Trade 100

Payment transactions are managed by НDС technologies ltd., registration no. HE 370778, address: arch.

Free forex bonuses

Makariou III & vyronos, P. Lordos center, block B, office 203 if you are an experienced trader, trade 100 bonus is your chance to get familiar with FBS platform. Trade on major currency pairs, enjoy low spreads and swap free option for your trading and, of course, make some profit out of our welcome gift!

TRADE 100 BONUS —

WORK OUT FOR MORE

Bonus information

Get our trade 100 bonus and start your forex career! It works the same way as in sport – first you train and learn, then you earn and get stronger, faster and more efficient. Trade 100 bonus is your personal tool for toning up your brain

What you get with trade 100 bonus

FREE $100 TO TRADE

FBS gives you real money to start your forex journey and trade real

BOOST YOUR SKILLS

To level up your trading you need power-ups: besides $100 you get a full set of educational materials

START WITHOUT DEPOSIT

Learn how to trade and make a real profit out of it – with no need for your own money involved in the process

How can trade 100 bonus help

Trade 100 bonus gives beginner traders a chance to study the basics, get fully involved in the process of real, thorough and effective trading. And the best part is – you don’t need any initial investments for it! Take your time to get to know forex and FBS platform, test your hand, gear up with knowledge – with fewer risks involved

If you are an experienced trader, trade 100 bonus is your chance to get familiar with FBS platform. Trade on major currency pairs, enjoy low spreads and swap free option for your trading and, of course, make some profit out of our welcome gift!

How to get $100 of profit?

Register a bonus account with $100 on it

Use the money to get 30 days of active trading and trade 5 lots

Succeed and get your profit of $100

Bonus conditions

- The bonus is available on metatrader5 platform;

- The order volume is 0.01 lot;

- The sum available for withdrawal is 100 USD;

- The required number of active trading days is 30 (active trading day is a day when the order was opened or closed);

- The maximum number of positions opened at the same time is 5;

- Client should have at least 5 lots traded in the period of 30 active trading days

View the full terms and conditions in the personal area

Share with friends:

Instant opening

Withdraw with your local payment systems

FBS at social media

Contact us

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

Thank you!

We've emailed a special link to your e-mail.

Click the link to confirm your address and get beginner forex book for free.

You are using an older version of your browser.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

UK 100 FTSE 100 index

Containing some of the largest companies in the world, the UK 100 is correlated to the country's economic indicators as well as global growth.

Latest research

Week ahead: BOE, RBA, coronavirus and more “short squeezes”?

US market open: stocks continue to struggle after tumultuous week

Top UK stocks to watch: avon rubber on track as pandemic drives-up demand

Interesting facts

The UK 100 is one of the most widely used metrics when evaluating the performance of the UK economy. The index is comprised of the largest companies in the UK by market capitalisation, and the larger the company the more influence it has over the index’s price. In the UK, the largest companies are usually found in the mining, energy (particularly oil and gas) and financial services sectors.

Price drivers

The UK 100 is closely linked to economies throughout europe through trade and geographical proximity, thus it can be influenced by investor sentiment surrounding large equity markets in europe. Furthermore, during times of global crisis the economy can sometimes ignore domestic fundamentals in favour of overall investor sentiment (for example: 08/09 financial crisis and the european debt crisis), with the possible exception being the bank of england’s interest rate decisions and policy announcements. More specifically, the index is susceptible to the sentiment surrounding global banking markets due to the high weighting banking stocks have on the index. Also, mining and energy companies account for a significant proportion of the index, which means investors should keep an eye on commodity prices and the level of demand for these assets.

Pivot points

Distance

Distance shows the difference between the pivot point and bid rate. It is calculated by subtracting the ask rate from the pivot point rate.

Daily

Weekly

Monthly

Last updated:

Understanding pivot points

Economic calendar

Trade a demo account risk free

Trade market events in live market conditions for 30 days.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Your form is being processed.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

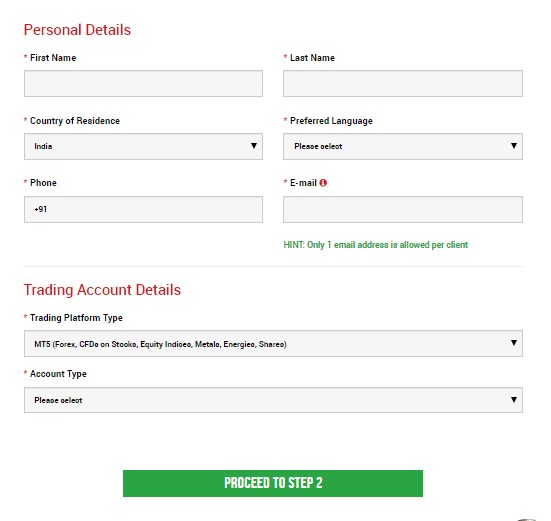

Step 2: filling the personal details

Fill all the box with accurate details

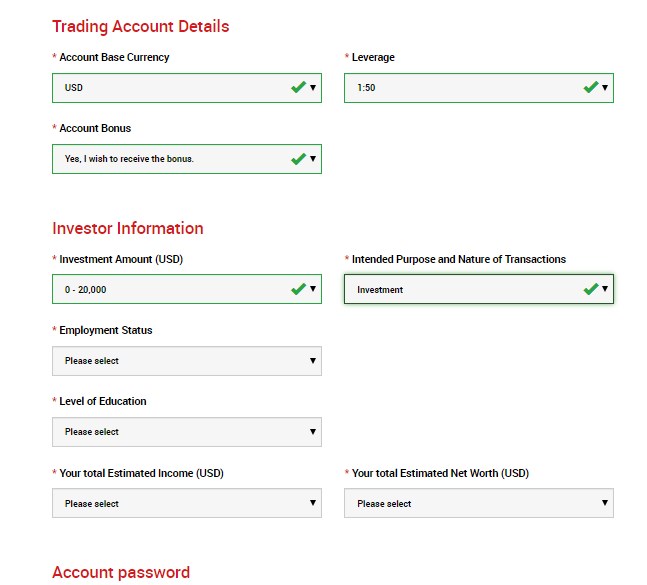

Step 3: investor information & trading account details

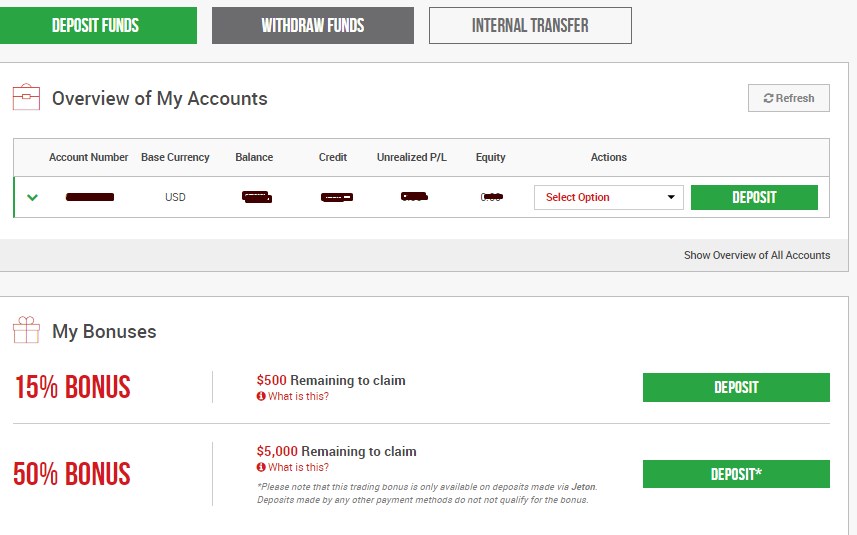

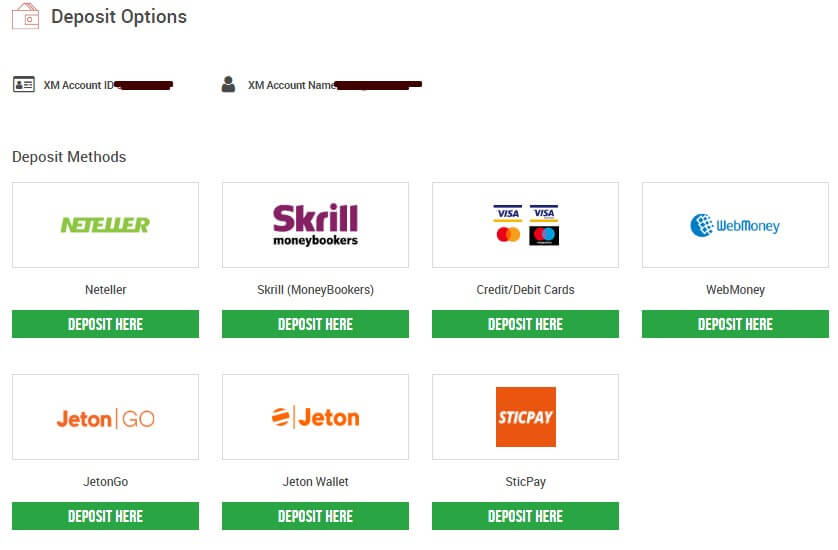

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

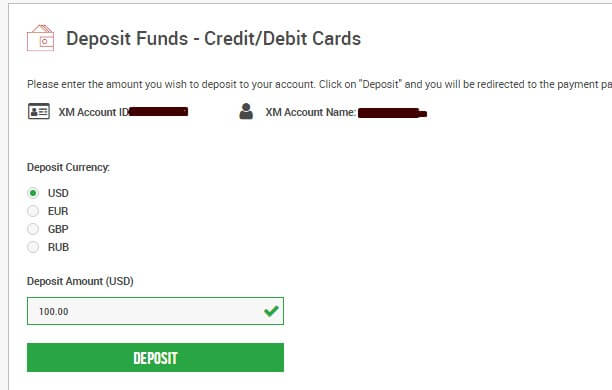

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

TRADE 100 BONUS —

TREINE PARA RENDER MAIS

Informações do bônus

Receba nosso trade 100 bonus e comece sua carreira no câmbio! Funciona da mesma forma que nos esportes: primeiro você treina e aprende, depois ganha e se fortalece, ficando mais veloz e eficiente. O trade 100 bonus é a sua ferramenta pessoal para malhar o cérebro

O que você leva com o trade 100 bonus

$100 GRÁTIS PARA NEGOCIAR

A FBS lhe dá dinheiro de verdade para começar sua jornada no câmbio e operar em condições reais.

APRIMORE SUAS HABILIDADES

Para aprimorar o seu trading, você precisa de suplementos: além dos $100, você recebe um conjunto completo de materiais de instrução

COMECE SEM DEPÓSITO

Aprenda a negociar e tirar lucros de verdade, sem necessidade de envolver seu próprio dinheiro no processo

Como o trade 100 bonus pode ajudar

O trade 100 bonus dá aos traders iniciantes a chance de estudar os fundamentos, envolver-se completamente no processo do trading real, aprofundado e eficaz. O melhor de tudo: você não precisa de investimento inicial para isso! Familiarize-se com o mercado cambial e com a plataforma FBS, teste a si mesmo e arme-se de conhecimento, com menos riscos envolvidos

Se você é um trader com experiência, o trade 100 bonus é a sua chance de se familiarizar com a plataforma FBS. Negocie com os principais pares de moedas, aproveite spreads baixos e a opção swap free para o seu trading e, é claro, ganhe um dinheiro com nosso presente de boas-vindas!

Como lucrar $100?

Cadastre uma conta bônus e receba $100 nela

Use o dinheiro para conseguir 30 dias de trading ativo e negociar 5 lotes

Consiga êxito e receba seu lucro de $100

Condições do bônus

- O bônus está disponível na plataforma metatrader5;

- O volume de ordem é de 0,01 lote;

- A quantia disponível para saque é de 100 USD;

- O número exigido de dias de trading ativo é 30 (dia de trading ativo é um dia no qual uma ordem foi aberta ou fechada);

- O número máximo de posições abertas ao mesmo tempo é 5;

- O cliente deve ter pelo menos 5 lotes negociados no período de 30 dias de trading ativo;

Veja todos os termos e condições na área pessoal

Compartilhe com os amigos:

Abertura instantânea

Saque com sistemas de pagamento locais

FBS at social media

Fale conosco

- Zopim

- Fb-msg

- Viber

- Line

- Telegram

Jurídico: o domínio e todos os direitos são pertencentes à FBS inc.; registro número 74825; endereço: ajeltake road, ajeltake island, majuro, marshall islands MH96960

O site é de propriedade de e operado por mitsui markets ltd. Endereço: 133 santina parade, elluk, port vila, efale, vanuatu

O serviço não é oferecido nos seguintes países: japão, EUA, canadá, reino unido, mianmar, israel e a república islâmica do irã

Transações de pagamentos são administradas por НDС technologies ltd.; registro número HE 370778; endereço: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

Aviso de riscos: antes de começar a negociar, você deve compreender completamente os riscos que envolvem o mercado de câmbio e negociações com margem, e você deve estar ciente do seu nível de experiência.

Qualquer cópia, reprodução, republicação, física ou na internet, de quaisquer recursos ou materiais deste site é somente possível mediante autorização por escrito.

Aviso de coleta de dados

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “aceitar“, você concorda com nossa política de privacidade.

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em 00:30:00

Se você tiver um problema urgente, por favor, fale conosco pelo

chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!

Livro de forex para iniciantes

O livro de câmbio para iniciantes vai guiar você pelo mundo do trading.

Obrigado!

Nós enviamos um link especial para o seu e-mail.

Clique nesse link para confirmar seu endereço e receber um guia forex para iniciantes gratuito.

Você está usando uma versão antiga de seu navegador.

Atualize para a versão mais recente ou experimente outro navegador para uma experiência comercial mais segura, confortável e produtiva.

How to trade FTSE 100

FTSE trading is a popular pursuit for those interested in financial markets. Originally a joint venture between the financial times and the london stock exchange (LSE), the FTSE 100 is an index of the UK’s top 100 companies by market capitalization. Managed by the FTSE group, the index is updated and published every 15 seconds.

In this piece, we’ll cover the key tips and strategies for trading FTSE 100, which both beginner and advanced traders can use to gain an edge over this popular market.

FTSE 100 trading basics

The FTSE 100 is one of the most widely traded indices in the world. Trading the index began in 1984 at a level of 1,000, and on may 21 , 2018 reached all-time intra-day and closing highs of 7868 and 7859 respectively. The FTSE 250 and the FTSE 350 represent the next largest companies outside of the top 100.

It is worth remembering that while the FTSE 100 is focused on the leading UK companies by market cap, a majority of the revenues of the constituent companies are made overseas, so it may not be as strong a barometer of the domestic economy as it appears. It also means that if the pound falls, the FTSE often rises as companies benefit from their products being priced more competitively overseas.

As with other stock markets, FTSE trading can, where permitted, be undertaken through derivatives such as cfds and spread betting, which enable you to speculate on the price movements of the index.

Understanding how the FTSE 100 market works

When it comes to knowing how to trade the FTSE 100, the first step is to understand how the market works. The figure quoted for the FTSE 100 is calculated using the total market capitalization of the companies in the index. When the index is revealed as being ‘up’ or ‘down’, the change is quoted against the previous day’s close.

Traders should be aware of the nature of the constituent companies in the index as their performance – and in turn the index – can be affected by a range of diverse and global political and economic factors.

FTSE 100 companies: top 10 ranking by market capitalization

Royal dutch shell (A and B shares combined)

Banking & financial services

British american tobacco

Sources: london stock exchange, bloomberg

*correct as of december 4 , 2018

What moves the FTSE 100 market?

It’s also important for traders of FTSE 100 to know what moves the market. Factors which affect price movements include political and economic events, interest rates, earnings reports, and commodity prices.

Political and economic events

Political and economic turbulence can have a significant impact on indices, and the FTSE 100 is no exception. Naturally, different events can affect the index in different ways. For example, after the brexit referendum, the plunge of the pound has been a boon for the overseas profits of FTSE 100 constituents, a factor contributing to the index rising to in excess of 7750 in july 2018. With around 60% of the FTSE 100 company revenues coming from outside the UK, falls in the pound’s value can have a very positive impact.

However, during the financial downturn of 2008, the FTSE 100 index suffered its worst ever year, falling by 391 points in a single day at one point. The plunge was fueled by the banking crisis and fears of a global recession, and mirrored the falls of other major stock markets around the world.

Interest rate adjustments can have a noticeable effect on the FTSE 100 index. When they rise, investment in FTSE 100 equities often falls due to decreased corporate profitability caused by higher interest repayments.

There have been a number of interest rate hikes since the inception of the index in 1984. For example, in august 2018, the bank of england base rate was raised to 0.75% representing only the second rise in a decade, prompting the FTSE 100 to slip by more than 1% on the news.

Traders should pay attention to the earnings reports of major FTSE 100 constituents. Valuations are in part driven by expectations, and giant individual stocks such as shell and glaxosmithkline are capable of dragging the index higher or lower by themselves.

The FTSE 100 index is influenced greatly by commodity price fluctuations due to its heavy bias towards oil and mining stocks. Indeed, there are five oil companies in the FTSE 100 and their share prices, in turn, are affected more by events in the middle east than in the UK. Additionally, around 10% of the index is composed of mining companies, which are sensitive to supply and demand in countries such as china.

FTSE 100 trading strategies and tips

The following strategies and tips will help maximise your chances of trading FTSE 100 successfully:

- Decide on y our s trategy: position trading, swing trading, day trading and scalping are all options you can choose when trading the FTSE 100 . Position trading is a longer-term strategy with traders holding their position for weeks, months or even years. Swing trading is more medium term, while day trading and scalping represent a short-term approach, making a high volume of very frequent trades.

- Study the charts: look at longer-term charts such as daily and weekly charts to get a feel of market sentiment. Assess recent price action to get a feel for what the market may do that day. Our FTSE 100 live chart is a key resource to use.

- Prepare a n intraday chart like a 2 hour or 4 hour chart: the FTSE intraday timeframe chart is used by many professional and beginner traders alike to trade the FTSE 100. You may want to prepare the chart by placing horizontal support and resistance lines according to the most important levels of the last session of trading, to provide a context to trades. Look for the patterns to fit with your support and resistance levels; patterns to look out for might include a ‘shooting star’ or ‘double top’.

- Look out for FTSE trading signals: assess the candlesticks and patterns as they present themselves during the trading day. Is the FTSE in a trend? Look for momentum trades , reversal trades, trends in either direction, and trend channels.

- Assess the reward and risk: before placing a trade, work out the reward to risk ratio. A 2:1 ratio is a popular choice, but traders should never go below 1:1.

- Place stops and profit targets: based on your reward to risk ratio above, set a stop loss just outside a recent swing high or low. Then, set a reasonable target for a positive reward to risk ratio.

- Know the FTSE 100 trading hours: FTSE tends to be more liquid during UK’s business hours making it easier to get in and out of the trades are you desired price. The FTSE trading hours to bear in mind are 8:00 to 16:30 (UK time) .

Further reading on FTSE 100

Stay up to date with live price movements using our FTSE 100 live chart , and download our free quarterly equities forecast to better understand future trends in the market.

Dailyfx provides forex news and technical analysis on the trends that influence the global currency markets.

Nasdaq trading basics: how to trade nasdaq 100

Trading the nasdaq 100 index: an introduction

The nasdaq 100 is a modified market-capitalization weighted index that consists of the largest 100 non-financial companies that are listed on the nasdaq stock exchange. It should not be confused with the nasdaq composite index.

Nasdaq trading involves using fundamental or technical analysis to determine price levels at which to enter a trade. Traders can take a bet on which way the price will go and then place stop losses and take-profits to manage risk.

This article will cover top nasdaq 100 trading strategies for traders of all levels, as well as an overview of the nasdaq trading hours.

Why trade the nasdaq 100 index?

Trading the nasdaq 100 gives traders a diversified exposure to great number of companies in the non-financial sector. Other reasons to trade the nasdaq 100 index include:

- The nasdaq 100 is one of the world’s most popular and widely followed indexes. There is no shortage of technical and fundamental analysis.

- The clear technical chart patterns which provide distinct entry and exit signals.

- The nasdaq provides traders with a great deal of liquidity which leads to tight spreads that offer inexpensive costs to enter and exit trades.

- Traders can trade the E-mini NASDAQ 100 futures on the CME (chicago mercantile exchange) almost 24/5.

How to trade nasdaq 100: top tips & strategies

Successful nasdaq trading involves similar analysis techniques used to trade a range of financial markets. Before entering a trade, traders should have a reason to enter the trade based on technical or fundamental analysis. Professional traders stick to strategies which contain principles and guidelines that they follow to be successful.

How to T rade the nasdaq 100 using technical A nalysis

Traders use technical analysis to analyze charts, looking for buy or sell signals. Technical analysts can use indicators to help them identify current trends in the market, shifts in sentiment or potential retracement patterns.

In the chart above we show how the MACD (moving average convergence divergence) can be used to filter buy and sell signals when trading nasdaq 100. The MACD consists of a MACD-line (blue line) and signal-line (orange line), when the two cross on the bottom, as shown in the chart above by the green circle, it offers a buy-signal. When the two cross at the top (the red circle) it offers a sell-signal.

There are a variety of different indicators that traders use. It is important that traders use an indicator they understand and feel comfortable. Indicators do not work all the time, so traders must implement proper risk management. Risk management includes using appropriate leverage , a positive risk-reward ratio and limiting the exposure of all open trades to less than 5% of total equity.

Technical indicators are not the only way to look for buy and sell signals when trading the nasdaq 100. Traders also use price patterns like support and resistance, ascending triangles, trend channels, elliot waves and others to find opportunities in the market.

How to trade the nasdaq using fundamental A nalysis

When trading the nasdaq, a range of underlying fundamental variables affect the price of the index. Traders must be aware of these variables and their possible impact on the index. These variables can range from macroeconomic variables to the fundamental composition of the index. Here are some of the main movers of the nasdaq 100 index:

- The largest companies in the nasdaq 100. The nasdaq is a market-capitalization weighted index so the largest companies tend to move it the most, like apple, microsoft and amazon. Some indices are weighted differently, and this can affect their price. It is important to understand the differences between the major indices .

- Changes in the federal reserve’s stance on monetary policy can have adverse effects on all stock markets, including the nasdaq 100 index.

- Economic data like inventory levels, employment, CPI, interest rates and GDP. This data can signal what actions the central bank will take on monetary policy.

- Trade wars and currency wars can impact large companies in the nasdaq by way of tariffs and trade barriers.

Advanced tips for trading the nasdaq 100 index

It is important for nasdaq traders to be patient and disciplined before entering a trade. Before even looking for a trade, a trader should know how much they are willing to risk and have a reasonable expectation of what they are looking to gain through the trade.

Here are some expert tips for trading the nasdaq 100:

- At dailyfx we recommend limiting your exposure to less than 5% on all open trades.

- Before entering a trade, decide on a risk-reward ratio. It is extremely important to have a positive risk-reward ratio. See our guide to traits of successful traders for the statistics on taking trades with a positive risk-reward ratio.

- Entering a trade before major economic data releases should be avoided. Major economic data can cause massive spikes in volatility, it is better to wait for the markets to settle before trading again.

- Record all your trades so that you can preview the trades afterwards. By doing this you can pinpoint and work on your weak spots.

- Do not trade if you are emotional, tired or bored. Only trade when you have done your research and analysis and are confident in the trade.

- Select the correct trading time frame that suites your goal.

Nasdaq trading hours

Nasdaq 100 futures can be traded on the chicago mercantile exchange (CME) from:

Sunday – friday 6:00pm – 5:00pm ET with a trading halt from 4:15pm – 4:30pm ET and a daily maintenance period from monday – thursday 5:00pm – 6:00pm ET.

There are also etfs that track the nasdaq 100 like invesco QQQ trust (QQQ) which trades on the NASDAQ exchange. This has:

- Pre-market trading hours from 4:00 a.M. To 9:30 a.M. ET

- Market hours from 9:30 a.M. To 4:00 p.M. ET

- After-market hours from 4:00 p.M. To 8:00 p.M. ET

Take your nasdaq trading to the next level

To stay ahead of the curve when trading nasdaq 100, traders should follow the nasdaq 100 live chart for price movements. We also recommend downloading our quarterly trading forecast on equities and reading our reputable traits of successful traders guide - where we analyzed over a million live trades and came to a striking conclusion.

Below is a snippet from our expert guide on the differences between dow, nasdaq, and S&P 500 such as how market capitalization and volatility affect them and how they are weighted.

Dailyfx provides forex news and technical analysis on the trends that influence the global currency markets.

E*TRADE is offering a sweet $100 cash bonus on new accounts

Please note: that the E*TRADE limited time offer is no longer available.

*their standard offering is $0 commissions for online stock, ETF, & options trades.*

If you’ve considered dabbling in investments but haven’t taken the leap, E*TRADE is rolling out a new cash back promo that may entice you to open an account. For the next couple of months, E*TRADE is offering an extra $100 for customers who deposit or transfer a minimum of $5,000 into their E*TRADE accounts.

While E*TRADE regularly rolls out cash-back promotional offers, it often requires a much heftier deposit than $5,000 to qualify. But if you’re interested in taking advantage of this free promo money, you need to get moving, because E*TRADE is only offering this deal until jan. 6, 2020.

This is just one of many offers E*TRADE has rolled out recently. Earlier this month, the electronic trading platform stepped up its game and cut commissions to $0 while removing the account minimum for brokerage accounts.

And, if you’re ready and willing to invest a little more than $5,000, E*TRADE is offering another cash-back promo that you may want to take advantage of. This offer is only valid through the end of 2019, but it could help you rake in up to $2,500.

Here’s the deal: if you open a non-retirement brokerage account by dec. 31, 2019 and fund it with new funds or securities from an outside account within 60 days, you’re eligible for a cash bonus of between $200 and $2,500. There are several tiers of qualifying deposits and cash bonuses, which range from:

- A $200 cash bonus for depositing or transferring between $25,000 and $99,999

- A $300 cash bonus for depositing or transferring between $100,000 and $249,999

- A $600 for depositing or transferring between $250,000 and $499,999

- A $1,200 for depositing or transferring between $500,000 and $999,999

- A $2,500 for depositing or transferring $1 million or more

There are a couple of caveats, though. To receive the cash bonus, you have to fund your account with money or securities from an outside account — so you can’t take advantage of this offer by moving the funds you already have sitting in your E*TRADE account. The other caveat is that you have to keep your new account open for at least six months or you’ll lose your cash bonus. On the upside, E*TRADE will make your bonus funds available to you within seven days of funding your account.

List of trade careers

Related

If you want a career path that doesn’t require four years of college yet provides a comfortable salary, a trade career might be the ideal option. Manual labor jobs that require a specific skill set or training are categorized as trade careers. Many trades provide on-the-job training, or you can go to a vocational school and hit the ground running in less than two years. Among the several categories of trade careers, jobs include mechanics, plumbers, welders and paramedics.

A booming trade area is the health-care industry. In 2016, the median pay for a medical sonographer was $64,280, and a respiratory therapist earned $58,670, as reported by the bureau of labor statistics. When you compare these salaries to a minimum wage job, a trade career is a solid alternative.

Building trades

Building trades encompass a variety of construction jobs, including carpentry, flooring, masonry and plumbing. If you want to begin work immediately and have some basic skills, you can land a job as a painter, landscaper or carpet installer with very little training or experience. As you learn the trade, you may decide to open your own business or move into a larger company. If you want to become an electrician, plumber, pipe fitter or welder, you will need to go to vocational school and complete an apprenticeship. For example, becoming an electrician requires learning the trade, becoming an apprentice and practicing alongside a certified electrician, prior to becoming licensed. This journey may take five years, but you will be paid while in training.

- Carpenter

- Carpet installer

- Electrician

- Heavy equipment operator

- Insulation installer

- Landscaper

- Painter

- Plumber

Mechanical trades

Many mechanical trades require a certification of competency that spans two qualification levels. The first level is referred to as the journey level, and this requires an apprenticeship or experience that is equivalent. The second level is the master level. You must work as a journeyman or journeywoman for a minimum of a year and take a competency test to become a master. Attaining a college degree or taking classes at a vocational school provides additional knowledge, but it is possible to become certified through job training or an apprenticeship. Working as an assistant in a mechanical trade while in high school or networking with mechanical experts will help pave the way.

- Auto mechanic

- HVAC installer

- Machinist

- Mechanical drafter

- Locksmith

- Mechanical insulator

- Elevator mechanic

- Mechanical installer

Industrial trades

Industrial trades encompass jobs rooted in manufacturing and technology. These careers involve designing, building and problem-solving. A high school diploma is usually the first requirement, but special skills, previous experience and technical education will set you apart. Like other trade positions, an apprenticeship can gain you entrance into this field. If hired, you can complete your apprenticeship requirements while employed. Working in an industrial trade job provides an opportunity for advancement. You may be promoted to a foreman or supervisory position after you gain the proper experience.

- Steam engineer

- Cargo freight agent

- Ironworker

- Line installer and repairer

- Paving equipment operator

- Metal fabricator

- Asbestos worker

Medical trades

You don’t have to be a doctor or nurse to work in the health-care industry. A certificate program or two_-_year degree from a community college will prepare you to work in a variety of health-care jobs. For example, becoming a dental hygienist or a radiologist only requires two years of college. In 2016, the bureau of labor statistics indicated that both positions had potential earnings in excess of $50,000. An ultrasound technologist or certified nursing assistant only requires a certificate program. Medical trade positions are widely available and offer benefits, along with competitive compensation packages.

So, let's see, what we have: welcome bonus trade 100 is not a demo account. FBS gives you real money and real account to start your investment career without a deposit. Learn how to trade and make a real profit out of it at trade 100

Contents of the article

- Free forex bonuses

- TRADE 100 BONUS — WORK OUT FOR MORE

- Bonus information

- What you get with trade 100 bonus

- How can trade 100 bonus help

- How to get $100 of profit?

- Bonus conditions

- Share with friends:

- What you get with trade 100 bonus

- Instant opening

- Withdraw with your local payment systems

- Data collection notice

- Beginner forex book

- Thank you!

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- UK 100 FTSE 100 index

- Latest research

- US market open: stocks continue to struggle after...

- Top UK stocks to watch: avon rubber on track as...

- Interesting facts

- Price drivers

- Pivot points

- Distance

- Daily

- Weekly

- Monthly

- Economic calendar

- Try a demo account

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- TRADE 100 BONUS — TREINE PARA RENDER MAIS

- Informações do bônus

- O que você leva com o trade 100 bonus

- Como o trade 100 bonus pode ajudar

- Como lucrar $100?

- Condições do bônus

- Compartilhe com os amigos:

- O que você leva com o trade 100 bonus

- Abertura instantânea

- Saque com sistemas de pagamento locais

- Aviso de coleta de dados

- Livro de forex para iniciantes

- Obrigado!

- How to trade FTSE 100

- FTSE 100 trading basics

- Understanding how the FTSE 100 market works

- FTSE 100 companies: top 10 ranking by market...

- What moves the FTSE 100 market?

- FTSE 100 trading strategies and tips

- Further reading on FTSE 100

- Nasdaq trading basics: how to trade nasdaq 100

- Trading the nasdaq 100 index: an introduction

- Why trade the nasdaq 100 index?

- How to trade nasdaq 100: top tips & strategies

- Advanced tips for trading the nasdaq 100 index

- Nasdaq trading hours

- Take your nasdaq trading to the next level

- E*TRADE is offering a sweet $100 cash bonus on...

- List of trade careers

- Building trades

- Mechanical trades

- Industrial trades

- Medical trades

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.