or relying on such material lies with the client and tradefw accepts no responsibility for any loss or damage including without limitation to any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Tradefw, investfw and tradedwell are the trade names of itrade global (CY) ltd , authorised and regulated by the cyprus securities and exchange commission (licence number 298/16). The head office of the company is located at isiodou, andrea laskaratou & emanouel roides street 10-12, 2nd floor, ayia zoni, 3031 limassol, cyprus

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

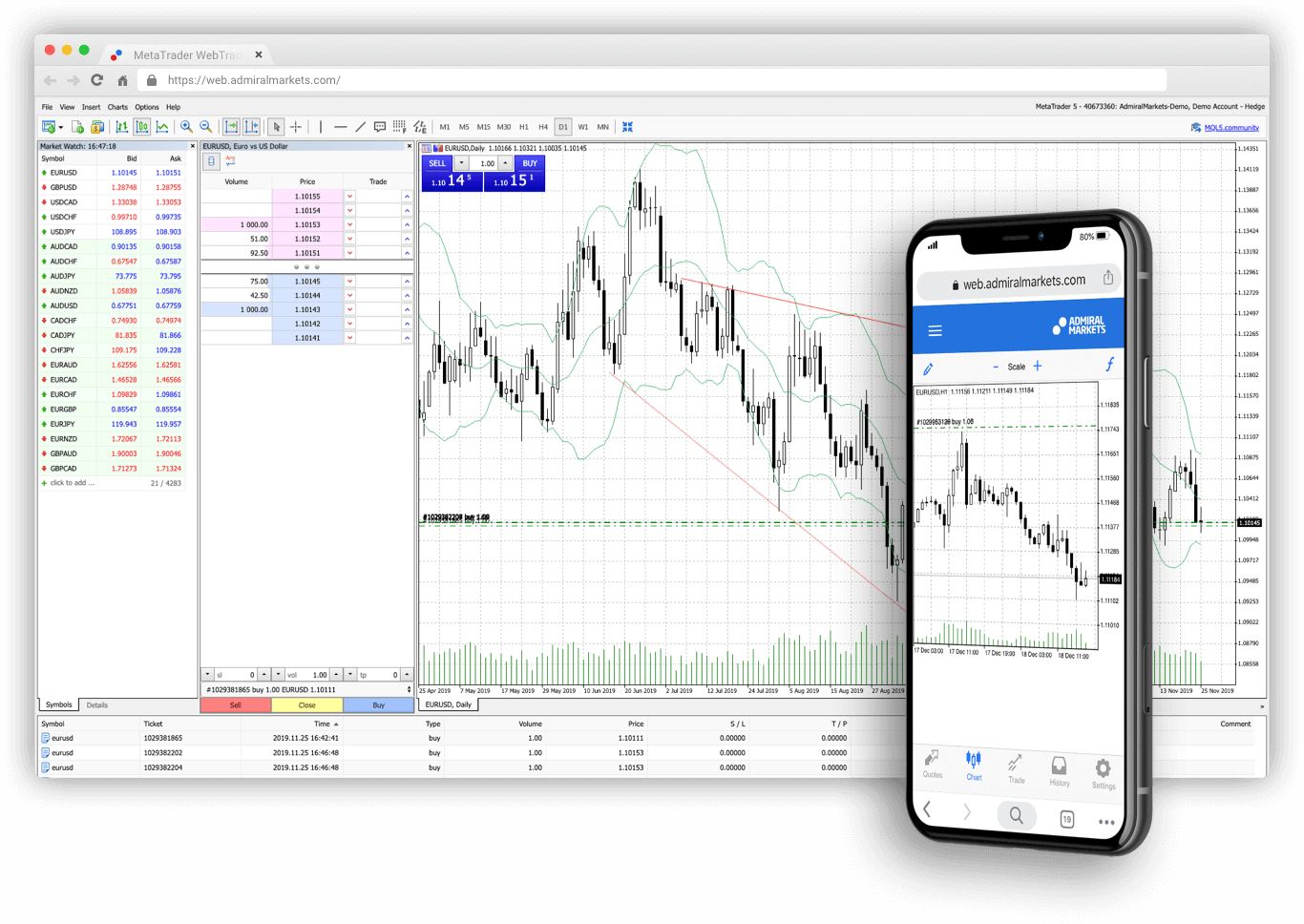

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, agricultures, indices, bonds, etfs & stocks.

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader apps" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Trading advantages of roboforex forex broker

No limits in providing outstanding benefits to roboforex clients.

- Tight spreads

from 0 pips - Fastest order

execution - 4 account currencies

(EUR, USD, CNY, GOLD) - Micro accounts with the

minimum lot size of 0.01 - 8 asset

classes - Affiliate program

50% profit sharing

Roboforex bonus programs

Roboforex provides for its clients best promotional offers on financial markets.

Start trading with roboforex now and unleash the powerful benefits!

Profit share bonus

up to 60%

- Bonus up to 20,000 USD.

- Can be used during "drawdown".

- Deposit from 10 USD.

- Withdraw the profit received when trading your own funds.

Get bonus

Classic bonus

up to 120%

- Bonus up to 50,000 USD.

- Сan’t be used during "drawdown".

- Deposit from 10 USD.

- Trade with bonus funds and withdraw the profit.

Get bonus

Cashback (rebates)

up to 15%

- Receive cashback for the trading volume of just 10 lots.

- Available for all verified clients.

- Receive real money as cashback and withdraw it instantly.

Learn more

Up to 10%

on account balance

- Payments for the trading volume starting from 1 lot.

- No restrictions: withdraw instantly.

- Receive % on account balance every month.

Learn more

Account types

- First deposit

- Execution type

- Spreads

- Instruments

- Bonuses

- Platforms

Pro-standard

The most popular account type at roboforex, which is suitable for both beginners and experienced traders.

Prime

"prime" accounts combine all best features of ECN accounts and are suitable for advanced traders.

Pro-cent

Pro-cent accounts provide an opportunity to trade micro lots and is best suitable for beginners, who want to test our trading conditions with minimum investments.

ECN account type is intended for professionals, who prefer the best trading conditions with tight spreads.

R trader

R trader is a multi-asset web platform, which combines modern technologies, a classic but taken to a new level design, and access to the world’s major financial markets.

- First deposit 100 USD

- Execution type market execution

- Spreads floating from 0 points

- Instruments over 12,000 stocks, indices,

forex, etfs, cfds, cryptocurrencies - Bonuses not available

- Platforms R trader - web platform

By opening a demo account at roboforex, you can test our trading conditions - instruments, spreads, swaps, execution speed - without investing real money.

- First deposit not required

- Execution type market execution

- Spreads depends on type of account

- Instruments depends on type of account

- Bonuses limited number of offers

- Platforms

depends on type of account

Trading platforms

The most popular platform for trading on the forex market, which includes a knowledge database, trading robots, and indicators.

- 3 types of order execution

- 9 time frames for trading

- 50 integrated indicators for technical analysis

- Variety of order types

The latest version of metatrader platform with an opportunity to choose between netting and hedging systems.

- 4 types of order execution

- Multi-currency tester

- Market depth

- 6 types of pending orders

Roboforex trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

- Trade from any browser or mobile device (ios, android).

- Get the same functionality as on desktop platforms.

- Control your positions and orders from any place in the world.

Multi-asset web-based trading platform with the fastest in the industry financial charts and advanced technical analysis tools.

- Over 12,000 stocks, indices, FX, etfs, cryptocurrencies.

- Minimum deposit: 100 USD.

- Trading robots builder. No programming skills required.

Trading platforms center

Exclusive trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

Security of client's funds

Your funds are fully secured when you trade with roboforex.

- Regulated activities: IFSC license

no. 000138/107 - Negative balance

protection - Participant of the financial

commission compensation fund - Execution quality certificate

start trading now

8 asset classes

Discover the world’s key markets through roboforex accounts and platforms.

Forex

We offer transparent and reliale access to trading FX with more than 40 currency pairs

Forex trading benefits

- Institutional spreads from 0 points

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:2000

- Fastest execution possible

read more

Stocks

Access to more than 12,000 stocks through R trader platform and more than 50 via metatrader 4/5 terminals

Stocks trading benefits

- Minimum deposit: 100 USD

- Free stock exchange market data online

- Leverage: up to 1:20

- Metatrader4, metatrader5, R trader platforms

read more

Indices

In its most regularly traded format, an index is defined as a portfolio of stocks that represents a particular market or market sector

Indices trading benefits

- Metatrader4, metatrader5, R trader platforms

- Tight spreads - no mark up

- Leverage: up to 1:100

- Over 10 instruments

read more

Trade fast-growing global ETF industry with over $3 trillion in assets in management

Etfs trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Leverage: up to 1:20

- Сorporate events supported and handled by the system automatically

read more

Soft commodities

Trade etfs on grown commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit

Soft commodities trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Over 100 instruments

- Leverage: up to 1:20

read more

Energies

Trade cfds and commodity etfs on energy market including oil, natural gas, heating oil, ethanol and purified terephthalic acid

Energies trading benefits

- Tight spreads

- Metatrader4, R trader platforms

- Ideal instrument for day traders

- Minimum deposit: 10 USD

- Leverage: up to 1:100

read more

Metals

Trade cfds and commodity etfs on precious metals including gold, platinum, palladium, silver as well as gold/dollar and silver/dollar pairs.

Metals trading benefits

- Hedge against political instability and dollar weakness

- Minimum deposit: 10 USD

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:1000

read more

Cryptocurrencies

Bitcoin, litecoin and ethereum proved to have great potential for investment and speculation

Cryptocurrencies trading benefits

- Metatrader4, metatrader5, R trader platforms

- Over 20 cryptoinstruments

- Leverage: up to 1:50

- Trading 24/7

read more

0% commissions

When our clients deposit their trading accounts, the commission is always 0%. Roboforex covers all expenses. Choose the payment system according to your convenience, not cost effectiveness.

Roboforex also compensates its clients' commission for funds withdrawal twice a month.

Instant withdrawals

- Automatic withdrawal system: withdrawals within a minute for certain payment methods

- System works 24/7

- Simple, reliable, and fast

More than 20 ways to deposit funds

Become an investor on forex

For easy short-term investments

- Choose among over 1,000 traders.

- Get detailed statistics on trader's performance.

- Unsubscribe at any time.

Copyfx platform will be perfect for those, who search for a simple but reliable way to invest on forex.

Roboforex market analytics

Forex analytics

Fibonacci retracements analysis 29.01.2021 (BITCOIN, ETHEREUM)

EURUSD is under pressure again. Overview for 29.01.2021

Ichimoku cloud analysis 29.01.2021 (NZDUSD, USDJPY, USDCAD)

Economic calendar

Exclusive market analytics

Claws & horns is an independent analytical company providing brokers with a set of necessary analytical tools.

Fxwirepro™ is a leading analytical company, which provides the participants of financial markets with research reports in the real-time mode.

Company news

Roboforex: changes in trading schedule (martin luther king jr. Day)

Roboforex: changes in trading schedule (christmas and new year holidays)

Roboforex received prestigious awards of the financial sector

Winner of more than 10 prestigious awards

Roboforex was recognized by the most respected experts of the financial industry.

More than 800,000 clients from 169 countries.

Best investment products (global)

Best partnership program (LATAM)

Most trusted

broker

Most transparent

asian forex broker

Best global mobile

trading app

Best broker

of the CIS

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

So, let's see, what we have: list of top 25 the best forex brokers in 2021 for buy sell major currency, lets compare our fully regulated online trading company and platforms. At trade forex broker

Contents of the article

- Free forex bonuses

- Fxdailyreport.Com

- Top recommended and the best forex brokers for...

- Alpari cashback

- Your path to trading glory starts here

- Your path to trading glory starts here

- Join an industry leader and trade over 250...

- Want more out of your forex trading?

- High-tech solutions meet instant execution

- We are one of the world’s most trusted brokers

- We cater to all experience levels

- Refer-a-friend

- So many payment options for deposits & withdrawals

- Learn how to trade with alpari international

- Trading advantages of roboforex forex broker

- Roboforex bonus programs

- Profit share bonus up to 60%

- Classic bonus up to 120%

- Cashback (rebates) up to 15%

- Up to 10% on account balance

- Account types

- Trading platforms

- Roboforex trading platforms

- Exclusive trading platforms

- Roboforex bonus programs

- Security of client's funds

- 8 asset classes

- 0% commissions

- Instant withdrawals

- Become an investor on forex

- Roboforex market analytics

- Forex analytics

- Fibonacci retracements analysis 29.01.2021...

- EURUSD is under pressure again. Overview for...

- Ichimoku cloud analysis 29.01.2021 (NZDUSD,...

- Economic calendar

- Exclusive market analytics

- Company news

- Roboforex: changes in trading schedule (martin...

- Roboforex: changes in trading schedule (christmas...

- Roboforex received prestigious awards of the...

- Forex analytics

- Winner of more than 10 prestigious awards

- Best investment products (global)

- Best partnership program (LATAM)

- Most trusted broker

- Most transparent asian forex broker

- Best global mobile trading app

- Best broker of the CIS

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- 8 asset classes

- Trade forex broker

- Authorized, licensed, registered, and regulated

- Award-winning broker

- Best performing CFD broker, europe 2020

- Best multi asset trading platform europe 2020

- Best forex CFD provider 2020

- Global banking & finance award 2020

- Chasing investment? Seeking opportunities?...

- Let’s find the right product for you

- New to investing? See how far investing can take...

- Chasing investment? Seeking opportunities?...

- We have the right tools for you

- We’ve got the right account for you

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors...

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors...

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Trade and invest in 8,000+ markets today

- Top trading conditions

- Why choose admiral markets?

- We are global

- We are regulated

- Funds are secured

- Start from €1

- We are global

- We are regulated

- Funds are secured

- Start from €1

- Try demo trading

- Get in touch

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Trading advantages of roboforex forex broker

- Roboforex bonus programs

- Profit share bonus up to 60%

- Classic bonus up to 120%

- Cashback (rebates) up to 15%

- Up to 10% on account balance

- Account types

- Trading platforms

- Roboforex trading platforms

- Exclusive trading platforms

- Roboforex bonus programs

- Security of client's funds

- 8 asset classes

- 0% commissions

- Instant withdrawals

- Become an investor on forex

- Roboforex market analytics

- Forex analytics

- Fibonacci retracements analysis 29.01.2021...

- EURUSD is under pressure again. Overview for...

- Ichimoku cloud analysis 29.01.2021 (NZDUSD,...

- Economic calendar

- Exclusive market analytics

- Company news

- Roboforex: changes in trading schedule (martin...

- Roboforex: changes in trading schedule (christmas...

- Roboforex received prestigious awards of the...

- Forex analytics

- Winner of more than 10 prestigious awards

- Best investment products (global)

- Best partnership program (LATAM)

- Most trusted broker

- Most transparent asian forex broker

- Best global mobile trading app

- Best broker of the CIS

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- 8 asset classes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.