Best forex broker for big accounts

The best forex brokers for large accounts are not easy to find.

Free forex bonuses

In order to trade forex or any other financial market, you have to use a broker. There is simply no way around it. Many retail brokers allow those with small amounts of money to open small accounts or micro accounts. There is no shortage of market makers who offer such retail trading terms. But when it comes to choosing the best forex brokers for large account, it is another proposition entirely. What makes it even scarier is how easy it is for the brokers who have all the presentations of being the brokers for large accounts to get exposed by some market events. 4) capitalization

alpari UK was regulated, offered an ECN/DMA platform for its large accountholders, and had a separate account type for traders with large accounts. So from all accounts, it was one of the best forex brokers for large accounts. But the company’s solvency was called to question when it was challenged with negative positions of its clients’ accounts during a massive slippage in mid-january 2015. This event exposed one major flaw: the company was not as capitalized as most people thought. Alpari UK was not the only brokerage challenged by the events of that week in january 2015, but the difference between it and other brokers that survived the SNB’s tsunami was that other firms were well capitalized and had better internal risk management controls.

Fxdailyreport.Com

The best forex brokers for large accounts are not easy to find. In order to trade forex or any other financial market, you have to use a broker. There is simply no way around it. Many retail brokers allow those with small amounts of money to open small accounts or micro accounts. There is no shortage of market makers who offer such retail trading terms. But when it comes to choosing the best forex brokers for large account, it is another proposition entirely. What makes it even scarier is how easy it is for the brokers who have all the presentations of being the brokers for large accounts to get exposed by some market events.

For instance, one of the brokerages that went insolvent following the SNB-fuelled events of january 15, 2015 actually had accounts types which served those who could afford to deposit more than $100,000 into a trading account. Not many can stand the shock of having to wait for administration and liquidation to get back such huge sums of money. So choosing the best forex broker for large account is not something to be taken lightly. We need to identify the characteristics of the trusted forex brokers for large accounts and look at the parameters that traders with large amounts of capital can use in picking the best.

Recommended forex brokers of 2021

| broker | min deposit | spread | leverage | regulation | open account |

|---|---|---|---|---|---|

| $5 | from 0.2 pips | 500:1 | FSA (saint vincent and the grenadines), cysec | visit broker | |

| $1 | from 0 pips | 3000:1 | cysec, IFSC | visit broker | |

| $5 | from 0 pips | 888:1 “*this leverage does not apply to all the entities of XM group.” | ASIC, cysec, IFSC belize | visit broker | |

| $1 | from 0 pips | 2000:1 | FCA UK, cysec, FSP, bafin, CRFIN | visit broker | |

| $100 | starting 0 pips | up to 400:1 | FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| $300 | floating, from 0 pips | 500:1 | FCA UK reference number 579202 | visit broker | |

| $200 | starting 0 pips | 500:1 | ASIC australia, FCA UK | visit broker | |

| no minimum deposit | 1.2 pips | 50:1 | CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| $10 | cysec | visit broker | |||

| $200 | from 3 pips | 400:1 | NFA, FCA, cysec | visit broker |

Parameters for choosing the best forex brokers for large accounts

It is important to understand that not many traders who trade on their own have access to a large amount of money that is considered disposable enough to trade with. So if you are such a trader, understand your status: you are qualified to play in the big leagues. Big league traders have advantages that other smaller traders do not have. You can get access to the best platforms, the best tools and the best services. Brokers will also be willing to give you plenty of add-ons and benefits. So you need to maximize this opportunity fully so you get full value for money.

1) account type

the best forex brokers for large accounts must have separate account types and trading conditions for this purpose. Usually, forex brokers in this category set aside benefits and bonuses for traders with large capital that other traders do not get. So why settle for less when your money can give you more?

2) regulation

if there was any other time forex traders had to be very careful about regulation, it is when they have to open large accounts. The best forex broker for large account must be regulated. You simply cannot commit hundreds of thousands of dollars to an unregulated bucket shop of a broker. It is just too risky. Regulation mandates forex brokers to maintain certain standards set out by regulators to provide transparency and safety of funds. If a forex broker claims that they are regulated, do not take their word for it. You must identify the headquarters of the broker claiming to be one of the trusted forex brokers for large accounts, then find out the regulator for the country where the broker’s HQ is domiciled. Next, go to the regulator’s website or put a call across to their regulatory department and find out directly if the broker in question is either regulated or in good standing. It does not stop there. You should also try to scour the internet for forums where traders who have used that broker before have given an account of their experiences. You will be surprised how little details that could save you hundreds of thousands of dollars or pounds will emerge from such due diligence checks.

3) platform type

trading conditions under forex brokers that work as market makers are not great for large account holders. The conditions are badly skewed against traders and plunging such huge funds into market maker platforms is an invitation to potential disaster. The platforms that suit holders of large accounts are direct market access (DMA) platforms, which provide direct interbank trading. What this means in plain language is that holders of large forex accounts can deal directly with the big banks and liquidity providers using ECN platforms. There is transparency and there are no funny price manipulations or requotes.

4) capitalization

alpari UK was regulated, offered an ECN/DMA platform for its large accountholders, and had a separate account type for traders with large accounts. So from all accounts, it was one of the best forex brokers for large accounts. But the company’s solvency was called to question when it was challenged with negative positions of its clients’ accounts during a massive slippage in mid-january 2015. This event exposed one major flaw: the company was not as capitalized as most people thought. Alpari UK was not the only brokerage challenged by the events of that week in january 2015, but the difference between it and other brokers that survived the SNB’s tsunami was that other firms were well capitalized and had better internal risk management controls.

Therefore, in addition to all that has been stated above, traders must be able to extend their due diligence checks to ascertain the financial state of the forex broker they want to open a large account with as well as what their risk mitigation strategies are.

5) account segregation

earlier in this article, a mention was made about some of the benefits that the best forex brokers for large accounts offer their clients. One of these benefits is the ability of traders to withdraw their money directly from a segregated account as if they were doing this on a checking account. This feature is not always available on the platforms of the best forex brokers with large accounts, but this is an added advantage if your broker offers this.

Conclusion

one question some traders may ask is this: what if I started small and ended up with a large account? A particular trader in africa grew his account from $3,000 to $75,000 in one year trading with a market maker. Not a small feat considering the conditions offered him. If you belong to the category of traders who are able to grow their money, you need to transit from a market maker to any of the best forex brokers for large accounts. This is the only way to guarantee that your funds do not outgrow the ability of your market maker to pay you as at when due.

Top 10 best forex brokers for big accounts 2021

Top rated:

Are you looking for the best forex broker for big accounts because you want to start making some serious trades?

First off, it is well-known that many brokers try to offer big accounts, in fact, they are very competitive on this point. In order to stay competitive, brokers often need to offer potential clients more than just a large account.

Some of the best forex brokers for large accounts have services dedicated to those who want to move large volumes or offer advantageous conditions for those who make large deposits, like VIP accounts or particularly favorable trading conditions.

The best forex brokers should also strive to impress you with other features too like their platform and number of instruments, and, most importantly, reflect the trading style you wish to emulate.

So, in this article, we’re going to look at forex brokers for large accounts that provide their clients with a truly reliable and trustworthy service.

Remember, don’t just look for a ‘big account’, look for a service with the benefits you want.

Top 10 of the best forex brokers for large accounts for 2021

1. Pepperstone

Pepperstone is a solid all-rounder when it comes to forex trading and is highly recommended by many. A lot of their success is down to their razor ECN account which benefits from some of the best technology on offer, flexible leverage and advanced algorithms. Professional clients are also able to reap a number of benefits with pepperstone too, such as leverage as high as 1:500 on certain instruments, meaning their funds can go further. In 2018, they were also rewarded ‘best forex ECN broker’ by the UK forex awards.

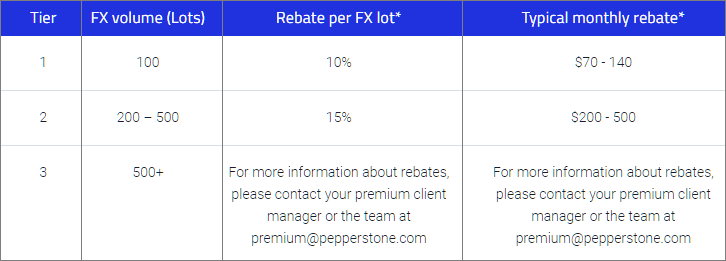

Alongside these accolades and benefits, trading at pepperstone brings a great experience with some of the fastest execution and lowest spreads around, starting from 0 pips. For those looking for big account trading, pepperstone offers VIP treatment through their active trader program. This means that once you make a significant deposit and trade at least 200 lots per month, you will be eligible for these VIP benefits. The program is highly regarded among big traders and can lower your trading cost as much as 15% along with rebates and other benefits.

Best forex broker for big accounts

The best forex brokers for large accounts 2021.

The best forex brokers for large accounts 2021.

You tend to see myriads of posts and articles related to the best brokers for small forex traders, but finding a good institutional forex broker for large accounts is equally as difficult as the former.

Since the average retail trader is starting up with small capital, finding good guidance is troublesome for bigger investors who need large account forex brokers. However, it is time to fix that issue right now.

When do you need large account forex brokers?

This is subjective, yet it is important to determine what we will use as a “large account” for the purpose of this article.

It can be considered as “large” any account funded with more than $10,000 USD .

Not only is this beyond the VIP account for many brokers, but it also grants you access to exceptional trade sizes when paired with leverage.

Additionally, large account forex brokers are a necessity if you plan on depositing this amount (or more) in a gradual way.

That is, a large account also occurs when your overall funding plan (in parts) meets or exceeds this sum.

The reason why this quantity requires a special forex broker is that the risk becomes greater than with accounts funded with $1,000 or less. You become much more paranoid as your funds increase.

With that in mind, anyone willing to invest $10,000 or more will also expect the best possible performance in the market, and that is a feature belonging to a handful of brokers.

What makes A good forex broker for large accounts?

There are not many traders who own such amounts of money for an initial investment, so you need to be aware of what that makes you; you must expect excellency from anything handling that money.

First, you need the ability to choose an account that can guarantee the best features and tools for the standard your investment demands.

Most forex brokers offer better add-ons as your initial deposit increases, so you should be able to take full advantage in the moment you open an account.

Since keeping that money safe is a priority, most large traders will opt for licensed institutional forex brokers.

We cannot judge you for preferring unregulated brokers as long as you know what you are doing, but regulated brokers are required to have measures for safeguarding your investment in case of an emergency. Keep yourself informed about any broker you choose.

Another important feature to look for is the platform they offer.

Market maker are unlikely to be good large account forex brokers due to how they compete against the trader, so it is much better to go with ECN or similar brokers that let you trade against the market and not the broker.

A large account makes you able to deal with large institutions, and you should!

Last but not least, account segregation can be a fundamental advantage and safety measure when it comes to broker features for large accounts. However, this can be a somewhat rare feature even among the best brokers, so it should not be prioritized.

Which are the best institutional forex brokers for large investors?

The following brokers fulfill—at least—most of the requirements listed above, so feel free to choose one among our favorites!

Top 3 forex brokers for large accounts

IC markets

IC markets was also founded in australia, making it regulated by the ASIC, and it has grown exponentially as time progresses, with many users today proving their effectiveness.

The broker offers a quantity of trading platforms to suit every trader, with MT4 and 5 as well as ctrader. Clients can trade over 60 forex pairs and several cfds, from metals to cryptocurrencies. Copy trading is also available with the famous zulutrade. All platforms include a mobile version.

Trading accounts are equal in pricing, for they differentiate by offering different commission and fees as well as which platform is accessed. The idea is not to divide users by initial deposit but by trading styles.

Lastly, customer service is efficient, with connection times not reaching a full minute (for phone users).

Fp markets

FP market is the second broker risen as an “opposition” to the popular market makers that spearheaded the CFD insertion in australia. The result is FP markets, the longest running DMA broker of the region, so that is another check for the list of requirements.

While they do not have their own platform, they offer MT4 and IRESS for their customers, with access to several global exchanges and trading instruments. Both platforms are also available ios, android, and mac—the last being a strong point in the forex market.

As for our search of institutional forex brokers for large accounts, FP markets has a minimum deposit of $1,000 for their professional account, with platinum and premier opening for $25,000 and $50,000 respectively.

Each account gradually offers less commissions and fees to the point where premier users pay virtually nothing.

The broker is regulated by the ASIC, with client funds stored in the national australian bank and dealt according to the nation’s financial standards.

Biggest forex brokers 2021 – best forex brokers for big accounts

As you know, biggest forex brokers or largest forex brokers are better is the service they provide, as they offer many advantages to traders, such as economies of scale, a better liquidity position and increased public and regulatory oversight.

Here is a list of the best biggest forex brokers or best largest forex brokers who offer services dedicated to those who wish to transfer large volumes or offer advantageous terms to those who make large deposits, such as vip accounts or particularly favourable trading conditions.

- Xm – best overall broker 2020, tight spreads

- Hotforex – best client funds security global, most reliable online trading platform 2019

- Exness – multiple account types and execution methods,

- Markets.Com – extensive in-platform research, mobile apps sync with web platform

- Easymarkets – well regulated broker

1. XM

XM is a global forex broker founded in 2008, this broker is regulated by the FCA in the united kingdom, ASIC in australia and cysec in cyprus.

XM offers a wide range of trading accounts and features and offers both the metatrader 4 and metatrader 5 trading platforms which are well-known trading platforms in the industry and, as such, they vary little in terms of presentation and functionality from one broker to another. XM offers more than 1000 currency pairs and also offers a wider range of trading assets, including forex, equity cfds, energy cfds, precious metals cfds, commodities cfds, equity indices and crypto currencies.

Xm offers its clients several MICRO, STANDARD, ZERO and ULTRA LOW trading accounts, with a minimum deposit of $5 for micro accounts with low spreads, flexible leverage with maximum levels in accordance with the regulations in force in each country where the broker operates, ultra-fast execution, and good customer support available by phone, fax, email or live chat.

Founded in: 2008

regulation cysec, FCA,ASIC,IFSC

min. Deposit $5

mini. Lot size: 0.01 lot

leverage: 1:888

platforms: metatrader 5, metatrader 4

payment options: bank wire, credit card, neteller, skrill, webmoney and more

2. Hotforex

hotforex is an international forex broker that offers its retail, corporate and white label clients access to interbank interest rates through an advanced automated trading platform. Fully licensed and regulated by cysec, FSB, FSC and other regulatory bodies.

The company offers a wide range of trading account types, tools that allow customers to trade cfds and currencies on the web. The minimum deposit to open a trading account with hotforex is $5, with tight pricing based on your trading account, a leverage of up to 1:1000 depending also on your trading account.

Hotforex offers as a trading platform metatrader 4 and metatrader 5 which is available through the software, mobile apps and hotforex also offers a web-based trading platform for those who like trading via the web.

As for customer support, the company has set up an excellent support centre combining professionalism and listening, accessible via several fixed lines, emails and a contact form.

Founded in: 2010

regulation FSCA, cysec, FSC, DFSA,

min. Deposit $5

mini. Lot size: 0.01 lot

leverage: 1:1000

platforms: metatrader 5, metatrader 4, hotforex FIX/API

payment options: bank wire, credit card, neteller, skrill, fasapay, webmoney, cashu and ukash.

Exness is a broker founded in 2008 and regulated by cysec and FCA. It has six additional registrations in different countries.

Exness offers clients more than 120 financial instruments to trade, including currencies, precious metals and crypto-currencies, forex to choose from.

Exness’ main mission is to offer all its clients the best possible service, as well as access to the latest trading technology. Exness offers two trading platforms metatrader 4 and metatrader 5, beginner traders will find here the opportunity to follow a quick training using demo and cent accounts, as well as with a minimum deposit and leverage of up to 1:2000 depending on your account and country. For professional late arrivals you will find here everything you need for currency trading with tight spreads, high speed order execution, a wide choice of trading instruments, the presence of ecn accounts, the possibility of using expert advisors and all trading strategies.

Founded in: 2008

regulation cysec

min. Deposit $1

mini. Lot size: 0.01 lot

leverage: 1:2000

platforms: metatrader 4, metatrader 5, webplatform

payment options: bank wire, credit card, neteller, skrill

4. Easy markets

easymarkets is a broker that has been offering trading services since 2003. The company is engaged in forex trading in nearly 150 countries. Easymarkets is regulated. This means that easymarkets are supervised by the cysec and asic regulatory authorities, whose conduct is controlled.

Easymarkets is a broker that offers several trading platforms including a web-based trading platform that allows you to trade from any computer, anywhere in the world. The metatrader 4 trading platform provides extensive support for technical traders, graphs, indicators and various other analysis tools. Tarderdesk offers a customized marketing error, which allows customers to create customized trading presentations.

Easymarkets offers a range of account options tailored to each operator. This included all commission-free transactions and fixed spreads, leverage of up to 1:300, allows you to trade multiple trading instruments such as more than 300 markets, including currencies, commodities, metals, vanilla options and indices, and customer support available in multiple languages 24/5.

Founded in: 2001

regulation cysec, ASIC

min. Deposit $100

mini. Lot size: 0.01 lot

leverage: 1:400

platforms: web trading, metatrader4, iphone app

payment options: bank wire, credit card, neteller, skrill, webmoney

5. Markets.Com

markets.Com is a broker that offers its clients the possibility to trade several trading instruments such as gold, equities, oil, commodities, equities, currencies and many others.

Markets.Com offers three types of classic, standard, or premium trading accounts, with a minimum deposit of $100 to open an account. As for trading platforms they offer a range of trading platforms to cover all possible trading needs. Metatraders 4 which is the most equipped, powerful and user-friendly platform among the heaviest on the scale, markets web trader is their own trading platform that is available on the web, and markets mobile trader covers another essential aspect of mobile online trading, you can also read about zero spread forex brokers.

Markets.Com does not charge any commissions or trading fees on its platform and the trading company provides traders with fixed spreads that are properly tightened and fully dependent on the market situation. Markets.Com also provides a default leverage of 1:50 on all departure positions. The maximum leverage is 1:300 depending on your country and trading accounts.

Founded in: 2006

regulation cysec, ASIC, FSCA

min. Deposit $100

mini. Lot size: 0.01 lot

leverage: 1:200

platforms: web trading, metatrader4, mobile app, markets webtrader

payment options: bank wire, credit card, neteller, skrill, paypal

Broker to trading

Best forex broker for big accounts

| online broker | premium account minimum deposit | online trading platforms | key features |

|---|---|---|---|

| city index | premium trader: £10,000+ |

Forex brokers for big accounts

Some traders may wish to trade with large account sizes. Brokers may cater to these traders by offering account type with special features for higher deposits. Traders who meet requirements related to assets, traded volume and experience in financial services may be classified as or may choose to apply to be an elective professional trader.

However, the brokers in the table offer retail trading accounts which have features for those who have larger accounts. Retail traders, while they are offered lower maximum leverage in the european economic area (EEA) than professional traders, have account protections such as negative balance protection and a stop out set at 50%, to protect the capital in the account, as well as a range of other protections.

ECN brokers may offer premium accounts with features for ECN traders, for example lower or even no commission charges. These premium accounts tend to have at least one feature in common, that they offer personalised service to the trader, for example with a dedicated account manager. The requirements may be related to volume traded (e.G. Lots traded per month), but account size and volume traded are closely related, as larger account sizes are needed to trade larger volumes.

As for which is the best forex broker for big accounts, it depends on a range of factors, such as the type of trading used by the trader, for example whether they want to use ECN services or not, or wish to trade a wider range of markets in addition to forex (as ECN brokers tend to be focused on forex, offer less markets and may not provide stocks cfds). The trader can use the online trading platforms other traders can use, but traders with larger account sizes may be eligible to access the broker's FIX API.

Best forex broker for big accounts

The caveats about picking a best broker being noted, it may be possible to point towards a possible pick, based on the requirements that it be a forex broker supporting big accounts. The pick would be pepperstone. This is partly because it provides a range of platforms supporting forex trading, indeed it began as a broker offering mostly forex pairs (but has since expanded its offering of markets), as well as supporting larger volume traders. Pepperstone offers platforms which are suited to forex trading and supports styles of forex trading such as scalping, news trading and automated trading (and even supports social and copy trading).

Forex scales to some extent relatively easily, as it is a huge liquid market meaning forex trading can be done on the small scale, for example micro lot trading, or on the larger scale as the trader increases the lot size and number of lots. Forex is a hard to trade, complex market no matter what the order size, though. Trading larger volumes requires a larger account size. Pepperstone's active trader program supports higher volume trading with features for traders who trader larger volumes, with cash rebates available T&cs apply, along with other additional support for forex traders, such as complimentary VPS hosting, T&cs apply.

Top 6 best brokers with true micro accounts for 2021

Top rated:

As a forex trader, undoubtedly you want to be dealing with the top forex brokers in the industry. Before you take a deep dive into big money trading though, you may want to explore your options in micro trading.

With choosing the best micro forex broker in mind, here we have listed six of the very best in the industry to select from.

These forex trading brokers will all allow you the chance to trade in micro-lots which are 0.01 of a standard lot. This is a great option if you are looking for an opportunity to trade within a lower risk area.

Although many brokers may claim to offer trading in micro-lots and even smaller in the case of nano lots, though only a few will offer dedicated micro-accounts. These are the micro trading brokers that we will list for your knowledge.

Table of contents

Forex micro vs standard account (micro lots)

Delving deeper into the trading experience to find out exactly what are micro-lots and micro-accounts and what can you as a forex trader get from them, we can see that micro lots allow you to trade for a minimal fraction of a standard lot. As mentioned above, a micro lot is 0.01 of a standard lot size. Which is often offered by forex standard accounts.

Taking this into account, where a standard lot on any of the forex currency pairs would cost $100,000 to trade with 1:1 leverage, a micro lot would cost $1,000 with the same leverage. These types of lots are pretty much offered by every forex broker nowadays. Then you have micro accounts.

Within a micro account for forex trading, you can often trade in smaller lots than even the micro lot, a nano lot, or 0.001 of a standard lot is typically available on these accounts. This would lower your real money trading cost to $10 per nano lot using the same calculation as above.

This low risk is only slightly more than you would experience with a forex demo account and is great for those looking to start out.

Let’s recap briefly the difference between a forex micro account and a forex standard account:

Forex standard accounts usually offer minimum trade sizes as low as 1 micro lot.

Forex micro accounts, on the other hand, offer minimum trade sizes as low as 1 nano lot.

If you are looking for a low risk, no minimum deposit broker, then look no further than our low no minimum deposit broker top 10.

Top 6 micro account forex brokers

Here are what we believe to be some of the best micro account forex brokers for you to choose from:

Best forex broker for big account

Best forex broker for big account

updated : 8 january 2021

The winner : pepperstone

Pepperstone active trader program

Pepperstone is an australian forex broker that offers active trader program

and considered safe, as it is regulated by top-tier financial authorities.

- Year founded : 2010

- Regulators : ASIC / FCA

- Minimum deposit: 200$

- Maximum leverage: 1:500

- US clients: no

- Funding methods: visa/mastercard, poli, bank transfer, paypal, neteller, skrill, unionpay

- Platform : MT4 / MT5 / social trading

Benefits of pepperstone active traders

1. Premium rebates

- Earn daily rebates.

- Rebate will depend on how many standard lots you trade each month.

- More trade = higher rebate

2. Priority client support

- Dedicated account manager for active trader.

- Premium client solutions.

- Guidance to help you achieve your trading goals.

3. High speed VPS hosting

- Complimentary VPS hosting solution to run EA (expert advisors)

- Take advantage of our low latency EDGE infrastructure.

4. Advanced insights and reports

- Exclusive insights from pepperstone’s market analysts.

- Daily autochartist signals

- Trade reporting you’d expect from an award-winning broker.

Best forex brokers for beginners in 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

The best forex brokers for beginners offer three essential benefits. The first, and most important, they are a regulated and trusted brand that offers a user-friendly web-based platform. Second, they provide a strong variety of educational resources. Third, they provide access to quality market research.

In our review of forex and CFD broker offerings, we spent endless hours opening demo accounts, navigating forex platforms, conducting market research, testing website usability, as well as watching educational videos and webinars.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65-82% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

What is forex trading?

Forex trading is the process of exchanging one currency for another, known as buying or selling currency pairs, based on prevailing exchange rates from the forex market. The forex market is the largest global market, with nearly $6.59 trillion in currency traded on average, per day.

What is a forex broker?

When it comes to trading foreign currency, you use a forex broker, also known as a currency trading broker, to place your trades. When you trade forex, you buy or sell in currency pairs, e.G. "EUR / USD" (euro / U.S. Dollar). You open an account, deposit funds, then use the broker's trading platform to buy and sell currency using margin. The forex markets are open 24 hours a day, five days a week.

To learn more about the basics of trading forex, we recommend the school of pipsology alongside the NFA's trading forex booklet.

The best forex brokers for beginners

Here's a summary of the best forex brokers for beginner forex traders.

- Plus500 - best for beginners overall

- IG - excellent education, most trusted

- Etoro - best trading platform for copy trading

- Avatrade - quality educational resources

- CMC markets - best web trading platform, excellent education

- XTB - best customer service, great education

- OANDA - quality research, user-friendly platform

Best for beginners overall

Plus500 is a trusted global brand that offers retail forex and CFD traders an easy-to-use platform and a thorough selection of tradeable instruments. While educational materials are limited, the plus500 web-based trading platform is extremely user-friendly, making it excellent for beginner forex and CFD traders. Disclosure: being good for beginners does not mean it is easier to make money. Trading is risky. (76.4% of retail investor accounts lose money) read full review

Excellent education, most trusted - visit site

Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products. This fantastic all-round experience makes IG the best overall broker in 2021. (75% of retail investor accounts lose money) read full review

Best trading platform for copy trading - visit site

Etoro is excellent for social copy trading and cryptocurrency trading, and is our top pick for both categories in 2021. Furthermore, etoro offers a user-friendly web platform and mobile app that is great for casual investors, including beginners. (75% of retail investor accounts lose money) read full review

Quality educational resources - visit site

Avatrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found avatrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. (73% of retail investor accounts lose money) read full review

Best web trading platform, excellent education

When it comes to education, CMC markets competes with the best in the industry by offering forex and CFD traders a diverse selection of education in a variety of formats, including written articles, video updates, podcasts, and live webinars. Education aside, the CMC markets next generation trading platform is fast, reliable, and comes packed with tools and features. (76% of retail investor accounts lose money) read full review

Best customer service, great education - visit site

As a trusted multi-asset broker, XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the xstation 5 trading platform. I was left impressed with XTB's education offering, thanks to its extensive written content and video materials. The only drawback is a lack of live webinars currently, although archived recordings are available. (82% of retail investor accounts lose money) read full review

Quality research, user-friendly platform

As a trusted global brand, OANDA provides forex and CFD traders a limited offering of FX pairs and cfds but stands out for its reputation and quality market research. OANDA's trading platform suite, fxtrade, is easy-to-use for new forex traders. OANDA provides a good balance of educational materials in both written and video formats, along with webinars conducted by its staff. (73.5% of retail investor accounts lose money) read full review

Educational materials comparison

Taken from our forex broker comparison tool, here's a comparison of the education features for the best forex brokers for beginners.

| Feature | plus500 | IG visit site | etoro visit site | avatrade visit site |

| has education - forex | no | yes | yes | yes |

| has education - cfds | no | yes | no | no |

| client webinars | no | yes | yes | yes |

| client webinars (archived) | no | yes | no | yes |

| videos - beginner trading videos | no | yes | yes | yes |

| videos - advanced trading videos | no | yes | yes | yes |

| investor dictionary (glossary) | no | yes | yes | yes |

How much money do you need to trade forex?

While some forex brokers do not require a minimum deposit to start trading forex, most do. Unless opening a demo account, which uses virtual money to practice, most forex brokers require a minimum deposit of between $100 - $250 to start trading.

What are the most popular currency pairs?

The seven most frequently traded currency pairs (also known as the “majors”) are EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD, and USD/CAD. Approximately 85% of all forex trades take place across these seven pairs.

Can you get rich by trading forex?

While some forex traders will be able to get rich trading forex, the vast majority will not. Forex trading is risky. Historically speaking, several hedge fund managers have been able to get rich trading forex. For example, george soros made over £1 billion in profit by short selling the sterling in 1992.

How do I start trading forex?

First, it is important to practice. Start by opening a demo account so you can get used to the trading platform and tools. Reading books is also important to learn how to conduct market research and perform technical analysis. Then, when ready, open an account, fund it, and start trading.

How do I choose a forex broker?

To select a forex broker, start by looking for brokers that are regulated in your country. Next, read full length forex reviews to assess the trading costs, tools, research capabilities, customer service, and other features of each forex broker. Finally, compare your top two choices side-by-side to decide on a winner.

Which forex brokers accept US or non-US clients?

Forex brokers who hold regulatory status in the US can accept US-based clients. Meanwhile, forex brokers who accept non-US clients will usually need to hold licenses in the countries where their clients reside.

For example, if you reside within the european union (EU), you will be able to open an account with an EU-regulated broker. In contrast, if you live in a US state, you will need to open an account with a US-regulated broker.

The best forex trading platforms for beginners

- Plus500 - webtrader

- IG - IG web platform

- Etoro - etoro copytrader

- Avatrade - avatrade webtrader

- CMC markets - next generation

- XTB - xstation 5

- OANDA - fxtrade

Read next

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

About the author: blain reinkensmeyer as head of research, blain reinkensmeyer has 18 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the new york times, forbes, and the chicago tribune, among others.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909).

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Best forex brokers – top 10 brokers 2021 in ukraine

How should you compare forex brokers, and find the best one for you? In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options – everything that makes a broker tick, and impacts your success as a trader.

The “best” forex broker will often be a matter of individual preference for the forex trader. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements.

But we can help you choose…

Below are a list of comparison factors, some will be more important to you than others but all are worth considering. Details on all these elements for each brand can be found in the individual reviews.

Forex brokers in ukraine

How to find the best forex broker

The main criteria for finding the best forex brokers in ukraine 2021 are these – we will expand on each area later on in the article:

- Trading conditions/fees – this is the most important part of your global forex broker appraisal. There is no way around that. One forex broker may charge you 10 times less for the same trade than another. Take note of “hidden” fees, such as withdrawals fees, or inactivity fees.

- Market coverage – you need to be able to trade the fx pair or product of your choice/preference.

- Accessibility and affordability – beginner forex traders and small-timers need love too. You should never be forced into making a minimum deposit that you cannot afford to lose. Minimum deposits range from $10 to $1000 (or the £ / € equivalent). It might be worth investing more for a platform that suits you better, so stay open minded.

- Trading platforms – the forex trading platform and the tools it features are your primary weapons in your personal war for profits. Pick the one that suits you best. Remember many platforms are configurable, so they can be tailored to suit you. Personal preference will play a large part here, as many trading platforms offer very similar services, but look and feel very different. Is a mobile platform your priority, or a desktop web trading platform?

- Mobile trading apps – being able to trade on the go may be important. Some mobile apps are superior to others. Ideally the mobile platform will function just as the web based version.

- Deposits and withdrawals – you have to move funds to and from the broker, quickly and preferably cheaply. The deposit/withdrawal methods supported by the forex broker determine whether or not you can accomplish that. Financing an account may also require a specific payment method.

- Reputation – people talk. It is well worth listening to what traders say about a forex broker they have already tried.

- Regulation – when push comes to shove, legal recourse is your first, last and only hope to settle the problems you might have with your forex broker. A proper regulatory framework is preventive in nature. It aims to keep such problems from popping up in the first place.

- Customer support – you need someone to talk to when you run into problems with your deposits, actual trading, or – god forbid – withdrawals. Competent support is a must. From opening an account, to help with the platform, customer support can be important.

- Company background and history – knowing the past exploits of your forex broker can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet for example. You want peace of mind that your trading funds are segregated, and held safely and securely.

- Education – it never hurts to improve your understanding of how the forex markets work and how you can make the most of the opportunities they present. Some brokers offer extensive educational tools.

- Account opening / registration – is it a simple process to open an account? Do clients need to be verified? These processes are not always the same and might be worth considering if opening a trading account has been problematic in the past.

Broker costs

The services that forex brokers provide are not free. You pay for them through spreads, commissions and rollover fees. Low trading fees are a huge draw.

The fee structures differ from one forex broker to another, and even from one account type to another. There are two widely used basic setups.

- The broker charges a spread only. All other fees – with the exception of the rollover rate – are included in the spread.

- Besides the spread, a commission is charged as well. This commission is based on the amount you trade.

Spreads

Of these two forex broker fee arrangements, the second one is arguably the more transparent. That said, the commission/spread combination may not be the cheaper choice in every instance.

The spread can be fixed or variable. Fixed spreads are always constant. ECN broker may even deliver zero spreads. Variable spreads change, depending on the traded asset, volatility and available liquidity.

A currency market and spread go hand in hand.

Daily spreads may only differ slightly among brokers, but active traders (or even hyper active traders) are trading so frequently that small differences can mount up and need to be calculated to compare trading costs.

The lowest spreads suit frequent traders.

Some brokers focus on fixed spreads. There are indeed 1 pip fixed spread forex brokers out there too.

Forex brokers with low spreads are certainly popular. Do take commission and rollover/swap into account as well with such brokers though.

What is the rollover rate?

Forex positions kept open overnight incur an extra fee. This fee results from the extension of the open position at the end of the day, without settling. The rollover rate results from the difference between the interest rates of the two currencies. The first of the pair is the base currency, while the second is the quote currency.

Forex pairs traded

While most forex brokers offer impressive-looking selections of currency pairs, not all of them cover minors and exotics. Does the broker offer the markets or currency pairs you want to trade?

If you are trading major pairs (see below), then all brokers will cater for you.

If you want to trade thai bahts or swedish krone as the base currencies you will need to double check the asset lists and tradable currencies.

Majors

The aussie dollar ans swiss franc, while considered ‘minor’ pairs, are often traded in high volume. You can read more about those here: aud/usd or usd/chf

That said, there are brokers out there that will truly go out of their way to cater to their traders’ needs. Some will even add international exotics and currency markets on request.

Such flexibility is obviously a major asset, positively impacting the overall quality of the service.

What about crypto?

Cryptocurrency pairs are quite ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are both popular.

The massive volatility associated with these products makes scalping a viable strategy for profitable trading.

Some traders are in the forex game specifically to trade the crypto volatility. Such operators obviously need a forex broker that features as many crypto pairs as possible.

Micro accounts

Not everyone trades forex on a massive scale. In fact, many forex traders are small-timers. Such forex clients appreciate forex brokers’ micro accounts, some of which have the US dollar as their base currency.

Some forex micro accounts do not even have a set minimum deposit requirement. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings.

Note however that the spreads/commissions on such micro accounts tend to be quite adverse.

It is however, a cheaper introduction to a complex market (similar to cfd accounts) – and trading for real beats a demo account for genuine experience learning how to trade.

Trading platforms

Forex trading platforms are more or less customisable trading environments for online trading.

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Some may include sentiment indicators or event calendars.

Metatrader 4 or 5

Integration with popular software packages like metatrader 4 or 5 (MT4 or MT5) might be crucial for some traders. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure.

Trading view

Tradingview is also a popular choice. Some forex brokers allow their traders to trade directly on the world’s top social trading network.

Proprietary solutions are often interesting, though in some cases less than optimal. For traders who base their strategies on the use of eas and VPS, a proprietary platform that does not support such features, is useless.

While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and eas.

Make sure you understand any and all restrictions in this regard, before you sign up.

If you want scalping, see if your broker is a forex broker for scalping.

For those who want to trade on the go, a mobile trading app is obviously important. While all forex brokers feature such apps these days, some mobile platforms are very simplistic.

They lack all the advanced analysis and market research features, and as such, are hardly useful.

Tools & features

From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience.

Again, the availability of these as a deciding factor on opening account will be down to the individual.

Level 2 (or level II) data is one such tool, where preference might be given to a brand delivering it.

Deposits and withdrawals

There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. Such disparities mostly result from the internal procedures observed by different brokers.

At one given broker, it can take as much as 5 times longer to fund an account than at another. The incurred costs differ quite a bit as well.

Otherwise, the payment process largely hinges on the accepted money transfer methods.

It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark.

Education

Some traders may rely on their broker to help learn to trade. From guides, to classes and webinars, educational resources vary from brand to brand.

A broker however, is not always the best source for impartial trading advice. Consider checking other sources too – such as our trading education page!

Payment methods

The most common methods are bank wire, VISA and mastercard. The majority brokers tend to accept skrill and neteller too.

Forex brokers with paypal are much rarer. The same goes for forex brokers accepting bitcoin.

We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency.

Proper forex brokers always provide a local-specific payment solution to their target countries.

Customer feedback

Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums.

You have to take this type of feedback with a grain of salt, to say the least.

First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased.

Secondly: not all of this feedback is factually correct. Furthermore, there is no way to actually fact-check/verify this data. Even sites like trustpilot are blighted with fake posts or scam messages. There is no quality control or verification of posts.

That said, it is still relevant. If there’s a forex broker about which no one has ever said anything good, chances are it might have issues. To the trained eye, genuine trader reviews are relatively easy to spot.

The utter lack of community feedback is red flag as well. People always have something to say about their forex broker or trading account. Therefore, something is definitely amiss if there is no information available in this regard.

Regulation

Regulation should be an important consideration if trading on the forex market. Whether the regulator is inside, or outside, of europe is going to have serious consequences on your trading.

ESMA (the european securities and markets authority) have imposed strict rules on forex firms regulated in europe. This includes the following regulators:

ESMA have jurisdiction over all regulators within the EEA

The rules include caps or limits on leverage, and varies on financial products. Forex leverage is capped at 1:30 (or x30). Outside of europe, leverage can reach 1:500 (x500).

Traders in europe can apply for professional status. This removes their regulatory protection, and allows brokers to offer higher levels of leverage (among other things).

Outside of europe, the largest regulators of trading accounts and brokers are:

These cover the bulk of countries outside europe. Forex brokers catering for india, hong kong, qatar etc are likely to have regulation in one of the above, rather than every country they support.

Some brands are regulated across the globe (one is even regulated in 5 continents). Some bodies issue licenses, and others have a register of legal firms.

So to reiterate, an ASIC forex broker can offer higher leverage to a trader in europe.

Offshore regulation – such as licensing provided by vanuatu, belize and other island nations – is not trust-inspiring. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections.

Regulators such as ESMA (european securities and markets authority) generally frown upon bonuses.

Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. Those same ESMA rules are also why some brands are duty bound to display warnings about CFD trading creating a “risk of losing all your money“.

Security

Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security.

Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed.

A worthy consideration. Some regulators will set a higher benchmark than others – and being registered is not the same as being regulated.

Account security also differs among brokers. Some may offer the additional layer of protection of 2FA (two-factor authentication) to ensure only you have access to the account.

Demo accounts

Try before you buy. Most credible brokers are willing to let you see their platforms risk free. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances.

Try as many as you need to before making a choice – and remember having multiple accounts is fine (even recommended).

FX leverage

For european forex traders this can have a big impact. Forex leverage is capped at 1:30 by the majority of brokers regulated in europe. Assets such as gold, oil or stocks are capped separately.

In australia however, traders can utilise leverage of 1:500. That makes a huge difference to deposit and margin requirements. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish.

Just note that higher leverage increases potential losses, just as it does potential profits.

Company history

A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers. It will also likely blacklist them.

This practice creates a sort of online trail, an operational history of sorts, highlighting the past sins of currently “reputable” forex brokers.

What’s interesting about this history is how little exposure it receives. You actually have to scour the archives of regulators to happen upon such relevant bits of information.

Bonus

From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Regulatory pressure has changed all that.

Bonuses are now few and far between. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice.

Also always check the terms and conditions and make sure they will not cause you to over-trade. Many have time limits or turnover requirements.

Additional account details

When comparing brokers, there are also other elements that may affect your decision. These will not affect all traders, but might be vital to some.

Order execution types

Once you click the “open trade” or “enter” button in your trading interface, you start a rather intricate process. Your broker uses a number of different methods to execute your trades.

Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Some brokers only support certain order execution methods. For instance, your broker may act as a market maker and not use an ECN for trade execution.

If you are looking for this method specifically, you will need to seek out an ECN forex broker.

Ecns are great for limit orders, as they match buy and sell orders automatically within the network.

Some other options that your forex broker can use are:

- Order to the floor. Mostly used for stocks. This execution type is handled manually, through actual trading floors/regional exchanges. It is therefore extremely slow.

- Order to third market maker. This execution type involves a third party, which is a market maker. This party is the one handling the order.

- Order to market maker. This method is essentially the same as the above one. The market maker handles trade execution. Some market makers pay brokers to send them orders. Thus, your order may not end up with the best market maker.

- Internalization. When using this method, the broker matches the order from its own inventory of assets. This execution method is therefore extremely fast.

Order execution is extremely important when it comes to choosing a forex broker. It also goes hand-in-hand with regulatory requirements.

Broker reporting

Both ESMA and the US’s SEC require brokers to report the quality of the execution their services provide. Regulators aim to make sure that traders get the best possible execution.

Mifid II sets clear guidelines in this regard. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

This may seem tedious, but it is the only way to head off fraud. The prices are compared to the public quotes. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do.

If it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

These examples yet again showcase the importance of a proper regulatory background.

Account types

From cash, margin or PAMM accounts, to bronze, silver, gold and VIP levels, account types can vary. The differences can be reflected in costs, reduced spreads, access to level II data, settlement or different leverage.

Micro accounts might provide lower trade size limits for example.

Retail and professional accounts will be treated very differently by both brokers and regulators for example. An ECN account will give you direct access to the forex contracts markets.

So research what you need, and compare it to what you are getting.

Scams

Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;

- Were you ‘cold called’? Reputable firms will not call you out of the blue (this includes emails, or facebook or instagram channels)

- Are they offering unrealistic profits? Just stop and consider for a minute – if they could make the money they are claiming, why are they cold calling or advertising on social media?

- Are they offering to trade on your behalf or use their own managed or automated trades? Do not give anyone else control of your money.

If you have any doubts, simply move on. There are plenty of legitimate, legal brokers.

With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you.

We have ranked brokers based on our own opinion and offered ratings in our tables, but only you can award ‘5 stars’ to your favourite!

Read who won the daytrading.Com ‘best forex broker 2021‘ on the awards page.

Difference between A broker and A market maker?

A broker is an intermediary. Its primary (and often only) goal is to bring together buyers and sellers. By matching orders, hopefully automatically, without human intervention (STP), a broker fulfils its task. For this service, it collects its due fees.

A market maker on the other hand, actively creates liquidity in the market. It always buys and it always sells, acting as a counterparty to traders. Should your forex broker act as a market maker, it will in effect trade against you.

The conflict of interest in this setup is obvious, but it does happen.

The bottom line

Hopefully, you now understand some of the methods we’ve used to create our forex brokers ranking list.

Picking the right broker is no easy task, but it is imperative that you get it right. While we can point you in the correct general direction, only you know your personal needs. Take them into account, together with our recommendations.

Forex broker reviews

Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Note that some of these forex brokers might not accept trading accounts being opened from your country.

If we can determine that a broker would not accept your location, it is marked in grey in the table.

So, let's see, what we have: fxdailyreport.Com the best forex brokers for large accounts are not easy to find. In order to trade forex or any other financial market, you have to use a broker. There is simply no way around at best forex broker for big accounts

Contents of the article

- Free forex bonuses

- Fxdailyreport.Com

- Recommended forex brokers of 2021

- Top 10 best forex brokers for big accounts 2021

- Top 10 of the best forex brokers for large...

- Best forex broker for big accounts

- When do you need large account forex...

- What makes A good forex broker for large...

- Which are the best institutional forex brokers...

- Top 3 forex brokers for large accounts

- Biggest forex brokers 2021 – best forex brokers...

- Broker to trading

- Best forex broker for big accounts

- Top 6 best brokers with true micro accounts for...

- Forex micro vs standard account (micro lots)

- Top 6 micro account forex brokers

- Best forex broker for big account

- The winner : pepperstone

- Best forex brokers for beginners in 2021

- What is forex trading?

- What is a forex broker?

- The best forex brokers for beginners

- Educational materials comparison

- How much money do you need to trade forex?

- What are the most popular currency pairs?

- Can you get rich by trading forex?

- How do I start trading forex?

- How do I choose a forex broker?

- Which forex brokers accept US or non-US clients?

- The best forex trading platforms for beginners

- Read next

- Methodology

- Forex risk disclaimer

- Best forex brokers – top 10 brokers 2021 in...

- Forex brokers in ukraine

- How to find the best forex broker

- Broker costs

- What is the rollover rate?

- Forex pairs traded

- Micro accounts

- Trading platforms

- Metatrader 4 or 5

- Tools & features

- Deposits and withdrawals

- Education

- Payment methods

- Customer feedback

- Regulation

- Security

- Demo accounts

- FX leverage

- Company history

- Bonus

- Broker costs

- Additional account details

- Scams

- Difference between A broker and A market maker?

- The bottom line

- Forex broker reviews

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.