Trade account format

The following items are often seen in the control account questions. As these times are closely related to the "sales and trade receivables", students often confuse and record them in the S L control account. But these items should not be recorded in the control accounts. Lets check these items below. Total of trade receivable' balances at the end of the current accounting period.

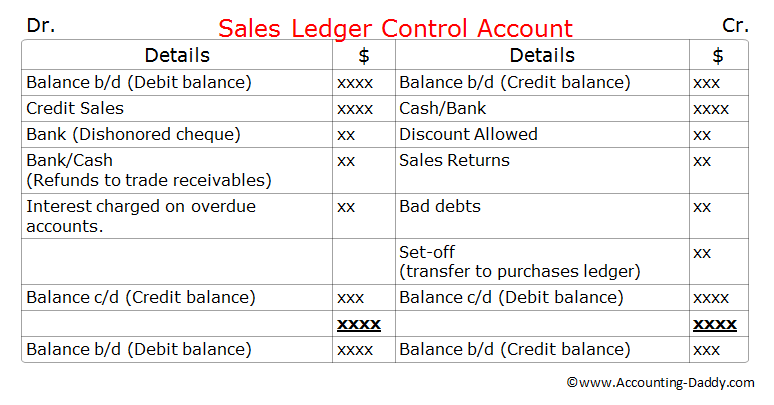

Sales ledger control account.

Sales ledger control account is a summary account which checks the arithmetical accuracy of the sales ledger. It enables us to see at a glance whether the general ledger balance for the sales ledger agrees with the total of all the individual trade receivable accounts held within the sales ledger.

Sales ledger control account typically looks like a "T-account" or a replica of an individual trade receivable ( debtor) account, but instead of containing transactions related to one trade receivable (debtor) it contains transactions related to all the trade receivables (all the debtors) in the business. As this control account contains the summarized information of all the trade receivables accounts in the sales ledger, it is also called as "total trade receivables account"("total debtors account").

Check out the format of this control account below and try to perceive the similarities with individual trade receivable account (debtors account).

Format:

Sales ledger control account is generally prepared at the end of the financial year or "whenever" it is required to check the arithmetical accuracy of the individual trade receivable accounts.

As we discussed earlier, this control account is prepared as an independent check on the arithmetical accuracy of the sales ledger (debtors ledger). So, we should not obtain the information required to prepare this control account from the sales ledger (debtors ledger), instead all the information required should be obtained from books of original entry or prime entry.

How to check the arithmetical accuracy of the sales ledger:

Once the control account is prepared using the above format with the information obtained from various books of prime entry/original entry, the total of balances on the individual trade receivable accounts in the sales ledger should match with the closing balances on the sales ledger control account.

If the closing balances of sales ledger control and the total of balances on the individual trade receivable accounts in the sales ledger agrees, we can presume that there are no errors or fraud occurred in the sales ledger. If the balances differ, it indicate that there are errors in the individual trade receivables accounts in the sales ledger or in the control account. So to locate these errors, accountants need to check each and every trade receivables account in the sales ledger carefully until the error is found or the fraud is detected.

Source of information for sales ledger control account:

The following table provides the details of source of information for the sales ledger control account items.

Source of information

Opening trade receivables (opening debtors)

Total of trade receivable' balances at the end of the previous accounting period.

Total credit sales from the sales day book (sales journal).

Sales returns (return inwards)

Total sales returns from the return inwards day book (sales returns journal).

From the cash column on the debit side of the cash book.

From the bank column on the debit side of the cash book.

Total of the discount column on the debit side of the cash book.

From the the journal (proper journal).

From the bank column on the debit side of the cash book.

Refunds to trade receivables

From cash/bank column on the credit side of the cash book.

Set off (transfer to purchases ledger)

From the journal (proper journal).

Interest charged on overdue accounts.

From the journal (proper journal).

Closing trade receivables (closing debtors)

Total of trade receivable' balances at the end of the current accounting period.

Items should not be entered in the sales ledger control account.

The following items are often seen in the control account questions. As these times are closely related to the "sales and trade receivables", students often confuse and record them in the S L control account. But these items should not be recorded in the control accounts. Lets check these items below.

Cash sales are recorded cash book but not in the sales ledger. So cash sales should not be entered in the S L control account which checks the arithmetical accuracy of the sales ledger.

If previously written off bad debts are recovered now, it should not be recorded in the S L control account as "bad debts recovered account appears in the general ledger but not in the sales ledger.

3. Increase or decrease in the provision for doubtful debts:

Provision for doubtful debts account is kept in the general ledger. An increase or decrease in the provision for doubtful debts affects the general ledger but not the sales ledger. So it should not be recorded in the S L control accounts.

Reasons for opening and closing credit balances in the S L control account:

Trade receivables (debtors) accounts generally shows debit balance in the business books. This balance represents money owed by the trade receivable (debtor) to the business. However some times trade receivable (debtor) account may show a credit balance. It indicates business owes money to the trade receivable. It may happen due to one of the following reasons:

- An error in one of the individual trade receivables account.

- Over payment made by the credit customer (trade receivable).

- Advance payment by the trade receivable for the goods.

- Accountant forgot to deduct the cash discount before collecting the amount from the credit customer.

- A trade receivable returns the goods after making the full payment but he is not yet refunded.

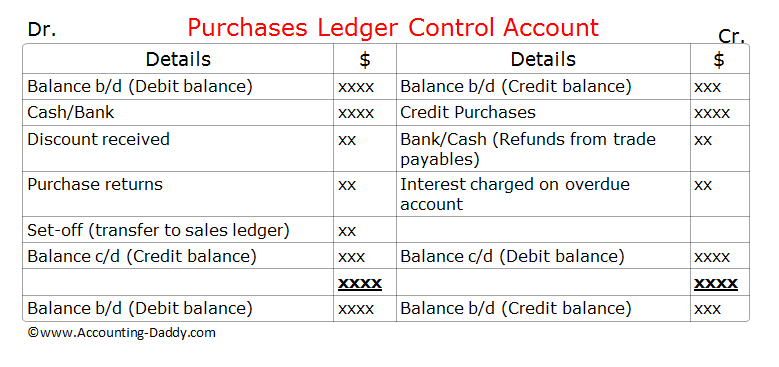

Purchases ledger control account.

Purchases ledger control account is a summary account which checks the arithmetical accuracy of the purchases ledger. It enables us to see at a glance whether the general ledger balance for the purchases ledger agrees with the total of all the individual trade payable accounts held within the purchases ledger.

This control account typically looks like a "T-account" or a replica of an individual trade payable ( creditor) account, but instead of containing transactions related to one trade payable (creditor) it contains transactions related to all the trade payables (all the creditors) in the business. As this control account contains the summarized information of all the trade payables accounts in the purchases ledger, it is also called as "total trade payables account"("total creditors account").

Check out the format of this control account below and try to perceive the similarities with individual trade payables account (creditors account).

Format:

Purchases ledger control account is generally prepared at the end of the financial year or "whenever" it is required to check the arithmetical accuracy of the individual trade payable accounts.

As we discussed earlier, this control account is prepared as an independent check on the arithmetical accuracy of the purchases ledger (creditors ledger). So, we should not obtain the information required to prepare this control account from the purchases ledger (creditors ledger), instead all the information required should be obtained from books of original entry or prime entry.

How to check the arithmetical accuracy of the purchases ledger:

Once the control account is prepared using the above format with the information obtained from various books of prime entry/original entry, the total of balances on the individual trade paybales accounts (creditors accounts) in the purchases ledger should match with the closing balances on the purchases ledger control account.

If the closing balances of purchases ledger control account and the total of balances on the individual trade payables accounts in the purchases ledger agrees, we can presume that there are no errors in the purchases ledger or fraud occurred in the business. If the balances differ, it indicate that there are errors in the individual trade payables accounts in the purchases ledger or in the control account. So to locate these errors, accountants need to check each and every trade payables account in the purchases ledger carefully until the error is found or the fraud is detected.

Source of information for purchases ledger control account:

The following table provides the details of source of information for the purchases ledger control account items.

Source of information

Opening trade payables (opening creditors)

Total of trade payables balances at the end of the previous accounting period.

Total credit purchases from the purchases day book (purchases journal).

Purchase returns (return outwards)

Total purchase returns from the return outwards day book (purchase returns journal).

From the cash column on the credit side of the cash book.

From the bank column on the credit side of the cash book.

Total of the discount column on the credit side of the cash book.

Refunds from trade payables (creditors)

From cash/bank column on the debit side of the cash book.

Set off (transfer to sales ledger)

From the journal (proper journal).

Interest charged on overdue accounts.

From the journal (proper journal).

Closing trade payables (closing creditors)

Total of trade payables balances at the end of the current accounting period.

Items should not be entered in the purchases ledger control account.

The following items are often seen in the control account questions. As these times are closely related to the "purchases and trade payables", students often confuse and record them in the P L control account. But these items should not be recorded in the control accounts. Lets check these items below.

Cash purchases are recorded cash book but not in the purchases ledger. So cash purchases should not be entered in the P L control account which checks the arithmetical accuracy of the purchases ledger.

Reasons for opening and closing debit balances in the P L control account:

Trade payables (creditors) accounts generally shows credit balance in the business books. This balance represents money owed to the trade payables (creditors) by the business. However some times trade payable (creditor) account may show a debit balance. It indicates trade payable owes money to the business. It may happen due to one of the following reasons:

- An error in one of the individual trade payables account.

- Over payment made to the credit supplier (trade payable).

- Advance payment to the trade payable for the goods.

- Accountant forgot to deduct the cash discount before paying the amount to the credit supplier.

- Business returned the goods after making the full payment to the credit supplier but the supplier has not yet refunded the amount.

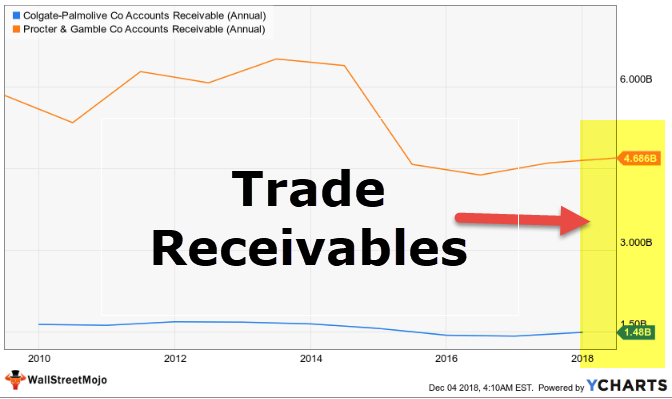

Trade receivables

What is trade receivables?

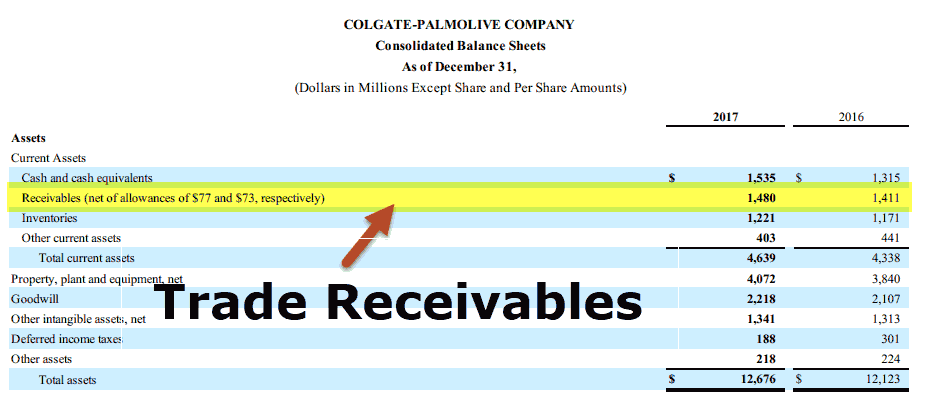

Trade receivable is the amount which the company has billed to its customer for selling its goods or supplying the services for which the amount has not been paid yet by the customers and is shown as an asset in the balance sheet of the company.

In simple words, trade receivable is the accounting entry in the balance sheet of an entity, which arises due to the selling of the goods and services on credit. Since an entity has a legal claim over its customer for this amount and the customer is bound to pay the same, it classifies as current asset in the balance sheet of the entity. Trade receivables and accounts receivable are used interchangeably in the industry.

Similar to accounts receivables, company’s also have non-trade receivables, which arises on account of transaction unrelated to the regular course of business.

Trade receivables on the balance sheet

Below is the standard format of the balance sheet of an enterprise.

It is generally classified under the current assets in a balance sheet.

Example

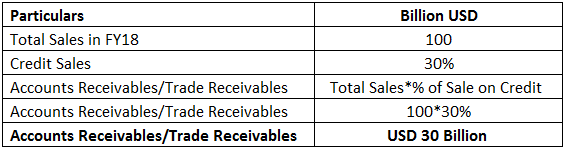

ABC corporation is an electrical equipment manufacturing company. It recorded a sales of USD 100 billion in FY18 with 30% sales on credit to its corporate customers. The trade receivables accounting entry for the transaction in its balance sheet will be as below:

Accounts receivables in the above example is calculated below:

In this example, accounts receivables will be recorded as USD 30 billion in the current asset head in the balance sheet.

Why trade receivables is a critical?

I will try to demonstrate why accounts receivables are very critical for the liquidity of companies, and many a time becomes the sole reason for companies becoming bankrupt. The liquidity analysis of an enterprise comprises of a company’s short-term financial positions and its ability to pay its short-term liabilities.

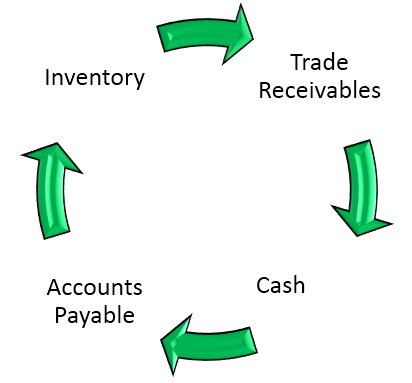

One of the most important metrics we look at while analyzing the liquidity positions of companies is the cash conversion cycle. The cash conversion cycle is the number of days which an enterprise takes to convert its inventory into cash.

The above picture explains it in more detail. For an enterprise, it starts with the purchase of inventory, which may be on cash or credit purchase. The enterprise converts that inventory into finished goods and makes sales out of it. The sales are made or cash or credit. The sales made on credit is recorded as trade receivables. So the cash conversion cycle is the total number of days it takes for an enterprise to convert its inventory into final sales and realization of cash.

The formula to calculate the cash conversion cycle is as below:

From the above formula, it is evident that a company with a significantly higher proportion of trade receivables will have higher days’ receivables and, therefore, a higher cash conversion cycle.

Note: of course, the cash conversion cycle depends on the other two factors, also which are days inventory outstanding and days payables outstanding. However, here to explain the impact of receivables, we have kept the other two parameters indifferent.

A higher cash conversion cycle for an enterprise may lead to a significantly increased working capital loan requirement to meet its short-term demand for day to day operations. Once such receivables level reaches the alarming degree, it may create serious trouble for the enterprise creating short-term liquidity issues where the company will not be able to fund its short-term liabilities and which may further lead to suspending operations of the company.

Essential part of working capital loan assessment

A company avails working capital loans to meet its short-term requirements for day to day operations. The assessment for the amount of working capital limit is carried out by lenders taking into account all the current assets of the company. Since receivables make an essential and considerable part of the total current assets of the company, it is critical for lenders to access the level of trade receivables as well as the quality of receivables to approve working capital limits for the company.

Analysis and interpretation

The liquidity analysis and interpretation for the level of trade receivables should always be looked into in the context of the specific industry. Certain industries operate in an environment with a high level of receivables. A typical example of the same is electricity generation companies operating in india, where receivables level are very high and days receivable for generation companies varies between as low as one month to as high as nine (9) months.

On the other side, some companies operate with virtually very few or no trade receivables. Companies operating and toll road project developers and operators have very fewer accounts receivables as their revenue is toll collection from commuters on the road. They collect the toll from commuters as and when they pass by toll plaza.

So for a meaningful analysis, one should look at the receivables levels of the top 4-5 companies in the respective industry. If your target company has higher receivables in comparison, than it is doing something wrong either in terms of business model or client/customer targeting or incentives in terms of credit sales to promote sales.

To conclude, one can safely assume that lower the receivables level and days receivables, better the liquidity position for the company.

Trade receivables video

Recommended articles

This has been a guide to trade receivables. Here we discuss its definition, how it works. Examples and see why trade receivables are critical for the liquidity of companies. You can learn more about accounting from the following articles –

Trading account and profit and loss account and balance sheet - an example:

Learning objectives:

Understand the procedure of preparing trading and profit and loss account and balance sheet of a business.

Free forex bonuses

The following trial balance have been taken out from the books of XYZ as on 31st december, 2005.

| Dr. $ | cr. $ |

| plant and machinery | 100,000 |

| opening stock | 60,000 |

| purchases | 160,000 |

| building | 170,000 |

| carriage inward | 3,400 |

| carriage outward | 5,000 |

| wages | 32,000 |

| sundry debtors | 100,000 |

| salaries | 24,000 |

| furniture | 36,000 |

| trade expense | 12,000 |

| discount on sales | 1,900 |

| advertisement | 5,000 |

| bad debts | 1,800 |

| drawings | 10,000 |

| bills receivable | 50,000 |

| insurance | 4,400 |

| bank balances | 20,000 |

| sales | 480,000 |

| interest received | 2,000 |

| sundry creditors | 40,000 |

| bank loan | 100,000 |

| discount on purchases | 2,000 |

| capital | 171,500 |

| 795,500 | 795,500 |

Closing stock is valued at $90,000

Required: prepare the trading and profit and loss account of the business for the year ended 31.12.2005 and a balance sheet as at that date.

XYZ

trading and profit and loss account

for the year ended 31st, december 2005

| Opening stock | 60,000 | sales | 480,000 | |

| purchases | 160,000 | less discount | 1,900 | 478,100 |

| less discount | 2,000 | 158,000 | ||

| closing stock | 90,000 | |||

| carriage inward | 3,400 | |||

| wages | 32,000 | |||

| gross profit (transferred to P&L) | 314,700 | |||

| 568,100 | 568,000 | |||

| carriage outward | 5,000 | gross profit (transferred to P&L) | 314,700 | |

| salaries | 24,000 | interest received | 2,000 | |

| trade expenses | 12,000 | |||

| advertisement | 5,000 | |||

| bad debts | 1,800 | |||

| insurance | 4,400 | |||

| net profit (transferred to capital) | 264,500 | |||

| 316,700 | 316,700 |

Note: discount on purchases and discount on sales are deducted from purchases and sales respectively. They may be shown on the credit and debit side of profit and loss account respectively and it will not affect the net profit of the business. The gross profit will be affected if discount is treated so.

XYZ

balance sheet

for the year ended 31st, december 2005

Trading profit and loss account

The trading profit and loss account is made up of two separate accounts within the general ledger.

- The trading account

- The profit and loss account

The purpose of the two accounts is to separately identify the gross profit and net profit of the business. The trading account is the top part of the trading profit and loss account and is used to determine the gross profit. The profit and loss account is the lower part of the trading profit and loss account and is used to determine the net profit of the business.

Both the trading account and the profit and loss account form part of the double entry as they are used to close off the temporary accounts at the end of an accounting period.

The trading and profit and loss accounts are discussed in more detail below.

The trading account

The trading account is particularly useful for a merchandising business or trading business involved in the buying and selling of finished products. The account allows the merchandiser to easily determine its overall gross profit and gross profit percentage which are important indicators of how efficiently a business is buying and selling its products.

Trading account formula

The trading account shows the gross profit which is determined by deducting the cost of goods sold from the net sales revenue of the business.

The gross profit is calculated using the trading account formula.

In the formula net sales is equal to the gross sales of the business less sales returns, allowances, and discounts.

It should be noted that carriage outwards is not included in the trading account. Carriage outwards is an expense included in the profit and loss account discussed below.

The cost of goods sold used in the formula can be expanded using the following formula.

Net purchases is equal to the gross purchases of the business including carriage inwards less any purchase returns, allowances, and discounts.

Preparation of trading account

The trading account is prepared by closing the temporary revenue and purchases accounts and adjusting the inventory accounts using a closing journal entry as shown in the example below.

| account | debit | credit |

|---|---|---|

| sales | 105,000 | |

| sales returns | 5,000 | |

| purchases | 49,000 | |

| purchase returns | 3,000 | |

| beginning inventory | 8,000 | |

| ending inventory | 9,000 | |

| trading account | 55,000 | |

| total | 117,000 | 117,000 |

Each account is closed and transferred to the trading account. The credit entry to the trading account of 55,000 represents the gross profit for the period.

Trading account example

After the closing journal entry has been posted the trading account would take the format shown in the example below.

| trading account | ||||

|---|---|---|---|---|

| debit | credit | |||

| sales returns | 5,000 | sales | 105,000 | |

| purchases | 49,000 | purchase returns | 3,000 | |

| beginning inventory | 8,000 | ending inventory | 9,000 | |

| balance c/d | 55,000 | |||

| total | 117,000 | total | 117,000 | |

| balance b/d | 55,000 | |||

For clarity, in this example each line item is posted to the general ledger trading account leaving a credit balance brought down of 55,000 which represents the gross profit of the business.

In the example above the trading account has a net credit balance of 55,000 which indicates sales are greater than the cost of goods sold and the business has made a gross profit. If the trading account had a net debit balance brought down it would indicate (unusually) that sales were less than the cost of goods sold and the business had made a gross loss.

Trading account in final accounts

In the final accounts the trading account is usually presented in a more readable format. Assuming the figures relate to the month ended 31 december an example of a trading account might appear as follows.

| net sales | 100,000 |

| net purchases | 46,000 |

| beginning inventory | 8,000 |

| ending inventory | -9,000 |

| cost of goods sold | 45,000 |

| gross profit | 55,000 |

Again the trading account shows the gross profit of 55,000 the business made on the products it buys and sells.

In addition since the trading account shows the net sales the gross profit percentage can be easily calculated as follows.

The profit and loss account

The profit and loss account is used to determine the net profit of the business. The starting point for the profit and loss account is the balance carried down from the trading account which is the gross profit of the business.

Profit and loss account formula

The profit and loss account shows the net profit which is the determined by deducting the expenses of the business from the trading account gross profit and adding other income.

The net profit is calculated using the profit and loss account formula.

In the above formula expenses refers to all the costs of the business which are not included in cost of goods sold in the trading account such as wages and salaries, rents, insurance, bank charges etc.

Other income refers to any income other than that included in sales revenue such as interest received.

Preparation of profit and loss account

The profit and loss account is prepared by closing the trading account, expense accounts and other income accounts using a closing journal entry.

| account | debit | credit |

|---|---|---|

| trading account | 55,000 | |

| expense accounts | 48,000 | |

| other income | 5,000 | |

| profit and loss account | 12,000 | |

| total | 60,000 | 60,000 |

Each account is closed and transferred to the profit and loss account in the general ledger. The credit entry to the profit and loss account of 12,000 represents the net profit for the period.

Profit and loss account example

After the closing journal entry has been posted the profit and loss account would take the format shown in the example below.

| profit and loss account | ||||

|---|---|---|---|---|

| debit | credit | |||

| gross profit b/d | 55,000 | |||

| expenses | 48,000 | other income | 5,000 | |

| balance c/d | 12,000 | |||

| total | 60,000 | total | 60,000 | |

| balance b/d | 12,000 | |||

Again for clarity, in this example each line item is posted to the general ledger profit and loss account leaving a credit balance brought down of 12,000 representing the net profit of the business.

In the example above the profit and loss account has a net credit balance of 12,000 which indicates sales and other income are greater than the cost of goods sold and expenses and the business has made a net profit. If the profit and loss account had a net debit balance brought down it would indicate that sales and other income were less than the cost of goods sold and expenses and the business had therefore made a net loss for the accounting period.

Profit and loss account in the final accounts

The profit and loss account starting with gross profit is not usually shown as a separate statement and is normally combined with the trading account and shown as a combined trading profit and loss account format shown later in this post.

For the sake of completeness, assuming the figures relate to the month ended 31 december, a separate profit and loss account starting with gross profit might appear as follows.

| gross profit | 55,000 |

| expenses | 48,000 |

| other income | 5,000 |

| net profit | 12,000 |

Again the profit and loss account shows the net profit of 12,000 the business has made for the accounting period.

Using the net sales from the trading account the business can quickly calculate the net profit percentage as follows.

Trading profit and loss account format

The trading account and the profit and loss account can be combined into a single summary known as a trading profit and loss account.

An example trading profit and loss account format is shown below.

| net sales | 100,000 |

| net purchases | 46,000 |

| beginning inventory | 8,000 |

| ending inventory | -9,000 |

| cost of goods sold | 45,000 |

| gross profit | 55,000 |

| expenses | 48,000 |

| other income | 5,000 |

| net profit | 12,000 |

By using the trading profit and loss account the merchandising business can clearly see both the gross and net profit of the business and can quickly calculate the gross and net profit percentages based on net sales.

About the author

Chartered accountant michael brown is the founder and CEO of double entry bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with deloitte, a big 4 accountancy firm, and holds a degree from loughborough university.

Top excel templates for accounting

By andy marker on dec 29, 2015

In this article, you’ll find the most comprehensive list of free, downloadable accounting templates for a variety of use cases.

Accounting journal template

An accounting journal is an accounting worksheet that allows you to track each of the steps of the accounting process, side by side. This accounting journal template includes each step with sections for their debits and credits, and pre-built formulas to calculate the total balances for each column.

We’ve also included links to similar accounting templates in smartsheet, a spreadsheet-inspired work management tool that makes accounting processes even easier and more collaborative than excel.

See a head-to-head comparison of microsoft excel and smartsheet

Discover how these two tools compare across five factors, including: work management, collaboration, visibility, accessibility, and integrations. Plus, see a quick demo of smartsheet.

Accounts payable template

When making large purchases for items like inventory, supplies, or equipment it may be necessary to do so on credit, which could result in multiple monthly payments made to different vendors or suppliers, due on different dates. Using this accounts payable template will help to keep track of what you owe to each party, and will provide a quick look at the total outstanding balances and due dates.

Accounts receivable template

Every company should have a process in place to manage the outstanding balances owed to them. Using this accounts receivable template will help streamline the process by providing a place for you to track the amounts due to your company and help prioritize collection efforts.

Bill to invoice template

For any company providing goods or services, using an invoice that looks professional and can be customized to fit your needs, is important. This simple bill template will help you get started quickly. Add your company details and payee information, provide an itemized list of the description, quantity, and price of each item you are charging for, and include directions on how your customer may remit payment.

Bill of lading template

A bill of lading is a document detailing how goods are being shipped from a seller to a recipient. It includes details about the items being shipped, the quantity of items included in the shipment, and the destination address. Use a bill of lading template to ensure you complete this document for each shipping transaction. This template includes a signature section that should be signed by you, then the shipping company, and finally the recipient, so that if the shipment is lost, the signature detail will help identify at what point it was lost and who was liable.

Billing statement template

A billing statement is helpful if you receive regular bi-monthly or monthly payments from your customers. Use this billing statement template to track customer invoices, account details, and billing status, all in one location. Additionally, this template looks professional and is customizable to match your needs.

Cash flow statement template

A cash flow statement is important to provide a good picture of the inflow and outflow of cash within your company. It shows where the money came from (cash receipts) and where the money went to (cash paid). Use a cash flow statement template, in conjunction with your balance sheet and income statement, to provide a comprehensive look into the financial status of your company. This cash flow template includes two additional worksheets to track month-to-month and year-to-year cash flow.

Cash flow forecast template

Creating a cash flow forecast can be helpful for managing your business’ finances. It enables you to estimate how much money your business will make and spend at any given point, and will allow you to take the appropriate steps to ensure that your cash outflow is not more than your inflow. Use a simple cash flow forecast template to get started quickly. Be sure you include all income including revenue and investments, and account for all expenses including fixed costs.

Expense report template

A simple expense report is helpful to keep track of business expenses for an individual, department, project, or company, and provides a quick way to document and track expense details. You can require that your team submit monthly expense reports or as the expenses are accrued. Use this expense report template to quickly input specific expense details and obtain approvals as needed.

Income statement template

An income statement, or profit and loss statement, provides a look into the financial performance of a company over a period of time. The statement provides a summary of the company’s revenue and expenses, along with the net income. Use this income statement template to create a single-step statement that groups all revenue and expenses, and is helpful for businesses of all sizes.

Payment schedule template

You will likely have multiple bills to pay in a month, to different companies and on different dates. It is important to have a way to track when specific bills are due, the amount that is due, and to whom. Use a simple payment schedule template to track these details. This payment schedule template will help you remember when each bill is due and be able to budget accordingly.

Simple balance sheet template

A simple balance sheet template provides a quick snapshot of a company’s financial position, at a given moment. Use this balance sheet template to summarize the company’s assets, liabilities, and equity, and give investors an idea of the health of the company.

Travel itinerary template

Whenever you or your team are scheduled for business trips, it’s helpful to have a travel itinerary that lists the details for transportation, lodging, car rentals, meetings and more. Use a simple business travel itinerary template to keep all of these details in one location, and be able to share the details with important stakeholders.

Save hours of manual work with smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try smartsheet for free, today.

Standard chart of accounts

In accounting, a standard chart of accounts is a numbered list of the accounts that comprise a company’s general ledger . Furthermore, the company chart of accounts is basically a filing system for categorizing all of a company’s accounts as well as classifying all transactions according to the accounts they affect. The standard chart of accounts list of categories may include the following:

- Assets

- Liabilities

- Owners’ equity or shareholder’s equity

- Revenues

- Cost of goods sold

- Operating expenses

- Other relevant accounts

- (see the following standard chart of accounts example below).

The standard chart of accounts is also called the uniform chart of accounts. Use a chart of accounts template to prepare the basic chart of accounts for any subsidiary companies or related entities. By doing so, you make consolidation easier.

Organize in numerical system

Furthermore, a standard chart of accounts is organized according to a numerical system . Thus, each major category will begin with a certain number, and then the sub-categories within that major category will all begin with the same number. If assets are classified by numbers starting with the digit 1, then cash accounts might be labeled 101, accounts receivable might be labeled 102, inventory might be labeled 103, and so on. Whereas, if liabilities accounts are classified by numbers starting with the digit 2, then accounts payable might be labeled 201, short-term debt might be labeled 202, and so on.

Number of accounts needed

Depending on the size of the company , the chart of accounts may include either few dozen accounts or a few thousand accounts. Whereas, if a company is more sophisticated, then the chart of accounts can be either paper-based or computer -based. In conclusion, the standard chart of account is useful for analyzing past transactions and using historical data to forecast future trends.

You can use the following example of chart of accounts to set up the general ledger of most companies . In addition, you may customize your COA to your industry by adding to the inventory , revenue and cost of goods sold sections to the sample chart of accounts.

SAMPLE CHART OF ACCOUNTS

Refer to the following sample chart of accounts. Each company’s chart of accounts may look slightly different. But if you are starting from scratch, then the following is great place to start.

1000 ASSETS

1010 CASH operating account

1020 CASH debitors

1030 CASH petty cash

1200 RECEIVABLES

1210 A/REC trade

1220 A/REC trade notes receivable

1230 A/REC installment receivables

1240 A/REC retainage withheld

1290 A/REC allowance for uncollectible accounts

1300 INVENTORIES

1310 INV – reserved

1320 INV – work-in-progress

1330 INV – finished goods

1340 INV – reserved

1350 INV – unbilled cost & fees

1390 INV – reserve for obsolescence

1400 PREPAID EXPENSES & OTHER CURRENT ASSETS

1410 PREPAID – insurance

1420 PREPAID – real estate taxes

1430 PREPAID – repairs & maintenance

1440 PREPAID – rent

1450 PREPAID – deposits

1500 PROPERTY PLANT & EQUIPMENT

1510 PPE – buildings

1520 PPE – machinery & equipment

1530 PPE – vehicles

1540 PPE – computer equipment

1550 PPE – furniture & fixtures

1560 PPE – leasehold improvements

1600 ACCUMULATED DEPRECIATION & AMORTIZATION

1610 ACCUM DEPR buildings

1620 ACCUM DEPR machinery & equipment

1630 ACCUM DEPR vehicles

1640 ACCUM DEPR computer equipment

1650 ACCUM DEPR furniture & fixtures

1660 ACCUM DEPR leasehold improvements

1700 NON – CURRENT RECEIVABLES

1710 NCA – notes receivable

1720 NCA – installment receivables

1730 NCA – retainage withheld

1800 INTERCOMPANY RECEIVABLES

1900 OTHER NON-CURRENT ASSETS

1910 organization costs

1920 patents & licenses

1930 intangible assets – capitalized software costs

2000 LIABILITIES

2100 PAYABLES

2110 A/P trade

2120 A/P accrued accounts payable

2130 A/P retainage withheld

2150 current maturities of long-term debt

2160 bank notes payable

2170 construction loans payable

2200 ACCRUED COMPENSATION & RELATED ITEMS

2210 accrued – payroll

2220 accrued – commissions

2230 accrued – FICA

2240 accrued – unemployment taxes

2250 accrued – workmen’s comp

2260 accrued – medical benefits

2270 accrued – 401 K company match

2275 W/H – FICA

2280 W/H – medical benefits

2285 W/H – 401 K employee contribution

2300 OTHER ACCRUED EXPENSES

2310 accrued – rent

2320 accrued – interest

2330 accrued – property taxes

2340 accrued – warranty expense

2500 ACCRUED TAXES

2510 accrued – federal income taxes

2520 accrued – state income taxes

2530 accrued – franchise taxes

2540 deferred – FIT current

2550 deferred – state income taxes

2600 DEFERRED TAXES

2610 D/T – FIT – NON CURRENT

2620 D/T – SIT – NON CURRENT

2700 LONG-TERM DEBT

2710 LTD – notes payable

2720 LTD – mortgages payable

2730 LTD – installment notes payable

2800 INTERCOMPANY PAYABLES

2900 OTHER NON CURRENT LIABILITIES

3000 OWNERS EQUITIES

3100 common stock

3200 preferred stock

3300 paid in capital

3400 partners capital

3500 member contributions

3900 retained earnings

4000 REVENUE

4010 REVENUE – PRODUCT 1

4020 REVENUE – PRODUCT 2

4030 REVENUE – PRODUCT 3

4040 REVENUE – PRODUCT 4

4600 interest income

4700 other income

4800 finance charge income

4900 sales returns and allowances

4950 sales discounts

5000 COST OF GOODS SOLD

5010 COGS – PRODUCT 1

5020 COGS – PRODUCT 2

5030 COGS – PRODUCT 3

5040 COGS – PRODUCT 4

5700 freight

5800 inventory adjustments

5900 purchase returns and allowances

5950 reserved

6000 – 7000 OPERATING EXPENSES

6010 advertising expense

6050 amortization expense

6100 auto expense

6150 bad debt expense

6200 bank charges

6250 cash over and short

6300 commission expense

6350 depreciation expense

6400 employee benefit program

6550 freight expense

6600 gifts expense

6650 insurance – general

6700 interest expense

6750 professional fees

6800 license expense

6850 maintenance expense

6900 meals and entertainment

6950 office expense

7000 payroll taxes

7050 printing

7150 postage

7200 rent

7250 repairs expense

7300 salaries expense

7350 supplies expense

7400 taxes – FIT expense

7500 utilities expense

7900 gain/loss on sale of assets

If you want to take your business to the next level, then download our three most powerful tools.

[box] strategic CFO lab member extra

Access your strategic pricing model execution plan in SCFO lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your execution plan. Not a lab member?

Originally posted by jim wilkinson on july 24, 2013.

Sample chart of accounts for a small company

This is a partial listing of another sample chart of accounts. Note that each account is assigned a three-digit number followed by the account name. The first digit of the number signifies if it is an asset, liability, etc. For example, if the first digit is a "1" it is an asset, if the first digit is a "3" it is a revenue account, etc. The company decided to include a column to indicate whether a debit or credit will increase the amount in the account. This sample chart of accounts also includes a column containing a description of each account in order to assist in the selection of the most appropriate account.

Asset accounts

Liability accounts

Owner's equity accounts

Operating revenue accounts

Operating expense accounts

Non-operating revenues and expenses, gains, and losses

Accounting software frequently includes sample charts of accounts for various types of businesses. It is expected that a company will expand and/or modify these sample charts of accounts so that the specific needs of the company are met. Once a business is up and running and transactions are routinely being recorded, the company may add more accounts or delete accounts that are never used.

At least two accounts for every transaction

The chart of accounts lists the accounts that are available for recording transactions. In keeping with the double-entry system of accounting, a minimum of two accounts is needed for every transaction—at least one account is debited and at least one account is credited.

When a transaction is entered into a company's accounting software, it is common for the software to prompt for only one account name—this is because the software is programmed to automatically assign one of the accounts. For example, when using accounting software to write a check, the software automatically reduces the asset account cash and prompts you to designate the other account(s) such as rent expense, advertising expense, etc.

Some general rules about debiting and crediting the accounts are:

- Expense accounts are debited and have debit balances

- Revenue accounts are credited and have credit balances

To learn more about debits and credits, see our explanation of debits and credits and quiz for debits and credits.

To learn more about the role of bookkeepers and accountants, see our accounting career center.

Take our practice quiz

We recommend that you now take our free practice quiz for this topic so that you can.

- See what you know

- See what you don't know

- Deepen your understanding

- Improve your retention

Note: you can receive instant access to our PRO materials (visual tutorials, flashcards, quick tests, quick tests with coaching, cheat sheets, video training, bookkeeping and managerial guides, business forms, printable PDF files, and progress tracking) when you join accountingcoach PRO.

Please note.

You should consider our materials to be an introduction to selected accounting and bookkeeping topics, and realize that some complexities (including differences between financial statement reporting and income tax reporting) are not presented. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances.

Debtors and creditors

control accounts

What are control accounts? Why do we need them?

In this lesson we're going to answer these questions and more.

Introduction

As previously mentioned, we not only have the general ledger, but also two other ledgers:

- the debtors ledger

- the creditors ledger

We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger .

For example, here is a debtor's ledger with a number of individual debtor T-accounts:

Now, as far as we know, debtor and creditor T-accounts only go in the debtor and creditor ledgers, right?

None of the information about debtor or creditor T-accounts goes in the general ledger, right?

The general ledger does contain information about debtors and creditors.

In fact, it contains two special accounts relating to the above, called control accounts.

There is one control account for debtors and another for creditors:

Why are these called "control accounts?"

and what are they used for?

The reason these accounts are called control accounts is because one uses them to ensure there are no errors or mistakes in our records relating to debtors and creditors. Thus one gets more control . I will show you exactly how this is done shortly.

Control accounts are essentially summary accounts in the general ledger. They contain totals instead of amounts relating to individual debtors or creditors. They allow one to see the totals, without getting into too much details from individual accounts.

Where do the totals for the control accounts come from?

Entries in the control accounts such as "total sales", "total purchases" as well as "bank" come from the relevant accounting journals.

For example, the "total sales" figure of $16,300 in the debtors control account above comes from the total in the sales journal below (which shows sales on credit).

Also, the "bank" figure of $7,400 in the debtors control account would come from the total of the "debtors" column in the cash receipts journal:

Similarly, the "total purchases" figure of $3,900 in the creditors control account could be traced back to the purchases journal (which shows purchases on credit).

And the "bank" figure of $6,000 in this same account could be traced back to the cash payments journal (which shows all payments of cash).

The debtors control account is also known as the sales ledger control account. This name is sometimes used for this account because it reflects the total of the individual sales on credit (sales to debtors), as reflected in the sales ledger.

Likewise, the creditors control account is also known as the purchases ledger control account. Again, this name is used because it reflects the total of the individual purchases on credit (purchases from creditors), as reflected in the purchases ledger.

So how exactly do these control accounts ensure there are no errors?

For debtors, we compare the closing balance of the debtors control account in the general ledger to the total of all the closing balances of the individual debtor accounts in the debtors ledger.

As you can see above, the debtors control account has a closing balance of $10,700. The debtor T-accounts come to the same figure ($8,000 + $1,400 + $1,300 = $10,700).

If the debtor T-accounts came to a different figure – let's say $11,000 – we would know for sure that there was some error, either in one of the individual debtor accounts in the debtors ledger or in the debtors control account (general ledger).

And we would then go about trying to find that error and then correcting it.

Reconciling control accounts

Traditionally bookkeepers or other accounts personnel perform a reconciliation on a regular basis between the control accounts (general ledger) and the total of the debtors or creditors ledger.

The word reconciliation actually comes from reconcile, which means to make two amounts agree in value.

Accounts personnel may even produce a debtors or creditors reconciliation statement, which is a report showing the discrepancies between the control account (general ledger) and the total of the individual T-accounts (in the debtors or creditors ledger).

So that's our lesson on control accounts. I hope it helped shed some light on this important topic.

Next up, we're going to tackle the penultimate step in the accounting cycle - the trial balance.

So, let's see, what we have: sales ledger control account : format, uses and source of information for the items in the control account. At trade account format

Contents of the article

- Sales ledger control account.

- Format:

- How to check the arithmetical accuracy of the...

- Source of information for sales ledger control...

- Items should not be entered in the sales ledger...

- Reasons for opening and closing credit balances...

- Purchases ledger control account.

- Format:

- How to check the arithmetical accuracy of the...

- Source of information for purchases ledger...

- Items should not be entered in the purchases...

- Reasons for opening and closing debit balances in...

- Trade receivables

- What is trade receivables?

- Trade receivables on the balance sheet

- Example

- Why trade receivables is a critical?

- Essential part of working capital loan assessment

- Analysis and interpretation

- Trade receivables video

- Recommended articles

- Trading account and profit and loss account and...

- Free forex bonuses

- Trading profit and loss account

- The trading account

- Trading account formula

- Preparation of trading account

- Trading account example

- Trading account in final accounts

- The profit and loss account

- Profit and loss account formula

- Preparation of profit and loss account

- Profit and loss account example

- Profit and loss account in the final accounts

- Trading profit and loss account format

- About the author

- Top excel templates for accounting

- See a head-to-head comparison of microsoft excel...

- Accounts payable template

- Accounts receivable template

- Bill to invoice template

- Bill of lading template

- Billing statement template

- Cash flow statement template

- Cash flow forecast template

- Expense report template

- Income statement template

- Payment schedule template

- Simple balance sheet template

- Travel itinerary template

- Save hours of manual work with smartsheet

- Standard chart of accounts

- Organize in numerical system

- Number of accounts needed

- SAMPLE CHART OF ACCOUNTS

- 1000 ASSETS

- 1200 RECEIVABLES

- 1300 INVENTORIES

- 1400 PREPAID EXPENSES & OTHER CURRENT...

- 1500 PROPERTY PLANT & EQUIPMENT

- 1600 ACCUMULATED DEPRECIATION &...

- 1700 NON – CURRENT RECEIVABLES

- 1800 INTERCOMPANY RECEIVABLES

- 1900 OTHER NON-CURRENT ASSETS

- 2000 LIABILITIES

- 2100 PAYABLES

- 2200 ACCRUED COMPENSATION & RELATED ITEMS

- 2300 OTHER ACCRUED EXPENSES

- 2500 ACCRUED TAXES

- 2600 DEFERRED TAXES

- 2700 LONG-TERM DEBT

- 2800 INTERCOMPANY PAYABLES

- 2900 OTHER NON CURRENT LIABILITIES

- 3000 OWNERS EQUITIES

- 4000 REVENUE

- 5000 COST OF GOODS SOLD

- 6000 – 7000 OPERATING EXPENSES

- Sample chart of accounts for a small company

- Asset accounts

- Liability accounts

- Owner's equity accounts

- Operating revenue accounts

- Operating expense accounts

- Non-operating revenues and expenses, gains, and...

- At least two accounts for every transaction

- Debtors and creditorscontrol accounts

- Introduction

- Why are these called "control accounts?"

- Where do the totals for the control accounts come...

- So how exactly do these control accounts ensure...

- Reconciling control accounts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.