List of currency pairs with positive swap

When you hold a position open overnight from wednesday to thursday, swap triples.

Free forex bonuses

Currencies with higher interest rates,

Secrets behind forex swap

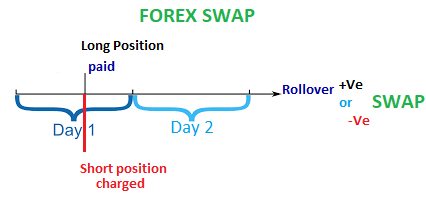

In forex swap, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position.

And this depends on the underlying interest rates of the two currencies in the pair.

We previously looked at what forex swap is.

Now time for us to get into the details of it and see how one can gain from these swaps.

What is forex swap?

Swap is an interest fee that you either pay or receive on your account at the end of each trading day, for holding an overnight position with your broker.

It is either negative or positive depending on what you’re selling or buying.

When negative, you will lose some money for holding overnight positions. When positive, your broker will add some money to your account.

How does forex swap work?

If you hold a short position overnight on a currency with higher interest rate against a low-interest currency, you pay some fee.

But if you have a long position on a currency with higher interest rate against a low-interest currency, then you receive some fee for each day that you hold that trade.

Some brokers may not charge swaps on overnight positions.

This is common especially on currency pairs whose interest rate differentials is equivalent to zero or when very low.

However, sometimes, you will realize that the swap on your trades is larger than usual.

This happens especially when you open a trade position on wednesdays and hold it over the weekend.

In such a scenario, you will have a triple swap charge.

Why positive swap?

To hold a position overnight, you pay interest on the currency you sell and receive interest for the currency you buy.

If the interest on the currency bought is greater than the interest paid for the sold currency, you receive a positive swap for holding a position overnight.

Your trading account gains.

If you sell EUR/USD, then you are selling euros and buying dollars.

When you hold the position overnight, you will pay interest for selling euros, and receive interest for buying dollars.

The fact that the U.S. Dollar has a higher interest than the euro, you stand a chance to have a positive swap.

Note: the longer you stay in a winning position, the greater the possible interest income accumulation on your account.

Why negative swap?

If the interest on the currency bought is less than the interest you pay for the currency you sold.

You receive a negative swap for holding a position overnight.

Your trading account is debited with a swap fee.

On the other hand, if we use the same pair as in the above example.

If you buy EUR/USD, it means, you buy the euro, as you sell the dollars.

If you hold the position overnight, you will receive interest for buying the euros, and pay interest for selling the dollars.

The U.S. Dollar has a higher interest than the euro.

In this case we shall have a negative swap. The swap value will be deducted from your account when you close out the trade.

In case your trade goes against your prediction, you will see a bigger loss than normal after closing out the trade.

This is due to a negative swap accruing on your trade.

How do I avoid negative swap?

You earn a negative swap when you hold a short position for currencies with higher interest rate as you buy currencies with low interest rates.

Namely; NZD/JPY, AUD/JPY,USD/JPY, AUD/CHF, NZD/CHF,USD/CHF, GBP/CHF, GBP/JPY

How to avoid negative swap is very simple, mind the currency pair positions you hold overnight.

When you sell currencies with higher interest rates as you buy currencies with lower rates, it results to a negative swap on overnight trades.

When you choose a pair to trade, you must know the interest rate for both currencies in a pair. If you sell a currency with higher interest rate overnight, expect a negative swap.

You can also avoid swap fees completely.

Close your open trade positions before the end of the trading day. That is 5pm EST, (9pm GMT) as simple as that.

Can I make money from swap in forex trading?

You can make money from swap fees on trades but only if you do it the right way.

Carry trading.

Carry trading in forex is a type of strategy where traders sell currencies of countries with relatively low-interest rates and use the proceeds to buy currencies of countries with higher interest rates.

The forex trader borrows money in one country with a lower interest rate, and invests it in another country with a higher interest rate.

Their aim is to benefit/profit from interest differences.

In order to successfully benefit from carry trading, the first step is to find a forex currency pair with high interest differential.

Currency pairs you should consider for carry trade

USD/JPY, USD/CHF, AUD/JPY, AUD/CHF, GBP/CHF, GBP/JPY, NZD/CHF, NZD/JPY, CAD/JPY, CAD/CHF.

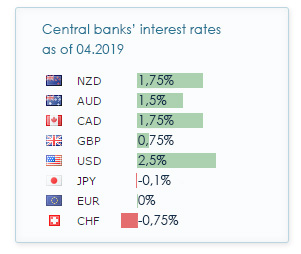

Currencies with higher interest rates;

U.S dollar(USD), new zealand dollar(NZD), australian dollar(AUD), british pound(GBP) and canadian dollar(CAD)

Some examples of low yielding rates are;

The most popular high yielding currencies to look at are, the U.S. Dollar (USD), the australian dollar (AUD) and new zealand dollar (NZD).

If we consider the U.S. Dollar and japanese yen (USD/JPY) as the yielding pair.

Current rates for the dollar is 2% and the yen rate is -0.1.

If you hold a buy position overnight on USD/JPY, you earn a positive carry/swap.

However, this is more meaningful when a trade is moving to your favour.

There is no point earning a pip a day in swap if the pair is moving against you 100 pips a week. In addition, carry trade is applicable when you hold a trade for a long time.

- Find a pair with the highest interest rate differential.

- The pair should be stable or in favor of an uptrend for the currency with a high interest rate.

- Identity your risk before entering a trade.

- Also, study the current economic conditions for the countries in a pair and relate to fundamental and technical analysis.

How swap is added or deducted from your trading account?

Forex swap is calculated automatically at the end of every trading day.

For wednesday to thursday rollover, swap is deducted/added in a triple size.

When you hold a position open overnight from wednesday to thursday, swap triples.

This is because the value date is moved forward 3 days, to monday (skipping over the weekend). Remember, the banks close on weekends.

Swap triples because you are paid or charged interest for 3 days instead of just one.

You can see the size of the swaps in the trading terminal on the MT4/5 platform next to the position you have.

Swap is deducted from/added to our account automatically when you close your position.

If you see a swap fee on your position in the trading terminal on the platform,

Try to compare the closing value of your trade and the real profit/loss after closing out the trade.

You will notice either an increase or decrease on the profit added to your account.

List of currency pairs with positive swap

Best swap rates forex brokers

When you are looking for the best forex brokers for long term trading, best swap rates are more important than low spreads.

Well, spreads are always important and you can take them into account while choosing a broker suitable for long term trading but you should consider swap rates first.

You want a broker with high positive swaps and low negative ones or a forex broker that the sum of its positive and negative swap rates is to the benefit of you the most.

In this post, we are going to talk about swap and its types and become familiar with the forex brokers that have the best and more favorable swap rates.

You'll see in this article:

What is swap?

Swap is the interest paid at the time of rollover. When you hold a position overnight in a margin FX contract or CFD, they will be rolled to the next business day, which may result in you paying a swap charge or earning a swap benefit.

If you pay, it’s a negative swap and when you earn, it’s called a positive swap.

As you can see, you don’t pay or earn swap if you are a day trader or more specifically if you don’t hold to your position for the next day.

That’s why it’s just important if you are a long term trader, not a scalper or day trader.

The reason that you earn or pay swap is that every central bank around the world has an interest rate so when you buy or sell a currency pair in a way that you hold it more than one day, your trade or exchange is exposed to this interest rate.

For example, the federal reserve sets an interest rate of 1.70% for USD and the bank of japan has an interest rate of 0.1%.

If I buy USDJPY, since the interest rate of USD is higher than JPY, I get a positive swap. In other words, I earn profit because technically I sell a currency with lower interest rate and buy the one with a higher rate and hold to it until the next day so I receive an interest rate for one day.

On the other hand, if I sell USDJPY, I have to pay swap or I receive a negative swap rate.

Every day that you hold your position, you receive positive or negative swap, regarding the currency pair or any other instruments you trade.

What is rollover and when does it happen?

Rollover is when the market is closed for a few minutes each day so that swap can be charged or paid to positions held at rollover.

Rollover is from 23:55 – 00:10 MT4 server time or 5 PM EST to 5:15 PM EST every day from monday – friday.

This is basically the time that you see a new daily candle starts in your platform in a standard version.

The swap on wednesdays is tripled for forex pairs because it’s the swap of three days which includes weekends and wednesdays.

It can be an important factor if your long term trades last for a few days. Basically it means you are a swing trader rather than position trader.

Both swing trading and position trading are considered long term trading but in swing trading, you hold your trades for a shorter period of time but it still lasts for a few days.

Anyway, if you are a swing trader, as far as your tps and sls are probably smaller than position traders, you may want to avoid larger negative swaps.

It’s worth noting that since trading on wednesdays brings you triple swaps so you’d better avoid negative ones on wednesdays and you can take advantage of positive swaps.

Why is swap important for long-term trading?

Generally, when it comes to the cost of trades, the first thing that people look into is spread. Traders want to pay as fewer pips as possible especially if they are scalpers or even day traders.

However, when we are talking about the best forex brokers for long term trading, swap is more important than spread.

Imagine you are a position trader and your average traders last 10 days. The average spread for EURUSD in your broker is 0.2 pips and the commission is $7 roundturn which becomes 0.7 pips for eurusd and 0.9 pips in total (spread + commission).

Your broker has a negative swap of 0.6 pips on eurusd (-0.6 pips) as well which means for each day that you keep your trade; you have to pay 0.6 pips as swap.

Let’s say that you open one standard lot EURUSD so you have to pay $9 as spread. Your trade lasts for 10 days which means you have to pay a 10-day swap.

Since the swap for each day is 0.6 pips and your lot size is 1 standard lot ($10) and you also hold the trade for 10 days, you have to pay $60 for swap.

As you can see, although the swap is less than spread + commission at first, the main part in your cost of trade is the swap because you pay for spread and commission only once but you have to pay for the swap every day you keep the trade.

In conclusion, spread and commission are important and crucial factors in scalping or day trading but for long-term trades, swap plays the major part and can change your profit margin.

How can I avoid swap?

The only way that you can avoid swap is keeping your trades open within a day however there are some ways that you can either decrease the swap cost or even benefit from that.

If you want to lessen the amount of money you have to pay as swap, you should find and choose the forex brokers suitable for long-term trading. In other words, the ones that give you more favorable swap.

There are two ways that you can do that. Either you can go through all the brokers’ websites and find the swaps they have or alternatively choose from the list of brokers that you can see here.

I’ve dug into more than 100 brokers to find the best conditions for long term trading particularly the most favorable swap rates.

Another approach is to benefit from swap. It means to choose the trades with positive swap rates.

It may seem not a good idea to always do that because it probably put a dent on your trading opportunities and you might have to lose some trades because of negative swap rates, however, you can consider that if you see a pair with a larger positive swap rate or avoid when you see a pair with a considerably big negative swap rate.

How to select brokers with best sawp for long term trading?

There are a lot of forex brokers out there but how you can figure out which brokers are the best ones for long term trading or have the best swap rates?

Do you have to go through the websites of hundreds of brokers and check their swap rates out?

Although it’s possible to do so it takes too much and is really time-consuming. First, you have to find forex brokers, some you already know and some you have to discover.

Then you have to find the swap sections and enter their swap rates into excel so that you can compare brokers’ swap rates later.

However, there’s a better way.

How to find brokers with the best swap rates?

I used the swap section of myfxbook where there are more than 100 forex brokers with their swap rates for many currency pairs including major, minor, exotic, gold, etc.

You can sort the brokers out based on swap rates both short and long and find the best positive and negative swap rates, however, there are some flaws that need to be fixed if you want to have correct and reliable results.

First, not all the swap rates in the myfxbook swap table are correct so you should double-check with the websites of the forex brokers.

Most of the websites have a section that shows the swap rates but some of them don’t.

If you can’t find the swap rates on the brokers’ websites, you can find them through the platform of the brokers.

For example, in the market watch of MT4, you can right-click on the pair you want its swap rate and then select specification. You can see the swap rate on the contract specification window.

You can also do the same for other platforms like the proprietary trading platforms of brokers.

Some of forex brokers have also a calculator that calculates the swap rates of that broker so you can check rates from there.

What types of swap rates does forex brokers have?

After finding the correct swap rates, I changed the rates of some brokers because they are not all based on the same metrics.

Some brokers show their swap rates based on pips. Others are based on base currency, margin currency, or interest rate percentage.

Because I wanted to compare the brokers to find the best swap and consequently best brokers for long term trading, I unified them based on pip.

For example, a swap rate of a currency pair such as USDJPY is based on base currency; which is USD for USDJPY, and it is $3.2 so we turn it into pip so it becomes 0.32 pips.

For those swap rates that are based on percentage, you need to use the following formula in order to turn them into dollar and then into pip:

Contract value is equal to daily close price multiplied by contract size

Contract size for forex pairs is:

- 1 lot= 100000

- 0.1= 10000

- 0.01= 1000

For example, a broker shows the swap rate of EURUSD for short (sell) positions as 1.2%.

The daily close price, let’s say on monday, is 1.1104. For finding the swap rate for EURUSD we need to put this information in the above formula.

And if we want it as pip, it becomes 0.37 pips approximately.

After finding the correct swap rates and integrating them into pip, I sorted them out and selected the forex brokers with the best and most favorable swap rates for trading long term.

I also checked their regulations and eliminated the ones that are not regulated.

Although there are some unregulated brokers that seem reliable and have shown a good performance choosing from regulated brokers is safer in my opinion.

Swap rates changes every day so you may see different rates than you see in the table here, however, this difference is not pivotal in a way that changes the rank of the brokers and turns a broker with good positive or negative swap into a bad one.

Forex brokers with the best swap for long-term trading

Here’s a list of top 10 forex brokers with the best swap rates for long term trading:

Note: all the brokers in the table below are the best forex brokers for long term trading and the above brokers are listed based on the best swap for EURUSD. For more information, read the following lines and find the broker that best suits your needs.

In our table, we put three types of swap: long, short, and average.

Since we want the best forex brokers for long term trading, we need the best swap both negative and positive, however, some brokers have a favorable positive swap but the negative swap is not good and vice versa.

For example, a broker may have a 3-pip positive long swap for eurusd which is absolutely high but it has an 8 pip negative short swap as well so the swap rate is not in your favor in general.

For finding out the total swap rates that you receive, I put the average of swap rates (long and short) in the table so you can sort the table based on that to see the brokers with the best swap rates in total.

There’s only a selection of currency pairs here which includes 4 pairs: EURUSD, GBPUSD, USDCAD, and GBPJPY. If you trade specific selections of pairs that are not included here, you can find their swap rates on the website of the following brokers.

Swap rates change every day and the following rates are just a sample that shows the brokers with the best swap rates. In other words, the swap rates change but the rankings of the forex brokers stay intact to a great extent.

Click on average swap headers to sort the brokers based on the most favorable swap rates according to the mentioned currency pairs.

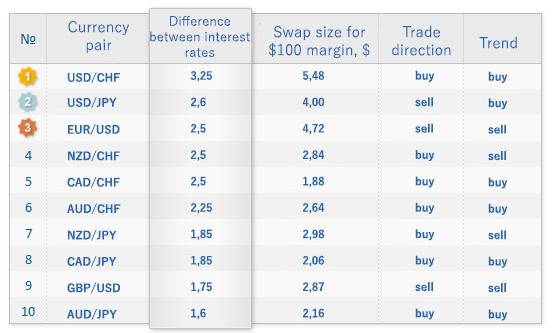

TOP 10 currency pairs for carry trade in 2021

Most sources provide outdated information on carry trade strategy, in particular the interest rates of banks that underlie this strategy.

If you are familiar with carry trade, you can skip the next paragraph and go directly to:

Carry trade is a conditionally win-win strategy, which basic principle is not a technical analysis of currency pairs, but using the difference between the interest rates of central banks to make money. In other words, carry trade is focused on profiting from a swap (carrying a position to the next trading day), which size, as you know, depends on the difference between bank interest rates.

The currency pair chosen for this strategy must meet two conditions:

- Have a positive swap;

- Be trending in the “right direction” (it refers to the trend having the same direction as a trade opened with the carry trade strategy).

Rating of currency pairs for carry trade in 2019

The following table shows our analysis of the maximum difference between interest rates (potential swap size) and a trend for each currency pair. This will help us to identify the best pairs for carry trade in 2019:

- USD/CHF has the largest swap size that makes it the most attractive pair for carry traders. Speaking about a trend, the negative interest rate on swiss franc will further boost this currency pair.

- Margin is important for carry trade, because we just have to take into account the maximum movement against our position. This is why the table presents the swap size for every $100 margin. We consider it one of the basic parameters for the given strategy. By the way, brokers usually indicate the swap size based on the lot size, but it may merely confuse us in this case.

- Please note that AUD/JPY, which has always been widely regarded as the best pair for carry trade, now ranks last. If you google the word “AUD/JPY”, you’ll see that most sources still recommend it as the best pair for this strategy. That’s why it makes sense to figure out how to choose the best pair for carry trade.

How to choose the best currency pair for carry trade

Let's look at the current bank interest rates:

Choosing the best currency pair for carry trade is a three-step process:

- Find the maximum difference between interest rates. In this case, it’s calculated as follows: USD(2.50%) – CHF(-0.75%) = 3.25%. Accordingly, the best potential pair (we don’t necessarily have to choose it) is USD/CHF.

- Determine a trade direction by the following principle: we should buy a currency with a higher interest rate for other currency with a lower interest rate. Accordingly, we need to buy USD/CHF. Note that it’s the other way around for GBP/USD.

- Next, we need to look at the chart, read the news and the forecasts for this pair, and identify the trend. If the trend doesn’t coincide with a trade direction, we consider the next potential pair.

In conclusion, we want to ask our readers a question: have you ever applied this strategy in practice? What were the results?

What is swap rate in forex

At about 5 pm EST (time varies with some brokers) if you are holding an open position overnight your account is either credited, or debited, an interest charge on the full size of your open positions, depending on your established margin and position in the market. Depending on the interest rate differential, you may pay or receive interest fees, also known as rollover fees.

This interest rate is called rollover in forex. Why does this interest credit or debit occur? Can you avoid swap rates? Learn what is a swap rate in forex.

The rollover happens when an open position from one value date (settlement date) is rolled over into the next value date. Rollover transactions are carried out automatically by your broker if you hold an open position past the change in value date.

Behind the scenes, the settlement occurs in two business days. Thus, if it is monday before 5PM currencies are trading for value on wednesday. After 5PM on monday the trade date becomes tuesday and they are traded for value on thursday.

Rollover applies to positions open past 5 PM EST

rollovers are applied to open positions after 5 pm EST change in value date, or settlement date. They are NOT applied if you don’t carry your position over the change in value date; thus, if you open and close your trade before 5 pm you will never incur rollover charge or debit.

Wednesday carries a 3-day rollover

on 5PM EST on wednesday the value date changes from friday to monday, a weekend rollover, which means a three day rollover (saturday, sunday, monday), which means that the rollover costs/gains are going to be three times as much as any other day.

Why does this interest credit or debit occur?

Because when you are trading currencies, you are trading cash. When you go long on a currency, it is like holding a deposit at a bank, and you would expect to earn interest on your deposit, and when you go short on a currency, it is like borrowing, and you would expect to pay interest on the loan. The likeness becomes more complicated because with a currency pair, you are holding one currency with a positive balance (the currency you are long) and one with a negative balance (the currency you are short), and the difference between the interest rates of the two countries is called the interest-rate differential.

Whether you are credited or debited depends on two factors: 1) whether you are holding a long or short position; and 2) the interest rate differential between the two currencies in the pair you are trading.

Since every currency trade involves borrowing one currency to buy another, interest rollover charges are part of forex trading. Interest is paid on the currency that is borrowed, and earned on the one that is bought. In effect, you earn or pay interest depending on the direction of your position. If you are buying a currency with a higher interest rate than the one you are borrowing, the net differential will be positive (i.E. AUD/USD) – and you will earn funds (be credited) as a result. If you are selling a currency with a higher interest rate than the one you are borrowing, the net differential will be negative, and you will end up paying (be debited) for that rollover. The rollover costs/credits are based on your position size, with the larger the position, the larger the cost or gain to you.

How does one find out the interest rates of different countries?

For instance, the above website presents the interest rates in an easy to read table like the one below (accurate as of june 2020):

From the chart above, you can gather that the australian rate of 0.25% is significantly greater than the slim 0.0% of the EU ECB. For investors, this would mean that one would earn more interest in being long australian dollars and being short the EUR (i.E., long AUD/EUR).

How do you calculate the rollover rate of a particular currency pair (in general)?

Bear in mind that rollover transactions are carried out automatically by your forex broker if you hold a position past the change in value date.

However, for various reasons, you might like to know the calculation behind the scenes.

Here is the rollover calculation formula:

Example of rollover calculated in USD:

You buy 1 lot AUD/USD while AUD/USD price at rollover time is 1.0486. How much swap should you pay/receive at 5 PM EST?

AUD/USD price at 5:00 PM EST: 1.0486

australia borrow rate= 4.75% per annum

US lend rate = 0.25% per annum

Therefore: $100,000 * (4.75% – 0.25%) / 365 * 1.0486

further: $100,000 * 4.50% / 382.74 = 11.75 per day

That was just an example and swap can change on a daily basis.

Note: we use 365 because the interest rate shown is paid over a daily basis. Since our trader only kept the position open one day, we have to divide it by 365.

If you want a cool calculator to help you calculate the current potential positive or negative rollover you might be charged if you were to carry a position over a number of days, you can use the oanda interest calculator.

The snapshot of this calculator is below:

You always want to indicate the hours held to be greater than 24 to fully appreciate the rollover calculation.

Note: this calculation gives you a good idea of current rollover rate of a currency pair you are long or short, but it is particular to oanda’s own rates. To know the current rollover rate of your particular brokerage, you can use the tools below.

Quick way to see overnight interest of any pair of any broker

If you want to know the rollover rate of your individual currency pair, some forex platforms such as FXCM’s tradestation publish these particular rates. However, if you are working with an MT4 platform, you can apply the following two MT4 information indicators to your chart:

| Indicator | descriptor |

|---|---|

| statmonitor_1.1-phat | displays spread, buy/sell swap, volume of chart symbol |

| display info all pairs | author: hanover. Displays valuable information on multiple pairs: pair abbreviation [column1], bid price [column2], ratio of day range to average daily range (also as a %) [column3-5], spread ( also as % of ADR) [column6-7], pip value [column8], buy swap rate[column9], sell swap rate [column10]. |

A picture of both these handy indicators applied to the AUDUSD chart of fxpro looks like this:

The first indicator, statsmonitor_1.1phat.Mq4 , displays a spread of 20 (which is 2.0 pips because it is 5 digit broker), a buy swap of 14.83 and a sell swap of 17.06. Thus on any normal rollover day, except for wednesday, you would receive a credit of $14.83 for being long 100,000 standard position of AUD/USD if you held it past the rollover time, and you would receive a deduction of $17.06 for being short 100,000 standard position of AUD/USD. The second indicator, display info all pairs. Ex4 , displays bid price, average daily range, spread, pip value and buy/sell swap information on a multiplicity of pairs, saving you much time in trying to discover this information piece by piece, pair by pair. At a glance, you can quickly see that AUD/USD has a much higher swap rate than the others, which would be useful information for anyone thinking about what could be the next carry trade.

Why are the negative swap rates much higher than the positive swap rates?

In an ideal world, the positive and negative swap rate should be an equal rate (that is, in the illustration above, both the positive and negative swap of AUD/USD should be 14.83), but instead, the negative swap rate usually appears much greater than the positive swap rate. This is probably not fair but it is the way the brokerage game is set up. If your trading history were to present an equal number of longs and shorts carried out over more than 1 day, you would probably have an overall negative swap charged on the total of all your trades. It may not come out to much but it is something you have to end up factoring as a cost of trading.

You may also discover that some brokers will incur a negative swap rate for being either long or short a currency pair. If you see a broker doing this, you might want to reconsider having an account with him.

How can you avoid paying swap rates?

There are at least three ways you can avoid paying swap rates.

1. Trade in direction of positive interest.

You can go trade only in the direction of the currency that gives positive swap. This is generally not recommended unless trading in that specific direction has been the most favorable direction in terms of back-tested and forward testing trading results.

2. Trade only intraday and close positions by 5:00 PM.

You would avoid the swap because you are in and out before rollover time. However, you should not decide to become an intraday trader because of the swap. The only reason that can make you become an intraday trader should be your strategy and your performance results rely on being intraday. Not because of the swap.

3. Open up a swap free islamic account, offered by some brokers.

This is an option offered to muslim customers, though in reality non-muslims frequently choose the category if offered. These particular accounts are run in full compliance with islamic beliefs and the policy of no interest to be paid upon business transactions. If you believe you will be having many overnight transactions, you might consider opening a swap free islamic account.

You might also like to read:

Forex rollover (SWAP) rate

Forex trading rollover rates (forex SWAP)

Different currencies pay different interest rates and the rollover rate is a method of balancing these differences. The rollover rate or forex SWAP rate is the net interest return on any position held overnight and can be positive or negative for the trader’s account balance.

What is the forex rollover rate or forex SWAP?

A forex SWAP or rollover rate is a formula for converting annual currency interest rates into daily cash returns. This rate applies to all forex trading positions that are held overnight. The rollover rate is based on the interest rate differential between the two currencies involved in a forex pair and can be either positive or negative.

How does the rollover work for weekends?

As the foreign exchange market is officially closed during weekends, there is no rollover rate on saturday and sunday. To balance that, most forex brokers charge a 3-day rollover rate on wednesdays. In simple words, the rollover rate is tripled (X3) on wednesdays.

□ normal swaps rate: monday, tuesday, thursday, friday

□ triple swaps rate: wednesday

□ no swaps rate: saturday, sunday

How does the rollover work for holidays?

There is no rollover rate on holidays. To account for that, forex brokers charge an extra rollover two (2) business days before the holiday. If that day is wednesday, then that means four (4) days worth of interest on a single day.

- The rollover rate is paid at midnight according to each broker’s time server

- On wednesday the rollover rate is tripled (X3) in order to cover the weekend

- During holidays there is no rollover rate (that is covered two days before the holiday)

- The rollover rate can be positive or negative, according to the interest differential between the two currencies involved in any forex pair

- A positive rollover rate is a gain for the trader and a negative rollover rate is a cost

- Depending on the forex broker, the rollover rate of the same currency pairs may differ significantly

- Some currency pairs may show negative rollover rates on both sides

- There are SWAP-free accounts, that meet the needs of islamic traders

Calculating the daily rollover rate

Some simple steps for calculating the rollover rate, common for every forex pair:

(1) we start by subtracting the annual interest rate (%) of the base currency

(2) the amount produced must be divided by 365 times the base exchange rate in order to calculate the daily rollover rate

For example, if the base currency offers a 5% annual interest rate (%) and the quote currency offers a 10% annual interest rate (%), we get a 5% annual rate. Then by d ividing 5% by 365 days times the exchange rate we get the daily rollover rate.

■ the formula for calculating the forex rollover rate is:

R(base) = the annual interest rate of the base currency

R(quote) = the annual interest rate of the quote currency

365 = the days of the year

ER = the exchange rate (i.E. 1.20 for the EUR/USD)

Why the rollover rate really matters to traders?

The rollover rate matters to all forex traders who maintain their positions overnight. For example, swing traders, position traders, and long-term traders.

The rollover rate paid by any trader depends on three variables :

·the interest rate (%) for each currency involved

Trader-A wants to open a long position worth 10 standard lot on EUR/AUD (euro/australian dollar). The euro traditionally offer a lower interest rate than the australian dollar. That means this trader borrows money from a high-yield currency (AUD) to buy a low-yield currency (EUR). In other words, this trader will have to pay a rollover fee, if he keeps his position after midnight.

On the other hand, trader-B is going short 10 lots on EUR/AUD, borrowing money from a low-yield currency to buy a high-yield currency. Therefore, the second trader will earn a rollover rate, if he keeps his position after midnight.

Let’s suppose the EURAUD rollover rate is +$2 for shorts and -$10 for longs:

□ trader-A: pays (10 lots x -$10/lot ) = -$100

□ trader-A: earns (10 lots x $2/lot ) = +$20

Why the negative rollover rates are significantly higher than the positive rollover rates?

In theory, if two currencies offer the same interest rate, their positive and negative rollover rates should be equal. In reality, the negative rollover rate is usually significantly greater than the positive rollover. This is happening as forex brokers make money out of overnight SWAP rates. Note also that ECN/STP brokers offer much better swap rates than dealing-desks (DD).

When the rollover rate becomes significant ?

But let’s see when the rollover rate becomes really crucial for traders:

- When the interest rate differential between two currencies is significant (more than 0.50%)

- When a trading position is held for long periods

- When a trading position is held overnight at wednesday (the rate is tripled on wednesday)

- When traders use trading leverage

- When a forex broker is not very competitive (ECN brokers offer traditionally better rollover rates than dealing-desks)

What is a carry trade strategy?

Carry trade or carry trading is a popular forex trade strategy that involves selling a low-yield currency and buying a high-yield currency. The concept is to make money out of the interest-rate differential. Carry trade can also mean borrowing in a low-interest rate currency, converting it to a high-interest-rate currency, and buying the highest-rated bonds.

Carry traders will usually go long on currencies such as the new zeeland dollard and the canadian dollar, and go short on currencies such as the japanese yen and the swiss franc. The most popular currency pairs for carry trading are:

■ AUD/JPY, NZD/JPY, EUR/JPY, USD/TRY, and GBP/CHF

How rollover rates are important to automated strategy backtesting?

As the SWAP rates may alter significantly the profit or loss potential of a trade that is held overnight, it is important to consider and include the SWAP rates when backtesting an automated trade strategy.

-the MT4 strategy tester does not include values for SWAP rates, but fortunately, there are tools on MT4 that may help traders to include the effect of swap rates

-that is particularly important for trade strategies that hold positions for several days

Compare SWAP rates

Table : comparing ECN/STP forex brokers and their SWAP values (long vs short)

FOREX SWAP RATES (*)

■ SWAP RATES:

- EURUSD long (↑): - $0.38 | short (↓): +$0.128

- GBPUSD long (↑): -$0.173 | short (↓): +$0.00

- USDJPY long (↑): +$0.00 | short (↓): -$0.23

- USDCAD long (↑): -$0.058 | short (↓): -$0.115

- 0.0 pip plus $7.0 per round-lot

■ number of currency pairs: 50+

- ASICaustralia (AFSL-318232)

- FCA UK (509746)

$10 for standard account

$1,000 for pro account

Tight trading spreads starting as low as 0.0 pips plus $7 commissions per full traded lot

■ SWAP RATES:

- EURUSD long (↑): -$0.53 | short (↓): -$0.07

- GBPUSD long (↑): -$0.33 | short (↓): -$0.33

- USDJPY long (↑): -$0.19 | short (↓): -$0.35

- USDCAD long (↑): -$0.44 | short (↓): -$0.35

- 0.1 pip plus $6.0 per round-lot

■ number of currency pairs: 45+

$10 for standard account

$1,000 for pro account

ECN processing via access to 20 interbank liquidity providers

Tight trading spreads and free VPS

■ SWAP RATES:

- EURUSD long (↑): - $0.96 | short (↓): +$0.36

- GBPUSD long (↑): -$0.75 | short (↓): -$0.08

- USDJPY long (↑): +$0.23 | short (↓): -$0.82

- USDCAD long (↑): -$0.37 | short (↓): -$0.38

- 1.5 pip spread (no commissions)

■ number of currency pairs: 70+

■ founded: 2005

■ regulation:

- FCA UK (license 579202)

- FSP new zeeland (license 192685)

■ min. Account: $10

■ leverage: 1/30 and up to 1/500

■ SWAP RATES:

- EURUSD long (↑): - $1.27 | short (↓): +$0.34

- GBPUSD long (↑): -$0.98 | short (↓): +$0.12

- USDJPY long (↑): +$0.30 | short (↓): -$1.22

- USDCAD long (↑): -$0.16 | short (↓): -$0.49

- 0.1 pip plus $4.0 per lot

■ number of currency pairs: 50+

$5 and $500 for ECN account

■ SWAP RATES:

- EURUSD long (↑): -$0.90 | short (↓): +$0.49

- GBPUSD long (↑): -$0.71 | short (↓): +$0.09

- USDJPY long (↑): +$0.36 | short (↓): -$0.80

- USDCAD long (↑): -$0.25 | short (↓): -$0.35

- 0.1 pip plus $7.0 per round-lot

■ number of currency pairs: 55+

Swap points and its importance in forex trading strategies

This article will write how to calculate swap points and their importance in forex trading strategies.

Swap points and its value in forex trading techniques

Fx swap points or currency swap points are the difference between the spot rate and the forward rate in currency pairs indicated in pips. Normally this is carried out for a certain type of currency pair which you want to trade.

Within this, a financial concept called interest rate parity is used to calculate the points. This concept reveals that after investing some money and after getting the returns for different foreign currencies, you have to compare with the interest rate without a doubt.

Forward dealers using this concept identifies swap points in forex currency trading simply by considering the advantage or the net cost when borrowing and lending currency mathematically over a period of time covering the forward delivery and spot value date.

How to calculate swap points – a formula

Forward prices, swap points in forex trading

To be able to calculate the based currency of forwarding rate with U.S dollar, the equation below can help you:

Spot price x (1 + ir foreign) / (1+ir US) = forward price

Where “ir foreign” means the rate of interest for counter currency, whereas “ir US” indicates the rate of interest in the united states, using this equation, you can calculate the swap points; now you can get:

Forward price – spot price =swap points

Spot price x (1 + ir foreign) / (1+ir US) – 1)

Rollover swap in currency pairs

To understand the equation and how it works for rollover swaps, you have to carry out a practical example for calculating the fair value.

Being aware of interbank’s deposit rates for each currency pair you want to deal with is extremely important. You have to know the predominant terms based on the time period of the interbank. After learning the terms, you can compute the swap points for the currency pairs you want to deal with by creating the base currency with the U.S. Dollar using the equation above.

By discovering the interest rate of the currency pairs, you can furthermore calculate the rollovers. Being aware of the rollover from the delivery date to the following day where you can carry on doing business in the foreseeable future is certainly one of the best examples of rollover swap.

You can also make and crank out money using the interest rate of currency pairs that you buy and keep them for a long time if the interest rate is 0.25% U.S. Dollar for a short period of time. Because the interest rate is 5% for the australian dollar for the short term, the currency held is short, and you have to pay the currency pair’s interest rate.

A variation in the interest rate of 4.25% of currency pair is annualized in the rollovers. And you adjust to the specific time frame by implementing the tomorrow/ next swap rollovers for 1 year if you aren’t trading with rollovers.

Keeping an overnight position for a short AUD/USD, there will be a variation in the interest rate of 4.25% annually divided by 360 for a dealer as a rollover fee. Plus for a rollover period of one day is represented by 30/360. And for a day rollover swap, it’s represented by tomorrow/ next rollovers.

By multiplying the transaction’s sum with the interest rate for tomorrow/ next period, you’ll get the rollover fee of currency pairs. And by converting the currency into AUD/USD to get a fair value price, retail brokers usually charge the rollover fee in pips.

Holding a long position to get the sum equal to the AUD/USD dealers would try to roll over for a long term deal. But because of the forex broker agents’ downward offer, the amount received will be less. Find more answers read articles about “usage of basis swaps for hedging.”

Swaps free brokers list

on our website, we promote mostly swaps free forex brokers. Please visit our page where we listed top forex brokers.

List of currency pairs with positive swap

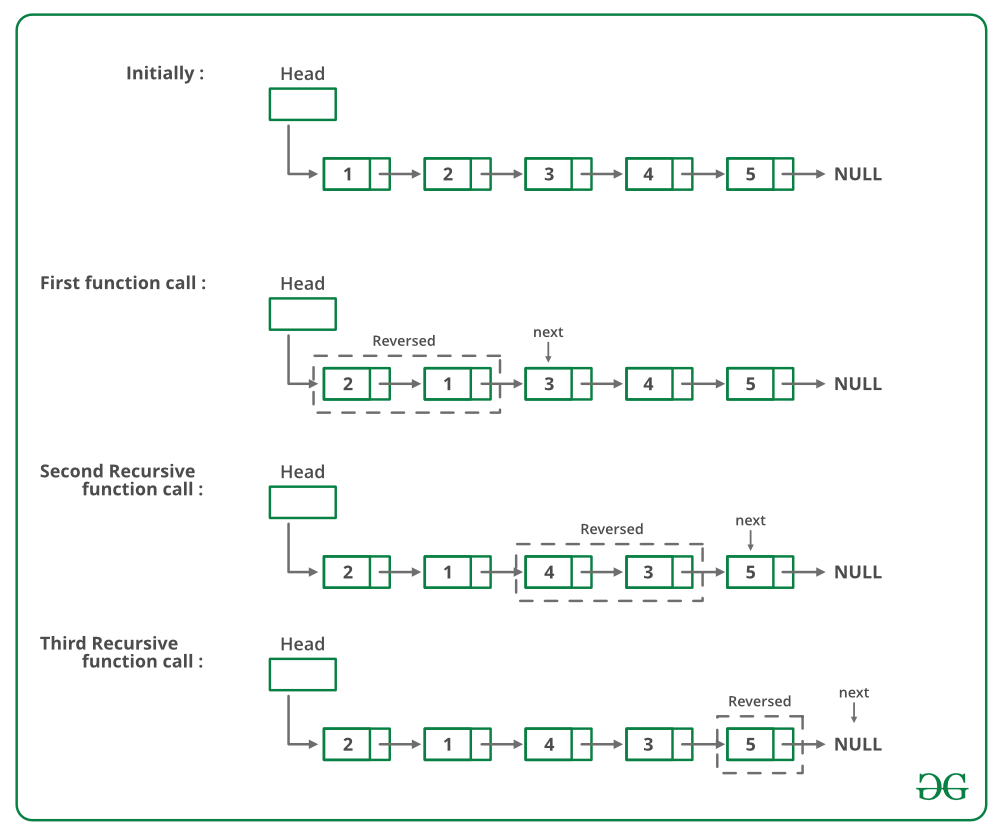

Given a singly linked list, write a function to swap elements pairwise.

Input : 1->2->3->4->5->6->NULL

output : 2->1->4->3->6->5->NULLInput : 1->2->3->4->5->NULL

output : 2->1->4->3->5->NULLInput : 1->NULL

output : 1->NULL

For example, if the linked list is 1->2->3->4->5 then the function should change it to 2->1->4->3->5, and if the linked list is then the function should change it to .

Recommended: please solve it on “PRACTICE” first, before moving on to the solution.

METHOD 1 (iterative)

start from the head node and traverse the list. While traversing swap data of each node with its next node’s data.

Below is the implementation of the above approach:

Python

METHOD 2 (recursive)

if there are 2 or more than 2 nodes in linked list then swap the first two nodes and recursively call for rest of the list.

Below image is a dry run of the above approach:

Below is the implementation of the above approach:

The solution provided there swaps data of nodes. If data contains many fields, there will be many swap operations. See this for an implementation that changes links rather than swapping data.

Please write comments if you find any bug in above code/algorithm, or find other ways to solve the same problem.

Attention reader! Don’t stop learning now. Get hold of all the important DSA concepts with the DSA self paced course at a student-friendly price and become industry ready.

A trader’s guide to currency pair correlations in the forex market

Currency pair correlations show whether there is a relationship between the value of two separate forex pairs. Here, we explain what a currency correlation is and how to trade forex correlations with some worked examples.

What is currency correlation in forex?

A currency correlation in forex is a positive or negative relationship between two separate currency pairs. A positive correlation means that two currency pairs move in tandem, and a negative correlation means that they move in opposite directions.

Correlations can provide opportunities to realise a greater profit, or they can be used to hedge your forex positions and exposure to risk. If you can be certain that one currency pair will move alongside or against another, then you can either open another position to maximise your profits, or you could open another position to hedge your current exposure in case volatility increases in the market.

However, if your forecasts are wrong when trading currency correlations, or if the markets move in an unexpected way, you could incur a steeper loss, or your hedge could be less effective than anticipated.

The strength of a currency correlation depends on the time of day, and the current trading volumes in the markets for both currency pairs. For example, pairs which include the US dollar will often be more active during the US market hours of 12pm to 9pm (UK time), and pairs with the euro or the pound will be more active between 8am and 4pm (UK time) – when the european and british markets are open.

What is the correlation coefficient?

The correlation coefficient is used in pairs trading, and it measures the correlation between different assets – in this case, currency pairs. It ranges from 1 to -1, with 1 representing a perfect positive correlation and -1 representing a perfect negative correlation. If the coefficient value is 0, it means that there is no correlation between the price movements of different currency pairs.

The pearson correlation coefficient is the most used measure of currency correlations in the forex market, but others include the intraclass correlation and the rank correlation. In the context of currency correlations, the pearson correlation coefficient is a measure of the strength of a linear relationship between two different forex pairs. Many traders will use a spreadsheet computer program to calculate the pearson correlation coefficient, because the method for doing so manually is very complex.

What are the most highly correlated currency pairs?

The most highly correlated currency pairs are usually those with close economic ties. For example, EUR/USD and GBP/USD are often positively correlated because of the close relationship between the euro and the british pound – including their geographic proximity, and their status as two of the world’s most widely-held reserve currencies.

The table below gives examples of the correlations between some of the most traded currencies in the world. The correlations were calculated over a one-day period on 26 november 2019 using the pearson correlation coefficient:

| EUR/USD | GBP/USD | USD/CHF | USD/JPY | EUR/JPY | USD/CAD | AUD/USD | |

| EUR/USD | 1 | 0.81 | - 0.54 | 0.51 | 0.87 | - 0.72 | 0.79 |

| GBP/USD | 0.81 | 1 | - 0.35 | 0.83 | 0.94 | - 0.56 | 0.76 |

| USD/CHF | - 0.54 | -0.35 | 1 | -0.08 | -0.32 | 0.37 | - 0.48 |

| USD/JPY | 0.51 | 0.83 | - 0.08 | 1 | 0.86 | - 0.52 | 0.64 |

| EUR/JPY | 0.87 | 0.94 | - 0.32 | 0.86 | 1 | - 0.71 | 0.82 |

| USD/CAD | - 0.72 | - 0.56 | 0.37 | - 0.52 | - 0.71 | 1 | - 0.67 |

| AUD/USD | 0.79 | 0.76 | - 0.48 | 0.64 | 0.82 | - 0.67 | 1 |

How to trade on forex pair correlations

You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each other. In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative.

This is because if there was a perfect negative correlation between USD/CAD and AUD/USD, having a long position on both pairs would effectively cancel each other out since the pairs would be assumed to move in opposing directions. But, if the correlation was perfectly positive, separate long positions on different pairs might help to increase your profits – or it could increase your losses if your forecasts are incorrect.

Traders will typically take positions on correlated pairs in order to diversify themselves while maintaining the same overall direction – either up or down. This could be to protect themselves from the risk of a single pair moving against them, as they will still have the opportunity to profit on the other pair if that happens. It should be stated, that perfectly correlated currency pairs are very rare, and there is always a degree of uncertainty when trading the financial markets.

You can also trade on forex pair correlations to hedge your risk on your active currency trades. For example, you could take out a long position on USD/CHF to hedge any losses you might incur on an active long EUR/USD position. That’s because these two currency pairs have a strong historical negative correlation.

Let’s say you’ve put £10 per point of movement on EUR/USD. To hedge your exposure, you put £8.50 per point of movement on USD/CHF and both currency pairs move 10 points. EUR/USD falls 10 points, resulting in a -£100 loss but, given the negative correlation, USD/CHF rises 10 points for an £85 gain.

While there is still a net loss of -£15, the £85 profit from the USD/CHF position meant that the loss was not -£100, as if you had only opened the EUR/USD trade. Alternatively, you could open two opposite positions on two positively correlated pairs, and the gains on one would offset the losses on the other.

An example of a positively correlated hedge would be if you thought that EUR/USD and GBP/USD were about to break their positive correlation. This could be because the bank of england is expected to dramatically alter interest rates, or there is economic slowdown expected in the eurozone. If this was the case, you might choose to take a temporary short position on GBP/USD to offset any losses on your long EUR/USD position.

EUR/USD and GBP/USD correlation trade example

EUR/USD and GBP/USD are positively correlated forex pairs, with an increase or decrease in one often seeing an equal increase of decrease in the other. The reason for this correlation is the close relationship between the US dollar, the euro and the pound – with these three currencies being entwined by the strong economic ties between each of their respective economies.

As an example of the positive correlation between these two pairs, you could open two long positions on the EUR/USD and the GBP/USD currency pairs. If the correlation is currently present in the market and if the pairs increased in price, you could potentially increase your profit.

Equally, you could open two short positions on these pairs if you believed that the price of one was about to fall. If the positive correlation was currently strong, you would expect the price of the other to fall alongside it.

You can take a position on currency correlations with financial derivatives such as cfds and spread bets. Because you never take ownership of the underlying currencies when trading with these financial products, they enable you to go long and speculate on prices rising, as well as short and speculate on prices falling.

EUR/USD and USD/CHF correlation trade example

The correlation between EUR/USD and USD/CHF is negative, with USD/CHF often moving in an opposite direction to EUR/USD. The negative correlation between these pairs is usually below -0.70, but it can go as low as -0.97.

The table below shows the negative correlation between these two currency pairs between 8am and 9pm (UK time) on monday 25 november 2019. These times were chosen because they include the open and close of both the london and new york trading sessions, starting with the london open of 8am and ending with the new york close of 9pm (UK time):

| time (UK time) | correlation between EUR/USD and USD/CHF |

| 8am | - 0.967 |

| 9am | - 0.968 |

| 10am | - 0.970 |

| 11am | - 0.969 |

| midday | - 0.969 |

| 1pm | - 0.970 |

| 2pm | - 0.969 |

| 3pm | - 0.965 |

| 4pm | - 0.962 |

| 5pm | - 0.950 |

| 6pm | - 0.942 |

| 7pm | - 0.936 |

| 8pm | - 0.935 |

| 9pm | - 0.933 |

As the data shows, the correlation between EUR/USD and USD/CHF was almost perfectly negative on this trading day. You could use the negative correlation to hedge your exposure to risk in one of the underlying currency pairs.

For example, you could go long on EUR/USD and on USD/CHF – despite their negative correlation – in order to protect yourself against any short-term volatility in these forex pairs which might see one of them decline in value.

As previously mentioned, this would be effective if the price of EUR/USD fell by a certain amount per point, but USD/CHF increased for a certain amount per point. In this, the gains on the USD/CHF long position would offset the losses on the EUR/USD position.

Commodities correlated with currencies

The value of some currencies is not only correlated to the value of other currencies, but it is also correlated to the price of commodities. This is particularly true if a country is a net exporter of a particular commodity, such as crude oil or gold.

CAD and crude oil

The price of the canadian dollar is often positively correlated with the price of oil. Typically, an increase in the price of oil will see an increase in the value of the canadian dollar on the forex market. This is often reflected in the movements the USD/CAD pair because oil is traded in the US dollar, which is generally negatively correlated with the price of oil.

This means that when the price of the US dollar increases, the price of oil tends to decrease. It also means that an increase in the price of oil usually causes a decrease in the value of the US dollar. As a result, traders could use this information to take a long position on the canadian dollar – such as in the CAD/JPY pair – when oil is rising, or take a short position on the US dollar – such as in the USD/CAD pair – when the same thing happens.

AUD and gold

The price of gold is often positively correlated with the price of the australian dollar, especially in the AUD/USD currency pair. Because australia is a net exporter of gold, when the price of gold appreciates so does the price of AUD/USD; when gold slumps, AUD/USD also slumps.

If the price of AUD/USD rises, you would need to sell more US dollars in order to buy a single australian dollar – which means that the australian dollar is strengthening compared to the US dollar.

Similar to the correlation between the canadian dollar and crude oil, the value of the australian dollar and gold are usually positively correlated, and the price of the US dollar is usually negatively correlated to both.

The australian dollar is known as a commodity currency because its value is tied closely to the value of australia’s commodity exports such as copper, coal, agricultural products and gold. These exports are also often correlated to the value of the australian dollar, but gold has arguably the greatest positive correlation with the australian dollar.

JPY and gold

The yen is the third most traded currency in the world, and its value often moves in tandem with the price of gold. One reason for this is that the yen is one of the world’s reserve currencies alongside the US dollar, the euro and the british pound.

The yen is also widely believed to be a safe-haven currency, and gold is known as a safe-haven asset. Because of this, investors will often move their money into yen or gold in times of economic uncertainty, or when the markets are experiencing slow growth. This often means that while the price of one unit of yen and one unit of gold might be quite different, the overall up and down movements of these two assets tend to mirror each other.

Some market commentators state that the reason for the correlation between the value of yen and gold is the similarity of the real interest rates for the two assets. The real interest rate is the rate of interest that a market participant will receive after accounting for inflation.

Currency pairs correlation in forex market: cross currency pairs

As a forex trader, you can check several different currency pairs to find the trade setups.

If so, you have to be aware of the currency pairs correlation, because of two main reasons:

1- you avoid taking the same position with several correlated currency pairs at the same time, not to increase your risk.

Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- if you know the currency pairs correlations, it may help you to predict the direction and movement of a currency pair easier.

Sometimes the other correlated currency pairs form stronger signals that help you to take strong movements on the other currency pair.

Before you read the rest of this article, you can click here to learn about my ebook and my other articles.

How currency pairs correlation helps you to trade

Let’s start with the four major currency pairs:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

In both of the first two currency pairs (EUR/USD and GBP/USD), USD works as money.

As you know, the first currency in currency pairs is known as commodity and the second one is money.

So when you buy EUR/USD, it means you pay USD to buy euro.

In EUR/USD and GBP/USD, the currency that works as money is the same (USD).

The commodity of these pairs are both related to two big european economies.

These two currencies are highly connected and related to each other and in 99% of cases they move on the same direction and form the same buy/sell or long short trade setups.

Sometimes, they moved differently, for example because of economy changes, but their main bias is still the same.

What does it mean?

It means if EUR/USD shows a long trade setup, GBP/USD should also show a long trade setup with minor differences in the strength and shape of the trade setup.

If you analyze the market and you come to this conclusion that you should go short with EUR/USD, and at the same time you decide to go long with GBP/USD, it means something is wrong with your analysis, and you are wrong at least with one of your decisions.

So you should not take any positions until you see the same signal in both of these pairs, or at least one currency pair should not show something opposite.

(of course, when these pairs really show two different directions (which rarely happens), it will be a signal to trade EUR/GBP. I will tell you how.)

Accordingly, USD/CHF and USD/JPY behave so similar, but not as similar as EUR/USD and GBP/USD, because in USD/CHF and USD/JPY, money is different.

Swiss franc and japanese yen have some similarities because both of them belong to oil consumer countries.

But the volume of industrial trades in japan makes JPY different compared to CHF.

Generally, when you analyze the four major currency pairs, if you see long trade setups in EUR/USD and GBP/USD, you should see short trade setups in USD/JPY.

If you also see a short trade setup in USD/CHF too, then your analysis is more reliable.

Otherwise, you have to revise and redo your analysis, or at least wait for another trade setup.

EUR/USD, GBP/USD, AUD/USD, NZD/USD, GBP/JPY, EUR/JPY, AUD/JPY and NZD/JPY usually have the same direction.

Just their movement pattern sometimes becomes more similar to each other and sometimes less.

What do I prefer?

If I find a short trade setup with EUR/USD and GBP/USD and a long trade setup with USD/JPY, I prefer to take the short position with one of the EUR/USD or GBP/USD.

The reason is that downward movements are usually stronger.

I will not take the short position with EUR/USD or GBP/USD and the long position with USD/JPY at the same time.

The reason is that if any of these positions goes against me, the other one will do the same as well.

So, I don’t double my risk by taking two opposite positions with two currency pairs that move against each other.

How to use the currency pairs correlation to predict the direction of the markets?

When there is a signal formed with a pair that has to be confirmed to form a trade setup, I refer to the correlated currency pairs or cross currency pairs and look for the confirmation.

For example, let’s say I see a MACD divergence in USD/CAD four hours chart.

But there is no close support breakout in USD/CAD four hours or one hour chart.

I want to take a short position, but I just need a confirmation.

If I wait for confirmation, it can become too late and I may miss the chance.

I check a correlated currency pair like USD/SGD, and if I see a support breakout in it, I take the short position with USD/CAD.

Now the question is: why I don’t take the short position with USD/SGD and I use its support breakout to go short with USD/CAD?

I do it because USD/CAD movements are stronger and more profitable.

One currency pair as an indicator of the other one

I use USD/SGD just as an indicator to trade USD/CAD.

It happens that you take a position with a currency pair, but it doesn’t work properly and you don’t know if it was a good decision or not.

On the other hand, you don’t see any sharp signal on that currency pair to help you to decide if you want to hold the position or close it.

In cases like these, you can check a correlated currency pair and look for a continuation or reversal trade setup.

It helps you to decide about the position you have.

Sometimes, some correlated currency pairs don’t move the way they are supposed to.

For example, EUR/USD and USD/JPY go up at the same time, whereas they usually move against each other.

It can happen when euro value goes up and USD value doesn’t have a significant change, but at the same time JPY value goes down, for some reason.

In cases like these, you can use the chart below to find and trade the currency pair that its movement is intensified by an unusual movement in two other currency pairs.

In this example, if EUR/USD and USD/JPY go up at the same time, EUR/JPY will go up much stronger (see the chart below).

Or, if EUR/USD goes up and AUD/USD goes down at the same time, EUR/AUD goes up strongly.

Another important example

If EUR/USD goes up and GBP/USD goes down at the same time, EUR/GBP goes up strongly.

Maybe this is the most important case that we can trade based on this rule.

It happens many times that EUR/USD and GBP/USD move against each other and that is the best time to trade EUR/GBP.

Now you know why EUR/GBP doesn’t move strongly most of the time.

It is because EUR/USD and GBP/USD move in the same direction most of the time.

For example, they go up at the same time.

Therefore, EUR/GBP doesn’t show any significant movement, because when the value of both of the currencies of a currency pair go up or down at the same time, that currency pair doesn’t show any strong movement and direction.

I hope you know why a currency pair goes up or down.

It goes up when the first currency’s value goes up OR the second currency’s value goes down.

For example, EUR/USD goes up, if euro value goes up or USD value goes down.

If this happens at the same time, then EUR/USD goes up much stronger.

The below chart includes almost all of these unusual movements and their impact on the third currency pair.

If EUR/USD and USD/JPY then EUR/JPY means: if EUR/USD and USD/JPY go up at the same time, then EUR/JPY goes up much stronger.

So, let's see, what we have: in forex swap, when you keep a position open through end of the trading day, you will either be paid or charged interest on that position. This depends.. At list of currency pairs with positive swap

Contents of the article

- Free forex bonuses

- Secrets behind forex swap

- What is forex swap?

- Why positive swap?

- Why negative swap?

- Can I make money from swap in forex...

- How swap is added or deducted from your...

- List of currency pairs with positive swap

- Best swap rates forex brokers

- What is swap?

- What is rollover and when does it happen?

- Why is swap important for long-term trading?

- How can I avoid swap?

- How to select brokers with best sawp for long...

- Forex brokers with the best swap for long-term...

- TOP 10 currency pairs for carry trade in 2021

- Rating of currency pairs for carry trade in 2019

- How to choose the best currency pair for carry...

- What is swap rate in forex

- Why does this interest credit or debit occur?

- How does one find out the interest rates of...

- How do you calculate the rollover rate of a...

- Quick way to see overnight interest of any pair...

- Why are the negative swap rates much higher than...

- How can you avoid paying swap rates?

- 1. Trade in direction of positive interest.

- 2. Trade only intraday and close positions by...

- 3. Open up a swap free islamic account, offered...

- Forex rollover (SWAP) rate

- Swap points and its importance in forex trading...

- How to calculate swap points – a formula

- List of currency pairs with positive swap

- Recommended: please solve it on...

- Python

- A trader’s guide to currency pair correlations in...

- What is currency correlation in forex?

- What is the correlation coefficient?

- What are the most highly correlated currency...

- How to trade on forex pair correlations

- Commodities correlated with currencies

- Currency pairs correlation in forex market: cross...

- How currency pairs correlation helps you to trade

- How to use the currency pairs correlation to...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.