Review xm broker

We ranked XM's fee levels as low, average or high based on how they compare to those of all reviewed brokers. 🏆 top 5 stock brokers

Free forex bonuses

XM review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex and CFD traders who prefer metatrader platforms and seek great account opening

XM is an online broker whose parent company is trading point holding, a global CFD and FX broker founded in 2009.

XM is available globally and is regulated by three financial authorities: the cyprus securities and exchange commission (cysec), the australian securities and investments commission (ASIC) and the international financial services commission of belize (IFSC).

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

XM pros and cons

XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account.

On the other hand, XM has a limited product portfolio as it offers mainly cfds and forex. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

| Pros | cons |

|---|---|

| • low stock CFD and withdrawal fees | • limited product portfolio |

| • easy and fast account opening | • average forex and stock index CFD fees |

| • great educational tools | • no investor protection for non-EU clients |

| ��️ country of regulation | cyprus, australia, belize, united arab emirates |

| �� trading fees class | low |

| �� inactivity fee charged | yes |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $5 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 11 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD, real stocks for clients under belize (IFSC) |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

XM review

fees

| pros | cons |

|---|---|

| • no withdrawal fee | • inactivity fee |

| • low stock CFD fees | • average FX fees |

| assets | fee level | fee terms |

|---|---|---|

| S&P 500 CFD | low | the fees are built into the spread, 0.7 points is the average spread cost during peak trading hours. |

| Europe 50 CFD | average | the fees are built into the spread, 2.6 points is the average spread cost during peak trading hours. |

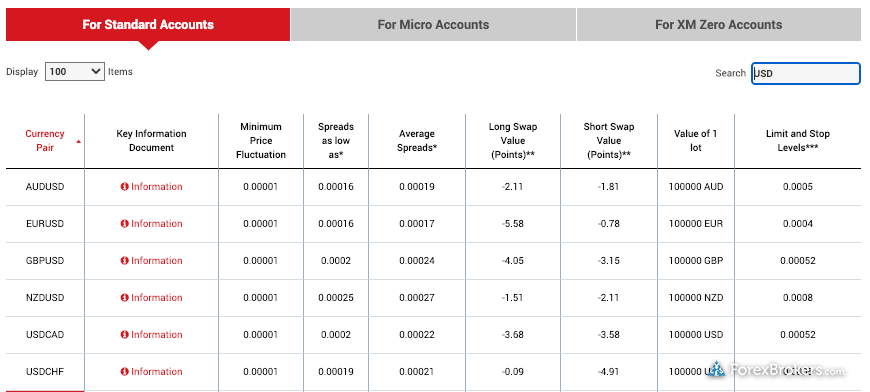

| EURUSD | average | with standard, micro, and ultra-low accounts the fees are built into the spread. 1.7 pips is the standard account's average spread cost during peak trading hours. With XM zero accounts, there is a $3.5 commission per lot per trade and a small spread cost. |

| Inactivity fee | low | $15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive. |

How we ranked fees

We ranked XM's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let's go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of XM for each asset class. For example, in the case of forex and stock index trading, spreads, commissions and financing rates are the most important fees.

We also compared XM's fees with those of two similar brokers we selected, XTB and etoro. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of XM alternatives.

To have a clear overview of XM, let's start with the trading fees.

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The standard, micro, and ultra low accounts charge higher spreads but there is no commission. The XM zero account charges lower spreads, but there is a commission. The following calculations were made using the standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index cfds: SPX and EUSTX50

- Stock cfds: apple and vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock cfds, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index cfds

- 5:1 for stock cfds

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

| XM | XTB | etoro | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.6 | $1.4 | $1.5 |

| europe 50 index CFD fee | $2.4 | $1.8 | $2.7 |

| apple CFD fee | $6.4 | $17.3 | $6.7 |

| vodafone CFD fee | $1.2 | $20.8 | - |

Forex fees

XM's forex fees are average compared to its competitors.

| XM | XTB | etoro | |

|---|---|---|---|

| EURUSD benchmark fee | $9.5 | $8.3 | $8.8 |

| GBPUSD benchmark fee | $8.4 | $6.0 | $8.5 |

| AUDUSD benchmark fee | $10.3 | $6.5 | $8.2 |

| EURCHF benchmark fee | $9.7 | $8.9 | $12.6 |

| EURGBP benchmark fee | $10.5 | $8.4 | $12.3 |

Real stock fees

Clients onboarded under IFSC can also trade real stocks using the shares account.

The real stock fees are lower than XTB's, but lag behind etoro's commission-free real stock offers.

| XM | XTB | etoro | |

|---|---|---|---|

| US stock | $1.0 | $10.0 | $0.0 |

| UK stock | $9.0 | $12.0 | $0.0 |

| german stock | $5.0 | $12.0 | $0.0 |

The commissions are volume-tiered with a minimum fee.

| stock market | commission | minimum commission |

|---|---|---|

| USA | $0.04 per share | $1 |

| UK | 0.10% | $9 |

| germany | 0.10% | $5 |

Non-trading fees

XM has average non-trading fees. There is no account fee and XM charges no withdrawal fee in most cases, though bank withdrawals below $200 carry a $15 fee.

There is a $15 one-off maintenance fee after 1 year of inactivity, and this is followed by a $5 monthly fee if the account remains inactive.

XM review

Trading point of financial instruments

XM group is a group of online brokers. XM group offers the MT4, MT5 and webtrader currency trading platforms. XM.Com offers over 55 currency pairs and cfds on stocks, metals, commodities, equity indices, and energies for your personal investment and trading options.

Former websites of this broker include trading-point.Com.

Other websites related to this company include xmtrading.Com, pipaffiliates.Com, xmarabia.Net, XM.Co.Uk, xmsina.Com.

Broker details

Live discussion

Join live discussion of XM.Com on our forum

XM.Com profile provided by chris zacharia, mar 28, 2017

XM is a forex broker. XM offers the metatrader 5, metatrader 4 and mobile global forex trading top platforms. XM.Com offers over 55+ forex pairs, stocks,cfds, equities, indices, metals, and energies for your personal investment and trading options.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Super legit platform

I have started trading with real money on december 7,2020 and at the end of the month thursday 31 my account was up approximately 53 % .

Everything is working more than expected. And if there is more than five starts for evaluation I will give them all the starts in the sky. What a wonderful company .

They are very honest and sincere and think of clients more than themselves. Any question I ask I get a prompt reply from professional works that really appreciate to help you make money as they earn money too. It is a win win game.

In short, there is no company as good as xm.Com it is really the business itself.

Deposit easy, but its difficult to withdraw

I ve been trading for 2 months use XM broker, yesterday as i want to withdraw quite large above 3000usd suddenly they ask for scan of my bank account with my name on it, i understand that this is for security.

So I sent them as they request, but then they reply I need to sent from my registered email. Now the registered email using gmail that has dots, they receive my email without dots( so they assume its not registered how come since they sent all the daily confirmation to my same email address)

So i ve already change the email with dots and until now there is no reply from them

I just got info that XM has been awarded with best global forex 2020, and I hope they act like one

Length of use: over 1 year

Length of use: over 1 year

I am utterly disappointed with XM, yesterday they recorded a lower price compared to other platforms and brokers. Due to this irregular behavior and price move, my positions were stopped out and thus disrupting my day, throwing me off balance completely.

Can anyone let me know if such behavior is possible? Customer support always gives you generic response, the feeling of helplessness when you discover your broker does not have your best interest at heart is devastating.

I am now convinced that perhaps I should look for another broker.

I am new to FPA, but I have been looking at the site for a long time, I saw the alerts about xm, but as I had support in portuguese I decided to take a chance, I figured that the problems described might not occur to me!

It was a big mistake on my part, i made some deposits, and i went through unsuccessful operations i lost a good amount of money at xm, so far so good, they are not to blame for that. When I finally make a new deposit and I have a "good" day, I deposited 100 and made 105.71 of total profit 105.71, I thought I will make a withdrawal and continue using the broker, that's when my headache started, I asked for the withdrawal via neteller, in which I had already deposited an amount, my withdrawal was denied and I was asked to withdraw via an astropaycard which had been the method of my last deposit, I went to the chat to complain, because I know about the money laundering law, I should be able to withdraw a part by neteller, after much discussion I was informed that I should withdraw by astropaycard, I accepted and withdrew, but in just 2 minutes after leaving the chat the following email arrived:

Important news

dear client,

We are contacting you regarding account (s) number 40025313 ("your account (s)") maintained at our company.

The trading patterns in your account (s) raise serious concerns regarding the trading bonuses credited to your account (s), as these were used in “cash-back arbitration” activities.

In accordance with the terms and conditions applicable to our credit bonuses, the following activities qualify as "cash-back arbitration":

any form of commercial arbitration

bonuses claimed by multiple accounts that have been registered using the same IP address

various bonus handling practices

violation of any points that are included in our bonus terms and conditions

any fraudulent activities, disputes or situations that our company considers to be fraudulent.

Given the fact that your account (s) trading patterns do not comply with the terms and conditions of the respective trading bonus program, we regret to inform you that any bonuses previously assigned to your account (s) will be deducted, with immediate effect and your account (s) is / are not eligible to participate in any future trading bonus programs.

Please note that our decision on this matter must be considered as definitive and binding on all participants and that, in addition to the notification set forth hereinafter, no further correspondence will be made on the matter in question.

I know that there are people who abuse the bonus programs, but it is not my case, I would be very happy if XM pointed out a concrete proof to the FPA, because accusing customers of having broken the rules at random is very easy for them to steal customers ! And all this happens only when you ask for a withdrawal! While I was losing money with them everything was great, everything was beautiful, it was me having a small profit that started this antics!

It is not a large amount, but note that in the current situation it is complicated to keep losing small amounts! The worst is the feeling of helplessness that we have when dealing with these scams!

I have further investigated the issue raised in your review and I can confirm that it was correctly decided that you will no longer be eligible to participate in any trading bonus programs, due to the nature of your trading activity.

Particularly and for your better understanding, please note that the trading patterns and trading behavior in your trading account(s) held with our company indicated that you were exploiting arbitrage opportunities. As you were accurately informed by the relevant department of our company via email, any actions taken in relation to your trading account(s) were fully in line with our company’s controls and procedures. At this point, I would like to stress the fact that no adjustments were performed to your trading account(s).

In view of the above, kindly note that the same trading conditions will apply to any new trading account(s) registered with our company. In this respect, I regret to inform you that your request to remove these trading conditions from your trading accounts is rejected.

I hope that the above information explains what has occurred, and I would like to assure you that it is not our wish to trouble our clients and further confirm that we always abide by the client - company agreement which governs our business relationship.

Length of use: over 1 year

Please note that I have investigated the issue raised in your review and I can confirm that your withdrawal request under question was correctly and successfully executed by our back office department as per our internal withdrawal procedures.

Notwithstanding the above, you have contacted our company claiming that you did not receive the relevant funds as such, our personnel correctly informed you that in order for us to be in position to escalate the case we need some supporting documents. More specifically, you were requested to provide us with a bank statement starting from the date of the withdrawal (i.E., 25/11/2020) as proof of non receipt of the funds so as to investigate further with the bank.

Due to the fact that we were not provided with the requested document, the relevant department of our company was not in position to escalate the case and as such, I would like to inform you that once we are provided with the requested proof, all the necessary actions will be taken.

I have further investigated the issue raised and I can confirm that the reason as to why your withdrawal requests are being rejected is due to the fact that the bank details submitted are invalid.

Particularly and as you were accurately informed via email by our back office department, we were unable to proceed with your withdrawal requests, as the bank account information you have provided us with was incorrect. At this point, I would like to stress the fact that you submitted several withdrawal requests using different bank accounts; however all of them were bouncing back as invalid.

In addition to the above, I can further confirm that you were requested to provide additional documentation in order to prove that all bank details you input were correct, but we never received any documentation from you and as such, we could not raise the case to our payment service provider.

I would like to assure you that it is not our wish to trouble our clients and further confirm that upon receipt of the requested documentation, the relevant steps will be taken.

Low lavrage

Length of use: 6-12 months

Length of use: over 1 year

->->->->->->->"is hedging allowed on XM MT4/MT5 trading accounts?

Answer:

Yes, you can hedge your positions as much as you can with XM.

The margin requirements will be balanced out and there is no required margin for hedging with XM.

However, for hedging CFD instruments, margin is only required once.

*even when hedging positions, the required margin can be increased due to market conditions.

Please note that XM does not allow ‘arbitrage’ trading on their trading platforms.

There are certain rules to protect other traders and the broker’s benefit. For more information, please refer to XM’s terms and conditions or contact the support team.

Date: mo., 9. Dez. 2019 um 01:01 uhr

subject: important notice - account no. 19123879, 19125255, 19122186, 19125256, 19117576, 18059051, 21188365, 19124598, 19124597, 21188390

to:

cc: christos gogas

Dear sir/madame,

we are writing in connection with your account no. 19125255 19125256(hereinafter “your account”) with our company.

In that regard, our anti-fraud department has brought to our attention that the trading patterns in your account(s) raise serious concerns that your account was being used for ‘arbitrage’ activities.

Pursuant to the terms and conditions such activities are being qualified as fraudulent.

Accordingly, we regret to inform you that, in accordance with the terms and conditions, we have decided, with immediate effect to:

- close all of your trading account(s);

As a result, you are kindly requested to submit a withdrawal request for your remaining balance through the withdrawals section of our members area and this shall be processed accordingly. If no withdrawal request is received within the next 48 hours, your funds will be sent back to the source.In view of the above, please note that you will be strictly prohibited from opening any new trading account(s) and trade with our company. Nonetheless, in cases where you may successfully open an account and trade with our company due to any technical and/or human error, we reserve every right to immediately close your account upon identification, nullify any profit/loss generated and refund the original amount of deposit, excluding any deposit and withdrawal charges, back to the same source of deposit.

Please note that, in accordance with the terms and conditions, our decisions are final and binding on all participants and that, other than the notification set forth herein, no further correspondence will be entered into.

Kind regards

--

XM team

Hello,

I don't use "arbitrage". I only use hedging with 2 accounts. I've been your customer since 3 years and you wanna close all my accounts yet?You will lose a lot of customer because I did free marketing for you. I told all my own customer about you. In these 3 years I never did a mistake and now you will close all my accounts?Then I will switch to another broker and tell all my customer what you do. I like XM and I show my loyality to XM. But you close negative trades and I lose one whole day. How you will make it good?

Best regards

anthony ******

That's now 1 year ago. I write them a new message some days ago to clarify:

Hello,

it‘s now 1 year ago you close all my accounts because you say I did arbitrage. I said to you, I don‘t did arbitrage. I hedged my trades but you don‘t give me a chance to show that. You didn‘t show me any proof. Now I work with a lot of big other brokers. I‘m ready to apologize your mistake because I want to be a customer of xm. Because I know xm has good conditions. Is it possible to clarify? For me it‘s not important. I can be a customer from the other brokers too. That’s your decision. I am not dependent on you. So you can choose now, if you maybe has a very loyal customer, who recommends you to other people or you haven‘t.

Best regards

anthony ******

---------- forwarded message ---------

von: christos gogas

date: mo., 19. Okt. 2020 um 10:54 uhr

subject: my account 19117576

to:

Dear sir/madam,

thank you for contacting us.

Regarding your concern I would like to ask you to refer to the email you received about the status of your account.

Kind regards,

I think they don't read the message, they are all to lazy to clarify that. XM has good conditions but the support isn't existing.

Dec 26, 2019 - 2 stars hello,

XM has good conditions for their customers.

I prefer the deposit bonus and the margin stop out level. The spreads are very stable.

But the support ist terrible. I have been your customer for more then 3 years.

I never did a mistake.

For more then 2 weeks ago I opened two low spread accounts. With one account I bought EURUSD and with the other I sold EURUSD. At the midnight I got a message that I'm a scammer because I used "arbitrage". That's not f***ing arbitrage. That's hedging. So they close all my accounts. After that I wrote a message to my account manager and to the support. I replied the message of them. But they only wrote back "we can't do anything".

What the hell. I was a very loyal customer, I told other people that xm is the best broker. Some of my customers are customers of xm because I told them about them.

You can make one mistake and they give a f on you. That's not a support. They should get 0 stars for that. But I see the positive sides too.

I'm very angry about that. They destroyed my ranking on MQL5 and had stolen more than 4 hours of my life. But thanks to god. I got a meesage from another broker which want to work with me. I would have deposit a very big amount in xm. But now it's to late. I don't want to work with a broker who gives a f on their customer. Bye.

Reply by chris zacharia submitted jan 8, 2020 dear at0nu5,

In order for us to properly investigate this and be able to provide you a comprehensive reply we would need the account number of one of the accounts which you used.

Reply by chris zacharia submitted oct 30, 2020 dear at0nu5,

Following investigation of your trading accounts and trading activity, I can confirm that our business relationship was correctly terminated due to the fact that you were placing opposite orders within your trading accounts. Kindly note that the latter is also confirmed by you in your review above.

This cannot be deemed as an acceptable strategy as you create an environment which does not follow the fair rules of trading and makes the strategy in a way risk free and therefore not permitted. It should be also noted that the latter constitutes a violation of our terms and conditions of business. In addition to the previously-mentioned, I can confirm that the remaining balance in your trading account has been withdrawn.

In view of the above, I regret to inform you that unfortunately, due to the above violation, we are not in position to accept you as a client again.

Kindly note that our company allows its clients to use the hedging strategy; however, by placing opposite orders in-between your trading accounts, you create an environment which does not follow the fair rules of trading and makes the strategy in a way risk free(i.E., exploiting arbitrage opportunities) and therefore not permitted.

Due to our “no negative balance” policy, the trading strategy described above would have limited the potential loss to the entire balance of the account having the loss-making position and the account having the profit-making positions to have unlimited upside potential which would duly cover the losses suffered in the loss-making account.

In this respect, kindly bear in mind that the above cannot be deemed as an acceptable strategy and it is considered as a violation of the company’s terms and conditions of business.

Frequently asked questions

Is XM a good broker?

The best way to answer if XM is a good broker is to read the unbiased traders reviews on forex peace army. Https://www.Forexpeacearmy.Com/forex-reviews/7214/xm-forex-brokers.

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we recommend to check recent XM broker community discussions: https://www.Forexpeacearmy.Com/community/tags/xmcom/

What is the minimum deposit for XM broker?

XM brokers offers several account types. Micro and standard accounts have a minimum deposit of $5. Other account types vary in their minimum deposit requirements by region.

How do I deposit money in to my XM broker?

XM's broker deposit procedure is fairly straightforward. Once the account is registered and approved, follow these simple steps:

- Login to XM broker members area.

- Select the deposit method (credit and debit cards, neteller, bank wire transfer or other).

- Select the XM account and specify the deposit amount.

- Enter the appropriate payment details.

Funds availability depend on the funding method, with card deposit being "instant". If you have any questions or problems contact XM broker live chat.

How long does it take to withdraw from XM?

XM broker says they process nearly all withdrawal requests within 24 business hours.

Then it may take another 2-5 business days for the bank to process wire or for card transaction to be reflected in your account.

For faster XM withdrawal you may opt for the XM card or e-wallet, these payments are received the same business day.

Can I withdraw XM bonus?

Profits made by trading XM bonuses are withdrawable. However, you can not withdraw XM bonus itself.

Check the terms and conditions of any bonus program before accepting a bonus.

How much can I withdraw from XM?

XM's minimum withdrawal amount is $5 for credit/debit cards and e-wallets and is $200 for the bank wire.

The maximum withdrawal amount from XM is determined by the payment method with bank wire limits being the highest.

Please be aware of the XM withdrawal priorities, if you deposited money with the credit card or e-wallet, then withdrawal is processed via the same method up to amount deposited before you are able to select other withdrawal methods.

Does XM allow scalping?

XM allows scalping as well as trading during time of increased volatility.

It is always a good idea to check fresh reviews on forex peace army to see if traders recently encountered any serious problems with scalping using XM trading platforms.

Https://www.Forexpeacearmy.Com/forex-reviews/7214/xm-forex-brokers.

What is XM zero account?

XM zero accounts feature near-zero spreads (EURUSD average spread is as low as 0.1 pips) and a no requotes execution policy with all trading styles welcome.

The trade off is a broker commission of $7 per lot round turn charged when opening the trade.

Some regions may have different account options.

Is XM a regulated broker?

XM broker is regulated by several government regulators:

- Australian securities and investments commission (ASIC), registration #443670;

- Belize international financial services commission (IFSC), registration #IFSC/60/354/TS/18;

- Cyprus securities and exchange commission (cysec), registration #120/10.

Does XM charge commission?

XM broker offers several account types:

- Micro account and standard account are commission free

- XM zero account features ultra-thin spreads but charges commission of $7 per round lot traded payable at the order opening time

- Some regions may have other account types

What is XM leverage?

XM offers flexible leverage from 1:1 to as high as 888:1 that can be instantly changed in your account members area.

Higher leverage allows to trade the borrowed capital which increases both the profit potential and the risk of loss.

Some trading strategies like automated scalping may require high leverage while many professional traders do not use much leverage.

Please trade responsibly selecting the leverage based on your risk appetite and loss tolerance level. Some regions may only offer lower leverage.

XM group review

While XM group struggles to stack up against industry leaders, in terms of its platform offering, range of markets, and pricing, XM group provides an outstanding offering of quality educational content and market research.

Top takeaways for 2021

Here are our top findings on XM group:

- Founded in 2009, XM group is regulated in two tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (average-risk) for trading forex and cfds.

- XM group is a best in class metatrader broker in 2021, that offers the complete metatrader suite, along with a few notable upgrades to enhance the experience, in addition to custom indicators. Besides social copy trading, where XM group finished best in class (7th place), XM group’s research offering is rich with depth and variety, challenging industry leaders such as IG and saxo bank.

- Pricing at XM group varies by account type. Overall, the broker is not a stand out for low-cost trading when compared to pricing leaders such as CMC markets and IG.

Special offer:

Overall summary

| feature | XM group |

|---|---|

| overall | 4 stars |

| trust score | 84 |

| offering of investments | 4 stars |

| commissions & fees | 4 stars |

| platforms & tools | 4 stars |

| research | 4.5 stars |

| mobile trading | 4 stars |

| education | 4.5 stars |

Is XM group safe?

XM group is considered averge-risk, with an overall trust score of 80 out of 99. XM group is not publicly-traded and does not operate a bank. XM group is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and one tier-3 regulator (low trust). XM group is authorised by the following tier-1 regulators: australian securities & investment commission (ASIC) and financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | XM group |

|---|---|

| year founded | 2009 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 2 |

| tier-2 licenses | 2 |

| tier-3 licenses | 1 |

| trust score | 84 |

Offering of investments

Through its various brands, XM offers traders a total of 1,230 cfds across multiple asset classes, including forex, along with 100 exchange-traded securities (non-cfds). The following table summarizes the different investment products available to XM group clients.

| Feature | XM group |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 57 |

| cfds - total offered | 1273 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Traders who need instant execution will appreciate no requotes or rejections with XM’s zero account, compared to market execution offered by other agency-only brokers. That said, XM group still trails the best forex brokers when it comes to its pricing for budget and active traders.

Account options: the commissions and fees at XM group depend on the type of account and which global entity you choose. There are three primary accounts. While the commission-free micro and standard accounts are expensive, the commission-based XM zero account is more competitive.

Spreads and commissions: in the commission-based XM zero account, average spreads on the EUR/USD stands at 0.1 pips (according to XM group website data), making the effective spread 0.8 pips after including the $7 per round-trip commission. The standard and micro accounts have average spreads of 1.6 to 1.7 pips for the same pair and are comparably less attractive options at XM group.

Execution method: XM group acts as the sole dealer (principal market-maker) in all trades it executes. This execution method allows XM group to provide execution for up to $50 million worth of currency at a time and permits up to 200 simultaneous open positions which is reasonable compared to peers.

Shares trading: forex and cfds aside, XM group provides a shares account that requires a $10,000 deposit and is for investors who want to trade shares directly (non-CFD) with no leverage. This account is not available at all the entities of the group.

Gallery

| Feature | XM group |

|---|---|

| minimum initial deposit | $5-100 |

| average spread EUR/USD - standard | 1.6 (aug 2020) |

| all-in cost EUR/USD - active | 0.8 (aug 2020) |

| active trader or VIP discounts | no |

Platforms and tools

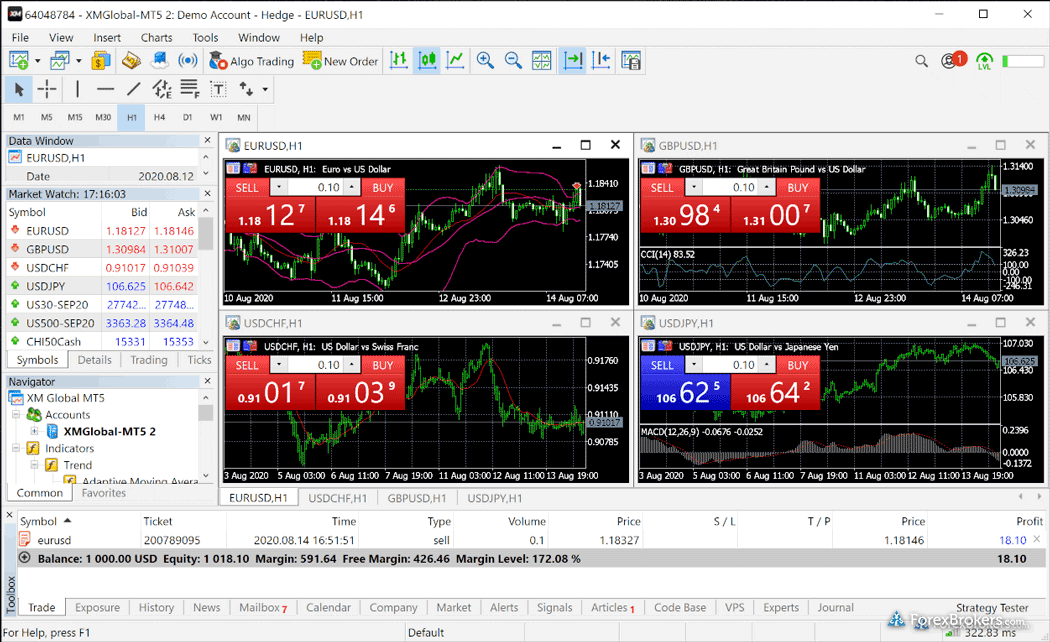

Offering the full metatrader suite (MT4, MT5) with additional platform add-ons is a crucial distinction among the best metatrader brokers. XM group checks these boxes, offering the full MT suite alongside multiple proprietary indicators, such as the rivers indicator developed by its in-house staff.

Gallery

| Feature | XM group |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | yes |

| ctrader | no |

| duplitrade | no |

| zulutrade | no |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

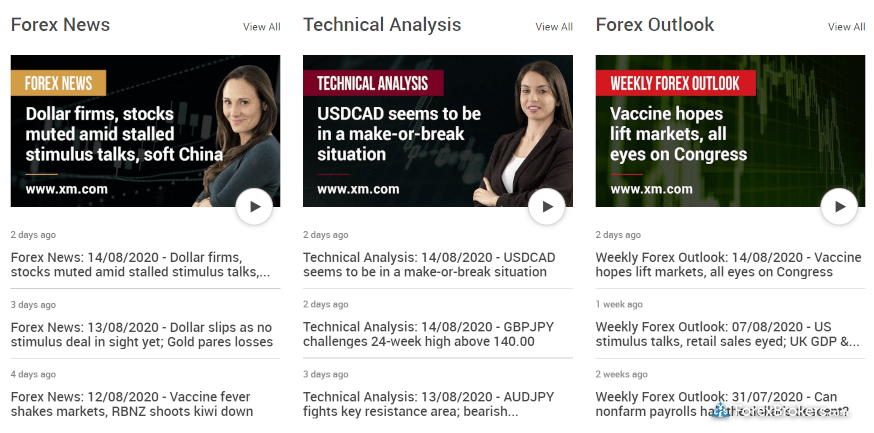

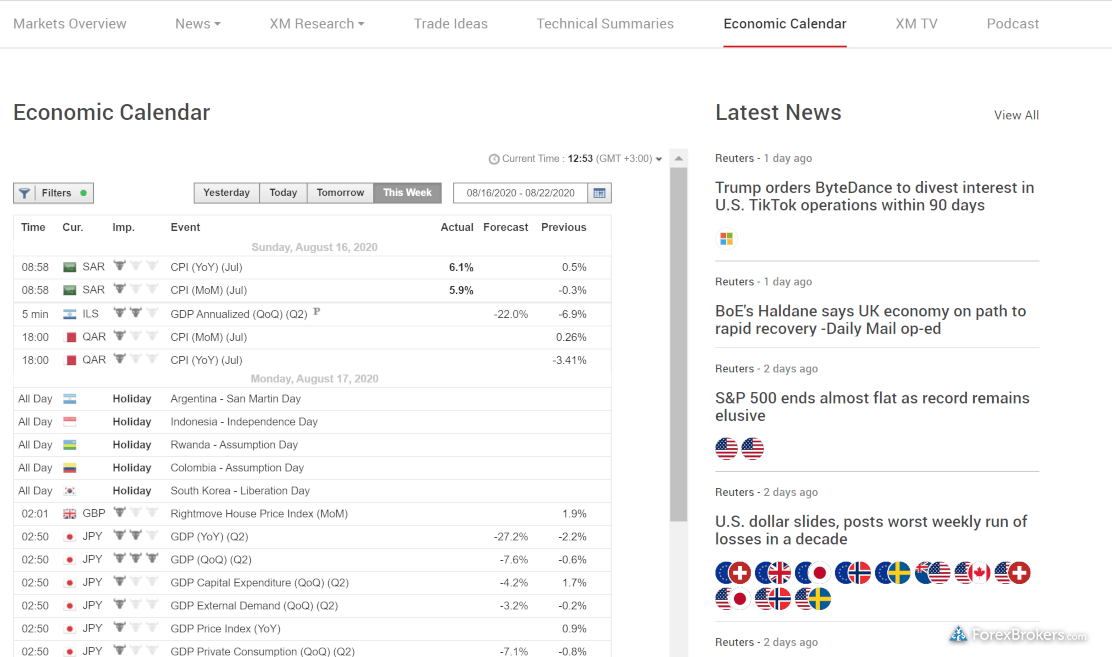

Research

XM group’s XM TV is a winner, delivering excellent daily in-house market commentary that competes with industry leaders in video including IG, saxo bank, and CMC markets. And, while market research is found primarily outside of MT4, XM group offers a comprehensive and quality package that will satisfy most traders.

XM TV: XM group has done a great job creating daily forex news videos with market analysis explained in a TV interview-style format. The audio from these videos is also uploaded as a podcast to syndicate the content across media formats.

Articles: video aside, the news section on the XM group’s website allows filtering content by asset classes, making it easier to find articles about forex, indices, stocks, and cryptocurrencies. It is easy to appreciate the scope of research content with XM group, thanks to quality daily market recaps alongside technical and fundamental analysis articles.

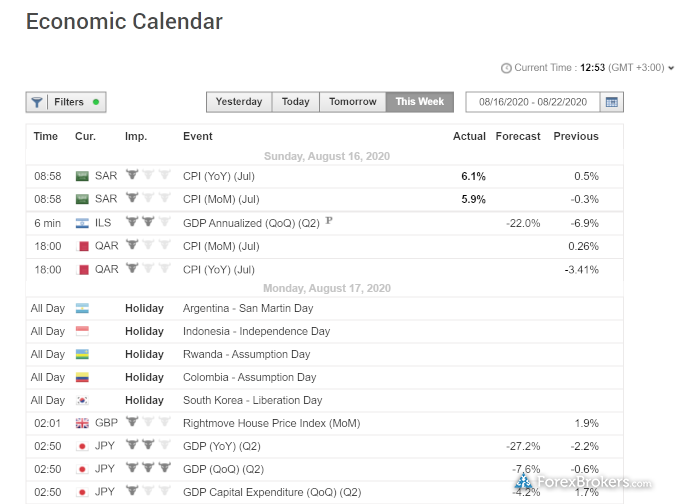

Trading signals: XM group offers its trade ideas and technical summaries hub to live account holders, with signals streaming from autochartist and analyzzer. The broker also provides trading ideas (shares only) from trading central. In addition to the metatrader signals market, which allows automated trade copying, XM group supports social copy trading from compatible expert advisors developed by analyzzer.

Accessibility: given that the trading platforms are segmented away from the research, XM is at a slight disadvantage when compared to the best forex brokers for research. For comparison, saxo bank, IG, and CMC markets integrate research features into their platforms.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

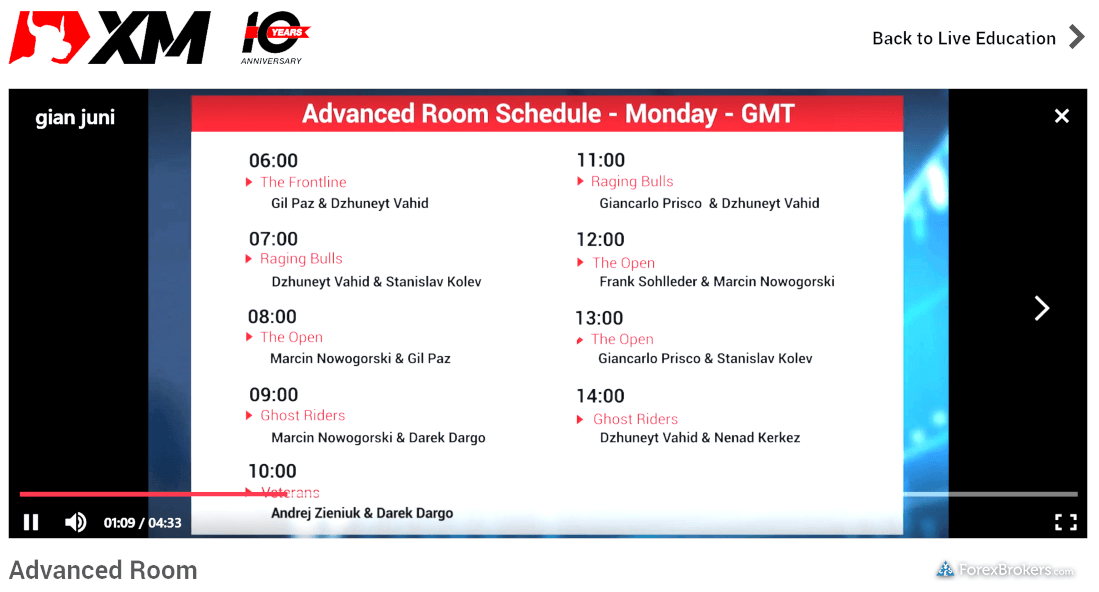

XM group offers a high quality, diverse selection of educational content. For example, the in-house video collection, tradepedia, is a great collection for beginners to reference. No question, XM group holds its own against education leaders such as FXCM, IG, and saxo bank.

Tradepedia: XM group offers tradepedia, an in-house video course that provides educational forex and CFD content. I found the series useful with 39 videos across seven chapters with good quality coverage for beginner and advanced video content.

For example, the course instructor demonstrates how to use some of the firm’s proprietary indicators, such as the avramis river indicator. The video had multiple examples to help users interpret this particular study in different market conditions.

Webinars: with 49 webinar instructors covering 19 languages throughout the week, XM group has extensive coverage of time-zones and a detailed schedule organized by experience level for traders to subscribe.

Articles: there are a series of 53 written articles that are organized in a progressive format across six chapters covering 13 lessons regarding forex, starting with basics, and ending with advanced subjects. Pros aside, XM group should consider adding CFD education for other asset classes to further enhance its educational coverage.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

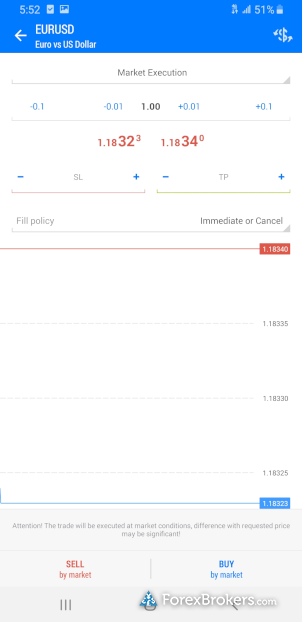

Mobile trading

Since XM group is a metatrader-only broker, the ios and android versions of the MT4 and MT5 mobile apps come standard and are both available for download from the apple itunes store and android play store, respectively. With no proprietary mobile app available, XM group trails the industry leaders in this category, such as IG, and saxo bank.

Gallery

| Feature | XM group |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | yes |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

As a vanilla metatrader broker, XM group offers over 1300 instruments, including 57 currency pairs, yet trails behind the best forex brokers who offer many thousands of tradeable symbols. Meanwhile, while XM group’s pricing on commission-based accounts is close to the industry average, its standard account spreads are expensive.

Drawbacks aside, XM group provides traders excellent research and education, making it a strong choice for beginners and traders who appreciate quality market research.

About XM group

XM group consists of multiple entities that use the XM brand and hold regulatory status in various jurisdictions. The group’s first entity was founded in 2009 in cyprus and is regulated by cysec (license 120/10) under the name trading point of financial instruments ltd.

In 2015, the group established an entity in sydney, australia, regulated by ASIC (license number 443670). In the united kingdom (UK), XM holds regulatory status in london through its FCA-regulated entity (license number 705428), under trading point of financial instruments UK ltd. Finally, in 2017 XM global limited obtained regulatory status in belize, where it is regulated by the IFSC (license number IFSC/60/354/TS/19).

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Broker’s profile

Testing the mettle and serviceability through a thorough review of its forex brokerage service is the XM group.

XM group took form in 2009 in cyprus with its former name, trading point of financial instruments ltd. The XM brand is a group of online regulated forex. Over the years, this brokerage group has amassed a huge number of traders and reached to more than 196 countries globally. XM group is most known for its metatrader platform suite offering, while its trademark service is its customer care, which provides 30 language options to support its clients.

XM group continues to evolve to provide better trading services to traders worldwide. Its ten years of existence in the trading industry has earned its reputation as a good forex broker, albeit it has been performing under the shadows of broker giants dominating the markets today.

Broker’s security and regulatory status

Establishing its integrity as an honest brokerage institution, XM group is multiple licensed brokers. It has earned several distinctions along with its license to operate forex brokerage from the australian securities & investment commission (ASIC) and the financial conduct authority (FCA).

Besides the above-mentioned regulatory merits, XM group has also subscribed to the regulations set by the markets in financial instruments directive (mifid) lording over the european union nations. XM group intently worked this out to boost its advocacy to build a secure trading institution among its clients. Hence, XM group is compelled to be liable over its jurisdictions in hungary, france, and italy.

Over the past decade, XM group has established itself as a safe and reliable forex broker rendering forex trading services in different parts of the world. In 2017, XM global limited was founded in belize and was regulated by the IFSC.

Trade offerings, accounts, and condition

XM’s several broker brands will walk interested investors to multiple trade baskets in the form of cfds with 1200 stocks, 8 commodities, 4 metals, 5 energies, 30 indices, and 57 currency pairs.

Currently, XM offers varying trading account types, including standard accounts, micro accounts, cent accounts, swap-free accounts, and islamic accounts. The standard, micro, and zero accounts all have this distinctive feature – these have custom-oriented conditions. Each of these accounts can be used for an islamic account.

When we deal with the transaction costs using XM-sanctioned brokerage sites, the prices vary depending on the account type. The micro and standard accounts are both commission-free accounts, while the zero account is commission-based. XM also offers the XM ultra-low account, but it is not offered across all XM brands.

Using the XM zero account, traders are faced with average spreads on the EUR/USD pair with 0.1 pips. If you take a look at the commission-free standard account and micro account, its average spreads for the same currency pair is at 1.7 pips. However, if we put the commission-based account into the picture, the average spreads will have traders trading the same forex pair at 0.8 pips.

In terms of the leverage level, XM group observes varying levels depending on the account type. XM clients choose their leverage level between 1:1 and 888:1. However, recent rulings from regulatory bodies in europe prohibited brokers from offering high leverages to avoid stupendous losses of clients. They have set a maximum leverage of 30:1. But since XM group has clients outside the european bloc, its australian clients are liberated to use high leverage levels that go up to 300:1.

Interestingly, XM brands are all acting as principal dealers in all their trade executions and do not offer re-quoting in all their trading account types. In essence, XM brands can afford to offer low spreads during particular market conditions.

XM has done a good job in its transparency in transaction fees. All the costs traders are charged during trading are available in the spreads and does not practice hidden fee charges. What XM group charges its clients on trade transactions is the overnight fee.

One clear advantage XM group has against its competitors is its no inactivity fees and zero deposit fees. Traders are not charged per month if their trading accounts are not actively used. What’s more interesting is when traders open an account with any XM brand, they are not obliged to render a deposit fee.

Educational materials and trading resource

If traders are to consider the research aspect of brokerage service provided by XM, they might find nothing surprising. XM has the same features that traders could also enjoy at some other research instruments used by other typical and mediocre forex brokerage sites.

XM has this feature called tradepedia, which provides insightful resources for technical analysis. This usually details indicator tools, charts, and graphs. Tradepedia caters to the beginning traders and even to the most seasoned traders in search of trading strategies and significant trade signal visuals.

XM’s daily feeds of forex and economic news are quite interesting as they are presented in a creative format wherein users are just like watching a TV interview.

Some other noteworthy features of XM’s research facility include webinars, economic calendars, how-to videos, forex seminar s streaming, technical indicator tools, etc.

In assessment, the educational and research facility offering of XM is sufficient though most of its features can also be found in other brokerage services. XM has to offer something new to the table to stay relevant in the forex research offerings out in the markets.

Trading platforms and special perks

This aspect of trading service offerings is the lackluster side of XM group that needs to be upgraded if they want to find themselves at the upper echelon of the forex broker elite group. Unfortunately, XM group offers conventional and ordinary metatrader platforms. XM offers both the MT4 and MT5 web and app platforms for its clients. As most traders know, the metatrader platforms feature the usual set of technical analysis tools, including some stop and trailing orders. Metatrader 4 and metatrader 5 are both available in ios and android devices.

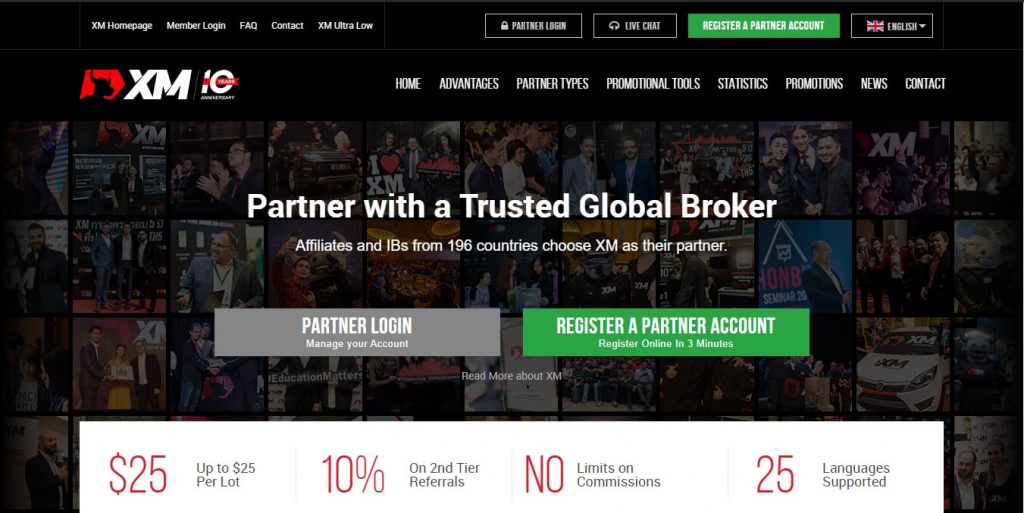

Since the XM group sports nothing-fancy-but-simple-yet-reliable trading platforms, investors may be enticed by the company’s special perks and bonuses offered. Let us leaf through some of XM’s promotional bonuses that might interest traders around.

First on our radar is the NO DEPOSIT BONUS offer. This is a great catch for traders, especially those who are afraid of bumping into fraudulent forex brokers. It is also a good impression for traders that they have nothing to risk as they sign in for an XM trading account. However, that’s the only time first-time XM trader account users can enjoy that bonus.

Another perk awaiting newly-signed up traders is the WELCOME BONUS. This particular reward is only earned by traders who signed up for an account and opted to make an initial deposit. They are rewarded with 100% as a welcome bonus to them.

For the old users of XM trading accounts, they get to receive LOYALTY BONUSES. Traders need to apply for this special perk and earn a certain number of points that traders can get upon executing trades with XM. The more they trade, the higher the points they accumulate, which can be converted to the LOYALTY BONUS after application.

Lastly, XM offers special seasonal bonuses. These benefits are coming every once in a while during trading with XM brands. This way, traders are treated by their eagerness and enthusiasm in trading forex. But these can all be discovered when traders stay being XM clients.

Deposit and withdrawal practices

If you think you’ve seen pretty much everything about what XM group has to show off, wait till you learn about its conduct of withdrawal and deposit schemes.

XM group provides an easy way for its clients to deposit and withdraw trading funds from their accounts. XM offers different avenues for money transfer, including credit cards, bank wire transfer, and e-wallets. E-wallets can be in the form of neteller, china unionpay, western union, IDEAL, SOFORT, moneybookers, webmoney, moneygram, bitcoin, and skrill.

XM group is committed to providing a convenient funding transaction to its clients; that’s why it allowed local bank transfer that enables its clients to deposit their trading accounts through commercial banks with no conversion charges. Note, however, that XM group imposes a minimum five dollar deposit amount for the payment mentioned above options in all countries across the globe.

On top of it, clients are charged with no fees for both withdrawal and deposit transactions. XM group also covers the transfer fees of its clients. Convenience at its finest, it is for XM group brokerage funding service.

Leave or cleave?

After a thorough rundown of XM group’s brokerage services, let us weigh in all aspects of the services to find out which type of traders can fit into the brand.

XM group seems to be a fine and classic kind of broker. Safety and convenience are both guaranteed, although nothing special or new is on its service platter. XM is a steady and ever ready forex service provider, a good characteristic of a broker for traders who look for a dependable firm.

There may not be anything special by its trading platforms in metatrader, but the seamless trading service is what it has to offer.

XM group is not the kind of broker traders would shun as its security and transparency are the vanguards of its brokerage service.

XM group review

Since it was founded in 2009, XM group has grown to become one of the largest and well-established investment firms with more than 1,500,000 clients worldwide.

XM group provides support for more than 30 languages, while it aims for 99.35% of all its trading orders to be executed in less than one second, with no re-quotes and no rejections.

With clients from more than 190 countries, XM group offers a range of services including currency trading, cfds on equity indices, precious metals, and energies. There are also more than 25+ secure payment methods available to traders, across 16 full feature trading platforms.

XM group is a group of online regulated brokers. Trading point of financial instruments ltd was established in 2009 in limassol, cyprus and is regulated by cysec with license number 120/10. XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (000261/106)

- Used by 700,000+ traders

- Established in 2009

- Regulated by IFSC, cysec, and ASIC

- Min. Deposit from €5

To open a live account, you’ll need a minimum deposit of at least €5. Alternatively, XM group offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by cysec (licence: 120/10), and ASIC (AFSL #443670). XM group puts all client funds in a segregated bank account and uses tier-1 banks for this. XM group has been established since 2009, and have a head office in cyprus & belize.

Before we dive into some of the more detailed aspects of XM group’s spreads, fees, platforms and trading features, you may want to open XM group’s website in a new tab by clicking the button below in order to see the latest information directly from XM group.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

What are XM group's spreads & fees?

Like most brokers, XM group takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on XM group’s website. The colour bars show how competitive XM group's spreads are in comparison to other popular brokers featured on brokernotes.

| XM group | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.1 pips + $10.00 | 0.09 pips + $5.00 | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.1 pips + $10.00 | 0.59 pips + $5.00 | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.1 pips + $10.00 | 0.25 pips + $5.00 | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.2 pips + $10.00 | 0.17 pips + $5.00 | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.2 pips + $10.00 | 0.35 pips + $5.00 | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.2 pips + $10.00 | 0.31 pips + $5.00 | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.3 pips + $10.00 | 1.1 pips + $5.00 | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.2 pips + $10.00 | 1.0 pips + $5.00 | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, XM group’s minimum spread for trading EUR/USD is 0.1 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with XM group vs. Similar brokers.

How much does XM group charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with XM group at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $9.85. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| XM group | IG | XTB | |

|---|---|---|---|

| spread from : | $ 1.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 1.00 | $ 6.00 | $ 2.00 |

| $5 more | $1 more | ||

| visit XM group | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with XM group?

XM group offers over 261 different instruments to trade, including over 55 currency pairs. We’ve summarised all of the different types of instruments offered by XM group below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | XM group | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 55 | 90 | 48 |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | yes |

| exotic forex pairs | yes | yes | yes |

| cryptocurrencies | no | yes | yes |

| commodity cfds | XM group | IG | XTB |

|---|---|---|---|

| # of commodities offered | 15 | 34 | 21 |

| metals | yes | yes | yes |

| energies | yes | yes | yes |

| agricultural | yes | yes | yes |

| index & stock cfds | XM group | IG | XTB |

|---|---|---|---|

| # of stocks offered | 160 | 8000 | 1606 |

| UK shares | yes | yes | yes |

| US shares | yes | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see XM group's instruments | see IG's instruments | see XTB's instruments |

What’s the XM group trading experience like?

1) platforms and apps

XM group is one of the few brokers that offer both of the metatrader platforms; MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

XM group also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

XM group allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. XM group allows you to execute a maximum trade of 100 lot.

As a market maker, XM group may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, XM group are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

XM group also offers a number of useful risk management features, such as stop losses (with trailing stops), limit orders negative balance protection price alerts and much more. You can see all of the account features offered by XM group here.

Finally, we’ve listed some of the popular funding methods that XM group offers its traders below.

Trading features:

- Allows scalping

- Allows hedging

- Low min deposit

- Offers negative balance protection

Accounts offered:

- Demo account

- Micro account

- Standard account

- Zero spread account

- Islamic account

Funding methods:

3) client support

XM group support a wide range of languages including arabic, chinese, english, french, german, greek, hindi, hungarian, indonesian, italian, japanese, korean, malay, polish, portuguese, russian, spanish, swedish, thai, and turkish.

XM group has a brokernotes double AA support rating because XM group offer over three languages

4) what you’ll need to open an account with XM group

As XM group is regulated by IFSC, cysec, and ASIC , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore XM group’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with XM group you can visit their website here.

A review & guide to trading with XM

XM group is a group of online regulated brokers. Trading point of financial instruments ltd was established in limassol, cyprus and is regulated by cysec with license number 120/10. Trading point of financial instruments pty ltd was established in sydney, australia and is regulated by ASIC with license number 443670. Let us take a quick look at some of the basic features of this platform which are important to note when considering XM as an online broker.

Trading systems

XM offer a variety of trading platforms, including web trader, MT4 and MT5. Web trader is excellent due to the fact that a client can access real-time market information directly through the website without having the need to download any software. This is ideal for those with limited hard disk space or who wish to access their account through a smartphone.

Metatrader 4 is one of the most popular systems currently in place. Not only are all prices and movements clear, but its user-friendly nature will vastly increase the performance of any trader. It should be noted that both manual and automatic trading options are available through metatrader 4.

Types of accounts

The first level of trading account is known as their micro trading account, which can be opened with $5. This is aimed at those who are learning the forex markets and wish to trade micro lots.

XM group’s standard trading account represents the next level up. As the name suggests, this is the type that is primarily used by seasoned traders who are willing to expose themselves to a moderate amount of risk with standard lots. One of the primary differences with this account is that larger contract sizes are available.

XM zero accounts require a minimum deposit of $100 and offer spreads as low as zero pips, along with XM’s no re-quotes execution policy. It’s important to note that XM charge a total commission of $7 for every $100,000 traded on their zero account.

Demonstration accounts are also available. These are intended for those who wish to try out the platform before making an ultimate decision. Interestingly enough, no less than $100,000 dollars in virtual funds are provided. It should be mentioned that XM also offers islamic accounts for those who wish to trade under the principles of sharia law.

Spreads and commission

As with most online forex brokers, the spreads will depend upon the trading system and the type of account. Spreads can start as low as zero pips (on a zero spread account). An added benefit in regards to these pips is that fractional pricing is available; five digits are provided as opposed to the standard four digits offered in other sites. Both fixed and variable spreads can be chosen by the trader.

There are no commissions charged by XM. Instead, the company makes a profit on the spreads of the trades themselves. There are therefore no hidden fees and the gains (or losses) which a trader makes are quite real.

Underlying assets

There are several different instruments that can be traded through XM. Some of the most popular are:

- Forex

- Stocks cfds

- Commodities cfds

- Precious metals cfds

- Energies cfds

- Equity indices cfds

No EFT trading is supported by this platform.

Reliability and efficiency

XM.Com is considered by many to be one of the most reliable platforms available for those who wish to execute real-time trades (nearly 100% are completed in less than one second). There will be no re-quotes and all figures are as they stand upon the execution of a position. Due to the use of the previously mentioned trading platforms, there is little lag times between the observed prices and their actual market equivalents. However, this will partially rely upon the processing power of one’s computer and its connection speed.

Payment and withdrawal methods

XM group accepts the most commonly used local payment methods today including credit/debit card, neteller, skrill, bank wire transfer, etc.

It should be noted that it’s currently not possible to use paypal to deposit or withdraw funds.

Customer support

XM boasts appreciable levels of client engagement and support. A live chat widget, email and telephone number are offered as standard to clients of all account levels. One of the most interesting features of this support is that (currently) XM provides customer service in no less than 20 different languages. Facsimiles are also able to be sent to four different numbers depending upon one’s physical location. These support services are only available from monday through friday. Any requests put forth during the weekend will be addressed on the next business day.

Conclusion

XM group is quite a popular online broker for traders of all skill levels. Its primary benefits are the high reliability of trade executions, easily manageable platforms, and no order rejection.

Still, there are some downsides to be noted. As mentioned previously, the use of paypal for money transfers is currently not supported. There is little difference (besides the risk and trading volume) of the three account types. Finally, the fact that customer support is only available from monday until friday may slightly aggravate some traders who wish to execute positions during the weekend. XM.Com is nonetheless a powerful online forex broker which should not be overlooked.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from www.Xm.Com on 01/01/2021.

XM group not quite right?

Compare these XM group alternatives or find your next broker using our free interactive tool.

So, let's see, what we have: A global CFD and FX broker. Offers low stock CFD and wtihdrawal fees, account opening is seamless, however the product portfolio is limited. At review xm broker

Contents of the article

- Free forex bonuses

- XM review 2021

- Summary

- XM review fees

- XM review

- Trading point of financial instruments

- Broker details

- Live discussion

- XM.Com profile provided by chris zacharia, mar...

- Video

- Traders reviews

- Super legit platform

- Deposit easy, but its difficult to withdraw

- Low lavrage

- Frequently asked questions

- Is XM a good broker?

- What is the minimum deposit for XM broker?

- How do I deposit money in to my XM broker?

- How long does it take to withdraw from XM?

- Can I withdraw XM bonus?

- How much can I withdraw from XM?

- Does XM allow scalping?

- What is XM zero account?

- Is XM a regulated broker?

- Does XM charge commission?

- What is XM leverage?

- XM group review

- Top takeaways for 2021

- Overall summary

- Is XM group safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About XM group

- 2021 review methodology

- Forex risk disclaimer

- Broker’s profile

- Broker’s security and regulatory status

- Trade offerings, accounts, and condition

- Educational materials and trading resource

- Trading platforms and special perks

- Deposit and withdrawal practices

- Leave or cleave?

- XM group review

- What are XM group's spreads & fees?

- What can you trade with XM group?

- What’s the XM group trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with XM...

- A review & guide to trading with XM

- Trading systems

- Types of accounts

- Spreads and commission

- Underlying assets

- Reliability and efficiency

- Payment and withdrawal methods

- Customer support

- Conclusion

- XM group not quite right?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.