Tickmill trading

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

Free forex bonuses

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

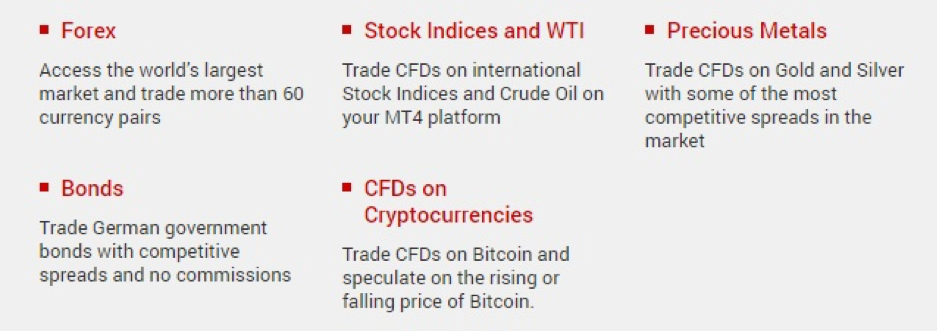

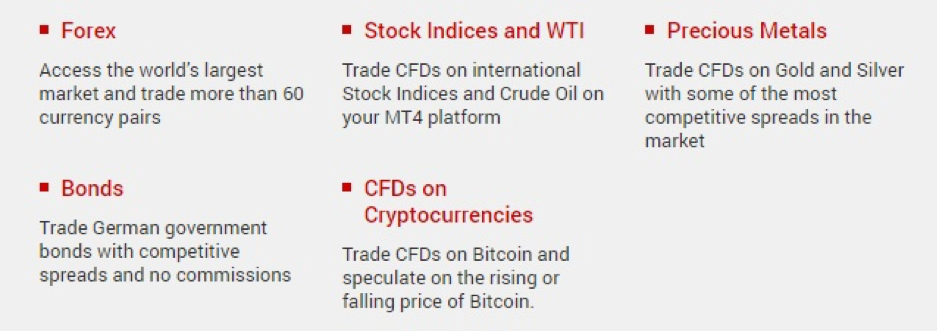

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

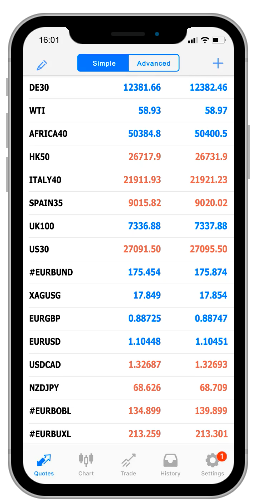

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

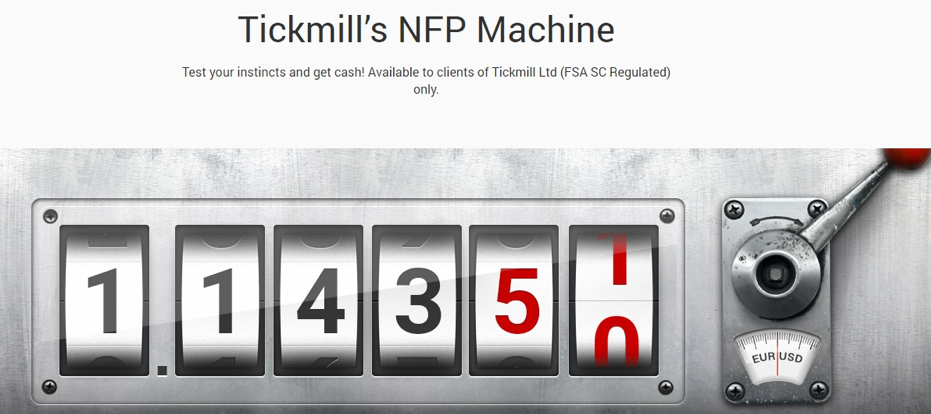

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

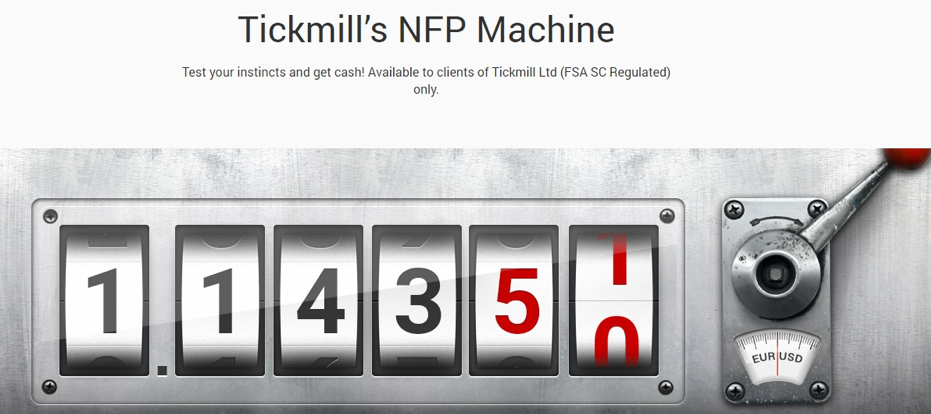

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

USDCAD is facing bullish pressure from our upside confirmation at 1.2871, in line with the 100% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Neutral outlook for UKOIL as technical indicators are mixed. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 38.2% fibonacci retracement where we could see a further drop below this level to our first support target. Ichimoku cloud is showing signs of bearish pressure as well, in line with our bearish bias.

Price is facing bearish pressure from our first resistance, in line with our horizontal pullback resistance, 100% fibonacci extension and 50% fibonacci retracement where we could see a reversal below this level to our first support target. Ichimoku cloud and 20 EMA are showing signs of bearish pressure as well, in line with our bearish pressure.

Price is facing bullish pressure from our first support and we could see a bounce above this level to our first resistance target. Stochastic is approaching support as well where we could see a bounce above this level.

USDCAD is facing bullish pressure from our upside confirmation at 1.2838, in line with the 78% fib extension and horizontal swing high, where we could see a further bounce above this level towards 1st resistance where 127% fib extension is. EMA also shows that price is on support.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 61.8% fib extension and 61.8% fib retracement, where we could see a further drop below this level towards 1st support where 50% fib retracement is. Stochastics also shows that price is near resistance.

UKOIL bounced off 55.85 where it could potentially rise further to 56.32 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks

USDCAD is facing bearish pressure from 1st resistance level, in line with the 78.6% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance and 38.2% fibonacci retracement could provide the bullish acceleration to our first resistance target.

UKOIL reversed off its resistance at 56.00 where it could potentially drop further to 55.07 trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

Price is facing bullish pressure from our first support and a break above our upside confirmation level, in line with our horizontal overlap resistance, 61.8% fibonacci extension and 61.8% fibonacci retracement could provide the bullish acceleration to our first resistance target.

USDCAD is facing bearish pressure from 1st resistance level, in line with the 100% fib extension and 78.6% fib retracement, where we could see a further drop below this level towards 1st support where the horizontal swing low is. Trendline also shows that price is near resistance.

UKOIL reversed off its resistance at 55.58 where it could potentially drop further to 54.48. Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

One click trading

Streamline your trading with our one click trading EA!

What is the

one click trading EA?

The one click trading EA is as simple as it sounds! You’re able to perform multifaceted trade operations with just the click of a mouse.

Placed directly within your MT4 terminal, you’ll automatically be shown trading levels, with trade commands clearly displayed. You can:

create buy and sell orders at the push of a button. Close all your positions – including hedges – in a single click. View your profit and loss in pips. Place stop losses and take profits in pips.

Why use tickmill’s

one click trading EA?

Streamlining a process always makes it more efficient, so why not do that with your trading? By using our one click trading EA you’re able to utilise all trading operations within a compact interface, directly in your MT4 terminal.

Human error is limited as stop loss and take profit calculations are automatically calculated while you still maintain the control of opening and closing the trade!

You’re even able to make sure that you have a constant internet connection by using our VPS. Click here for more information about the tickmill VPS.

Ready to start using our OCT EA?

Check out our user manual and download it below:

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill

Predictions and analysis

The currency stay strong from falling any further against USD and now NZD. Timeframe analysis shows the blueprint of bulls to take price on a long struggle with the bears ; it has support from the channel it finds itself in , weekly chart, daily chart, 4hr chart and partially 1 hr with the smaller time-frames making minute advances from both the bears and bulls.

A BEST TRADER KNOWS HOW TO MANAGE THEIR CAPITAL ORDERS GIVES MOST ACURATE RESULTS COZ THEY WAIT FOR THE MOVEMENT TO HAPPEN BUY STOP N SELL STOP DONT FORGET THEIR STOP LOSSES

Cad-jpy breakout of channel

The USDCAD got knocked down by a trendline

Market short below the trendline

On a monthly chart, the price pushed away from point 3 of the rising channel and on the weekly chart was closed by takeover. Also the price rebounded from the horizontal support 3.52688. There are two options. The first is buying when the market opens. The second is buying from the middle of the takeover: buy limit 3.5500, SL = 3.4900, TP1 = 3.7000, TP2 =.

By bitcoin we pushed away from the level of 3600.00, having formed a reversal candlestick pattern "skylight in the clouds". We also pushed off from the 50% fibo level, which was stretched over the last upward movement (1830-4979.9). These are direct signals for the purchase of crypto-currencies, even from current prices. Oleg svirgun

According to the british currency, we came very close to the point 3 of the descending channel, which is formed on the weekly timeframe, and also there passes level 1.3680 - this is the punched horizontal from the monthly timeframe. Wait for the candle signals with subsequent sale of sterling, we will look at the daily chart. Oleg svirgun

The british pound, on the daily timeframe, pushed off the horizontal level of 1.3265 and is trying to form a veil of dark clouds (although for the complete formation of candle patterns one must wait for the closing of the day). It is also worth looking at the four-hour timeframe. If today the price closes below the level of 1.3220 and draws a veil of dark clouds.

On the ruble, we still formed a candle signal - absorption, which rested against a broken downstream and an upward channel. Here, at the opening of the market, we will try to buy a pair. Buy 57.30, SL=56.60, TP=58.90. Oleg svirgun

On gold, we rested the falling star in the upper line of the day's rising channel. The deal is against the trend, but we are waiting for correction to the level of 1295. Oleg svirgun

For USD/RUB pair, we trample at the broken neck line of the upturned head with shoulders, and also near the apprentice - an interesting signal for entering long positions. Although, perhaps, here it is worth waiting for the formation of a white candle.

Silver touched 50% of the level of fibo, which also passes the level at 17,748. Now it's risky to sell - we can break through the horizontal level and fly further. Here tactics such - we wait tomorrow or the day after tomorrow of formation of candle signals and then we already make a decision - to sell the instrument or not. Goals, in the case of sales, while we.

On the weekly chart of the european index EURO STOXX 50, which includes the leading "blue chips" for the eurozone, rested on the ascending channel with a beautiful hammer. Let's move on to the daily chart. Usually we buy from the middle of the hammer - this is the level of 3480.00, also there is our upcoming weekly channel: buy limit 3408.00, SL = 3347.00, TP =.

On the daily chart, the price of the crypto currency fell back to 50% of its value - 0.2000. Now the prices are slowly growing, and at the moment there is interest in buying the asset at current prices and waiting for a level of about 0.4000, although other, heavier crypto-currencies have shown that the highs easily break through and the price of 0.4000 may be a.

By the e-fever we are selected at the level 412.21. To say that this is the key level is to say nothing. The question is: will we break this level and rise even higher, or will the 412.21 level become a turning point in the price dynamics. It remains for us to wait and see how the price behaves near this level (look at the candlestick signals). Although we.

On gold, on the daily chart, we rested a falling star at the upper boundary of the range. Also, the body of the shooting star blocked the previous candle, thereby also absorbing. Now we have a very good signal for the opening of short positions. The first option is selling at the opening of the market. The second option is to sell from the middle of a shooting.

Tickmill trading

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill trading

| Website | https://tickmill.Com/ |

| live chat | YES |

| telephone | +852 5808 2921 |

| broker type | non deal desk (NDD) |

| regulations | FCA and FSA |

| min deposit | $100.00 |

| account base currency | USD, EUR, GBP, PNL |

| max leverage | 500:1 |

| trading platforms | metatrader 4, webtrader |

| markets | forex, index CFD trading, precious metals, energy, cryptocurrencies, bonds |

| bonus offered | $30.00 welcome bonus |

| funding options | credit / debit card, china union pay, bank transfer, dotpay, skrill, neteller, fasa pay |

Tickmill review 2021

Overview

This UK-based FCA and FSA-regulated brokerage firm based in the republic of seychelles offers trading to institutions and retail clients globally. Its forex business offers gold and silver as well as 62 currency pairs (including cryptocurrency) for trading. The broker have a lower minimum deposit compared to some of the other brokers on this list. It is a great broker firm for beginners to try their hand.

Accounts

Tickmill offers various types of accounts for various trader profiles. Commission-free classic accounts for beginners, pro accounts, VIP accounts for those who trade a lot and want special service, and islamic accounts. Traders will be thrilled to find the demo account offers metatrader 4 for testing, and includes real-time prices and volatility.

Minimum deposit

$100 in classic and pro accounts, 50,000 minimum balance in VIP accounts.

Maximum leverage

Features

Tickmill offers two platforms to trade on. Metatrader 4 is the main platform. For those who want to trade quickly through their browsers without downloading any software, there is the web trader.

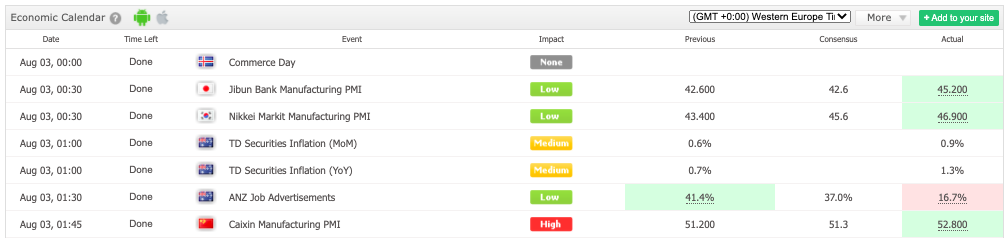

Tickmill also offers a variety of tools including forex margin and currency calculators, autochartist for technical analysis, forex calendar, and myfxbook autotrade. The tickmill VPS keeps the MT4 eas and signals running when the customer is offline. One-click trading option enables quicker real-time trading.

Promotions like the introducing broker service allows traders to earn commissions on reference. A multi account manager is also available.

Educa tion

Webinars and video tutorials are available.

Deposits/withdrawals

Several funding options are available to customers, and withdrawals are processed within one working day.

Customer service

24/7 via online chat or email, and support lines on weekdays.

Tickmill review and tutorial 2021

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: forexbroker is your one stop portal for comparing the best forex brokers, stock brokers and trading platforms in the world! At tickmill trading

Contents of the article

- Free forex bonuses

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tickmill

- One click trading

- What is the one click trading...

- Why use tickmill’s one click...

- Ready to start using our OCT EA?

- Check out our user manual and download it below:

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Check out our user manual and download it below:

- Tickmill

- Predictions and analysis

- Tickmill trading

- Tickmill trading

- Tickmill review 2021

- Overview

- Accounts

- Minimum deposit

- Maximum leverage

- Features

- Educa tion

- Deposits/withdrawals

- Customer service

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.