Fbs micro account review

One the main reasons why traders choose FBS is due to the very low barrier to enter the markets, as the minimum deposit required for an FBS account is $1.

Free forex bonuses

There are two types of accounts available for smaller traders, which include the cent and the micro accounts. The cent account starts at $1 deposit, while the micro account starts at $5 deposit. The cent account also has very tight spreads starting from 1 pip, and the micro account has fixed spreads starting from 3 pips. The maximum leverage offered is different for both accounts, as the cent account has a maximum leverage of 1:1000 and the micro account has a maximum leverage of 1:3000. Can you withdraw FBS bonus?

A factual FBS review for retail forex traders

- Website: www.Fbs.Com

- Myanmar: +951 651135

philippines: +632.632.7634

tunisia: +216 52 925 626 - Office address:

- No. 414, 9th street, thamine (1) ward,

- Mayangone township,

- Yangon

FBS, or financial brokerage services, is predominantly an asian forex broker that has its offices in china, malaysia, philippines, indonesia, jordan, vietnam, and russia. The IFSC in belize is the primary regulatory organization that regulates all the financial components of the company. FBS regulation is not one of the high points for the firm since most trusted brokers are regulated by organizations such as the CFTC, NFA, FCA, ASIC, and cysec. Belize is a tax haven, and the regulatory guidelines of IFSC are still under debate as to whether it can be compared to the more established and highly reputed international regulatory organizations.

FBS was initially based out of russia and started its FX operations in 2009. The broker claims to have more than 700,000 clients from 120 different countries across the world. Although that might be an accurate representation of the reach of the broker by modern standards, the reality lies in the fact that the broker does not have any traders from the US, and the lack of EU regulation also prevents the broker from actively promoting their services in the euro zone. However, despite all the confusion surrounding the regulatory status, the broker has indeed managed to receive numerous awards and recognitions for their services. The broker has also been able to receive positive FBS reviews from existing customers; however, the broker is not entirely free from criticisms either.

FBS trading account features at A glance

- Minimum deposit of $1

- Maximum FBS leverage of 1:3000

- Five different types of accounts

- FBS spreads starting from 0 pip

- ECN account offered with tight spreads and a commission per lot

- Full range of payment options

- Trading instruments include 32 currencies and two metals

- MT4 & MT5 trading platform

One the main reasons why traders choose FBS is due to the very low barrier to enter the markets, as the minimum deposit required for an FBS account is $1. There are two types of accounts available for smaller traders, which include the cent and the micro accounts. The cent account starts at $1 deposit, while the micro account starts at $5 deposit. The cent account also has very tight spreads starting from 1 pip, and the micro account has fixed spreads starting from 3 pips. The maximum leverage offered is different for both accounts, as the cent account has a maximum leverage of 1:1000 and the micro account has a maximum leverage of 1:3000.

The cent account is certainly the more attractive proposition here due to the reduced cost of trading, as on the contrary, the micro account spread of 3 pips is immensely higher than the average micro account. Traders with a higher deposit of $100 can take advantage of a standard account that has all the features of the micro account albeit with tighter spreads of 1 pip.

The ECN account is offered as a zero spread account, which allows traders to enjoy up to 0 pips in spreads at the cost of a commission of $20 per lot. The minimum deposit required for the ECN account is $500, while the leverage is set at a maximum of 1:3000. The final type of trading account is the unlimited account that is usually reserved for institutional and professional traders, which offers a maximum leverage of 1:500 along with floating spreads starting from 0.2 pips. There is no commission for the unlimited account, and the initial deposit starts from $500. The unlimited account is the best type of FBS account due to its favorable trading conditions, lower cost of trading, comparatively lower leverage, and high speed of trade execution.

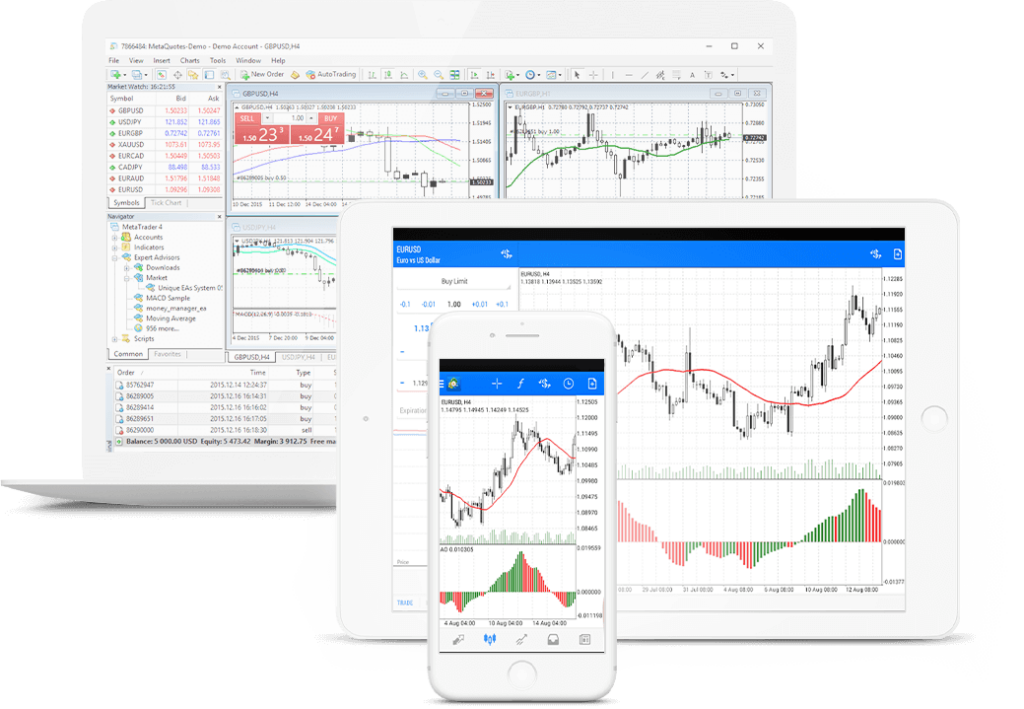

FBS utilizes the MT4 and MT5 trading platforms for accessing the FX markets on both desktop and mobile devices. The FBS trading platforms are connected to high-speed servers, and the company has tweaked the platform slightly to offer the best trading results. The FBS mobile platforms are available as downloadable MT4 apps on the itunes and google play stores, while traders can also use the MT4 web trader for browser-related trading requirements.

How does FBS treat their clients?

FBS customer support is available in 18 different languages and is designed to offer the most comprehensive support to clients from a majority of asian, european, and middle eastern clients. The live chat feature is an excellent feature to get immediate assistance, and official correspondence can be made through emails or phone calls.

Unlimited account holders also enjoy SWAP-free accounts, which is a great feature for long-term traders who hold on to overnight trades. FBS account can help in reducing the cost of trading to a great extent, which is indeed one of the most significant advantages of FBS.

One of the other perceived benefits of FBS is the availability of a 100% deposit bonus, which is offered for all traders opening a new account making their first deposit. The FBS bonus is certainly not preferred, as a majority of negative FBS reviews are due to the conflicts arising between traders and FBS over withdrawal issues. Brokers only offer a bonus if traders are willing to accept their terms and conditions, and it is often difficult to satisfy these trading conditions before making a withdrawal of the initial invested amount.

The maximum leverage also plays negatively to the company’s strength, the 1:3000 leverage is indeed the highest offered by any broker in the industry. Novice and even experienced traders are susceptible to the risks of higher leverage, as a huge margin of 1:3000 can wipe out the investment with just a 3 pip move. Considering that the starting spread for the micro account is 3 pips, it is easy to understand how a trader can face a margin call for initial deposits as low as $5. The high leverage is also another factor that contributes to the overall negative image of the company.

On the other hand, if used wisely, both leverage, as well as lower spreads, can work remarkably in the trader’s favor. Profitable FX trading is dependent on striking the perfect balance between all the different tools of the trade, and if done carefully, FBS offers the best resources for making consistent profits in the forex markets.

Is FBS regulated?

Yes, our review of FBS found that the broker is regulated and licensed by cysec, which ensures regular reporting, transparency, and fairness for EU clients. For those trading outside the EU, it is regulated by the international financial services commission of belize (IFSC).

Can you withdraw FBS bonus?

Yes, if you are trading from a country that allows a bonus from FBS, it can be withdrawn after two lots are traded and profit reaches $25. To withdraw, proper account registration and verification is required too. This means supplying FBS with proof of identification and address.

What is FBS account?

FBS offers two live trading accounts (standard and cent) and two demo account types (standard and cent). There are zero commissions on trades, leverage of up to 1:30, and spread starting from 1 pip. Standard accounts are available with a €100 initial deposit, whilst cent accounts start from €10. Swap-free accounts are also available.

How long does FBS withdrawal take?

Withdrawal times at FBS depend on which method you are using to receive your funds. All withdrawals are processed by the broker within 48 hours on business days. E-wallet and crypto transfers are processed within minutes, whilst wire transfers can take up to 48 hours.

What is the minimum deposit on FBS?

Minimum deposit limits at FBS depend on the account type you have selected. For international clients, there is a micro account that allows deposits from $1. For european clients, the lowest entry point is the cent account at €10. Standard accounts require a minimum deposit of €100.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

Trading

Upgrade your profit, trade with the best conditions!

Account comparsion

- Floating spread from 1 pip

- Fixed spread from 3 pips

- Floating spread from 0,5 pip

- Fixed spread 0 pip

- Floating spread from -1 pip

- Up to 1:1000

- Up to 1:3000

- Up to 1:3000

- Up to 1:3000

- Up to 1:500

Maximum open positions and pending orders

- From 0,01 to 1 000 cent lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,01 to 500 lots

(with 0,01 step) - From 0,1 to 500 lots

(with 0,1 step)

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- From 0,3 sec, STP

- ECN

Account types, except ECN account, support the following trading instruments: 35 currency pairs, 4 metals, 6 CFD.

Frequently asked questions

What trading account should I choose?

FBS offers various account types designed to meet your needs, including cent , micro , standard , zero spread , and ECN accounts with unique trading conditions. For newbies who have no trading experience, we recommend opening a demo account first, and only after that a micro or cent account. For those who are not the first day in trading, we advise opening a standard account – a classic one. And for real professionals, we suggest a zero spread account or ECN account.

What is a trading account?

To start trading on forex, you must open an account. The primary purpose of trading accounts is to make transactions (open and close orders) with various financial instruments. The trading account is similar to the bank one – you use it to store, deposit, and withdraw money. However, deposits and withdrawals are available only after you verify your account.

What is forex trading?

Forex, also known as the foreign exchange market or FX market, is the world's most traded market, with a $5.1 trillion turnover per day. In simple words, forex trading is the process of converting one country's currency into the currency of another country, aiming to make a profit from the changes in its value.

Why is FBS the best broker for online trading?

FBS is a legitimate forex broker regulated by the international financial services commission, license IFSC/000102/124 , which makes it trustworthy and reliable. We offer our clients the best trading conditions on the market, including different bonuses, convenient trading tools such as CFD trading and stock trading among trading classic currency pairs , regular promotions , the most transparent affiliate commission up to $80 per lot, 24/7 customer support, and more.

How do I start trading?

First, it's really important to remember that becoming a successful trader isn't an overnight process. It takes time to become familiar with the markets, and there's a whole new vocabulary to learn. For this reason, legitimate brokers like FBS offer demo accounts. To open a demo account, you need to register first. After that, download trading software to open and close your first order.

Download trading platform

Metatrader 4

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download multiterminal

- Download for mac os

Metatrader 5

- Download for windows

- Download for ios in appstore

- Download for android in googleplay

- Start trading online

- Download for mac os

Deposit with your local payment systems

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

You are using an older version of your browser.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

FBS spreads review - types and characteristics (2021)

If you have opened an FBS account, you will notice that all FBS account types feature some form of spread.

This is the major way in which the broker profits due to the commission-free trading nature of FBS.

These spreads are very minimal on all of the assets traded, but nevertheless they are something which vary between brokers and which you should consider when making your choice of who to trade with.

On that note, we have compiled this comprehensive guide to bring you through every type of FBS spread. This includes what they mean and how much they are on each asset.

You can also see our FBS review for a full in depth look at the broker.

Table of contents

74-89% of retail CFD accounts lose money

Type of spreads with FBS

Here we will describe exactly the types of FBS spread which are implemented on each instrument and each of the FBS accounts which you may sign-up for.

Variable and fixed spread

An important point to note for you and all other traders is that fact that FBS offer opportunities to trade with either fixed spread or variable spread. This may not be the case with some brokers and at least allows you the freedom of choice.

Both the FBS fixed spread and FBS variable spread available are very competitive when compared with the industry average. This should give you a certain peace of mind for trading.

Spread on instruments

The spread on the different instruments at FBS is firstly subject to change based on the jurisdiction where you are trading. This means that if you are trading on FBS.Com as a global trader, you may experience a different spread than if you were using FBS.Eu as a european-based trader.

Another point to note about the jurisdictional differences when trading through FBS is that only markets on metals and forex trading are available through FBS.Eu. In the case of FBS.Com, a much wider choice of markets are available to trade.

A final point to note in this regard is that the spread will also be liable to change depending upon which account type you choose, although, no matter what, you do not have to worry about FBS requotes or mark-up on assets.

Spread on accounts

As mentioned, the spread may vary depending upon your FBS account type choice. Here are some of the main examples of how the spread impacts each account type.

Cent account

The FBS cent account allows for a great introduction to forex trading. The account allows you to trade in cents and therefore keeps your risks proportionality lower in trading. This is ideal for those who are just starting out or thinking of opening an FBS account.

The FBS cent account spreads too are very competitive. If you are an EU trader you can rely on a floating spread which starts from 1 pip with no commission.

Similarly if you are a non-EU international trader, FBS spreads start on this account from a floating 1 pip and also with no commission as well as STP execution.

Standard account

The FBS standard account is one of the most selected and again is available to both EU and international traders. The FBS standard spread varies between a floating spread from 1 pips with no commissions for EU traders and a floating spread also with no commission and STP execution for international account holders.

Micro account

The FBS micro account it is important to mention first of all, is only available to those who are trading outside the EU on an international market account from FBS.Com.

Assuming that this is the case, the FBS micro account features a fixed spread which starts from 3 pips. This account, as with many of the FBS account types features commission-free trading. You can also benefit from the speed and accuracy of STP processing which helps ensure you get the best possible price from your trade.

Zero account

Many top brokers feature some form of zero account. FBS is no different. The FBS zero account also features a fixed spread which starts from 0 pips.

This is one of the few FBS accounts which does also charge a commission. This remains competitive at $20 per lot and is balanced by the proportionately lower spread.

The account also uses STP processing. The FBS zero account is only available to those trading on the international market side of FBS.

ECN account

Again the FBS ECN account is available only to those traders on the international markets side of the broker. With this account, spreads actually start from a highly competitive -1pips.

With the ECN account, you will find a commission of $6 per lot applied to trades, and the account trading options offer only trading in forex currency pairs. Still this may be suitable to some higher volume traders in specific markets.

FBS spread review on various assets

Now let’s take a more detailed look at what the FBS spreads are on each asset class so you can factor it into your trading decisions. Full details are also provided in the charts.

Forex

Starting with the FBS forex currency assets, these are all much as you would expect with any top broker. The one point to note here is that the spread may differ slightly between EU and non-EU global market accounts.

If there are commissions to be charged on a trade as you will see in the zero and ECN accounts, these are per lot and will be charged in your base currency.

Comparing account types again for a moment, you will see that the EU cent account has a higher spread than the EU standard account. This is something to be aware of, but again the cent account is still great for getting to know forex trading with FBS.

The FBS micro account also has a comparatively high spread, particularly during the night. This is another thing to keep your eye on.

| FBS.Eu | standard | cent |

|---|---|---|

| EURUSD | 0.5 | 0.5 |

| USDJPY | 1.1 | 1.1 |

| GBPUSD | 0.6 | 0.6 |

| EURGBP | 2.1 | 2.1 |

| FBS.Com | standard | cent | micro (fixed) | zero (fixed) | ECN |

|---|---|---|---|---|---|

| EURUSD | 0.8 | 0.8 | 3.0 | 0.00 + $20 | -0.1 |

| USDJPY | 1.0 | 1.0 | 3.0 | 0.00 + $30 | 0.1 |

| GBPUSD | 0.7 | 0.7 | 3.0 | 0.00 + $30 | 0.2 |

| EURGBP | 1.0 | 1.0 | 3.0 | 0.00 + $30 | 0.4 |

Cryptocurrencies

FBS cryptocurrency trading is available, however this is only the case if you sign up with FBS.Com as a global markets (non-EU) trader. Crypto trading is also only available through a standard or cent account.

Once again here, the commissions denoted below are on a per lot basis and charged in your base currency. The spread on cryptocurrency is generally marginally higher than many other assets with most brokers due to market volatility.

Indices

FBS indices CFD trading encompasses a range of markets and the spreads here are typically the same or very close to that across each account type where cfds trading is offered. Here you will also note that there’s a flat commission when trading indices.

| FBS.Eu | standard | cent |

|---|---|---|

| NASDAQ | 25 +$25/lot | 25 +$25/lot |

| FBS.Com | standard | cent | micro (fixed) | zero (fixed) | ECN |

|---|---|---|---|---|---|

| US500 | 25 +$25/lot | 25 +$15/lot | 25 +$25/lot | 25 +$25/lot | n/a |

| NASDAQ | 25 +$25/lot | 25 +$15/lot | 25 +$25/lot | 25 +$25/lot | n/a |

Stocks

FBS stick trading features selection of globally prominent stocks which can be traded. This form of trading is only made accessible again through standard or cent accounts.

With stocks, the commissions noted are again per lot and charged in your base currency. An important point to remember here is that spreads and commissions on stock trading are the same, regardless of which stock you are trading. This applies even to the broader range of FBS stocks which are not listed.

| FBS.Com | standard | cent | micro (fixed) | zero (fixed) | ECN |

|---|---|---|---|---|---|

| US stocks | $3.00 | $3.00 | n/a | n/a | n/a |

Commodities

Finally, metals are available on all accounts with the exception of FBS ECN accounts. Another key point to remember here is that spreads may be higher during the night time and that commission is applied to traders using a zero spread account to trade metals. Again this charge is per lot and in your base currency.

| FBS.Eu | standard | cent |

|---|---|---|

| GOLD | 10 | 10 |

| US OIL | 3.0 +$25/lot | 3.0 +$25/lot |

| UK OIL | 1.0 +$25/lot | 1.0 +$25/lot |

| fbscom | standard | cent | micro (fixed) | zero (fixed) | ECN |

|---|---|---|---|---|---|

| GOLD | 10 | 10 | n/a | n/a | n/a |

| US OIL | 2.0 | 2.0 +$15/lot | 2.0 +$25/lot | 2.0 +$25/lot | n/a |

| UK OIL | 2.0 | 2.0 +$15/lot | 2.0 +$25/lot | 2.0 +$25/lot | n/a |

FBS spread comparison with other major brokers

Comparing FBS with other top brokers in the industry is a natural way to conclude our information and hopefully it can help you make the right choice when choosing your broker.

We can say that FBS do offer a very low spread with very competitive no-commission account types across most that are offered. This can be great for the majority of traders. There are also no requotes at all which is always a good sign from a top broker.

If you are interested in scalping with FBS, you will also be glad to know that this activity is allowed by the broker too.

Overall, the FBS spread is objectively very competitive and the broker appears to try the best to have a minimal impact on the cost of your trading activity. The one time to be mindful of the spread is during the night period or on certain markets when it can increase substantially.

74-89% of retail CFD accounts lose money

FBS REVIEW - IS FBS A GOOD FOREX BROKER?

BRKV - FBS is rising as one of the best forex brokers for the asian regions in 2019, especially in thailand and indonesia. So, today I will give an FBS review for new traders who are still struggling to find themselves a suitable forex broker. FBS was founded in 2009. They allow traders to trade up to 35 currency pairs, 4 precious metals, 2 CFD, and cryptocurrencies.

When finding the best brokers, we need to have standards to rate them. These standards are the fundamentals that any brokers who want to become the best should meet. Those are:

| Trustworthy | trading costs | trading conditions | local services |

| regulations | low spread | good quotes | payment system |

| historical activities | low commission | trading platforms | local offices |

| low slippages | availability | ||

| good rebate / bonus | |||

| low swap |

Now, let’s have an FBS review based on the standards mentioned above. Also, I will compare some aspects of this broker to the top brokers such as exness or XM.

Credibility of FBS review

When it comes to credibility, of course I’m talking about regulations. The first and foremost factor used to judge a broker is their regulations. Regulations are the licenses that trusted financial organizations give to a broker to manage that broker. Regulation is the thing that makes sure a broker has to follow a certain set of rules to guarantee traders’ safety. Only big forex brokers can meet the demands of those regulations. FBS is regulated by cysec and IFSC , two of the most trusted regulations. So you can rest assured that you are in safe hands.

Speaking of regulations, there is one thing I think I need forex traders to understand. Some new traders tend to think that the broker who has more regulations is better than those who have less. This is actually a wrong idea. Having many regulations doesn’t mean that broker is better in term of trading. There are two scenarios here. If your country already has a regulation, you should work with broker who has that regulation. You won’t need any other regulations from elsewhere. Your own country’s regulation is enough. FBS has IFSC, a south african regulation, so traders in south africa can be safe when trading with FBS. On the other hand, if your country does not have a regulation, like most asian countries, you should trade with brokers who have at least one trusted regulation, FBS in this case is cysec. Too many regulations will only put more limits on the broker. Regulation is just a signal that lets us know that this broker is decent, reliable, and safe to trade with. A broker only need one trusted regulation.

Trading costs of FBS review

Spread of FBS review

Most traders would love to do business with a low-spread broker. Spread is the difference between the ask price and the bid price of a currency pair. The spread of FBS is only from 0.2 to 1.1 pip which is in the top low spread brokers . And it's spreads are much lower than XM, FXTM, FXCM. CHECK FBS SPREAD -> HERE.

Commission of FBS review

Some brokers charge commissions for income, so does FBS. Based on the type of account, FBS has different commission rates. For the cent and standard accounts, there is no commission. CHECK FBS COMMISSION RATE -> HERE.

Bonuses of FBS review

FBS offers many types of bonuses like deposit bonus, welcome bonus, or loyalty program. They have a bonus with the highest rate ever, up to $100. Their deposit bonus gives back trader 100% of the deposit amount. Also, there is the cashback program, which rebate you $7 for every lot traded. Right now, they are having the $50 bonus. You just need to sign up and $50 will be transferred to your account immediately. CHECK FBS BONUSES -> HERE.

Trading conditions of FBS review

Account types of FBS review

BRKV - FBS offers traders 4 different types of account, which are the regular accounts (cent account, standard account, and fixed spread account) and the ECN account. Each account type has its own features that are suitable for different types of traders.

Cent account: this is the account for beginners or new traders. Why so? The required deposit is only $1. When you first start trading, you don’t want to put too much money in it because 90% of new brokers lose everything when they begin trading. With only $10, I think you can practice trading in real-life conditions for up to 3 months. The spread is relatively low, only around 1 pip. The order volume is from down to 0.01 lot cent up to 1000 lots. The lower the better because that way you won’t lose too much money. And even better, this type of account does not charge any commission, so you can trade as much as you want without costing a penny.

CHECK FBS CENT ACCOUNT NOW.

Standard account: traders with a bit more experience will trade with this account. The minimum deposit is average, at about $100. The spread is better, only around 0.5 pip. The leverage is up to 1:3000, which is pretty high. Higher leverage is better. XM’s standard account leverage is only 1:888. The order volume is from 0.01 to 500 lots. And just like cent account, this account is commission free, which is amazing.

Fixed spread account: it is also called zero spread account. You can tell it by the name. This type of account has no spread. Instead, it charges traders $20 for commission. This is understandable because spread is main income of brokers. If the spread is zero, the broker must charge commission. The minimum deposit for this acco unt is $500. The other features are the same as standard account like the leverage and the order volume.

ECN account: this is the account for experts and long-term traders. The minimum deposit required is $1000, which is pretty high, but the commission are much lower than other brokers ($6). Actually, this commission rate is just as low as that of exness and XM, which is $5 and $6 respectively.

CHECK FBS ECN ACCOUNT NOW.

Payment system of FBS review

I’m sure that some US or UK brokers are very good in their country, but overseas, they are relatively bad, especially in asian countries like thailand or indonesia. In asia, if traders deposit by their credit cards, their banks will charge them from 1.7 to 4% of their total fund. Having a profit rate at 5% monthly is hard enough and now they have to pay 4% just for depositing? I don’t think so. That’s why it is not wise for thai traders to trade with those US and UK brokers. Therefore, choosing brokers who can offer local payment systems is very important. FBS is great in this field. They offer depositing and withdrawing through almost all local banks and e-wallets in asian countries. Furthermore, what makes FBS really wonderful is their transferring speed. They only come second to exness , the fastest in the market. Transactions at FBS only take from half to an hour to complete through banks, while other brokers can waste you hours or even days.

Customer support of FBS review

Customer care is vital in this forex field, because forex is a very complicated subject. Traders are constantly need as much help and support from brokers as possible. That’s why how a broker assist its clients is a standard to evaluate it. FBS supporting team is fantastic in my opinion. They can support clients in english 24/7 on live chat. You can even tell them to call you back. That can show how dedicated they are to customers. For non-english speakers, they have offices in indonesia, malaysia, egypt, thailand, china, korea and myanmar that are always ready to help customers 5 days a week.

Fanara filippo

Hey, I’m fanara filippo. I’m the founder of this site. I'm currently living in bangkok, thailand. I have been trading forex for more than 5 years. You can read my articles about the best forex brokers on this page. Let’s review brokers today.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

FBS review

FBS is a regulated brokerage offering online trading on a limited amount of forex and cfds via the MT4/MT5 trading platforms. They also provide a range of trading tools, market analysis and educational materials.

FBS review, pros & cons

- Only $1 is required to commence live trading

- Copytrade which is a social trading platform

- Multiple account types to suit every trader

- No service to clients from USA, UK, japan, israel, canada and other countries

- Limited tradable assets; less than 90

- Very high spreads on cent accounts

- Limited trading platforms & tools

In this detailed FBS review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

FBS is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including FBS.

FBS review: summary

FBS is a global online forex and CFD broker that has been in operation for over a decade and has become very popular amongst online traders. FBS inc. Began operations in 2009 and has grown in strength, size and capital. Today, the broker has offices and partners from all parts of the world. The website is translated in over 17 languages.

The broker claims that every day, thousands of new online trading accounts are opened. These accounts belong to both traders and new partners. FBS boasts of millions of clients from over 190 countries across the world.

FBS provides access for traders to buy and sell over 75 trading instruments. The platforms available are the popular MT4 and MT5 trading platforms. The broker uses ECN and STP brokerage model which means that they do not trade against the trader or take the opposite position as a market maker broker would. The brand offers spreads starting from 0 pips along with ECN technology for pricing and executions.

Over the years, FBS has won industry standard awards for its online brokerage services. These awards are in different areas such as trader education, trading accounts and copy trading. Additionally, FBS has won the overall ‘best broker award’ in various jurisdictions.

FBS review: online broker awards

FBS review: regulation

The european arm of the brokerage (www.Fbs.Eu) is owned and operated by ‘tradestone ltd’ which is a financial investment services firm based in cyprus. Tradestone ltd is regulated by the cyprus security and exchange commission (cysec). The registration number is 331/17.

The global website (www.Fbs.Com) is operated by FBS markets inc. Which is regulated by the international financial services commission (IFSC) in belize. The license number is IFSC/60/230/TS/18.

The european clients are given some form of insurance by the investors’ compensation fund (ICF). If for any reason the broker becomes bankrupt, the ICF can compensate traders up to a maximum amount of €20,000.

All clients are fully verified using the ‘proof of id’ and ‘proof of address’ method. The broker also adheres to the anti money laundering (AML) policy.

Industry standard secured socket layer (SSL) has been implemented across all platforms and websites. This is to deter hackers and cyber criminals.

FBS review: countries

FBS does not allow clients from the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran. Some FBS broker features and products mentioned within this FBS review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

FBS review: trading platforms

MT4 & MT5

These are the metatrader platforms made available to FBS clients. These two platforms are the products of metaquotes software corporation which is a firm specialised in developing trading softwares. They came up with the MT4 in 2005 and later in 2010; they developed its updated version known as the MT5. Basically, the two platforms look alike in appearance and have very similar features. The only difference is that the MT5, being the newer version, has more features and even expanded the features already existing in the MT4. Both platforms are available as desktop applications for windows and MAC computers. They are also available as webtrader and as mobile apps. The webtrader version can be accessed from the FBS website on a web browser. It requires no downloads or installations. The MT4 and MT5 apps can be downloaded from the android and ios app stores. The apps are easy to use and have most of the features of the desktop application.

Here are a few of the features of the metatrader platforms:

- Customisable interface, windows, lists and overall appearance.

- The market watch and charts display the live ‘bid and ask’ price of every instrument.

- Three chart styles which includes bar chart, candlestick and line charts.

- MT4 has 9 timeframes while the MT5 has 21 timeframes.

- MT4 has 30 inbuilt indicators while the MT5 has 38.

- Supports the automation of strategies using expert advisors (eas).

- Access the metatrader market where you can buy trading tools like signals, indicators, eas, etc.

FBS review: trading platforms

MT4 multiterminal

This is the version of the MT4 trading platform designed for account managers. The MT4 multiterminal is capable of managing different trader accounts from a single manager account. The manager can place trades in multiple accounts with a single click.

FBS trader

This is the mobile trading platform from FBS for trading on the go. The app is designed for ios and android devices and can be downloaded from their respective app stores. It has a simple interface and is user friendly. It integrates with the metatrader platforms and can also be used to fund and withdraw from trading accounts. With the app, live quotes, charts and statistics can be accessed. Trade positions can easily be entered, modified or closed from the app.

FBS copytrade platform

FBS copytrade is a social trading platform where investors replicate the trades of other expert traders who wish to share their strategies. The investor can copy traders whilst the expert trader receives a commission. The copytrade platform ranks the expert traders according to their success. Investors can then profile their statistics and make a choice. The minimum investment amount is $100. Copytrade is only available via its mobile app which is developed for ios and android devices. With the app, you can customise your favourite traders, start and stop copying a trader in one click and also chat with the support team. It should be noted that past performance is by no means any guarantee of future performance.

FBS review: copytrade app

FBS review: trading tools

FBS personal area mobile app

This is an android app designed by FBS in order to access the FBS personal area. With this app, you can create both demo and real accounts and manage all of them. From the app, you can manage your personal profile, fund and withdraw from your trading accounts and also view the accounts history. Account verification can be done from the app. Customer support is also accessible from the app.

FBS review: personal area mobile app

Virtual private server (VPS)

A virtual private server (VPS) can run your trading platform remotely 24/7 offering reduced latency, consistent internet connection and overall reliability. Traders who use complicated trading systems and automated trading systems (eas) often insist on using VPS to solve the problem of fast connection round the clock. With a VPS, you do not need to keep the trading platform running on your computer as it runs remotely. FBS allows clients to set up a free VPS server. However, the client must be an active trader with a minimum balance of $450.

FBS review: virtual private server (VPS)

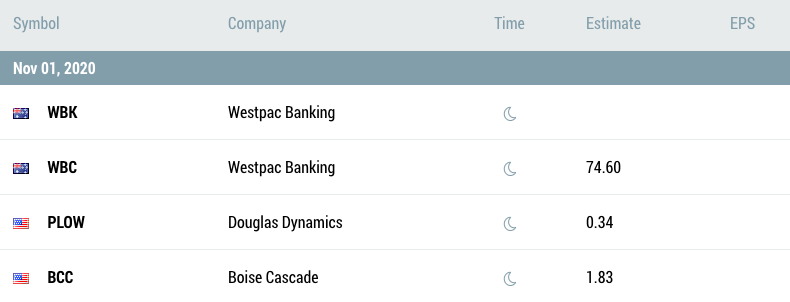

Economic calendar

This is an important tool for fundamental analysis. This calendar is on the FBS markets website and on the MT5 trading platform. It shows the date and time at which an event is to take place. These events are most likely to have an impact on the forex/CFD market. Analysts’ forecasts and history of past releases are shown on the calendar. The calendar can be searched using filters on the right hand side.

FBS review: economic calendar

Currency converter

This is used to convert one currency to another using the prevailing exchange rates. This is useful for traders who have a different currency from that of the trading instrument. It is also useful for traders whose account currency is different from their local currency.

Trader’s calculator

This is a very useful tool used to calculate estimated potential profits from a trade. You are to choose the account type, trading instrument, currency, leverage and prices. The trader’s calculator gives you the estimated profit for the trade based on your inputs.

FBS review: trader’s calculator

Forex news

The news is updated every business day. It is grouped under the asset classes of commodities, currencies, stocks and economy.

Daily market analysis

This analysis is presented by FBS analysts. This section of the website looks at selected trading instruments and uses technical and fundamental analyses to make predictions. Trading ideas are given to traders to either buy or sell. Sometimes even ‘take profit’ and ‘stop loss’ prices are given. There is no guarantee on the quality of the analysis offered due to the unpredictable nature of trading.

Forex TV

This is made up of videos on daily and weekly market insights. There are also videos on daily trading plans and video recordings of past webinars.

FBS review: education

Forex guidebook is the ultimate introduction to the world of forex trading. It is arranged in order for beginners, elementary, intermediate and experienced traders. The guide consists of articles, pictures and clear illustrations.

A library of the recommended forex books is listed on the website. This is to encourage beginners to buy some of these books and read. Most of the books can be bought from amazon and the link to buy is provided. There are over 100 books to choose from.

Webinars and seminars are announced from time to time. Webinars are more frequent as it comes up almost every week. Seminars are periodically held in different cities.

Also, there are video lessons on metatrader, FBS services and general forex trading.

FBS review: trading instruments

FBS offer 28 forex pairs which includes the major and the minor currency pairs. Also there are 9 exotic pairs, 5 metal assets, 3 cfds and 33 US stocks.

FBS review: trading accounts & fees

The following online broker account types are available:

- Cent account: this minimum opening balance is $1 and the floating spread starts from 1 pip. The trading fee is incorporated into the spread. The maximum leverage is 1:1000. For european clients, the opening balance is €10 and the spread is 1:30.

- Micro account: the amount required to open this account is $5. The spread is fixed and it starts from 3 pips. The maximum leverage is 1: 3000.

- Standard account: this is the entry level account for a trader. The minimum account opening balance is $100. The variable spread starts from 0.5 pips and the maximum leverage is 1:3000. For european clients, the opening balance is €100 and the maximum spread is 1:30.

- Zero spread account: the opening balance is $500 and the spread is fixed at 0 pips. Commissions are charged at $20 per lot. The maximum leverage is 1:3000.

- ECN account: this is the premium account offered by FBS. The floating spread starts from 1 pip and a commission of $6 is charged. The maximum leverage is 1:500 and the minimum opening balance is $1000.

FBS review: account types

Commissions are only charged on the ‘zero spread’ and ECN accounts. Only the standard and cent accounts are available to european clients. The maximum leverage is 1:30 due to ESMA regulations.

Demo accounts are available for all account types. Islamic accounts are available on request. Islamic accounts do not incur rollover charges.

As broker fees can vary and change, there may be additional fees that are not listed in this FBS review. It is imperative to ensure that you check and understand all of the latest information on the official FBS website before opening a brokerage account.

FBS review: customer service

FBS proudly asserts that its customer support desk is always available 24/7. The support team is multilingual and can be reached via phone, email, fax and ‘call back’ form. The call back form is used to schedule a call from the support team at your convenience.

For instant chats, they can be reached on web chat, viber, facebook messenger and telegram. On social media, they are on facebook, instagram, twitter and youtube.

FBS review: deposit & withdrawal

FBS offers multiple payment options. The broker only accepts online payments and card payments. Withdrawal requests are processed within 48 hours. All clients must be verified before withdrawal requests are approved. Here are the account payment options:

- Credit/debit cards: the acceptable cards are visa and mastercard. The deposits are processed instantly. No commissions are charged because FBS covers the charges.

- Electronic payments: the electronic payments accepted are perfect money, skrill, neteller and sticpay. FBS covers most of the commissions except for sticpay which is charged 2.5% + $0.3.

- Bitwallet: this is allowed only in JPY. No commissions are charged and the payments are instantly processed.

- Local exchangers: FBS allows for local exchanges in several jurisdictions. This is achieved because of the numerous partnerships across the globe.

FBS review: payment options

Accounts can be opened in EUR, USD. The different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

FBS review: account opening

To register for a new account, click on ‘open account’ found on the topmost right hand side of the website. Fill your email address and name in the form that displays.

FBS review: online broker account form

Then, click on ‘register as trader’. If you already have a facebook or google account, you can simply click on the icons to allow FBS to receive your profile information from these websites.

You are issued a temporary password but advised to change it. Choose a new password and click ‘change’. An email confirmation is sent to the entered email address. Confirm your email address by clicking on a link in the email. You will be directed to the FBS website and personal area where you can create more accounts, make a deposit and commence trading.

FBS review: conclusion

FBS is an established online trading broker that has been built with a desire to accommodate all levels of traders as well as trading styles. It is a regulated brand that has implemented all the necessary security procedures that are standard in the online brokerage industry.

The beginner is fully supported with unlimited demo accounts and a selection of comprehensive training resources. With as little as $1, live trading can commence on the provided platforms. Spreads start from 0 pips and with ECN technology, trades are executed in seconds with minimal slippage.

The FBS copytrade, analytics and trading tools are also commendable. They have won multiple awards and serve millions of traders across the globe. Despite that, there are other online brokers who offer much more trading instruments and more favourable fees overall.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.76.2% of retail accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Min $1 deposit

FBS is a regulated brokerage offering online trading on a limited amount of forex & cfds via the MT4/MT5 trading platforms. They also provide a range of trading tools, market analysis & educational materials.

FBS review 2021

Regulated by cysec & IFSC | segregates client funds | trust rating: B | true ECN

CFD trading involves high risk be careful with your investement

CFD trading involves high risk be careful with your investement

This post is also available in: deutsch italiano

With this FBS review we want to find out if FBS is really one of the best forex brokers of 2019.

We conducted an in-depth review in january 2021 to find out the answer and bring it to you!

Now here's a real surprise broker that you may not have come across yet!

Founded in 2009 and headquartered in belize, this true ECN and STP broker is authorised and regulated by the cyprus securities and exchange commission (cysec) and has a lot to offer.

They have already won tons of awards, have clients in over 120 countries throughout the world and have established a sound customer base that currently exceeds 5 million traders.

FBS is extremely well represented in important regions across asia and has offices in china, thailand, turkey, malaysia, indonesia, lao, myanmar and egypt.

Clients are entitled to receive all sorts of promotions and trade forex, metals, cfds and four of the major cryptocurrencies: bitcoin, ethereum, litecoin and dash.

| �� trading platform | metatrader |

| �� head office | belize |

| �� founded | 2009 |

| ⭐ reviews | 4.4 - 43 reviews trust pilot |

| ↔ maximum leverage | 3000:1 |

| �� execution servers | LD5 |

| �� broker type | ECN |

| �� negative protection | no |

| �� trading options | forex, cfds, crypto |

| OUR RATING: 7.8 | |

| the overall raiting is based on review by our experts | |

| �� reliability: 7 / 10 | �� spread: 9 / 10 |

| �� offers: 8 / 10 | �� speed of execution: 8 / 10 |

| �� customer service: 7 / 10 | �� uptime: 8 / 10 |

| trading conditions | |

| max leverage: | 3000:1 |

| platform: | |

| min deposit: | $1 |

| spread: | from 0.0 pips |

| cuts out dealing desk: | yes |

| methods of deposit and offers | |

| deposit / withdraw: | |

| welcome offer: | $123 free and 100% deposit bonus on all deposits |

| rebates engine forex: | coming soon! |

SECURITY, MARGINS AND TECHNOLOGY

SECURITY

In summary

- Cysec & IFSC regulated

- True ECN broker

- No dealing-desk intervention

- Segregates clients’ funds

FBS is the trading name of FBS markets inc., parallax incorporated, tradestone limited and is licensed and regulated by the cyprus securities and exchange commission (cysec) and the international financial services commission (IFSC).

Deposit insurance of up to 100%

for most account models, the broker offers forex traders so-called deposit insurance. In this way, traders secure the amount of their deposit at 100 per cent. For this purpose, a certain number of positions must be traded. For example, if you want to hedge a deposit of 100 US dollars, you will need 12 trades. In this way, traders can protect themselves against losses of their trading capital without additional investment.

In our FBS forex broker review, we found that dealing with FBS can be considered to be safe and secure. Overall, the company goes a long way to ensure transparency and the safety of its clients' money.

Spreads comparison

PEPPERSTONE

THINK MARKETS

OANDA

IC MARKETS

CHARGES AND MARGINS AT FBS

In summary

- Spread mark-up or

- Commissions per standard lot R/T

- 6 account options to choose from

- Up to 3000:1 leverage

FBS offers a choice between six unique trading account types, each of which offers distinct advantages and features. Clients can select from MT4 and MT5, true ECN or STP account options.

Minimum deposits range from $1-1000 with a huge maximum leverage of up to 3000:1.

All account types, except its ECN account, support the following trading instruments: 35 currency pairs, 4 metals, 2 cfds and 4 cryptocurrencies. The ECN account focusses solely on forex trading and allows users to trade 25 currency pairs.

Leverage is up to 3000:1 on the micro, standard and zero spread accounts, up to 1000:1 on the cent, and up to 500:1 on the unlimited and ECN account options.

FBS only charges commissions on two of its account types: the zero spread (from $20 per lot round-turn) and ECN ($6 per lot round-turn) accounts.

Here is a quick overview of all six account types and it's main characteristics:

- Standard account: the FBS standard account can be accessed from a deposit of at least $100. The maximum leverage is selectable up to 3000:1 and the fees are calculated over a variable spread (from 0.5 pips).

- Cent account: an account from $1 deposit for trading small amounts. There are even cent lots available for trading. The maximum leverage is 1000:1 and the average spreads start from 1 pip.

- Micro account: an account from $5 with fixed spreads. So the fees are 100% clear for the trader before. The spreads start at 3 pips, and the leverage goes up to 3000:1.

- Zero spread account: with this account, there is no spread (fixed at zero spread) applied, but a commission of minimum $20 per lot R/T has to be paid. This is an FBS account option that can be accessed with deposits from $500. However, a $20 commission per lot is quite steep.

- ECN account: direct access to interbank trading with no spread (from -1 pip). A commission of $6 per lot is due, and the maximum leverage can be set to 500:1. You get a direct market execution from an initial deposit of $1000.

- Unlimited account: an account type similar to the standard account, but with smaller, floating spreads starting from 0.2 pips. Available from $500 deposits with a leverage of up to 500:1.

A comprehensive comparison table of the different settings and features for each of FBS' account types is presented below:

TECHNOLOGY

In summary

- Metatrader 4 (MT4)

- Proprietary FBS trader

- Metatrader 5 (MT5)

- FBS copy trader

FBS clients are welcome to use the popular MT4 trading platform or can select its younger brother, MT5. Both trading platforms are available for all six account types.

Both platforms can be used with desktop computers or as a browser-based webtrader. Mobile trading is available for all common android and ios devices.

Both metatrader platforms allow for a wide range of leverage and trade execution without requotes. The full set of MT's standard features are available, such as the use and implementation of expert advisors (eas), micro-lot trading, one-click trading and an embedded news section. Technical analysis tools, including 50 indicators and charting tools with three types of charts, are at hand as well as the option for VPS service support.

FBS further offers the metatrader 4 multiterminal, which is a multi-account-management solution for MT4. With this terminal, account and money managers have the ability to manage multiple trading accounts simultaneously under one portfolio. The status of open positions and pending orders can be monitored and controlled via this tool. Quotes and news are received in real time just like on any metatrader account.

FBS trader is the broker's new, proprietary trading platform. The broker highlights that this trading platform is as powerful as the popular metatrader platforms but simpler to use.

The FBS trader is available for download on desktop computers or as a mobile platform for android and ios devices. It offers real-time stats and a smart interface for editing orders and account settings in just a few clicks.

FBS copytrade platform:

FBS jumped on board of the popular social trading train with their FBS copytrade platform. It is a copy trading platform where traders can automatically replicate (copy) the strategies and trades of other traders.

Copytrade enables all types of traders to engage in the financial markets and invest in professional or more experienced traders. The broker provides a list of advanced traders displaying their general profiles, generated returns in a given period, number of copiers and copy-fees charged. A trader can then check the statistics of the relevant traders and select those they want to follow or to copy.

On the other hand, experienced traders can set up their accounts to allow copy trading and specify a commission percentage that they wish to charge. This can serve as a major source of income for successful traders as they can earn huge commissions from a potentially unlimited number of copiers. FBS copytrade is available as an android and ios app, which can be downloaded and installed from the respective app stores.

A free VPS service is available to those clients that meet the conditions of depositing at least $450 and trading a minimum of just 3 lots per month. A VPS is a tool that most professional traders use to stay online and connected to the trading servers anywhere and anytime. Especially those traders using expert advisors (eas) as well as high-frequency traders that require a stable and fast server connection where slippage is reduced to the absolute minimum should consider using a VPS.

Execution of speed comparison

PEPPERSTONE

THINK MARKETS

OANDA

IC MARKETS

CUSTOMER SERVICE, TRADING OPTIONS AND SPECIAL FEATURES

CUSTOMER SERVICE AND CLIENTS SUPPORT

In summary

- 24/7 customer support

- Global presence with large client base

- 6 account types to choose from

- Demo account option available

Customer support service at FBS is available 24/7, a significant advantage given that most other brokers only offer 24/5 support. Support is available in 19 different languages including arabic, chinese, malay, thai, korean, indonesian, russian, laotian, french, italian, spanish and portuguese. Localized support services are available for traders in china, egypt, indonesia, korea, malaysia, myanmar and thailand.

Worldwide, more than 5 million traders from over 120 countries have already chosen FBS’ services and registered a trading account with the company. The company has won tons of industry awards and is ranked as one of the top forex trading providers in asia.

Both new clients to FBS and established traders have access to the multitude of promotions and bonuses on offer. These bonuses and promotions include a $123 no deposit bonus (welcome offer that is available to clients from selected regions only), 100% deposit bonus "trade 100 bonus" and many more.

In addition to providing a news and info section, the company also offers in-depth insight and education on all forex and trading-related topics. This includes webinars, seminars, videos, guidebooks for traders and much more. Both newbies and professional traders can significantly benefit from this wealth of insider information.

An economic calendar, forex market news, daily market analysis and forex TV are all accessible via the forex broker's homepage fbs.Com.

For the more serious or professional traders who have funded their account with at least $10,000 and traded a minimum of 50 lots, FBS offers an individual VIP approach through which clients benefit from consultations with a dedicated account manager, priority deposit and withdrawal processing, and gifts.

All customers can choose between six distinct account types that vary in terms of leverage, minimum deposit amounts, starting spread levels and other features, as shown above.

The available trading products include 35 currency pairs, 4 metals, 3 cfds, a small selection of stocks from around the globe and 4 cryptocurrencies.

Even though other forex brokers offer a more extensive portfolio of trading tools, FBS’ selection of trading tools represents a solid and sound variety that is especially beneficial for a more targeted trading approach that focuses on forex and cryptocurrency trading.

To get started and test FBS' overall trading conditions, we recommend to open a demo account first. This option is free of charge with the broker for both metatrader 4 and 5 platforms.

One of the negative FBS broker experiences is that charges are generally levied for payment transactions with the exception of credit cards or bank transfers. The deposit fees for this vary between 0.8 and 7.5 per cent.

The fees for withdrawals via e-wallet are also quite high. Traders should, therefore, use a credit card wherever possible. For transfers to bank accounts, a flat fee of $30 is charged. This also applies if part of the payment is booked to the credit card. If the payout exceeds the amount previously paid in with the credit card, the difference in excess will be transferred to a bank account of the trading account holder. Payments to third party accounts are not possible here either.

Available deposit / payment methods include:

- Credit card and debit card (visa only)

- Neteller

- Skrill

- Stic pay

- Perfect money

- Bitwallet

- Bank wire transfer

With the online broker FBS traders have a chance in competing in various contests and trading tournaments. Prices include exclusive products such as cars, electronic devices, vacation or cash.

Clients looking to invest in experienced traders instead of trading themselves will find the FBS copytrade platform interesting. Retail investors can join a network of traders and copy their strategies and trades for a commission set by the individual traders. Typical commission charges vary between 10 and 30% of the trading profits generated by the trader. Followers have access to information and statistics of all available traders. These stats an be viewed and compared at any time.

On the other hand, successful traders have the opportunity to present their trading portfolio and offer to being copied to the FBS network of investors. For each investor following their strategy and copying their trades these strategy managers earn extra commission from successful trades.

So, let's see, what we have: considering FBS for your next forex broker? Do you know which FBS account type to choose? Or which platform does FBS offer? Read all here. At fbs micro account review

Contents of the article

- Free forex bonuses

- A factual FBS review for retail forex traders

- FBS trading account features at A glance

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- Trading

- Account comparsion

- Frequently asked questions

- What trading account should I choose?

- What is a trading account?

- What is forex trading?

- Why is FBS the best broker for online trading?

- How do I start trading?

- Download trading platform

- Deposit with your local payment systems

- Data collection notice

- Beginner forex book

- Thank you!

- FBS spreads review - types and characteristics...

- Type of spreads with FBS

- FBS spread review on various assets

- FBS spread comparison with other major brokers

- FBS REVIEW - IS FBS A GOOD FOREX BROKER?

- Credibility of FBS review

- Trading costs of FBS review

- Trading conditions of FBS review

- Customer support of FBS review

- FBS review

- FBS review: summary

- FBS review: regulation

- FBS review: countries

- FBS review: trading platforms

- FBS review: trading tools

- FBS personal area mobile app

- Virtual private server (VPS)

- Economic calendar

- Currency converter

- Trader’s calculator

- Forex news

- Daily market analysis

- Forex TV

- FBS review: education

- FBS review: trading instruments

- FBS review: trading accounts & fees

- FBS review: customer service

- FBS review: deposit & withdrawal

- FBS review: account opening

- FBS review: conclusion

- FBS review 2021

- SECURITY, MARGINS AND TECHNOLOGY

- CUSTOMER SERVICE, TRADING OPTIONS AND SPECIAL...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.