Online trading money

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning. Discover the FOREX.Com

pro service

Trade major US tech stocks this earnings season

Why are traders choosing FOREX.Com?

Global market leader

Connecting traders to the currency markets since 2001

Professional accounts

Discover the FOREX.Com

pro service

Innovative & award-winning

Our new mobile app offers one-swipe trading and lightning fast execution

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex trading platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader trading platforms" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Top stories

Watch for news over the weekend as to if the.

Central banks may not have as much patience as stock.

Find out the definition of a short squeeze, and how.

Ready to learn about forex?

/media/forex/images/global/homepage/newtrader.Svg" alt="new trader" />

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

/media/forex/images/global/homepage/createplan-latest.Svg" alt="new trader" />

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

/media/forex/images/global/homepage/strategies-latest.Svg" alt="have some experience" />

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

*based on active metatrader servers per broker, apr 2019. **based on CFD spreads and financing competitor comparison on 28/08/19.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Online stock trading 101: A beginner's guide

Learn the ropes if you're a newbie to online trading

Image by hilary allison © the balance 2020

It's important to educate yourself before you consider any type of investment or investment strategy. This beginner's guide to online stock trading will give you a starting point and walk you through the basics so you can feel confident in assessing your options, picking a brokerage, and placing a trade.

Choose an online broker

If you haven't already opened a brokerage account with a respected online stock brokerage, do it now. Take your time researching so you can feel confident you are choosing the best online stock broker for your situation. As you research, consider factors like whether there are trading commission fees (many brokerages offer free trading), how intuitive the app or website is, and any research or educational tools available for customers.

Choosing the best brokerage ultimately comes down to personal preference, and traders have a lot of options. Established giants like fidelity and charles schwab have channeled their decades of expertise into both online and app-based trading tools. There are also newcomers that specialize in perfecting the user experience of their apps, such as robinhood, webull, and sofi.

Research stocks to trade

Once you have a brokerage, you can buy stocks, but what stocks should you buy? If you're brand new to trading, the best place to start may not be with stocks, but with exchange-traded funds (etfs). Etfs allow investors to buy a bundle of stocks at once—which can help if you don't feel confident choosing one company over another. Etfs built to replicate major indices like the dow, nasdaq, and S&P 500 are good places to start to give your portfolio broad exposure to the U.S. Stock market. Many traders also diversify their holdings with assets other than stocks, such as bonds, as a way of hedging their risk during stock market downturns.

If you decide to invest in individual stocks, make sure to use some financial analysis ratios to compare a company's performance to its competitors. Successfully choosing individual stocks is difficult, but extensive comparative analysis can help ensure you're adding the best stocks to your portfolio.

Decide what kind of trade is right for you

When you want to buy (or sell) a stock, ETF, or any other traded asset, you have options for the type of trade order you want to place. The two most basic types are market orders and limit orders. Market orders execute immediately for the best price available at that moment. Limit orders won't necessarily execute right away, but they give you greater control over the price you pay (or receive, when selling). Once you own a stock, you might consider placing a trailing stop loss sell order, which allows you to continue riding positive momentum and automatically sell when the trade starts to turn on you.

No order type is necessarily better than another. They all have their place, and by learning as many of them as possible, you ensure you're using the right tool for your scenario.

Know what it'll cost you to trade stocks

One of the biggest enemies of successful stock trading is expenses. They represent money you pay just to own or trade securities. One type of expense is a commission fee, which you should consider while shopping around for brokerages.

If you're buying individual stocks through a brokerage that doesn't charge commission fees, you might not incur any expenses. However, when you start trading etfs, mutual funds, and other types of investments, then you need to understand expense ratios. These funds are managed by a person who is paid a percentage of the fund's assets every year. So, if an ETF has an expense ratio of 0.1%, that means that you will pay $0.10 per year in expenses for every $100 you invest in the ETF.

Aside from expenses, you also need to consider your risk tolerance. A common risk assessment method involves considering a hypothetical scenario in which your investments suddenly lose 50% of their value. Would you buy more after the crash, do nothing, or sell? If you would buy more, you have an aggressive risk tolerance, and you can afford to take more risks. If you would sell, you have a conservative risk tolerance, and you should seek out relatively safe investments.

Understanding how you would emotionally react to losses is one thing, and understanding how much you can lose without sacrificing financial stability is another. You may have an aggressive risk tolerance, but if you don't have an emergency fund to fall back on in case of sudden job loss, then you shouldn't use your limited funds to invest in risky stocks.

Understand how trading stocks affects your tax bill

Along with expenses, it's important to understand the tax rules for each of your positions, especially if you're going to actively trade stocks. The taxes you pay on stock profits are known as capital gains taxes. In general, you pay more capital gains taxes when you hold a stock for less than a year, and you pay less when you hold a stock for more than a year. This tax structure is designed to encourage long-term investing.

While selling stocks for a profit will increase your tax bill, selling stocks for a loss will decrease your tax bill. To prevent people from taking advantage of these tax benefits, there's something known as the "wash sale rule." essentially, this rule delays the tax implications of any profits or losses if you re-enter the same position within 30 days. in other words, if you sell a stock for a loss, and then buy the same stock a week later, your loss will no longer give you tax benefits—it's carried over into your new position. The loss will be accounted for once you sell the stock again.

If minimizing your tax bill is a primary concern, consider investing in a retirement account like a roth IRA or 401(k) plan instead of using a standard brokerage account.

Compare online trading platform

These companies could help you grow the value of your portfolio with an online trading account. Compare online trading platforms that can make it cheaper and easier for you to trade.

Your investments are not guaranteed; they can decrease in value as well as increase and you may not get back

the full amount you put in.

Show me affiliated products first

Free forex bonuses

The listings above are affiliated with us

- Most popular

- Share dealing

- Online trading

- Execution only

- More from share dealing

- Certificated

- Share dealing guides

- Who we compare

What is online stock trading?

Online stock trading is the process of buying and selling company shares over the internet. It's sometimes called share dealing.

A 'share' is a unit of ownership in a particular company.

Share dealing allows you to buy stock in companies like apple, facebook or google.

How do you start stock trading?

If you're interested in online trading, you'll need to open a stock trading or share dealing account online. Then you can add money to it and start to buy shares online and sell them as a way of making money.

You do this by using a stock trading platform. A trading platform is software that you use to conduct your trading. This includes opening, closing, and managing market positions through a financial intermediary such as an online broker.

How can an online stock broker help?

Online stock brokers act as a middlemen between you and the stock market.

There are three different types of stock brokers:

Advisory brokers: these are brokers who suggest the shares you should buy.

Execution only brokers: these brokers only make the trades you instruct them to.

Discretionary brokers: these brokers act on your behalf buying and selling shares at their own discretion to earn you the most profit.

How to find the best trading platform

Different stock trading platforms offer varying features and fee structures. So when looking for the best trading platform, UK residents should think about these factors:

Fees: all online market trading platforms, UK wide, charge you a fee for each transaction you make. This is the case whether you want to buy shares online or sell them. If you're doing a larger trade, the fee might be calculated as a percentage of the transaction. Some providers also charge an ongoing annual or monthly fee on top of this. The best platforms usually have more fancy features, which will cost you more.

Ease of use: online stock trading can be complex. Often you'll need to respond quickly to market changes. So look for a share dealing platform that lets you make fast, accurate, hassle-free trades.

Access to data and research: the best online trading platform for your needs will give real-time market updates. Others give dynamic or delayed market updates. And sometimes, a share dealing platform will give you research and broker analysis on individual stocks. This information can be helpful to make decisions about which shares to buy.

Trade options: look at what options are available for you to buy shares or sell them. Can you buy or sell shares at a set price? Are stop loss orders an option? This will help reduce your risk.

Margin loans: some people borrow money to help build their investment portfolio. If you want to do this, check to see if your share dealing platform or online broker offers margin loans.

Security: how secure is the platform? The best trading platform will make sure your funds are safe.

Stock trading platforms can come in the form of desktop software, web-based platforms, or even smartphone apps.

What is a stop-loss order?

A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. The purpose of a stop-loss order is to limit losses. For example, if the stop loss order is set to 5% below the price you bought the shares, the broker will sell the shares if the price of the stock falls by 5%.

Choosing the best stock trading app

There are a few online trading apps you might want to try before you commit. Each has different features and designs.

It's hard to say which is the best online trading platform, UK wide. But when you're choosing you should think about factors such as share selection, design and extra features.

The best stock trading app should offer you a wide variety of stocks to trade. If it has a limited share selection, and the shares you want to buy aren't on the app, you could miss out on important money-making opportunities.

The design of an online trading app should make it easy to use. It's important that you can find all the features and tools you need quickly.

Some stock trading apps offer extra features, like demo accounts and stop loss functions.

When you're trying to choose the best online stock broker, you should look at what they offer in these areas.

What is the best trading platform?

The best share dealing platform for you is the one that suits your financial needs and your investing strategy.

Some well-known and reputed online market trading platforms include:

Earn with online trading

How to earn with online trading?

Successful dealers know the ins and outs of a market and double the amount of the money they earn with online trading.

With the easy accessibility of the internet, online stock markets are one of the means that can help you earn money. Keep reading to know how to be successful in online stock markets.

Let us go first over some terms that will help you understand how online stock markets work. Next, we will discuss the tools that you need to start trading in the online stock market.

Let us start with the terms’ definitions.

What is stock?

A stock, also called a share, represents a claim on a company’s assets and earnings. A company divides its assets into a certain number of shares. These shares are then made available for the public to buy and sell.

The company’s capital, revenues and other factors determine the price per stock. As the company becomes more successful, its stock’s price increases.

Since the stock’s price increased, the generated revenues increase and shareholders gain money according to EPS, earnings per share.

What is stock market?

A stock market is a network of buyers and sellers of companies’ shares. Companies gain capital when investors buy a part of the ownership of the company, a stock.

Who is broker?

A broker is the communication link between companies and investors. A broker is the person that buys and sells assets for others.

They help people to exchange stocks in the stock market in return for a commission rate or fee. Usually, brokerage firms provide their customers with a trading software.

What is trading software?

A trading software portrays the stock market online. Regularly, the software updates the investors with the latest changes and prices. It demonstrates a live action of the market on the internet.

Some well-known trading software are metastock and esignal.

So, how do you start investing in a stock market? You need to have these six things.

Strong trading & stock market background

“knowledge is power” – francis bacon

Expand your knowledge in this field. Learn the ropes of the market and use them to your advantage. Investopedia is a good website that will help you sharpen your skills in the market.

Risk capital

You need to have a sum of money that you can risk. If you end up losing it, it won’t lessen your financial status tremendously.

Computer & high-speed internet connection

These two are necessary. They are the building blocks of your way to success in the stock market. They are the means that help you stay connected to the stock market.

Online broker

A smart online broker is your ticket to success in the stock market. You need to check the broker’s commission rate or fee, services, and network. Pick one that suits your interests and goals.

Trading software

Trading software is the interface that you will use to make your deals. You need to be comfortable using it. You will spend most of your time checking it for latest stocks’ prices and news.

Detective skills

You need to conduct a thorough research about a company before investing in it. Check the company’s earnings reports, future plans and exit strategy.

Connect with traders

Stockwits is a social network that connects traders with each other. Check it out from time to time and make new friends. Increase your social network to increase your resources for latest news, updates, and advice.

Overall, you need to know that investing in the stock market isn’t always a win situation.

You might lose some money and you might gain some money. You need to be well prepared and patient.

Online trading journal & money management

Tradebench is an online trading journal for you to plan, journal and learn from your trades.

You’ll get a structured approach to earn more money from your trading.

Become a more profitable trader. Cost free.

Join over 40,000 other traders and see what a difference tradebench will make in your trading!

* in return for free personal usage you accept to receive & open 1 sponsored e-mail per month as well as one of the following two: A) add a link to tradebench.Com somewhere relevant or B) support us with a donation. More info here (includes commercial use info). Note: feel free to try our tools a couple of days before fulfilling A or B. Our general term & conditions and privacy policy also apply and can be found here.

Join these traders and 40,000 others!

“thank you so much for your wonderful trading tools. I am amazed that you provide them for free and have never seen such a comprehensive trading journal.”

– hamid esnaashari

“just wanted to send you a thank you note. I am a new trader but very organized and detailed. Your platform is like heaven sent. Thank you very much.”

– julio richardson

I was looking for a proper trading journal for some time and finally found tradebench. It has great functionality, including import & export for excel. I can create trade plans to ensure I only enter trades that suit my personal strategy, avoiding emotional trades. If you’re looking for a trade journal, you should give tradebench a try.”

– mathias burmeister

What you get…

✔️ trade planning

✔️ position sizing

✔️ labels & checklists

✔️ open trades dashboard

✔️ reports, review & learn

✔️ compare potential trades

✔️ customizable parameters

✔️ risk & money management

✔️ worldwide exchanges

✔️ almost all trading vehicles

Try it hands on – cost free!

Sign up for immediate access

Trading journal, trade planning, risk & money management

Tradebench is a cost free online trading journal, trade planning, position sizing and risk management software for private stock, futures, CFD and forex traders in the financial markets.

Our number one goal is to make you a more profitable trader. This is achieved by offering a structured approach to your trade planning and position sizing/risk management as well as an easy-to-use way of journaling your trades making reviewing and learning from previous trades an integral part of your trading routine.

Learn more about the features or click the button below to do a quick sign up for immediate access. It’s cost free.

How to make money from online trading

Can I really make money trading online?

Since there is no certainty in online FX trading, it is vital that you approach the trading platform with common sense, level headedness and a practical mind-set. It takes time, practice, and certain patience to achieve success in online trading; the market is not something that can be tackled or beaten. Instead, it takes a certain skillset to earn money online from your trades, including clear-sighted market knowledge that will allow you to tip the balance ratio of wins to losses in your favour.

How to make money online from forex trading

Below are seven important steps that every trader should take to profit from online trading:

Learn the forex market

Improving your forex trading knowledge is essential if you wish to become an accomplished trader. There are countless resources available and your forex broker is an excellent place to begin. Take advantage of the forex trading services, educational resources, and trading tools provided by your forex broker. The latter could include access to forex news, market insights, and much more.

You may also consider taking a trading course, either as an online webinar or live seminar, as this will immerse you in a positive trading environment where you get to practice your skills with a demo trading account until you feel ready for live trading. Octafx offers comprehensive video tutorials as well as articles, manuals, traders’ tools, and much more.

Establish a trading strategy

Creating and following an effective trading strategy is your ticket to currency trading success. There are many trading strategies that investors can choose from to improve their chances and learn how to make money online. For example, will you follow trends or trade against them? Will you be an intraday trader or a long-term trader? Above all else, you should be comfortable with your selected strategy and ensure it suits your personality and trading style.

Most traders fall into one of two analytical camps: technical analysis and fundamental analysis. Technical analysis involves analysing price charts to ascertain future price movements. It focuses carefully on individual price movements in an attempt to analyse trends and profit from anticipated price movements. Technical analysts must learn about the different analytical tools available and how to use them.

Fundamental analysis involves analysing forex news and economic indicators in order to better understand why prices are moving at a particular moment. Fundamental analysis offers an in-depth analysis of your chosen currency pair and gives you a wider macroeconomic outlook on the markets. While many traders stick exclusively to either fundamental or technical analysis, others analyse the markets using a combination of the two.

Understand the impact of forex leverage

With the application of leverage, traders can amplify the value of their funds almost instantaneously. For example using leverage of 1:100, you can automatically amplify the value of your funds from $1,000 to a value of $100,000, demonstrating just how powerful and impactful online trading can be. However, leverage is regarded by many as a blade that cuts both ways, as although it can produce magnificent profits, it can also blow your entire account within minutes. For this reason, it’s essential to create a solid risk management plan that uses leverage conservatively, regardless of your level of trading experience.

Implement a risk management plan

No matter which financial instrument you choose to trade, make sure to apply risk management in order to keep your losses to a minimum. This involves trading with discipline and limiting your risk on trades to no more than 1% of capital per trade. This means that even if you incur losses on individual trades, this will not have a significant impact on your account.

It’s also important to protect your account using stop loss and take profit orders, which automatically close the trade if the predetermined entry or exit point is reached. This is an excellent way to cut your losses short and prevent a trade from taking a potentially dangerous turn.

Practice with your demo account

Many people mistakenly believe that the key to beating the market is to get started as quickly as possible. The forex market isn’t going anywhere and the quicker you rush to trade on a live account the sooner you are likely to lose funds.

Instead, trade using demo accounts relentlessly for a number of months until you feel completely ready. Practicing enables you to test different strategies, refine your skills, develop trading ideas, and completely familiarise yourself with the trading platform.

Demo trading plays an important role in your overall trading success and without it, you cannot know or understand where your trading strategy might fail or possess weaknesses.

Avoid emotional trading

Emotional traders tend to trade on emotions such as anger, fear, hope, faith, or any combination of the above. They tend to believe that the market is against them, which leads them to fear the market and view it as a dangerous and challenging place. Instead of focusing on the return percentage, they focus on having a high win percentage, which ultimately results in them making impulsive decisions.

Emotional trading is a surefire way to lose out during currency trading. It leads to a distorted perception of the market and the inaccurate execution of trades. If you feel like you are beginning to trade on emotion, step away from the platform until you have a clear mind. Review your risk management plan and trading strategy, and do not deviate from them. Only then should you consider re-entering the forex trading platform and placing more trades.

Understand tax implications

Once you have a trading strategy in place and have implemented your risk management plan, you will need to consider the implication of tax on your trade earnings. Full-time traders who make consistent profits may be able to claim trader tax status to make use of available tax deductions; however, since tax laws change on a regular basis, it is advised to seek the guidance of a professional for advice and management of any tax-related matters in your country of residence.

Are you ready to make money online from FX trading?

It takes determination and hard work to establish yourself on the trading as a trader easy and there is no guarantee of profit in any situation. By following the above tips, you will be better able to approach the market in an organised, level-headed, and professional way and earn money online from your trades.

Online stock trading 101: A beginner's guide

Learn the ropes if you're a newbie to online trading

Image by hilary allison © the balance 2020

It's important to educate yourself before you consider any type of investment or investment strategy. This beginner's guide to online stock trading will give you a starting point and walk you through the basics so you can feel confident in assessing your options, picking a brokerage, and placing a trade.

Choose an online broker

If you haven't already opened a brokerage account with a respected online stock brokerage, do it now. Take your time researching so you can feel confident you are choosing the best online stock broker for your situation. As you research, consider factors like whether there are trading commission fees (many brokerages offer free trading), how intuitive the app or website is, and any research or educational tools available for customers.

Choosing the best brokerage ultimately comes down to personal preference, and traders have a lot of options. Established giants like fidelity and charles schwab have channeled their decades of expertise into both online and app-based trading tools. There are also newcomers that specialize in perfecting the user experience of their apps, such as robinhood, webull, and sofi.

Research stocks to trade

Once you have a brokerage, you can buy stocks, but what stocks should you buy? If you're brand new to trading, the best place to start may not be with stocks, but with exchange-traded funds (etfs). Etfs allow investors to buy a bundle of stocks at once—which can help if you don't feel confident choosing one company over another. Etfs built to replicate major indices like the dow, nasdaq, and S&P 500 are good places to start to give your portfolio broad exposure to the U.S. Stock market. Many traders also diversify their holdings with assets other than stocks, such as bonds, as a way of hedging their risk during stock market downturns.

If you decide to invest in individual stocks, make sure to use some financial analysis ratios to compare a company's performance to its competitors. Successfully choosing individual stocks is difficult, but extensive comparative analysis can help ensure you're adding the best stocks to your portfolio.

Decide what kind of trade is right for you

When you want to buy (or sell) a stock, ETF, or any other traded asset, you have options for the type of trade order you want to place. The two most basic types are market orders and limit orders. Market orders execute immediately for the best price available at that moment. Limit orders won't necessarily execute right away, but they give you greater control over the price you pay (or receive, when selling). Once you own a stock, you might consider placing a trailing stop loss sell order, which allows you to continue riding positive momentum and automatically sell when the trade starts to turn on you.

No order type is necessarily better than another. They all have their place, and by learning as many of them as possible, you ensure you're using the right tool for your scenario.

Know what it'll cost you to trade stocks

One of the biggest enemies of successful stock trading is expenses. They represent money you pay just to own or trade securities. One type of expense is a commission fee, which you should consider while shopping around for brokerages.

If you're buying individual stocks through a brokerage that doesn't charge commission fees, you might not incur any expenses. However, when you start trading etfs, mutual funds, and other types of investments, then you need to understand expense ratios. These funds are managed by a person who is paid a percentage of the fund's assets every year. So, if an ETF has an expense ratio of 0.1%, that means that you will pay $0.10 per year in expenses for every $100 you invest in the ETF.

Aside from expenses, you also need to consider your risk tolerance. A common risk assessment method involves considering a hypothetical scenario in which your investments suddenly lose 50% of their value. Would you buy more after the crash, do nothing, or sell? If you would buy more, you have an aggressive risk tolerance, and you can afford to take more risks. If you would sell, you have a conservative risk tolerance, and you should seek out relatively safe investments.

Understanding how you would emotionally react to losses is one thing, and understanding how much you can lose without sacrificing financial stability is another. You may have an aggressive risk tolerance, but if you don't have an emergency fund to fall back on in case of sudden job loss, then you shouldn't use your limited funds to invest in risky stocks.

Understand how trading stocks affects your tax bill

Along with expenses, it's important to understand the tax rules for each of your positions, especially if you're going to actively trade stocks. The taxes you pay on stock profits are known as capital gains taxes. In general, you pay more capital gains taxes when you hold a stock for less than a year, and you pay less when you hold a stock for more than a year. This tax structure is designed to encourage long-term investing.

While selling stocks for a profit will increase your tax bill, selling stocks for a loss will decrease your tax bill. To prevent people from taking advantage of these tax benefits, there's something known as the "wash sale rule." essentially, this rule delays the tax implications of any profits or losses if you re-enter the same position within 30 days. in other words, if you sell a stock for a loss, and then buy the same stock a week later, your loss will no longer give you tax benefits—it's carried over into your new position. The loss will be accounted for once you sell the stock again.

If minimizing your tax bill is a primary concern, consider investing in a retirement account like a roth IRA or 401(k) plan instead of using a standard brokerage account.

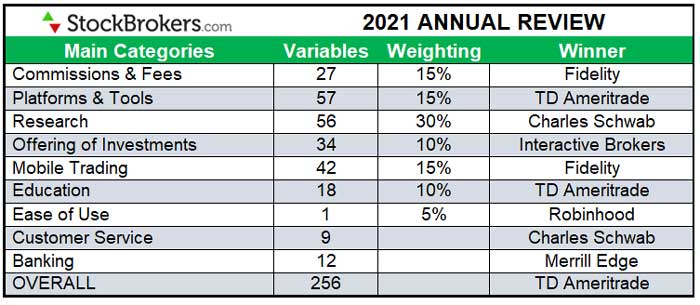

Best trading platforms 2021

The stockbrokers.Com 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

Do you want to buy shares of stocks like apple (AAPL), facebook (FB), netflix (NFLX), or tesla (TSLA)? If so, you’ll need to set up a trading account with an online broker.

Every stock trading platform is unique. And now – with every broker offering $0 stock and ETF trades – deciding which one to use comes down to differences in the overall trading experience. Investment options, trading tools, market research, beginner education, customer service, and ease of use are all factors investors should consider when choosing a broker.

Having led these annual reviews for the past 11 years, I have seen the industry evolve firsthand. I placed my first stock trade when I was just 14 years old. (it was starbucks.) today, at 34, my lifelong tally of trades is now more than 2,500.

I geek out over every aspect of the trading experience, which is why our review process is so exhaustive. This year we measured more than 250 individual variables. I couldn't have done this alone, though. Big thanks to my teammates steven hatzakis, jessica hoelscher, and joey shadeck, along with the rest of our awesome editorial staff.

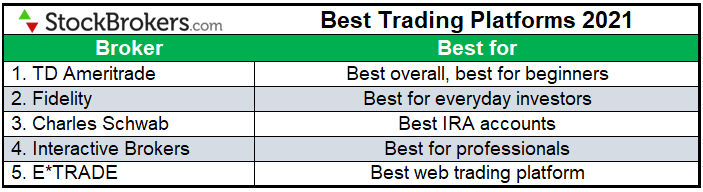

Best trading platforms 2021

Here are the best online brokers for 2021, based on 256 variables.

- TD ameritrade - best overall, best for beginners

- Fidelity - best for everyday investors

- Charles schwab - best IRA accounts

- Interactive brokers - best for professionals

- E*TRADE - best web trading platform

Best overall, best for beginners

TD ameritrade delivers $0 trades, fantastic trading platforms, excellent market research, industry-leading education for beginners, and reliable customer service. This outstanding all-around experience makes TD ameritrade our top overall broker in 2021. Read full review

Best for everyday investors

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools, an easy-to-use mobile app, and comprehensive retirement services. Serving over 32 million customers, fidelity is a winner for everyday investors. Read full review

Best IRA accounts

With more than $6 trillion in client assets, charles schwab understands how to consistently deliver value to its customers. Highlights include $0 trades, excellent stock research, a diverse selection of trading tools, and an industry-leading offering of financial planning services. Read full review

Best for professionals| open account

exclusive offer: new clients that open an account today receive a special margin rate.

Once again, in 2021, interactive brokers is our top pick for professionals because of its institutional-grade desktop trading platform and rock bottom margin rates. Professionals aside, interactive brokers also appeals to casual investors with $0 trades and its user-friendly web platform. Read full review

Best web trading platform

Founded in 1982 as one of the first online brokerages in the united states, E*TRADE highlights include $0 trades, two excellent mobile apps, and the power E*TRADE platform, which is great for beginners, active trading, and options trading. Read full review

Other trading platforms

In addition to our top five trading platforms for 2021, we reviewed six others: merrill edge, firstrade, ally invest, tradestation, webull, and robinhood. Here's our high-level takeaways for each. To dive deeper, read our reviews.

6. Merrill edge

Merrill edge offers $0 trades with industry-leading research tools (especially ESG research) and excellent customer service. Better yet, for current bank of america customers, merrill edge's preferred rewards program provides the best rewards of any bank broker we tested in 2021. Read full review

7. Firstrade

While firstrade is easy to use and terrific for chinese-speaking investors, its overall offering struggles to stand out against brokers who also offer $0 stock trades. Read full review

8. Ally invest

for current ally customers looking to invest in stocks, ally's universal-accounts experience and easy-to-use website is a convenient solution. Read full review

9. Tradestation

As a trading technology leader, tradestation supports casual traders through its web-based platform and active traders through its award-winning desktop platform, all with $0 stock and ETF trades. Read full review

10. Webull

webull offers a unique community experience and easy to use trading platforms that will satisfy most young investors. However, for everyday investing, webull lacks the trading tools and features to compete with industry leaders who also offer $0 stock and ETF trades. Read full review

11. Robinhood

robinhood is very easy to use; however, now that all online brokers offer $0 stock and ETF trades, robinhood's lack of trading tools and research leaves it a step behind the competition. Read full review

2021 overall ranking

Here's the overall rankings for the 11 online brokers who participated in our 2021 review, sorted by overall ranking.

Note: due to the pandemic and extensive market volatility, customer service was not scored as a main category.

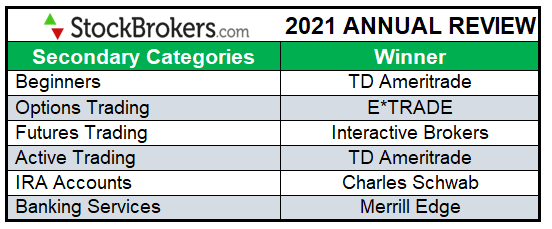

2021 industry awards

For the stockbrokers.Com 2021 review, all online broker participants were assessed on 256 different variables, with 2,816 data points collected in total. Here are the 2021 main category, secondary category, and industry award winners. Here's how we tested.

What is the best stock broker for beginners?

Based on over 30 variables, the best stock broker for beginners is TD ameritrade. Alongside paper (practice) trading, TD ameritrade offers the largest and most diverse selection of educational content. Highlights include over 200 videos, progress tracking, quizzes, and over 100 monthly webinars, among others.

Which online broker has the lowest fees?

When it comes to buying stocks online, our research found fidelity has the lowest fees overall. Fidelity is the only online brokerage to offer $0 stock trades and not accept payment for order flow (PFOF). Since every broker offers free stock trades, hidden costs matter.

Which online trading platform is best?

Online trading platforms come in one of three forms: desktop (download), web (browser), and mobile (app). After testing 11 brokers and collecting 2,816 data points, we found that TD ameritrade has the best desktop trading platform, E*TRADE has the best web trading platform, and fidelity has the best stock trading app.

Summary

To recap, here are the best trading platforms overall for 2021.

Read next

Explore our other online trading guides:

Methodology

For the stockbrokers.Com 11th annual best trading platforms review published in january 2021, a total of 2,816 data points were collected over three months and used to score brokers. This makes stockbrokers.Com home to the largest independent database on the web covering the online broker industry.

Participation is required to be included. Each broker completed an in-depth data profile and offered executive time (live in person or over the web) for an annual update meeting. Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

More from the editor

Alongside the stockbrokers.Com annual review, our fifth annual forex brokers review, which included 27 forex brokers, was also published on our sister site, forexbrokers.Com. Finally, be sure to check the latest financial advisor ratings, which you can view on investor.Com.

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

TD ameritrade, inc. And stockbrokers.Com are separate, unaffiliated companies and are not responsible for each other’s services and products. View terms.

1 $0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader apps" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

So, let's see, what we have: FOREX.Com UK offers forex and CFD trading with award winning trading platforms, tight spreads, quality executions and 24 hour live support. At online trading money

Contents of the article

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

- Online stock trading 101: A beginner's guide

- Learn the ropes if you're a newbie to online...

- Choose an online broker

- Research stocks to trade

- Decide what kind of trade is right for you

- Know what it'll cost you to trade stocks

- Understand how trading stocks affects your tax...

- Compare online trading platform

- Free forex bonuses

- What is online stock trading?

- How do you start stock trading?

- How to find the best trading platform

- Choosing the best stock trading app

- What is the best trading platform?

- Earn with online trading

- How to earn with online trading?

- What is stock?

- What is stock market?

- Who is broker?

- What is trading software?

- Strong trading & stock market background

- Risk capital

- Computer & high-speed internet connection

- Online broker

- Trading software

- Detective skills

- Connect with traders

- Online trading journal & money management

- Join these traders and 40,000 others!

- Trading journal, trade planning, risk & money...

- How to make money from online trading

- Can I really make money trading online?

- How to make money online from forex trading

- Learn the forex market

- Establish a trading strategy

- Understand the impact of forex leverage

- Implement a risk management plan

- Practice with your demo account

- Avoid emotional trading

- Understand tax implications

- Are you ready to make money online from FX...

- Online stock trading 101: A beginner's guide

- Learn the ropes if you're a newbie to online...

- Choose an online broker

- Research stocks to trade

- Decide what kind of trade is right for you

- Know what it'll cost you to trade stocks

- Understand how trading stocks affects your tax...

- Best trading platforms 2021

- Best trading platforms 2021

- Other trading platforms

- 2021 overall ranking

- 2021 industry awards

- What is the best stock broker for beginners?

- Which online broker has the lowest fees?

- Which online trading platform is best?

- Summary

- Read next

- Methodology

- More from the editor

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.