Tickmill withdraw

You can make a deposit inside your client area using a funding option that suits you best.

Free forex bonuses

There are no fees on deposits. We process all withdrawal requests within one working day. The time necessary for the funds to reach your bank account depends on your bank’s policy. Bank withdrawals can take 3-7 working days to be seen on the client’s account. Credit/debit card withdrawals can take up to 8 working days to be seen on the client’s account.

Tickmill withdraw

We do not support broker to broker transfer, we only offer our standard payment methods.

How do I deposit funds to my account?

You can make a deposit inside your client area using a funding option that suits you best. There are no fees on deposits.

What is the minimum deposit?

The minimum deposit for all account types is $100. However, to get a VIP account, you have to reach a balance of minimum $50,000.

How do I withdraw funds from my account?

Log in to your client area and fill in the respective withdrawal form. There are no fees on withdrawals.

Do you have any charges on deposits and withdrawals?

Tickmill has a zero fees policy on deposits and withdrawals.

How fast do you process my withdrawals?

We process all withdrawal requests within one working day.

How long does it take for funds to reach my bank account?

We process all withdrawal requests within one working day. The time necessary for the funds to reach your bank account depends on your bank’s policy. Bank withdrawals can take 3-7 working days to be seen on the client’s account. Credit/debit card withdrawals can take up to 8 working days to be seen on the client’s account.

Can I withdraw via a different payment method from the one I used to deposit?

Tickmill’s policy is to process withdrawals via the same method that you used to deposit. For example, if you deposited using a credit card, the card will be credited with the amount equal to the deposit amount. Upon request, we can send any profits via other payment methods under your name.

Can I withdraw my money if I have an open position(s)?

Yes, you can. However, at the moment of withdrawal processing, your free margin must exceed the amount specified in the withdrawal instruction including all payment charges. Free margin is calculated as equity minus the necessary margin (which is required to maintain an open position).

If you do not have sufficient free margin on your trading account, we will not carry out the withdrawal request until you submit a corrected withdrawal form and/or close the open positions on your account.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

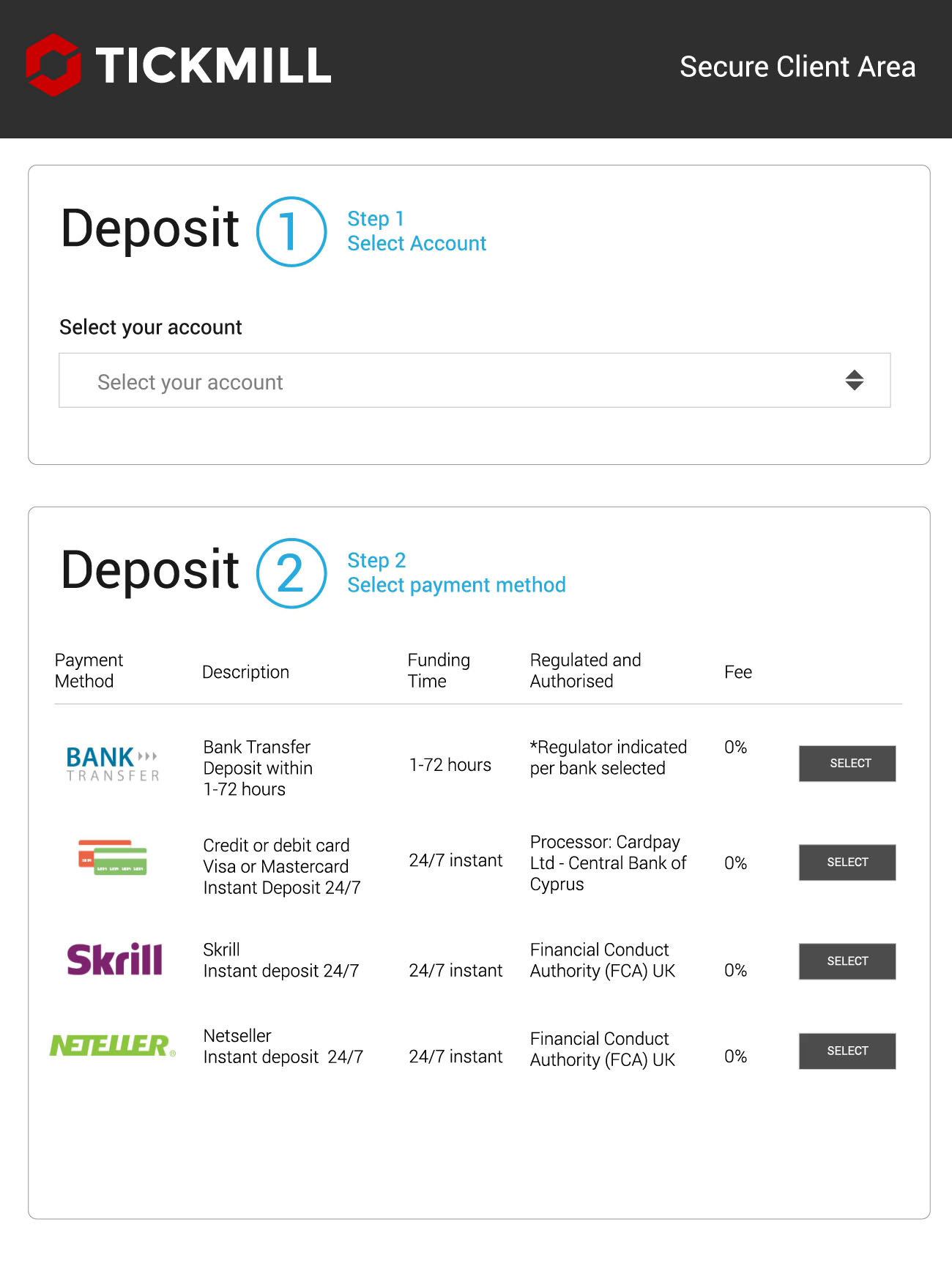

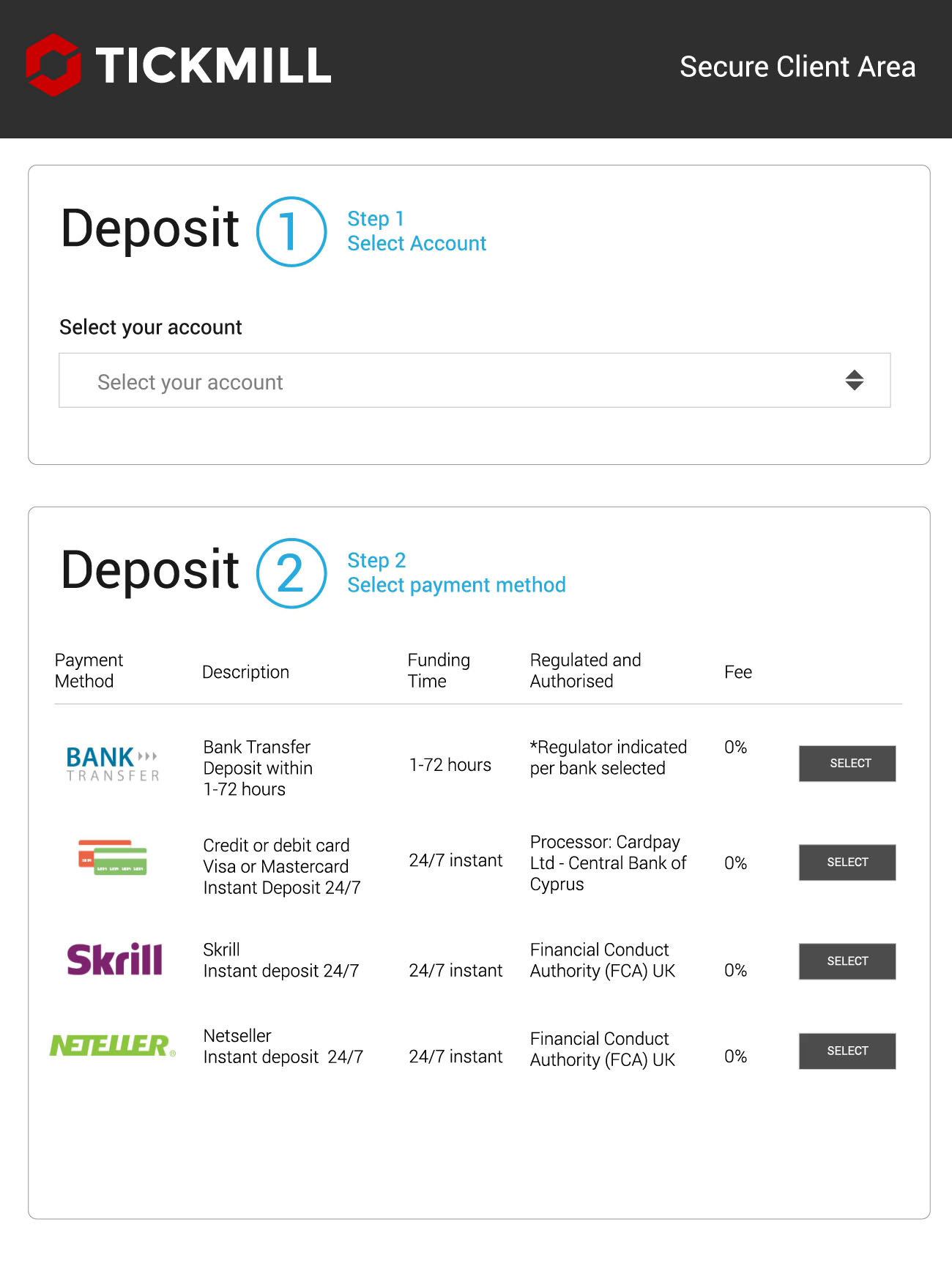

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

No deposit bonus, withdraw profits – tickmill

Make your perfect risk-free start with $30 forex no-deposit welcome bonus presented by tickmill. Feel the superior execution quality and the perfect trading environment with no-deposit bonus where no investment involves trading live forex. Besides, withdraw all profit earned traded by non-deposit welcome bonus, with a single condition given below. Each client can open only one account for this welcome no-deposit promotion.

€£$ TICKMILL 30 forex no-deposit welcome bonus

Joining link: get-bonus

Ending date: december 31, 2021

Offer is applicable: new traders with a live account

How to apply:

- Register a client account

- Make a live account under client profile

- Bonus is added after complete the registration.`

Cash out: only profits can be withdrawn as below

- Verify the profile by uploading the required documents.

- Trade 5 lots to withdraw all profits.

- At least a 100 deposit must be made to another live trading account.

Terms – tickmill NO deposit bonus

The bonus is not available for the client of algeria, armenia, australia, azerbaijan, belarus, bulgaria, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

Bonus need to claim within 14 business days from the date of registration.

This forex bonus is available to one per client.

Tickmill withdrawal bonus

When you want to be able to have a top-class experience regarding what is considered to be one of the most optimal trading platforms within the industry of trading that will be will an opportunity that is free of risk, this can become your reality when you get the thirty dollars welcome account that is offered by tickmill at no cost to you. It is absolutely free. However, it is to be noted that when you use the tickmill trading platform as a new trader, there is no provision of access to a tickmill withdrawal bonus.

IF you get a $30 free trading bonus from tickmill, no deposit bonus can be withdrawn. A trader can withdraw only the profit that he made without a bonus amount. You can easily transfer profit from $30 to $100. Money needs to be transferred from a welcome account to a new live account by email or chat support request.

To take advantage of the free offer, it is certainly understood that you must engage in the opening of an account with the tickmill trading platform. The good news is that this free welcome offer is provided as a terrific opportunity for all traders. Therefore, this means that there are no limitations placed on who may participate in this awesome free offer that surely prevents a great level of risk for those who would like to try their hand at trading on the tickmill platform.

Tickmill is rather generous by grating the starting point of thirty dollars for free to welcome new traders to the platform. Therefore, it is noted that the funds associated with this endeavor are provided in US dollars. This money will allow traders to commence engaging in the conducting of trades via the forex market, which is done online.

While this welcome package from the tickmill platform is highly alluring, it is to be noted that each person who wishes to try this package for the sake of conducting trades on forex via this platform with no risk involved can only open this type of account one time. This means that they cannot have access to more than one such free welcome account of thirty dollars in US funds with this trading platform.

The good news is that the truth is presented right at the onset that there are no risks to those who get the thirty-dollar welcome package from this platform for free. This means that there are no snares to trap you slyly, and unexpectedly that can sometimes happen with some platforms that may not demonstrate high integrity levels toward traders. There are no extra costs with this platform when you engage in using this type of welcome package. It is also nice to realize that there are no hidden commission costs that are tagged onto this type of welcome package offered via this trading platform.

When someone is coming to the platform as a new investor, the person will need to commence with a welcome account on the tickmill platform. Then the person will be granted credentials for the sake of being able to login into the designated MT4 account.

The person can then commence engaging in the conducting of trades on the forex market by using the provision of the free funds in USD without the need to engage in the risk of using his or her own finances. If the person is successful in making a positive profit via the conducting of trade, the person is thus permitted to make a withdrawal of the profit in the amount of thirty to one hundred US dollars in such cases that the new trader complies with meeting the essential criteria for this type of transaction on this trading platform.

Therefore, if this trading platform by tickmill that is offering this amazing promotion gains your interest and curiosity, you will likely want to then make your way over to the promotion page hosted on the official website of tickmill. Once you arrive at the site, you will want to find FSA SC, then promotions, and the $30 welcome account.

It will then be needful to fill out the application form provided directly on the page of the promotion for the welcome account. When your application has been granted approval by the tickmill trading platform, your welcome account will be formulated, and t. Details that will enable you to log onto the trading platform will be delivered to the email address that you provide. Do note that these credentials are deemed only as valid for the sake of being able to provide access to the welcome account and do not provide you with any leverage of access to the client area of this trading platform.

You will then be able to enjoy commencing in the conducting of trades with this welcome account. You will need to be sure to engage in downloading the MT4, which refers to the metatrader4. Or you may decide to engage in accessing the platform via the web directly through the official website of tickmill. Another plus is the fact that you can engage in downloading applications for mobile devices as well, such as for ios devices and android devices.

When you are making efforts to conduct trades via the usage of the welcome account provided by tickmill with the provision of thirty US dollars at no cost to you, it is important to realize that there are some things to keep in mind. It is forbidden for you to engage in expert advisors’ usage when you are using a welcome account. Also, it is not permitted for you to apply a strategy that entails arbitrage trading when you use this type of trading account. This means that you are not allowed to engage in the hedging of trading positions at an internal level, such as using other designated accounts that you may have tickmill is holding that. It is also forbidden to engage in the usage of other accounts that are under the holding power of other brokers for trading purposes. It is also strictly prohibited to apply the usage of failures that are noted in the quote flow for the sake of obtaining a guaranteed profit.

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN , USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | via alternative methods |

| currencies | EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | EUR , PLN , GBP , USD |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | during 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to [email protected] .

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

Forex & cfds

Futures

TRADING CONDITIONS

Forex & cfds

Futures

TRADING ACCOUNTS

Forex & cfds

Futures

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

ABOUT US

SUPPORT

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ. Authorised and regulated by the financial conduct authority. FCA register number: 717270.

Clients must be at least 18 years old to use the services of tickmill UK ltd.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading cfds or our other products and seek advice from an independent adviser if you have any doubts. Past performance is not indicative of future results. Please refer to the summary risk disclosure.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill withdraw

The bonus amount itself (30 USD of tickmill’s welcome account) cannot be withdrawn .

You can only withdraw profit from the ‘welcome account’ by meeting the following requirements.

Profit amount reaching 30 USD

The available profit withdrawal amount is from 30 – 100 USD.

The profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

Complete online registration & verification

Other than the welcome account, you also need to register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.).

Also, you need to provide the necessary identification documents required to validate the client area account;

Deposit at least 100 USD

Once you opened a live MT4 trading account inside the client area, you need to deposit a minimum of $100 (or equivalent in other currencies).

After a deposit is made to a live MT4 account, please contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

Restricted trading strategies on tickmill MT4 (welcome account)

While trading in tickmill’s 30 USD welcome account, you must make sure that you are not violating any of their T&C.

Here are 3 main restricted trading strategies on the welcome account.

- Use of expert advisors (eas)

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse

For more information or inquiries regarding to the promotion, please contact support team from tickmill official website.

Posted by FXBONUS.Info

Please check tickmill official website or contact the customer support with regard to the latest information and more accurate details.

Tickmill official website is here.

Please click "introduction of tickmill", if you want to know the details and the company information of tickmill.

Tickmill withdrawal bonus

When you want to be able to have a top-class experience regarding what is considered to be one of the most optimal trading platforms within the industry of trading that will be will an opportunity that is free of risk, this can become your reality when you get the thirty dollars welcome account that is offered by tickmill at no cost to you. It is absolutely free. However, it is to be noted that when you use the tickmill trading platform as a new trader, there is no provision of access to a tickmill withdrawal bonus.

IF you get a $30 free trading bonus from tickmill, no deposit bonus can be withdrawn. A trader can withdraw only the profit that he made without a bonus amount. You can easily transfer profit from $30 to $100. Money needs to be transferred from a welcome account to a new live account by email or chat support request.

To take advantage of the free offer, it is certainly understood that you must engage in the opening of an account with the tickmill trading platform. The good news is that this free welcome offer is provided as a terrific opportunity for all traders. Therefore, this means that there are no limitations placed on who may participate in this awesome free offer that surely prevents a great level of risk for those who would like to try their hand at trading on the tickmill platform.

Tickmill is rather generous by grating the starting point of thirty dollars for free to welcome new traders to the platform. Therefore, it is noted that the funds associated with this endeavor are provided in US dollars. This money will allow traders to commence engaging in the conducting of trades via the forex market, which is done online.

While this welcome package from the tickmill platform is highly alluring, it is to be noted that each person who wishes to try this package for the sake of conducting trades on forex via this platform with no risk involved can only open this type of account one time. This means that they cannot have access to more than one such free welcome account of thirty dollars in US funds with this trading platform.

The good news is that the truth is presented right at the onset that there are no risks to those who get the thirty-dollar welcome package from this platform for free. This means that there are no snares to trap you slyly, and unexpectedly that can sometimes happen with some platforms that may not demonstrate high integrity levels toward traders. There are no extra costs with this platform when you engage in using this type of welcome package. It is also nice to realize that there are no hidden commission costs that are tagged onto this type of welcome package offered via this trading platform.

When someone is coming to the platform as a new investor, the person will need to commence with a welcome account on the tickmill platform. Then the person will be granted credentials for the sake of being able to login into the designated MT4 account.

The person can then commence engaging in the conducting of trades on the forex market by using the provision of the free funds in USD without the need to engage in the risk of using his or her own finances. If the person is successful in making a positive profit via the conducting of trade, the person is thus permitted to make a withdrawal of the profit in the amount of thirty to one hundred US dollars in such cases that the new trader complies with meeting the essential criteria for this type of transaction on this trading platform.

Therefore, if this trading platform by tickmill that is offering this amazing promotion gains your interest and curiosity, you will likely want to then make your way over to the promotion page hosted on the official website of tickmill. Once you arrive at the site, you will want to find FSA SC, then promotions, and the $30 welcome account.

It will then be needful to fill out the application form provided directly on the page of the promotion for the welcome account. When your application has been granted approval by the tickmill trading platform, your welcome account will be formulated, and t. Details that will enable you to log onto the trading platform will be delivered to the email address that you provide. Do note that these credentials are deemed only as valid for the sake of being able to provide access to the welcome account and do not provide you with any leverage of access to the client area of this trading platform.

You will then be able to enjoy commencing in the conducting of trades with this welcome account. You will need to be sure to engage in downloading the MT4, which refers to the metatrader4. Or you may decide to engage in accessing the platform via the web directly through the official website of tickmill. Another plus is the fact that you can engage in downloading applications for mobile devices as well, such as for ios devices and android devices.

When you are making efforts to conduct trades via the usage of the welcome account provided by tickmill with the provision of thirty US dollars at no cost to you, it is important to realize that there are some things to keep in mind. It is forbidden for you to engage in expert advisors’ usage when you are using a welcome account. Also, it is not permitted for you to apply a strategy that entails arbitrage trading when you use this type of trading account. This means that you are not allowed to engage in the hedging of trading positions at an internal level, such as using other designated accounts that you may have tickmill is holding that. It is also forbidden to engage in the usage of other accounts that are under the holding power of other brokers for trading purposes. It is also strictly prohibited to apply the usage of failures that are noted in the quote flow for the sake of obtaining a guaranteed profit.

Cara withdrawal tickmill

Withdrawal tickmill | IB tickmill indonesia terbaik

Tickmill withdraw | rebate tickmill terbesar

Saat ini BFX rebate belum bisa melayani withdraw tickmill, bagi klien yang ingin melakukan withdrawal tickmill silahkan gunakan fasapay. Berikut langkah-langkah cara withdrawal tickmill menggunakan fasapay :

- Pastikan mempunyai akun fasapay baik .Co.Id maupun .Com

- Silahkan login di client area tickmill

- Silahkan isi form order withdraw tickmill seperti pada contoh gambar berikut :

Gambar 1 withdraw tickmill

Panduan

Tickmill

Rebate tickmill

Download platform trading

Partner broker BFX

- INSTAFOREX vip ib

- FIREWOODFX vip ib

- FXOPTIMAX vip ib

- FBS vip ib

- EXNESS vip ib

- FXTM vip ib

- SUPERFOREX vip ib

- FXPRO vip ib

- WELTRADE

- XM

- TICKMILL

- JUSTFOREX

- JUNO MARKET

- OCTAFX

Office

SKYLINE BUILDING 19TH floor, sakura suites

jl. M.H. Thamrin kav.9 jakarta 10340, indonesia

telepon : +62-21-3430.6161

faks : +62-21-390.5141

BFX rebate

List broker forex

Artikel forex

Rebate

Operational

Disclaimer : BFX rebate TIDAK menerima investasi dalam bentuk apapun dan tidak menjalin kerjasama dengan pengelola investasi manapun. Segala bentuk investasi yang mengatasnamakan BFX rebate bukan dari pihak BFX rebate. Berinvestasi di pasar forex melibatkan resiko yang tinggi, termasuk kehilangan dana secara total dan kerugian lainnya, dan tidak sesuai untuk semua investor. Klien harus memiliki pertimbangan yang baik tentang apakah berinvestasi di pasar forex cocok atau tidak, terkait dengan kondisi finansial, pengalaman investasi, toleransi resiko, dan faktor lainnya. BFX rebate tidak bertanggung jawab apabila suatu hari nanti terjadi kebangkrutan terhadap broker forex yang kami layani.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: check out our faqs to find answers to popular questions regarding trading conditions, accounts, trading platforms, deposits and withdrawals and more. At tickmill withdraw

Contents of the article

- Free forex bonuses

- Tickmill withdraw

- How do I deposit funds to my account?

- What is the minimum deposit?

- How do I withdraw funds from my account?

- Do you have any charges on deposits and...

- How fast do you process my withdrawals?

- How long does it take for funds to reach my bank...

- Can I withdraw via a different payment method...

- Can I withdraw my money if I have an open...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- No deposit bonus, withdraw profits – tickmill

- €£$ TICKMILL 30 forex no-deposit welcome bonus

- Tickmill withdrawal bonus

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- Forex & cfds

- Futures

- TRADING CONDITIONS

- Forex & cfds

- Futures

- TRADING ACCOUNTS

- Forex & cfds

- Futures

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill withdraw

- Restricted trading strategies on tickmill MT4...

- Posted by FXBONUS.Info

- Tickmill withdrawal bonus

- Cara withdrawal tickmill

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.