What is tickmill

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Free forex bonuses

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

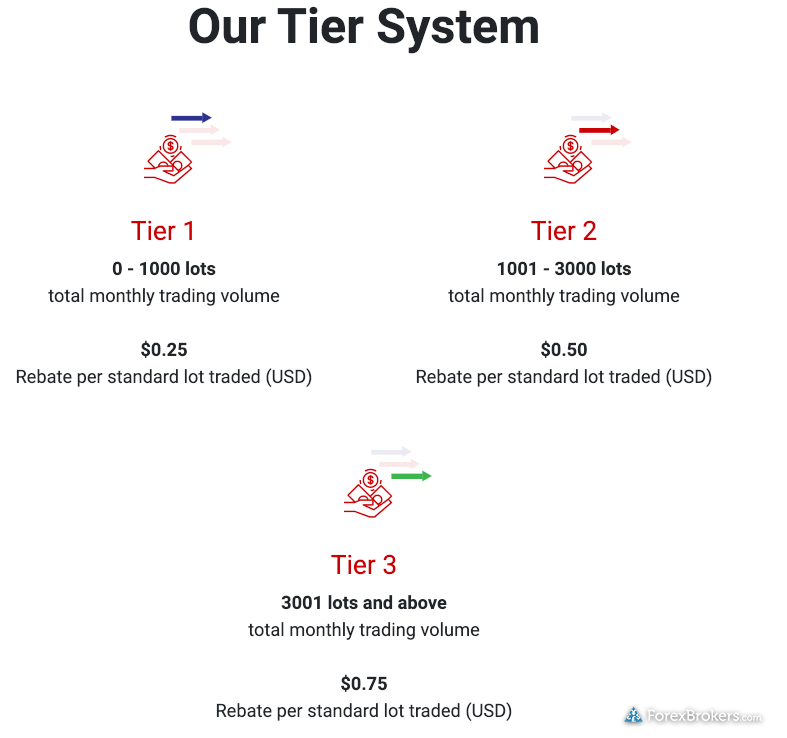

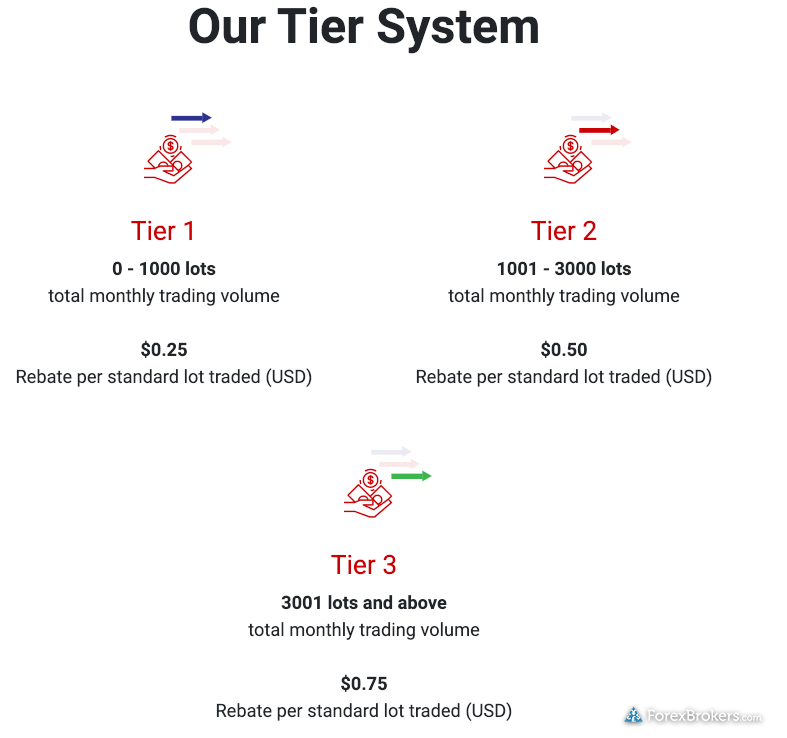

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

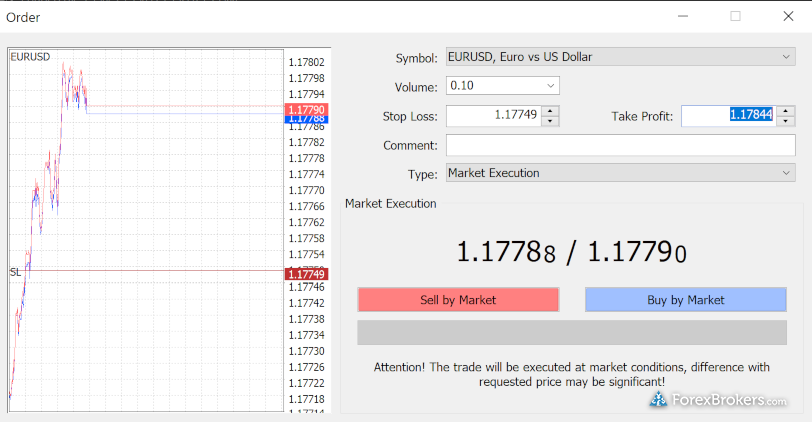

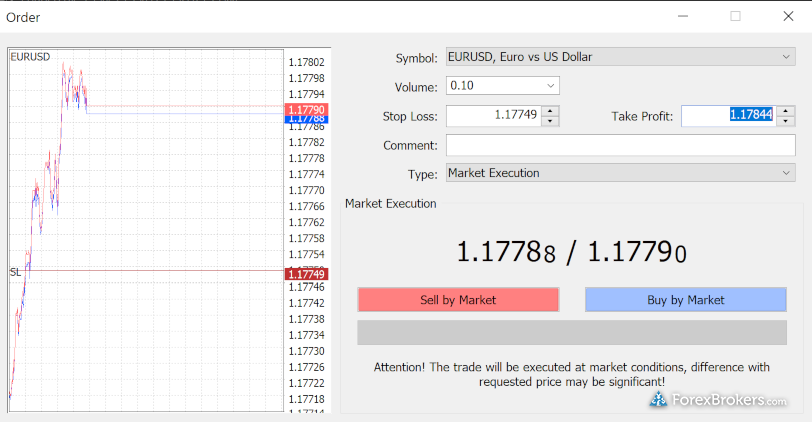

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

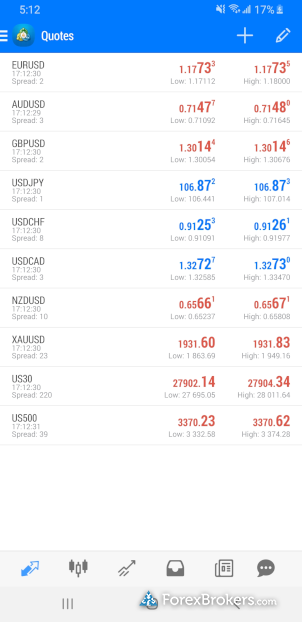

Mobile trading

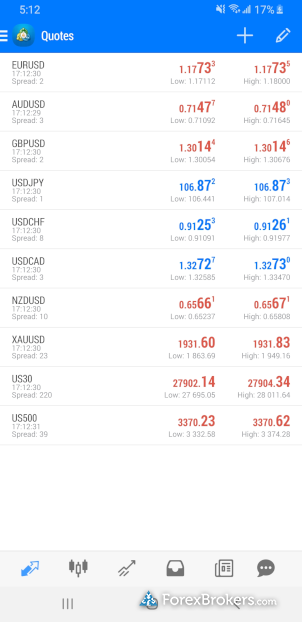

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

USDCAD is facing bullish pressure from our upside confirmation at 1.2871, in line with the 100% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 38.2% fibonacci retracement where we could see a further drop below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish bias.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 100% fibonacci extension and 50% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud and 20 EMA are showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

USDCAD is facing bullish pressure from our upside confirmation at 1.2838, in line with the 78% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 61.8% fib extension and 61.8% fib retracement, where we could see a further drop below this level towards 1st support where 50% fib retracement is. Stochastics also shows that price is near resistance.

UKOIL bounced off 55.85 where it could potentially rise further to 56.32 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks

USDCAD is facing bearish pressure from 1st resistance level, in line with the 78.6% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

UKOIL reversed off its resistance at 56.00 where it could potentially drop further to 55.07 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 100% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance.

UKOIL reversed off its resistance at 55.58 where it could potentially drop further to 54.48. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Tickmill review

Tickmill

Leverage: 1:30

Regulation: FCA, FSA, cysec

Min. Deposit: 100 US$

Platforms: MT4, webtrader

Found in: 2014

Tickmill licenses

- Tickmill UK ltd - authorized by FCA (UK) registration no. 717270

- Tickmill ltd seychelles - authorized by FSA (seychelles) registration no. SD008

- Tickmill europe ltd (ex vipro markets ltd) - authorized by cysec (cyprus) registration no. 278/15

- Tickmill asia ltd - authorized by labuan FSA registration no. MB/18/0028

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- What is tickmill?

- Awards

- Is tickmill safe or a scam?

- Leverage

- Accounts

- Fees

- Market instruments

- Deposits and withdrawals

- Trading platform

- Customer support

- Education

- Conclusion

What is tickmill?

Tickmill is a new player among the brokers and online trading world since the company established in 2014 with its headquarter in london, UK as well as offices in seychelles. Tickmill strives to innovate a unique trading experience to its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Indeed, the broker develops rapidly and their yearly achievements are quite impressive. Recently tickmill management responsibilities expanded, since additional part to “tickmill family” been added in the name of a tickmill europe ltd (ex vipro markets ltd).

| Pros | cons |

|---|---|

| fully regulated broker | conditions vary according to regulation and entity |

| globally recognized and multiple awarded broker | no 24/7 support |

| standard and pro trading conditions | |

| good costs and commissions | |

| excellent support, learning and research tools |

10 points summary

| �� headquarters | UK |

| ��️ regulation | FCA, FSA, cysec |

| �� instruments | 62 currency pairs, cryptocurrencies, bonds, cfds and precious metals, stock indices |

| �� platforms | mt4, webtrader |

| �� EUR/USD spread | 0.3 pips |

| �� demo account | available |

| �� base currencies | USD, GBP, EUR |

| �� minimum deposit | 100 USD |

| �� education | professional education center with trading blog |

| ☎ customer support | 24/5 |

Awards

Tickmill as a new company has grown rapidly throughout only a few years so that the broker has been recognized by industry publications already, which is definitely great for the building of a successful portfolio.

Along with that tickmill constantly runs a range of fascinating promotions, which helps to boost trading and enhancing even beginning traders’ possibilities.

Is tickmill safe or a scam?

When it comes to defining whether tickmill or any other broker is a legit and safe broker, we definitely check on the registration where the broker operates and applicable regulatory obligations that oversee the forex trading industry.

| Pros | cons |

|---|---|

| regulated broker with good record | additional offshore entity |

| FCA license and overseeing | |

| negative balance protection | |

| global expand and cysec license with european cross border authorization |

Is tickmill legit?

Tickmill is a multiply regulated broker is various jurisdictions, thus considered a safe broker to trade with. Tickmill trading name of a tickmill UK ltd and tickmill ltd seychelles regulated as a securities dealer.

The broker authorized and regulated by two major UK financial conduct authority and by the financial services authority of seychelles, hence either entity includes strict regulations. Besides, tickmill now grows to asia region as well and establishes its entity to cover the proposal.

In addition, newly added to the company line tickmill europe ltd (ex vipro markets ltd) is authorized and regulated by the cyprus securities and exchange commission (cysec) and is a member of the investor compensation fund (ICF).

Customer protection

To ensure security and transparency of transactions tickmill keeps clients’ funds in segregated accounts with trusted financial institutions, as per FCA regulations. In addition, clients are covered by the FSCS with investments up to £50,000.

Leverage

Being a UK and european based regulated broker tickmill follows strict guidelines set by the european authority ESMA. A recent update from the european regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

- Clients of tickmill europe may use leverage up to 1:30 for forex products, 1:5 for cfds and 1:10 for commodities.

- International traders since tickmill serves entity through seychelles and other entity as well, so the clients with the opened account under this jurisdiction may enjoy high level of leverage.

Accounts

Tickmill clients can benefit from the various types of accounts with quite competitive trading conditions. Tickmill contends attractive packages and a new way of trading with low market spreads, no requotes, transparency and innovative trading technology. There are 3 main account types in tickmill’s proposal.

| Pros | cons |

|---|---|

| fast account opening | none |

| standard account | |

| commission based pro account | |

| islamic account | |

| account base currencies USD, GBP, EUR |

Account types

There are 3 main account types in tickmill’s proposal, where you can choose either account based on spread only classic account or with commission per trade pro account. The third account is designed for high-volume traders and is named VIP account where conditions are tailored and defined as per agreement.

Additionally, islamic or swap-free account, been added to the broker features recently too. These accounts comply with the sharia law, which has exactly the same trading conditions and terms, but there is no swap or rollover interest on overnight positions, that is against the faith.

How to open account at tickmill

As we already see by the account offering, there are different price modes according to the account type you choose. Besides, fee conditions always vary according to the regulatory rules authority impose and broker obliges to. So be sure to verify specific conditions as well. Here we will check a brief of spreads and commission charges that are defined by the account type.

| Pros | cons |

|---|---|

| options between spread account or commission account via pro account | none |

| low CFD fees and stock fees | |

| good standard account spreads | |

| no hidden costs |

Our find on trading fees

For a better understanding of the tickmill pricing model and spread see the table below, yet as mentioned before according to the type of account trader will enjoy lower costs along with some commission per trade. In the tale we compare standard spread conditions, while pro accounts are based on the commission of 2 per side and interbank spreads from 0 pips.

The overnight fee should be considered as a cost as well, e.G. EURUSD swap for long position is -11.742 while for short is 6.693 US$.

You can also compare tickmill trading fees to another popular broker forex CT.

Comparison between tickmill fees and similar brokers

| asset/ pair | tickmill fees | GO markets fees | XM fees |

|---|---|---|---|

| EUR USD | 0.3 pips | 1.2 pips | 1.6 pips |

| crude oil WTI | 4 | 1.9 | 5 |

| gold | 20 | 1.4 pip | 35 |

| inactivity fee | yes | yes | yes |

| deposit fee | no | no | no |

Trading instruments

Tickmill europe ltd is fully licensed to provide the investment services of agency only execution which deliver high-grade trading instruments 62 currency pairs, cryptocurrencies (opportunity to trade CFD on bitcoin, with margin 20% and 0 commission per side, per 1 CFD).

Stock indices, bonds, cfds and precious metals, with a minimum deposit requirement of only 25$, fluctuating spreads from 0.0 pips, some of the lowest commissions in the industry and no requotes, delays or interventions policy.

Deposits and withdrawals

For the deposit or withdrawal options broker using convenient methods with perform payments with ease and diverse.

Deposit options

Payment options including popular bank transfers, credit/ debit cards, E-wallets neteller, fasapay, unionpay, dotpay, nganluong. Vn (only for clients of the tickmill ltd seychelles) with available currencies USD, EUR, GBP, PLN.

| Pros | cons |

|---|---|

| fast digital deposits | conditions may vary according to entity rules |

| no internal deposit fees or withdrawal fees | |

| multiple account base currencies EUR, USD, GBP |

What is the tickmill minimum deposit?

The minimum allowed deposit is 100$, which is a fantastic opportunity for the trader of even very small size, in reverse 10$ is set for withdrawals which is good as we see in our tickmill review.

Withdrawals

All money manipulation withdrawals, deposits or requests are submitted via your online account area. While tickmill process withdrawals within 1-2 business days as per regulatory obligations.

Moreover, at tickmill a zero fee policy is employed, where no charges or fees applicable to monetary transactions. All deposits from 5,000$ also including zero fee policy and all fees up to 100$ will be covered.

Trading platforms

Like most brokers the broker using as mainstay trusted and well-tried MT4. Trading platform available on desktop or tablet, in web or on the go with a smartphone. As well, though many among the brokers do not allow stop and limit orders placing close to market prices, tickmill allows so, so it is another good point in tickmill’s proposal.

| Pros | cons |

|---|---|

| MT4 and webtrader | no alternative platform or proprietary software |

| copy trade, social trading and technical indicators | |

| no restrictions on strategies | |

| fast execution | |

| available in various languages |

Web platform

Web platform is very useful to any size of the trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop platform

It is fact that every platform is different even you trade metatrader4, as it is a broker decision what to include and propose in its software. Good news that tickmill platforms have been enhanced with the span of useful tools including:

- Autochartist – powerful technical analysis tool with automatic recognition feature

- Myfxbook autotrade – allows following of the strategies developed by the successful trader

- One click trading – trading through eas (by the company statistics about 63% of the executes are placed by algorithms and eas)

- Tickmill VPS – keeps eas and signals active even while the trader is offline

- Forex calendar – plugging market insights and news

- Forex calculators – displays currency converter, margin calculators, etc.

Tickmill striving to reach success trading among their client, hence they do not impose restrictions on profitability and allows all trading strategies including hedging, scalping and arbitrage. Nevertheless, be sure to verify conditions with particular entity regulatory restrictions as those may apply.

Mobile platform

Customer support

Also good to consider customer support, where tickmill shows a professional team available around the clock and supporting international languages accessible via live chat, email, and phone lines in various regions including the UK and international as well.

Yet, customer service isn’t available during the weekends, so you can leave your request via the contact form to be advised.

| Pros | cons |

|---|---|

| 24/5 support | no 24/7 client support |

| relevant answers | |

| live chat, international phone lines and email |

Education

Another good point to note in tickmill proposal and offering is established learning center along with professional trading blog where traders can find recent updates, various educational materials and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars and traders community of minded traders all is a very good level and available for all.

| Pros | cons |

|---|---|

| education programs free trading signals and research tools | none |

| seminars, webinars and video lessons | |

| market outlook and research | |

| trading blog |

Conclusion

Overall, tickmill inviting clients with their attractive features such as a low minimum deposit (only 25$), technical solutions, a great range of instruments and interesting promotional campaigns. Moreover, the company’s strive to achieve targets quickly and effectively while posing tickmill as a high-tech and trustable forex broker, either to start or to gain new apex with.

The fact that the company been established only in 2014 and until now became one of the industry progress which stand in the leaders’ row, definitely means a lot. Also considering the fact, that company recently grow by establishing a branch of tickmill europe ltd, which been done by the purchase of vipro markets ltd.

Thus, tickmill should be strongly considered while choosing the broker with whom a trader or investor will start his journey to the financial markets.

Nevertheless, it is always good to know your opinion about tickmill which you may share in the comment area below.

Global provider of FX and CFD brokerage services tickmill has announced that it has sponsored the kyrenia triathlon team at the IRONMAN austria, one of the most exciting races in the world. Known to be one of the greatest challenges of endurance that triathlon has to offer, IRONMAN austria took place on 7th july 2019.

Tickmill as a relatively new player among the brokers that offers its services 2014 but already showed its significant impact on the trading industry by the number of clients and gains they report. The rapid development of tickmills’ trading environment recently brings the fantastic achievement of a record increase in net profits consolidated for 3.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

Mobile trading

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

So, let's see, what we have: tickmill is a vanilla MT4 broker that offers a small selection of tradeable securities and lacks standout features. For the best rates, agency execution and competitive commission-based pricing can be found with tickmill's VIP and PRO accounts. At what is tickmill

Contents of the article

- Free forex bonuses

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill

- Tickmill review

- Top 3 forex brokers

- What is tickmill?

- Awards

- Is tickmill safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Deposits and withdrawals

- Trading platforms

- Customer support

- Education

- Conclusion

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.