Fortrade minimum deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk.

Free forex bonuses

It is quite convenient by investing little money because emotions need practice. Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Firstrade minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

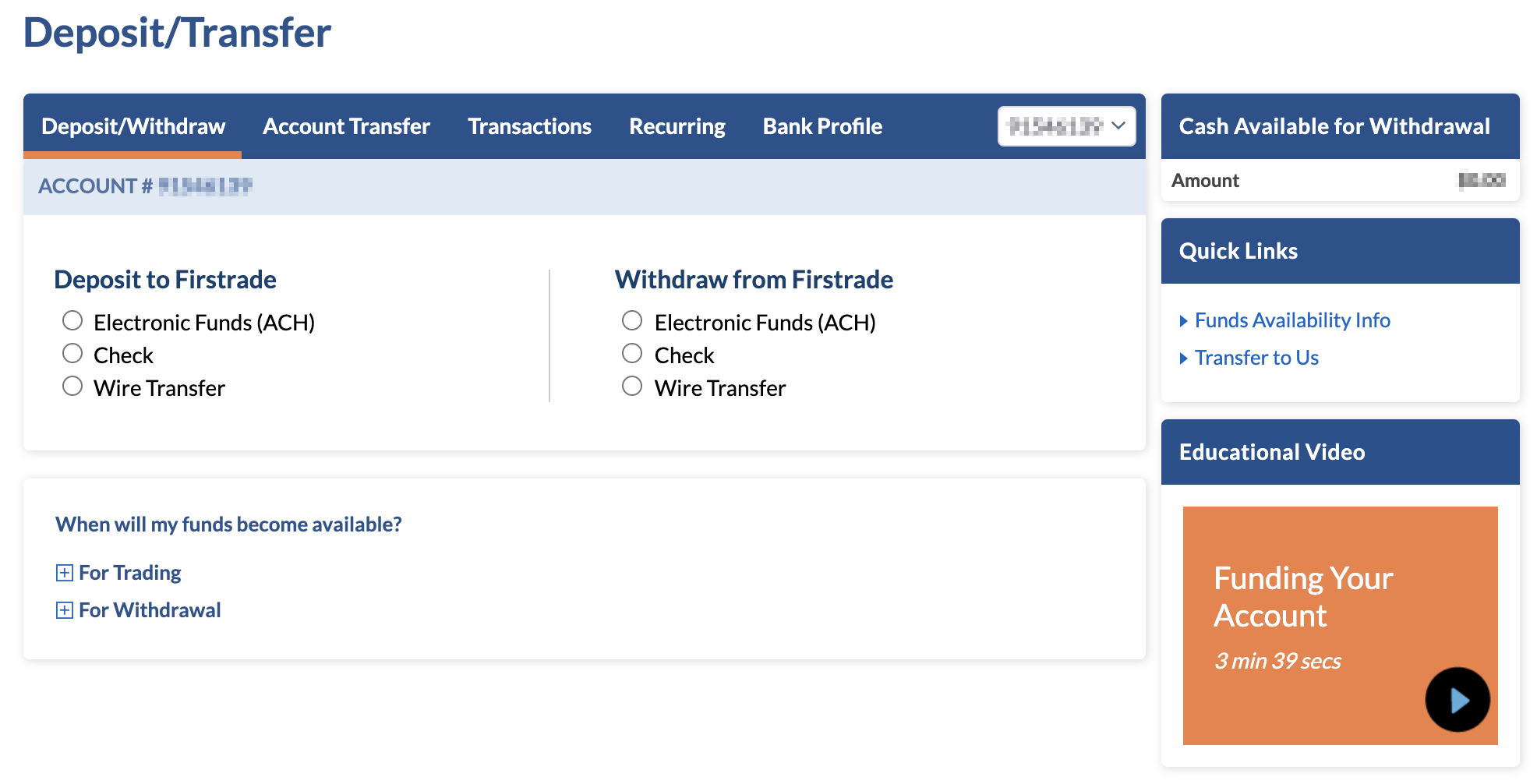

Firstrade minimum deposit amount

There is no minimum deposit required by firstrade.

This means that it's an ideal broker if you want to trade or invest with a smaller amount. It is a good broker to start your investment journey with, as you can add more funds to your account later as you get more experienced in managing your investments. Brokers that don't require a minimum deposit do so to encourage people to try their service without requiring a large initial commitment.

| firstrade | fidelity | E*TRADE | |

|---|---|---|---|

| minimum deposit | $0 | $0 | $0 |

Besides the firstrade zero minimum deposit, there is a $2,000 minimum requirement for margin accounts. A margin account is where you trade with borrowed money, also known as leverage.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at firstrade. Here are the main pros and cons when it comes to depositing at firstrade:

| Pros | cons |

|---|---|

| • no minimum deposit | • credit/debit card deposit is not possible |

| • no deposit fee | • only one account base currency |

| • depositing is user-friendly |

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Firstrade minimum deposit

firstrade deposit fees and deposit methods

Firstrade does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about firstrade fees, check out the fee chapter of our firstrade review.

While there is no deposit fee at firstrade, the available deposit methods are also important for you. See how firstrade deposit methods compare with similar online brokers:

| firstrade | fidelity | E*TRADE | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | no | no | no |

| electronic wallets | no | yes | no |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to firstrade is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to firstrade on their official website:

Firstrade minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| firstrade | fidelity | E*TRADE | |

|---|---|---|---|

| number of base currencies | 1 | 16 | 1 |

Unfortunately, firstrade supports only one currency, which is USD. This means that if you send your minimum deposit in a currency other than this, firstrade will convert it and charge a currency conversion fee. This is not an issue for you if you would deposit in USD anyway, but it's not ideal if you use any other currency.

A convenient way to save on the currency conversion fee can be to open a multi-currency bank account. Revolut or transferwise both offer digital bank accounts in USD. The account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

Firstrade minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to firstrade might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like paypal, skrill, neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you'll have to enter your credentials (username and password) and carry out your transaction.

Step 3: review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

Fortrade review

Fortrade is a forex and CFD trading broker. They give traders access to a wide variety of instruments in several markets like currencies, commodities and bonds. For traders interested in cryptocurrencies like bitcoin, fortrade offers cryptocurrency cfds.

To open a live account, you’ll need a minimum deposit of at least €1. Alternatively, fortrade offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 609970). Fortrade puts all client funds in a segregated bank account and uses tier-1 banks for this. Fortrade has been established since 1992, and have a head office in UK.

Before we dive into some of the more detailed aspects of fortrade’s spreads, fees, platforms and trading features, you may want to open fortrade’s website in a new tab by clicking the button below in order to see the latest information directly from fortrade.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

86.59% of retail investor accounts lose money when trading cfds with this provider

What are fortrade's spreads & fees?

Like most brokers, fortrade takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on fortrade’s website. The colour bars show how competitive fortrade's spreads are in comparison to other popular brokers featured on brokernotes.

| Fortrade | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | not offered | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | not offered | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | not offered | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | not offered | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | not offered | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | not offered | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | not offered | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | not offered | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, fortrade’s minimum spread for trading EUR/USD is pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with fortrade vs. Similar brokers.

How much does fortrade charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with fortrade at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $16.91. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Fortrade | IG | XTB | |

|---|---|---|---|

| spread from : | $ 10.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 10.00 | $ 6.00 | $ 2.00 |

| $4 less | $8 less | ||

| visit fortrade | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with fortrade?

Fortrade offers over 304 different instruments to trade, including over 70 currency pairs. We’ve summarised all of the different types of instruments offered by fortrade below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | fortrade | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 70 | 90 | 48 |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | yes |

| exotic forex pairs | yes | yes | yes |

| cryptocurrencies | yes | yes | yes |

| commodity cfds | fortrade | IG | XTB |

|---|---|---|---|

| # of commodities offered | 0 | 34 | 21 |

| metals | yes | yes | |

| energies | yes | yes | |

| agricultural | yes | yes |

| index & stock cfds | fortrade | IG | XTB |

|---|---|---|---|

| # of stocks offered | 190 | 8000 | 1606 |

| UK shares | yes | yes | |

| US shares | yes | yes | |

| german shares | yes | yes | |

| japanese shares | yes | yes | |

| see fortrade's instruments | see IG's instruments | see XTB's instruments |

What’s the fortrade trading experience like?

1) platforms and apps

Fortrade offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers.

Fortrade also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Fortrade allows you to execute a minimum trade of . This may vary depending on the account you open. Fortrade allows you to execute a maximum trade of . As fortrade offer STP execution, you can expect tighter spreads with more transparency over the price you‘re paying to execute your trades.

As a nice bonus, fortrade are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Fortrade also offers a number of useful risk management features, such as stop losses (with trailing stops), limit orders negative balance protection and much more. You can see all of the account features offered by fortrade here.

Finally, we’ve listed some of the popular funding methods that fortrade offers its traders below.

Trading features:

- Allows scalping

- Allows hedging

- Offers STP

- Low min deposit

- Offers negative balance protection

Accounts offered:

Funding methods:

3) client support

Fortrade support a limited number including .

Fortrade has a brokernotes double AA support rating because fortrade offer live chat, phone, email support and less than three languages.

4) what you’ll need to open an account with fortrade

As fortrade is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore fortrade’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with fortrade you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from https://www.Fortrade.Com/ on 01/01/2021.

Fortrade not quite right?

Compare these fortrade alternatives or find your next broker using our free interactive tool.

Fortrade review

Founded in 2013, fortrade is a regulated online broker focused on simple and accessible trading for all, providing user friendly platforms with a large amount of educational materials and a vast market analysis area.

Fortrade review, pros & cons

- Strict regulation

- Vast educational materials

- In-depth news & market analysis

- Trading central

- Marked up spreads

- Non-ECN

- No fixed spread accounts

- No US clients

In this detailed fortrade review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

Fortrade is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including fortrade.

Fortrade review: summary

Fortrade is an online trading broker offering 24-hour market access to hundreds of trading instruments including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies, etfs & cfds to individual and institutional traders across the globe.

Established in 2013, fortrade pride themselves on being a transparent, secure, trusted and reliable broker with a large online trading community. They aim to make trading more accessible and enjoyable with simple yet powerful solutions for all levels of trader.

Fortrade offer a vast selection of educational materials and trading tools to help clients improve their trading knowledge and skills. Amongst the free resources are daily market analysis, video tutorials, trading courses, weminars, ebooks and more.

Fortrade offers the popular metatrader 4 (MT4) platform as well as their very own fortrade web, mobile and desktop platform. The platforms have intuitive designs for friendly, simple and fast online trading whether you are a novice or advanced trader. They also include advanced technology for analysing the markets and executing trades.

Trading accounts can be opened with a minimum deposit of $100 whilst spreads and execution speeds are competitive compared to other online brokers. They also charge no commission on trades.

According to managing director nick collison, “fortrade now serves over 10,000 private and institutional traders from across the globe, and continues to grow. We are not content to rest on our laurels and we continue to improve, innovate and develop products to ensure we offer the best to our customers. We believe that trust is essential to succeed in our industry, and we pride ourselves on our integrity, dependability and transparency. As a UK-based broker we are authorised and regulated by the financial conduct authority (FCA). This ensures our commitment to safeguarding our customers’ interests and adherence to the FCA’s treating customers fairly code.”

Fortrade review: regulation

Fortrade are regulated and hold client funds in accordance with strict rules and regulation. Regulation helps to give clients the peace of mind that they are using a reliable and trusted broker in addition to having advantageous trading conditions. Fortrade’s motto is “trust and transparency in all that we do”.

Fortrade ltd.Is authorised and regulated by the financial conduct authority (FCA) in the united kingdom.

Fort securities LLC. Is authorised and regulated by the national bank of the republic of belarus (NBRB) in belarus.

Fort securities australia PTY LTD (T/A fortrade australia) is licensed and regulated by the australian securities and investments commission (ASIC).

Fortrade canada limited is regulated by the investment industry regulatory organization of canada (IIROC) and a member of the canadian investor protection fund (CIPF).

Fortrade review: countries

Fortrade accept clients from most countries excluding residents of the united states, japan or belgium and any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Some fortrade broker features and products mentioned within this fortrade review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

Fortrade review: trading platforms

Fortrade clients can choose between the popular metatrader 4 (MT4) trading platform or fortrade’s very own platform. Both platforms are available for desktop, web and mobile.

Fortrade review: trading platforms

Metatrader 4 (MT4) desktop

The MT4 desktop platform allows you to trade global markets from your PC or laptop. It streams hundreds of real time price quotes and charts from a range of trading instruments across different markets. You can view charts on multiple timeframes and use the built-in technical indicators to analyse charts for potential trading opportunities.

There are a range of order types available, trading strategy templates, drawing objects and alert notifications. MT4 also supports custom indicators and automated trading strategies commonly known as expert advisors (eas).

Although fortrade only offer the MT4 desktop platform for windows, it is available from other brokers for mac.

Fortrade review: metatrader 4 (MT4) desktop

Metatrader 4 (MT4) mobile app

The powerful MT4 app includes all of the advanced capabilities of the traditional desktop version, offered in an intuitive and feature-rich package. It is available for download on both android and ios from the relevant app stores.

Fortrade review: metatrader 4 (MT4) mobile app

Metatrader 4 (MT4) webtrader

The MT4 webtrader is accessible from all major PC and mac browsers, without needing to download or install any software. It provides you with access to over 300+ CFD asset classes including forex, stocks, commodities, indices, etfs and bonds, all from directly within your web browser. The webtrader maintains all of the advanced capabilities of the traditional desktop version.

Fortrade review: metatrader 4 (MT4) webtrader

Desktop fortrader

The fortrader desktop platform allows users to trade 150+ forex currencies and cfds with the intuitive software, benefitting from the accuracy and functionality of fully-automated trade executions. You can download and access the feature-packed platform to conveniently and securely place orders online.

The platform displays live-streaming price quotes, charts and has built-in technical indicators to help your market analysis and get the most out of your trading strategies. It has a flexible and user-friendly interface that allows you to control and customise your trading environment in a way that best suits your trading style and strategies.

Fortrade review: desktop fortrader

Web fortrader

The fortrader web platform gives instant access to the global financial markets without needing to download or install any additional software. Users can enjoy a reliable trading solution via an internet connection and most modern browsers, accessible in just a few clicks of your mouse. You can open, modify and close positions – in the office, on your holidays or during any other situation you please – provided there is an internet connection. It’s fully synced, quick and easy to use.

Fortrade review: web fortrader

Mobile fortrader

The fortrade mobile app enables you to stay connected and manage your account from anywhere in the world and at any time. You can easily and effectively turn your android or ios device into a virtual trading desk from within the palm of your hand. The mobile platform is available for download on both android and ios.

Fortrade review: mobile fortrader

Fortrade review: trading tools

Fortrade have a selection of useful trading tools including trade calculators, currency convertor and trading central.

Trading central

Fortrade have partnered with trading central to offer a complete package of technical analysis tools to help improve your trading skills and to understand the basics of charting.

Its technical analysis outputs, charts and indicators are based on information collected from a consortium of investment banks and asset managers.

Trading central can assist with trading decisions and is constantly being updated with more insightful technical analysis reports and sophisticated chart-pattern recognition tools. It is simple to use and can be located in the platform’s chart section on the desktop, web and mobile platforms.

Fortrade review: trading central analysis

Currency converter tool

The currency converter tool uses real-time market rates to convert your predefined amount to and from various currencies.

Fortrade review: currency converter tool

Margin percentage calculator

The margin calculator provides a simple percentage calculation of the required leverage for each tradable instrument offered by fortrade. This enables you to calculate exactly how much margin is required in order to open a position, and adjust its size accordingly, if necessary.

Fortrade review: margin percentage calculator

Swap rates calculator

Swap rates determine the costs for holding a position overnight. This occurs at 21:00 GMT time, on any trades held open at this time. You can use the swap calculator to quickly calculate the swap fees that you will be charged, based on the instrument, account currency and trade size.

Fortrade review: swap rates calculator

Pip value calculator

The pip calculator finds out the exact value of your trading positions in the currency of your trading account. This can help to understand how your trade sizes are being calculated.

Fortrade review: pip value calculator

Fortrade review: education

Fortrade have a free online trading academy with a range of useful resources for improving traders knowledge and skills. There are webinars, ebooks, trading courses, trading videos, video tutorials, trading strategies, news and market analysis.

Fortrade review: education

Webinars

Fortrade offer professional and free online webinars covering a range of trading topics such as market analysis (technical & fundamental), money management, technical indicators, trading psychology and much more.

Fortrade review: webinars

Trading ebooks

The trading ebooks offer a detailed overview of the markets and trading principles. They are a good place to get started and learn more about trading with a good variety of topics covered.

Fortrade review: trading ebooks

Trading courses

Fortrade offer beginner and advanced trading courses covering a wide range of topics including different markets, trading strategies, types of orders, terminology and more. These courses are fun and easy to follow, in bitesize digestible slides.

Fortrade review: trading courses

Trading videos

The trading videos are very professional and detailed, providing a wide range of advanced education on numerous topics ranging from market analysis, trading psychology, technical and fundamental analysis and more. The videos are fun and friendly, suitable for all trader skill levels.

Fortrade review: trading videos

Video tutorials

Fortrade have a collection of video tutorials covering various trading topics and how to use fortrade services. There are videos for opening accounts, using trading platforms, conducting chart analysis, using trading tools and more.

Fortrade review: video tutorials

Trading strategies

Fortrade share some trading strategies that can be used as stand alone strategies for market analysis or implemented as part of another strategy.

Fortrade review: trading strategies

Glossary of terms

The glossary of terms contains frequently used trading terminology and definitions.

Fortrade review: glossary

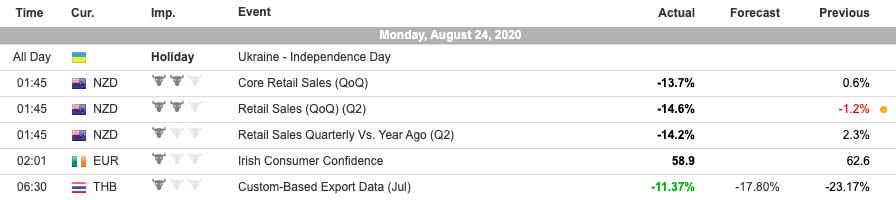

News & market analysis

Fortrade have a frequently updated analysis area that covers daily / weekly / historical analysis which can be used for finding potential market opportunities and to assist with strategies. Analysis is very detailed with technical and fundamental analysis covered across multiple markets. There is an economic calendar that displays upcoming news releases at possible impact on the markets.

Fortrade review: news & market analysis

Fortrade review: trading instruments

Fortrade offers traders over 300+ CFD products across a range of asset classes including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies, etfs & cfds.

They have more than 60+ forex currency pairs based on majors, minors and exotics. There are 20 indices, 180 stocks, 5 metals including gold and silver, 5 types of energy including gas and oil, and 5 types of soft commodities.

Fortrade review: trading instruments

Fortrade review: trading accounts & fees

Fortrade offer a demo practice account and real trading account. They do not charge a commission and instead add costs into the spread which is marked up. The minimum deposit required is $100 which provides access to all platforms and trading products. Islamic swap free accounts that comply with sharia law are also available.

Professional account

Traders who qualify as a professional client can apply for a professional account. To be eligible for a professional account you need to have traded in significant size an average frequency of 10 times in each of the last 4 quarters on cfds or forex, have an investment portfolio of + €500,000. (including cash savings / financial instruments), have worked for at least one year in the financial sector in a professional position, gaining knowledge of CFD and forex trading. Whilst a professional account can give EU traders leverage of up to 1:200 instead of 1:30, it also reduces the protection offered from the broker.

Inactivity fee

If for any consecutive period of 180 days, you do not trade on your account then fortrade will deem the account to be inactive or dormant and charge you an administrative fee of $10.00 which represents fortrade’s administrative cost of continuing to operate the inactive account. The fee is deducted from the client account balance following the expiration of the grace period and every thirty days thereafter.

As broker fees can vary and change, there may be additional fees that are not listed in this fortrade review. It is imperative to ensure that you check and understand all of the latest information before you open a fortrade broker account for online trading.

Fortrade review: customer service

Fortrade offer multilingual customer service 24/5 via online chat, telephone and email. There are international telephone numbers and the live chat is very prompt to attempt to answer questions. Support are happy to answer any questions you may have about fortrade products or services. They also welcome any feedback or comments.

Fortrade review: deposit & withdrawal

Fortrade accept a range of funding options including all major credit/debit cards, bank transfers, neteller and skrill. The method you opt for may depend on how long it takes to process. If you want something quick then you may consider an online payment processor. Please note that some methods may only be available to specific countries.

Some fees may be charged when using certain payment methods. Bank transfers may take a few business days to clear whilst some methods can be instant.

Accounts can be opened in GBP, EUR, USD. The different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

Fortrade review: funding options

Fortrade review: account opening

Opening an account to start trading at fortrade is quick and easy. You simply complete the short account opening form and verify your account with some form of identification and proof of address such as a passport and utility bill. Once verified, you can create a free demo practice account or fund your live account and start trading on the MT4 or fortrade platform desktop, web and mobile platforms.

Fortrade review: account opening

Fortrade review: conclusion

Fortrade is regulated and offers a good range of trading instruments on flexible trading platforms suitable for different trader skill levels. The educational material is extremely vast as is the market analysis area. Whilst account types are limited and spreads are marked up, useful trading tools are available.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Min $100 deposit

Founded in 2013, fortrade is a regulated online broker focused on simple & accessible trading for all, providing user friendly platforms with a large amount of educational materials & a vast market analysis area.

Fortrade review

Fortrade is a well-established broker since 2013. Fortrade has a headquarter in united kingdom. It is are generally well-suited for fortrade to provide their forex/CFD trading services to global clients.

This broker has also been regulated by ASIC 493520, cysec 385/20., FCA (UK) 609970, IIROC 20-0021 and NBRB (belarus) 193075810. Simple yet detailed information upon this broker can be seen below.

Company information

Country

united kingdom

Regulation

ASIC 493520

cysec 385/20.

FCA (UK) 609970

IIROC 20-0021

NBRB (belarus) 193075810

Features

Islamic accounts available

Account information

This broker offers standard. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by fortrade is up to 1:100. Meanwhile, you can open an account with a starting capital of $500

If you want to look for further information about this broker's offered account(s), please take a look at the list below.

Minimum deposit $500

Minimum position 0.01 lot

Instruments traded

Besides lots of currency pair, fortrade also offers some instruments you would like to trade on, such as forex, stocks, indexes, agriculture, soft commodities and energies for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Soft commodities

1:100

Payment methods

Neteller : like paypal, neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept neteller as a payment method for their clients' fund deposit and withdrawal. Although the neteller system is available almost all over the world, it remains particularly popular in europe.

Paypal : online payment was not a thing back in the early 2000s, but paypal has been in the market since 1999 and thus deserves to be regarded as one of the first e-payment services in the world. The US-based company is popular across many online platforms, including forex brokers.

Skrill : mostly, all forex brokers provide skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a skrill e-wallet account.

Wire transfer : wire transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don't have credit cards.

Fortrade also provides payment with credit/debit cards

Trading platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitabiliy by placing well-planned trades.

Hereby, fortrade offers you desktop fortrader.

Customer support

Do you have any question or find any trouble related to fortrade? If you do, you should reach fortrade's support to get the information that you need. Here is the detail of the broker's customer support:

Fortrade review 2021

Overview

Fortrade is yet another brokerage firm that came into existence in the year 2011 but got its license from the FCA (financial conduct authority) in the united kingdom in the year 2014. The platform aims to provide CFD (contracts for difference) and forex trading platforms to various clients settled all over the world (except for a few countries where it is not regulated). To get an FCA (financial conduct authority) license, every broker has to comply with some of the strictest eligibility requirements along with the mandatory need to produce proof of financial stability. Therefore, when fortrade has begun operating as a CFD broker, it means that it has undoubtedly gone through all these requirements to establish itself as one of the leading brokerage firms. Also, to get the FCA license, the brokerage firms need to keep a minimum of €730,000 on hand; this amount should not be clubbed with the clients’ funds, which needs to be kept separate.

The fortrade trading platform operates in 15 different languages, thereby providing a hassle-free trading environment for both the novice and the experienced traders. Cfds trading gives opportunities to the traders to venture on the asset price even without having the ownership of the accounts.

Features fortrade broker

Here are some of the amazing features of the fortrade platform discussed for the traders’ easy perusal, which is the onus of doing this fortrade review. After going through fortrade reviews, the users will gain an insight into whether or not they should invest in such a brokerage firm or whether or not this brokerage platform matches their requirements.

Multiple types of assets:

Fortrade offers multiple types of assets and trading instruments ranging from currency pairs, stocks, agricultural products, energy products, precious metals, and us treasuries for trade. This, in turn, widens the scope of online exchanging that the brokerage firms like the fortrade aim to achieve. Users can checkout over its 70 currency pairs and much more.

No discrimination in account types:

This is yet another amazing feature that the clients of fortrade are open to enjoy. According to fortrade reviews, at fortrade, no discrimination is made based on account types, and as such, there is no need to create separate accounts and make deposits separately. In fact, no special privilege is given to user for more deposits. Fortrade believes inequality, and that is what it brings forwards through this feature, that treats every trader equally, be it a beginner or an experienced one.

This feature is something that only genuine & good forex brokers can provide. Therefore, if this feature is considered a parameter for genuineness, then fortrade is undoubtedly a genuine broker. A demo account requires investing zero money and the real trading experience options available. This also mitigates the unnecessary losses that the client’s face when they are new to trading. The demo account is virtually funded but exposes the trader to real-time trading with all the necessary trading tools that are required to place a trade. This gives the traders a golden opportunity to learn trade tactics without risking their money.

Fortrader mobile trading:

This is perhaps the most convenient feature that the traders enjoy. The brokerage firm has come out with a free trading option with the fortrader mobile application feature that is available for easy download from the apple app store or google play store. Hence it becomes very easy and convenient for the users to trade anytime and from anywhere as they do not have to carry their laptops everywhere. With just a swipe on their mobile phones, they can easily place their trades. This software is also accessible from the ipad and other tablets.

In this online trading platform, the minimum deposit requirement of $100, that needs to be deposited into the trader’s account to initiate trade. This, in fact, serves the purpose of the working capital that is mandatory for every trade as so for the online trading cfds as well.

Fortrade considers the traders’ education as the topmost priority. From fortrade reviews, we get to know that there is a separate section on the official website of fortrade. It is dedicated exclusively for imparting various trading insights for both the novice user as well as for the experienced traders. Various webinars are occasionally arranged by the brokerage firm in order to familiarize the investors with the platform. There are also provisions for ebooks and other trading course materials that the user can easily get from the platform itself to get themselves acquainted with how online forex and CFD exchanging take place.

The registration process at fortrade is pretty simple and easy. As per the fortrade review 2021, the whole process gets completed in a few minutes if you follow the right steps. All that the traders need to do is visit the official homepage of fortrade and fill up a registration form by feeding in some personal details, and they are done. Document verification is not required in the very first step. It is required when the investors min deposit funds to their accounts as the next step to start trading online.

Excellent customer support:

An online broker cannot be trusted if it is not backed by a robust customer support team that can be contacted at any time of the day to address issues faced by the clients while operating on the platform. Fortrade has an amazing customer support team that can be contacted at any time of the day via phone calls, emails, live chat etc. Even if all these mediums fail, the customer support team is quite active on social media platforms. Therefore, the clients can also post their queries in the comment sections, which would be responded instantly as the customer care representatives also scan them regularly.

Benefits of using fortrade

In this part of the fortrade reviews, we shall discuss why customers should trade via the fortrade forex trading platform, what are the benefits that this platform provides, that is not generally available to other platforms. Here’s to why fortrade?

With myriads of trade options and digital resources available, both the trading cfds and forex tend to become of utmost confusion, especially if the investors have no previous trading experience in online trading and using software like fortrade. But with fortrade, things become much easier with its easy-to-use features based on fortrade reviews that let even the novices enjoy online exchanging without any fuss and hassles. The user-friendly, yet top-notch technology that the platform utilizes gives the investors a powerful trading environment where the traders feel at peace and place their trades in the most hassle-free ways.

Helps the traders to grow:

Fortrade considers its customers’ success as its own. Therefore, this platform provides all the necessary resources that are required to educate the users regarding the trade strategies, market trends, process of placing trades so that it yields the maximum profits etc. The platform arranges for trade webinars, fortrade also offers ebooks and other resources on its website, which are too completely free of cost so that the investors can get them right away from the platform itself.

Secure and reliable platform:

When it comes to online brokerage firms, all that it matters is whether the firm is reliable or not. For fortrade, this never has been an issue as the broker is regulated by the FCA or the financial conduct authority in the united kingdom and the national bank of the republic of belarus (NBRB), as well as IIROC. Also it is regulated by fort securities australia pty ltd (T/A fortrade australia) which is licensed and regulated by the australian securities and investments commission (ASIC). Therefore offers a legit platform that cannot be questioned. Due to this reason, the investors feel at peace while trading via this platform with full confidence that their funds are safe and secured.

Low deposits and zero commissions:

Fortrade does not require high deposits in order to get started on the platform, which in turn mobilizes a large count of customers to give it a try on the fortrade platform, even if they know very little about CFD trading and forex trading. The min deposit, competitive spreads, high leverage ratios like 1:200, along with the amazing promotional offers and bonuses, are some of the amazing benefits that fortrade comes up with for its customers. Also, there are no commissions charged by the platform that reduces the traders’ expenses immensely.

Fortrade offers its investors unlimited access to trade anytime and from anywhere. With the advent of modern-day technologies, getting access to the markets anytime and from anywhere is no longer rocket science, and fortrade has proved it once again from fortrade review. This fully scalable trading platform enables the users to monitor the global derivatives and financial services markets and then capitalize on the price movements anytime and anywhere.

In the online forex and CFD trading, even a single millisecond can make a huge difference in making or breaking a trader’s fortune. Therefore, online brokerage firms ought to deliver a high-speed transaction when it comes to placing effective trades. With fortrade, the investors can rest assured with the speed of processing transactions. We get to know from fortrade reviews, orders are processed instantly as and when they are received, and the users enjoy full control over their portfolios with just a single swipe on their mobile phones, which is the best part of trading via fortrade.

Pros and cons of fortrade

| pros | cons |

| it is a well-regulated brokerage firm. | Cryptocurrency trading is not available at fortrade and so is cannabis trading. |

| It is a 100% legit platform wherein the traders can trade in peace. | Fortrade offers only one account option. |

| The payout and withdrawals are handled with utmost care. And also its doesn’t charge any withdrawal fees. |

Is it a fortrade scam platform?

No, fortrade is not a scam. As such, it is 100% genuine. Fortrade is licensed by one of the strictest regulatory bodies, FCA, or the financial conduct authority in the UK that guarantees its legitimacy. Moreover, regulated brokers never manipulate market prices, so that way, fortrade being a regulated broker is 100% legit. When any withdrawal request is sent to fortrade, this is honored. It is also a fact that if anytime fortrade violates any regulatory rules, their regulated status would be stripped without any delay.

All the payments funded to the fortrade forex trading platform are held in a segregated bank account, and for this, fortrade uses the tier-1 banks to keep their clients’ funds safe and secure.

When are withdrawals processed on fortrade?

The processing time for the withdrawals on the fortrade forex trading platform depends on the trading mode of withdrawals and the amount. Generally, it takes 2 weeks for the amount withdrawn to reflect in the trader’s account.

How do I withdraw money from fortrade?

Withdrawing money from the fortrade account is pretty simple. All that the investors need to do is, log in to the respective fortrade account by feeding in the necessary credentials that he used while filling up the registration form. Next, the trader needs to click on the drop-down menu on the right-hand side of the screen and click in the “withdrawal” tab, here the trader needs to specify which mode of withdrawal to choose and mention the amount that he wants to withdraw. Sometimes this section needs a little more account information from the trader in order to verify his trading account details with the recorded details. Depending on the mode of transfer, the withdrawal would take the processing time accordingly. When trading cfds with this provider, some retail investor accounts lose money. So, it would be best to consider whether you could afford to take the high risk of losing your money.

How to begin trading with fortrade?

To begin trading with fortrade, the foremost thing that is required for the investors is to get themselves registered on the fortrade platform, which is pretty very simple and takes less than 10 minutes to complete all the formalities. As the fortrade platform is regulated by the FCA or the financial conduct authority in the united kingdom, it requires the traders to provide some more details like uploading some photo identity on the platform that would be later used to verify their details.

Our experts get to know from fortrade reviews that registration is absolutely free, and for this, the traders need to sign up on the official homepage of fortrade that directs them to a form that needs to be filled up by feeding in some personal details like full name of the trader, full address, valid email address, valid phone number, etc. A strong password should protect these details. After feeding in the details, not the investors need to upload the scanned documents with a photo like a passport, utility bills, or bank statement. But make sure that the utility bills or the bank statements should be recent and not more than 6 months old.

After the trader’s account has been registered, he would be sent an auto-generated email address to confirm his registration on the fortrade platform. After this, the trade needs to minimum deposit some funds, which should serve as the working capital to initiate trading. For this, the trader can use any of the various modes of payments allowed by fortrade like credit cards, bank transfers, wire transfers, neteller, skrill, etc. Alternatively, the traders can sign up for a demo account that is virtually funded with $10,000 that the investors can use as a working capital without risking their own real money, however small the amount be. This mitigates the risk of losing and also exposes the users to real-time trading so that they can get some basic concepts of real trading before they actually get into the world of online trading.

Now the traders have the liberty to start trading over the fortrade platform with the fund which they have credited their account with. But before placing a trade, the users need to set the criteria as per their trading preferences, and if their preferences vary, they have to set their criteria accordingly. The broker will match the criteria with the available market conditions and opportunities. Once they match with the set criteria, a trade is placed on behalf of the customers, and profit is earned accordingly. The users can withdraw these earned profits any time they want by filling in the withdrawal details and the mode of payments. Generally, in fortrade, the withdrawal request needs 2 weeks’ time to start processing and reflecting in the traders’ account, which is sometimes complained against by the investors.

Wrap up

Thus, after doing this fortrade review, we concluded that fortrade offers an intuitive trading platform that is focussed on making online trading simple, fast, and user-friendly. It provides the right platform for both the new investors as well as the experienced traders. The low deposit fees, myriads of digital resources to gain trade insights from, free demo account to practice trade without risking own money etc., attract the newbies, whereas the professionals gain from the numerous trading solutions that this platform provides.

The platform helps their clients grow, which is an important virtue that most brokerage firms do not possess. Prioritizing the clients’ profits and welfare over the respective profits is something that has taken this platform to great heights to date. Moreover, fortrade provides a secured and licensed trading environment that is regulated by FCA, due to which the traders can trade at peace via this platform. Fortrade is fairly transparent with no hidden commissions or fees and therefore causes no conflicts of interest, which is the best part of this platform. While trading cfds with this provider, some retail investor accounts lose money. So, it would be best to consider whether you could afford to take the high risk of losing your money.

1. Can fortrade be used before actually it is paid for?

Yes, there is a demo account feature allowed on this platform, that can be tried before investing on this broker. For this, the customer needs to open a demo account on the fortrade platform, which is virtually funded but exposes the user to real-time trading to gain some insights into how online trading is done without risking real money.

2. What are the different modes of payments accepted by fortrade?

Fortrade accepts various modes of payments according to the traders’ discretion. The various modes of payments include credit cards, bank transfers, neteller, skrill, e-wallets, bank wire transfers, mastercard, visa, etc to name a few.

3. How many languages does fortrade support?

Fortrade supports a total of 15 languages that include english, spanish, croatian, german, french, polish, italian, slovene, dutch, portuguese, russian, arabic, swedish, albanian and macedonian.

4. Is fortrade considered to be a good broker?

Yes, fortrade is considered as a good broker, by the top tier financial regulators like the financial conduct authority or FCA. It allows trading cfds and forex.

5. Can you make money with fortrade?

Yes, as per our fortrade review, the fortrade platform is absolutely meant to earn profits. The official website of fortrade has a lot of customer testimonials that implies that they are greatly satisfied with the services that the fortrade offers. For this, the users need to educate themselves thoroughly, use the demo account to plan their real trading strategies, which will immensely enhance their chances of earning huge profits. But it is recommended never to trade with funds that the users cannot afford to lose.

6. Is fortrade the market maker?

No, fortrade is just a brokerage firm and not a market maker. The definition of a market maker goes like this, “an entity that can speed up trading by purchasing the stocks and commodities of the buyers even when they are not lined up”, which is definitely not something that fortrade is up to.

Fortrade review and tutorial 2021

Fortrade is a multi-asset broker offering a simple live account with advanced tools.

Trade a breadth of forex pairs with up to 1:30 leverage.

Trade four leading crypto coins against the US dollar.

Fortrade is an international forex broker offering online CFD trading across multiple asset classes and two platforms. This review of the website looks at demo accounts, minimum deposits, the login process, and more. Find out if you should start trading with fortrade.

Fortrade company details

Fortrade limited was established in 2013 in the united kingdom and is regulated by the financial conduct authority (FCA). Over the last few years, the brokerage has also established offices and regulatory frameworks in belarus, australia, canada, and cyprus.

The broker’s core team is based in london and watford in the UK, and headed up by CEO, nick collison.

Fortrade now provides trading services in forex, commodities, indices, stocks, and etfs on the metatrader 4 platform as well as the proprietary fortrader web platform. The group offers clear and simple solutions for both individual and institutional clients.

Trading platforms

Metatrader 4

Whether you are a novice or a seasoned trader, the metatrader 4 (MT4) platform is an award-winning favourite. The platform hosts a selection of features that provide a powerful trading experience to suit a variety of strategies.

Users benefit from 30 built-in technical indicators and 24 graphical objects, plus nine timeframes and three charting types. Automated trading is also available through expert advisors (eas) along with multiple order types and one-click trading. Users also benefit from access to full trading histories.

Metatrader webtrader

MT4 webtrader is suitable for mac users or those who don’t wish to install software. Clients have easy and convenient access to all the same customisable features as the desktop platform, including over 30 technical indicators to analyse trends and graphical tools such as gann lines or fibonacci curves. The nine time-frames allow you to track detailed price movements on one of three types of charts; line, candlestick, or bar.

Webtrader can be accessed straight from the broker’s website using your login details.

Web fortrader

Fortrade also offers its own proprietary platform – fortrader webtrader, accessible from any PC with an internet connection. The platform is a low-latency system, yet powerful at delivering real-time data with high speed and precision. The one-stop-shop function allows traders to track, analyse, and trade using a cross-device platform which saves time and hassle.

Popular alternatives to fortrade

Markets

Traders can access a wide range of markets at fortrade:

- Currencies – trade over 60 forex pairs from around the world, including majors

- Precious metals – trade long and short on gold, silver, copper, platinum, and palladium

- Indices – access world-leading market indices such as the FTSE 100 and DAX 30

- Commodities – trade on energies and agricultural products including crude oil and sugar

- Cryptocurrencies – trade bitcoin and other crypto coins against the US dollar

- Bonds – trade on 5-year, 10-year, or 30-year US treasury notes and bonds

- Stocks – buy and sell equity cfds in some of the largest global companies

- Etfs – trade long or short on exchange traded funds

Spreads & commission

Fortrade’s commission is built into the spread. Average spreads on major currency pairs are around 2 pips for the EUR/USD and 3 pips for the EUR/GBP. These are perhaps not as low as competitors like etoro, but they are fairly reasonable. Gold is around 1 pip and the NASDAQ around 1.5.

Other fees include overnight rollover fees as well as an inactivity fee of 10 (GBP/EUR/USD) on accounts left dormant for 6 months.

Leverage

Leverage up to 1:30 is available at fortrade, with specific limits depending on the market:

- Commodities – 1:10

- Currencies – 1:30

- Indices – 1:20

- Metals – 1:20

- Cryptos – 1:2

- Bonds – 1:10

- Stocks – 1:5

- Etfs – 1:5

Margin requirements can be found on the trading conditions page.

Mobile apps

The metatrader 4 platform is available as a convenient mobile app, compatible with ios and android (APK) smart devices. Users can access trades and manage accounts from anywhere, with many of the same features as the desktop version, including easy scrolling, push notifications, one-touch trading, and more.

The fortrader platform is also available as a mobile app, suitable for ios and android smart devices. Traders can enjoy full-scale functionality on a user-friendly interface from anywhere and at any time.

Both apps can be downloaded from the app store or google play store.

Payment methods

Deposits

Fortrade offers some good funding options, including credit and debit cards, bank transfers, and e-wallets such as neteller and skrill. The recommended initial deposit requirement is 500 (GBP/USD/EUR), however, it is possible to deposit as little as 100. Deposits need to be approved by emailing a copy of the deposit receipt to the broker. Fortrade does not charge any deposit fees.

Unfortunately, limited information is available on deposit times.

Withdrawals

The same methods apply for withdrawals, however processing times can take up to 5 business days for bank wire and up to 15 business days for cards. These aren’t the quickest timescales compared to other brokers. Also, any bank withdrawal fees incurred by fortrade are passed on to the customer, which is usually around $40.

Demo account

Users can practice their trading strategy with a €10,000 virtual investment, available on either the fortrader or metatrader 4 platforms. There is no time limit to the demo account, making it a great training tool for beginners who wish to practice within a real environment, with no risk or pressure.

Deals & promotions

Fortrade is a fully regulated broker and therefore does not offer no deposit bonus deals or promotions.

Regulation

Fortrade ltd is regulated by the financial conduct authority (FCA) in the united kingdom, with firm reference number 609970. The brokerage is also regulated under several other global entities, including the NBRB (belarus), ASIC (australia), IIROC (canada), and cysec (cyprus).

The FCA’s client assets (CASS) rules ensure that fortrade.Com segregates its client funds at trusted financial institutions. Fortrade ltd is also covered by the financial services compensation scheme (FSCS), meaning £85,000 compensation per person is available in the event of liquidation.

Overall, this review is satisfied that fortrade is a legitimate broker and not a scam.

Additional features

Fortrade offers a comprehensive selection of educational resources and tools suitable for all levels. The academy contains several online seminars, ebooks, training courses, tutorial videos, tips, and more.

Traders can also access a wide range of resources and market research from the market analysis centre, with morning, evening, and weekly news analysis, as well as trading central, a package of technical analysis tools.

Other practical features include a currency converter, calculators, and a useful economic calendar.

Account types

Fortrade operates a single account, where specific trading conditions vary depending on the asset and trade size. The minimum recommended deposit is 500 (GBP/EUR/USD), though you can deposit as little as 100.

To open an account, head to the sign up button on the website to fill in your personal registration details and verify your identity. You can then manage your account from within the client portal.

Islamic swap-free accounts are also available and can be requested by email.

Benefits

Advantages of trading with fortrade include:

- Cross-platform trading

- Unlimited time demo account

- Wide range of markets available

- Multi-entity regulation including FCA

- Good customer reviews & online opinions

Drawbacks

Fortrade’s ratings fall down in the following areas:

- Limited information on funding methods

- Clients from the USA not accepted

- Slow withdrawals process

- Wide spreads

Trading hours

In general, trading hours for most forex pairs are sunday to friday at 21:01 – 20:59 GMT. Trading hours for other markets are listed below. Note that some will vary depending on the specific asset. All times are in GMT.

- Etfs – 13:31 – 19:59

- Bonds – 22:01 – 20:59

- Metals – 22:01 – 20:59

- Cryptos – 21:05 – 20:59

- US stocks – 09:00 – 19:59

- Indices – varies, see website

- Commodities – varies, see website

- EU stocks – opens 07:01, closing times vary

Customer support

You can contact the multilingual support team via:

- E-mail – support@fortrade.Com

- Online enquiry form – support page

- Live chat – chat logo located at the top of the home page

- Telephone – +44 203 966 4506 (UK). Other country phone numbers available

Live chat support is particularly good with short wait times and staff able to help with a range of queries, from withdrawal problems and apps not working to how to close or delete an account. Alternatively, see the FAQ section for self-service assistance.

Fortrade’s head office is located at michelin house, 81 fulham road, london, SW3 6RD, united kingdom. See the broker’s website for the address of their belgrade, istanbul, albania, kosovo or other offices.

Client security

Both the fortrader and metatrader 4 platforms are safe to use and protected by secure sockets layer (SSL) encryption. You can also enable two-factor authentication (2FA) at the login stage. All client transactions are also carried out via an SSL-encrypted connection and servers are located in high-quality SSAE 16/SAS 70 type I and type II locations.

Fortrade verdict

Fortrade offers online trading across a wide variety of asset classes through one simple account. Trading conditions are decent, though not the lowest spreads in the industry. The broker does, however, offer a good selection of educational resources and daily market analysis, making it a great option for beginners.

Accepted countries

Fortrade accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use fortrade from united states, belgium.

Does fortrade offer any no deposit bonuses?

As per regulatory restrictions, fortrade does not offer no deposit bonus deals or promotions.

Is fortrade legit?

Fortrade is a legitimate brokerage company registered in multiple jurisdictions and regulated by the FCA, ASIC, cysec, IIROC, and NBRB. On this basis, we have no reason to believe that fortrade is operating as a scam.

How do I delete my fortrade account?

You can close your account by emailing support@fortrade.Com. Alternative contact details can be found in our review.

How do I make a withdrawal at fortrade?

Withdrawals can be made from within the client area by filling out the online withdrawal form. Requests are processed within 2 days of being submitted.

What platforms does fortrade offer?

The broker offers the metatrader 4 platform on desktop, mobile and web, and the fortrader platform on mobile and web.

So, let's see, what we have: list of forex brokers according to the minimum deposit for opening a forex trading account. At fortrade minimum deposit

Contents of the article

- Free forex bonuses

- Forex minimum deposit

- Trading with a small deposit

- Firstrade minimum deposit

- Firstrade minimum deposit amount

- Firstrade minimum deposit firstrade deposit...

- Firstrade minimum deposit deposit currencies

- Firstrade minimum deposit steps of sending...

- Fortrade review

- What are fortrade's spreads & fees?

- What can you trade with fortrade?

- What’s the fortrade trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Fortrade not quite right?

- Fortrade review

- Fortrade review: summary

- Fortrade review: regulation

- Fortrade review: countries

- Fortrade review: trading platforms

- Metatrader 4 (MT4) desktop

- Metatrader 4 (MT4) mobile app

- Metatrader 4 (MT4) webtrader

- Desktop fortrader

- Web fortrader

- Mobile fortrader

- Fortrade review: trading tools

- Trading central

- Currency converter tool

- Margin percentage calculator

- Swap rates calculator

- Pip value calculator

- Fortrade review: education

- Webinars

- Trading ebooks

- Trading courses

- Trading videos

- Video tutorials

- Trading strategies

- Glossary of terms

- News & market analysis

- Fortrade review: trading instruments

- Fortrade review: trading accounts & fees

- Fortrade review: customer service

- Fortrade review: deposit & withdrawal

- Fortrade review: account opening

- Fortrade review: conclusion

- Fortrade review

- Company information

- Features

- Account information

- Instruments traded

- Payment methods

- Trading platforms

- Customer support

- Fortrade review 2021

- Overview

- Features fortrade broker

- Benefits of using fortrade

- Pros and cons of fortrade

- Is it a fortrade scam platform?

- When are withdrawals processed on fortrade?

- How do I withdraw money from fortrade?

- How to begin trading with fortrade?

- Wrap up

- 1. Can fortrade be used before actually it is...

- 2. What are the different modes of payments...

- 3. How many languages does fortrade support?

- 4. Is fortrade considered to be a good broker?

- 5. Can you make money with fortrade?

- 6. Is fortrade the market maker?

- Fortrade review and tutorial 2021

- Fortrade company details

- Trading platforms

- Popular alternatives to fortrade

- Markets

- Spreads & commission

- Leverage

- Mobile apps

- Payment methods

- Demo account

- Deals & promotions

- Regulation

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Client security

- Fortrade verdict

- Accepted countries

- Does fortrade offer any no deposit bonuses?

- Is fortrade legit?

- How do I delete my fortrade account?

- How do I make a withdrawal at fortrade?

- What platforms does fortrade offer?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.