Jp markets login

There are no withdrawal fees, except for credit card ones. The minimum withdrawal amount is $25.

Free forex bonuses

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

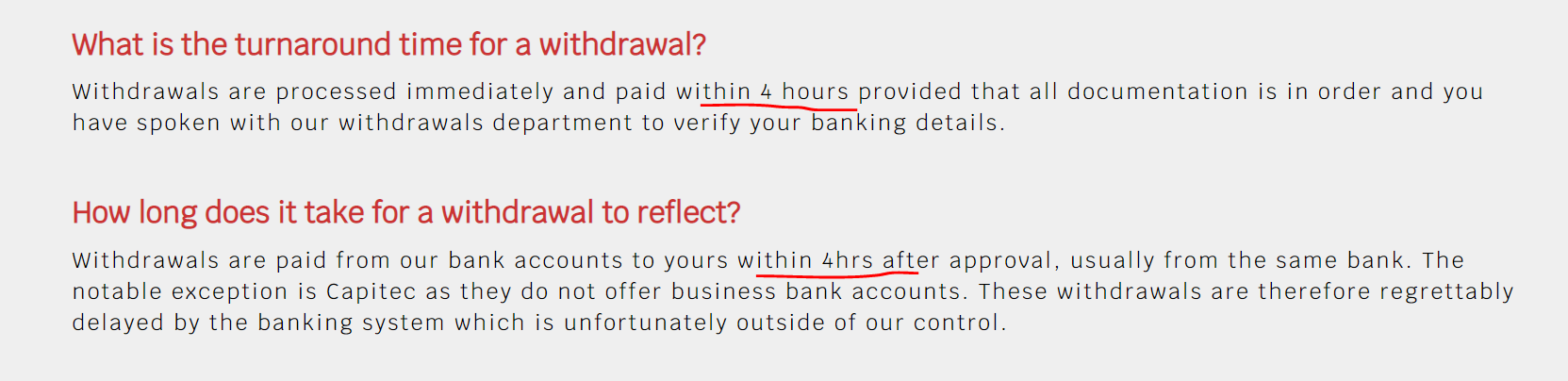

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Services

J.P. Morgan is a leader in wholesale financial services, serving one of the largest client franchises in the world. Our clients include corporations, institutional investors, hedge funds, governments and affluent individuals in more than 100 countries. Clients turn to J.P. Morgan for our complete platform of financial services combined with seamless execution.

Asset management

Morgan money

J.P morgan asset management’s institutional liquidity management platform, morgan money, is a multi-currency, open architecture trading and risk management system. The platform, launched in 2019, is designed to deliver a seamless customer experience, centered on operational efficiency, end-to-end system integration, and effective controls to allow customers to invest when, where and how they want — securely.

Institutional asset management

institutional asset management provides account-specific information, including performance reports, holdings, transactions and market value information for global institutional asset management clients, consultants and custodians.

Commercial banking

Chase connect

chase connect SM enables middle market clients to control cash flow and manage banking activities for their business. By using chase connect, clients can easily monitor account activity, transfer funds, make payments and take care of routine banking activities. Specific service features include: information reporting, payments and transfers, check and statement services and system administration.

Merchant services

Paymentech online

paymentech online reconciles your payment operations to give you quick access to transaction data. It can help manage your bottom line and make more informed adjustments.

Resource online

resource online places all your payment processing data in one place to more easily manage cash flow and spot fraudulent activity.

The world of financial markets, your way

Welcome to a more individual approach to the world of trading and investing.

One that gives you all the tools and insight you need to track and react to every aspect of the market. With VIP service that treats you like a human being, not a number. All backed by the assurance of a company operated by a FTSE 250 subsidiary. See the markets.Com difference for yourself.

Long term, short term, always on your terms

Whether you’re looking to trade fast or invest for the future, our products put you in control.

World class tools and insight that give you the edge

Supercharge your strategies and enhance your instincts with the very latest tech and knowledge.

Lower margins for higher potential returns

We keep our prices low to help you maximise your profit without ever sacrificing on service.

“marketsx has provided me with the experience of self-brokerage, free choice and education needed for executing and trading shares. I would highly recommend marketsx to experienced and novice traders as myself.”

“markets.Com customer service is spot on and they’re always on hand to help out with any issues.”

“as an experienced investor returning after a break of several years, I was recommended to try markets.Com. The staff have been extremely helpful, lawrence in particular.”

Tim

experienced investor

Who we are

It’s not just what you know, it’s who you know that matters too. As part of finalto limited, a constituent of playtech, a FTSE 250 listed company, we have deep knowledge of the financial markets along with access to the very latest in next generation trading platform technology.

Why markets.Com?

Markets.Com is the place trading and investing. From leveraged products to share dealing, you can control everything from one account on our intuitive, cutting-edge platform. It’s the only site you’ll ever need.

No tools match your filter.

Leading technologies

Our cutting-edge platforms give you the power to trade and invest on your own terms.

Take your trading to the next level. Top tools and insight, low spreads and VIP service, on a fast, rock solid platform. So, when the market moves, you can move with it.

Exceptionally low spreads

Take control of your investments. Invest in stocks from the world’s major exchanges without an intermediary and use our investment strategy builder tool to build your portfolio.

You choose how to invest

Latest markets.Com news

We’re here to help

Phone support

Our dedicated customer support team is here for you, round the clock, from mon 00:00 to friday 23:55 PM (GMT +2) which is sun 22:00 PM – friday 21:55 UK time.

Live chat

Chat anytime directly to our customer support team via our live chat function. Our live chat is available 24/5 to answer your questions.

Knowledge centre

Our knowledge centre is filled with essential advice and information about every aspect of trading and investing.

Trading tools

From fundamental, to technical and sentiment tools, as well as our live xray trading channel, we give you everything you need to trade smarter.

The domain www.Markets.Com is solely and exclusively operated by safecap investments limited (‘safecap’), which is regulated by the cysec under license no. 092/08 and by the FSCA under license no. 43906. Safecap is located at 148 strovolos avenue, 2048, strovolos, P.O.Box 28132, nicosia, cyprus.

High risk investment warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.6% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please read the full risk disclosure statement which gives you a more detailed explanation of the risks involved.

The value of shares bought through a share dealing account can fall as well as rise, which could mean that you get back less than you originally put in. Please ensure you fully understand the risks involved and manage your exposure. Past performance is no guarantee of future results.

Depending on the country of your citizenship or permanent residence, we may be required under the applicable local laws, rules and regulations to offer you certain additional protection mechanisms (such as a guaranteed stop loss mechanism) or impose additional restrictions on your trading. You must carefully review our investment services agreement for the details of such protections or restrictions that may apply to you.

Restricted jurisdictions: we do not establish accounts to residents of certain jurisdictions including japan, canada, belgium and USA. For further details please see the investment services agreement

Safecap investments limited is owned by finalto limited and is a subsidiary of playtech PLC, a company traded on the london stock exchange’s main market and a constituent of the FTSE 250 index.

Engaging with your clients simplified.

Consolidated everything an IB needs into a single experience

Ultra low

spreads

250+ trading

instruments

$10 minimum

deposit

Leverage

1:500

Immediate deposits

and withdrawals

24/5 email

support

Instruments

250+ instruments in the platform.

Desktop, tablet, mobile

Desktop, tablet, mobile and web based trading with metatrader 4 and metatrader 5

Automated trading platforms

A range of automated trading platforms and EA compatibility

Spreads offering

Competitive spreads offering

Client funds security

Client funds are held in segregated accounts for increased security

Multilingual languages

Trading website in more than 20 languages

Customer support

Connect through whatsapp

Whatsapp contact to reach customer support

Why trade with veracity markets?

Veracity markets is continuously working hard to become a major player in the online financial field, with a proven track record of positive customer satisfaction. Our key responsibility is to offer top-notch services to all our traders.

Trade anywhere

any time

Successful online trading depends on efficient and powerful trading technology. Veracity markets offers you the best trading platforms to get you into the market quicker and easier. You can access quality information and trading tools to help ensure you make educated trading decisions.

Choose your account type

| standard account |

|---|

| initial deposit : $250 |

| spreads : floating from 1.6 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| pro account |

|---|

| initial deposit : $250 |

| spreads : floating from 2 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisors : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| ECN account |

|---|

| initial deposit : $250 |

| spreads : floating from 0.00 pips |

| commission : $7 lot only FX & metals* |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: not available |

| read full account terms & description here |

| open account |

Access the world's top tradable assets

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum cursus sit amet metus id ultricies.

Become a

just perfect trader

today and receive 100%

on your first deposit

Trade a broad range of markets

Discover hundreds of markets available to trade, with more to be added soon

Forex trading

Over 38 major, minor & exotic pairs

Cryptocurrencies

Trade a broad range of cryptocurrencies

Indices

9 globel indices available

Metals

Trade gold, silver, platinum & copper

Commodities

Oil, gas & agricultural commodities

Shares

Over 150 shares to choose from

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Start your trading with veracity markets in 4 simple steps:

Register

Verify

Trade

Trade

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

Services

J.P. Morgan is a leader in wholesale financial services, serving one of the largest client franchises in the world. Our clients include corporations, institutional investors, hedge funds, governments and affluent individuals in more than 100 countries. Clients turn to J.P. Morgan for our complete platform of financial services combined with seamless execution.

Asset management

Morgan money

J.P morgan asset management’s institutional liquidity management platform, morgan money, is a multi-currency, open architecture trading and risk management system. The platform, launched in 2019, is designed to deliver a seamless customer experience, centered on operational efficiency, end-to-end system integration, and effective controls to allow customers to invest when, where and how they want — securely.

Institutional asset management

institutional asset management provides account-specific information, including performance reports, holdings, transactions and market value information for global institutional asset management clients, consultants and custodians.

Commercial banking

Chase connect

chase connect SM enables middle market clients to control cash flow and manage banking activities for their business. By using chase connect, clients can easily monitor account activity, transfer funds, make payments and take care of routine banking activities. Specific service features include: information reporting, payments and transfers, check and statement services and system administration.

Merchant services

Paymentech online

paymentech online reconciles your payment operations to give you quick access to transaction data. It can help manage your bottom line and make more informed adjustments.

Resource online

resource online places all your payment processing data in one place to more easily manage cash flow and spot fraudulent activity.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

JP markets FSP license suspended – full story

South african financial regulator, FSCA again suspended JP markets license in june 2020 and is currently working towards the liquidation of the company. What is the story behind this bizarre case?

13 july, 2020 | atoz markets – the financial sector conduct authority (FSCA) has suspended the licence of JP markets SA (pty) ltd (JP markets), FSP number 46855, as there is a reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services.

Moreover, on the 25th of march 2019, JP markets FSP license has been temporarily suspended without any prior notice by the regulatory body, according to the broker. Founded in 2016, the south africa based forex broker, JP markets was holding a licence and regulated by the financial services board, south africa under FSP no: 46855.

Read the complete story below to know the complete scenario behind the JP markets and its licence suspension.

JP markets allegedly operated in absolute conflict with its clients

Financial sector conduct authority (FSCA) again temporarily suspended JP markets license in june 2020. FSCA said JP markets had problems processing customer withdrawals. The regulator has frozen the JP markets bank account and also ordered the company to force the liquidation of all assets.

The regulator believes that JP markets violates financial sector laws, including operating an unlicensed over-the-counter derivative provider (ODP) business. FSCA said, forex broker trades against customers and interferes with trading terms to reduce profitability for high-income earners and increase company profits. It became clear that the broker was operating in an “absolute conflict” with the customer.

The regulator said the broker had to notify all affected clients of this and, with it, is prohibited from concluding any new business. FSCA also added:

“however, clients were not trading on an online decentralised global financial market; they were merely entering trades on a platform that was no more than an off-the-shelf software application that recorded these trades. In fact, clients were purchasing cfds issued by JP markets. JP markets required an over-the-counter derivative provider licence to conduct these services lawfully.”

JP markets FSP license suspended

According to JP markets’ BD manager, phumulani nkosinathi simamane, there is no reason behind the temporary suspension. It might rather be an embarrassing situation as the forex broker forgot to pay levies on time. When the company’s FSP number was registered, justin (the founder of the JP markets) was using a jpinvest.Co.Za web address. However, the JP team no longer uses the jpinvest.Co.Za domain. After numerous email account updates to his jpmarkets.Co.Za address, the FSP regulator failed to update their system. So, they did not receive any warnings or notice from the regulator. While this could have easily been avoided if the email address had been updated. The FX broker took the responsibility since they should have followed up and paid on time.

In the interests of transparency, the FX broker has attached the notice clearly outlining the reasons for suspension. Moreover, the FX broker had paid the outstanding amount 2 days before FSP suspended the license, and are in process to have this unfortunate oversight remedied immediately.

Furthermore, under section 3 of the grounds of suspension and under section 4 the FSP confirms the reasons as missing to pay the necessary payments. Simply, JP markets did not pay in time despite paying 2 days prior to the suspension.

However, the brokerage firm has been apologizing for any concern that it may have caused. They have tried to assure that the investor’s funds are safe and secure. It is business as usual as the grounds for suspension have already been remedied. The company is just waiting for the FCSA to update the suspension status on the website.

JP markets south africa interview with atozmarkets

Atozmarkets team: “have you made any changes to your protocols in order to avoid such issues in the future? If yes, what?”

JP markets management: unfortunately, there isn’t an amazing story behind it. The TLDNR version is that the FSCA was sending reminders to an old email address, and we were not vigilant enough to follow up with them and the licensing dates. The company has grown exponentially in both the number of clients as well as the various services we have on offer.

We are keen not to repeat this kind of mistake again. The company has assigned a dedicated responsible employee to oversee those of compliance payments. We have also set up digital reminders hosted in the cloud. So, even if we update our servers or lose everything locally the reminders will come through. Finally, we made sure that the FSCA updated their records correctly for any future communication. We have assigned two of our senior company employees to oversee the new email address too.

Atozmarkets team: “since you already remedied this case, how long do you think that regulator will keep the suspension?”

JP markets management: the ramifications of our FSP license suspension can be quite severe. However, the cause was merely a simple oversight on our side, as well as poor communication from the FSCA. While payment for the license was made late, it was still done prior to the suspension of the license. Which is why we are hoping for them to update the website as quickly as possible.

We expect them to update their website any day now. And we would like our clients to know that we do accept our share of the responsibility for this oversight and have already made adjustments to ensure this never happens again.

About JP markets

JP markets offers trading in around 30 forex pairs, stock indices, oil, gold, and OTHER cfds. The company behind the brand, JP markets SA (pty) ltd. Holds its license from the financial services board (FSB), south africa, FSP 46855. The broker also has a presence in kenya, pakistan, and bangladesh.

Lately, brokers see south africa as a financial market with great potential. The country is one of the most developed countries in africa. FSB is in charge of the licensing process and supervision of forex brokerages in the country. Besides, the south african regulator has enforcement powers to deal with breaches through the enforcement committee. The watchdog runs a customer complaints service, the office of the ombud for financial services providers.

Engaging with your clients simplified.

Consolidated everything an IB needs into a single experience

Ultra low

spreads

250+ trading

instruments

$10 minimum

deposit

Leverage

1:500

Immediate deposits

and withdrawals

24/5 email

support

Instruments

250+ instruments in the platform.

Desktop, tablet, mobile

Desktop, tablet, mobile and web based trading with metatrader 4 and metatrader 5

Automated trading platforms

A range of automated trading platforms and EA compatibility

Spreads offering

Competitive spreads offering

Client funds security

Client funds are held in segregated accounts for increased security

Multilingual languages

Trading website in more than 20 languages

Customer support

Connect through whatsapp

Whatsapp contact to reach customer support

Why trade with veracity markets?

Veracity markets is continuously working hard to become a major player in the online financial field, with a proven track record of positive customer satisfaction. Our key responsibility is to offer top-notch services to all our traders.

Trade anywhere

any time

Successful online trading depends on efficient and powerful trading technology. Veracity markets offers you the best trading platforms to get you into the market quicker and easier. You can access quality information and trading tools to help ensure you make educated trading decisions.

Choose your account type

| standard account |

|---|

| initial deposit : $250 |

| spreads : floating from 1.6 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| pro account |

|---|

| initial deposit : $250 |

| spreads : floating from 2 pips |

| commission : $0 |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisors : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: available |

| read full account terms & description here |

| open account |

| ECN account |

|---|

| initial deposit : $250 |

| spreads : floating from 0.00 pips |

| commission : $7 lot only FX & metals* |

| leverage : 1:500 |

| order volume (lots) : 0.01 - 250 (lot) |

| platforms : MT4 |

| expert advisers : supported |

| maximum open positions : unlimited |

| execution: market |

| swap free: not available |

| read full account terms & description here |

| open account |

Access the world's top tradable assets

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum cursus sit amet metus id ultricies.

Become a

just perfect trader

today and receive 100%

on your first deposit

Trade a broad range of markets

Discover hundreds of markets available to trade, with more to be added soon

Forex trading

Over 38 major, minor & exotic pairs

Cryptocurrencies

Trade a broad range of cryptocurrencies

Indices

9 globel indices available

Metals

Trade gold, silver, platinum & copper

Commodities

Oil, gas & agricultural commodities

Shares

Over 150 shares to choose from

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Start your trading with veracity markets in 4 simple steps:

Register

Verify

Trade

Trade

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

INNOVATIVE LIQUIDITY CONNECTOR ®

NOW YOU CAN ACCESS BEST BID/OFFER FROM OVER 50 DIFFERENT BANKS AND PRIME LIQUIDITY PROVIDERS

Market closes on FRIDAYS AT 17:00 EST

And reopens for the trading week on

| Symbol | bid | ask | spread | |

|---|---|---|---|---|

| GDAXI | 12632.59 | 12633.31 | 0.72 | |

| NDX | 7347.70 | 7348.40 | 0.7 | |

| AUS200 | 6228.50 | 6230.70 | 2.2 | |

| FCHI | 5416.80 | 5417.70 | 0.9 | |

| spxm | 2800.40 | 2801.10 | 0.7 | |

| WS30 | 25031 | 25033 | 2 |

Trade the global online commodities and CFD markets

OPEN A DEMO ACCOUNT

OPEN ACCOUNT

Innovative liquidity connector ®

Our state-of-the-art trading platforms are designed for active traders looking for an edge. Four platforms to choose from such as metatrader 4, metatrader 5, ctrader and currenex. With over 100 options to trade from.

Lower your

trading cost

Tightest spreads

in the industry

No markup

raw direct spreads

True ECN

market place

Fast, accurate, trade executions

- opportunity for price movements.

No dealing desk, no requotes,

no trading restrictions

Enjoy JP holding's quality trade executions, personalized customer service, and the flexibility of the most outstanding platforms in the market. JP holding offers MT4, MT5, ctrader and currenex platforms to traders interested in speculating in the commodity markets.

Trading platforms

Next level trading with four trading platforms to choose from: metatrader 4, metatrader 5, ctrader and currenex.

Innovative solutions

Introducing brokers

- Liquidity services

- White label solutions

- Money managers

- MAM software free of charge for fund managers

- Metatrader 4 bridge

read more

Multi account manager

- (MAM)

- Installation & help guide

- MAM - setup

- MAM getting-started

- Asset managers

read more

Fund security

- Accounts with top tier bank

- Segregation of client funds

- Risk management

- Strong data security measures

- Regular internal and external audits

read more

Funds safety

Regulation

JP holdings fully regulated and registered.

Secured banking

JP holdings only works with

tier 1 banks such as:

Risk management

JP holdings, through our trading platforms, provides an automated risk management system.

Secure deposit methods

JP holdings ltd is a fully registered broker/dealer

JP holdings LTD located in united kingdom

60 sackville st, manchester M1 3WE, UK

phone : +44 120 571 6325

There is a risk of loss in trading foreign currencies and it is not suitable for everyone. We are compensated for our services through the bid-ask spread. Copyright© 2018. All rights reserved.

The information on this website is not directed to residents of any country where FX and/or cfds trading is restricted or prohibited by local laws or regulations. By clicking the continue button, you agree to the terms and conditions.

So, let's see, what we have: JP markets: login, minimum deposit, withdrawal time? RECOMMENDED FOREX BROKERS JP markets is solid, at first glance, as african brokers go, but what is most important is that it is at jp markets login

Contents of the article

- Free forex bonuses

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Services

- Asset management

- Commercial banking

- Merchant services

- The world of financial markets, your way

- Who we are

- Why markets.Com?

- Leading technologies

- Latest markets.Com news

- We’re here to help

- Engaging with your clients simplified.

- Consolidated everything an IB needs into a single...

- Ultra low spreads

- 250+ trading instruments

- $10 minimum deposit

- Leverage 1:500

- Immediate deposits and withdrawals

- 24/5 email support

- Instruments

- Desktop, tablet, mobile

- Automated trading platforms

- Spreads offering

- Client funds security

- Multilingual languages

- Customer support

- Connect through whatsapp

- Why trade with veracity markets?

- Trade anywhere any time

- Choose your account type

- Access the world's top tradable assets

- Become a just perfect trader today...

- Trade a broad range of markets

- Forex trading

- Cryptocurrencies

- Indices

- Metals

- Commodities

- Shares

- Start your trading with veracity markets in 4...

- Register

- Verify

- Trade

- Trade

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- Services

- Asset management

- Commercial banking

- Merchant services

- Forex brokers lab

- What is JP markets?

- JP markets account types, spreads and leverage

- What is the difference between ECN and STP JP...

- Trading platforms

- Trading products

- What are JP markets fees?

- What is the minimum deposit for JP markets?

- JP markets bonuses and promotions

- JP markets deposit and withdrawal methods

- Is JP markets suspended?

- Customer services

- Conclusion

- JP markets FSP license suspended – full story

- JP markets allegedly operated in absolute...

- JP markets FSP license suspended

- JP markets south africa interview with...

- About JP markets

- Engaging with your clients simplified.

- Consolidated everything an IB needs into a single...

- Ultra low spreads

- 250+ trading instruments

- $10 minimum deposit

- Leverage 1:500

- Immediate deposits and withdrawals

- 24/5 email support

- Instruments

- Desktop, tablet, mobile

- Automated trading platforms

- Spreads offering

- Client funds security

- Multilingual languages

- Customer support

- Connect through whatsapp

- Why trade with veracity markets?

- Trade anywhere any time

- Choose your account type

- Access the world's top tradable assets

- Become a just perfect trader today...

- Trade a broad range of markets

- Forex trading

- Cryptocurrencies

- Indices

- Metals

- Commodities

- Shares

- Start your trading with veracity markets in 4...

- Register

- Verify

- Trade

- Trade

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- INNOVATIVE LIQUIDITY CONNECTOR ®

- Trade the global online commodities and CFD...

- Innovative liquidity connector ®

- Lower yourtrading cost

- Tightest spreads in the industry

- No markupraw direct spreads

- True ECN market place

- Fast, accurate, trade executions -...

- No dealing desk, no requotes, no...

- Enjoy JP holding's quality trade executions,...

- Trading platforms

- Innovative solutions

- Funds safety

- Secure deposit methods

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.