Hycm review

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

Free forex bonuses

HYCM brings over 40 years of operations and a lineup of global brands. Despite its respected history, HYCM struggles to differentiate itself beyond a basic metatrader experience.

HYCM (henyep markets) review

While its storied history is impressive, when it comes to trading forex and cfds across its global brands, HYCM fails to impress. Effective spreads are high across all account options, and research and education are sub-par when compared to industry leaders.

Top takeaways for 2021

Here are our top findings on HYCM:

- Founded in 1977, HYCM is regulated in two tier-1 jurisdictions and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- Compared to pricing leaders such as CMC markets and FOREX.Com, HYCM is expensive and not recommended for discount traders or active investors. Research and education continue to improve at HYCM, yet still fails behind industry leaders.

- HYCM is a plain-vanilla metatrader broker. Compared to industry leaders such as IG, CMC markets, and saxo bank, HYCM left us unimpressed.

Special offer:

Overall summary

| feature | HYCM |

|---|---|

| overall | 3.5 stars |

| trust score | 84 |

| offering of investments | 3 stars |

| commissions & fees | 3.5 stars |

| platforms & tools | 3.5 stars |

| research | 3.5 stars |

| mobile trading | 3.5 stars |

| education | 3.5 stars |

Is HYCM safe?

HYCM is considered average-risk, with an overall trust score of 84 out of 99. HYCM is not publicly traded and does operate a bank. HYCM is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). HYCM is authorised by the following tier-1 regulators: securities futures commission (SFC) and financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | HYCM |

|---|---|

| year founded | 1977 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 2 |

| tier-2 licenses | 2 |

| tier-3 licenses | 1 |

| trust score | 84 |

Offering of investments

HYCM offers a total of 347 tradeable markets. The available markets vary by account type and depend on the entity that houses your account across its global brands.

Product range by platform: HYCM's range of markets is higher on its MT5 offering than on MT4. Also, HYCM's cyprus entity doesn't offer cryptocurrency cfds and has a narrower field of share cfds. Comparably, the broker provides over 60 cryptocurrency CFD pairs via its offshore entity in saint vincent & the grenadines (SVG), helping it finish best in class in 2021 for its crypto offering.

Cryptocurrency: cryptocurrency trading is available through cfds, but not available through trading the underlying asset (e.G. Buying bitcoin). Note: crypto cfds are not available from any broker's UK entity, nor to UK residents.

The following table summarizes the different investment products available to HYCM clients.

| Feature | HYCM |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 69 |

| cfds - total offered | 278 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | yes |

Commissions and fees

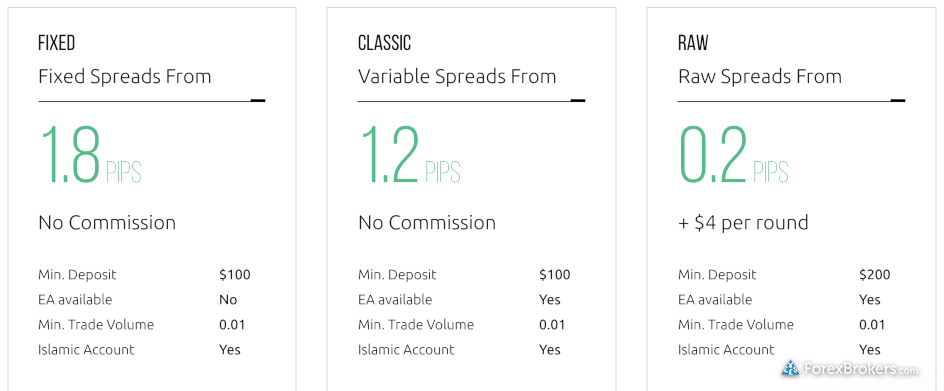

The forex trading costs at HYCM depend on which of the three account types you choose, ranging from the fixed, classic, or raw account. Overall, pricing is expensive.

Accounts comparison: average spreads for the EUR/USD stand near two pips for the fixed spread, and classic account, making them less attractive options at HYCM. The raw account has more competitive pricing, with 0.7 pips average spreads on the EUR/USD for july 2020. That said, with the commission of $4.00 per round turn trade, the effective spread on the raw account is 1.1 pips, which is not as competitive as tickmill, whose effective average spread on its pro account is 0.57 pips after including commissions.

Gallery

| Feature | HYCM |

|---|---|

| minimum initial deposit | $100 |

| average spread EUR/USD - standard | 2.00 |

| all-in cost EUR/USD - active | 1.10 |

| active trader or VIP discounts | yes |

Platforms and tools

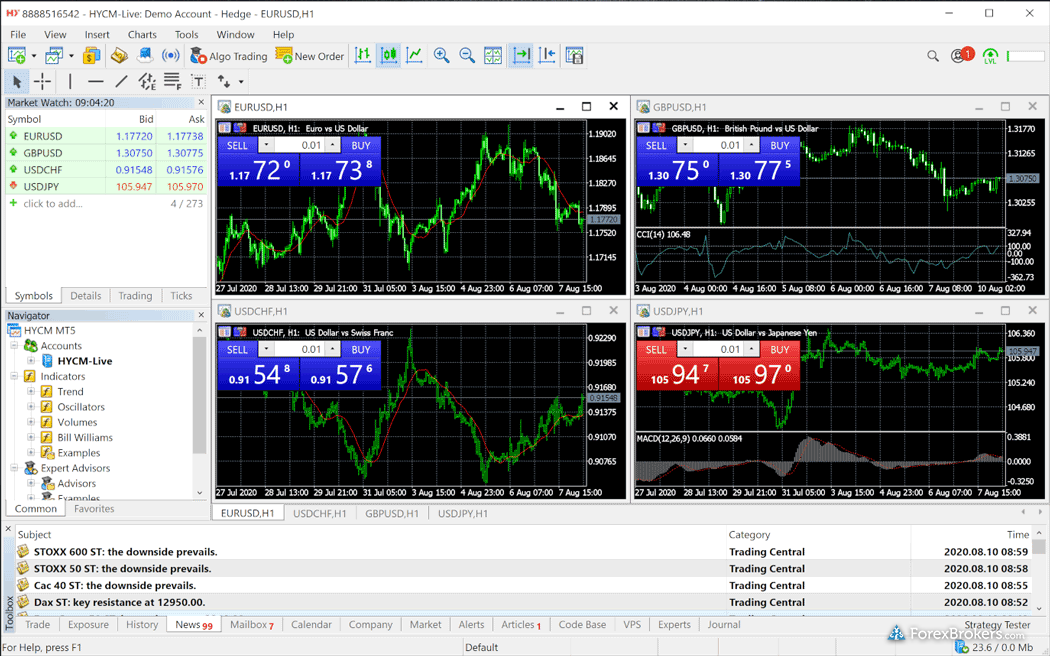

HYCM is a metatrader-only broker offering the metatrader 4 (MT4) and metatrader 5 (MT5) platform suite, for desktop and web. Compared to the best metatrader brokers that offer platform enhancements beyond the default metatrader experience, HYCM falls short in this category.

Asia: henyep securities offers a separate platform for its hong kong and china exchange-traded securities offering. However, we did not test that platform for this review as it is not available across all the firm's entities, including HYCM.

Gallery

| Feature | HYCM |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | yes |

| ctrader | no |

| duplitrade | no |

| zulutrade | no |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

HYCM provides slightly more than the bare minimum for forex traders to conduct FX market research. No question, HYCM trails far behind the best forex brokers for research.

Trading central: traders can access trading central - a popular service for automated technical analysis – which is available as an MT4 indicator, a daily newsletter, as well as via access to a dedicated web portal. Trading central also streams the forex news headlines within the metatrader platforms at HYCM.

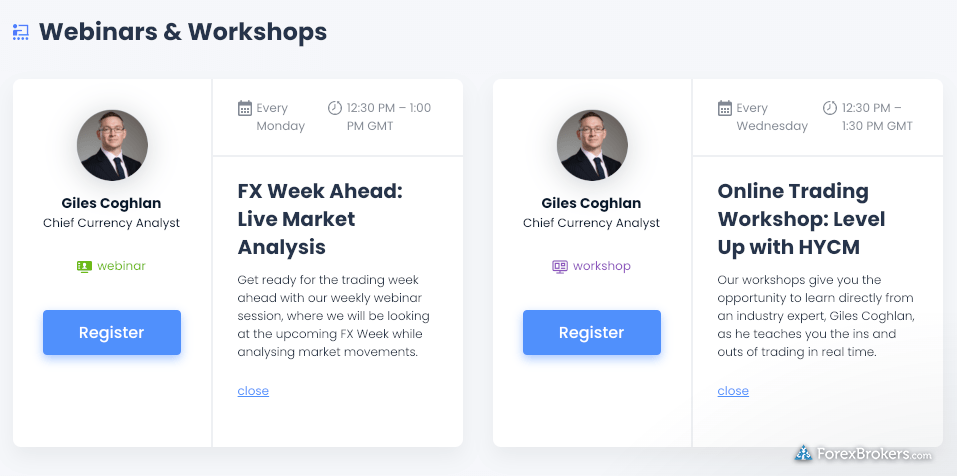

Video content: HYCM streams daily market analysis videos and provides access to an economic calendar on its website. It is worth noting that some content shown on the broker's site is outdated. For example, in the daily market review section, the last video has not been updated since july 2019. That said, HYCM did launch a new series titled market mood, which produces a daily update with market analysis.

Gallery

| Feature | HYCM |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | no |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | no |

| economic calendar | yes |

Education

When it comes to education, like research, HYCM left me wanting more. While HYCM provides a dedicated education section on its website, improvements are needed.

Videos: many of the videos in its beginner courses are no longer available (i.E., appear disabled on vimeo). Beyond this, there are over 20 interactive videos from MTE-media and four ebooks.

Courses: there are several videos per level of experience, with just five in the beginner course and ten covering strategies, including an advanced technical analysis video covering candlestick patterns. While this is a start, HYCM should add more videos to expand the scope of content across topics and experience levels.

Written content: adding more written content to HYCM's educational offering is a must, as the ebooks are not as convenient to access, even though I found some of the content useful.

Gallery

| Feature | HYCM |

|---|---|

| has education - forex | no |

| has education - cfds | no |

| client webinars | yes |

| client webinars (archived) | no |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | yes |

Mobile trading

Since HYCM is a metatrader-only broker, it provides both the standard ios and android versions of the MT4 app and MT5 app.

Proprietary trading app: HYCM app aside, which is set up only for accessing the client portal, HYCM does not offer a proprietary trading app. Like other metatrader-only brokers, providing just the standard metatrader app will always leave HYCM at a disadvantage when compared to competitors such as saxo bank, CMC markets, and TD ameritrade.

Gallery

| Feature | HYCM |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

HYCM brings over 40 years of operations and a lineup of global brands. Despite its respected history, HYCM struggles to differentiate itself beyond a basic metatrader experience.

About HYCM (henyep markets)

Founded in 1977 and headquartered in hong kong, HYCM has a long-standing reputation for providing financial services across global capital markets.

Henyep securities, regulated by the securities futures commission (SFC) since 2004, provides retail and institutional stock market investors access to the hong kong stock exchange (HKSE) and regional exchanges in mainland china.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Compare HYCM (henyep markets)

Find out how HYCM (henyep markets) stacks up against other brokers.

HYCM (henyep markets) competitors

Select one or more of these brokers to compare against HYCM (henyep markets).

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Hycm review

HYCM review

Overview

Established in 1977, HYCM is a brokerage providing traders with access to global capital markets for over 40 years. With its headquarters in london, the firm has a client base in 20 countries across three continents with offices in major cities.

Regulated for compliance by top regulatory agencies including FCA, CIMA, DFSA and cysec, the broker guarantees the safety of client funds. Traders enjoy complete transparency in deals, a vast array of asset choices and no slippage or re-quotes. HYCM has won multiple “best forex broker” awards in europe and in the middle east.

Account

Three different account types to fit the trading requirements of an individual, as well as institutional traders, are offered.

The 3 account types are: fixed, classic and raw accounts. While the fixed trading account gives spreads as low as 1.8 pips with no commission. The classic account has variable spreads starting from 1.2 pips with no commissions. Raw trading accounts have raw spreads starting at 0.2 pips with commissions of $4.00 per round lot.

All accounts have a minimum lot size of 0.01. Islamic swap free accounts without financial interest is available, the broker does offer demo accounts. Client deposits are kept in tier 1 banks in segregation from the operating capital.

Minimum deposit

Maximum leverage

Features

HYCM offers the industry standard MT4/5 for desktop and web-based trading. Traders can get access to some advanced charting and industry best technical analysis tools through the platforms.

Stop loss orders is available even at times of market volatility. HYCM has over 300 tradable instruments that include forex, stocks, indices, cryptocurrencies and commodities. Corporate and VIP account classes receive special treatment who actively trade larger volumes.

Generous bonuses welcome bonus worth up to $5000 are given, available to select countries. Negative account balance protection is also standard with HYCM.

Education

The brokerage has built an education section in its website aimed to educate traders, both beginners and advanced about capital markets, managing risk, analysis, trading strategies and more through video and text lessons.

On the education section of HYCM’s website you will find sections on: forex education, webinars & workshops and seminars.

Deposits/withdrawals

Deposits can be made through credit cards, wire transfer, and e-wallets.

An online form is to be filled to raise a withdrawal request. Canadians can also deposit their accounts with via interact online. The full list of funding methods are: visa/mastercard, bank wire, webmoney, neteller and skrill.

Customer service

Accessible 24 hours a day on all trading days via phone, email and live chat.

HYCM review

HYCM is an award winning, multi-regulated broker with over 40 years of experience providing a range of assets to traders across the globe with high speed trade execution, tight spreads and competitive trading costs.

HYCM review, pros & cons

- Strict regulation

- Fixed spread accounts

- Commission free accounts

- Multiple deposit / withdrawal methods

- Segregated client funds

- Multiple awards

- High speed trade execution

- Competitive costs

- Trading central

- No US clients

- Restricted leverage for EU clients

- Limited trading platforms

In this detailed HYCM review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

HYCM is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including HYCM.

HYCM review: summary

HYCM is a multi-regulated broker that has been providing trading services to clients across the globe since 1977. They offer a range of assets to trade across multiple markets including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies & cfds. They have established themselves as one of the leading providers of FX and cfds.

HYCM has over 40 years’ experience and have been regulated in the UK since 1998. They process around 25,000 orders each day with fast execution and 24/5 customer support with dedicated personal account managers available. There are over 300 trading instruments to trade across 6 asset classes with spreads from 0.2 pips and an average execution speed of just 12 milliseconds.

HYCM put a strong emphasis on providing excellent trading conditions with large liquidity pools, high speed trade execution, tight spreads and competitive trading costs. They embrace the latest innovative technologies in order to cater to traders ever demanding needs.

HYCM have accumulated over 15 global awards for their trading services, including best forex broker, europe 2018 and best forex broker, UAE 2017. This has helped them gain recognition as an industry leader and to become one of the online brokers of choice for many traders worldwide.

HYCM have a solid background as they are part of the henyep capital markets group, which is an international conglomerate with businesses in financial services, property, education and charity. They support many charitable causes and organisations including operation smile, hong kong AIDS foundation and the community chest of hong kong. Henyep’s operations are headquartered in hong kong’s central business district with regional offices in london, dubai and limassol.

HYCM review: regulation

HYCM are regulated by two of the most respected authorities which gives clients comfort that they are trading with a trusted and reputable broker. HYCM is authorised and regulated by the financial conduct authority (FCA) in the united kingdom and the cyprus securities and exchange commission (cysec).

This regulation means that HYCM must abide by strict regulatory requirements. They must undergo regular third-party audits to ensure that they are maintaining the highest standards with a qualified compliance officer ensuring their compliance with all regulatory responsibilities, fair treatment of clients and resolution of complaints. It is a legal requirement for them to submit financial reports and prove their capital adequacy.

HYCM operate in accordance with the european market infrastructure regulation (EMIR), where it is a legal obligation for all EU firms to report all derivatives to trade repositories. They report all clients’ executed trades through unavista, the LSE global hosted platform (FCA) and DTCC (cysec).

Safety of client funds, transparency and fair practice is a top priority to HYCM. They have partnered with top tier banks such as barclays and eurobank to hold client funds in segregated bank accounts so they cannot be used for any other purpose.

Clients are further protected by the financial services compensation scheme (FSCS) up to £50,000.00 and the investors compensation fund (ICF) up to €20,000.00, for eligible claims.

HYCM are also mifid compliant. The markets in financial instruments directive (mifid) is a set of stringent EU laws to help ensure that the financial markets are transparent and investors are protected.

They are also regulated by the dubai financial services authority (DFSA) and the cayman island monetary authority (CIMA).

HYCM review: countries

HYCM have some regional restrictions. They do not offer their services to residents of certain jurisdictions such as afghanistan, belgium, hong kong, japan, the united states of america and some other regions. Some HYCM broker features and products mentioned within this HYCM review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

HYCM review: trading platforms

HYCM offer the online brokerage industry standard metatrader platforms. Most trading brokers have these platforms which makes them one of the most popular choices. Metatrader was developed by software company metaquotes and has continued to grow over the years, often the go to platform for new traders.

Metatrader 4 (MT4) platform

HYCM offer one of the world’s leading trading platforms, metatrader 4 (MT4). It is considered to have a user-friendly interface and is thus very popular amongst many traders of all experience levels from across the globe.

MT4 utilises advanced technology to provide a powerful and flexible trading solution for all types of traders. MT4 is available on desktop (windows / MAC), web and mobile (iphone / ipad / android / tablet).

MT4 is customisable to suit your own unique preferences with a large collection of built in indicators and trading templates for technical chart analysis. You can also create your own indicators, templates and automated trading systems. There are 100 instruments available to trade through HYCM’s MT4 platform.

The key features of the MT4 trading platform include:

- User friendly platform with many online tutorials available

- Fully customisable charts & user interface to suit your trading style

- Supports multiple chart styles, order types & timeframes

- Vast collection of built in trading tools including technical indicators & graphical objects

- Conduct in-depth technical & fundamental market analysis across a large selection of trading instruments from multiple asset classes

- Automated trading through the use of expert advisors (eas)

- MQL4 programming interface to create customised indicators, scripts & eas

- Strategy tester for back testing eas over many years of historical data

- Large online community where you can get additional tools for the platform & copy trading signals

- Alert notifications via SMS, email & pop-ups

- Available on desktop, web & mobile devices (ios & android)

HYCM review: trading platform (MT4)

Metatrader 5 (MT5) platform

HYCM also offer metatrader 5 (MT5) which is similar to MT4 with some additional features including additional timeframes, more technical analysis indicators and an integrated economic calendar. MT5 also has around 300 trading instruments compared to the 100 on MT4. Despite the fact that the MT5 platform has more capabilities than MT4, the older platform still remains the most popular amongst traders. This is perhaps due to the fact that MT4 has an abundance of additional custom indicators and eas available online.

HYCM review: trading platform (MT5)

Mobile trading apps

Mobile trading is possible with the metatrader app for ios and android devices. This is useful if you plan to trade on the go. You can open, manage and close orders with complete control over your trading account from your mobile phone or tablet. The metatrader apps maintain most of the core features as the desktop platform. It is very user friendly with a simple layout and modern interface for quick and easy trading from within the palm of your hands.

HYCM review: trading platform (MT4 mobile app)

HYCM review: trading tools

There is a selection of tools that many traders will find useful on the HYCM website. These trading tools can compliment those already built into the trading platform very well. They can increase market analysis capabilities and overall trading efficiency.

Trading calculators

HYCM clients have access to a selection of easy to use trading calculators that can help with trade planning and management. These include the pip calculator, currency converter and margin calculator.

Economic calendar

You can keep track of market news events with the user-friendly economic calendar which can be filtered by country, category, impact, dates and more. The calendar is considered by many experts as an imperative aspect of fundamental analysis.

Market outlook

The market outlook provides the latest news, commentary, fundamental and technical analysis. It is updated frequently and goes into great detail including illustrated charts. This can help to inspire potential trading signals whilst also being useful if you have an open position you are keeping tabs on.

Trading central

HYCM offer trading central’s award winning analysis tools to use on their platforms to assist traders with their trading decisions. These tools include alpha generation, risk management and indicators lab. Trading central third-party plugins can be installed on the metatrader platforms to further enhance technical analysis and to provide market forecasts and commentary.

Alpha generation

Alpha generation has 3 tools to help with your trading:

Analyst opinion indicator

This indicator overlays research, forecasts, commentary and key levels (support/resistance/targets/stop pivots) from trading central’s analysts directly onto your charts. It displays the latest opinion of trading central analysts based on various timeframes on an intraday (30 min chart), short term (daily chart) or midterm (weekly chart) basis. You can program and fill in orders based on the analyst’s levels.

HYCM review: analyst opinion indicator

Adaptive candlesticks

Trading central adaptive candlesticks (TCAC) will mark your chart with valid candlestick patterns that can be incorporated into your own trading system and show potential trade setups whilst helping to improve trading skills and timing. There are 16 candlestick patterns included and you can roll your mouse over a mark up to reveal more information on a candlestick.

HYCM review: adaptive candlesticks

Adaptive divergence convergence signals

The adaptive divergence convergence (ADC) is a technical indicator that adapts according to the current market conditions, shortening in trending market and getting longer in ranging markets. This can help pin point trending and ranging markets. There are also slow and fast oscillators to assist with trading signals. As it has only one parameter, it can easily be optimised according to your preferences. Further information on entry and exit signals can be found by hovering your mouse over the mark up on the chart.

HYCM review: adaptive divergence convergence signals

Risk management

Risk management has 2 useful tools to help with your market analysis.

Probabilistic market classifiers

Probabilistic market classifiers (pmcs) show a probability of between 0 and 100 for a bearish, sideways and bullish market. This can help to differentiate between tending and ranging markets. It is possible to combine the PMC on multiple timeframes for a greater outlook.

HYCM review: probabilistic market classifiers

Probabilistic stops

Probabilistic stops can be used to find price levels for your stop loss that will allow for reasonable price fluctuations and can be adjusted according to your preferences.

HYCM review: probabilistic stops

Indicators lab

Indicators lab provides you with some indicators that you can use for your own trading systems and chart analysis.

Regularised momentum

This indicator can be used to remove unwanted momentum turning points and offers a smoothing technique to momentum which could otherwise be too noisy to interpret.

HYCM review: regularised momentum

Regularised buying selling pressure

Buying selling pressure (BSP) reflects the underlying tendency of close prices to gather near the highs in an uptrend or near the lows in a downtrend. As BSP can usually be a noisy signal, regularisation helps to get rid of some of this noise.

HYCM review: regularised buying selling pressure

Regularised RSI

RSI is used as an indicator with an exponential smoothing constant of one and regularisation parameter. This usage means regularisation is being used only for smoothing.

HYCM review: regularised RSI

HYCM review: education

HYCM has a wide selection of free educational materials suitable for novice and experienced traders. These educational tools are designed to help you improve your trading skills and knowledge of the financial markets.

Trading guides

Plenty of subjects are covered ranging from the basics of trading, trading psychology, chart analysis and much more. There are tutorials, videos, e-books, trading strategies, articles and courses.

Webinars & seminars

HYCM offer frequent webinars for traders to participate in and venue-based seminars that clients can attend. This adds to the overall transparency and friendly approach adopted by HYCM.

HYCM review: trading instruments

HYCM offer traders a range of assets to trade across multiple markets including forex, commodities, cryptocurrency, stocks, shares, indices, metals, energies & cfds. There are 100+ instruments available to trade on the MT5 platform and 300+ on MT5.

HYCM review: trading instruments

There is a large range of major, minor and exotic currency pairs to trade with spreads starting from just 0.2 pips.

Stocks in some of the world’s leading brands can be traded as can the global equity markets.

Commodities are available to trade without owning the financial instrument on which the contract is based.

The main cryptocurrencies can be traded without physically purchasing them, including bitcoin, ethereum and litecoin.

HYCM review: trading accounts & fees

HYCM offer a variety of trading accounts to suit individual trader needs and levels of experience. If you are not sure what account to choose, there is a short questionnaire that will help identify the most suitable for you. All accounts are islamic friendly and minimum deposits start at just $100.

HYCM review: account type comparison

Fixed spread account

The fixed spread account requires a minimum deposit of $100 with fixed spreads starting from 1.8 pips. There is no commission charged as fees are included within the spread.

Classic account

The classic account requires a minimum deposit of $100 with variable spreads starting from 1.2 pips. There is no commission charged as fees are included within the spread.

Raw spread account

The raw spread account requires a minimum deposit of $200 with variable spreads starting from 0.2 pips and $4 commission fee per round turn.

VIP account

There is a special VIP account for clients who actively trade larger volumes. The VIP account comes with lower spreads, a dedicated account manager and comprehensive market analytics.

As broker fees can vary and change, there may be additional fees that are not listed in this HYCM review. It is imperative to ensure that you check and understand all of the latest information before you open a HYCM broker account for online trading.

HYCM review: customer service

HYCM have a professional global customer support team on hand around the clock to assist. They welcome all questions and are on hand to support you from your initial inquiries all along your trading journey. Customer support is provided via online chat, telephone and email.

HYCM review: deposit & withdrawal

HYCM provide a variety of quick and convenient methods of depositing and withdrawing from your trading account. Online payment processors such as skrill and neteller may be preferred to clients who are looking for a faster method of funding.

Some fees may be charged when using certain payment methods. Bank transfers may take a few business days to clear. Accounts can be opened in USD, EUR & GBP. The different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

HYCM review: account opening

Opening a HYCM account is simple and fast. You simply complete the online registration form and fill out the brief trader’s questionnaire. Once your account has been verified by uploading your proof of identification and address, you can fund via your preferred method and commence trading.

HYCM review: account opening form

HYCM review: conclusion

HYCM is an award-winning global online broker that is under strict regulation and has been providing financial services to clients for over 40 years. They have a good selection of tradeable instruments over a range of markets. Execution speeds and spreads are very competitive whilst there are trading accounts suited to each individual trader’s needs. Various funding methods are available and customer service on hand for support. The charitable work from the henyep capital markets group is highly commendable and helps to emphasise strong business ethics.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Min $100 deposit

HYCM is an award winning, multi-regulated broker with over 40 years of experience providing a range of assets to traders across the globe with high speed trade execution, tight spreads and competitive trading costs.

Read our HYCM review and discover the merits of choosing a forex broker with more than 3 decades of experience.

HYCM.Com, formerly known as HY markets, is a member of the henyep group, an international conglomerate with more than 30 years’ experience in providing financial services. Choosing this broker guarantees peace of mind, as they have an international reputation for reliability and trustworthiness. Finding a forex broker with such an enviable pedigree is definitely going to be advantageous. If you want to know more about their service keep reading this HYCM review.

- 10% credit bonus on your first deposit

- Max leverage: 1:200

- Spread: 1.8

- Forex licences: FCA, FSCS

An introduction to HYCM

HYCM has its base in london, but is also represented in a number of other countries including hong kong, cyprus, kuwait, and the united arab emirates. The list of its regulatory compliances is pretty impressive, with licences issued by the FCA in the UK, the SFC in hong kong, and the DFSA in dubai. By virtue of their compliance with mifid, they are also authorised to operate throughout europe. HYCM is able to offer traders a wealth of trading opportunities, from stock and commodities to a long list of currency pairs. Both novice and more experienced traders can benefit from the services of such a market leader. With sections of the site dedicated to trader education, a selection of account types, segregated accounts, excellent customer service, a selection of MT4 trading platforms, low spreads, and much more, there is bound to be something for everyone.

HYCM have a proprietary platform as well as metatrader 4.

Wherever you might be located, and whatever time it is, HYCM has a trading platform to suit your needs. There is the usual metatrader 4 family of offerings, as well as a brand new proprietary platform called “prime trader”. And for those who prefer to trade on the move, HYCM mobile apps are compatible with any mobile or tablet device. A number of innovative trading tools have also been developed, as well as some special features and widgets that are easily accessible through any of the platforms.

Three different account types to choose from, but unfortunately no demo account.

To suit the needs of a broad range of traders, there are currently three different account types to choose from. The lack of a demo account is a little disappointing, but the low minimum deposit means you shouldn’t have to risk too much real money in order to start trading. The three accounts to choose from are as follows:

micro account

- Minimum deposit $100

- 50 tradeable products

- Minimum order size 0.01 lots

- Leverage up to 200:1

- Minimum fixed spread 1.8 pips

- Trading signals available

- Mobile trading supported

- Islamic account an option

Standard account

- Minimum deposit $1,000

- 120 tradeable products

- Minimum order size 0.01 lots

- Leverage up to 200:1

- Minimum fixed spreads 1.5 pips

- Trading signals available

- Mobile trading supported

- Islamic account an option

VIP account

- Minimum deposit $10,000

- 120 tradeable products

- Minimum order size 0.01 lots

- Leverage up to 200:1

- Minimum fixed spreads 1.5 pips

- Trading signals available

- Mobile trading supported

- Islamic account an option

HYCM accepts a number of different payment methods including visa and mastercard, webmoney, wire transfer and a number of other local payment methods. Only USD and EUR are accepted as base currencies. No fees are charged by HYCM for either deposits or withdrawals, but there are minimum requirements. All banking operations are safe and secure as their servers are encrypted with 128-bit keys, and personal and account information is encrypted using verisign-issued 128-bit-SSL certificates.

Such a prestigious history means there is little call for fancy bonuses.

The long-standing reputation of the henyep group means that HYCM has little need to attract new clients with dazzling promotions and special offers. It is, however, committed to rewarding loyal clients. Become a member of the HYCM loyalty program and you become entitled to an exclusive rebate of up to $3 for every lot traded, which is deposited straight into your trading account on a monthly basis. There are three tiers: silver, gold, and platinum, each with a required number of lots to be maintained, but you do have to keep trading in order to qualify. Further details are available on the HYCM site.

We should also mention the refer-a friend programme, which gives traders the opportunity to earn up to $250. As soon as the referral becomes an active customer, makes their deposit and begins trading, the referral reward is credited to your account. However, this reward is for trading purposes only.

Only the best customer support for HYCM traders

HYCM has a reputation for professionalism and excellence, and this is certainly not lacking in the area of customer service. The customer contact centre is open from 23.00 on sundays right through to 21.00 on fridays, which means there is always someone to help when needed. There are a number of ways to get in touch, including a number of head office email addresses, a telephone call centre, and the very helpful live chat option, for when an immediate response if required.

As well as taking care of customer problems, HYCM also believe in educating their clients, and to this end there is a great variety of online videos and ebooks available. Subjects covered include the very basic as well as more complex topics such as capital management trading psychology, market analysis, and trading strategies. Also included is a helpful guide to the metatrader 4 trading platform.

If it’s a reputable and trustworthy broker you’re looking for you can’t go far wrong if you choose HYCM. They are fully licensed and regulated, which means that your financial and personal details are secure. Using MT4 as one of their trading platforms makes HYCM a sensible choice, whether you are a newcomer to the world of forex trading or a more experienced trader. Customer service is much better than average, and the educational material available only adds to the experience. The lack of a demo account shouldn’t put many people off, as the low minimum deposit requirement means that new traders aren’t likely to get their fingers burnt.

HYCM reviews and comments 2021

I consider HYCM as one of the biggest forex scammers. Please if you are planning to trade with them don't do it. I made profits they refused to send my money instead they sent me some fictitious wire prove. I sent the information to my bank I was told by my bank that such wire information doesn't exist. They are owing me more than $6000. Right now they are not picking my calls nor reply my mails. I have sent them my bank officers name, phone numbers and email. I have sent them my account statement to prove such money never made it to my account.

Nicholas 15 june, 2020 reply

I made an account with HYCM and realized it wasn't the platform for me. I didn't make a single purchase and put in a request to withdraw my funds of $2,000 CAD. I have been waiting to have my money returned to me since february 28th. I have sent countless emails and received very little communication. This company is a complete scam and to not refund someone's money, is completely unethical.

Ashley 19 march, 2020 reply

Why do they have that many regulations? Isn't just one good one enough? Why didn't nthey stop with cysec or britiish regulator. Finally, are all these licenses that they post on their official website real?

Pascal 12 february, 2020 reply

HYCM's competence leaves no doubt, this is after the second time I withdraw profit. Before that I had some doubts, despite the fact that there was positive feedback about the broker, it still didn't help me to cope with anxiety caused by the fear of losing my investment and earnings.

Nicholas 7 october, 2019 reply

I've never regretted that I chose HYCM, I was always pleased with the profit, for several years of trading I managed to set a personal record and if I add up all my withdrawals, it turns out that I brought out several of my deposits. Sensible guys work here, I'm talking about tech support. Appealed more than once, all like clockwork, issues were resolved instantly and professionally. Well done!

Julius 1 october, 2019 reply

Most traders lose their deposit due to hastily opened transactions, the reason for which is impatience, because the most difficult thing is to wait for an obvious signal to open a position. At the beginning of my path as a trader, I came across this problem every time I opened a terminal. It is this impatience that can drain your deposit, so do not do it. From the broker, in fact, not much is needed to trade, the rest is up to the trader. The most important thing is that if the execution is perfect, as in HYCM, then there is no reason to worry at all. I have been trading for a long time, so I can't say that the rush here is generally inappropriate. For example, this month I close with a profit of 22% of my deposit. And how much I like that the broker withdraws even more than $1000 easily and in future trading the broker will not spoil your life, it is very honorable.

Daniel 25 september, 2019 reply

For the year that I've been tradung with the company, very big changes did not happen. Someone says that the company is not developing, but I do not agree. The company still keeps the brand and I really like it. The ability to look worthy against the background of competitors, and there are a lot of them in this area and the most different with different offers, you need to be able to. It's not even easy to be able to, but to work all the time on service, quality, and problems. This is development. Maybe they don't work so hard on the advertising company, but everything about the service - they have a solid 10 out of 10.

Andrea 17 september, 2019 reply

Hello! I want to leave a review about HYCM! Well, this broker, of course, did not conquer me right away, some time passed and I began to notice the clarity of execution, although slippage and requotes are also present, but the execution is really high-quality, fast and uninterrupted. Then, after a while, he began to output a little bit. First, a hundred, then a few hundred, and there thousands have already gone and with different intervals I withdraw, but always the money comes clearly on time. And now the question is: what else does a trader need for comfortable trading? Personally, I would also put emphasis on the service, which is at a good level in HYCM, but my friends, traders believe that high-quality execution and withdrawal guarantees are quite enough for a good and comfortable trading. Everything else depends on the trader and on his desire to learn and work. And that also makes sense.

Xlnt 2 september, 2019 reply

I've been choosing a broker for quite long time. As a result, I chose HYCM. I liked the conditions that they provide - an easy-to-understand trading agreement, a trading terminal that does not hang and there is also no fee for withdrawing funds, a wide range of trading tools. I like trading commodities and stocks. Already brought a profit of $ 560 dollars and this is for 1 month of work. Now I am confident that the time I spent searching for a good forex brokerage company was not in vain.

Archie 7 august, 2019 reply

In short, HYCM is a broker whose reality meets expectations. Well, if a person, of course, is not a dreamer and does not dream of getting rich in one day. HYCM offers what it does: analytics means analytics, leverage means leverage, flexible conditions means truly flexible. I've been there for three years, moved from a second-tier broker with a bunch of problems and the threat of a bankrupt at any moment. It was just heaven and earth, just everything - from the office and the application to analytics, which is really top in HYCM.

For me best brokers that really follow the standard withdrawals duration are XM, HF, FBS and the octafx. I traded them for almost 2 years already. Nichol

Nichol gadingan 8 july, 2019 reply

I started stocks and forex trading for almost 2 years now. Hycm is my latest broker when my I started 200usd account I withdrew my initial profit for a couple of days but when my account increased to 500usd my withdrawal did not credit to my bank account. There support team sent ARN's but still my withdrawal still unserved and the waiting period already lapsed. There adviced is to verify my bank but I used the bank account on my online transactions such as forex and etc. With no encountered problem contrary to the scenario now. I have no choice is to verify my bank personally if have time and I know this is a very tedious to the bank side to verify ARN's. As of now this is my very disgusting experienced hoping this will be resolved asap. Nichol

Nichol gadingan 8 july, 2019 reply

HYCM is a very good broker. It has long been c trading with them. My deposit is not the smallest, but not the largest. Convenient replenishment / withdrawal. A very wide range of terminals, performance is normal, without glitches and freezes. All that I earn they derive me without question. Fast execution, requote has never caught. Good spread, fast withdrawal. Personally, I am lucky with HYCM, it is very comfortable to work. A normal company that does not create problems for its customers, the main thing is that you yourself understand what to do. With the knowledge and your working strategy, you can work and earn money. Profit withdrawal without problems.

Trading in the last decade as I can see is in fashion, and almost every third trades in one or another company. So I decided to keep up with the trends and also decided to open an account with a forex broker - HYCM. As a result, I have been trading with this broker for several years. With the withdrawal of funds problems have never arisen, everything is very fast and transparent. Customer support can deal with some non-standard situations. Now I am considering opening additional accounts with other brokers. Some competitors have better conditions, now I decide whether I will switch to another broker partly, but in any case I will leave an additional account with HYCM.

The bulk of brokerage companies have a solid regulation on paper, but in reality it does not. They find all sorts of loopholes in the contract or just foolishly fool customers. Really, honest brokerage companies can be counted on the fingers of one hand. These several brokers include HYCM, in which I hurried to open an account almost immediately I stuck on them. I deposited the account, then withdrew everything, then replenished again and withdrew again. I haven't traded really much yet, because I was more focused on reliability testing. But since last month I started enjoying the trading. I must say that the execution is just instant. I haven't seen anything like this for a long time and was impressed, so I decided to write about it.

Sergio 18 june, 2019 reply

I have long been trading with this broker, I am satisfied with everything and in principle I am not going to change HYCM for some another broker. They give access to metatrader 5. The best though is probably the only platform for high-quality trading where everything necessary is there. It operates without failures, the speed of opening and closing orders is excellent, technically modern and at the same time the platforms remains understandable. Having a minimal experience of trading, you will quickly understand its options. In the extreme case, you can run a demo account and explore the functionality in practical conditions, but without risking money. In the rest, there is an opportunity to perform comprehensive analytics, a lot of technical analysis tools.

I want to learn how to trade, can someone help out?

Maurice 28 may, 2019 reply

Am struggling on downloading my MT4 demo account

They are bunch of crooks, 25 days waiting for the transfer which they claim they did. Thats just because i made money and want to withdraw all

I ve just received the 50 euros via neteller. Maybe they cannot proceed skrill withdrawal

Panos 21 march, 2019 reply

They are not returning me via skrill (the deposit was sktill also) the almost 50 euro saying that they cannot proceed the withdrawal. I m waiting 15 days

Panos 16 january, 2019 reply

I like the daily analysis news feed provided by the broker. Very helpful for trading on the news.

Paul 9 october, 2018 reply

Good performance, a platform without lags, terms of trade are also quite acceptable. Pleases a large number of trading tools. I also like their analyst. A good channel with the most relevant news. There are many ways of replenishment and withdrawal. In general, I have not found any special problems yet.

Nick 3 october, 2018 reply

Good conditions, good work, fast execution but there are some disadvantages comparing with others, good and stable, well known also but not the best

Crazyone 1 october, 2018 reply

Since I'm still new to the financial markets, I need more insights that can help me to make a decision whether to buy or to sell. In their website, they provide brief market review from their experts which is really helpful to help me making my own decision in several currency pairs.

Penny 27 september, 2018 reply

Trading with HYCM is unexpectedly easy and stable. There are different plans with different trading conditions with various amounts to deposit and trading platforms to use. Here you can count on relatively low spreads.

I use hycm for 1.5 years, I saw the review on the smartlab, and began to read, eventually opened the account. My profit on average 30-40% per month with pairs and stocks

They work well so there is nothing to blame. Almost two years of trading here without problems on execution of orders and deduction of money from the account. I think quite a long time so that you can trust them. Here it is still worth considering that they have been more than two decades in the market. Worthy of respect!

Great thanks HYCM for a wide diversity of different instruments. I've chosen metals and trading result is succesfull enough. I havent lost anything and even earned some money. I dont have much experience but the conditions are really good. They give bonuses - thats really nice of them. What else, very fast withdrawals, withing 48 hours - really. I adore this company and will try working with smth brand new for me, because they have a lot of studing. Thanks again!

Dear ali, thank you for such a positive review! We are happy to hear you are having a positive experience with HYCM! If there is something we can help you with please reach out to support@hycm.Com. Best regards, HYCM team

HYCM team 17 april, 2018

I really like HYCM! They are my first company and im just in love with them. It has very useful things like news and signals, wide range of instruments and lots of studing materials for those who dont know what to start with. Like i used to be.. Now i work with real account and the income is not so big that i expected but it is good for start. Btw, it is better than to work on somebody.

Mathias 10 may, 2018 reply

Comments and reviews about forex trading can be found on multiple web resources, and their diversity indicates that forex market is complicated and implies a lot of risk.

Some people believe that real traders' reviews can hardly be found online, as most of the published statements are either libeling the broker's competitors or aiming at raising popularity of certain companies. Sad but true - this really may happen, as some not too scrupulous companies do promote themselves this way.

This section is addressed to the traders who seek completely objective and truthful information about the forex market. Of course, no one can guarantee that each review is realistic and impartial, but we continuously monitor the published content and believe it is useful for both forex novices and professional traders.

Reviews about HY markets that you will find here are of different kind - some of them are positive, some are emotional or even rampant: our site visitors are free in expressing themselves when discussing various issues related to HY markets performance. You can disprove somebody else's viewpoint or support it: whether to trade with this company or not, this is what each trader decides for himself. It is impossible to guarantee that any company's operational work will be the same as was described in the clients' comments.

Does the broker really care for the clients' needs? Is their response to the clients' claims efficient? Are trading conditions profitable? Are there any covert issues that peep up only after the contract with the broker has been signed? Reviews about HY markets help to get the general idea about the broker's performance.

HYCM is online trading division of henyep capital markets, which is a major investment company established in 1977. The company’s headquarters are located in london, united kingdom. The henyep capital markets activities are regulated by such financial regulators as FCA, mifid, DFSA and SFC.

Regulation: cysec, FCA, mifid, DFSA, SFC

so, let's see, what we have: while its storied history is impressive, when it comes to forex and cfds trading in europe and its surrounding countries, HYCM fails to impress. At hycm review

Contents of the article

- Free forex bonuses

- HYCM (henyep markets) review

- Top takeaways for 2021

- Overall summary

- Is HYCM safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About HYCM (henyep markets)

- 2021 review methodology

- Forex risk disclaimer

- Compare HYCM (henyep markets)

- HYCM (henyep markets) competitors

- Hycm review

- HYCM review

- Overview

- Account

- Minimum deposit

- Maximum leverage

- Features

- Education

- Deposits/withdrawals

- Customer service

- HYCM review

- HYCM review: summary

- HYCM review: regulation

- HYCM review: countries

- HYCM review: trading platforms

- HYCM review: trading tools

- Trading calculators

- Economic calendar

- Market outlook

- Trading central

- HYCM review: education

- HYCM review: trading instruments

- HYCM review: trading accounts & fees

- HYCM review: customer service

- HYCM review: deposit & withdrawal

- HYCM review: account opening

- HYCM review: conclusion

- Read our HYCM review and discover the merits of...

- An introduction to HYCM

- HYCM have a proprietary platform as well as...

- Three different account types to choose from, but...

- Such a prestigious history means there is little...

- Only the best customer support for HYCM traders

- HYCM reviews and comments 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.