Treadmill forex

For health and weight loss you'll succeed far more if you choose a speed you can stick to and perform regularly.

Free forex bonuses

I've taken it to the extreme in my own weight loss goals. If you see my progress, I'm running (jogging) at 5 mph and working up to doing that for 60 minutes a day and the weight is falling off. I couldn't run any quicker than 5 and maintain it or a period of time. Weight loss is what I want so time is the important factor. A question amongst beginners is often what speed is jogging and what is running. Here we'll investigate. Walking begins at any speed above 0. If the treadmill is moving no matter how fast to begin with then you're walking. Although jogging will come into it soon. Walking speed is 0.1 mph to 4 mph (0.1 km/h to 6.4 km/h).

What is A good treadmill speed?

Unlike running outside, on a treadmill you can set your speed and stick to it. You won't go faster or slower if you don't change the speed up or down. This is great if you want to commit yourself to do a certain speed for weight loss or as part of training for a race. By knowing your speed you can see how long it would take you to run a mile for example.

What is a good treadmill speed for some may not be good for others. Comparing yourself on a treadmill with others is never a good idea. Whether it's the speed you read online or the person on the treadmill next to you is going so much faster. Forget them, concentrate on your own goals and you'll get to those goals more successfully.

Treadmill speed for walking, jogging and running

A question amongst beginners is often what speed is jogging and what is running. Here we'll investigate. Walking begins at any speed above 0. If the treadmill is moving no matter how fast to begin with then you're walking. Although jogging will come into it soon. Walking speed is 0.1 mph to 4 mph (0.1 km/h to 6.4 km/h).

Jogging is that zone between walking and running, you're actively lifting your feet above the ground but not going very fast. Jogging is when the exercise gets a lot harder to maintain. That's why it's such good exercise and is classed as vigorous physical activity by the CDC. Whereas brisk walking the CDC calls moderate physical activity. Jogging speed is 4 mph to 6 mph (6.4 km/h to 9.6 km /h).

Remember jogging and running is different for different people. Someone who is very tall and has a long stride will still be jogging at 6 mph whereas someone shorter with a small stride will be running fast at 6 mph. It's what works for you and not what the speed is called. However actual running is the goal of many runners and it does look good on the treadmill when someone is running. Running speed is 6+ mph (9.6+ km/h).

Speed is not important, time is

Unless you're training for a race and/or doing some speed training, the speed you're going shouldn't really be important. This is especially the case for a beginner. If you're just starting out exercising then you need to get used to the treadmill and your body needs to get used to the exercise. Set a speed to something comfortable but still causes heavy breathing.

For a beginner the time spent exercising is far more important than speed. A 20 minute jog is a valuable day of exercising whereas a 3 minute fast run is not. It's not a competition. If you walk at the moment and that causes heavy breathing then keep doing that for a good period of time. If you want to get started running then we have a couch to 5k walk/run schedule that begins very slowly and gets you running in 9 weeks.

Your purpose of exercising

As we said before, if you're training for a race then knowing and sticking to your speed is important to get the time you want. If you're a beginner and want to get healthy and lose weight then you need to log time or miles on the treadmill. More calories are burned the longer you can keep exercising. The CDC recommends 30 minutes of brisk walking or 15 minutes of jogging per day, 5 days a week. This sounds a lot and will take time to work up to.

For health and weight loss you'll succeed far more if you choose a speed you can stick to and perform regularly. I've taken it to the extreme in my own weight loss goals. If you see my progress, I'm running (jogging) at 5 mph and working up to doing that for 60 minutes a day and the weight is falling off. I couldn't run any quicker than 5 and maintain it or a period of time. Weight loss is what I want so time is the important factor.

Summary

So a good treadmill speed is one that you can keep up with. Whether you want to call it running, jogging or walking as long as it's helping you achieve your goal then it doesn't matter. If you run at home or in a gym keep going and progress, walk or run that little bit further every week then you'll be able to achieve what you want. Your treadmill speed will be secondary.

While you're on a treadmill then take advantage of it's features. Get the fan on and use the water bottle holders. The aim of most of us is to get fit and healthy and some to lose weight. The treadmill is ideal and people of all ages and sizes can use one. Try and keep exercise as part of your normal routine so you can stick to it. You will be getting so many health benefits from your efforts.

I'm simon gould. I've been around treadmills my whole life. From running on them at an early age to working in treadmill dept's of national stores. I've run outside and I've run on treadmills and I prefer running on treadmills. I still run on one nearly every day and love it.

Please see a health care professional before undertaking any exercise program.

Where you see a * in the link, it means it's an affiliate link and I maybe compensated if you make a purchase.

You won't pay any more for the product and the content is not influenced by this.

It's just a way of funding the site itself.

The 15 best treadmills for every type of runner

Running inside may never be fun, but it doesn’t have to suck.

Rain, crowded trails and paths, and COVID-19 are all real hurdles that keep a runner from getting outdoors for daily mileage. That’s when it’s helpful to have one of the latest treadmills, packed with powerful training tools, cool interactive elements, and more performance features than ever. Running inside might not bring the same rush as getting outdoors, but you can’t beat the convenience and safety of jumping on a good machine, especially during times of social distancing.

Take a look below at quick info on five of the best treadmills, then keep scrolling for buying advice and more in-depth reviews of these and other high-performing models.

A quality treadmill with a variety of programming and interactive features can set you back a few thousand dollars, but that investment will pay dividends for many years as you bank miles and workouts you might otherwise have missed. We put 36 of the newest models through their paces in the RW test zone to find the top performers based on their quality, features, and affordability. Whether you’re upgrading an older version or searching for your first treadmill, one of these will suit your needs. (and once you have a treadmill, check out these great workouts that help you increase speed, build strength, and burn fat.)

Why run on a treadmill at all

Why would you want to get a treadmill for your home or climb onto one in a gym when you can just run outside? Well, there are several key benefits.

Treadmills are safe and convenient

treadmill sales skyrocketed in early 2020, as the world went on lockdown to stop the spread of the novel coronavirus. During the stay-home period, there’s no safer way to get your workout in than from the comfort of your own house or apartment. Plus, there’s no rain or muddy surfaces to deal with.

You can better simulate your race

if you live in a flat region but have a hilly course coming up, a treadmill can let you mimic the course with its incline setting. Some newer treadmills even allow you to preload real course profiles and will automatically adjust up and down to follow the incline. (some with larger screens even show the entire route as a course preview.)

It may help your form

some research shows that runners have reduced stride lengths and higher stride frequencies (turnover) on a treadmill as compared with ground running. You could also use the treadmill on speed workouts to hit intended time goals, since you have no choice but to run at the speed that you’ve punched into the machine. (just be safe and attach the key to your clothing so that if you slip the treadmill will stop automatically.)

What’s new for 2020

Connected fitness has invaded our home gyms, closely replicating the studio class experience. That’s a boon during the COVID-19 pandemic, as runners can still get in group workouts without a studio or gym to visit. Gone are the days of staring at an LED representation of a 400-meter track, watching your little blinking dot complete laps. The newest treadmills, even at the budget level, are packed with entertainment and virtual coaching options—usually delivered via touchscreens embedded into the consoles.

At higher prices, you’ll find larger displays that let you take advantage of video workouts. Manufacturers are increasingly using live trainers in fitness studios or real-world footage of exotic locations, sometimes with a coach serving as tour guide, to help you beat the boredom and get a high-intensity workout. Even woodway, which has been focused on serious, high-level training, has expanded its machines with consoles that let you stream video and get interactive coaching.

The biggest change in 2020 is availability: many treadmills sold out quickly when stay-at-home orders early in the pandemic limited our ability (and, sometimes, determination) to get outside and run. And while manufacturers are catching up after the huge surge in demand, there’s still a wait for many models.

How we tested

Every treadmill on this list has been thoroughly evaluated and tested by our team of editors. We research the market, speak with product managers and engineers, and use our own experience running on treadmills for extended sessions in our offices in pennsylvania to determine the best options. Our team of experienced testers skipped their daily runs outdoors to spend many hours and miles assessing all the features of these machines. We’ve done easy runs while listening to music, long runs watching movies, and even workouts to test the machines’ interactive and studio class functions. We evaluated them on performance, price, comfort, durability, value, reliability, and fun factor to come up with this list of treadmills that will best serve your needs when you can’t get outside.

—PUT IT ON AUTO-PILOT—

Nordictrack commercial 2950

Running surface: 22 in. Wide x 60 in. Long | max speed: 12 mph | max incline: 15% | max decline: -3% | programs: 40 | motor: 4.3 HP

3 quick reminders when setting up A forex trading station

When starting a new hobby or endeavor, it’s easy to get suckered into buying things that you think you need but eventually find that you don’t, at least not in the beginning.

Jake, for example, bought the fanciest treadmill, a thighmaster, his own shake weight, and a full set of under armour gear after deciding to adopt a healthy lifestyle at the beginning of the year. Ditto for his friend, ian, who bought half the electronics store when he decided to take up vlogging.

Both could’ve furthered their goals with much less investment, but chose to buy unnecessary items anyway because it’s what they see on youtube tutorials and it makes them feel more comfortable, more confident in taking on their new ventures.

This happens all too often in forex trading. It’s not unusual to hear about newbie traders who end up buying new computers, a bajillion monitors, and fancy software and eas because they think it will help them get pips.

Luckily, you don’t necessarily need all these in order to be a consistently profitable trader. Here are three tips you should consider when setting up your trading station:

1. Stick to the essentials

Start with a good laptop or PC and a solid internet connection. Then, pick a good trading platform and install it on your unit.

Mobile devices could work for checking on your open trades, but are barely any good if you want to check the news, your charts, your trading journals, and your trades simultaneously.

No need for multiple monitors yet, unless you already have some experience and you know that you’ll need it.

2. Invest where it counts

Sticking to the essentials doesn’t mean scrimping on your investments. Just like a chef or an engineer invests in the right set of equipment, forex traders should also invest on the best tools available to maximize your trading skills.

Investing on a sturdy desk and comfortable chair, for example, helps you stay in the zone for longer periods of time.

Choosing good charting software and trading platform could help you identify setups easier and backtest trading systems and execute orders faster.

Likewise, subscribing to reputable forex-related journals and newsletters could give you economic insights and the edge that other traders don’t have. In an aggressive market like forex, you’ll need all the edge you could get.

3. Minimize distractions

There’s no use spending money on good trading software if you’re using your laptop to look at your friends’ facebook updates and viral videos half the time.

Remember that trading is a business and it requires focus, discipline, and consistency in order to make money from it.

You can start by placing your trading station at a corner where there’s the least amount of distraction. It could be your in basement, your second bedroom, or even a big closet. Try not to face your xbox, PS4, or your cat.

Use your TV only to catch the news and avoid bringing non-trading-related stuff into your station. That means no nerf guns, mini trebuchets, or your new sous vide machine (feel free to show it if you have them, though!).

There are tons of ways to be distracted from your trading pursuits, but you have to remember to treat it like work – no distractions until you’re done! If you find that you need help with this, I’ve got four tips that might help.

Although it also needs focus, discipline, and consistency, forex trading is not just a hobby.

Unless you’re in it for the pretty charts or the thrill of risking real money (in which case you’re a gambler, not a trader), then you should treat trading like a business. This means ensuring you have the best set of tools to maximize your trading skills.

How about you? What does your trading station look like? Feel free to share a description or a snapshot of your own little corner!

Introduction to forex trading

The foreign exchange market is the place where currencies are traded. It is a market where participants buy, sell, and exchange currencies. Currencies need to be exchanged in order to conduct business and foreign trade. Tourists know very well of the drill, as they exchange the equivalent value of their nation’s currency for their travel destination’s locally accepted currency. As for business owners, retail industries for instance, they use the market when importing and exporting goods.

The need to exchange currencies is the major reason why the forex market is the largest and most liquid financial market in the world. When compared to the size of other markets, like the stock market, the forex market is way massive. It facilitates the trade of trillions of dollars worth of transactions per day.

How forex trading works

When you trade equities, you bet on the success of a company which affects the stock price in equities. When you trade currencies, you bet on a country’s economic performance which affects the value of its currency, and hence affects your exchange.

Traders who speculate on forex attempt to buy currencies they think will increase in value and sell currencies they think will decrease in value. For example, with 1 EUR, you can buy 1.19 USD. The exchange rate can change at any second. It’s the banks which are continuously adjusting to the rhythms of supply and demand, which are responsible for the exchange fluctuation.

1. What are the factors that contribute to the change in the FX market

- Monetary policy

- Political stability

- Economic outlook

- Interest rates

- Imports and exports

2. How to read currency pairs

For example, you want have US dollars and you want to exhange your money to euros. This is how currency pair is written:

The stronger currency written (EUR) is called your “base currency” and the weaker currency (USD) is called your “counter currency.” the base refers to your target currency while the counter refers to the currency you have to convert.

Let’s say you bet that the EUR will get stronger against the USD. When you believe that one currency will rise against another currency, you buy the stronger (base) and you sell the weak one (counter).

For example, you risk 10,000 EUR. Before you placed your bet five minutes ago, the 10,000 EUR would’ve bought you 11,911 USD. But after your bet is finalized, your 10,000 EUR is now equivalent to 11,918 USD. In just a short span of five minutes, you made a profit of 7 USD as the EUR gained 7 pips (percentage in point) against the dollar. 1 pip represents 1% or 1% or 0.0001 which is the smallest amount of fluctuation used by forex and a unit used to express the price change of an exchange rate.

3. Where does FX trading take place:

Unlike the stock market, there is no central location for like a stock exchange. Instead, money is traded through a network of international dealers and brokers and each take individual commissions. The sale of the currency is handled by an outside brokerage firm and all you have to do is to buy a EUR/USD pair.

4. When does FX trading take place:

You can trade currencies 24h a day, 5 days a week since there’s an extremely high amount of liquidity in the FX market.

The major risk in forex trading: leverage

Leverage is both a positive thing and a negative thing.

Let’s say you are so sure that the EUR will get much stronger against the dollar. You’re confident to risk 100,000 EUR but you just can’t afford it. The brokerage firms allow you to take this risk and lend you the hundred thousand EUR. All they need from you is a 1000 EUR asa collateral deposit . From the brokerage firms, you can borrow a hundred to four hundred times of the amount of your initial collateral deposit. If you want to bet 50K EUR with 1K EUR deposit, then you exercise leverage ratio of 50:1

Borrowed funds are used to amplify potential returms but they can also magnify the potential losses of trading positions. If the value of your positiopn grows due to market movements, then there wouldn’t be any problem. But if your position loses value to the point where you no longer meet the minimum margin requirements, then your broker can liquidate assets to help assure you don’t lose more money in your margin account.

How to set up your trading screens

Modern markets have evolved into vastly complicated organisms with thousands of data points competing for attention. It's our job to transform this information flood into an efficient set of charts, tickers, indexes and indicators that support our profit objectives. Part of this task requires observation of broad market forces, while the balance demands a narrow focus on specific securities used to execute our strategies.

Most traders have real-life jobs and responsibilities away from home, forcing them to access the markets through pint-sized smartphones, gathering the information needed to assume new risk and manage open positions to a profitable or unprofitable conclusion. These folks will benefit with the screen saving tips I've outlined in top strategies remote traders should follow.

Key takeaways

- If your'e an active trader, your trading platform is your workstation - and setting up your screen layout will help you take advantage of the information at your disposal.

- Whether it's one, two, or three or more screens, make sure that you can find the tools and data you need with just a glance so that you can take action when a signal appears.

- Many platforms offer customizable and modular screen customization, as well as pre-set defaults geared toward particular types of users.

Trading from screens

A fortunate minority sits at home or in a proprietary shop and trades full time. These folks need more detailed on-screen information because they're assuming greater risk. The additional data cover the same territory as the remote participant but in far greater detail. In addition, these traders need to set aside space for incubation of future opportunities, with a focus on market groups not currently being traded.

How many monitors do at-home traders need to watch the markets efficiently? The answer has changed over the years because monitor prices have dropped substantially while graphics cards now routinely support multiple monitor setups. Given the low cost, it makes sense to add as many monitors as you can fit comfortably in the space set aside for the function, while not exceeding your budget or your ability to promptly analyze the information you put on them.

Building effective trading screens

Generally speaking, traders do a poor job capturing the three types of information needed to support a comprehensive visual analysis: market observation, position management and incubator. Each square inch of screen space wasted with unnecessary charts or data contributes to an incomplete view that can be costly in an active trading style. Nearly all traders have made the most common mistake at some point in the careers, i.E. Loading up screens with too many charts and not enough tickers.

Reserve charting for must-watch tickers, with a second group set to different time frames that link to a single symbol from the watch list. If space is limited, add a time frame toolbar to fewer charts and flip through different settings on that chart. Specific time frames utilized for this analysis should match your market approach. While not set in stone, the following settings offer a good starting point:

- Scalpers: 5-minute, 15-minute and hourly charts.

- Swing traders: 15-minute, hourly and daily charts

- Market timers: hourly, daily and weekly charts or daily, weekly and monthly charts

Must-have charts may include the following:

- S&P 500 futures or SPDR S&P 500 trust (SPY) set to 15-minute time frame

- Nasdaq 100 futures or powershares QQQ trust (QQQ) set to 15-minute time frame

- VIX - CBOE volatility index (VIX) set to 15-minute time frame

- 24-hour 15-minute charts of market-moving securities such as apple inc. (AAPL), SPDR gold shares (GLD) and the US oil fund (USO).

If possible, keep two sets of S&P 500 futures charts, one for the U.S.-only session, starting at 9:30 a.M. ET and ending at 4:15 p.M. ET, and a second 24-hour 60-minute futures chart that tracks overnight action in asia and europe. This second chart is enormously useful in getting up to speed when you open your workstation in the morning.

What about a real-time news ticker? This is a personal choice because some strategies rely on breaking news to execute positions while the majority works perfectly well with a stand-alone third-party service or a carefully curated twitter stream. As a general rule, it is best to keep news off your charting and data programs, saving the precious space for charts and security tickers.

Sample setups

These images capture highlight methods to use screen space efficiently, regardless of the number of monitors used to watch the financial markets. The panels in these examples scale well when adding new screens, or when loading up a small laptop for travel. When pressed for space, reduce the number of charts and securities while keeping the entire set of indexes and indicators.

The top panel (1) highlights major benchmarks, showing detailed information on the dow industrial average, S&P 500, russell 2000 and nasdaq indexes. S&P 500 and nasdaq 100 futures contracts sit at eye level so traders can watch in real time during the market day. Open, high, low and last data columns reveal how current price is interacting with key levels, which also mark intraday support and resistance.

The center left panel (2) deconstructs the level 2 market depth screen, eliminating extraneous columns in favor of a streamlined view that displays just price and size. Market center data are no longer useful because the vast majority of intraday transactions never make it to this screen, due to high-frequency trading algorithms (HFT). The time and sales ticker on the right side has been reduced to core elements as well, showing just time, price and size.

The center right panel (3) displays a simplified portfolio view for long-term positions. It isn't required but is extremely useful when a position blows up and requires the trader's attention. The lower panel (4) contains detailed information on open positions as well as securities being watched for entry. Price and percentage change measure intraday performance, while volume and average volume reveal activity level compared with prior sessions. Open, high, low and last columns replace charts in many cases, allowing easy visualization of the daily pattern.

Top left (1) and top right (2) panels display scaled-down data on secondary ticker lists. These are compiled over time through news, scans, homework, media play and all the other ways we find interesting trade setups. Volume and average volume columns are especially important on these lists because they identify active securities in just a glance. The chart (3) links to tickers on all the panels through the green symbol on the upper left. Traders can also flip through time frames, from 2-minute to monthly, by clicking on the top toolbar.

Top left (1) and center left (2) panels display market internals and key indexes not shown on the first screen. Learning to interpret this background information correctly takes time, but the effort is worthwhile because it builds significant tape reading skills. The top right (3) panel contains the same columns as other secondary lists but focuses on a specific market group … energy and commodities in this case. Finally, the bottom left (4) chart keeps a real-time VIX on display, while the bottom right chart (5) shows a core security you’ll watch for years or decades.

The bottom line

Well-organized trading screens sum up intraday market action, breaking it into digestible bites that can speed up complex trading decisions as well as exposing conditions that can blossom into full-blown rallies, sell-offs and reversals. When carefully constructed, these screens mark a definable trading edge that can last a lifetime.

[no matter what kind of trader you are, the ideal setup for your trading screens will depend on the specific indicators and oscillators you choose to analyze. To learn more about these tools, check out the technical analysis course on the investopedia academy, which includes on-demand videos and interactive content to help you improve your trading skills.]

How to add or remove horizontal and vertical lines in metatarder 4

Horizontal lines in metatarder 4

Horizontal lines are mainly used to mark horizontal support and resistance areas on the chart, usually by connecting the price highs (resistance) or price lows (support).

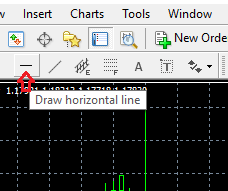

To add horizontal lines, simply click on the tab on which a horizontal line is drawn. You will find this tab on the left side of the toolbar of the MT4 platform.

The following symbol will appear:

And, after it has appeared, just click on the specific points to which you want the horizontal line to be applied.

Alternatively, you can click anywhere and later use your cursor to drag the horizontal line into position. As a rule, a horizontal line can only be used as a valid support or resistance line if it touches at least two price lows or price highs respectively.

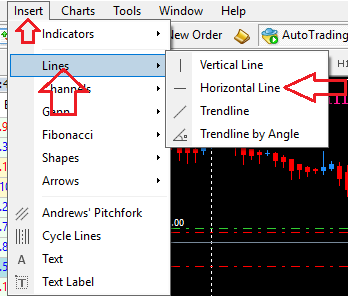

An alternative method of adding a horizontal line to the chart is by clicking on the “insert” tab located on the top left-hand side of the platform’s navigation bar.

After clicking on “insert,” scroll down to “lines” on the drop-down menu, then select the type of line you want which, such as a horizontal line.

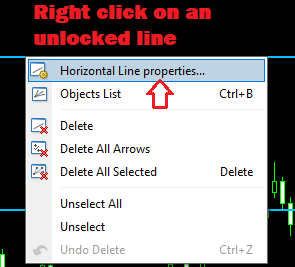

NB: double-clicking on a horizontal line locks and unlocks it. You can only move or edit an unlocked lined. A small box next to the line, located close to the price pane on the right of the chart implies that the line is unlocked.

Locked line

Unlocked line

You can edit the properties of a horizontal line. To do so, right-click on an unlocked line, and the following window will appear.

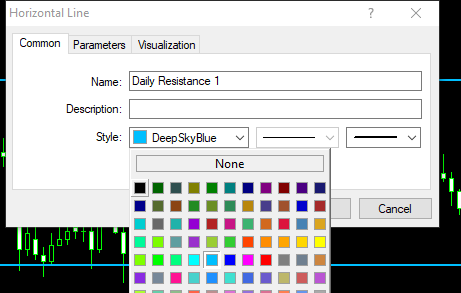

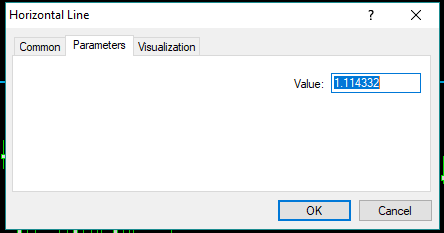

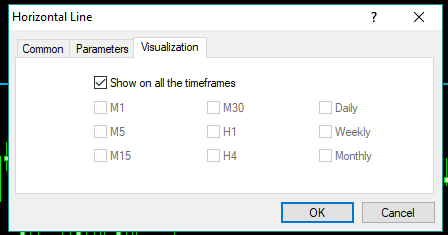

After clicking on horizontal line properties, the following pop-up window will appear.

At this point, you can change the name, color, style, and thickness, as well as add a description to the horizontal line. On the “parameters” tab in the pop-up window, you can set the horizontal line to a specific price level.

On the “visualization” tab, you can set the timeframe on which you want the line to appear. This is done by checking the box beside the time frame(s) of your choice.

Vertical lines in metatarder 4

On MT4, vertical lines are mainly used to mark the date and time at which a candlestick has appeared. They are very useful for conducting back tests. An example of a vertical line is shown below.

Following the same process as with adding horizontal lines, adding vertical lines on a chart is by a simple click on the designated vertical line button and clicking on where you want it to be located.

The process of editing and customizing vertical lines is similar to the methods discussed above.

To delete vertical or horizontal lines, double-click on them to unlock them and press “delete.” alternatively, you can right-click on an unlocked line and click on “delete” as shown in the picture below.

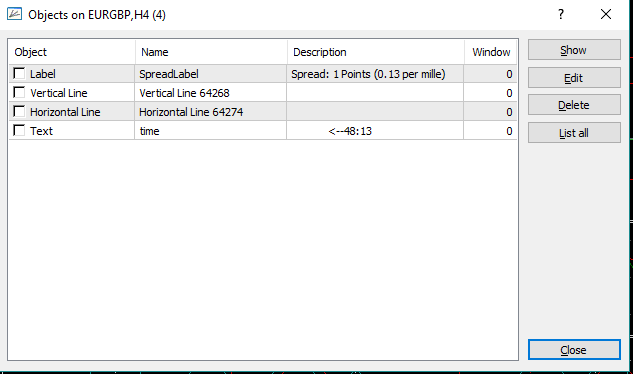

Viewing the objects list in metatrader 4

The objects list is a summary window that shows you all the objects included in a chart. It simplifies the process of locating and editing particular objects.

To activate the objects list, simply press ctrl + B or right-click on the chart and select object list. The picture below shows what the object list looks like.

Author profile

DIY trading expert

I'm the DIY trading expert.

I used to have a column on a DIY blog for home improvement projects. There were some small problems with people misreading my directions. Furniture collapsed. Plumbing caught fire. Buildings fell over. A few people died in ways my lawyer won't let me talk about.

Now I spend my time figuring out how to do all those things that experts are supposed to know. Then I make simple step-by-step guides to each one.

No one who's followed my advice about how to do things in their FX trading platform has been killed, yet. It's a perfect record and I'm very proud of it.

3 quick reminders when setting up A forex trading station

When starting a new hobby or endeavor, it’s easy to get suckered into buying things that you think you need but eventually find that you don’t, at least not in the beginning.

Jake, for example, bought the fanciest treadmill, a thighmaster, his own shake weight, and a full set of under armour gear after deciding to adopt a healthy lifestyle at the beginning of the year. Ditto for his friend, ian, who bought half the electronics store when he decided to take up vlogging.

Both could’ve furthered their goals with much less investment, but chose to buy unnecessary items anyway because it’s what they see on youtube tutorials and it makes them feel more comfortable, more confident in taking on their new ventures.

This happens all too often in forex trading. It’s not unusual to hear about newbie traders who end up buying new computers, a bajillion monitors, and fancy software and eas because they think it will help them get pips.

Luckily, you don’t necessarily need all these in order to be a consistently profitable trader. Here are three tips you should consider when setting up your trading station:

1. Stick to the essentials

Start with a good laptop or PC and a solid internet connection. Then, pick a good trading platform and install it on your unit.

Mobile devices could work for checking on your open trades, but are barely any good if you want to check the news, your charts, your trading journals, and your trades simultaneously.

No need for multiple monitors yet, unless you already have some experience and you know that you’ll need it.

2. Invest where it counts

Sticking to the essentials doesn’t mean scrimping on your investments. Just like a chef or an engineer invests in the right set of equipment, forex traders should also invest on the best tools available to maximize your trading skills.

Investing on a sturdy desk and comfortable chair, for example, helps you stay in the zone for longer periods of time.

Choosing good charting software and trading platform could help you identify setups easier and backtest trading systems and execute orders faster.

Likewise, subscribing to reputable forex-related journals and newsletters could give you economic insights and the edge that other traders don’t have. In an aggressive market like forex, you’ll need all the edge you could get.

3. Minimize distractions

There’s no use spending money on good trading software if you’re using your laptop to look at your friends’ facebook updates and viral videos half the time.

Remember that trading is a business and it requires focus, discipline, and consistency in order to make money from it.

You can start by placing your trading station at a corner where there’s the least amount of distraction. It could be your in basement, your second bedroom, or even a big closet. Try not to face your xbox, PS4, or your cat.

Use your TV only to catch the news and avoid bringing non-trading-related stuff into your station. That means no nerf guns, mini trebuchets, or your new sous vide machine (feel free to show it if you have them, though!).

There are tons of ways to be distracted from your trading pursuits, but you have to remember to treat it like work – no distractions until you’re done! If you find that you need help with this, I’ve got four tips that might help.

Although it also needs focus, discipline, and consistency, forex trading is not just a hobby.

Unless you’re in it for the pretty charts or the thrill of risking real money (in which case you’re a gambler, not a trader), then you should treat trading like a business. This means ensuring you have the best set of tools to maximize your trading skills.

How about you? What does your trading station look like? Feel free to share a description or a snapshot of your own little corner!

How to set up your trading screens

Modern markets have evolved into vastly complicated organisms with thousands of data points competing for attention. It's our job to transform this information flood into an efficient set of charts, tickers, indexes and indicators that support our profit objectives. Part of this task requires observation of broad market forces, while the balance demands a narrow focus on specific securities used to execute our strategies.

Most traders have real-life jobs and responsibilities away from home, forcing them to access the markets through pint-sized smartphones, gathering the information needed to assume new risk and manage open positions to a profitable or unprofitable conclusion. These folks will benefit with the screen saving tips I've outlined in top strategies remote traders should follow.

Key takeaways

- If your'e an active trader, your trading platform is your workstation - and setting up your screen layout will help you take advantage of the information at your disposal.

- Whether it's one, two, or three or more screens, make sure that you can find the tools and data you need with just a glance so that you can take action when a signal appears.

- Many platforms offer customizable and modular screen customization, as well as pre-set defaults geared toward particular types of users.

Trading from screens

A fortunate minority sits at home or in a proprietary shop and trades full time. These folks need more detailed on-screen information because they're assuming greater risk. The additional data cover the same territory as the remote participant but in far greater detail. In addition, these traders need to set aside space for incubation of future opportunities, with a focus on market groups not currently being traded.

How many monitors do at-home traders need to watch the markets efficiently? The answer has changed over the years because monitor prices have dropped substantially while graphics cards now routinely support multiple monitor setups. Given the low cost, it makes sense to add as many monitors as you can fit comfortably in the space set aside for the function, while not exceeding your budget or your ability to promptly analyze the information you put on them.

Building effective trading screens

Generally speaking, traders do a poor job capturing the three types of information needed to support a comprehensive visual analysis: market observation, position management and incubator. Each square inch of screen space wasted with unnecessary charts or data contributes to an incomplete view that can be costly in an active trading style. Nearly all traders have made the most common mistake at some point in the careers, i.E. Loading up screens with too many charts and not enough tickers.

Reserve charting for must-watch tickers, with a second group set to different time frames that link to a single symbol from the watch list. If space is limited, add a time frame toolbar to fewer charts and flip through different settings on that chart. Specific time frames utilized for this analysis should match your market approach. While not set in stone, the following settings offer a good starting point:

- Scalpers: 5-minute, 15-minute and hourly charts.

- Swing traders: 15-minute, hourly and daily charts

- Market timers: hourly, daily and weekly charts or daily, weekly and monthly charts

Must-have charts may include the following:

- S&P 500 futures or SPDR S&P 500 trust (SPY) set to 15-minute time frame

- Nasdaq 100 futures or powershares QQQ trust (QQQ) set to 15-minute time frame

- VIX - CBOE volatility index (VIX) set to 15-minute time frame

- 24-hour 15-minute charts of market-moving securities such as apple inc. (AAPL), SPDR gold shares (GLD) and the US oil fund (USO).

If possible, keep two sets of S&P 500 futures charts, one for the U.S.-only session, starting at 9:30 a.M. ET and ending at 4:15 p.M. ET, and a second 24-hour 60-minute futures chart that tracks overnight action in asia and europe. This second chart is enormously useful in getting up to speed when you open your workstation in the morning.

What about a real-time news ticker? This is a personal choice because some strategies rely on breaking news to execute positions while the majority works perfectly well with a stand-alone third-party service or a carefully curated twitter stream. As a general rule, it is best to keep news off your charting and data programs, saving the precious space for charts and security tickers.

Sample setups

These images capture highlight methods to use screen space efficiently, regardless of the number of monitors used to watch the financial markets. The panels in these examples scale well when adding new screens, or when loading up a small laptop for travel. When pressed for space, reduce the number of charts and securities while keeping the entire set of indexes and indicators.

The top panel (1) highlights major benchmarks, showing detailed information on the dow industrial average, S&P 500, russell 2000 and nasdaq indexes. S&P 500 and nasdaq 100 futures contracts sit at eye level so traders can watch in real time during the market day. Open, high, low and last data columns reveal how current price is interacting with key levels, which also mark intraday support and resistance.

The center left panel (2) deconstructs the level 2 market depth screen, eliminating extraneous columns in favor of a streamlined view that displays just price and size. Market center data are no longer useful because the vast majority of intraday transactions never make it to this screen, due to high-frequency trading algorithms (HFT). The time and sales ticker on the right side has been reduced to core elements as well, showing just time, price and size.

The center right panel (3) displays a simplified portfolio view for long-term positions. It isn't required but is extremely useful when a position blows up and requires the trader's attention. The lower panel (4) contains detailed information on open positions as well as securities being watched for entry. Price and percentage change measure intraday performance, while volume and average volume reveal activity level compared with prior sessions. Open, high, low and last columns replace charts in many cases, allowing easy visualization of the daily pattern.

Top left (1) and top right (2) panels display scaled-down data on secondary ticker lists. These are compiled over time through news, scans, homework, media play and all the other ways we find interesting trade setups. Volume and average volume columns are especially important on these lists because they identify active securities in just a glance. The chart (3) links to tickers on all the panels through the green symbol on the upper left. Traders can also flip through time frames, from 2-minute to monthly, by clicking on the top toolbar.

Top left (1) and center left (2) panels display market internals and key indexes not shown on the first screen. Learning to interpret this background information correctly takes time, but the effort is worthwhile because it builds significant tape reading skills. The top right (3) panel contains the same columns as other secondary lists but focuses on a specific market group … energy and commodities in this case. Finally, the bottom left (4) chart keeps a real-time VIX on display, while the bottom right chart (5) shows a core security you’ll watch for years or decades.

The bottom line

Well-organized trading screens sum up intraday market action, breaking it into digestible bites that can speed up complex trading decisions as well as exposing conditions that can blossom into full-blown rallies, sell-offs and reversals. When carefully constructed, these screens mark a definable trading edge that can last a lifetime.

[no matter what kind of trader you are, the ideal setup for your trading screens will depend on the specific indicators and oscillators you choose to analyze. To learn more about these tools, check out the technical analysis course on the investopedia academy, which includes on-demand videos and interactive content to help you improve your trading skills.]

5 best treadmills for losing weight

Overview

If you are in the market for a perfect treadmill to either maintain your fitness levels or improve it then you need a high quality treadmill to do this for you. A perfect running machine can make all the difference to your performance levels.

When it comes to choosing the perfect treadmill, i always look at the thickness of the frame and the functions on the treadmill that make it easy to exercise without restrictions.

You need to look for a treadmill that has a speed increase or decrease button that will allow you to easily change the pace that you want safely.

The thickness of the frame really will last a very long time.

5 treadmills that are great for fitness

Before we get into the list below of the best treadmills we believe to be the best out there right now, we would like to say that this list is not in order.

Losing weight with the right running machine will allow you to take control of your health moving forward.

We know the key features that really matter and we will break it down the simplest way for you to make a decision that is right for you.

One thing i will add before commencing, the prices of a treadmill right now have really skyrocketed and I am not sure why, maybe due to social distancing and the effect it has on gyms.

If you are looking for cheaper treadmills then check out ebay treadmills.

High speed folding treadmill, quiet, 15% incline & video streaming bluefin

Credit: amazon

The key features of the high speed folding treadmill, quiet, 15% incline & video streaming bluefin:

- Great treadmill that is assembled 90% already, connection to the kinomap app

- Able to fold up the treadmill very easily, the setup is very quick and easy too

- Low impact strides when you are hitting the treadmill hard, absorbs so much vibration, 5 layer anti static track that makes the treadmill very quiet

- Very energy efficient treadmill with speeds up to 20 km/h with a 15% hill climb, for professional training as it is silent

- Has wireless heart rate monitor to track your performance, displays all the best features on the screen such as speed, calories, running time, distance and so much more

Soft drop system treadmill 10-point absorption branx fold-able treadmill

Credit: amazon

The key features of the soft drop system treadmill 10-point absorption branx fold-able treadmill:

- The running area is 140x48cm (1400 x 480mm)

- Has a 10 point shock absorption system with a foldable treadmill

- Has a max speed of 21 km/h (13 mph)

- You get 2 years warranty on parts and 5 years warranty on the frame and motor

Running machine 13 programs sportstech F10 treadmill incline & foldable

Credit: amazon

The key features of the running machine 13 programs sportstech F10 treadmill incline & foldable:

- The max weight it can take is 120 KG, great for walking and running with speed up to 10 km/h

- You can start next generation training with practical tablet holder

- Displays speed, calories, pulse with 12 programs for better workout choices

- High quality running surface with extra side tread for better safety, 3 step incline

- Easily put away as it is foldable

Bluefin fitness 2-in-1 folding under desk treadmill walkpad in office

Credit: amazon

The key features of the bluefin fitness 2-in-1 folding under desk treadmill walkpad in office:

- Perfect for a home gym or in the office, you can choose many exercise modes with speeds up to 8km/h

- Good for daily fitness goals, great for burning calories

- Acts as a high performance running machine, low impact with soft running belt

- The traction is exceptional and moisture resistance, quiet and energy efficient motor

- Good smart app with bluetooth speakers, foldable tablet stand with your best entertainment when working out

LCD monitor 16km/h foldable F31 sportstech professional treadmill

Credit: amazon

The features for the LCD monitor 16km/h foldable F31 sportstech professional treadmill:

- The motor is very reliable, speeds up to 16 km/h, treadmill perfect for home with high quality long life DC motor

- Good size 5.5″ LCD monitor that displays all the relevant training information. Has AUX and MP3 for devices

- Useful tablet holder for home fitness 2.0 and next generation training

- 6 zone cushion system for knee and joint friendly training, with high tech running surface 1200x420mm

- Long lasting as the treadmill belt has a lubrication system for carefree use which is extremely useful

Summary

In order to sum up this article I would like to end it with some useful knowledge moving forward with your search for the perfect treadmill.

You must make sure that you choose a brand that you can be sure of.

As there are so many brands to choose from nowadays, this will be a difficult task.

The main things to look out for are a strong and thick steel frame and the essential button adjusters like speed and incline on your motorised treadmill.

If you would like to read more interesting articles then have a look at tomtom sat navs, car pressure washers or car carpet cleaners.

So, let's see, what we have: A good treadmill speed is one that you can comfortably maintain. I tell what you the ideal treadmill speeds are for walking, jogging and running. Plus how often and how long you should exercise on your treadmill for. At treadmill forex

Contents of the article

- Free forex bonuses

- What is A good treadmill speed?

- Treadmill speed for walking, jogging and running

- Speed is not important, time is

- Your purpose of exercising

- Summary

- The 15 best treadmills for every type of runner

- 3 quick reminders when setting up A forex trading...

- 1. Stick to the essentials

- 2. Invest where it counts

- 3. Minimize distractions

- Introduction to forex trading

- How forex trading works

- 1. What are the factors that contribute...

- 2. How to read currency pairs

- 3. Where does FX trading take...

- 4. When does FX trading take...

- The major risk in forex trading:...

- How to set up your trading screens

- Trading from screens

- Building effective trading screens

- Sample setups

- The bottom line

- How to add or remove horizontal and vertical...

- Horizontal lines in metatarder 4

- Vertical lines in metatarder 4

- Viewing the objects list in metatrader 4

- 3 quick reminders when setting up A forex trading...

- 1. Stick to the essentials

- 2. Invest where it counts

- 3. Minimize distractions

- How to set up your trading screens

- Trading from screens

- Building effective trading screens

- Sample setups

- The bottom line

- 5 best treadmills for losing weight

- Overview

- 5 treadmills that are great for fitness

- High speed folding treadmill, quiet, 15% incline...

- Soft drop system treadmill 10-point absorption...

- Running machine 13 programs sportstech F10...

- Bluefin fitness 2-in-1 folding under desk...

- LCD monitor 16km/h foldable F31 sportstech...

- Summary

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.