Trade forex for me

Conclusion if you are a complete beginner in this field, you should not simply start doing trading.

Free forex bonuses

If you get started in this field without having proper knowledge, the chances are you will lose. For a newbie, it is advisable to gain proper knowledge then get started with forex trading. Hence, if you want to trade forex by yourself, you have to spend a great amount of time learning.

Can I get someone to trade forex for me? (auto trading explained)

Are you a newbie forex trader? If yes, then you must be new to different terms and concepts of the forex market. As a newbie forex trader, you don’t want to lose money and learn. When you are completely new to this market, you have two options – either learn to trade from scratch or get someone to trade forex on your behalf.

So can you get somebody to trade forex for you?

Yes, you can get someone to trade forex on your behalf. There are so many professional forex traders out there in the market that can help you with forex trading. Getting this type of service to allow you to invest in the market without having expert-level knowledge. New traders often choose this kind of service, because this way they invest in the market and reduce the chances of losing money.

FOREX managed account brokers

A forex managed account is the account managed by the professional forex trader on behalf of his/her client. There are so many forex managed account brokers out there in the market. If you don’t want to spend time doing research, studying the market, and invest in the forex, then you can hire a professional forex trader or money manager for it.

The professional trader you hire will keep an eye on trading opportunities and based on his/her knowledge & experience, he/she will manage your forex trading account.

A managed forex account can be compared with the investment accounts of equities. These are the accounts in which the manager handles the account. Before hiring a particular forex professional to trade on your behalf, the money manager (forex professional) and you (client) have to sign a contract.

The signed agreement or document states that the client allows the trader to trade in the forex market on his/her behalf. By getting someone to trade forex on your behalf, you will not require any technical knowledge or skills regarding the forex market. Apart from this, this also helps you to save a great amount of time.

This way, you do not have to spend time researching the market and learning how to trade. While hiring someone trade forex for you, make sure the hired forex professional is reliable and trustable.

Pros & cons of letting someone trade forex for you

Whether you invest in the market by yourself or let someone trade for you, both of them have their pros and cons. Which one you should choose is based on your situation.

Pros of letting someone trade forex for you

Here are some benefits of getting someone trade forex for you:

1. You don’t have to spend time researching

The major headache in trading forex is you have to spend a huge amount of time doing research and understanding the market. If you don’t have enough time sitting and doing research, then letting someone trade forex on your behalf is a good idea. This way, you can avoid getting bored by doing research and looking at data charts for hours.

2. You don’t have to spend time studying the forex

If you are a newbie and want to start investing in the forex market, you have two options first, hire someone trade forex for you and the second one, trade forex by yourself. The major advantage of getting someone to trade forex for newbies is they don’t have to spend a huge amount of time studying the forex. When you have someone trading on your behalf, you don’t have to worry about studying from scratch (if you are new to the market)

Cons of letting someone trade forex for you

There are also some cons of letting someone trade forex for you. Here are some cons:

1. Hiring a professional forex trader can be expensive

The major disadvantage of hiring a professional trader is it can be really expensive. When you hire someone to trade for you, you have to pay commissions, depending upon the expertise of the trader.

2. Not all of them are reliable

While getting someone trade forex for you, you need to make sure that the professional you have selected is trustable and reliable. You don’t need to give access to your account and money to some stranger or the person you don’t trust. Hence, getting the wrong person for this may result in huge losses.

So these are some pros and cons of letting someone trade forex on your behalf. Depending upon your situation, this could be ideal for you. Now let’s discuss some pros and cons of trading forex by yourself.

Pros & cons of trading the forex by yourself

If you have got knowledge and experience in the forex market, then it is advisable to trade by yourself. Again, trading by self has its own pros and cons. Here’s the list:

Pros of trading the forex by yourself

Are you an experienced forex trader? Then, you should trade by yourself. Here are some major advantages of trading in the forex market on your own:

1. You don’t have to pay commissions

Hiring a professional forex trader for trading on your behalf can be expensive. And, this may not be suitable for each and every person out there. The best thing about trading your own is you do not have to pay any commission and you will earn all the profits you make. You will be responsible for the profits or losses that occur. So, if you have experience in forex trading, you should not hire anyone to trade on your behalf.

2. Don’t worry about finding the right trader

Another advantage of doing it yourself is you do not have to worry about finding the right professional forex trader. For the people who want to hire someone who can trade on their behalf, they have to mess with finding the right person. It is essential because no one would like to give account access & money to the professional who is not trustable.

Cons of trading the forex by yourself

There are also some disadvantages when it comes to doing forex trading your own. Here are some of them:

1. You have to mess with researching

If you don’t like researching and spending long hours looking at data charts, then you should consider hiring a professional who can trade forex on your behalf. In order to make correct decisions and make the most, it is important to focus on the research part. So, the major disadvantage of trading the forex by yourself is you have to spend long hours doing research.

2. You need to learn so much

If you are a complete beginner in this field, you should not simply start doing trading. If you get started in this field without having proper knowledge, the chances are you will lose. For a newbie, it is advisable to gain proper knowledge then get started with forex trading. Hence, if you want to trade forex by yourself, you have to spend a great amount of time learning.

Conclusion

So, the answer to this question is yes, you can get someone to trade forex on your behalf. By getting someone to trade for you, you will be worry-free and stress-free. This way, you do not have to worry about doing market research and spending long hours looking at data charts.

Forex managed account brokers provide this kind of service. They are the professional forex traders. While hiring someone to trade on your behalf, keep in mind the trust and reliability factor. It is essential because you should not give your account access to the stranger or someone unreliable.

Can you hire someone to trade forex for me, on my behalf?

Hiring A trader to trade for you

Hiring a team to administer your FX trading trading that you have confidence in is crucial. Acorn2oak offers you a totally FREE service that allows you to compare the best services, all in one location. We will link you up with money managers who will share their performance reports to make sure you have all the information you need prior to making a deposit.

Our top priority is to help you with administered FX by providing specialist advice and guidance to help you save time and money. If you want to benefit from this FREE service that allows you to compare services, please enter your details in the form above, it takes less than a minute.

Managed FX accounts services

Here at acorn2oak, we have pre approved a range of providers that we believe put the performance of their investor’s accounts first. They offer:

• access to trading teams with considerable experience in managing money

• A range of deposit levels in multiple currencies

• full 24 hour 7 days a week transparency so you can view your account

• A proven trading strategy that has demonstrated consistent returns

More and more individuals are attracted to fund administration for their trading account because they simply don’t have the time to buy and sell or are yet to access the profits of the markets. If this is you we have made it our number one goal to connect you with the highest quality of services that best suit your requirements.

Let acorn 2 oak connect you to a range of regulated providers currently available

Benefits of our service

We provide instant access to performance reports of managed FX providers

- Managed FX guides to assist you with your due diligence

- Up to date performance reports

- Tailor made quotes to suit your requirements

We only deal with regulated providers

- Acorn 2 oak code of conduct

- Existing investors feedback

- Returns independently verified

Make a smarter forex investment and save money by choosing the best provider for you

- Here you can find regulated managed forex account providers

- Free quotes from up to 4 providers

- Compare managed FX providers in one place

Are you a managed FX provider looking for investors?

Testimonial

“acorn 2 oak connected me with a leading provider that had the consistent returns I was looking for. I would never have found them without using the free service at acorn 2 oak”

The smarter way for traders to find forex opportunities

Thousands of traders looking to find a forex provider, carry out your search here

Can you hire someone to trade forex for me, on my behalf?

Can I hire someone to trade forex for me, on my behalf? I hear you ask.

Yes you can.

In fact, hiring someone to buy and sell in the forex market for you is a becoming a popular thing to do and increasingly more so as folk, like yourself, discover them.

They are a relatively unknown investment, that historically have been only accessible to large financial institutions and investors with a lot of money behind them. With the advent of the internet and high speed broadband connections, they have become accessible to everyone.

You are probably wondering how it is done, well, I will tell you.

It is all very straightforward. First of all you don’t need to go out and find a trader for yourself, nor do you need to negotiate deals with them. No, it is all done for you. You end up paying them to buy and sell currency for you but it is taken out of the profits that they make for you.

This type of trading is called managed FX trading, and you can read all about them on this site, starting here acorn2oak-fx.Com.

In summary though, this is what happens –

• you open up a forex trading account in your name.

• you fund the account.

• you give the trader an LPOA (limited power of attorney). This enables them to buy and sell FX for you.

• they do the buying and selling for you.

• the trader takes a performance fee from the profits. Usually 25% to 50%. Although I have found one that only charges 15% .

• you withdraw funds whenever you want to.

Quite simple really: as I said, you will find much more info on this site, FAQ, due diligence etc.

COMPARE LEADING FOREX FUND MANAGERS – GET YOUR PERSONALISED QUOTE NOW

Is forex for me?

What the average investor should know about the world’s most liquid market.

Even if you’re a casual investor, you’ve probably heard of forex. It’s a fancy finance portmanteau that sounds sophisticated — but is it worth your time?

For the casual, set-it-and-forget-it investor, probably not. For more active investors that enjoy economics, it could be.

Regardless, it’s at least worth understanding. And to help you develop that understanding, let’s walk through the basics of forex.

What is forex?

Forex stands for foreign currency exchange. In other words, it’s taking one currency (like the U.S. Dollar) and trading it for another (like the mexican peso). Some of the world’s most traded currencies are:

- U.S. Dollar (USD)

- European euro (EUR)

- British pound (GBP)

- Japanese yen (JPY)

- Swiss franc (CHF)

- Canadian dollar (CAD)

- New zealand dollar (NZD)

- Australian dollar (AUD)

Quick aside: does it bother you like it bothers me that the swiss franc’s symbol isn’t intuitive? A quick use of the google machine tells us the latin name of switzerland is “confoederatio helvetica.” combining that with the franc, and we get “CHF.” how pompous.

Of course, there are many currencies beyond these eight. Currencies that aren’t considered “major” are known as exotic currencies and trade at lower volumes. The indian rupee (INR) and russian ruble (RUB) are two examples.

Before we go any further, it’s helpful to revisit what fiat currencies are. Fiat currency, like USD, is issued by the government and standardizes commerce. Instead of trading textiles for tobacco or milk for a haircut, you have a government-backed currency that simplifies the exchange of goods and services. An economy that has a lot of production, trade, and stability will have a strong currency.

The forex market allows investors to peg the strength of one currency against another — or, to look at it another way, one economy versus another. When an investor trades for a currency, they think one economy is better relative to the other.

How does forex trading work?

Institutions and individual investors can trade forex 24 hours a day, 5 days a week. While institutions can enter trades over the weekend, retail investors have stricter windows. For instance, the U.S. Forex market shuts down for the weekend at 5 pm EST before reopening sunday evening at 5 pm EST.

There isn’t a centralized exchange for forex. Instead, currencies trade “over the counter” (OTC), meaning they’re purchased and sold via a network of banks in whatever market is open. Beyond the U.S. Forex center in new york, the other major hubs are in sydney, london, and tokyo.

Currencies are traded in pairs, so you’ll see them priced this way. For example, if you want to convert your USD into EUR, the exchange rate is quoted as EUR/USD. This rate tells you how many U.S. Dollars it’ll take to buy one euro. The first currency listed is known as the base currency, and it’s always the one you’re purchasing. The second currency is known as the quote currency.

Here’s a list of the major currency pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD

Unlike stocks, forex rates are priced out to the fifth decimal. For example, as of right this second, the EUR/USD exchange rate is $1.21937. In the forex world, you’ll often hear the term “pip” to quantify price movements. This stands for “point in percentage.”

For dollar-related exchanges, a pip refers to the changes to the fourth decimal place, so if the EUR/USD moves from 1.219 37 to 1.219 57, then the rate moved two pips.

Of course, the fifth decimal has playful monikers too — pipettes and micro pips.

Currencies are traded in “lots,” which vary in size.

- Micro lots are 1,000 units of a currency

- Mini lots are 10,000 units of a currency

- Standard lots are 100,000 units of a currency

Now, let’s walk through an example of a trade.

Let’s assume you buy 10,000 units of EUR using USD when the EUR/USD rate is 1.2200 (ignoring pipettes). Over the following day, the EUR/USD rate moves to 1.2230. You decide to sell, making a 30-pip profit. Since you purchased 10,000 units, each pip is valued at $1 (10,000 units x 0.0001). So, your profit would be $30 ($1 x 30 pips).

What is leverage?

Leverage enables investors to enter a trade for only a fraction of the trade’s purchase price. A lender covers most of your position, while you’re responsible for a small percentage — which is known as margin. Think of it like putting a downpayment on a house or a car. You pay 10–20% upfront, while the lender covers the rest.

Let’s look at the same example from earlier. You purchased 10,000 units of EUR at the EUR/USD rate of 1.2200. This would require an upfront deposit of $12,200 (10,000 units x 1.2200).

However, if you used leverage to make this purchase at a 10% margin, your exposure would only be $1,220. Your total position is still $12,200, but the lender funds the other 90%. Your total exposure relative to your margin is called your leverage ratio. In this case, your leverage ratio is 10:1 (i.E. $12,200 / $1,220).

The EUR/USD rate increases by 30 pips, your position increases to $12,230. You sell and earn a profit of $30.

Whether you use leverage or not, your profit is still $30 in this example. That said, your upfront exposure is only $1,220 with leverage — versus $12,200 without. Leverage opens the door for investors to amplify their gains with less upfront capital.

However, that concept works in the reverse too. Investors must be aware of leverage’s risks.

Just as it can amplify your gains, leverage amplifies your losses too if rate movements go against your expectations.

Leveraged trading allows you to enter trades well above your actual capital. It’s not uncommon to see investors trade at leverage ratios of 100:1 or even 200:1. In other words, if you have $1,000 to trade, you’d have $100,000 of trade capital at your disposal with 100:1 leverage.

A 10% loss on a $1,000 trade without leverage is a loss of $100. A 10% loss on a $100,000 leveraged trade is a loss of $10,000. Leverage makes losses more severe. You’re still responsible for repaying your lender, so you could be in a scary financial bind if you take too much risk.

What influences exchange rates?

Several factors influence exchange rates, including inflation, interest rates, and production.

Don’t worry, I’ll keep the economics lecture short.

Inflation represents increasing prices of goods and services, which means the associated currency has less purchasing power. When inflation is high in a particular country, there’s less demand for that country’s currency — and vice versa.

Federal governments can use interest rates to manipulate inflation and exchange rates. Higher interest rates mean higher returns for lenders and bank accounts, which can increase cash inflows into a country. So, higher interest rates tend to increase demand for a country’s currency, while low interest rates have the opposite effect.

Production, as measured by gross domestic product (GDP), illustrates whether an economy is growing, receding, or stagnant. A growing economy is more appealing, driving exchange rates up. On the other hand, if a country is struggling through a recession or political turmoil (sound familiar to anyone?), demand for that country’s currency will decline.

However, these aren’t the only influencers. A country’s trade policies, like tariffs on imported goods, can impact the demand for its currency too. So can a country’s balance of payments and government debt balance. There are a lot of moving pieces within an economy to consider.

How to learn more about forex

Forex trading isn’t something you pick up and master on a casual sunday afternoon because you’re bored. It takes time to understand and learn effective strategies.

If you want to learn more about the forex market, there are countless free resources for you to explore. Investopedia does a decent job of simplifying a complex subject, and it has a wealth of information.

If you’re looking for something more hands-on without the risk, one free resource that I’ve found interesting is an app called trading game.

It has a couple of forex courses with 18 modules in total — plus quizzes to reinforce your learning. As you complete courses and quizzes, you unlock play money to practice making forex trades.

Forex isn’t easy, but they do a good job of simplifying it.

Can I pay someone to trade forex for me? 2020

“is it possible to pay someone to trade forex for me?”

I have heard that phrase many times during the time I have been involved with this website and my other websites.

The simple answer to this question is that, yes, there are companies that trade forex on your behalf.

The word “pay” is slightly erroneous because you don’t actually pay the company from your own money, the forex trader will get his payment from the profits that you make on your account. So yes, he gets paid because of you but it doesn’t actually cost you anything.

The type of investment that will get someone to trade for you is called forex managed accounts. Check out our sister site www.Acorn2oak-fx.Com/managedforexaccounts/blog/ukcitizens.Html they are not widely known as they are a type of alternative investment and are therefore different from traditional investments such as insurance, savings accounts, bonds, mutual funds etc.

A managed account that will trade your forex account for you are becoming more and more popular year by year, mainly because ease of access.

Only a decade ago, it was only high net worth individuals and institutional investors that had a minimum of 100,000 dollars and more often 1,000,000 dollars to take part in this investment, and they had to be invited to join.

Nowadays, managed forex companies will trade forex on your behalf with as little you depositing a minimum opening balance of £5,000 or $10,000 dollars. Some companies will let you start with as little as $1,000, but I would be very aware of these companies as the will not be regulated by the regulating body, such as the FCA (financial conduct authority) in the UK.

Why hire someone to trade forex for you? A little background information

In recent years, the forex market has become one of the largest liquid and fastest growing trading markets in the world. About $ 5 trillion dollars is expected to be exchanged in daily foreign exchange transactions, exchanged and paid at foreign exchange prices.

The bulk of trading has traditionally been large banks and multinational corporations that seek to minimise the impact of fluctuations in currency exchanges as professional fund managers

The emergence of electronic trading platforms such as metatrader 4 has made it possible for foreign investors to trade globally, and they trade around the clock, resulting in a very liquid and volatile market capable of generating huge profits as well as potentially large losses.

Forex is an incredibly complex market, influenced by many factors and very sudden movements and changes. It is important to be aware of market news, major economic news and further market fluctuations.

Various charts and technical analysis are available to help traders understand market movements and make decisions based on evidence and statistical modelling. However, in a poor world, learning how to effectively take all this information and make decisions on strategy and oversight is difficult if not your full time job.

Thus, more and more investors are turning to managed foreign exchange accounts and professional traders as a solution to participate in a potentially extremely profitable market and risk losses due to lack of time or understanding of the complexities of forex trading.

Interest in managed foreign exchange accounts is increasing from the early stages for many online forex brokers. In the last month alone, one of the leading brokers licensed to deal with the EU has noted an increase in the number of clients who are nominated from professional fund managers.

According to industry experts, if your account is run by someone who has a proven track record of trading and has excellent understanding and knowledge of the foreign exchange markets, this is potentially a great advantage.

Many traders have decided to hire a trader to trade forex for them because it is effective, like a shadow at work, and you have the opportunity to watch the expert trading your account, while you follow the markets and take away all the information available to you. This can be a great way to gain experience and speed up the learning curve without the risk of making many mistakes.

The challenge, as always, is to find someone who can do this effectively for you and who can provide ample evidence of successful trading history and experience, knowing that they will be right with their funds and seizing opportunities when they present themselves.

While many forex brokers actually manage accounts for retail investors, some provide fund managers with the ideal account management environment, as well as all the tools they need to effectively monitor their managed foreign exchange accounts on behalf of individual clients.

Fund managers are particularly interested in brokers who offer a high level of service, in particular on an individual basis, and some will prefer direct contact with an account manager without a commission or commission structure, allowing them to trade in the best conditions for their clients.

Some brokers also offer a variety of tools for managed currency accounts, such as the multi-account management tool or MAM and multitrader. Professional money managers also often become business partners for online forex brokers to generate additional income.

Chapter 3. Why forex is or isn’t for you

Chapter 3

Why forex is or isn’t for you

Don’t have time to read the guide now? Request a PDF version.

So, you might like the idea of being a forex trader, but it is not right for everyone.

Back in 2016 the UK’s financial services regulator, the FCA, conducted a review of retail trading – not just forex, but all types including CFD trading and binary options – and found 82% of retail traders lost money. Trading is a zero-sum game so there are going to be winners and losers but this ratio led us to two conclusions:

This underscores the importance of working out if forex is right for you…before you consider risking your money on it. It means the 18% balance must either breakeven or be profitable – about 1 in 5.

We’ve pulled together the reasons traders should and shouldn’t be trading forex for. All aspiring forex traders should be asking themselves their reasons for getting into forex trading before they get started.

If you can honestly say its for the right reasons, and not the wrong reasons you’ll have a much greater chance of making a success of it, of being in the 1 in 5 group of traders, over the long term.

Learn more, take our premium course: trading for beginners

5 reasons why you shouldn’t trade forex

In addition to the inherent risk linked to trading, with forex trading you need to add margin trading and leverage, which means that you can trade large amounts with little initial capital.

So, this high level of risk means that you need to be sure that you do not use money that you need to live on – it sounds an odd thing to say, but make sure you always trade with money you can afford to lose!

If you have no trading experience, and you do not know how markets work and relate to each other, forex trading might not be right for you – at least not yet.

That’s fine – as long as your profits are higher than your losses. Losing trades are part of the trading game – you need to be prepared for this and not take it personally!

In forex trading, you need to quickly recognise when you’re wrong, and close losing trades as early as possible. It’s important to develop your ability to accept your losses and learn from your trading experience.

But do remember, it’s ok to be wrong – you can’t be right 100% of the time in every single trade you execute. And if you can’t handle losing, you won’t be able to be profitable in the long run.

You can make huge returns in the FX market, but these kinds of returns do not come without risks, especially when using leverage.

So, if you’re generally a risk-averse person, forex trading is not going to fit your personality.

There are several trading styles you can use when trading currencies, each requiring a certain amount of time in front of the screens.

For example, you can use a trend following method, or position trading strategy, which will require less time than short term trades, like scalping or day trading.

Keep in mind that learning about trading, the forex market and how to develop the right trading plan takes time. You’d better be sure you have time to dedicate to this activity before starting to trade in currency pairs.

5 reasons you should trade forex

It provides great flexibility for traders who want to trade part-time and as there are no market opening or market closing times the opportunity for potential profits is 24 hours per day, 5 days per week!

Of course, trading volume varies depending on how many sessions overlap, and it often decreases when there are bank holidays in major sessions such as on wall street.

The impact of news is also strong on the forex market, as currencies quickly react to macroeconomic news, political events and economic data.

So, as a forex trader, you should monitor the economic calendar for fundamentals to determine when currency pair prices might accelerate and break important levels thanks to higher volatility.

Another example would be to adapt the size of your positions depending on the current trading conditions and the evolution of your trading capital. All these rules should be part of your trading plan and to be profitable, you should always stick to your plan!

Having a trading plan to follow when trading is vital if you want to be successful, but most importantly you need to be committed to follow it, and patience to open/close your positions according to your set-ups.

You need to develop your strategy first, or trading system, before trading real money on the forex markets – if not, how do you know what you’re doing, and that what you’re doing is making money?

A trading plan is a description of your trading method:

Trading style: scalping, day trading, swing trading, position trading currency pairs: majors, minors, exotics timeframes 5 min chart, 15 min chart, 4h chart size of your positions set-ups to follow to enter/exit the market risk and money management rules: risk/reward ratio, stop-loss and take-profit orders

According to the 2016 triennial central bank survey of FX and over-the-counter (OTC) derivatives markets from the BIS, trading in foreign exchange markets averaged $5.1 trillion per day in april 2016.

This high trading volume increases the liquidity of the market, which means that it’s easy and fast for a trader to enter a trade and also reduces the risk of potential price manipulation from others.

Forex trading also uses leverage that can magnify your returns (as well as your losses) in a very short period of time. This leverage allows you to manage more money than you currently have in your trading account for potentially higher profits.

Take our free course: getting started with chartstake our free course: how traders interact with the marketstake our premium course: trading for beginners

Rule of thumb

Deciding whether to trade or not to trade the forex markets is up to you, but remember that even if you’re one of the smallest actors on the forex market, you can still profit from it. Take your time going through your reasons for wanting to trade and you’re doing it for the right reasons – if you are it is more likely you’ll make a success of it.

If you want to take advantage of forex trading, it’s a good idea to use a demo account before risking real money in your trading account.

There is very little chance that you can be successful without trying out your broker’s trading platform first. This includes real-time charts and trading tools, its trading conditions to test your own trading system.

Start learning

Learn the skills needed to trade the markets on our trading for beginners course.

Chapters

Chapters

EDUCATION

SERVICES

FREE RESOURCES

COMPANY & PARTNERS

Currency

My trading skills® is a registered trademark and trading name of PMJ publishing limited. The material on this website is for general educational purposes only and users are bound by the sites terms and conditions. Any discussions held, views and opinions expressed and materials provided are for general information purposes and are not intended as investment advice or a solicitation to buy or sell financial securities. Any person acting on this information does so entirely at their own risk. Trading is high risk, it does not guarantee any return and losses can exceed deposits. My trading skills®, its employees and directors shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. The information on this site is not directed at residents of the united states or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

© 2021 copyright PMJ publishing limited. All rights reserved.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

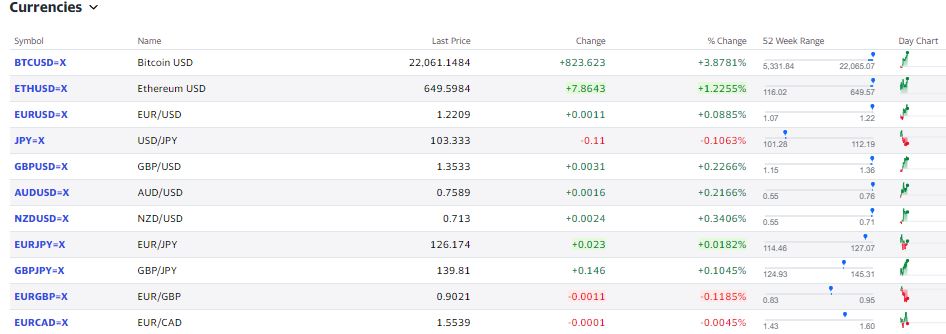

Forex quotes

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Is forex for me?

What the average investor should know about the world’s most liquid market.

Even if you’re a casual investor, you’ve probably heard of forex. It’s a fancy finance portmanteau that sounds sophisticated — but is it worth your time?

For the casual, set-it-and-forget-it investor, probably not. For more active investors that enjoy economics, it could be.

Regardless, it’s at least worth understanding. And to help you develop that understanding, let’s walk through the basics of forex.

What is forex?

Forex stands for foreign currency exchange. In other words, it’s taking one currency (like the U.S. Dollar) and trading it for another (like the mexican peso). Some of the world’s most traded currencies are:

- U.S. Dollar (USD)

- European euro (EUR)

- British pound (GBP)

- Japanese yen (JPY)

- Swiss franc (CHF)

- Canadian dollar (CAD)

- New zealand dollar (NZD)

- Australian dollar (AUD)

Quick aside: does it bother you like it bothers me that the swiss franc’s symbol isn’t intuitive? A quick use of the google machine tells us the latin name of switzerland is “confoederatio helvetica.” combining that with the franc, and we get “CHF.” how pompous.

Of course, there are many currencies beyond these eight. Currencies that aren’t considered “major” are known as exotic currencies and trade at lower volumes. The indian rupee (INR) and russian ruble (RUB) are two examples.

Before we go any further, it’s helpful to revisit what fiat currencies are. Fiat currency, like USD, is issued by the government and standardizes commerce. Instead of trading textiles for tobacco or milk for a haircut, you have a government-backed currency that simplifies the exchange of goods and services. An economy that has a lot of production, trade, and stability will have a strong currency.

The forex market allows investors to peg the strength of one currency against another — or, to look at it another way, one economy versus another. When an investor trades for a currency, they think one economy is better relative to the other.

How does forex trading work?

Institutions and individual investors can trade forex 24 hours a day, 5 days a week. While institutions can enter trades over the weekend, retail investors have stricter windows. For instance, the U.S. Forex market shuts down for the weekend at 5 pm EST before reopening sunday evening at 5 pm EST.

There isn’t a centralized exchange for forex. Instead, currencies trade “over the counter” (OTC), meaning they’re purchased and sold via a network of banks in whatever market is open. Beyond the U.S. Forex center in new york, the other major hubs are in sydney, london, and tokyo.

Currencies are traded in pairs, so you’ll see them priced this way. For example, if you want to convert your USD into EUR, the exchange rate is quoted as EUR/USD. This rate tells you how many U.S. Dollars it’ll take to buy one euro. The first currency listed is known as the base currency, and it’s always the one you’re purchasing. The second currency is known as the quote currency.

Here’s a list of the major currency pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD

Unlike stocks, forex rates are priced out to the fifth decimal. For example, as of right this second, the EUR/USD exchange rate is $1.21937. In the forex world, you’ll often hear the term “pip” to quantify price movements. This stands for “point in percentage.”

For dollar-related exchanges, a pip refers to the changes to the fourth decimal place, so if the EUR/USD moves from 1.219 37 to 1.219 57, then the rate moved two pips.

Of course, the fifth decimal has playful monikers too — pipettes and micro pips.

Currencies are traded in “lots,” which vary in size.

- Micro lots are 1,000 units of a currency

- Mini lots are 10,000 units of a currency

- Standard lots are 100,000 units of a currency

Now, let’s walk through an example of a trade.

Let’s assume you buy 10,000 units of EUR using USD when the EUR/USD rate is 1.2200 (ignoring pipettes). Over the following day, the EUR/USD rate moves to 1.2230. You decide to sell, making a 30-pip profit. Since you purchased 10,000 units, each pip is valued at $1 (10,000 units x 0.0001). So, your profit would be $30 ($1 x 30 pips).

What is leverage?

Leverage enables investors to enter a trade for only a fraction of the trade’s purchase price. A lender covers most of your position, while you’re responsible for a small percentage — which is known as margin. Think of it like putting a downpayment on a house or a car. You pay 10–20% upfront, while the lender covers the rest.

Let’s look at the same example from earlier. You purchased 10,000 units of EUR at the EUR/USD rate of 1.2200. This would require an upfront deposit of $12,200 (10,000 units x 1.2200).

However, if you used leverage to make this purchase at a 10% margin, your exposure would only be $1,220. Your total position is still $12,200, but the lender funds the other 90%. Your total exposure relative to your margin is called your leverage ratio. In this case, your leverage ratio is 10:1 (i.E. $12,200 / $1,220).

The EUR/USD rate increases by 30 pips, your position increases to $12,230. You sell and earn a profit of $30.

Whether you use leverage or not, your profit is still $30 in this example. That said, your upfront exposure is only $1,220 with leverage — versus $12,200 without. Leverage opens the door for investors to amplify their gains with less upfront capital.

However, that concept works in the reverse too. Investors must be aware of leverage’s risks.

Just as it can amplify your gains, leverage amplifies your losses too if rate movements go against your expectations.

Leveraged trading allows you to enter trades well above your actual capital. It’s not uncommon to see investors trade at leverage ratios of 100:1 or even 200:1. In other words, if you have $1,000 to trade, you’d have $100,000 of trade capital at your disposal with 100:1 leverage.

A 10% loss on a $1,000 trade without leverage is a loss of $100. A 10% loss on a $100,000 leveraged trade is a loss of $10,000. Leverage makes losses more severe. You’re still responsible for repaying your lender, so you could be in a scary financial bind if you take too much risk.

What influences exchange rates?

Several factors influence exchange rates, including inflation, interest rates, and production.

Don’t worry, I’ll keep the economics lecture short.

Inflation represents increasing prices of goods and services, which means the associated currency has less purchasing power. When inflation is high in a particular country, there’s less demand for that country’s currency — and vice versa.

Federal governments can use interest rates to manipulate inflation and exchange rates. Higher interest rates mean higher returns for lenders and bank accounts, which can increase cash inflows into a country. So, higher interest rates tend to increase demand for a country’s currency, while low interest rates have the opposite effect.

Production, as measured by gross domestic product (GDP), illustrates whether an economy is growing, receding, or stagnant. A growing economy is more appealing, driving exchange rates up. On the other hand, if a country is struggling through a recession or political turmoil (sound familiar to anyone?), demand for that country’s currency will decline.

However, these aren’t the only influencers. A country’s trade policies, like tariffs on imported goods, can impact the demand for its currency too. So can a country’s balance of payments and government debt balance. There are a lot of moving pieces within an economy to consider.

How to learn more about forex

Forex trading isn’t something you pick up and master on a casual sunday afternoon because you’re bored. It takes time to understand and learn effective strategies.

If you want to learn more about the forex market, there are countless free resources for you to explore. Investopedia does a decent job of simplifying a complex subject, and it has a wealth of information.

If you’re looking for something more hands-on without the risk, one free resource that I’ve found interesting is an app called trading game.

It has a couple of forex courses with 18 modules in total — plus quizzes to reinforce your learning. As you complete courses and quizzes, you unlock play money to practice making forex trades.

Forex isn’t easy, but they do a good job of simplifying it.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

So, let's see, what we have: are you a newbie forex trader? If yes, then you must be new to different terms and concepts of the forex market. As a newbie… at trade forex for me

Contents of the article

- Free forex bonuses

- Can I get someone to trade forex for me? (auto...

- FOREX managed account brokers

- Pros & cons of letting someone trade...

- Pros & cons of trading the forex by...

- Can you hire someone to trade forex for me, on my...

- Hiring A trader to trade for you

- Managed FX accounts services

- Benefits of our service

- Can you hire someone to trade forex for me, on my...

- Can I hire someone to trade forex for me, on my...

- You are probably wondering how it is done, well,...

- Is forex for me?

- What the average investor should know about the...

- What is forex?

- How does forex trading work?

- What is leverage?

- What influences exchange rates?

- How to learn more about forex

- Can I pay someone to trade forex for me? 2020

- Chapter 3. Why forex is or isn’t for you

- Chapter 3

- 5 reasons why you shouldn’t trade forex

- 5 reasons you should trade forex

- Rule of thumb

- Start learning

- Chapters

- Chapters

- EDUCATION

- SERVICES

- FREE RESOURCES

- COMPANY & PARTNERS

- Currency

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Is forex for me?

- What the average investor should know about the...

- What is forex?

- How does forex trading work?

- What is leverage?

- What influences exchange rates?

- How to learn more about forex

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.