Biggest lot size forex

All forex brokers will accept people from most countries, but only a small number of brokers are truly able to handle a diverse client base.

Free forex bonuses

In order to better serve people from various countries and continents, a broker must be able to easily handle deposits and withdrawals with a vast number of internationally used payment methods. The brokers must also allow for accounts denominated in different currencies, have multilingual websites and dedicated customer support for many countries and languages. The brokers targeting a worldwide audience may hold multiple licenses and operate in different jurisdictions in order to provide the best trading conditions for people in different regions. While many of the big forex companies are specialized in serving more than one demographic, we have identified a set of brokers which have a truly global presence and are well suited to handle traders from any corner of the world. Figure 2: costas cleanthous, XM's CEO at the shanghai forex expo

Largest forex brokers in the world 2020

A lot of traders think that a big broker is better than a smaller one because a larger company has many advantages such as economies of scale, a better liquidity position and is the subject of higher scrutiny from the public and the regulators. While this basic assumption has some merit and to some degree "bigger is better", it is not a total correlation between size and quality of forex brokers. This means that the largest broker is not necessary the best, although all good brokers are sufficiently large in order to be competitive.

If you want to find out which are the biggest forex companies in the world, you should continue reading this article. However, if you want to know which are the best forex brokers in the world when it comes to trading conditions and customer satisfaction, you should check our special forex brokers ranking.

How to measure the biggest forex companies

When it comes to measuring the size of a company, there are several criteria that are generally used. The most common criteria used in ranking companies by size are market capitalization, revenue and profits. Also, when it comes to financial companies such as banks or insurance companies, another way to measure size is by comparing the total assets under management. While these values can be relevant in some situations and industries, they are totally irrelevant when it comes to forex brokers. Here is why:

Market capitalization - the only companies that can be ranked by market capitalization are public companies (those listed on a stock exchange). This would leave most forex brokers out of the ranking. It is also important to note that market capitalization represents the value investors give to a specific company. A small but profitable company can have a higher market value than a large company unable to generate profits.

Revenue - while ranking forex brokers by revenue will render more accurate results, this criteria is still far from being relevant in this particular case. A broker's revenues will come from the commissions it charges and the spreads the traders have to pay. A broker with higher commissions and spreads will generate more revenue than a similar sized broker with lower spreads. There is also the problem of integrated products offered by the companies. A company offering stocks trading, options and futures along with forex trading will generate revenue from more sources as compared to a pure forex broker. If the stocks business generates most of the revenue, the company can be very large but the forex division can still be small compared to others.

Profits - ranking forex brokers by profits is totally irrelevant, as this criteria includes the same problems we identified when discussing about revenues, and many more. Just think about a large company with a bloated business that has huge operating costs. It can be a really big company but generate no profit.

Assets under management (AUM) - in the case of forex brokers, the closest thing to AUM are the client funds. While they are not managed by the brokers, they represent the total value of the client accounts. This measure is much more relevant than the previous ones, but it still lacks the differentiation between the forex business and the other services offered by the company. If you mix stocks trading with forex, it is very likely that the largest part of the client funds will be used in trading stocks, not forex. Another thing that makes clients funds less relevant is the different leverage used by brokers. Lower leverage needs more funds in the broker's custody for the same operations. Also, it is possible to have large forex accounts with very little trading activity.

Considering the above mentioned criteria are irrelevant when judging the size of forex brokers, we must come up with a measure that is more relevant to this specific business. In this case, we think that the most relevant criteria to rank forex brokers is by the average volume of daily transactions.

Average volume of daily transactions (AVDT) - the daily transactions of a forex broker can vary a lot, but the more active clients the broker has, the less volatile the value of daily transactions will be. In order to get a better idea about the real volume of a broker, it is better to calculate the average volume for a larger period of time, as daily and seasonal fluctuations will be less relevant. We think the AVDT becomes relevant when at least the last three months are being taken into consideration when calculating the average. In order for a forex broker to be considered large it must have an AVDT of at least one billion dollars (more than 10,000 standard lots traded daily).

We noticed that all the high quality forex brokers are also large ones and have their AVDT of at least three billion dollars. This is why, in this article we will list only brokers with daily transactions exceeding three billion US dollars.

Largest forex brokers by volume

Below you will see the biggest forex companies in the world by volume of daily transactions. We have separated the companies based on their location, as we have identified four major regions when it comes to forex brokers: united states of america, europe, australia and the rest of the world. The regions we identified have different regulation and the brokers in each region must abide by specific rules. The data presented on this article was compiled from different sources such as company presentations and other information found on the internet. The data is not audited and we cannot guarantee it is accurate. Please take the information about AVDT with a grain of salt as it may contain errors and inaccuracies.

Figure 1: major forex regulators around the world

In order to make it easier for you to identify the best forex brokers from the rest, we have also added our rating next to each broker. The ratings vary from A+ (best) to C- (worst). We have a dedicated page where you can read more information about our forex broker ratings.

Largest forex brokers in the united states

The united states is one of the largest forex markets in the world, but due to very restrictive regulation it has been declining in recent years. It is also the most isolated market since US traders are unable to open account with offshore forex brokers because the FATCA regulations imposed on foreign financial institutions has made it too expensive for anyone to accept US clients.

The strict rules and protection from outside competition had led to consolidation among local brokers, with the most important development being the acquisition of FXCM client base by gain capital (also known as forex.Com). Right now there are only three forex brokers in the united states, and one of them is mostly an institutional broker (interactive brokers), so retail clients have basically only two choices (forex.Com and oanda). Because the CFTC and NFA regulation greatly limits leverage and has the unpopular FIFO rule, the US based brokers have been unable to get traction in foreign markets and the vast majority of their clients are from the US.

Below is the ranking of the biggest US forex brokers by volume:

| AVDT* | rating | broker |

| 15.5 | B- | forex.Com (GAIN capital holdings inc) |

| 10.7 | B+ | oanda (oanda corporation) |

| 3.9 | C- | interactive brokers (interactive brokers LLC) |

* average volume of daily transactions in billion USD

Largest forex brokers in europe

This is where most of the large forex companies are located. Because of europe's cultural and linguistic diversity, local brokers had to adapt early to very different markets and stiff competition, but this has proven to be a great asset when they expanded globally. European brokers are based in different countries and have multiple trading licenses, but the hot spots of forex trading in europe are cyprus (cysec) and the united kingdom (FCA). This is where most brokers are located thanks to the world leading regulation, and even brokers located in other countries such as denmark's saxo bank use a cysec license for their forex trading division. While european regulation varies from country to country, they are all compliant with the MIFID legislation of the european union which adds another layer of protection for traders.

Some of the european brokers have gone global, and their operations are spread on different continents. European brokers are used by many traders in asia, africa, the middle east and latin america, and their total volumes are greatly boosted by their international operations. Some brokers may have the bulk of their activity from non-european clients attracted by the safety of european regulations and the excellent trading conditions offered by some of the world's leading brokers.

Here you can see the largest forex brokers in europe:

| AVDT* | rating | broker |

| 13.4 | A | XM group (trading point of financial instruments ltd, trading point of financial instruments pty ltd and XM global limited) |

| 12.3 | B | saxo bank (saxo bank A/S) |

| 7.8 | B+ | ava trade (ava trade ltd) |

| 6.8 | B- | IG markets (IG group) |

| 6.5 | C | FX pro (fxpro financial services limited) |

| 4.7 | B+ | swissquote (swissquote group holding SA) |

| 4.4 | B- | plus500 (plus500 ltd) |

| 4.3 | C- | etoro (etoro europe ltd) |

| 4.2 | C | markets.Com (safecap investments limited) |

| 3.9 | B- | CMC markets (CMC markets UK plc) |

| 3.8 | B- | FXCM (FXCM group) |

| 3.6 | C+ | forex time (forextime limited) |

| 3.5 | B | dukascopy (dukascopy bank SA) |

| 3.3 | B- | FXDD (fxdirectdealer LLC) |

| 3.2 | C+ | admiral markets (admiral markets group AS) |

* average volume of daily transactions in billion USD

Figure 2: costas cleanthous, XM's CEO at the shanghai forex expo

Biggest forex brokers in australia by volume

We have a separate section for australian brokers because they have their own regulation under the australian securities and investments commission (ASIC). Australian brokers are well represented outside australia's borders as well, because the jurisdiction is very solid and some of the brokers are offering top notch conditions and liquidity. The major forex brokers in australia are also very successful in other english speaking countries as well as in china and southeast asia.

There are three major australian forex brokers that generate very high average daily volumes, and all of them are experiencing good growth rates. Below you can find the largest forex brokers in australia:

| AVDT* | rating | broker |

| 18.9 | A+ | IC markets (international capital markets pty ltd) |

| 6.7 | A- | pepperstone (pepperstone group limited) |

| 5.3 | A- | AXI trader (axitrader limited) |

* average volume of daily transactions in billion USD

Largest forex brokers from other jurisdictions

There are several high volume forex brokers located in other jurisdictions than the ones presented above (australia, europe and united states). Since the remaining big brokers are spread around the world and are not concentrated in a smaller region, we have included them in the "rest of the world" category. The brokers listed here come from very different jurisdictions such as st. Vincent and the grenadines, belize, british virgin islands or cayman islands in the caribbean, seychelles or bermuda.

The brokers in this category abide by different regulation and can vary a lot when it comes to reliability. However, this does not mean that such brokers cannot be good, as you will see that the ratings they received are very different, from very good to very bad.

Here is the list of the largest forex brokers from the rest of the world:

| AVDT* | rating | broker |

| 11.5 | A | hot forex (HF markets ltd) |

| 9.7 | A | vantage FX (vantage international group limited) |

| 9.1 | A- | IFC markets (ifcmarkets corp) |

| 8.4 | A- | exness (exness limited) |

| 5.8 | B | instaforex (instaforex group) |

| 4.3 | B+ | roboforex (roboforex ltd) |

| 4.1 | B | iron FX (notesco limited) |

| 3.8 | B- | X-trade brokers (xtrade international limited) |

| 3.7 | B | eagle FX (eaglefx ltd) |

| 3.5 | B | IQ option (iqoption ltd) |

| 3.3 | B- | FX open (fxopen markets limited) |

| 3.2 | C | easy markets (EF worldwide ltd) |

| 3.1 | B | olymp trade ( inlustris ltd. ) |

| 3.0 | C- | alpari (alpari limited) |

* average volume of daily transactions in billion USD

Which large forex brokers are truly global?

While US traders will have to settle with a US based broker since they are not allowed to open accounts with foreign companies, people from the rest of the world are free to trade using an offshore forex broker account. In most cases, europeans will settle for an european broker and australians will choose a local one as well, but what about people from the rest of the world? What about people in canada, central and south america, the caribbean, africa and asia? They make up more than 85% of the world population, and they must choose a foreign forex broker to trade with. What are their best options?

All forex brokers will accept people from most countries, but only a small number of brokers are truly able to handle a diverse client base. In order to better serve people from various countries and continents, a broker must be able to easily handle deposits and withdrawals with a vast number of internationally used payment methods. The brokers must also allow for accounts denominated in different currencies, have multilingual websites and dedicated customer support for many countries and languages. The brokers targeting a worldwide audience may hold multiple licenses and operate in different jurisdictions in order to provide the best trading conditions for people in different regions. While many of the big forex companies are specialized in serving more than one demographic, we have identified a set of brokers which have a truly global presence and are well suited to handle traders from any corner of the world.

Here are the largest truly global forex brokers:

| AVDT* | rating | broker |

| 18.9 | A+ | IC markets (australia, seychelles) |

| 13.4 | A | XM group (cyprus, australia and belize) |

| 12.3 | B | saxo bank (denmark) |

| 11.5 | A | hot forex (st. Vincent and the grenadines, cyprus, south africa, seychelles, mauritius) |

| 9.1 | A- | IFC markets (british virgin islands) |

| 7.8 | B+ | ava trade (ireland) |

| 6.5 | C | FX pro (united kingdom) |

| 5.8 | B | instaforex (british virgin islands) |

* average volume of daily transactions in billion USD

Disclaimer: the average trading volumes presented on this page are the result of out efforts to gather and compile information from different internet sources. We have no guarantee that the numbers are correct, and considering the volatility of the forex market and the seasonal dynamics, it is possible that such numbers will suffer significant changes from month to month. Please also note that the ratings we give to forex brokers are based on our own research and criteria, but do not represent an endorsement or a critique of any broker. We are not giving investment advice and we think anyone should do his/her personal due diligence before registering with a specific broker. Forex trading is a risky activity and you should never trade with money you cannot afford to lose.

More articles about forex brokers:

Choosing a forex broker can be a very daunting task because the number of available options is overwhelming. With so many brokers advertising themselves as being the best, people go to specialized websites to read reviews and see broker rankings hoping they will find which broker is their best choice. Read more

Since there is a lot of confusion among retail traders about the overall quality of forex brokers, we have decided to create an advanced rating system and evaluate all the major forex brokers in the world according to the same set of criteria. Because we are aware that it is impossible to evaluate all forex brokers. Read more

There are many reasons why people decide to open bank accounts offshore. They can include a better privacy protection, access to better banks where money are safer or simply better services that home based banks don't offer. The same reasons apply when it comes to brokerage accounts. Read more

3 types of forex trade sizes

The key to profits in the forex market often depends on the correct position size, so rob pasche of dailyfx.Com , explains the three kinds of lot sizes that forex brokers typically offer.

Ten-20 years ago, forex brokers typically offered only one contract size, 100,000 units of currency. So when a trader said they wanted to trade one (lot), that meant they were trading 100,000 units. But over the course of the last decade, as technology became more efficient and transactions costs decreased, forex brokers began offering lot sizes in smaller increments. This required new terminology to describe what amounts we were actually trading.

Micro lot

A micro lot is the term used for a 1,000-unit trade, which on most major pairs come out to about $0.10 of risk per pip. This is the smallest trade size available and is a great size for traders who don't have much capital to trade. Using dailyfx's usual rule of 10, we would want to have at least $100 in our trading account per micro lot that we wanted to trade at a time. You won't make a fortune, but you won't lose too much either trading micros, that's why it's a great place to cut your teeth in forex.

Mini lot

A mini lot is the term used for a 10,000 unit trade, which on most major pairs means we are trading $1 a pip. Trading mini lots packs a punch 10x larger than a micro lot, so we want to make sure we are properly capitalized before trading them. We recommend having at least $1,000 deposited into your account for each mini lot you plan to have open simultaneously. It's a good trade size for a serious part-time forex trader who has the capital or a full-time trader wanting to start with a smaller lot size.

Standard lot

A standard lot is the term used for a 100,000 unit trade, which on most major pairs means we are trading $10 per pip. We want to make sure we are fully prepared for large swings of gains and losses we can face when trading standard lots. Gains/losses could reach $1,000-$2,000 or more per standard lot on a fairly common day in the forex market, so having a larger account size is mandatory to trade them seriously. Our account should have at least $10,000 per standard lot we are looking to trade, which normally means you are very serious trader in the FX market, part-time or full-time.

Trading EUR/USD with different lot sizes

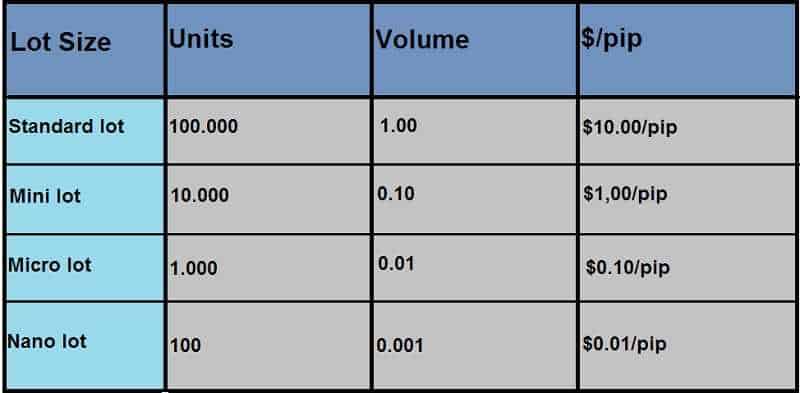

In the image above, we can see what each trade size translates to in an actual currency pair, the EUR/USD. Notice the trade size refers to the first currency in the currency pair, in this case euros for the EUR/USD pair. So a micro lot, mini lot, and standard lot means ?1,000, ?10,000, and ?100,000.

Open a forex trading demo account and place a 1k, 10k, and 100k trade across three different pairs. This will give you a good sense at how trade size affects the profit/loss on your currency positions.

What is a lot in forex?

Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell.

A “lot” is a unit measuring a transaction amount.

When you place orders on your trading platform, orders are placed in sizes quoted in lots.

It’s like an egg carton (or egg box in british english). When you buy eggs, you usually buy a carton (or box). One carton includes 12 eggs.

The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units.

| Lot | number of units |

|---|---|

| standard | 100,000 |

| mini | 10,000 |

| micro | 1,000 |

| nano | 100 |

Some brokers show quantity in “lots”, while other brokers show the actual currency units.

To take advantage of this minute change in value, you need to trade large amounts of a particular currency in order to see any significant profit or loss.

Let’s assume we will be using a 100,000 unit (standard) lot size. We will now recalculate some examples to see how it affects the pip value.

- USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per pip

- USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per pip

In cases where the U.S. Dollar is not quoted first, the formula is slightly different.

- EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 rounded up will be $10 per pip

- GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 rounded up will be $10 per pip.

| Pair | close price | pip value per: | ||||

|---|---|---|---|---|---|---|

| unit | standard lot | mini lot | micro lot | nano lot | ||

| EUR/USD | any | $0.0001 | $10 | $1 | $0.1 | $0.01 |

| USD/JPY | 1 USD = 80 JPY | $0.000125 | $12.5 | $1.25 | $0.125 | $0.0125 |

Your broker may have a different convention for calculating pip values relative to lot size but whatever way they do it, they’ll be able to tell you what the pip value is for the currency you are trading at that particular time.

In other words, they do all the math calculations for you!

As the market moves, so will the pip value depending on what currency you are currently trading.

What the heck is leverage?

You are probably wondering how a small investor like yourself can trade such large amounts of money.

Think of your broker as a bank who basically fronts you $100,000 to buy currencies.

All the bank asks from you is that you give it $1,000 as a good faith deposit, which it will hold for you but not necessarily keep.

Sounds too good to be true? This is how forex trading using leverage works.

The amount of leverage you use will depend on your broker and what you feel comfortable with.

Typically the broker will require a deposit, also known as “margin“.

Once you have deposited your money, you will then be able to trade. The broker will also specify how much margin is required per position (lot) traded.

No problem as your broker would set aside $1,000 as a deposit and let you “borrow” the rest.

Of course, any losses or gains will be deducted or added to the remaining cash balance in your account.

The minimum security (margin) for each lot will vary from broker to broker.

In the example above, the broker required a 1% margin. This means that for every $100,000 traded, the broker wants $1,000 as a deposit on the position.

Let’s say you want to buy 1 standard lot (100,000) of USD/JPY. If your account is allowed 100:1 leverage, you will have to put up $1,000 as margin.

The $1,000 is NOT a fee, it’s a deposit.

You get it back when you close your trade.

The reason the broker requires the deposit is that while the trade is open, there’s the risk that you could lose money on the position!

Assuming that this USD/JPY trade is the only position you have open in your account, you would have to maintain your account’s equity (absolute value of your trading account) of at least $1,000 at all times in order to be allowed to keep the trade open.

If USD/JPY plummets and your trading losses cause your account equity to fall below $1,000, the broker’s system would automatically close out your trade to prevent further losses.

This is a safety mechanism to prevent your account balance from going negative.

Understanding how margin trading works is so important that we have dedicated a whole section to it later in the school.

It is a must-read if you don’t want to blow up your account!

How the heck do I calculate profit and loss?

So now that you know how to calculate pip value and leverage, let’s look at how you calculate your profit or loss.

Let’s buy U.S. Dollars and sell swiss francs.

- The rate you are quoted is 1.4525 / 1.4530. Because you are buying U.S. Dollars you will be working on the “ASK” price of 1.4530, the rate at which traders are prepared to sell.

- So you buy 1 standard lot (100,000 units) at 1.4530.

- A few hours later, the price moves to 1.4550 and you decide to close your trade.

- The new quote for USD/CHF is 1.4550 / 1.4555. Since you initially bought to open the trade, to close the trade, you now must sell in order to close the trade so you must take the “BID” price of 1.4550. The price that traders are prepared to buy at.

- The difference between 1.4530 and 1.4550 is .0020 or 20 pips.

- Using our formula from before, we now have (.0001/1.4550) x 100,000 = $6.87 per pip x 20 pips = $137.40

Bid/ask spread

Remember, when you enter or exit a trade, you are subject to the spread in the bid/ask quote.

When you buy a currency, you will use the offer or ASK price.

When you sell, you will use the BID price.

Next up, we’ll give you a roundup of the freshest forex lingos you’ve learned!

What is a lot size in forex?

In this article we will see what a lot in forex is and how a lot size in forex can be classified.

For instance there are different lot sizes in forex, each of them with a different value.

When trading, each selected lot size in forex involves a different amount of money.

This can range from a micro lot which is equal to 0.01, to a standard lot (1).

What is a lot in forex?

A lot represents a unit of measure in a forex transaction. Thanks to this it’s possible to know how much money a trader needs to use for a single trade.

The smallest lot size in forex is called a microlot and it’s worth 0,0. There’s then the minilot which is 0,1 and it’s the medium size.

However, there’s no limit to the highest amount – even if some brokers set a maximum of 20 lots for every single trade position.

A standard lot size forex (1) represents 100.000 units, but this doesn’t mean that a trader should have $100.000 in their account.

Let’s explain this better with an example.

Example of lot size in forex

In forex trading, a very important factor is the leverage.

In fact, if the chosen leverage is 1:200, it’s just necessary to have $500 to open a position of 1 lot.

We know that this concept can sound a bit complicated, but to keep it simple when trading just remember what the starting leverage is.

Tutorial:

Once you have the starting leverage, you just need to divide 1 lot (so 100.000) for the leverage (200 in this case). The result represents the amount of money you’re going to invest for that position if you decide to open 1 lot.

So this would be $500 in our example.

If $500 is too much for a single investment, it’s possible to select a lower amount of lots, for example 0,1 lot and invest just $50.

How to set up the lot size on metatrader 4

When trading on the MT4 or metatrader 4, setting up the size is essential.

To trade, it’s necessary to press the F9 button and the trading window will open.

There in the volume window (as you can see in the picture), it’s possible to set up the desired lot size.

Finally, to complete the trade, you just need to enter the stop loss and take profit values. You must also decide if you want to sell or buy.

Each forex broker platform will have a different trading window layout. So you can take your time getting to know all the features and how to set up the stop loss etc.

Many brokers offer free forex demo account versions, so new clients can practice trading for free with a set amount of virtual funds. This practice can include opening positions and trying out different combinations of lot sizes and leverage.

How to set up the lot size in a forex platform

The minimum lot size which can be selected is the microlot, so 0.01 lots. To set up the lot size, you need to open up the trading window on your selected forex platform.

Some brokers offer you the chance to trade whilst deciding directly the amount of money you wish to invest in each position.

This might be a big help for beginners who have some difficulties understanding the amount of money invested on lots.

Another big help some trading platforms offer, is the margin call.

What is the margin call

The margin in forex represents a minimum quantity of money which must be in the trading account before a trade can be opened.

Every broker has a different margin requirement, usually between the 1% and 2%.

This means that to open a position with 1 lot (100.000 units) a trader needs to have at least $1000 funded in their account.

Because the 1% of 100.000 units are 1.000 units which represent $1000.

An alternative for the trader can be to open a position with 0.01 which is exactly 1.000 units.

A margin call will happen in the case the trader does not have enough money in their forex account to trade.

If this happens the broker will send a message or an email asking for a new deposit. Alternatively they could also stop the trade automatically.

Click here to learn more about how to trade forex: https://tradingonlineguide.Com/what-is-forex-trading/how-to-trade-forex/

Author of this article and founder of tradingonlineguide.Com

My aim is to help you increase your trading knowledge with helpful content. I come from an economic background and have a strong passion for forex trading. With more than 6 years in the online trading world, I want to share my financial knowledge so that anyone can develop their investment skills.

In my spare time I enjoy cooking and travelling.

Here you can learn more about our review methodology.

Forex lot size vs. Leverage

The terms used by participants in the forex market can be confusing for novice traders. But everyone who comes to the exchange to earn money should understand these concepts. Below we will look at such key concepts as leverage and lot size on forex, and find out what pips are.

The article covers the following subjects:

Leverage and lots in forex

Leverage vs lot size are different concepts on forex, but there is a certain connection between them. Let's figure out what are leverage and lots means.

Leverage means that the trader borrows funds from their forex broker or a related third party. With this financial support, they can open trades more effectively than without leverage.

Now let's define the concept of lot on forex.

Lot is a contract measured in base currency units. So the number of lots or portions of a lot determines the size of the opened trade.

The trader sets the volume in contracts when opening a position. Its value can be from 0.01 to 100.

It is important for beginners on forex to remember the connection between the concepts of forex lot size and leverage.

Leverage actually doesn’t affect the size of the contract and its price. However, the concept of leverage plays a significant role in determining the size of a trader's position. The greater the leverage, the more a trader can afford to buy or sell large lots in quantities that are many times greater than their own funds.

What are the pips?

Above we have discussed what lot and leverage are. The connecting link between these two concepts is a pip (short for percentage in point). It represents the minimum fraction of the change in the value of a trading instrument.

In other words, a pip is the standard smallest unit of measure by which a currency quote can change. On the foreign exchange market, 1 pip is usually equal to $0.00001 in pairs with the US dollar.

Oil and stocks, for example, have two characters after the decimal point. So the last (second after the decimal point) figure is a pip for these assets.

Let's look at the concept of a pip through an example. This way we can clearly see the relationship between lot size and leverage on forex. Suppose we have a direct quote of EURUSD at 1.18699. This means that 1 euro is worth 1.18699 USD.

If this quotation grew by one point (up to 1.18700), the value of 1 US dollar would decrease relative to the euro, since now you have to pay 0.00001 USD more for 1 euro.

Even 1 pip of price change has a direct impact on the final value of the trade.

The standard size of one contract for most brokers is 100,000 units. 1 unit of EURUSD will be equal to 1.18699 USD.

Suppose an investor buys 0.1 lots, hence the contract size will be $11,869.9 (100,000 * 0.1 * 1.18699). Suppose the exchange rate of this pair increases by one pip. Then the price of the contract of the same size will be equal to $11,870.0.

So the cost of 1 pip with a 0.1 contract will be equal to 0.1 USD.

An investor can buy much more with leverage. Suppose that our trader uses a 1:100 leverage and can increase the position by 100 times – they will not buy 0.1, but 10 lots. With such a large position, the cost of 1 pip will be 10 USD.

This example clearly shows how leverage affects the value of a pip through trade size. The more leverage, the larger position a trader can open. The larger the position, the higher the value of one point.

What is lot size

Now let's expand our knowledge of lot sizes. We mostly encounter four varieties.

Number of units

Mini (1/10 of standard lot)

Micro (1/100 of standard lot)

Nano (1/1000 of standard lot)

Standard lot is perhaps the most common type of contract on the forex market and among brokers.

Mini lot is called fractional, it is equal to 1/10 of the standard lot size. It’s much less used than the standard lot. This type of contract is mostly used when trading contracts for cryptocurrency. Sometimes it can be encountered when trading on the metals market.

Micro lot is an even rarer on the forex market. This fractional contract is more common among forex brokers that provide access to CFD trading for cryptocurrencies and metals.

Nano lot is mostly found on the markets for raw materials, metals, and cryptocurrencies. This type of contract is extremely rare on the foreign exchange market.

Important! The size of one lot expressed in base units is usually not determined by the client, but by the requirements of the liquidity provider.

We can see through the example of liteforex that there are completely different lot sizes for different asset groups and types of trading instruments. Liteforex uses a standard lot of 100,000 units for currency pairs and a nano lot for gold. If you look at the cryptocurrencies, liteforex offers its clients to trade bitcoin and ethereum in lots of only 1 unit! Detailed information on contract sizes for each trading instrument can be found here.

It should be remembered that the cost of a position depends not only on the number of units in the contract but also on the value of the underlying asset or currency in which these units are expressed.

In the example above, we counted 0.1 lots for the EURUSD pair as 10,000 euro units denominated in dollars. Other instruments are calculated by the same principle.

For example, a position in XAUUSD with a lot of 100 units will be equal to 100 troy ounces in US dollars.

In the same way, for 1 GBPJPY contract equal to 100,000 units, the trade value will be 100,000 british pounds against the japanese yen.

What does all this mean for the forex market participant? Only that by buying cross rates (currency pairs that are not quoted against the US dollar), you are not only betting that the quoted instrument will grow, but also that the value of the quote currency will fall.

It is important for every trader and investor to know all the details of trading a specific instrument.

You can find the most detailed information about each asset in the trader's personal account. It’s accessible even without registration. To do this, go to the "trade" section, select the desired trading instrument, click on "instrument information" and scroll down to the "additional information" widget.

In addition to information about the lot, you can see a lot of useful data there:

The cost of one pip when buying 1 contract for this instrument.

Quoted currency - the monetary unit in which the quote price is expressed. It always comes second in the designation of the pair. So it’s pretty easy to identify. Stocks, oil, indices have no quotation currency in the name of the asset. You can find information on how the asset is denominated in the section “information about instrument”.

Base currency is the currency in which the contract price is expressed and which is traded in relation to the quoted currency.

Size of 1 lot and the currency it is expressed in for this asset. This currency is usually called the base currency.

Leverage set up on your account. If the broker has a leverage set for an asset in the form of % of the margin, you will also see the leverage it corresponds to.

The size of the buy and sell swap and the day of the triple swap. Swap is an overnight fee.

What is leverage

Leverage is a concept very closely related to margin. It is a financial tool that allows traders to trade a much larger position than their own trading account size allows.

You have deposited 5,000 USD to your balance. You have chosen to use 1:20 leverage. Therefore, you can open positions for a total amount of 20 times your account = 100,000 USD.

Want to know more about leverage and how it works? Then read this complete beginner's guide here.

Differences & relationship between leverage and lot size in forex

As we now know, leverage and lot size in forex are different concepts.

Let's emphasize again: leverage does not affect the value of one contract. The standard contract in currency will be one hundred thousand units at any leverage.

However, leverage affects the amount of funds at the trader's disposal. In order to see how the size of the forex lots and leverage affect the real value of the trade, let’s look at the calculation formulas with and without leverage.

With leverage, the trade value will be equal to the amount of margin.

So we see that the size of the contract is directly proportional to the value of the trade. This means with an increase in the size of the lot or its quantity, the value of the trade also increases.

The leverage ratio is inversely proportional to the value of the trade and with an increase in the amount of leverage, the value of the trade decreases.

Important: there are different recommendations for using leverage for different types of trading instruments, depending on the conditions of the liquidity provider the broker works with.

The liteforex broker uses leverage for metals, oil, indices, cryptocurrencies, and stocks. This is a decrease in the trade value by setting the percentage of the margin with. You can find this parameter in the specification of a trading instrument.

For currency pairs, the leverage is set by the trader.

So in order to open a position, depending on the asset, you need either a percentage of its actual value or the amount divided by the leverage set by the trader in their account settings:

Lot size in forex – what is it and how to calculate it?

A lot is the smallest trade size that you can place when trading the forex market

What is a lot? A lot is the smallest available trade size that you can place when trading the forex market. The brokers will point to lots by parts of 1000 or a micro lot. You have to know that lot size directly influences the risk you are taking.

Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. It has to be based on the size of your accounts. No matter if you exercise or trade for real. You must understand the amount you would able to risk.

In the stock market, lot size refers to the number of shares you buy in one transaction.

In options trading, lot size signifies the total number of contracts contained in one derivative security. The theory of lot size allows financial markets to regulate price quotes.

It basically refers to the size of the trade that you make in the financial market. With the regulation of prices, investors are always aware of exactly how many units they are buying an individual contract. Hence, they can quickly evaluate what is the price they are paying for each unit.

As it is already written in our previous post, currency movements are measured in pips and depending on your lot size a pip movement will have a different monetary value.

How much is 1 lot?

In forex, 1 standard lot refers to the volume of 100.000 units. So when you buy 1 lot of a forex pair, that means you purchased 100.000 units from the base currency.

Assume that you want to buy EUR/USD and let’s say that the EUR/USD exchange rate is 1.10.

When you buy 1 lot of EURUSD you will be making $110.000 worth of purchase.

If you are using leverage on your broker you don’t need to have $110.000. With 1:100 leverage, you will only need $1.100 (110.000 / 100 = $1.100) in order to be able to execute the order.

When the leverage goes higher, the margin you need to open the trade goes lower.

For example, if you are using 1:500 leverage, you need only $220 (110.000 / 500 = $220) to buy 1 standard lot of EUR/USD.

For 1 lot or standard lot, worth of one pip is equal to $10 if USD is on the counter currency in that pair. Therefore, if EUR/USD goes upwards for 100 pips after you buy, you will make $1000 of profit.

Every trader must define the volume of the trades based on own risk perception. The bigger lot means bigger the profit/loss from the trades.

Of course, it is reasonable sometime to open trades under 1 lot using the mini lot, micro lot and nano lot.

Mini lot size

Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses.

Mini lot is equal to 10% of standard lot (100.000 x 0.10 = 10.000 units). Thus, when you open 0.10 lot, you will trade 1 mini lot. With every mini lot, the worth of 1 pip for EUR/USD equals to $1.

If you are a novice and you want to start trading using mini lots, be well capitalized.

$1 per pip seems like a small amount but in forex trading, the market can move 100 pips in a day, occasionally even in an hour. If the market moves against you, that is a $100 loss. To trade a mini account, you should start with at least $2000.

Micro lot size

Micro lot is equal to %1 of standard lot (100.000 x 0.01 = 1.000 units).

When you trade 0.01 lot of EUR/USD, you buy or sell 1.000 units of EURUSD.

The worth of every 1 pip for EUR/USD is $0.10 if you use a micro lot (0.01).

Micro lots are the smallest tradable lot.

A micro lot is a portion of 1000 units of your accounting funding currency.

If your account is financed in US dollars a micro lot is $1000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents.

Micro lots are very good for beginners.

Nano lot size

Nano lot, named cent lot by some forex brokers, is equal to either 100 or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to 100 units.

Nano lot is not offered by many forex brokers.

Truly, only a few brokers offer this option as an account type such as FXTM and XM.

Nano lot is the safest way to trade if you are a novice trader or if you want to test a new trading strategy.

You can go through the training process with much less risk and loss.

Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Just in order to avoid big losses.

The bottom line

It is smart to likening the lot size that you trade and how a market move would affect you to the amount of support you have when something suddenly happens.

When you place an extremely large trade size relative to your accounts, you can be faced with many troubles.

Even small movement in the market could send a trader the point of no return.

Forex for beginners

Traders ask about:

- What is FOREX

- Beginner trading

- Forex brokers

- Forex currencies

- Forex indicators

- Forex pivot points

- Forex systems

- Forex technical analysis

- Fundamental analysis

- Leverage and margin

Forex lot sizes and risks

What is lot size and what's the risk?

Currencies in forex are traded in lots.

A standard lot size is 100 000 units.

Units refer to the base currency being traded. For example, with USD/CHF the base currency is US dollar, therefore if to trade 1 standard lot of USD/CHF it would be worth $100 000.

Another example: GBP/USD, here the base currency is british pound(GBP), a standard lot for GBP/USD pair will be worth £100 000.

There are three types of lots (by size):

Standard lots = 100 000 units

mini lots = 10 000 units

and micro lots = 1000 units.

Mini and micro lots are offered to traders who open mini accounts (on average from $200 to $1000). Standard lot sizes can be traded with larger accounts only (the requirements for a size of standard account vary from broker to broker).

The smaller the lots size traded, the lower will be profits, but also the lower will be losses.

When traders talk about losses, they also use term "risks". Because trading in forex is as much about losing money as about making money.

Risks in forex refer to the possibility of losing entire investment while trading. Trading forex is known as one of the riskiest capital investments.

With every standard lot traded (100 000 units) a trader risks to lose (or looks to win) $10 per pip. Where pip is the smallest price increment in the last digit in the rate (e.G. The smallest price change/move).

With every mini lot traded (10 000 units) a trader risks to lose (or looks to win) $1 per pip.

With each micro lot (1000 units) - $0.10 per pip.

In forex traders always search for the most efficient ways to limit risks or at least lessen risk effects. For this purpose various risk management and money management strategies are created.

It is impossible to avoid risks in forex trading. In order to limit risks traders use methods of setting protective stops, trailing stops; use hedging techniques, study scalping strategies, look for the best deals on spreads among brokers etc.

Traders with the best risk management strategy earn the largest profits in forex.

Would you like to add your own comment or ask another question?

Discussions speed up learning. Let's talk.

Where some brokers provide their lot size in the format below.How can i set it to 10,000.

0.01

0.0001

1.0 etc

With every mini lot traded (10 000 units) a trader risks to lose (or looks to win) $1 per pip.

With each mini lot (1000 units) - $0.10 per pip.

Isn't it supposed to be: with each MICRO lot (1000 units) - $0.10 per pip. ?

Yes, should be "micro" there. Thank you.

Don understand this lot thing, can i get detailed explanation

I' also new, when you guys say: 1000 units risk $0.1 per pip, you are assuming that my leverage is 1:100

To the average person;this is a stupid very explanation: pips, units. What is that?

Is there any fixed time limit to sell? How long one can wait for the sell to get profit or sell at no loss?

Pls what does it mean to have traded 40 standard lots for a 400 usd forex accoun

How do I set the lot size to receive $10.00 per pip?

If am trading with $3000 and I risk about 0.20 lot per trade, how much have I invested from my capital.

Thanks

How do I set the lot size to receive $10.00 per pip?

If am trading with $3000 and I risk about 0.20 lot per trade, how much have I invested from my capital.

Thanks > best to start off with a mini lot.

If u wanna knw/share all the info about forex add me on skype. My id is fx.Aarish

While changing the lot size adjusts the pip value, adjusting your stop loss and target price also affects the overall risk of that particular trade. Essentially, without a stop loss, you are risking your whole account. The larger the lot size, the faster you'll blow the account up, or the faster you'll double it.

Still trying to find good tools to calculate risk in metatrader4, but starting to get a feel for it.

For those who trade micro accounts using the metatrader 4 or 5 i will explain how the lot size goes. You would see a 0.01 format under lot size (some brokers use this format) what this really means is that you are trading at 1000 units which will mean $0.10 per pip. A pip is a price movement from one price to another so if the price of the EUR/USD was 1.4600 and it moved 5 pips upward the new price should be 1.4605, however if it moves 5 pips downward it should 1.4595. Prices move on a vertical scale (UP or DOWN) and therefore it all comes down to either buying the currency or selling it, plain and simple.

Here is further breakdown of the lot size, units traded and amount risked

0.02 - 2000 units - $0.20

0.03 - 3000 units - $0.30

0.04 - 4000 units - $0.40

0.05 - 5000 units - $0.50

1.00 - 10000 units - $1

2.00 - 20000 units - $2

3.00 - 30000 units - $3

I see this an old post but I am sure other new traders will come across this so I thought I would write this to try to help about your risk!

Basically 1 lot = $100.000 dollars or pounds depending on what the base currency is.

If you trade one lot $100.000 you risk to lose or profit $10 per pip.

If you trade one mini lot $10.000 you risk to lose or profit $1 per pip

if you trade one micro lot $1000 you risk to lose or profit $0.10 per pip

A good rule is not to risk more than 2% of your equity in your accounton any one trade.

If you have an acoount with $10.Ooo and trade one lot you would not want to risk any more than 2% which = $200 dollers so that gives you a 20 pip loss or profit at 1:100 levarage

So if you have a mini account and have $1000 dollers you would only have $20 dollers to risk so with a full lot that is two pips. Just dont do it you will lose your money in no time unless you win every trade which wont happen. You need to trade 1 mini lot which you can risk $20 and have a spread of 20 pips. And win or lose 1 doller a pip. It is not unuasal for a good patient trader to do 200 pips a week at a steady pace. Thats a 20% return on your account which is higher than most hedge fund managers .. Obviosly they deal in millions but the moral is all about % percantage return of your total equity.. Good luck pips.

If you want a good broker and you are in the uk .. Barx direct fx.. Min deposit 5000 pounds or fxpro ecn platform 1000 pounds min deposit.

Keep to this startergy ubtil you are in continuios profit and build up your account.

I want to start trading with $1000, what type of lot should i use? Can u help me.

Thanks

The principles behind lots trading and pips calculation

What you will learn:

- Lot definition

- Different lot sizes explained

- USD and EUR practical illustrations

- The correlation between margin and leverage

- Understanding the intrigues in margin call calculation

What is a lot size in forex?

In forex trading, a standard lot refers to a standard size of a specific financial instrument. It is one of the prerequisites to get familiar with for forex starters.

Standard lots

This is the standard size of one lot which is 100,000 units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the EUR and therefore, 1 lot or 100,000 units worth 100,000 eurs.

Mini lots

Now, let’s use smaller sizes. Traders use mini lots when they wish to trade smaller sizes. For example, a trader may wish to trade only 10,000 units. So when a trader places a trade of 0.10 lots or 10,000 base units on GBP/USD, this means that he trades 10,000 british pounds.

Micro lots

There are many beginners or small investors who wish to use the smallest possible lots sizes. In contrary to the mini lots that refer to 10,000 units, traders are welcome to trade 1,000 units or 0.01. For example, when someone trades USD/CHF with a micro lot the trader basically trades 1,000 usds.

Pip value

Now that we understand what lots are, let’s take one step further. We need to calculate the pip value so we can estimate our profits or losses from our trading.

The simplest way to calculate the pip value is to first use the standard lots. You will then have to adjust your calculations so you can find the pip value on mini lots, micro lots or any other lot size you wish to trade.

USD base currency

Our calculations in this sector are when your base currency is the USD. We will provide three different examples.

USD quote currency of the currency pair. You’re trading 1 standard lot (100,000 base units) that the quote currency is the USD such as EUR/USD. The pip value is calculated as below:

100,000*0.0001 (4th decimal)=$10

USD base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) and the base currency is the USD such as USD/JPY. The pip value is calculated as below:

The USD/JPY is traded at 99.735 means that $1=99.73 JPY 100,000*0.01 (the 2nd decimal) /99.735≈$10.03. We approximated because the exchange rate changes, so does the value of each pip.

Finding the pip value in a currency pair that the USD is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY.

The GBP/JPY is traded at 153.320. Because the value changes in the quote currency times the exchange rate ratio as

The pip value => 100,000*0.01JPY*1GBP/153.320JPY = 6.5 GBP

Because the base currency of the account is the USD then we need to take into account the GBP/USD rate which let’s assume that is currently at 1.53560.

6.5 GBP/(1 GBP/1.53560 USD)= $9.98

EUR base currency

Now let’s make our examples when the base currency of our account is the EUR

EUR base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) on EUR/USD. The pip value is calculated as below

The EUR/USD is traded at 1.30610 means that 1 EUR=$1.30 USD so

100,000*0.0001 (4th decimal)/1.30610 ≈7.66 EUR

Finding the pip value in a currency pair that the EUR is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY. From our example before, we know that the value is 6.5 GBP. Now, we need to take into account the EUR/GBP rate in order to calculate the pip value. Let’s assume that the rate is currently at 0.85000. So:

6.5GBP/(1GBP*0.85 EUR)= (6.5 GBP/1 GBP)/0.85 EUR≈7.65 EUR

Leverage – how it works

You are probably wondering how can I trade with lot sizes of 100,000 base units or even 1,000 base units. Well, the answer is very simple. This is available to you from the leverage you have in your account. So let’s assume that your account’s leverage is set at 100:1. This means that for every $1 used, you’re actually trading $100 in the forex market. In order for you to trade a position of $100,000 then the required margin to open such a position will be $1,000. As for any losses or gains these will be deducted or added to the remaining balance in your account.

If your account’s leverage is set at 200:1 this means that for every $1 you use you’re actually trading $200. So for a trade of $100,000 you will require a margin to be at $500.

Margin call – what you should know

Now looking at the examples above regarding the leverage you’re probably thinking that is the best to work with the highest possible leverage. However, you need to take into consideration your margin requirements as well as the risks associated with higher leverages.

Let’s just say that you have deposited first $5,000 to your trading account that the leverage is set at 100:1. Your nominated currency is the USD. The first time you will login to your MT4 trading account you will notice that the balance and the equity is $5,000 and this is due to the fact that you did not place any trades yet.

Now, you have decided to open a position on the USD/CHF of the 1 standard lot which means that you will require use a margin of $1,000. The floating P/L is at -9.55. The account will show the following

| balance | equity | margin | free margin | margin level |

|---|---|---|---|---|

| 5,000 | 4,990.45 (5,000-9.55) | 1,000 | 3,990.45 (4,990.45-1000) | 499.05% (4990.45/1000)*100 |

If your forex broker margin call level is set at 100% this means that when the margin level reaches this percentage it will notify you to add more funds. As you can understand from the example above, the P/L, and your margin will affect your margin level. Now, if your broker sets the stop out level at 50% this means that your position will be closed by the broker when the margin level reaches that level.

Let’s use another example when your leverage is set at 200:1. We will use the same example above to understand how the leverage will affect your margin level. Your account will show the following

By looking at the numbers above, you will prefer to use a higher leverage for your account. However, let’s assume that the market goes against you and you have bought 9 lots of USD/CHF but the pair falls. When you open your position you will have the following numbers:

As we explained above, the broker will give you a margin call when you have 100% margin level. This means that you will receive a margin call when the USD/CHF falls 5 pips only. On the other hand, if you had a leverage set at 100:1 the would not allow you to enter into such a position from the first place and you would have saved your equity.

So, let's see, what we have: A list with the largest forex brokers in the world, ranked by volume of daily transactions. See the biggest forex companies in each region. At biggest lot size forex

Contents of the article

- Free forex bonuses

- Largest forex brokers in the world 2020

- How to measure the biggest forex companies

- Largest forex brokers by volume

- Largest forex brokers in the united states

- Largest forex brokers in europe

- Biggest forex brokers in australia by volume

- Largest forex brokers from other jurisdictions

- Which large forex brokers are truly global?

- 3 types of forex trade sizes

- What is a lot in forex?

- What the heck is leverage?

- How the heck do I calculate profit and loss?

- What is a lot size in forex?

- What is a lot in forex?

- Example of lot size in forex

- How to set up the lot size on metatrader 4

- How to set up the lot size in a forex platform

- What is the margin call

- Forex lot size vs. Leverage

- Leverage and lots in forex

- Differences & relationship between leverage and...

- Lot size in forex – what is it and how to...

- A lot is the smallest trade size that you can...

- How much is 1 lot?

- Mini lot size

- Micro lot size

- Nano lot size

- Forex for beginners

- Traders ask about:

- Forex lot sizes and risks

- The principles behind lots trading and pips...

- What you will learn:

- What is a lot size in forex?

- Standard lots

- Mini lots

- Micro lots

- Pip value

- USD base currency

- 100,000*0.0001 (4th decimal)=$10

- The pip value => 100,000*0.01JPY*1GBP/153.320JPY...

- 6.5 GBP/(1 GBP/1.53560 USD)= $9.98

- EUR base currency

- Leverage – how it works

- Margin call – what you should know

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.