Who can trade forex for me

Let’s look at the same example from earlier. You purchased 10,000 units of EUR at the EUR/USD rate of 1.2200.

Free forex bonuses

This would require an upfront deposit of $12,200 (10,000 units x 1.2200). The forex market allows investors to peg the strength of one currency against another — or, to look at it another way, one economy versus another. When an investor trades for a currency, they think one economy is better relative to the other.

Is forex for me?

What the average investor should know about the world’s most liquid market.

Even if you’re a casual investor, you’ve probably heard of forex. It’s a fancy finance portmanteau that sounds sophisticated — but is it worth your time?

For the casual, set-it-and-forget-it investor, probably not. For more active investors that enjoy economics, it could be.

Regardless, it’s at least worth understanding. And to help you develop that understanding, let’s walk through the basics of forex.

What is forex?

Forex stands for foreign currency exchange. In other words, it’s taking one currency (like the U.S. Dollar) and trading it for another (like the mexican peso). Some of the world’s most traded currencies are:

- U.S. Dollar (USD)

- European euro (EUR)

- British pound (GBP)

- Japanese yen (JPY)

- Swiss franc (CHF)

- Canadian dollar (CAD)

- New zealand dollar (NZD)

- Australian dollar (AUD)

Quick aside: does it bother you like it bothers me that the swiss franc’s symbol isn’t intuitive? A quick use of the google machine tells us the latin name of switzerland is “confoederatio helvetica.” combining that with the franc, and we get “CHF.” how pompous.

Of course, there are many currencies beyond these eight. Currencies that aren’t considered “major” are known as exotic currencies and trade at lower volumes. The indian rupee (INR) and russian ruble (RUB) are two examples.

Before we go any further, it’s helpful to revisit what fiat currencies are. Fiat currency, like USD, is issued by the government and standardizes commerce. Instead of trading textiles for tobacco or milk for a haircut, you have a government-backed currency that simplifies the exchange of goods and services. An economy that has a lot of production, trade, and stability will have a strong currency.

The forex market allows investors to peg the strength of one currency against another — or, to look at it another way, one economy versus another. When an investor trades for a currency, they think one economy is better relative to the other.

How does forex trading work?

Institutions and individual investors can trade forex 24 hours a day, 5 days a week. While institutions can enter trades over the weekend, retail investors have stricter windows. For instance, the U.S. Forex market shuts down for the weekend at 5 pm EST before reopening sunday evening at 5 pm EST.

There isn’t a centralized exchange for forex. Instead, currencies trade “over the counter” (OTC), meaning they’re purchased and sold via a network of banks in whatever market is open. Beyond the U.S. Forex center in new york, the other major hubs are in sydney, london, and tokyo.

Currencies are traded in pairs, so you’ll see them priced this way. For example, if you want to convert your USD into EUR, the exchange rate is quoted as EUR/USD. This rate tells you how many U.S. Dollars it’ll take to buy one euro. The first currency listed is known as the base currency, and it’s always the one you’re purchasing. The second currency is known as the quote currency.

Here’s a list of the major currency pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD

Unlike stocks, forex rates are priced out to the fifth decimal. For example, as of right this second, the EUR/USD exchange rate is $1.21937. In the forex world, you’ll often hear the term “pip” to quantify price movements. This stands for “point in percentage.”

For dollar-related exchanges, a pip refers to the changes to the fourth decimal place, so if the EUR/USD moves from 1.219 37 to 1.219 57, then the rate moved two pips.

Of course, the fifth decimal has playful monikers too — pipettes and micro pips.

Currencies are traded in “lots,” which vary in size.

- Micro lots are 1,000 units of a currency

- Mini lots are 10,000 units of a currency

- Standard lots are 100,000 units of a currency

Now, let’s walk through an example of a trade.

Let’s assume you buy 10,000 units of EUR using USD when the EUR/USD rate is 1.2200 (ignoring pipettes). Over the following day, the EUR/USD rate moves to 1.2230. You decide to sell, making a 30-pip profit. Since you purchased 10,000 units, each pip is valued at $1 (10,000 units x 0.0001). So, your profit would be $30 ($1 x 30 pips).

What is leverage?

Leverage enables investors to enter a trade for only a fraction of the trade’s purchase price. A lender covers most of your position, while you’re responsible for a small percentage — which is known as margin. Think of it like putting a downpayment on a house or a car. You pay 10–20% upfront, while the lender covers the rest.

Let’s look at the same example from earlier. You purchased 10,000 units of EUR at the EUR/USD rate of 1.2200. This would require an upfront deposit of $12,200 (10,000 units x 1.2200).

However, if you used leverage to make this purchase at a 10% margin, your exposure would only be $1,220. Your total position is still $12,200, but the lender funds the other 90%. Your total exposure relative to your margin is called your leverage ratio. In this case, your leverage ratio is 10:1 (i.E. $12,200 / $1,220).

The EUR/USD rate increases by 30 pips, your position increases to $12,230. You sell and earn a profit of $30.

Whether you use leverage or not, your profit is still $30 in this example. That said, your upfront exposure is only $1,220 with leverage — versus $12,200 without. Leverage opens the door for investors to amplify their gains with less upfront capital.

However, that concept works in the reverse too. Investors must be aware of leverage’s risks.

Just as it can amplify your gains, leverage amplifies your losses too if rate movements go against your expectations.

Leveraged trading allows you to enter trades well above your actual capital. It’s not uncommon to see investors trade at leverage ratios of 100:1 or even 200:1. In other words, if you have $1,000 to trade, you’d have $100,000 of trade capital at your disposal with 100:1 leverage.

A 10% loss on a $1,000 trade without leverage is a loss of $100. A 10% loss on a $100,000 leveraged trade is a loss of $10,000. Leverage makes losses more severe. You’re still responsible for repaying your lender, so you could be in a scary financial bind if you take too much risk.

What influences exchange rates?

Several factors influence exchange rates, including inflation, interest rates, and production.

Don’t worry, I’ll keep the economics lecture short.

Inflation represents increasing prices of goods and services, which means the associated currency has less purchasing power. When inflation is high in a particular country, there’s less demand for that country’s currency — and vice versa.

Federal governments can use interest rates to manipulate inflation and exchange rates. Higher interest rates mean higher returns for lenders and bank accounts, which can increase cash inflows into a country. So, higher interest rates tend to increase demand for a country’s currency, while low interest rates have the opposite effect.

Production, as measured by gross domestic product (GDP), illustrates whether an economy is growing, receding, or stagnant. A growing economy is more appealing, driving exchange rates up. On the other hand, if a country is struggling through a recession or political turmoil (sound familiar to anyone?), demand for that country’s currency will decline.

However, these aren’t the only influencers. A country’s trade policies, like tariffs on imported goods, can impact the demand for its currency too. So can a country’s balance of payments and government debt balance. There are a lot of moving pieces within an economy to consider.

How to learn more about forex

Forex trading isn’t something you pick up and master on a casual sunday afternoon because you’re bored. It takes time to understand and learn effective strategies.

If you want to learn more about the forex market, there are countless free resources for you to explore. Investopedia does a decent job of simplifying a complex subject, and it has a wealth of information.

If you’re looking for something more hands-on without the risk, one free resource that I’ve found interesting is an app called trading game.

It has a couple of forex courses with 18 modules in total — plus quizzes to reinforce your learning. As you complete courses and quizzes, you unlock play money to practice making forex trades.

Forex isn’t easy, but they do a good job of simplifying it.

Who can trade forex for me

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

I RESIDE IN AJAH WHATSAPP ME ON

whatsapp

http:///2348136750311

You are more responsible than this statement ben.

Anyway thanks for the comment. And assistant in advance

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Sure i do have, i will contact you asap

Hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

Help a sister. I beg thee

Hairbyuj:

hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

Help a sister. I beg thee

There is a school for forex trader called www.Babypips.Com if u are focused u can actually learn forex for free there

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

When you finally see who to teach you, practice what you were taught for at least 3 months successfully before putting your money else you will keep losing money

There is a school for forex trader called www.Babypips.Com if u are focused u can actually learn forex for free there

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

I can help out on binary options trading and binary options signals. Most options brokers have what they call leaderboard, which is a list of top profit traders. I will link you up with the number one person on the leader board and show you how to copy his live trades

It's not free, you pay only when you confirm that you're getting is promised

Contact me if you're interested

http:///2348094414899

Hairbyuj:

hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

Can I get someone to trade forex for me? (auto trading explained)

Are you a newbie forex trader? If yes, then you must be new to different terms and concepts of the forex market. As a newbie forex trader, you don’t want to lose money and learn. When you are completely new to this market, you have two options – either learn to trade from scratch or get someone to trade forex on your behalf.

So can you get somebody to trade forex for you?

Yes, you can get someone to trade forex on your behalf. There are so many professional forex traders out there in the market that can help you with forex trading. Getting this type of service to allow you to invest in the market without having expert-level knowledge. New traders often choose this kind of service, because this way they invest in the market and reduce the chances of losing money.

FOREX managed account brokers

A forex managed account is the account managed by the professional forex trader on behalf of his/her client. There are so many forex managed account brokers out there in the market. If you don’t want to spend time doing research, studying the market, and invest in the forex, then you can hire a professional forex trader or money manager for it.

The professional trader you hire will keep an eye on trading opportunities and based on his/her knowledge & experience, he/she will manage your forex trading account.

A managed forex account can be compared with the investment accounts of equities. These are the accounts in which the manager handles the account. Before hiring a particular forex professional to trade on your behalf, the money manager (forex professional) and you (client) have to sign a contract.

The signed agreement or document states that the client allows the trader to trade in the forex market on his/her behalf. By getting someone to trade forex on your behalf, you will not require any technical knowledge or skills regarding the forex market. Apart from this, this also helps you to save a great amount of time.

This way, you do not have to spend time researching the market and learning how to trade. While hiring someone trade forex for you, make sure the hired forex professional is reliable and trustable.

Pros & cons of letting someone trade forex for you

Whether you invest in the market by yourself or let someone trade for you, both of them have their pros and cons. Which one you should choose is based on your situation.

Pros of letting someone trade forex for you

Here are some benefits of getting someone trade forex for you:

1. You don’t have to spend time researching

The major headache in trading forex is you have to spend a huge amount of time doing research and understanding the market. If you don’t have enough time sitting and doing research, then letting someone trade forex on your behalf is a good idea. This way, you can avoid getting bored by doing research and looking at data charts for hours.

2. You don’t have to spend time studying the forex

If you are a newbie and want to start investing in the forex market, you have two options first, hire someone trade forex for you and the second one, trade forex by yourself. The major advantage of getting someone to trade forex for newbies is they don’t have to spend a huge amount of time studying the forex. When you have someone trading on your behalf, you don’t have to worry about studying from scratch (if you are new to the market)

Cons of letting someone trade forex for you

There are also some cons of letting someone trade forex for you. Here are some cons:

1. Hiring a professional forex trader can be expensive

The major disadvantage of hiring a professional trader is it can be really expensive. When you hire someone to trade for you, you have to pay commissions, depending upon the expertise of the trader.

2. Not all of them are reliable

While getting someone trade forex for you, you need to make sure that the professional you have selected is trustable and reliable. You don’t need to give access to your account and money to some stranger or the person you don’t trust. Hence, getting the wrong person for this may result in huge losses.

So these are some pros and cons of letting someone trade forex on your behalf. Depending upon your situation, this could be ideal for you. Now let’s discuss some pros and cons of trading forex by yourself.

Pros & cons of trading the forex by yourself

If you have got knowledge and experience in the forex market, then it is advisable to trade by yourself. Again, trading by self has its own pros and cons. Here’s the list:

Pros of trading the forex by yourself

Are you an experienced forex trader? Then, you should trade by yourself. Here are some major advantages of trading in the forex market on your own:

1. You don’t have to pay commissions

Hiring a professional forex trader for trading on your behalf can be expensive. And, this may not be suitable for each and every person out there. The best thing about trading your own is you do not have to pay any commission and you will earn all the profits you make. You will be responsible for the profits or losses that occur. So, if you have experience in forex trading, you should not hire anyone to trade on your behalf.

2. Don’t worry about finding the right trader

Another advantage of doing it yourself is you do not have to worry about finding the right professional forex trader. For the people who want to hire someone who can trade on their behalf, they have to mess with finding the right person. It is essential because no one would like to give account access & money to the professional who is not trustable.

Cons of trading the forex by yourself

There are also some disadvantages when it comes to doing forex trading your own. Here are some of them:

1. You have to mess with researching

If you don’t like researching and spending long hours looking at data charts, then you should consider hiring a professional who can trade forex on your behalf. In order to make correct decisions and make the most, it is important to focus on the research part. So, the major disadvantage of trading the forex by yourself is you have to spend long hours doing research.

2. You need to learn so much

If you are a complete beginner in this field, you should not simply start doing trading. If you get started in this field without having proper knowledge, the chances are you will lose. For a newbie, it is advisable to gain proper knowledge then get started with forex trading. Hence, if you want to trade forex by yourself, you have to spend a great amount of time learning.

Conclusion

So, the answer to this question is yes, you can get someone to trade forex on your behalf. By getting someone to trade for you, you will be worry-free and stress-free. This way, you do not have to worry about doing market research and spending long hours looking at data charts.

Forex managed account brokers provide this kind of service. They are the professional forex traders. While hiring someone to trade on your behalf, keep in mind the trust and reliability factor. It is essential because you should not give your account access to the stranger or someone unreliable.

17 simple ways to raise $5,000 to fund forex trading account

How would you raise $5,000 to fund forex trading account? Live trading account, I mean?

For many, $5,000 could be 6 months salary, or 1 year’s salary. It really depends on which part of the world you live in. Now, even though $5,000 may be hard to get, it is not impossible.

Almost all forex websites you visit tell you about how to trade etc..But no-one really talks about the fact that in order to trade, you need cash and actually how to get the money required to start forex trading live.

I guess everyone assumes that anybody who wants to trade forex has adequate money to start with, right?

Actually, there are people interested in trading forex but really have no money at all.

Well, because that’s how the world works…some people have it, some people just don’t.

If something is hard to get…

If something is hard to get,what do you do?

You see, dreaming does not bring results. Taking action does.

When you are hungry, you do not dream about food or wish that food will fly to your mouth. It never happens. Not in this life.

Your hungry stomach will make you stand up, take a walk to the kitchen to cook something, or open the refrigerator to see if there is any food in it, or jump in the car and drive to mcdonalds or KFC or whatever.

When your stomach demands food it is near impossible to ignore it.

Let me construct the sequence of events that happens when you are hungry:

- Step 1: you feel hungry (situation)

- Step 2: your mind tells you where to find food (solution)

- Step 3: you leave whatever you are doing at the moment and you go and find food (taking action)

- Step 4: food in your hand, into your mount, into your stomach (mission accomplished!)

As a forex trader needing cash to fund a live forex trading account, you situation would be like this:

Situation: need to find $5,000 to fund forex trading account

Solution: what ways or options can I raise $5,000?

Taking action: this is when you start doing what it takes to get $5,000.

Mission accomplished: you finally get $5,000 and fund your forex trading account.

OK, how would you actually get $5,000?

Now, think of it this way…$5,000 in itself is quite a big number, or isn’t? It isn’t a huge amount when you break it down into smaller parts.

- Five thousand one dollars.

- Or five hundred $10 dollars

- Or one hundred $50

- Or 200 hundred $25

You get what I’m trying to say here?

In here are 17 actionable ways where I hope can give you some ideas on how to raise $5,000 to trade forex.

1: mow lawns for for 200 neighbors for $25

Do you have a ride-on mower?

Or just an ordinary push lawn mower?

Do you know 200 neighbors where you can ask to mow their laws for $25? Or what about 100 neighbors but you mow their lawns twice, maybe 1 or 2 months apart?

I’d happily pay anyone to mow my law for $25! You wan’t to know why? Because I’d rather sit in front of the computer than mow the lawn.

If I’m like that, imagine there are millions of people in the world today, who are so into technology, facebook, twitter, instagram, youtube…TV, you name it and they just can’t find the time to mow their own lawns. This situation is especially true in developed countries.

Mowing lawns in the past used to be something I enjoyed doing…now, its not. I hate mowing. Its my missus that actually “kicks my arse” to get out and mow the lawn.

If that is how I view mowing lawns, imagine that there are many more like me and and the’d be happy to pay you to mow their lawn…even if they have their own lawn mowers, just ask them.

Or what if you don’t have a lawn mower but your neighbor has a lawn mower and you realize that his lawn is getting tall.

You go up to his door, knock on the door and say ” hello mr neighbour, I noticed you need to mow the lawn but I can do it for you for $25.” (CLICK NUMBERED BUTTONS BELOW TO CONTINUE TO #2)

Can I pay someone to trade forex for me? 2020

“is it possible to pay someone to trade forex for me?”

I have heard that phrase many times during the time I have been involved with this website and my other websites.

The simple answer to this question is that, yes, there are companies that trade forex on your behalf.

The word “pay” is slightly erroneous because you don’t actually pay the company from your own money, the forex trader will get his payment from the profits that you make on your account. So yes, he gets paid because of you but it doesn’t actually cost you anything.

The type of investment that will get someone to trade for you is called forex managed accounts. Check out our sister site www.Acorn2oak-fx.Com/managedforexaccounts/blog/ukcitizens.Html they are not widely known as they are a type of alternative investment and are therefore different from traditional investments such as insurance, savings accounts, bonds, mutual funds etc.

A managed account that will trade your forex account for you are becoming more and more popular year by year, mainly because ease of access.

Only a decade ago, it was only high net worth individuals and institutional investors that had a minimum of 100,000 dollars and more often 1,000,000 dollars to take part in this investment, and they had to be invited to join.

Nowadays, managed forex companies will trade forex on your behalf with as little you depositing a minimum opening balance of £5,000 or $10,000 dollars. Some companies will let you start with as little as $1,000, but I would be very aware of these companies as the will not be regulated by the regulating body, such as the FCA (financial conduct authority) in the UK.

Why hire someone to trade forex for you? A little background information

In recent years, the forex market has become one of the largest liquid and fastest growing trading markets in the world. About $ 5 trillion dollars is expected to be exchanged in daily foreign exchange transactions, exchanged and paid at foreign exchange prices.

The bulk of trading has traditionally been large banks and multinational corporations that seek to minimise the impact of fluctuations in currency exchanges as professional fund managers

The emergence of electronic trading platforms such as metatrader 4 has made it possible for foreign investors to trade globally, and they trade around the clock, resulting in a very liquid and volatile market capable of generating huge profits as well as potentially large losses.

Forex is an incredibly complex market, influenced by many factors and very sudden movements and changes. It is important to be aware of market news, major economic news and further market fluctuations.

Various charts and technical analysis are available to help traders understand market movements and make decisions based on evidence and statistical modelling. However, in a poor world, learning how to effectively take all this information and make decisions on strategy and oversight is difficult if not your full time job.

Thus, more and more investors are turning to managed foreign exchange accounts and professional traders as a solution to participate in a potentially extremely profitable market and risk losses due to lack of time or understanding of the complexities of forex trading.

Interest in managed foreign exchange accounts is increasing from the early stages for many online forex brokers. In the last month alone, one of the leading brokers licensed to deal with the EU has noted an increase in the number of clients who are nominated from professional fund managers.

According to industry experts, if your account is run by someone who has a proven track record of trading and has excellent understanding and knowledge of the foreign exchange markets, this is potentially a great advantage.

Many traders have decided to hire a trader to trade forex for them because it is effective, like a shadow at work, and you have the opportunity to watch the expert trading your account, while you follow the markets and take away all the information available to you. This can be a great way to gain experience and speed up the learning curve without the risk of making many mistakes.

The challenge, as always, is to find someone who can do this effectively for you and who can provide ample evidence of successful trading history and experience, knowing that they will be right with their funds and seizing opportunities when they present themselves.

While many forex brokers actually manage accounts for retail investors, some provide fund managers with the ideal account management environment, as well as all the tools they need to effectively monitor their managed foreign exchange accounts on behalf of individual clients.

Fund managers are particularly interested in brokers who offer a high level of service, in particular on an individual basis, and some will prefer direct contact with an account manager without a commission or commission structure, allowing them to trade in the best conditions for their clients.

Some brokers also offer a variety of tools for managed currency accounts, such as the multi-account management tool or MAM and multitrader. Professional money managers also often become business partners for online forex brokers to generate additional income.

Is forex for me?

What the average investor should know about the world’s most liquid market.

Even if you’re a casual investor, you’ve probably heard of forex. It’s a fancy finance portmanteau that sounds sophisticated — but is it worth your time?

For the casual, set-it-and-forget-it investor, probably not. For more active investors that enjoy economics, it could be.

Regardless, it’s at least worth understanding. And to help you develop that understanding, let’s walk through the basics of forex.

What is forex?

Forex stands for foreign currency exchange. In other words, it’s taking one currency (like the U.S. Dollar) and trading it for another (like the mexican peso). Some of the world’s most traded currencies are:

- U.S. Dollar (USD)

- European euro (EUR)

- British pound (GBP)

- Japanese yen (JPY)

- Swiss franc (CHF)

- Canadian dollar (CAD)

- New zealand dollar (NZD)

- Australian dollar (AUD)

Quick aside: does it bother you like it bothers me that the swiss franc’s symbol isn’t intuitive? A quick use of the google machine tells us the latin name of switzerland is “confoederatio helvetica.” combining that with the franc, and we get “CHF.” how pompous.

Of course, there are many currencies beyond these eight. Currencies that aren’t considered “major” are known as exotic currencies and trade at lower volumes. The indian rupee (INR) and russian ruble (RUB) are two examples.

Before we go any further, it’s helpful to revisit what fiat currencies are. Fiat currency, like USD, is issued by the government and standardizes commerce. Instead of trading textiles for tobacco or milk for a haircut, you have a government-backed currency that simplifies the exchange of goods and services. An economy that has a lot of production, trade, and stability will have a strong currency.

The forex market allows investors to peg the strength of one currency against another — or, to look at it another way, one economy versus another. When an investor trades for a currency, they think one economy is better relative to the other.

How does forex trading work?

Institutions and individual investors can trade forex 24 hours a day, 5 days a week. While institutions can enter trades over the weekend, retail investors have stricter windows. For instance, the U.S. Forex market shuts down for the weekend at 5 pm EST before reopening sunday evening at 5 pm EST.

There isn’t a centralized exchange for forex. Instead, currencies trade “over the counter” (OTC), meaning they’re purchased and sold via a network of banks in whatever market is open. Beyond the U.S. Forex center in new york, the other major hubs are in sydney, london, and tokyo.

Currencies are traded in pairs, so you’ll see them priced this way. For example, if you want to convert your USD into EUR, the exchange rate is quoted as EUR/USD. This rate tells you how many U.S. Dollars it’ll take to buy one euro. The first currency listed is known as the base currency, and it’s always the one you’re purchasing. The second currency is known as the quote currency.

Here’s a list of the major currency pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD

Unlike stocks, forex rates are priced out to the fifth decimal. For example, as of right this second, the EUR/USD exchange rate is $1.21937. In the forex world, you’ll often hear the term “pip” to quantify price movements. This stands for “point in percentage.”

For dollar-related exchanges, a pip refers to the changes to the fourth decimal place, so if the EUR/USD moves from 1.219 37 to 1.219 57, then the rate moved two pips.

Of course, the fifth decimal has playful monikers too — pipettes and micro pips.

Currencies are traded in “lots,” which vary in size.

- Micro lots are 1,000 units of a currency

- Mini lots are 10,000 units of a currency

- Standard lots are 100,000 units of a currency

Now, let’s walk through an example of a trade.

Let’s assume you buy 10,000 units of EUR using USD when the EUR/USD rate is 1.2200 (ignoring pipettes). Over the following day, the EUR/USD rate moves to 1.2230. You decide to sell, making a 30-pip profit. Since you purchased 10,000 units, each pip is valued at $1 (10,000 units x 0.0001). So, your profit would be $30 ($1 x 30 pips).

What is leverage?

Leverage enables investors to enter a trade for only a fraction of the trade’s purchase price. A lender covers most of your position, while you’re responsible for a small percentage — which is known as margin. Think of it like putting a downpayment on a house or a car. You pay 10–20% upfront, while the lender covers the rest.

Let’s look at the same example from earlier. You purchased 10,000 units of EUR at the EUR/USD rate of 1.2200. This would require an upfront deposit of $12,200 (10,000 units x 1.2200).

However, if you used leverage to make this purchase at a 10% margin, your exposure would only be $1,220. Your total position is still $12,200, but the lender funds the other 90%. Your total exposure relative to your margin is called your leverage ratio. In this case, your leverage ratio is 10:1 (i.E. $12,200 / $1,220).

The EUR/USD rate increases by 30 pips, your position increases to $12,230. You sell and earn a profit of $30.

Whether you use leverage or not, your profit is still $30 in this example. That said, your upfront exposure is only $1,220 with leverage — versus $12,200 without. Leverage opens the door for investors to amplify their gains with less upfront capital.

However, that concept works in the reverse too. Investors must be aware of leverage’s risks.

Just as it can amplify your gains, leverage amplifies your losses too if rate movements go against your expectations.

Leveraged trading allows you to enter trades well above your actual capital. It’s not uncommon to see investors trade at leverage ratios of 100:1 or even 200:1. In other words, if you have $1,000 to trade, you’d have $100,000 of trade capital at your disposal with 100:1 leverage.

A 10% loss on a $1,000 trade without leverage is a loss of $100. A 10% loss on a $100,000 leveraged trade is a loss of $10,000. Leverage makes losses more severe. You’re still responsible for repaying your lender, so you could be in a scary financial bind if you take too much risk.

What influences exchange rates?

Several factors influence exchange rates, including inflation, interest rates, and production.

Don’t worry, I’ll keep the economics lecture short.

Inflation represents increasing prices of goods and services, which means the associated currency has less purchasing power. When inflation is high in a particular country, there’s less demand for that country’s currency — and vice versa.

Federal governments can use interest rates to manipulate inflation and exchange rates. Higher interest rates mean higher returns for lenders and bank accounts, which can increase cash inflows into a country. So, higher interest rates tend to increase demand for a country’s currency, while low interest rates have the opposite effect.

Production, as measured by gross domestic product (GDP), illustrates whether an economy is growing, receding, or stagnant. A growing economy is more appealing, driving exchange rates up. On the other hand, if a country is struggling through a recession or political turmoil (sound familiar to anyone?), demand for that country’s currency will decline.

However, these aren’t the only influencers. A country’s trade policies, like tariffs on imported goods, can impact the demand for its currency too. So can a country’s balance of payments and government debt balance. There are a lot of moving pieces within an economy to consider.

How to learn more about forex

Forex trading isn’t something you pick up and master on a casual sunday afternoon because you’re bored. It takes time to understand and learn effective strategies.

If you want to learn more about the forex market, there are countless free resources for you to explore. Investopedia does a decent job of simplifying a complex subject, and it has a wealth of information.

If you’re looking for something more hands-on without the risk, one free resource that I’ve found interesting is an app called trading game.

It has a couple of forex courses with 18 modules in total — plus quizzes to reinforce your learning. As you complete courses and quizzes, you unlock play money to practice making forex trades.

Forex isn’t easy, but they do a good job of simplifying it.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

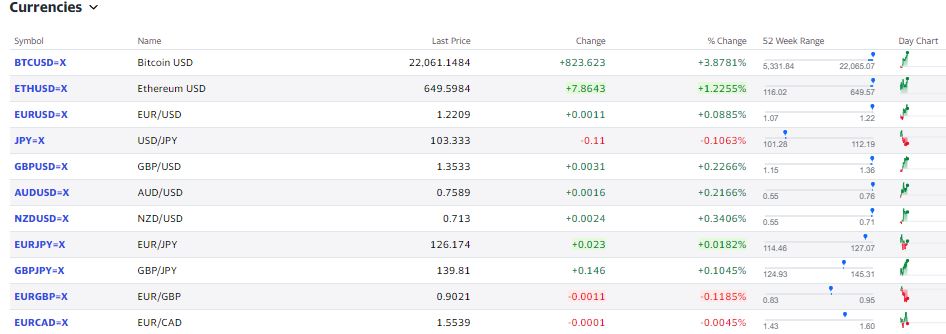

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Can forex trading be profitable for me?

You’ve probably heard that the vast majority of retail forex traders lose money. In this article, I examine the statistics reported by forex brokers on client profitability under ESMA regulations, as well as the results of research on the subject, to answer the question as to which traders lose or make money over long-term forex trading, and why. If you believe you can put the odds in your favor, check out our list of top forex brokers and consider opening an account.

We have all heard statistics quoted such as 95%, 90%, or 80% of people who open an account with a forex / CFD brokerage blow their account within six months. Some people tend to believe this out of respect for the pareto principle, which says that 80% of profit is made by only 20% of cases. Is there any way to know for sure whether any of these estimations might be true? Yes, thanks to new ESMA regulations in the european union, which oblige forex / CFD brokers to disclose prominently on their websites what their average retail investor’s percentage loss or gain. So, let’s take a look at the current statistics published by some of the biggest forex / CFD brokers in the world (in terms of trading volume) at the time of writing:

A few important conclusions can be drawn from this self-reported data:

- All the largest retail forex / CFD brokerages report very similar data, so it is reasonable to assume approximately 70% of all retail CFD traders lose money.

- The percentage of losers is very similar between brokers, suggesting it is the market and the traders themselves, not the brokers, who are responsible for their clients’ long-term losses.

- Although this data includes clients trading non-forex products, there is no reason to believe results differ between clients trading forex and non-forex cfds.

- Even retail forex traders seem to be more profitable than is widely believed, as traditional estimations of 80% to 90% as losers appears to be an over-estimation.

Why do 70% of retail forex traders lose money?

Now that we have established that for about 70% of people who try it, forex trading is not profitable, we should ask why. After all, if markets are random as the classic “efficient markets” hypothesis suggests, then shouldn’t winners and losers be divided at roughly 50 – 50?

An even division between winners and losers might make sense if forex were a zero-sum game, as there has to be a loser for every winner, and vice-versa. Yet retail forex / CFD trading is not a zero-sum game, it is a negative-sum game, because the retail forex trader:

- Must pay either a spread, a commission, or both in order to enter and exit a trade.

- Must usually pay an overnight fee on any open trades which are held over 5pm new york time.

This means that the odds are stacked against the retail forex / CFD trader. However, it is not impossible to overcome these odds, as the 30% of profitable retail traders can testify.

Some years ago, one large retail forex brokerage released data which showed two clear differences between profitable and losing traders. Traders who:

- Made higher deposits into their accounts, and

- Used lower true leverage

Were more likely to be profitable. We’ll examine each of these factors in turn, although they are related, because traders with lower deposits tend to use higher leverage.

Why are better capitalized forex traders more successful?

Retail forex traders who make larger deposits may be more likely to take their trading seriously, because they have more money at stake, and know instinctively that their chance of making a meaningful profit is greater too. For example, a trader who deposits $100 and makes a return of $20 should be just as proud of themselves as a trader who deposits $10,000 and makes a return of $2,000 as it is the same trading achievement – a 20% return. Yet very few people anywhere in the world will be able to get very excited over making $20. So, to some extent, this might be just a question of focus and meaning.

Why are forex traders with lower leverage more successful?

A characteristic of retail forex trading is the relatively high leverage offered by many forex / CFD brokers, especially those located outside the european union (australia allows leverage on forex as high as 500 to 1). Many brokers also allow accounts to be opened with deposits even lower than $100. This means that a lot of retail forex traders might deposit $50 and use 400 to 1 leverage to make one trade sized at $20,000. This trader will then either wipe out their account or maybe triple it, which would then probably lead to another over-leveraged trade with a similar result. While there is some logic at work here – a series of winning, highly leveraged traders would a way to make a huge return quickly in theory – the odds against such a gamble resulting in anything except a blown account after a few trades are vanishingly small.

It is also worth remembering that lower leverage makes it easier to control and limit risk, which is a key factor in long-term profitability. This risk issue is best illustrated by the fact that once a trader is down by more than 20% from peak equity, it begins to become exponentially more difficult to recoup the loss. A loss of 20% requires a profit of 25% to be regained; a loss of 50%, a profit of 100%.

Who can trade forex for me

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

I RESIDE IN AJAH WHATSAPP ME ON

whatsapp

http:///2348136750311

You are more responsible than this statement ben.

Anyway thanks for the comment. And assistant in advance

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Sure i do have, i will contact you asap

Hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

Help a sister. I beg thee

Hairbyuj:

hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

Help a sister. I beg thee

There is a school for forex trader called www.Babypips.Com if u are focused u can actually learn forex for free there

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

When you finally see who to teach you, practice what you were taught for at least 3 months successfully before putting your money else you will keep losing money

There is a school for forex trader called www.Babypips.Com if u are focused u can actually learn forex for free there

Hairbyuj:

WHO WILL TAKE ME ON HOW TO .TRADE FOREX OR .BINARY

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

Please help a sister on how to trade oh i beg you all

I can help out on binary options trading and binary options signals. Most options brokers have what they call leaderboard, which is a list of top profit traders. I will link you up with the number one person on the leader board and show you how to copy his live trades

It's not free, you pay only when you confirm that you're getting is promised

Contact me if you're interested

http:///2348094414899

Hairbyuj:

hmmmm well we could do a contract when i master the trade i will , for now i only have my time to invest to learn, when i start or master trading i will.

Please assist me on how to fish.

So, let's see, what we have: even if you’re a casual investor, you’ve probably heard of forex. It’s a fancy finance portmanteau that sounds sophisticated — but is it worth your time? For the casual, set-it-and-forget-it… at who can trade forex for me

Contents of the article

- Free forex bonuses

- Is forex for me?

- What the average investor should know about the...

- What is forex?

- How does forex trading work?

- What is leverage?

- What influences exchange rates?

- How to learn more about forex

- Who can trade forex for me

- Can I get someone to trade forex for me? (auto...

- FOREX managed account brokers

- Pros & cons of letting someone trade...

- Pros & cons of trading the forex by...

- 17 simple ways to raise $5,000 to fund forex...

- If something is hard to get…

- OK, how would you actually get $5,000?

- 1: mow lawns for for 200 neighbors for $25

- Can I pay someone to trade forex for me? 2020

- Is forex for me?

- What the average investor should know about the...

- What is forex?

- How does forex trading work?

- What is leverage?

- What influences exchange rates?

- How to learn more about forex

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Can forex trading be profitable for me?

- Why do 70% of retail forex traders lose money?

- Who can trade forex for me

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.