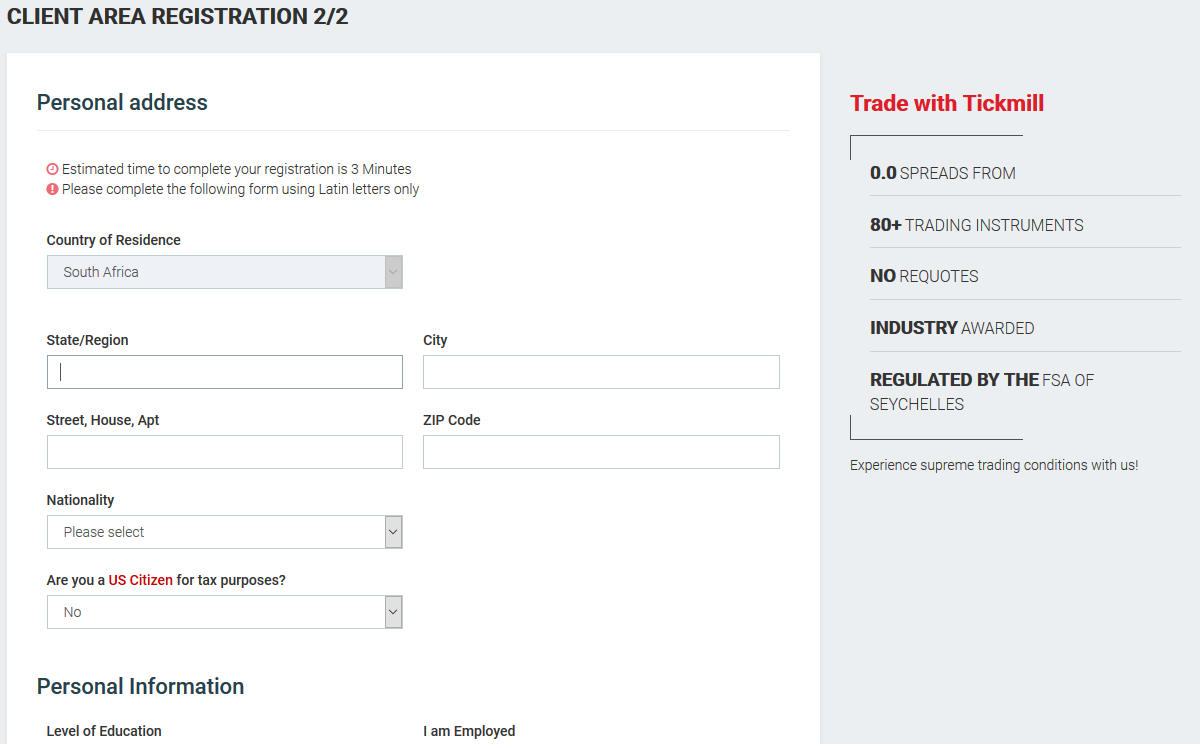

Tickmill client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only © 2015-2021 tickmill ™

Free forex bonuses

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Tickmill client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill client area

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to [email protected] and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

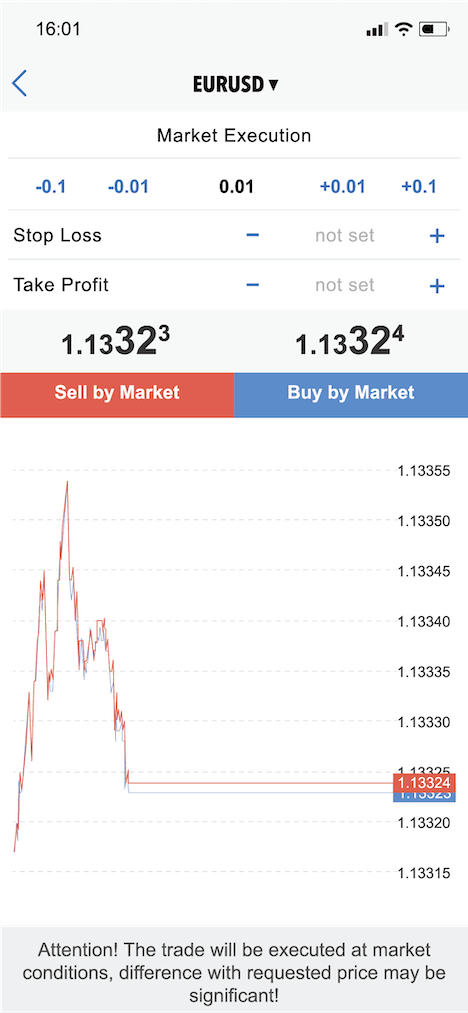

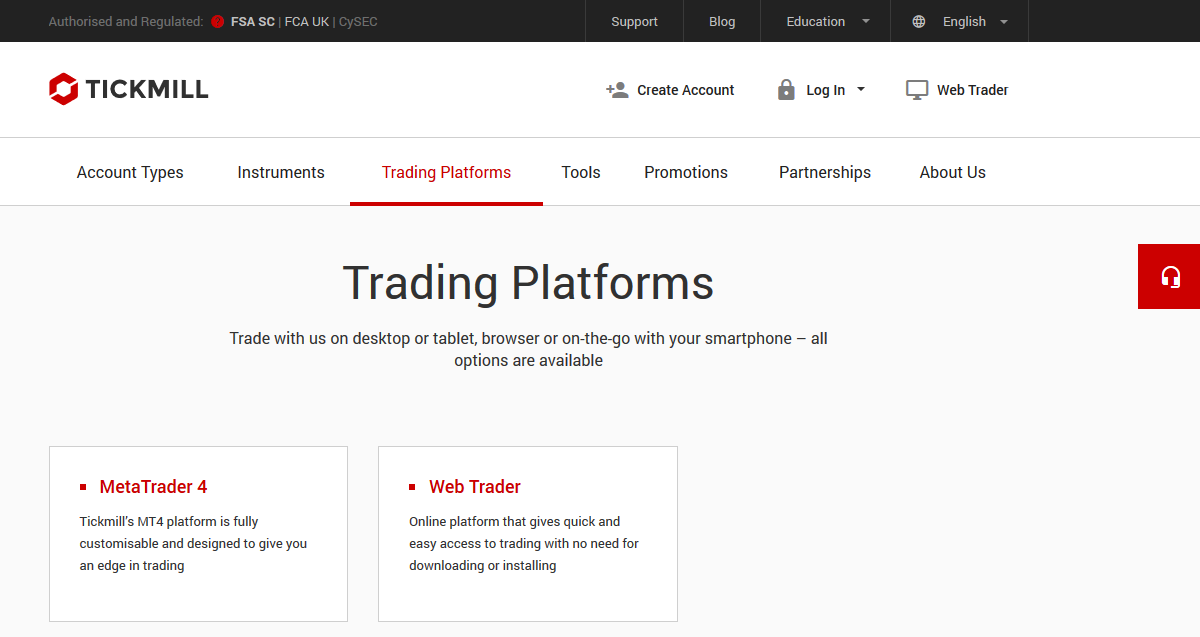

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

USDHUF trading chart

Choose another instrument

0.00000

0.00000

0.00000

Contract specifications

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill $30 no deposit bonus

Tickmill is giving away 30 USD for free to all new MT4 traders!

Experience one of the best trading environments in the industry risk-free with the $30 welcome account.

Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30 welcome account

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and conditions

Tickmill $30 welcome account

Tickmill offers free 30 USD to start trading forex online.

30 USD is available in the “welcome account” which each eligible client can open only one time.

No risks, costs or hidden commissions are involved to the promotion.

Here is how the promotion works for new investors.

- Open tickmill’s welcome account.

- Receive login credentials and login to the MT4 account.

- Start trading forex without risking your own funds.

- Withdraw profit (from $30 to $100) by meeting the criteria.

$30 welcome account is available for all new traders of tickmill!

Tickmill 30 USD no deposit bonus promotion

Here are the main information of tickmill’s $30 no deposit bonus promotion.

| Promotion type | no deposit bonus |

|---|---|

| cost for participation | zero |

| requirement | only account opening |

| trading platform | MT4 (metatrader4) |

| account type | pro |

| bonus withdrawal | not available |

| profit withdrawal | from $30 to $100 can be withdrawn |

Participating in the promotion and getting 30 USD in tickmill’s welcome account costs nothing.

All you need is internet connection and a desktop or mobile phone to trade forex online.

How to get tickmill’s $30 no deposit bonus?

To participate in the promotion and get 30 USD no deposit bonus from tickmill, follow the steps below.

1. Go to the promotion page

Go to tickmill official website and proceed to the main promotion page.

Then proceed to “FSA SC”, “promotions” and “$30 welcome account” as shown in the screenshot below.

2. Fill in the application form

Then fill in the application form available in the page.

3. Receive login credentials

Once your application has been approved, $30 welcome account will be created and login credentials will be sent to your registered email address.

4. Start trading in $30 welcome account

Download MT4 (metatrader4) or access to the web-based platform in tickmill official website.

You can also download mobile applications for android and ios devices.

When trading in $30 welcome account of tickmill, please note the following 4 important rules.

- Use of eas (expert advisers) is prohibited in $30 welcome account

- Arbitrage trading strategy is prohibited.

- The “arbitrage” trading strategy includes hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- $30 welcome account is available for trading for 90 days from the account opening date.

- Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

Fund withdrawal conditions of tickmill $30 welcome account

30 USD no deposit bonus amount itself cannot be withdrawn, but it is available only for trading purpose.

If you have made profits in $30 welcome account, you have an opportunity to transfer the profits to your other MT4 live accounts.

The available amount for profit transfer is from 30 USD to 100 USD.

The requirements for profit transfer are the followings:

- Registration to the client area

- Account verification

you must submit copies of ID and proof of address to complete your verification. - Live account opening

this can be done for free in tickmill’s client area. - $100 minimum deposit

After a deposit is made to a live MT4 account, the client should contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

After the transfer of profit is completed, you can use the amount for both trading and fund withdrawal as you want.

Faqs of tickmill $30 welcome account

Do you have any other questions to ask before participating?

Visit tickmill official website and contact multilingual support available for 24/5.

Tickmill $30 welcome account – terms and conditions

Here are the terms and conditions of the promotion “tickmill $30 welcome account”.

Make sure to read and understand the rules of the promotion before participating.

- The promotion is run by tickmill ltd licensed by FSA SC.

- Tickmill brand is owned and used by multiple companies. If your account is not registered with tickmill ltd, then you may not be able to participate in the promotion.

- The promotion is available for all new traders of tickmill ltd with restrictions of the following countries: algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- Investors residing in european union cannot participate in the promotion.

- Use of expert advisors (eas) in $30 welcome account is prohibited.

- The promotion is available only one time per person.

- $30 welcome account has the same trading conditions as pro account type. For more information about pro account type, please visit the page here.

- $30 welcome account is available for trading for 90 days from the date of account opening.

- $30 welcome account will be disabled after 90 days, but will be still accessible only for profit withdrawal for an additional 30 days.

- $30 welcome account has USD as the base currency.

- Once an eligible client register for the promotion, login credentials of his/her $30 welcome account will be sent to the registered email address.

- Registration and account opening of $30 welcome account does not give the eligible client access to the client portal.

- The profit amount you can transfer from $30 welcome account is limited from $30 to $100.

- Profit withdrawal from $30 welcome account can be done only one time.

- In order to withdraw profits from $30 welcome account, you must register your client profile with tickmill and deposit at least $100.

- Once profit is withdrawn from $30 welcome account, the account will be fully disabled.

- Any profits transferred to live MT4 trading accounts of tickmill can be withdrawn at anytime without limitation.

- You cannot make deposits to $30 welcome account.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

Tickmill review 2020

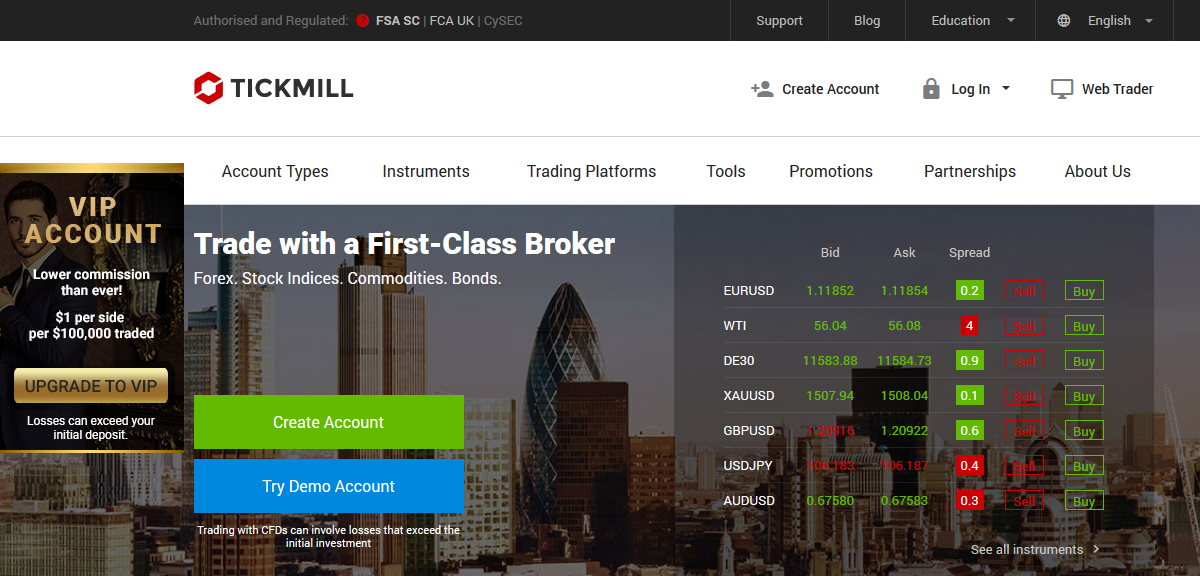

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

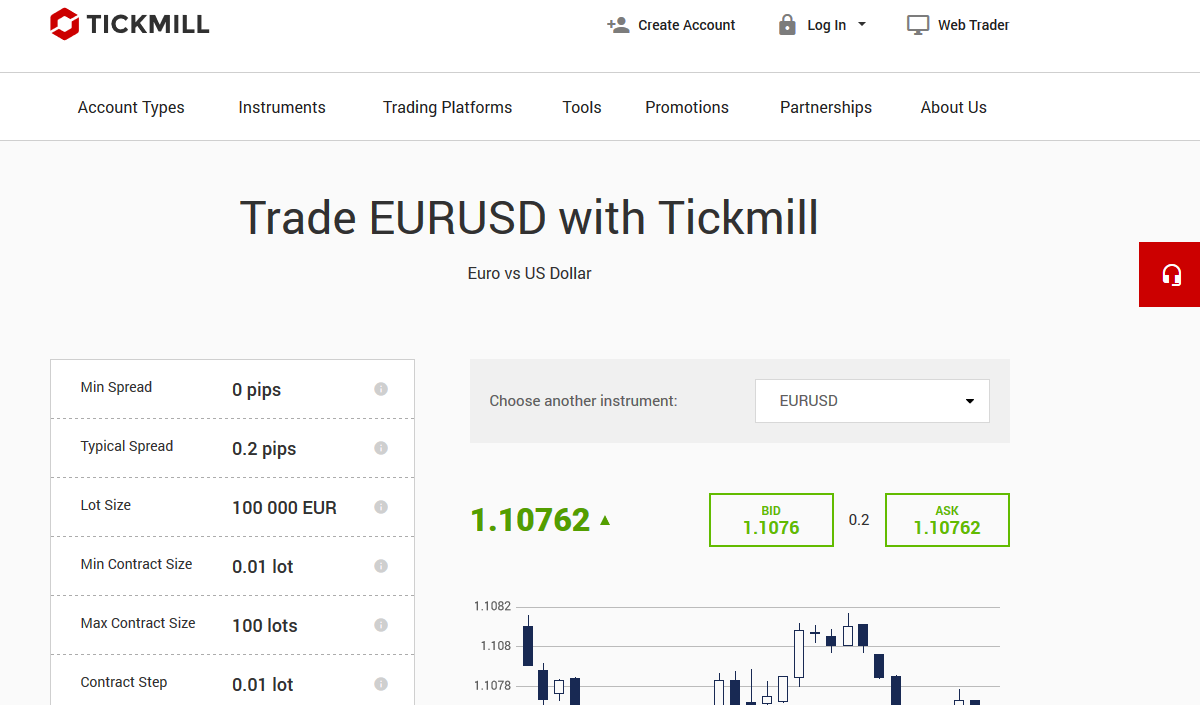

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

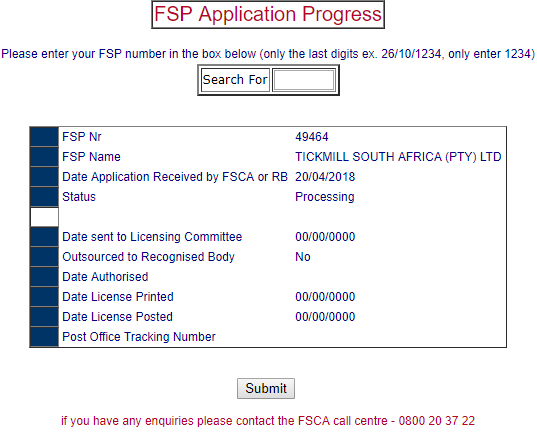

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

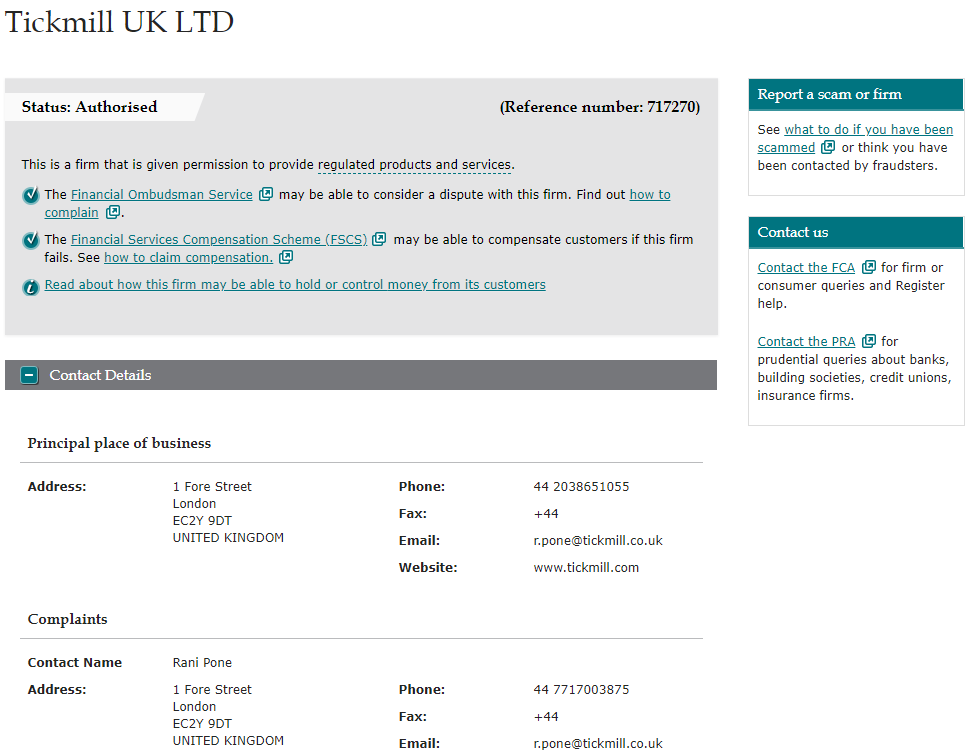

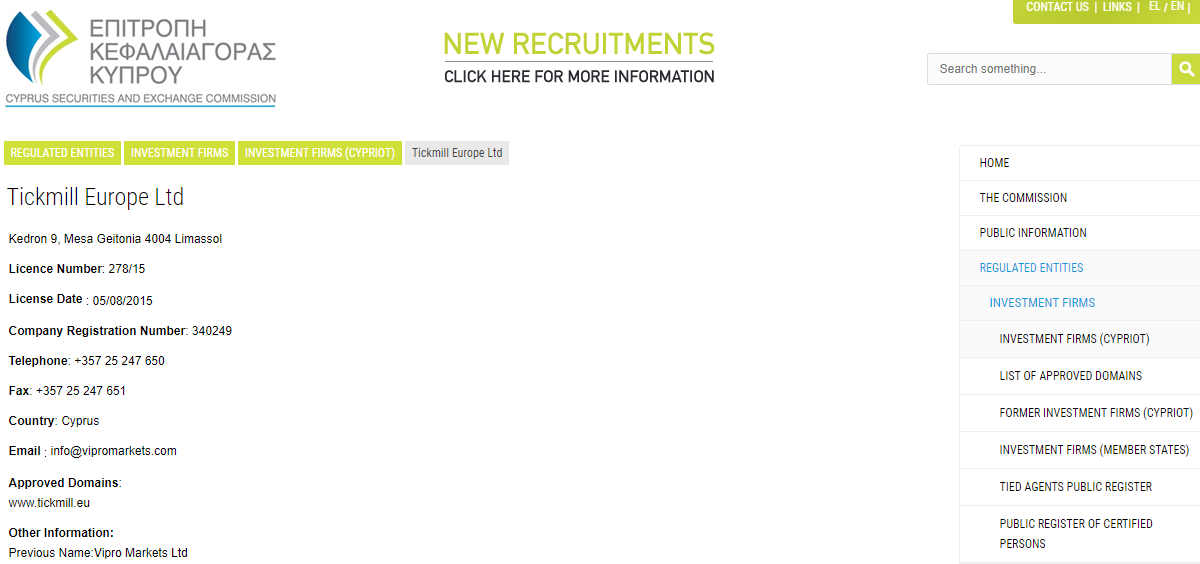

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

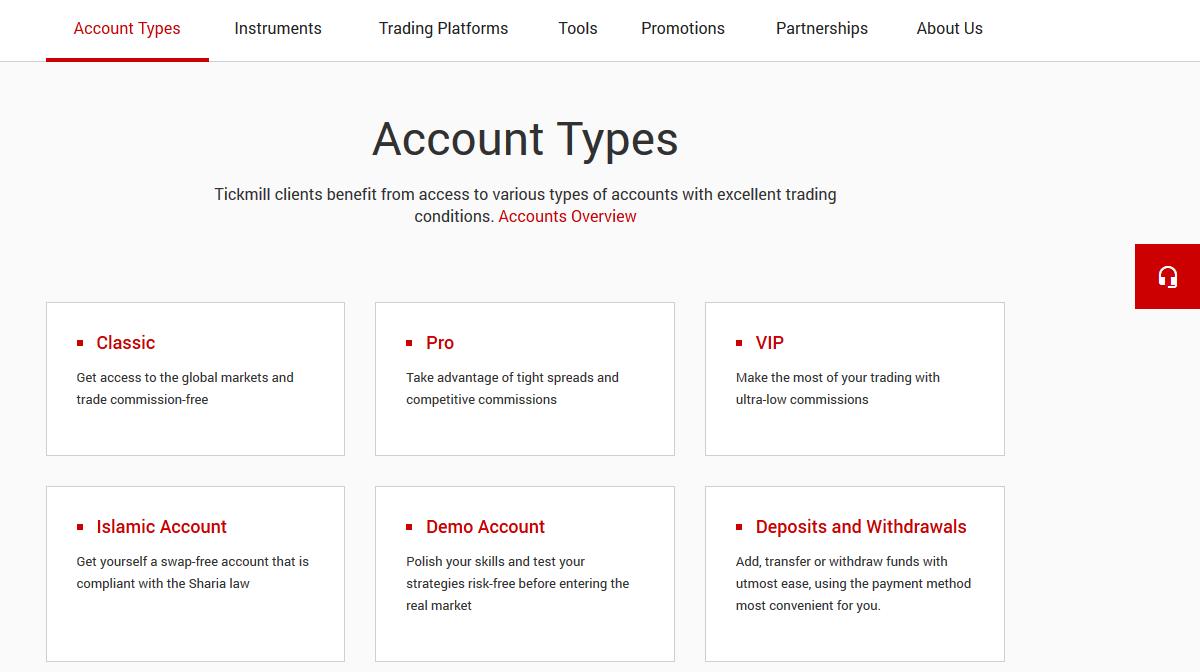

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

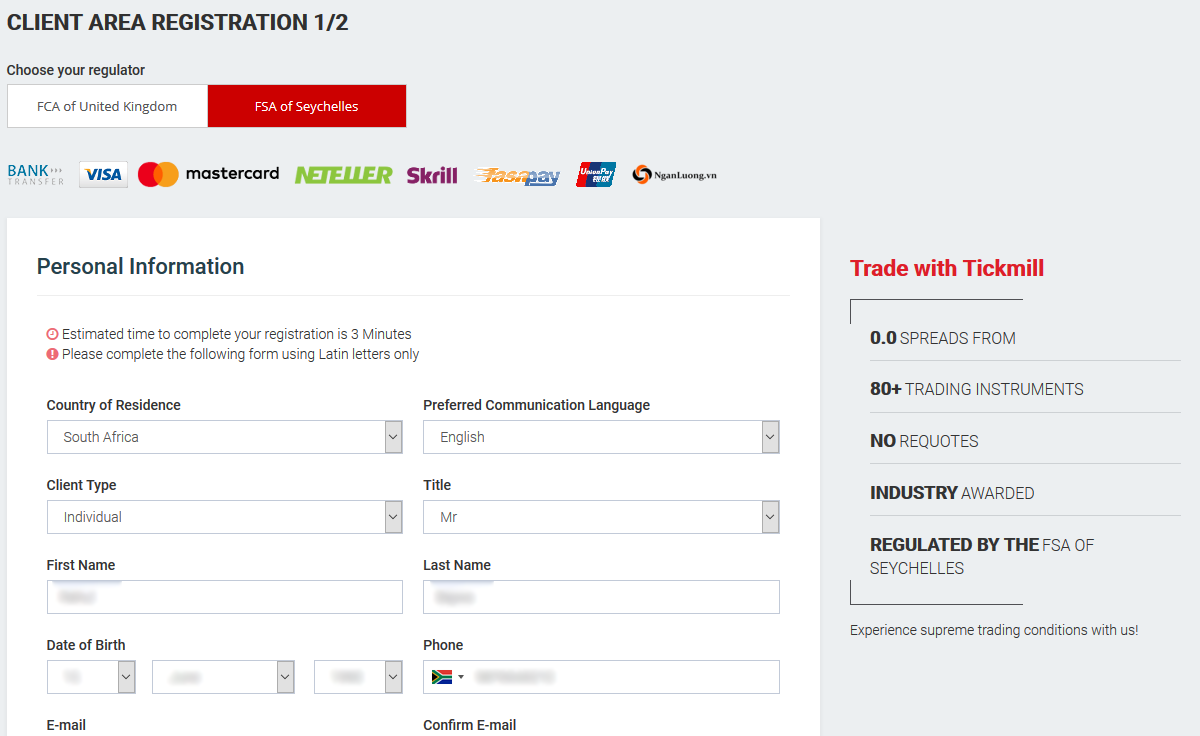

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

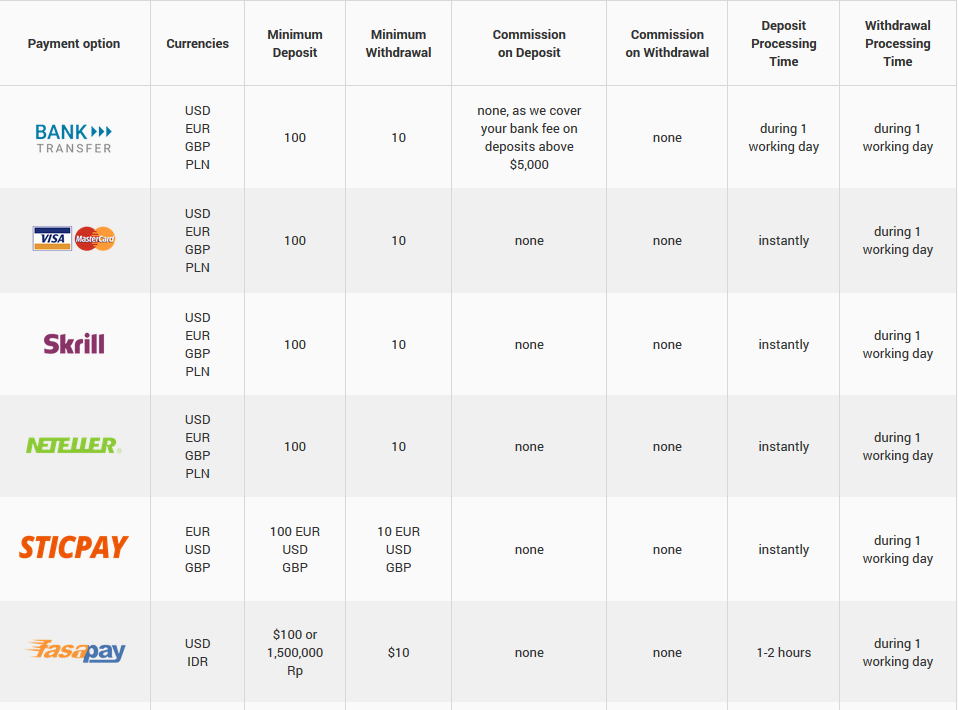

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

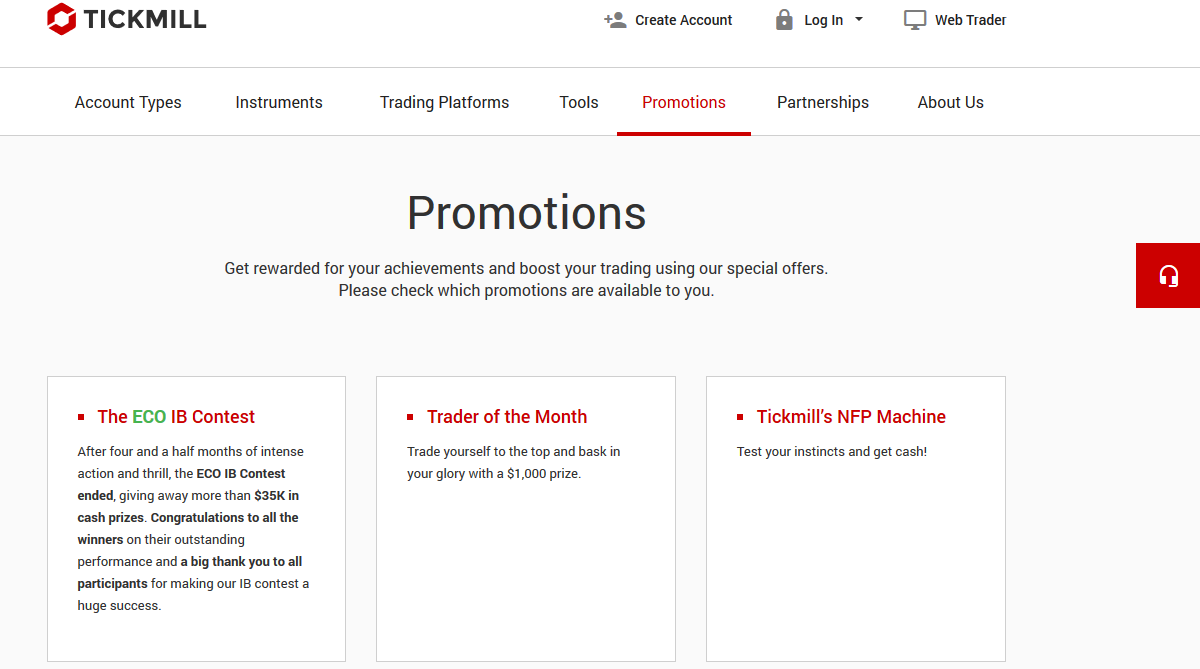

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

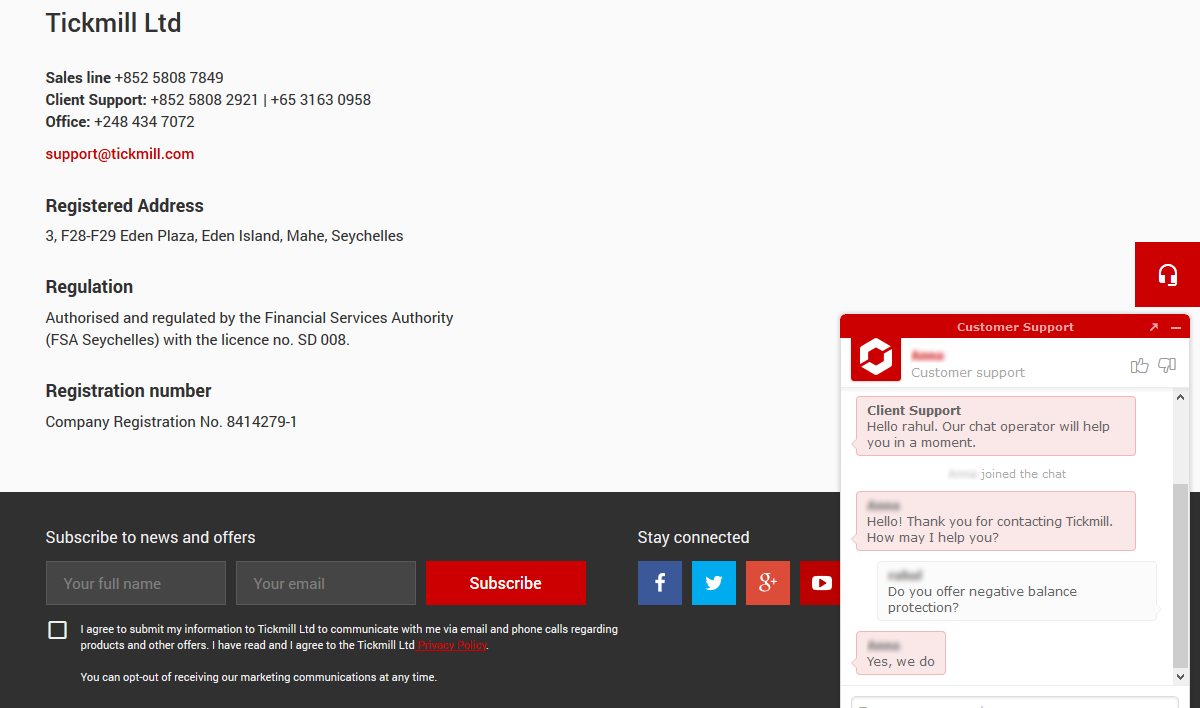

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

So, let's see, what we have: tickmill client area estimated time to complete your registration is 3 minutes please complete the following form using latin letters only © 2015-2021 tickmill ™ website terms & conditions at tickmill client area

Contents of the article

- Free forex bonuses

- Tickmill client area

- Tickmill client area

- Tickmill client area

- Tickmill client area

- Welcome account

- A special welcome to the world of...

- Your perfect start with...

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- USDHUF trading chart

- Contract specifications

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill $30 no deposit bonus

- Tickmill is giving away 30 USD for free to all...

- Promotion details

- Tickmill $30 welcome account

- Tickmill 30 USD no deposit bonus promotion

- How to get tickmill’s $30 no deposit bonus?

- 1. Go to the promotion page

- 2. Fill in the application form

- 3. Receive login credentials

- 4. Start trading in $30 welcome account

- Fund withdrawal conditions of tickmill $30...

- Faqs of tickmill $30 welcome account

- Tickmill $30 welcome account – terms and...

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.