Tikmill

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk.

Free forex bonuses

Losses can exceed the initial investment so please ensure you fully understand the risks. About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

USDCAD is facing bullish pressure from our upside confirmation at 1.2871, in line with the 100% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 38.2% fibonacci retracement where we could see a further drop below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish bias.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 100% fibonacci extension and 50% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud and 20 EMA are showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

USDCAD is facing bullish pressure from our upside confirmation at 1.2838, in line with the 78% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 61.8% fib extension and 61.8% fib retracement, where we could see a further drop below this level towards 1st support where 50% fib retracement is. Stochastics also shows that price is near resistance.

UKOIL bounced off 55.85 where it could potentially rise further to 56.32 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks

USDCAD is facing bearish pressure from 1st resistance level, in line with the 78.6% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

UKOIL reversed off its resistance at 56.00 where it could potentially drop further to 55.07 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 100% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance.

UKOIL reversed off its resistance at 55.58 where it could potentially drop further to 54.48. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Tickmill review

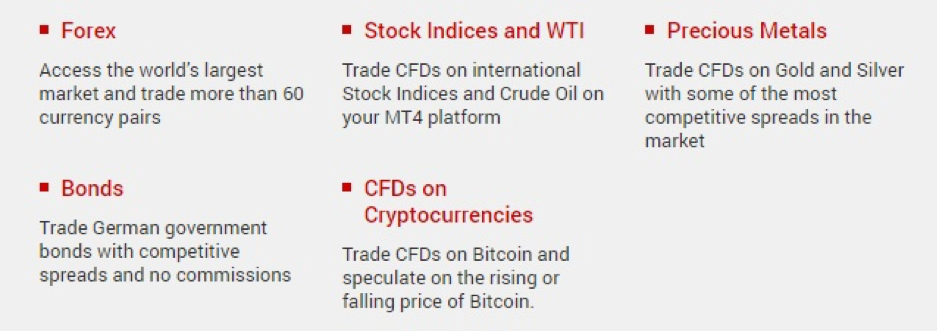

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tikmill

Pilih badan kawalan selia anda

Anggaran masa untuk menyelesaikan pendaftaran anda adalah 3 minit

sila lengkapkan borang berikut menggunakan huruf latin sahaja

© 2015-2021 tickmill ™

terma & syarat laman web | terma perniagaan | pendedahan risiko

tickmill.Com dimiliki dan dikendalikan di dalam syarikat tickmill group. Tickmill group terdiri daripada tickmill UK ltd, yang dikawal selia oleh lembaga kelakuan sektor kewangan(pejabat berdaftar: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, yang dikawal selia oleh komisyen sekuriti dan bursa cyprus (pejabat berdaftar: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, diatur oleh lembaga kelakuan sektor kewangan (FSCA) (pejabat berdaftar: the colosseum, tingkat 1, century way, office 10, century city, 7441, cape town), tickmill ltd, dikawal selia oleh lembaga kelakuan sektor kewangan seychelles dan anak syarikat 100% miliknya procard global ltd, nombor pendaftaran UK 09369927 (pejabat berdaftar: tingkat 3, 27 - 32 old jewry, london , england, EC2R 8DQ, united kingdom), tickmill asia ltd - dikawal selia oleh lembaga kelakuan sektor kewangan labuan malaysia (nombor lesen: MB / 18/0028 dan pejabat berdaftar: unit B, lot 49, tingkat 1, blok F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Amaran risiko: semua produk kewangan yang didagangkan pada margin mempunyai tahap risiko yang tinggi terhadap modal anda. Produk ini tidak sesuai untuk semua pelabur, dan anda mungkin kerugian melebihi nilai deposit awalan anda. Sila pastikan anda benar-benar memahami risiko yang terlibat dan dapatkan nasihat bebas sekiranya diperlukan. Rujuk pendedahan risiko kami.

Maklumat pada laman ini tidak disasarkan untuk penduduk amerika syarikat dan tidak bertujuan untuk pengedaran, atau penggunaan oleh, mana-mana individu di mana-mana negara atau bidang kuasa yang pengedaran atau penggunaannya akan bertentangan dengan undang-undang atau peraturan tempatan.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

USDCAD is facing bullish pressure from our upside confirmation at 1.2871, in line with the 100% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 38.2% fibonacci retracement where we could see a further drop below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish bias.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 100% fibonacci extension and 50% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud and 20 EMA are showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

USDCAD is facing bullish pressure from our upside confirmation at 1.2838, in line with the 78% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 61.8% fib extension and 61.8% fib retracement, where we could see a further drop below this level towards 1st support where 50% fib retracement is. Stochastics also shows that price is near resistance.

UKOIL bounced off 55.85 where it could potentially rise further to 56.32 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks

USDCAD is facing bearish pressure from 1st resistance level, in line with the 78.6% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

UKOIL reversed off its resistance at 56.00 where it could potentially drop further to 55.07 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 100% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance.

UKOIL reversed off its resistance at 55.58 where it could potentially drop further to 54.48. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Tickmill(ティックミル)の評判!知らないと損する4つのデメリット

もちろん、「少々利用しにくくても、ハイスペックな業者を利用したい中〜上級者」にはオススメ。

※tickmillは2020年3月31日をもって、日本から完全撤退いたしました。そのため、この記事は海外在住の日本人向けに解説しています。

1. Tickmill(ティックミル)とはセイシェルのライセンスを持つ海外FX業者

| 運営会社 | trop-X limited |

| サービス開始年 | 2015年 |

| 金融ライセンス | セイシェル金融庁(FSA) |

しかし、親会社の『tickmill UK limited』は厳格な審査で知られる「英国金融行動監視機構(FCA)」を取得しています。

日本では海外FX業者に対して規制が厳しいため、日本人向け口座に関してはセーシェルのライセンス表記がされていますが、親会社のライセンスを見ると信頼性は高く評価できるでしょう。

2. Tickmill(ティックミル)の6つの特徴・メリット

知名度こそ低いですが、大御所業者と肩を並べるスペックを持つことで密かに話題となっています。

2-1. NDD方式の採用で透明性の高い取引が可能

海外FXでは悪質な業者がトレーダーの注文を操作することが問題視されていますが、NDD方式の採用でより透明性の高い取引ができるでしょう。

2-2. 最大レバレッジ500倍で取引可能(追証無し)

さらに、追証なしのゼロカットシステムも採用されているため、証拠金を上回る損失が出ても借金は一切発生しません。

2-3. VIP口座・プロ口座のスプレッドが狭い

Tickmillの口座タイプのスプレッド比較

| ドル/円 | ユーロ/円 | ポンド/円 | 豪ドル/円 | ユーロ/ドル | 手数料 | |

| クラシック口座 | 1.8pips | 2.2pips | 3.6pips | 2.9pips | 1.8pips | – |

| プロ口座 | 0.6pips | 1.1pips | 1.5pips | 1.3pips | 0.6pips | 0.4pips |

| VIP口座 | 0.4pips | 0.9pips | 1.3pips | 1.1pips | 0.4pips | 0.2pips |

特に、プロ口座・VIP口座に関しては、取引手数料は発生しますが、かなりの低スプレッドを提供しています。

Tickmillと他社ecn口座のスプレッド比較

※全てのECN口座は取引手数料(往復)を上乗せしたスプレッド値を表示

※ 赤字 =比較上の最大値 緑字 =比較上の最小値

※1pips=1銭(0.01円)

そのため、tickmillではプロ口座の利用が最もオススメできます。

2-4. 取引における禁止事項が一切ない

- スキャルピング

- 両建て・裁定取引(アービトラージ)

- 大口での自動売買

そのため、「ワガママな手法でも思いっきり試したい」と言う方には、tickmillでの取引は非常に融通が効くでしょう。

2-5. ストップレベルが全てゼロに設定されている

ストップレベルが0に設定されていることで、待機注文の際に細かく利確や損切りを行うことが可能。

2-6. 口座開設で3000円のボーナスが獲得可能

Tickmillでは、新規口座開設で3000円のボーナスがもらえるキャンペーンを実施中。

3. Tickmill(ティックミル)の4つのデメリット

3-1. 入出金手段が海外銀行送金のみに限定

3-2. 日本円口座が無い

- 米ドル(USD)

- ユーロ(EUR)

- ポンド(GBP)

- ズウォティ(PLN)

3-3. 利用できる取引プラットフォームはMT4のみ

3-4. 信託保全の有無は明記されていない

最悪の事態を想定すると、資金の預けすぎには注意すべきでしょう。

4. Tickmill(ティックミル)の2chでの評判

357 :名無しさん@お金いっぱい。:2019/11/13(水)

tickmillの3つの弱み・デメリット入出金のたびにリフティングチャージで4,000円ほどの手数料がかかってしまう上に、口座への反映も2

243 :名無しさん@お金いっぱい。:2019/06/23(日)

tickmillはトレードコストが安いけど、以下の2つが良くない

・出金は海外送金しかない

・円口座がない引用元:2ちゃんねる-海外FX業者スレ part67

908 :名無しさん@お金いっぱい。:2019/01/19(土)

tickmillという業者めっちゃスプ狭いけど、使ってる人おる?926 :名無しさん@お金いっぱい。:2019/01/20(日)

ここ利益が出た場合、国際銀行送金でのドル送金になるから国内のドル預金口座持ってないと、ごっそり持ってかれるぞ。引用元: 2ちゃんねる-海外FX業者スレ part63

429 :名無しさん@お金いっぱい。:2019/11/08(金)

is6=よく止まる

gem=is6よりマシ

xm=最近止まることがある(割り当てられた鯖によるみたい)

fbs=止まらないけど約定の反応が遅い

ttcm=止まらない

tickmill=最近使ってないけど止まったことが無かったIs6は月末か年内で全出金するつもり

メインはxmからttcmに変えるか検討中引用元:2ちゃんねる-is6comってどうよ その15

282 :名無しさん@お金いっぱい。:2019/06/27(木)

tickmillの口座開設ボーナスも、出金するためには入金が必要なのね。

それじゃあ意味がない。どうせ溶かしちゃうし。引用元:2ちゃんねる-海外FX業者スレ part67

288 :名無しさん@お金いっぱい。:2019/08/31(土)

tickmillも口座開設でボーナスくれるけど、マイナンバーのコピーを提出しなくてはいけない。引用元:2ちゃんねる-海外FX業者スレ part69

217 :名無しさん@お金いっぱい。:2019/06/18(火)

低レバでいいので、追証無しで約定強い業者ないかな。

できればマイナススワップ低いか、片側がプラスになるところ。

手数料ありでも大丈夫です。219 :名無しさん@お金いっぱい。:2019/06/18(火)

>>217

> 追証無しで約定強い業者ないかな。

> できればマイナススワップ低いか、片側がプラスになるところ約定力の高さなら、XM/tickmill/TTCM(traders trust)あたり

スワポのマイナス低め(プラスも低め)ならTTCM ← USDJPYスワポは買2.17/売-3.92

スワポの片側プラスならmyfx markets使いやすいのはTTCMのプロ口座だと思う

引用元:2ちゃんねる-海外FX業者スレ part67

642 :名無しさん@お金いっぱい。:2019/04/30(火)

>>641

tickmillはマイナンバーカードが必要だからまだ開設していない。643 :名無しさん@お金いっぱい。:2019/04/30(火)

tickmill未入金ボーナス30ドルか

300ドルなら開設考えるけど、却下だな645 :名無しさん@お金いっぱい。:2019/04/30(火)

tickmillってスプレッド広げて刈るよね646 :名無しさん@お金いっぱい。:2019/04/30(火)

>>645

使ったことあんの?647 :名無しさん@お金いっぱい。:2019/04/30(火)

ボーナス口座だけどあるよ648 :名無しさん@お金いっぱい。:2019/04/30(火)

どこのネガキャンも常にスプで狩られただよな引用元:2ちゃんねる-海外FX業者スレ part66

888 :名無しさん@お金いっぱい。:2019/03/11(月)

tickmillはスペック的には良さそうなんだけど、円建てで出来ないのが欠点なんだよな

両替のコストぐらいケチるなと言われそうだが890 :名無しさん@お金いっぱい。:2019/03/11(月)

入出金なんとかしろtickmill893 :名無しさん@お金いっぱい。:2019/03/12(火)

tickmill知らなかったんで調べてみたら円口座無いんだね。確定申告が大変そう。

円口座ないとこ使う人は、自分で計算してるの?それとも税理士使ってる?895 :名無しさん@お金いっぱい。:2019/03/12(火)

>>893

圧倒的に税理士使った方が楽だよ

tickmillは円口座使ってくれたら申し分ないけど、妥協ではなくドル建てでも気にならん使い心地

あくまで俺個人の感想でしたが、30ドルの口座開設ボーナスあるんで試すだけ試してほしい会社かな引用元:2ちゃんねる-AXIORYってどうよ?

5. Tickmill(ティックミル)の利用をオススメできる人

ざっくり言うと、tickmillをオススメできる人は「利便性が低くてもスペックの高い業者を利用したい中〜上級者」の方。

5-1. ライセンスの信頼性を重視する人

しかし、親会社の『tickmill UK limited』は厳格な審査で知られる「英国金融行動監視機構(FCA)」を取得。

5-2. 狭いスプレッドで取引したい人

特に、狭いスプレッドのECN口座を利用したい方にとっては、tickmillのvip口座・プロ口座は非常にオススメできます。

5-3. スキャルピングで取引したい人

- ECN口座のスプレッドが狭い

- 約定力に関する評判が良い

- 取引制限が一切ない

特に、大口で取引する中〜上級者にとっては、取引コストを抑えてトレードすることが可能です。

まとめ|tickmill(ティックミル)はスペックは高いが日本人には利用しにくい

そのため、tickmillのオススメできる方は、「使いにくさはあっても、スペックの高い業者を利用したい中〜上級者」の方。

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

USDCAD is facing bullish pressure from our upside confirmation at 1.2871, in line with the 100% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 38.2% fibonacci retracement where we could see a further drop below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish bias.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 100% fibonacci extension and 50% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud and 20 EMA are showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

USDCAD is facing bullish pressure from our upside confirmation at 1.2838, in line with the 78% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 61.8% fib extension and 61.8% fib retracement, where we could see a further drop below this level towards 1st support where 50% fib retracement is. Stochastics also shows that price is near resistance.

UKOIL bounced off 55.85 where it could potentially rise further to 56.32 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks

USDCAD is facing bearish pressure from 1st resistance level, in line with the 78.6% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

UKOIL reversed off its resistance at 56.00 where it could potentially drop further to 55.07 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 100% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance.

UKOIL reversed off its resistance at 55.58 where it could potentially drop further to 54.48. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

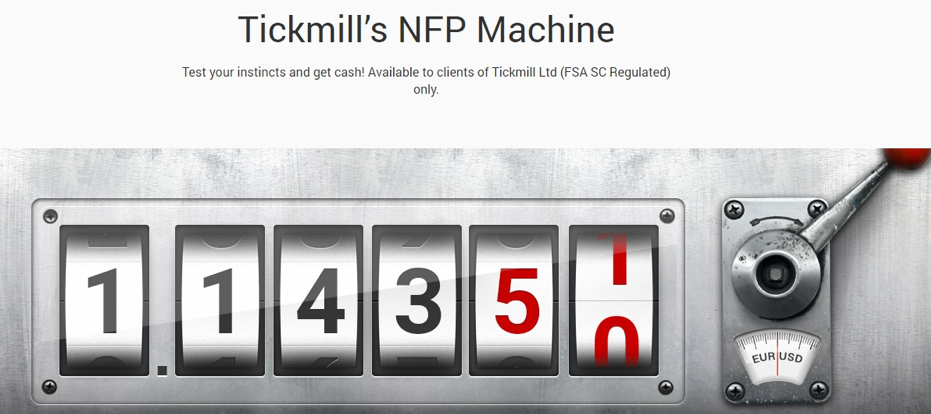

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tikmill

Pilih badan kawalan selia anda

Anggaran masa untuk menyelesaikan pendaftaran anda adalah 3 minit

sila lengkapkan borang berikut menggunakan huruf latin sahaja

© 2015-2021 tickmill ™

terma & syarat laman web | terma perniagaan | pendedahan risiko

tickmill.Com dimiliki dan dikendalikan di dalam syarikat tickmill group. Tickmill group terdiri daripada tickmill UK ltd, yang dikawal selia oleh lembaga kelakuan sektor kewangan(pejabat berdaftar: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, yang dikawal selia oleh komisyen sekuriti dan bursa cyprus (pejabat berdaftar: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, diatur oleh lembaga kelakuan sektor kewangan (FSCA) (pejabat berdaftar: the colosseum, tingkat 1, century way, office 10, century city, 7441, cape town), tickmill ltd, dikawal selia oleh lembaga kelakuan sektor kewangan seychelles dan anak syarikat 100% miliknya procard global ltd, nombor pendaftaran UK 09369927 (pejabat berdaftar: tingkat 3, 27 - 32 old jewry, london , england, EC2R 8DQ, united kingdom), tickmill asia ltd - dikawal selia oleh lembaga kelakuan sektor kewangan labuan malaysia (nombor lesen: MB / 18/0028 dan pejabat berdaftar: unit B, lot 49, tingkat 1, blok F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Amaran risiko: semua produk kewangan yang didagangkan pada margin mempunyai tahap risiko yang tinggi terhadap modal anda. Produk ini tidak sesuai untuk semua pelabur, dan anda mungkin kerugian melebihi nilai deposit awalan anda. Sila pastikan anda benar-benar memahami risiko yang terlibat dan dapatkan nasihat bebas sekiranya diperlukan. Rujuk pendedahan risiko kami.

Maklumat pada laman ini tidak disasarkan untuk penduduk amerika syarikat dan tidak bertujuan untuk pengedaran, atau penggunaan oleh, mana-mana individu di mana-mana negara atau bidang kuasa yang pengedaran atau penggunaannya akan bertentangan dengan undang-undang atau peraturan tempatan.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: charts, forecasts and trading ideas from trader tickmill. Get unique market insights from the largest community of active traders and investors. At tikmill

Contents of the article

- Free forex bonuses

- Tickmill

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Tikmill

- Tickmill

- Tickmill(ティックミル)の評判!知らないと損する4つのデメリット

- 1. Tickmill(ティックミル)とはセイシェルのライセンスを持つ海外FX業者

- 2. Tickmill(ティックミル)の6つの特徴・メリット

- 2-1. NDD方式の採用で透明性の高い取引が可能

- 2-2. 最大レバレッジ500倍で取引可能(追証無し)

- 2-3. VIP口座・プロ口座のスプレッドが狭い

- 2-4. 取引における禁止事項が一切ない

- 2-5. ストップレベルが全てゼロに設定されている

- 2-6. 口座開設で3000円のボーナスが獲得可能

- 3. Tickmill(ティックミル)の4つのデメリット

- 4. Tickmill(ティックミル)の2chでの評判

- 5. Tickmill(ティックミル)の利用をオススメできる人

- まとめ|tickmill(ティックミル)はスペックは高いが日本人には利用しにくい

- Tickmill

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tikmill

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.