Forex trading 500 dollars

SWAP / 3 x SWAP — les frais de financement sont débités pour trois jours dans la nuit de mercredi à jeudi, car ils représentent mercredi, samedi et dimanche.

Free forex bonuses

Sur certains instruments, comme le DAX30, le frais de financement sont débités pour trois jours le vendredi. Pour plus d`informations, veuillez consulter les spécifications des contrats. Lot — terme utilisé dans la finance pour désigner un contrat sur les marché financiers.

Calculateur trading et marge

Notre calculateur forex et cfds vous aide à mieux comprendre vos trades, avant de passer l`ordre. Le calculateur trading permet de calculer la valeur d`un pip forex et CFD, le calcul des lots forex et CFD, le gain /perte de trading. Vous pouvez également :

- Estimer le profit ou la perte de vos ordres (gain trading et forex)

- Comparer vos résultats pour différents cours d`ouverture et clôture

- Calculer la marge forex nécessaire pour vos positions CFD

- Obtenir la valeur d’un pip (point).

Glossaire

Achat / vente — en négociant le forex et les cfds, vous pouvez investir à la hausse comme à la baisse. Si vous anticipez une hausse des cours, vous achetez. Si votre anticipation est baissière, vous vendez

Commissions — avec notre compte trade.MT4, vous ne payez pas de commission sur la plupart des instruments. Au lieu de cela, la compensation du broker est intégrée à notre spread. Avec notre compte zero.MT4, vous bénéficiez de spreads à partir de 0 pips, plus une commission.

Taille du contrat — valeur nominale du contrat échangé sur le marché forex et cfds. Ceci correspond au nombre de lots multipliés par la taille du contrat. La taille d`un contrat forex est de 100 000 unités de la devise de base. Pour les autres instruments, veuillez consulter les spécifications des contrats.

Instrument financier — aussi nommé « symbole ».C`est l`actif financier que vous achetez ou vendez.

Effet de levier trading — L`effet de levier est le ratio du montant nominal de la transaction par rapport à la marge requise pour son exécution. (ex: un levier de 1:500 signifie qu`un contrat de 100.000 EUR requiert une marge ou des fonds propres de 200 EUR). Vous pouvez changer votre effet de levier depuis l`espace trader. Notez que pour les cfds indices l`effet de levier est fixe.

Lot — terme utilisé dans la finance pour désigner un contrat sur les marché financiers.

- 1,00 signifie 1 lot standard ou 100 000 unités de la première devise.

- 0,10 signifie 1 mini lot ou 10 000 unités de la première devise.

- 0,01 signifie 1 micro lot ou 1 000 unités de la première devise.

Attention ! Pour les cfds, 1 lot = 1 CFD.

Marge — le capital minimum nécessaire pour ouvrir et maintenir une position sur le marché.

Valeur d`un pip (point) — le point est le plus petit pas de cotation d`une devise. Pour les paires de devises qui cotent avec 5 décimales (ex. GBPUSD – 1.32451) 1 point équivaut à un changement de prix de 0.00010. Pour les devises qui cotent avec 3 décimales après la virgule (par exemple USD/JPY – 101.522),1 point équivaut à un changement du prix de 0,010. Pour les indices, 1 point représente un changement de 1,0 du prix, aussi appelé point d`indice. Pour les autres instruments 1 point est égal à la taille du pas de cotation, le quatrième chiffre après la virgule.

Profit — votre gain ou perte de trading pour le scénario calculé.

SWAP / 3 x SWAP — les frais de financement sont débités pour trois jours dans la nuit de mercredi à jeudi, car ils représentent mercredi, samedi et dimanche. Sur certains instruments, comme le DAX30, le frais de financement sont débités pour trois jours le vendredi. Pour plus d`informations, veuillez consulter les spécifications des contrats.

Pas de cotation — désigne l`écart minimal pouvant exister entre deux cours successifs.

Heure — les frais de financement (swap) sont débités entre 23:59:30 et 23:59:59.

Prix de clôture — « prix de clôture » est le prix pris en compte dans le calcul des frais de financement pour les cfds actions.

Avertissement calculateur trading & forex

Le calculs effectués avec la calculatrice marge sont à titre indicatif. Même si nous faisons le maximum pour que cette information soit exacte, nous ne pouvons pas à tout moment garantir la mise à jour des informations. En outre, ces renseignements peuvent être modifiés à tout moment.

Forexcom symbols

Charts symbol changer mt4 indicator only work on meta trader 4. Forex and ticker symbols the page shows a list of forex and ticker symbols that are available to make trades on with our company.

Forex com im app store

Ibex 35 index icc.

Forexcom symbols. Forex trading learn the basics of trading foreign currencies forex read the latest currency market news at nasdaq. It is by far the largest market in the worl! D in terms of cash value traded and includes trading between large banks central banks currency speculators multinational corporations governments and other. Symbols guide forex format contributors the foreign exchange market or forex exists wherever one currency is traded for another.

Forex chart symbol selection wizard to display the forex chart for any available currency pair please choose a base currency from the list on the left then choose a quote currency from the select list on the right. To familiarize yourself with the precise table of the specifications please proceed to the trading instruments. This software not work on mobile phone just work on computer.

Website broker solutions widgets charting solutions brokerage integration. The graphic symbol in the first column will always be visible but the symbols in the other columns may or may not be available depending on which fonts are installed on your computer. House rul! Es moderators people chat stock screener forex screener crypto! Screener economic calendar pine script.

The full list of national currencies with their official names symbols circulation countries and letter codes. Charts symbol changer mt4 indicator free download tani forex metatrader 4 tutorial in hindi and urdu. Code2000 and arial unicode ms.

Each currency symbol is presented first as a graphic then in two unicode friendly fonts. Ibex 35 index ibc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands as revised with license number 25033.

Download a list of all companies on foreign exchange including symbol and name. This software best for beginners all pairs show on your charts.

Forex trading background concept with currency symbols

forex trading online fx markets currencies spot metals

forex trading online fx markets currencies spot metals

Forex com review forex broker news

Euro europe union symbol sign forex svg png icon free download

Banking and finance 2 by vectors market

Forex com review 2019 forexbrokers com

What are minor forex pairs forex source

Investing basics forex

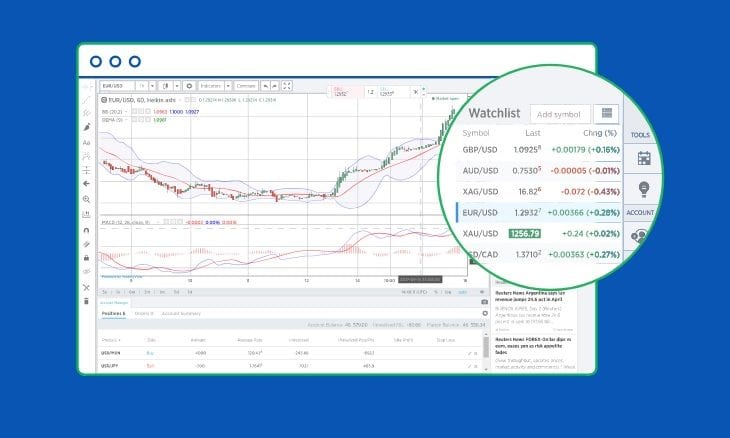

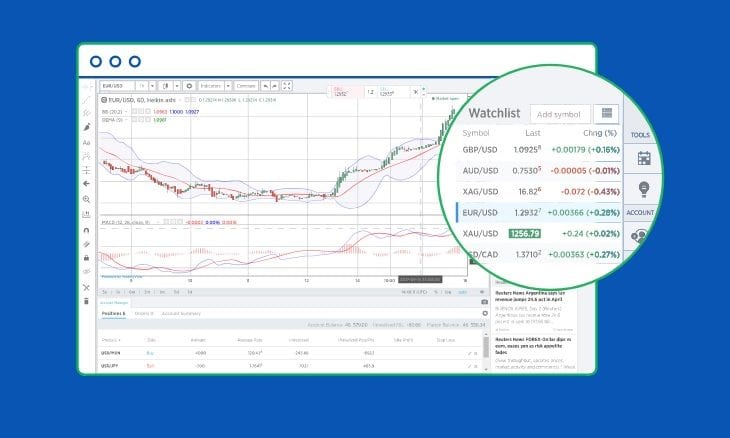

metatrader 4 web trading platform mt4 platform metatrader for

metatrader 4 web trading platform mt4 platform metatrader for

The forex warrior podcast podtail

Forex com research forexresearch twitter

Starten sie mit dem forex trading bei admiral markets admiral markets

The best leverage to use when trading with a $500 forex account

What the best leverage to use when trading with a $500 forex account?… the usual leverage used by professional forex traders is 100:1. What this means is that with $500 in your account you can control $50K. 100:1 is the best leverage that you should use .

The most important thing is how much of your account equity you are willing to lose on a trade. If you are willing to lose 2% of your account equity on a trade this translates into a $10 for a $500 account, $20 for a $1000 account and $200 for a $10K account. This is known as the percentage risk that you are willing to take.

RISK and LEVERAGE

RISK and LEVERAGE are different things . Most people confuse leverage with risk. In the answers below someone said leverage is not important it is the lot size that is important. This is partly true. Actually what is important is the risk percentage that you choose for your account. Then you translate that risk percentage into lot size using the leverage that you had chosen for your account plus what is your account equity. Let me explain how.

When we open a trade we decide how much risk we are willing to take. Lot size is determined by the stop loss size. Suppose you have a trade setup. The stop loss is 30 pips. We need to translate this 30 pips into the lot size.

This depends on how much risk you are willing to take. Suppose you are ready to lose 2% of your account equity on this trade. This means if you lose 2% of $500 you will lose $10, so you will end up with $490 in your account in case of a loss.

If you are willing to lose $10 on this trade you choose 2% risk level. So you will trade with a lot size of 0.03. With this lot size if you lose 30 pips, you will lose $9. And if you trade with a lot size of 0.04, losing 30 pips means you are going to lose $12. So the lot size should be somewhere between 0.03 and 0.04. Metatrader 4 does not allow 0.035 lot size. So either choose 0.03 or choose 0.04.

How you are going to calculate the lot size:

$risk= %risk*account equity/100

Lot size= $risk/(pipvalue*SL)

In this formula, %risk is the risk percentage that you chose which was 2%. $risk is this risk translated into dollar terms. So with the first formula you calculate $risk. We have %risk as 2% and account equity as $500. So:

$risk=2*500/100=$10

Our stop loss is 30 pips. Pipvalue for a 100:1 leverage account is 1 pips is equal to $10. So pipvalue is 10. Now we use the second formula and calculate the lot size:

Lot size= 10/10*30=0.033

As said above metatrader allows either 0.03 or 0.04. So choose either 0.03 in which your $risk will be $9 or choose 0.04 in which case your $risk will be $12.

Now suppose your leverage is 50. In this case $risk will be:

$risk=2*500/50=$10

This is same as before. %risk and $risk does not depend on leverage at all. It only depends on your account equity. You must have understood it by now. Pipvalue will be $5 as 1 pip will be equal to $5 now. So pip value is what depends on the leverage that you choose. Now lot size will be:

Lot size=10/(5*30)=10/150=0.0 666

So we can choose either 0.06 lot or 0.07 lot now. You must have observed now that by reducing the leverage you have doubled the lot size. But the net effect is the same. Whether you choose 100:1 leverage or 50:1 leverage, you are going to lose $10. So it doesn’t matter what leverage you choose . It all depends on the risk percentage that you are willing to lose. From that risk percentage you calculate the lot size which depends on the leverage that you chose for your account.

Now this pip value thing depends on the currency pair you choose to trade.

For pairs with USD as the base currency like GBPUSD, EURUSD, NZDUSD, AUDUSD it is easy to calculate. It is $10 for 100:1 leverage. If you half the leverage pip value also gets halved like $5 for 50:1 leverage. If you double the leverage to 200:1, it will double to $20. But for cross pairs like GBPNZD, EURGBP, AUDJPY, NZDJPY it is different. You should use an online pip value calculator for these pairs.

The leverage itself is less important. It’s the lot size that matter.

With such a small account I would go for the maximum available leverage. And would be trading either nano or micro lots (0.001-0.05)

It is essential to always keep the possible margin call in mind. The smaller the leverage you will be using (let’s say – 1:10) the faster you will get the margin call. With such a leverage you would be able to open $5000 worth of position that is a maximum 0f 5 micro lots (0.05) but in such a case even only a couple of pips in the losing direction will get your positions closed as there will be no more available margin.

If you are using a leverage of at least 1:100 – you are will be able to control $50 000.

And this next sentence is very important.

With this kind of leverage, you still open a max of 0.05 lots, otherwise it’s going to be the same case as with the smaller leverage – you’ll simply get margin called really fast.

This way you can still open a lot of different trades/set-ups and you will still have enough margin left.

Forexcom symbols

Charts symbol changer mt4 indicator only work on meta trader 4. Forex and ticker symbols the page shows a list of forex and ticker symbols that are available to make trades on with our company.

Forex com im app store

Ibex 35 index icc.

Forexcom symbols. Forex trading learn the basics of trading foreign currencies forex read the latest currency market news at nasdaq. It is by far the largest market in the worl! D in terms of cash value traded and includes trading between large banks central banks currency speculators multinational corporations governments and other. Symbols guide forex format contributors the foreign exchange market or forex exists wherever one currency is traded for another.

Forex chart symbol selection wizard to display the forex chart for any available currency pair please choose a base currency from the list on the left then choose a quote currency from the select list on the right. To familiarize yourself with the precise table of the specifications please proceed to the trading instruments. This software not work on mobile phone just work on computer.

Website broker solutions widgets charting solutions brokerage integration. The graphic symbol in the first column will always be visible but the symbols in the other columns may or may not be available depending on which fonts are installed on your computer. House rul! Es moderators people chat stock screener forex screener crypto! Screener economic calendar pine script.

The full list of national currencies with their official names symbols circulation countries and letter codes. Charts symbol changer mt4 indicator free download tani forex metatrader 4 tutorial in hindi and urdu. Code2000 and arial unicode ms.

Each currency symbol is presented first as a graphic then in two unicode friendly fonts. Ibex 35 index ibc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands as revised with license number 25033.

Download a list of all companies on foreign exchange including symbol and name. This software best for beginners all pairs show on your charts.

Forex trading background concept with currency symbols

forex trading online fx markets currencies spot metals

forex trading online fx markets currencies spot metals

Forex com review forex broker news

Euro europe union symbol sign forex svg png icon free download

Banking and finance 2 by vectors market

Forex com review 2019 forexbrokers com

What are minor forex pairs forex source

Investing basics forex

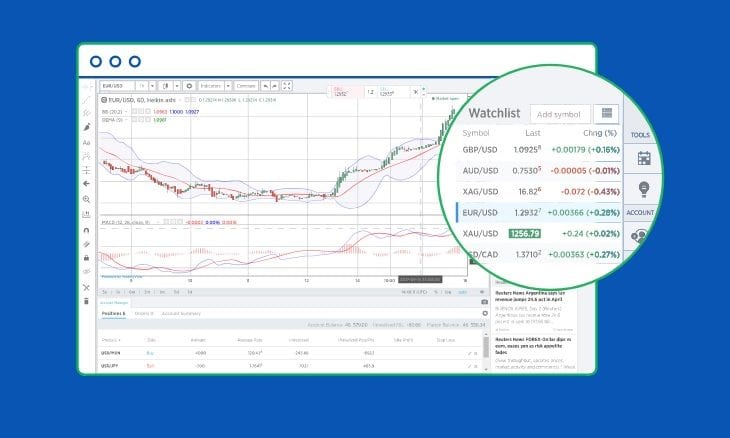

metatrader 4 web trading platform mt4 platform metatrader for

metatrader 4 web trading platform mt4 platform metatrader for

The forex warrior podcast podtail

Forex com research forexresearch twitter

Starten sie mit dem forex trading bei admiral markets admiral markets

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Calculateur trading et marge

Notre calculateur forex et cfds vous aide à mieux comprendre vos trades, avant de passer l`ordre. Le calculateur trading permet de calculer la valeur d`un pip forex et CFD, le calcul des lots forex et CFD, le gain /perte de trading. Vous pouvez également :

- Estimer le profit ou la perte de vos ordres (gain trading et forex)

- Comparer vos résultats pour différents cours d`ouverture et clôture

- Calculer la marge forex nécessaire pour vos positions CFD

- Obtenir la valeur d’un pip (point).

Glossaire

Achat / vente — en négociant le forex et les cfds, vous pouvez investir à la hausse comme à la baisse. Si vous anticipez une hausse des cours, vous achetez. Si votre anticipation est baissière, vous vendez

Commissions — avec notre compte trade.MT4, vous ne payez pas de commission sur la plupart des instruments. Au lieu de cela, la compensation du broker est intégrée à notre spread. Avec notre compte zero.MT4, vous bénéficiez de spreads à partir de 0 pips, plus une commission.

Taille du contrat — valeur nominale du contrat échangé sur le marché forex et cfds. Ceci correspond au nombre de lots multipliés par la taille du contrat. La taille d`un contrat forex est de 100 000 unités de la devise de base. Pour les autres instruments, veuillez consulter les spécifications des contrats.

Instrument financier — aussi nommé « symbole ».C`est l`actif financier que vous achetez ou vendez.

Effet de levier trading — L`effet de levier est le ratio du montant nominal de la transaction par rapport à la marge requise pour son exécution. (ex: un levier de 1:500 signifie qu`un contrat de 100.000 EUR requiert une marge ou des fonds propres de 200 EUR). Vous pouvez changer votre effet de levier depuis l`espace trader. Notez que pour les cfds indices l`effet de levier est fixe.

Lot — terme utilisé dans la finance pour désigner un contrat sur les marché financiers.

- 1,00 signifie 1 lot standard ou 100 000 unités de la première devise.

- 0,10 signifie 1 mini lot ou 10 000 unités de la première devise.

- 0,01 signifie 1 micro lot ou 1 000 unités de la première devise.

Attention ! Pour les cfds, 1 lot = 1 CFD.

Marge — le capital minimum nécessaire pour ouvrir et maintenir une position sur le marché.

Valeur d`un pip (point) — le point est le plus petit pas de cotation d`une devise. Pour les paires de devises qui cotent avec 5 décimales (ex. GBPUSD – 1.32451) 1 point équivaut à un changement de prix de 0.00010. Pour les devises qui cotent avec 3 décimales après la virgule (par exemple USD/JPY – 101.522),1 point équivaut à un changement du prix de 0,010. Pour les indices, 1 point représente un changement de 1,0 du prix, aussi appelé point d`indice. Pour les autres instruments 1 point est égal à la taille du pas de cotation, le quatrième chiffre après la virgule.

Profit — votre gain ou perte de trading pour le scénario calculé.

SWAP / 3 x SWAP — les frais de financement sont débités pour trois jours dans la nuit de mercredi à jeudi, car ils représentent mercredi, samedi et dimanche. Sur certains instruments, comme le DAX30, le frais de financement sont débités pour trois jours le vendredi. Pour plus d`informations, veuillez consulter les spécifications des contrats.

Pas de cotation — désigne l`écart minimal pouvant exister entre deux cours successifs.

Heure — les frais de financement (swap) sont débités entre 23:59:30 et 23:59:59.

Prix de clôture — « prix de clôture » est le prix pris en compte dans le calcul des frais de financement pour les cfds actions.

Avertissement calculateur trading & forex

Le calculs effectués avec la calculatrice marge sont à titre indicatif. Même si nous faisons le maximum pour que cette information soit exacte, nous ne pouvons pas à tout moment garantir la mise à jour des informations. En outre, ces renseignements peuvent être modifiés à tout moment.

Forex market xrp

I will write any content on forex trading xrp work

I will write any content on forex trading

Ripple price prediction 2019 xrp usd should I invest now ripple

Ripple price prediction 2019 xrp usd should i invest now ripple news

Ripple xrp 32 bitcoin etf apollo currency cryptocurrency

Ripple xrp 32 bitcoin etf apollo currency cryptocurrency market crash

Ripple xrp 2020 P! Rice prediction 25 xrp insidebitcoins com

Ripple xrp price prediction for 2020 25 xrp

Ripple wants A piece of the global payment system

Ripple wants a piece of the global payment system while it fights a cryptocurrency holy war

Forexmill fxcm increase crypto offering adds xrp! And bch cfds

Fxcm increase crypto offering adds xrp and bch cfds

One pay fx santander bank startet bezahldienst auf ripple basis

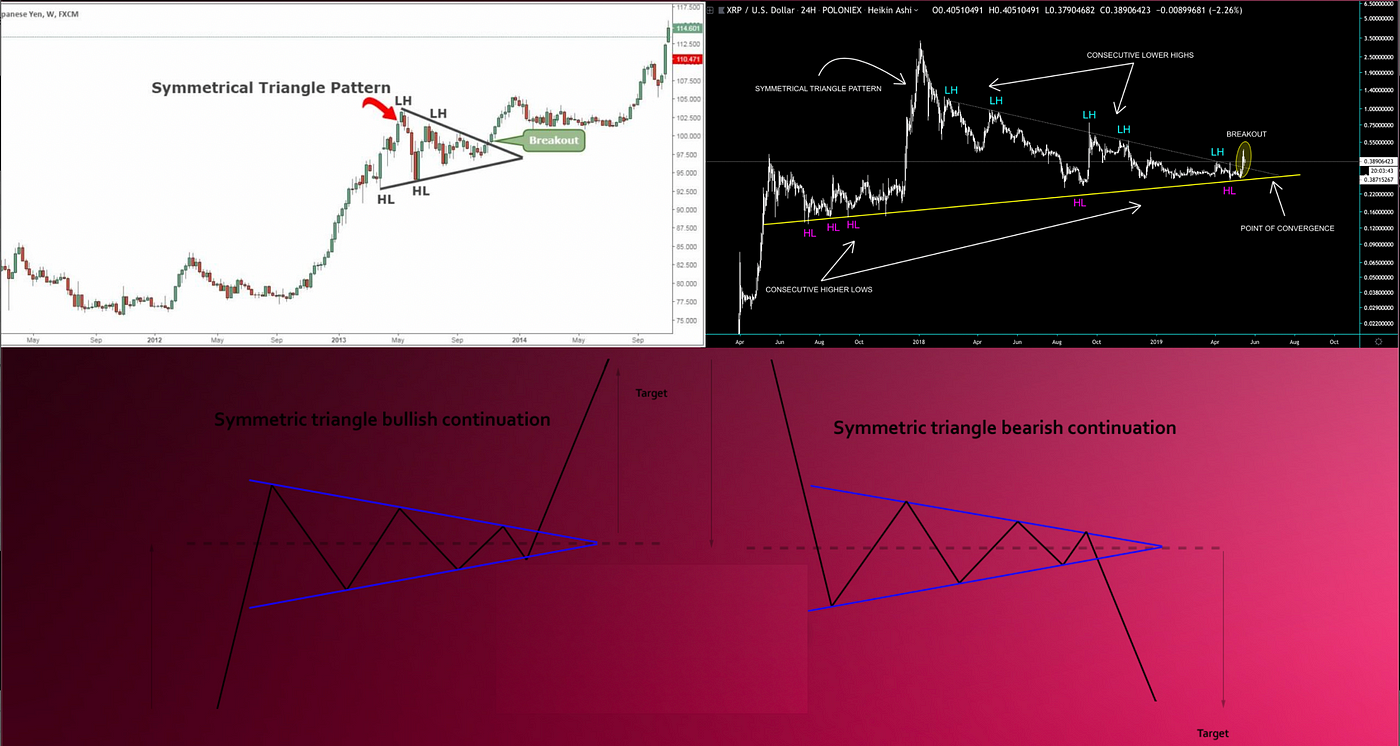

Major xrp breakout just days away cryptomaniac101 medium

From here we can see that we are in a symmetrical triangle with bullis! H continuation we have been consistently making lh lower highs within our pattern

Xrp xrp surged yesterday as sbi holdings tests xrapid in its fx

Ripple s arrival in the japanese foreign exchange market in the context of its strategic collaboration with sbi holdings is a documented achievement

Xrp adoption forex capital markets fxcm adds xrp support to its

Xrp gains new value with mainstream attention from market players

Ripple trading learn how to trade xrp like A pro avatrade

Xrp price crashes by 40 on beaxy exchange after coordinate! D sell off

Ripple xrp currency pairs home

These exact match com domains will enable new businesses to find your fx solutions internationally from profitable exotic countries with higher spreads

Ripple price news live xrp price prediction 2018 coinmarketcap

Part 2 ripple xrp the end game dread it run from it xrp still

In every scenario xrp seems to be something that is connecting everything together ripple and sbi holdings are connected through ripple s products

Xrp trading still bearish ripple may bounce up after test! Ing A

Forexcom symbols

Charts symbol changer mt4 indicator only work on meta trader 4. Forex and ticker symbols the page shows a list of forex and ticker symbols that are available to make trades on with our company.

Forex com im app store

Ibex 35 index icc.

Forexcom symbols. Forex trading learn the basics of trading foreign currencies forex read the latest currency market news at nasdaq. It is by far the largest market in the worl! D in terms of cash value traded and includes trading between large banks central banks currency speculators multinational corporations governments and other. Symbols guide forex format contributors the foreign exchange market or forex exists wherever one currency is traded for another.

Forex chart symbol selection wizard to display the forex chart for any available currency pair please choose a base currency from the list on the left then choose a quote currency from the select list on the right. To familiarize yourself with the precise table of the specifications please proceed to the trading instruments. This software not work on mobile phone just work on computer.

Website broker solutions widgets charting solutions brokerage integration. The graphic symbol in the first column will always be visible but the symbols in the other columns may or may not be available depending on which fonts are installed on your computer. House rul! Es moderators people chat stock screener forex screener crypto! Screener economic calendar pine script.

The full list of national currencies with their official names symbols circulation countries and letter codes. Charts symbol changer mt4 indicator free download tani forex metatrader 4 tutorial in hindi and urdu. Code2000 and arial unicode ms.

Each currency symbol is presented first as a graphic then in two unicode friendly fonts. Ibex 35 index ibc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands as revised with license number 25033.

Download a list of all companies on foreign exchange including symbol and name. This software best for beginners all pairs show on your charts.

Forex trading background concept with currency symbols

forex trading online fx markets currencies spot metals

forex trading online fx markets currencies spot metals

Forex com review forex broker news

Euro europe union symbol sign forex svg png icon free download

Banking and finance 2 by vectors market

Forex com review 2019 forexbrokers com

What are minor forex pairs forex source

Investing basics forex

metatrader 4 web trading platform mt4 platform metatrader for

metatrader 4 web trading platform mt4 platform metatrader for

The forex warrior podcast podtail

Forex com research forexresearch twitter

Starten sie mit dem forex trading bei admiral markets admiral markets

Forex trading 500 dollars

Give you over 500 articles on the stock market forex and currency trading

Lesson 5 section 1 how to make money trading forex

us dollar breakdown could coincide with major S P 500 volatility

us dollar breakdown could coincide with major S P 500 volatility

How to open A forex trading account in south africa

! Plus500 review 2019 pros and cons uncovered

Forextotal forex trading devisenhandel part 3

Trading options with 500 dollars

How to make money by instaforex trading guide make money online

Document of trading on the currency market forex stock image image

Leverage and forex trading best trading robot tiger X pro mt4 ea

Best forex brokers for large accounts

What does the fed decision mean for the dollar and S P 500

Wie sind mit banken im markt positioniert forex euro gold kurs los

74 forex trading ideas smart trading starts with right strategies

Bongo forex bongo fx dollar 200! Hadi 500 kwa wiki unajiingizia

Bearish bat pattern usd jpy folge dem echtzeit trading signal nr 160

so, let's see, what we have: calculateur trading - calcul taille position forex, lot et marge at forex trading 500 dollars

Contents of the article

- Free forex bonuses

- Calculateur trading et marge

- Forexcom symbols

- The best leverage to use when trading with a $500...

- Forexcom symbols

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Calculateur trading et marge

- Forex market xrp

- Forexcom symbols

- Forex trading 500 dollars

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.